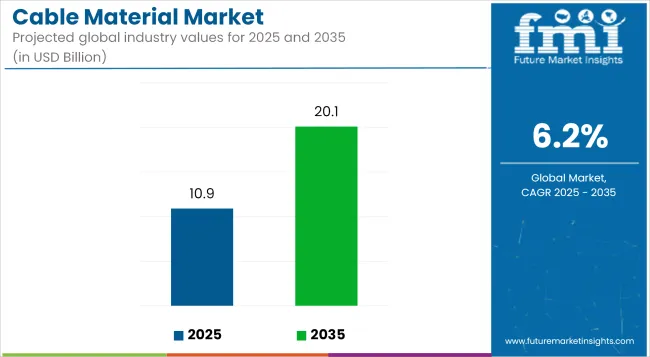

The global cable material market is projected to grow from USD 10.9 billion in 2025 to USD 20.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.2%. This growth is attributed to expansion in power transmission infrastructure, residential electrification driven by urbanization, and rising investments in data connectivity and distribution systems.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 10.9 billion |

| Projected Market Size in 2035 | USD 20.1 billion |

| CAGR (2025 to 2035) | 6.2% |

The cable materials segment is being reshaped by developments in electrification, renewable energy deployment, and smart infrastructure. Applications such as electric vehicle charging, grid modernization, and high-speed data transmission have placed new performance demands on cable materials. Requirements such as enhanced thermal resistance, mechanical strength, and insulation integrity have prompted industry-wide innovation in compound development.

Cross-linked polyethylene (XLPE) and low-smoke, halogen-free (LSHF) materials are being widely adopted to comply with updated fire safety and environmental standards. These materials are being selected for their ability to offer flame resistance and low toxicity in critical public infrastructure.

In Europe, the influence of REACH and Construction Products Regulation has led to increased deployment of LSHF-insulated cables, particularly in mass transit systems and public buildings. Germany’s rail modernization efforts, for instance, have incorporated LSHF materials to reduce risk and improve operational safety.

Material engineering has shifted toward high-performance composites. Polymer modifications involving nanofillers are being introduced to improve the durability and thermal properties of polyethylene used in cables. In East Asia, manufacturers have developed formulations that include graphene and carbon nanotubes, enhancing conductivity and extending service life in high-voltage transmission systems. These solutions are being deployed in utility upgrades across Japan and South Korea.

In Nordic countries, bio-based insulation derived from renewable feedstocks such as castor oil is being explored. These developments are supported by regulations that encourage green construction practices and lifecycle sustainability. Recyclable polymers and environmentally compatible alternatives to PVC are entering pilot phases in both residential and commercial sectors.

Advanced cable materials are being coupled with digital monitoring capabilities. Self-healing insulation layers and embedded sensors enable condition-based monitoring, particularly in data centers and critical energy networks.

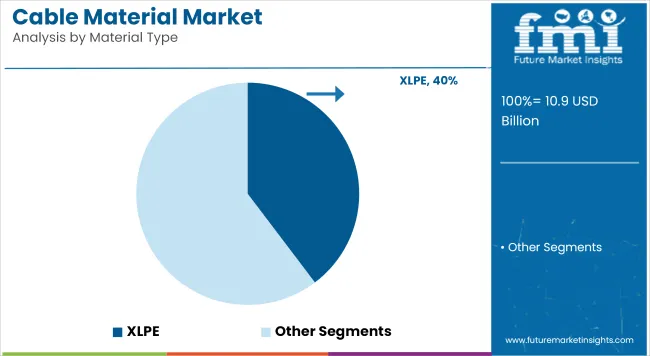

Cross-linked polyethylene (XLPE) is projected to account for approximately 39.7% of the market share in 2025 and is expected to grow at a CAGR of 6.3% through 2035. XLPE offers high dielectric strength, resistance to thermal aging, and mechanical robustness, making it suitable for low, medium, and high-voltage cable insulation. It is widely used in underground, submarine, and overhead power transmission systems.

The material’s cross-linked structure improves resistance to cracking and deformation under thermal and electrical stress. Growth in utility-scale grid modernization, renewable energy integration, and industrial electrification projects are expanding demand for XLPE-insulated cables.

In developing markets, adoption is increasing in long-distance and high-capacity transmission lines. Regulatory bodies and utility companies are setting XLPE as a standard in several infrastructure specifications due to its performance in thermal cycling and long-term reliability.

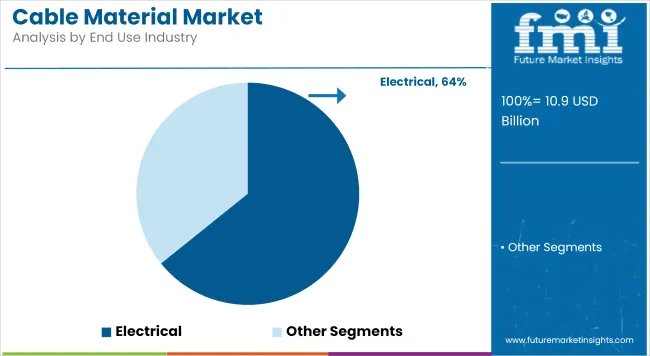

The electrical segment is projected to hold approximately 64.2% of the market share in 2025 and is forecast to grow at a CAGR of 6.4% through 2035. This segment includes cables used in residential wiring, commercial buildings, substations, industrial plants, and power transmission and distribution networks. Governments and private operators are investing in electrical infrastructure to meet energy access targets and integrate renewable energy systems.

Cable materials in this segment are selected based on insulation integrity, resistance to heat and chemicals, and ease of installation. XLPE, PVC, and rubber materials are used across medium and low-voltage systems. The electrical sector is a key consumer of high-volume, safety-compliant cable materials across global projects.

Rapid construction in urban centers, power reliability upgrades, and safety code revisions are supporting demand. In Asia and the Middle East, large-scale housing, industrial zones, and grid reinforcement programs are driving consistent procurement of electrical cables and materials.

Raw Material Price Volatility and Environmental Concerns

Fluctuations in the prices of raw materials such as copper, aluminium, and polymers used in insulation are among the main restrain able factor propelling the growth of the cable material market. Supply chain disruptions and geopolitical uncertainties can affect material availability and increase related production costs.

To add to that, increasing plastic waste and environmental impact issues have also resulted in stricter regulations on synthetic insulation materials, prompting manufacturers towards examining biodegradable or recyclable options.

Growth of Sustainable and High-Performance Cable Materials

The growing trend for sustainable and high-performance cable materials offers major growth prospect. Manufacturers are investing in bio-based, and recyclable insulation materials to lessen the ecological damage. Cable durability, efficiency, and fire resistance are being enhanced as well also advances in computer systems, nanotechnology, and composite materials.

The increasing penetration of electric vehicles, renewable energy projects, and smart grid technologies will drive the demand for next-generation cable materials, ultimately paving the way for long-term market growth over the next 10 years.

Factors such as rising demand for high-performance cables in telecommunications, power transmission, and industrial applications have made the USA the major market for cable materials.

The expanding market is driven by rapid 5G networks expansion, increasing renewable energy infrastructure deployment, and advancements in electric vehicle (EV) production. The increasing investments in smart grid technology and data centers are also a factor driving the demand for durable and efficient cable materials.

Factors such as the establishment of major cable manufacturers and the development of sustainable, recyclable insulation materials also contribute to driving industry trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

As digital native business in the cable material landscape, is benefitting from investments in digital infrastructure, uptick in renewable in power generation and increase in need for high-speed connectivity. Driving the market is the transition to fibre-optic networks and the electrification of transportation systems.

Moreover, stringent environmental regulations are bringing the huge gradually negotiations to renewable and halogen-free link materials. Advancements in cable technologies with superior monstrous durability and efficiency are also bolstering requirements for offshore wind farms and smart city projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

Wire Material Market in the European Union is headed by Germany, France, and Italy owing to their solid industrial infrastructure, increasing power grid modernization projects, and the shift towards electric mobility. Rotterdam, The Netherlands. The EU’s strict sustainability rules are spurring the adoption of halogen-free low-smoke, recyclable cable materials.

Also, high-voltage direct current transmission systems and the growing demand for lightweight materials in aerospace and automotive wiring applications are pushing innovation further. The region’s emphasis on energy efficiency and digital connectivity is also driving market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.1% |

The increase in investments that Japan is making in the field of high-speed telecommunications infrastructure, growing demand for advanced automotive wiring solutions, increasing renewable energy deployment, is driving the cable material market in Japan. Demand for high-durability and flexible cable materials is also being fuelled by the country’s leadership in robotics and industrial automation.

Moreover, Japan's emphasis on disaster-resilient power grid infrastructure is generating growth in the adoption of premium insulation and fireproofing materials in cable production. Emerging technologies include electric vehicles and ultra-high-speed fibre-optic technology, which are also affecting turn in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The fast-paced progress in the field of 5G technology, semiconductor manufacturing, and smart cities are positioning South Korea as a growing market for cable materials. The growth of the cable insulation material market is driven by the growing demand for lightweight, high-performance cable insulation materials in consumer electronics and automotive applications.

Government investments in green energy projects, such as solar and offshore wind energy, are also driving demand for specialized power transmission cables. The market dynamics are also being shaped through the expansion of electric vehicle charging infrastructure and next-generation data centers.

With growing concerns for eco-friendly and flame-retardant cable materials, the industry is anticipated to develop sustainable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The cable material market is undergoing transitions driven by advancements in insulation technology and a growing focus on sustainability. New material systems are being introduced that enhance thermal performance, increase current capacity, and extend operational life. Recent developments include the use of electron beam crosslinking and recyclable polypropylene-based compounds, which eliminate the need for traditional crosslinking agents.

These innovations aim to meet the requirements of infrastructure projects such as metros, airports, and hospitals, while also aligning with regulatory and environmental standards. Market participants are investing in precision manufacturing technologies and material reformulation to address both functional and ecological demands.

The overall market size for the Cable Material market was USD 10.9 Billion in 2025.

The Cable Material market is expected to reach USD 20.1 Billion in 2035.

The demand for cable materials will be driven by increasing investments in telecommunications infrastructure, rising adoption of renewable energy projects, expanding electric vehicle (EV) production, and growing demand for high-performance cables in industrial and commercial applications.

The top 5 countries driving the development of the Cable Material market are the USA, China, Germany, Japan, and India.

The Electrical Cable Material segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Cable Detector Market

Cable Flange Market

LED Cable Market

HVDC Cables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA