In 2025, the cable cleaning solutions market is valued at USD 863.5 million and begins a forecast period that will see a CAGR of 4.1%, reaching USD 1290.5 million by 2035.

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 863.5 million |

| Industry Size (2035) | USD 1290.5 million |

| CAGR (2025 to 2035) | 4.1% |

The growth is driven by increased installation of fiber optic and 5G infrastructure, offshore wind projects, and railway electrification-each requiring strict cable cleaning protocols. Regulatory changes across North America, Europe, and Asia-Pacific are accelerating demand for low-VOC, non-flammable, and biodegradable cleaning agents. Utility and telecom operators prefer pre-saturated wipes, aerosol sprays, and fast-drying fluids to maintain cable performance and minimize failures in high-voltage and automated systems.

The cable cleaning solutions market holds a niche share across its parent sectors, driven by specialized maintenance needs in power and telecom infrastructure. Within the industrial cleaning solutions market, it accounts for approximately 3-5%, given its role in electrical system maintenance. In the electrical maintenance market, its share is around 6-8%, supported by growing demand for reliability in transmission networks.

It represents about 4-6% of the wire and cable management market, where cleaning is integral to long-term cable performance. In the specialty chemicals industry, its presence is limited to 1-2%, as it competes with a wide range of industrial applications. Within the utility and power infrastructure maintenance market, it holds an estimated 2-3%, largely driven by periodic servicing requirements for medium- and high-voltage cables.

In a January 2024 interview with Utility Products, David Ancona, director of marketing at Polywater®, emphasized the operational importance of clean cables, stating that contamination compromises performance-particularly in high-voltage and fiber optic systems. He noted that, given the increasing load on energy and data infrastructure, effective cable cleaning has become a non-negotiable aspect of reliability planning. This viewpoint reflects a broader industry shift toward preventive maintenance as a strategic function

The cable cleaning solutions industry is experiencing growth due to increased maintenance cycles across utility-grade cabling, expanded fiber-optic deployments, and MRO activities in industrial plants. In 2025, the market is shaped by evolving safety norms, dielectric compatibility, and precision-based cleaning tools.

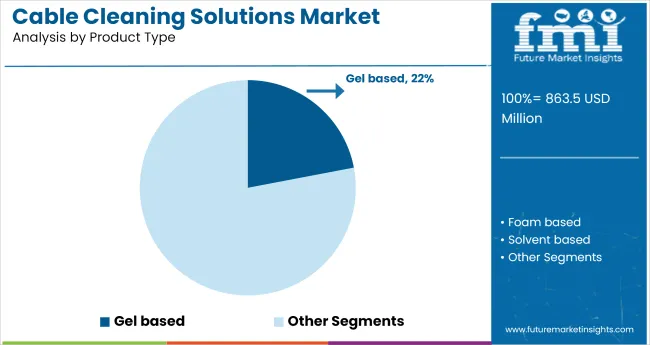

Gel-based cable cleaning products are estimated to hold 22% of total product-type demand in 2025. Their growth is tied to environments requiring precise application and minimal residue, particularly in sealed or overhead electrical systems.

Electrical cable cleaning accounts for 42% of the total application segment in 2025, driven by high-voltage asset life extension and dielectric surface decontamination in critical nodes.

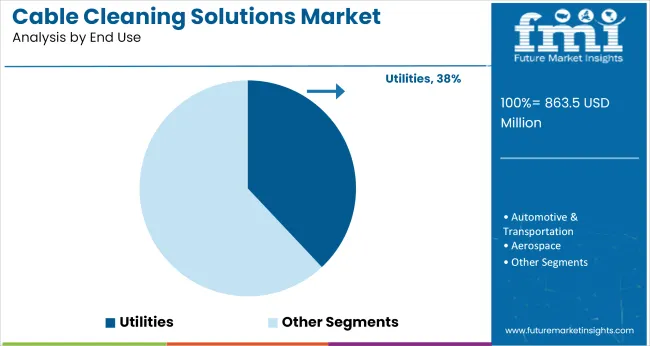

Utility companies are expected to represent 38% of total end-use demand in 2025. Their purchasing patterns are defined by asset density, inspection requirements, and regional grid expansion projects.

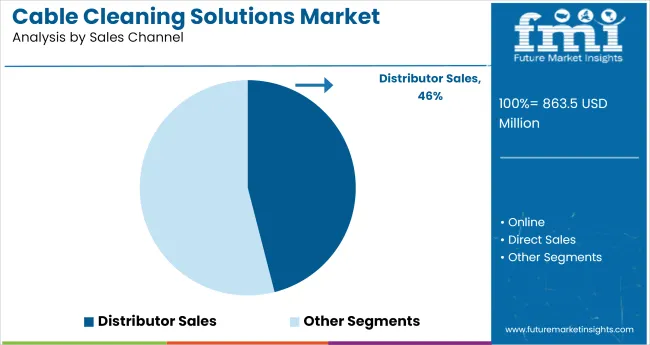

Distributor-based sales are projected to account for 46% of total cable cleaning solution sales in 2025, with growth driven by consolidated procurement and industrial partnerships.

The industry is driven by rising installation of high-voltage infrastructure, demand for uninterrupted power transmission, and maintenance of aging grid systems. Growth is influenced by stringent safety norms, increased utility investments, and deployment across telecom and data centers, with manufacturers focusing on efficiency, residue control, and dielectric integrity.

Adoption Rises Across Utilities and Data Infrastructure Projects

Cable cleaning solutions are being deployed to reduce failure rates in power and communication networks. Utilities are expanding usage of non-conductive solvents and lint-free wipes to minimize downtime during scheduled maintenance. In Q2 2025, procurement data from grid operators in Southeast Asia showed a 21% increase in bulk orders of gel-based degreasers for substation-level cleaning.

Fiber-optic deployments in Latin America are also driving demand for alcohol-based cleaning fluids, with regional telecom installers reporting a 14% drop in connector signal loss following regular cleaning protocol adoption. Portable cable-cleaning kits, packaged for field-service applications, are being rolled out through OEM maintenance contracts and EPC vendors.

Regulatory and Technical Standards Influence Product Selection

Compliance with fire safety, dielectric strength, and residue limits is determining solution choice. Cable manufacturers are specifying cleaning agents that meet IEC 61340 and ASTM D257 standards to ensure insulation performance. Since early 2025, demand for low-VOC formulations has risen among EU-based contractors, prompted by tightening indoor air quality rules under REACH compliance.

QR-coded safety data sheets and tamper-seal packaging have become default features across institutional supply contracts, reducing misuse and inventory misplacement. In response, vendors are investing in solvent blends with faster evaporation profiles and minimal residue-cutting post-cleaning downtime by 11% across heavy-duty installations in mining and metro rail networks.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.3% |

| China | 4.5% |

| United States | 3.8% |

| Germany | 3.5% |

| Japan | 3.2% |

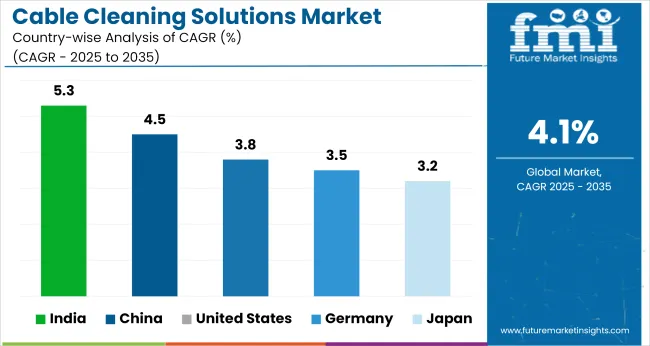

Global demand for cable cleaning solutions is projected to expand at a 4.1% CAGR from 2025 to 2035. India leads among the profiled countries at 5.3%, delivering a +29% premium over the global benchmark, driven by infrastructure investment and grid modernization. China follows at 4.5% (+10%), supported by rapid expansion in telecommunications and industrial electrification.

The United States lags slightly at 3.8% (-7%), while Germany and Japan trail further at 3.5% (-15%) and 3.2% (-22%), respectively, reflecting mature utility networks and slower replacement cycles. BRICS countries are exhibiting stronger growth than OECD peers due to ongoing electrification and industrial scale-ups.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The cable cleaning solutions market in China is projected to expand at a CAGR of 4.5% from 2025 to 2035. Growth is shaped by continuous expansion in industrial automation, high-voltage transmission, and electric vehicle production. Cleaning solutions have gained widespread application due to rising contamination risks in precision cable assemblies.

Domestic production of high-speed rail and smart grids reinforces cleaning protocols, especially in insulation-sensitive environments. Demand has been observed from state-owned enterprises managing large infrastructure corridors, where downtime prevention remains a top operational metric. Customized solvent-based formulations are being adopted in environments with varied humidity and dust levels.

The USA cable cleaning solutions market is expected to grow at a CAGR of 3.8% during the forecast period, driven by sustained investment in fiber optic infrastructure and military-grade cabling systems. Increased focus on reducing signal degradation in long-range data and power cables has intensified the use of high-performance cleaning systems.

Manufacturers are prioritizing lint-free cleaning agents and static-neutralizing compounds for structured cabling environments. Utilities and defense agencies have transitioned to certified cable cleaning protocols as part of system durability benchmarks.

The cable cleaning solutions industry in India is projected to grow at the fastest CAGR of 5.3% between 2025 and 2035. Demand growth is centered around the expansion of telecom towers, metro rail electrification, and transmission corridor upgrades. A visible shift has occurred toward alcohol-free and residue-free cable cleaning compounds in industrial and utility settings.

Maintenance contractors are adopting scheduled cleaning as part of SLA compliance in sectors including power, mining, and infrastructure. As reliance on fiber networks grows across Tier 2 and Tier 3 cities, cable care kits and portable cleaning systems are being increasingly procured by field service teams.

The cable cleaning solutions industry in Germany is set to expand at a CAGR of 3.5% from 2025 to 2035, underpinned by adoption in automotive wire harnesses and robotics-heavy manufacturing. Cable management practices have evolved with tighter tolerances in EV charging setups and factory floor automation.

The focus has shifted toward anti-corrosion, dielectric-safe formulations that extend cable life in high-heat industrial environments. Standards enforced across industrial production zones have created steady demand for cleaning solutions compatible with copper, fiber, and hybrid wiring. Preventive maintenance cycles integrated into Industry 4.0 platforms have institutionalized regular cable care procedures.

The cable cleaning solutions market in Japan is forecast to register a CAGR of 3.2% during the 2025 to 2035 period. Demand is driven by aging infrastructure in transport and power sectors, where cabling systems require preventive care. Cable cleaning agents designed for confined spaces and underground systems have gained prominence, particularly in densely packed substation and tunnel environments.

Compact cable systems in smart electronics and automation lines have furthered the shift toward residue-free, high-purity solvents. Cable integrity audits now include cleaning compliance to ensure insulation resistance and minimize downtime.

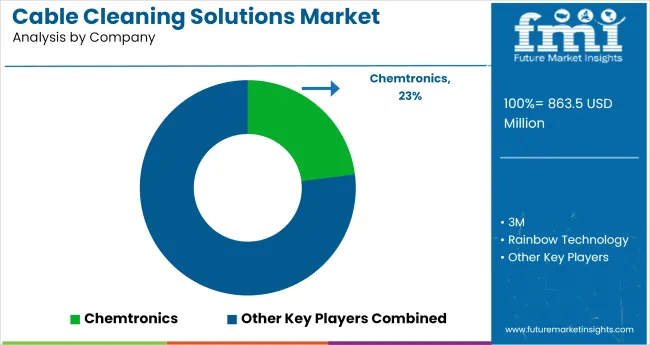

Leading player - Chemtronics holding 23% industry Share

The cable cleaning solutions market is shaped by key players with proprietary formulations and entrenched distribution networks. CRC Industries offers HF Precision Cleaner, widely used in substations, while 3M’s cable cleaning pads dominate fiber maintenance due to broad compatibility. Chemtronics has advanced its Electro-Wash range for residue-free field use, and Polywater’s Grime-Away wipes target utility installations. Rainbow Technology continues supplying region-specific kits for hybrid cable systems.

New entrants face barriers including patented chemical blends, regulatory delays, and long-standing procurement contracts. KleanGrip LLC has introduced single-use pouches to minimize job-site waste, while Carl Roth GmbH & Co. KG targets Western Europe via lab-grade imports.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 863.5 million |

| Projected Market Size (2035) | USD 1290.5 million |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Types Analyzed (Segment 1) | Gel-based, Foam-based, Solvent-based |

| Applications Analyzed (Segment 2) | Electrical Cable Cleaning, Fiber Optic Cable Cleaning, Telecom Cable Cleaning, Control Cable Cleaning |

| End Uses Analyzed (Segment 3) | Utilities, Automotive & Transportation, Aerospace, Construction and Infrastructure, Industrial Plants, Machine MRO Centres, Others |

| Sales Channels Analyzed (Segment 4) | Distributor Sales, Online, Direct Sales |

| Regions Covered | North America; Latin America; Eastern Europe; Western Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players | CRC Industries, KleanGrip LLC, Polywater, Global Specialty Products USA, Inc. (GSP USA), 3M, Chemtronics, Rainbow Technology, Carl Roth GmbH & Co. KG |

| Additional Attributes | Dollar sales, share by product type and application, increasing demand from fiber optic and telecom segments, adoption in industrial plants and machine MRO centers, regional production patterns and cross-border distribution from East Asia and North America. |

The industry is projected to grow at a CAGR of 4.1% during 2025 to 2035.

India leads with a forecast CAGR of 5.3% from 2025 to 2035.

Gel-based cleaners are estimated to account for 22% of product-type demand in 2025.

Electrical cable cleaning will represent 42% of the application segment in 2025.

Distributor-based sales are projected to hold 46% of the total industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Cable Detector Market

Cable Flange Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA