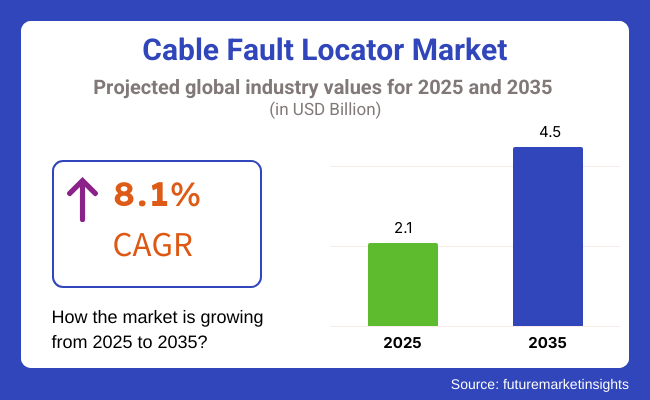

The cable fault locator market is valued at USD 2.1 billion in 2025 and is expected to reach USD 4.5 billion by 2035, expanding at an 8.1 % CAGR during the forecast period.

Within the cable fault locator market, North America emerges as the most lucrative region in 2025 owing to extensive smart-grid retrofits and strict reliability mandates, while India is set to be the fastest-growing national market through 2035 as utilities accelerate underground distribution expansion and 5G fiber roll-outs. The cable fault locator market continues to gain traction as reliable power and data connectivity become critical to urban growth.

Rapid modernization of electric grids, surging deployment of high-voltage underground links, and sweeping 5G backbone construction are driving the cable fault locator market. Utilities embrace TDR- and VLF-based diagnostics to minimize outage-related revenue losses, whereas telecom firms rely on OTDR-enabled kits to pinpoint fiber breaks within seconds. However, high upfront costs, operator-skill gaps, and complex multi-core cable architectures restrain broad adoption in price-sensitive regions.

Key trends reshaping the cable fault locator market include miniaturized handheld devices, cloud-connected analytics, AI-powered waveform interpretation, and IoT-ready test platforms that seamlessly integrate with supervisory control and data acquisition (SCADA) dashboards.

Looking ahead to 2035, the cable fault locator market is poised to transition from reactive testing toward predictive health monitoring. Vendors are embedding quantum-enhanced sensors for centimeter-level fault pinpointing and pairing them with machine-learning models that forecast insulation breakdown weeks in advance. Self-powered, solar-assisted testers will support remote off-grid networks, while autonomous robotic crawlers perform continuous subsea-cable inspection.

As governments enforce net-zero targets, grid operators will prioritize sustainability metrics, favoring energy-efficient locators that halve truck rolls and slash carbon footprints. Consequently, the cable fault locator market will remain integral to resilient, low-loss power and communications infrastructure worldwide.

Time-domain reflectometers (TDR) continue to underpin most revenue in 2025, accounting for roughly 42 % of global sales. Utilities and telcos favour TDRs because the technique’s fast rise-time pulses pinpoint high-resistance discontinuities over several kilometres, making it indispensable for both aged copper feeders and new XLPE power cables. Yet the very-low-frequency (VLF) test set category is forecast to expand at a market-leading 9.3 % CAGR through 2035. Several forces converge here:

HV undergrounding programmes in Europe and East Asia demand non-destructive insulation proof-testing, while IEC 60502/IEEE 400-series updates require routine VLF conditioning after splice work-greatly expanding addressable volume. Optical time-domain reflectometers (OTDR) and arc-reflection testers round out the mix, together supplying specialised needs such as metro-ring fibre diagnostics and shield-fault localisation for traction power.

Over the forecast period, vendors will bundle high-frequency TDR and VLF sources inside a single chassis, leveraging AI waveform analytics to recommend repair versus replacement, thereby improving first-time-fix rates and lowering truck rolls in harsh field conditions.

| Product Type (Key Sub-segment) | CAGR (2025 to 2035) |

|---|---|

| Very Low Frequency (VLF) Testers | 9.3 % |

The portability shift in the cable fault locator market is unmistakable: lightweight, battery-powered handheld units captured nearly 58 % of 2025 shipments and are expected to post an 8.9 % CAGR to 2035. Field crews prize sub-3 kg testers that integrate rugged touchscreens, GPS stamps, and Bluetooth/5G connectivity for cloud-based job logging.

Battery chemistry has improved-most new models promise 8-plus hours of dual-mode TDR + VLF operation-eliminating generator dependency on rural feeders. Meanwhile, embedded IP67 housings and wide-temperature silicon protect delicate pulse-forming networks from vibration and desert heat. Benchtop and van-mounted platforms will retain relevance in depot environments and subsea-cable yards, where ultra-long-range signal injection and high-voltage surge generators are still mandatory.

However, their collective share will slip below 35 % by 2030 as predictive maintenance contracts stipulate real-time in-field reporting. An emerging niche-drone-assisted fault-location payloads for overhead lines-could reach commercial viability by 2033, further eroding demand for conventional van-based labs.

| Portability Class | 2025 Share |

|---|---|

| Handheld/Portable | 58 % |

Power transmission & distribution (T&D) utilities dominate spending, accounting for 55 % of 2025 revenue, as regulators in North America and Europe mandate stricter SAIDI/SAIFI thresholds that penalise prolonged outages. Locators thus shift from emergency response tools to routine grid-health assets, especially in high-renewable penetration regions where cable faults jeopardise inverter uptime.

Nevertheless, the telecommunications segment is on track for the highest CAGR-about 9.0 %-fuelled by massive fibre-to-the-home (FTTH) roll-outs, 5G backhaul densification, and hyperscale data-centre interconnects.

Telecom operators demand dual-wavelength OTDR kits that identify microbends as short as 0.3 dB-a capability now common in next-gen smart locators. Industrial end users-oil & gas, mining, rail-remain steady adopters, prioritising ATEX-rated, intrinsically safe testers for hazardous zones.

Looking ahead, microgrid developers, EV fast-charging networks, and offshore wind export cables will collectively add USD 380 million in incremental demand between 2028 and 2035, tilting market focus toward medium-voltage polymeric insulation diagnostics and salt-fog-resistant enclosures.

Challenges

Some of the key challenges in the cable fault locator which are the investment in advanced fault-detecting technologies, which can be expensive throughout the entire process. Implementing sophisticated algorithms and expert knowledge to locate faults is difficult given the complexity of dense networks of underground cables.

"It's another big challenge to be compliant with regulatory. Mandatory safety and performance standards enforced by entities like the IEC, IEEE, and regional power commissions mean more validation and testing for the product. In addition, in developing, lack of awareness and insufficient knowledge in advanced fault location technologies limit acceptance, delaying the penetration of the sector in these geographical areas.

Opportunity

There are still many opportunities for growth , despite these challenges. AI-powered fault detection is being advanced to improve accuracy, reduce downtime, and improve maintenance efficiency. The growing need for smart grid solutions and remote monitoring systems also contributes to the advanced fault detection technologies.

Telecommunications infrastructure becoming more complicated with the expansion of 5G and fiber-optic networks globally is providing new opportunities for cable fault locators. Moreover, the rising focus on sustainability and renewable energy is driving investments in renewable power transmission networks, including offshore wind farms and solar grids. These opportunities are anticipated to propel the growth of the cable fault locator for the next decade as well.

The USA Cable Fault Locator is expected to grow at a steady rate, driven by the growing need for efficient power distribution, rising adoption of the smart grid, and aging infrastructure. According to the USA Department of Energy, as the nation's aging grid continues to struggle under the pressure of a growing population and health problems, the demand for advanced fault detection and location solutions is on the rise.

The requirement for periodic fault detection is being emphasized due to aging power transmission and distribution networks. The underground cabling trend in city areas is also generating robust demand for time-domain reflectometry (TDR) and very low-frequency (VLF) testing technologies. Companies such as Megger, Fluke, and HV Diagnostics are expanding their product offerings in the USA by introducing AI-based diagnostics for real-time fault detection.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

Technological advancements in cable fault locators: The growth of the United Kingdom cable fault locator industry can be attributed to increased investments in renewable energy infrastructure, an aging electrical network, and strong regulatory emphasis on minimizing power outages. This has resulted in increasing demand for emergent fault detection solutions as the UK's National Grid pours billions into power transmission underground.

The transition to renewable energy sources, including offshore wind farms, makes efficient fault location in long-distance power cables unavoidable. Cable fault locators with AI and IoT capabilities are enhancing real-time monitoring and proactive maintenance. The rising deployment of fiber optic networks is in turn boosting the demand for the telecom cable fault locator.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The cable fault locator in the European Union is expanding due to stringent regulations on power reliability, increasing investments in smart grid infrastructure, and growing demand for underground power cabling. The EU’s Horizon Europe Program has allocated €3.2 billion for grid modernization, boosting the adoption of fault detection technologies.

Germany, France, and Italy are leading in underground power transmission expansion, requiring advanced cable fault locator solutions. Additionally, the adoption of IoT-based monitoring and predictive maintenance solutions is driving growth. The increasing deployment of high-voltage direct current (HVDC) transmission lines is also boosting demand for high-precision fault location systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The Japan Cable Fault Locator Market is growing due to the aging electrical infrastructure, a growing focus on the resilience of the power system, and government initiatives. The need for an advanced fault detection solution is surging with Japan’s Ministry of Economy, Trade, and Industry (METI) designating USD 400 billion for power grid enhancements.

The country’s frequent seismic activity increases the need for high-accuracy underground cable fault locators. The adoption of AI-powered diagnostics in power distribution networks is improving operational efficiency. Furthermore, the expansion of 5G networks is driving demand for telecom cable fault locators.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The South Korea Cable Fault Locator Market is growing at a healthy rate owing to the rapid growth of smart cities, rising deployments of underground cables, and increasing government support towards digital transformation in the energy sector. The South Korean government is investing USD 2.5 million in power infrastructure modernization through its Ministry of Trade, Industry, and Energy (MOTIE), further expanding demand for fault locators.

High-speed rail and metro projects are expanding rapidly, thus leading to increasing demand for effective fault detection in underground power cables. Moreover, AI and IoT are combined upon smart grids to monitor real time and maintain (preventive) well. This segment is also expanding on account of the rising need for fiber optic networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Megger Group (12-17%)

Megger, a top manufacturer of cable fault location equipment, provides TDR, VLF, and bridge test-based locators. So we invest in automation and cloud-enabled tools for diagnosing underground cable efficiently.

Fortive Corporation (Fluke) (10-14%)

FlukeAI-enabled portable cable fault detection systems The company specializes in ease of use, safety, and real-time remote diagnostics.

HV Technologies Inc. (8-12%)

HV Technologies designs and manufactures high-voltage testing systems catering to the power utilities and industrial applications. His firm provides partial discharge detection products and state-of-the-art fault mapping devices.

BAUR GmbH (6-10%)

BAUR, known for its precision fault location systems, surge wave generators, and very low frequency (VLF) test systems. The company prides itself on speed of fault detection and limited service downtime.

Sonel S.A. (4-8%)

Sonel focuses on budget-friendly, compact cable fault locators with efficient diagnostics for utilities and construction sectors.

Other Key Players (45-55% Combined)

Numerous companies contribute to the cable fault locator, driving innovations in precision testing, real-time analytics, and AI-integrated diagnostics. These include:

This is poised for growth as demand for reliable, fast, and automated fault detection solutions increases across power utilities, telecommunication, and industrial applications.

The global cable fault locator industry is projected to witness a CAGR of 8.1% between 2025 and 2035.

The global cable fault locator industry stood at USD 2.1 billion in 2025.

The growth for Global Cable Fault Locator is expected to reach USD 4.5 billion by the end of 2035.

North America is projected to achieve the largest CAGR during the forecast period.

A few of the major players operating in the global cable fault locator industry are Megger, Fluke Corporation, Hubbell Incorporated, PCE Deutschland GmbH, 3M, Electrocon Systems, BAUR GmbH, High Voltage Inc., Kehui International Ltd., and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Portability Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Portability Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Portability Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Portability Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Portability Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Portability Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Portability Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Portability Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Portability Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Portability Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Portability Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Portability Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Portability Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Portability Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Portability Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Cable Detector Market

Cable Flange Market

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

LED Cable Market

HVDC Cables Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA