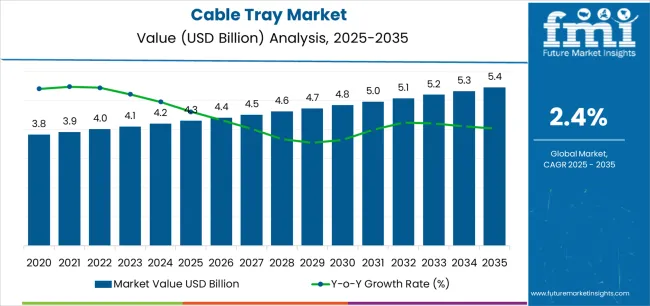

The Cable Tray Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.4% over the forecast period.

The cable tray market is experiencing robust growth driven by increasing demand for efficient cable management systems across industrial, commercial, and infrastructure projects. Expansion in power distribution networks, coupled with the growing need for reliable wiring frameworks, is stimulating product adoption. The current market scenario reflects strong penetration in industrial facilities and large-scale construction developments, supported by strict safety standards and regulatory compliance requirements.

Technological advancements in design, durability, and corrosion resistance are enhancing performance, thereby strengthening the market position of leading manufacturers. The future outlook indicates continued growth, driven by renewable energy projects, smart grid implementation, and modernization of aging electrical infrastructure.

Market participants are focusing on material innovation and modular system design to optimize installation efficiency and reduce maintenance costs The overall growth rationale is supported by rising infrastructure investment, urbanization trends, and the integration of advanced power transmission systems, ensuring sustained expansion across global regions.

| Metric | Value |

|---|---|

| Cable Tray Market Estimated Value in (2025 E) | USD 4.3 billion |

| Cable Tray Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 2.4% |

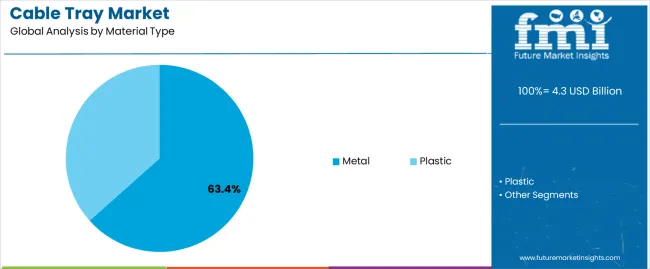

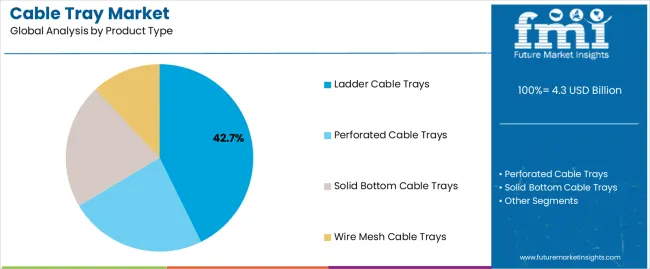

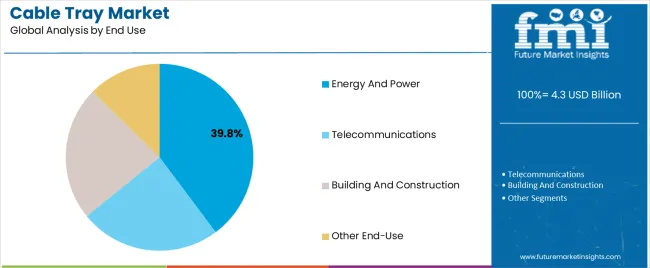

The market is segmented by Material Type, Product Type, and End Use and region. By Material Type, the market is divided into Metal and Plastic. In terms of Product Type, the market is classified into Ladder Cable Trays, Perforated Cable Trays, Solid Bottom Cable Trays, and Wire Mesh Cable Trays. Based on End Use, the market is segmented into Energy And Power, Telecommunications, Building And Construction, and Other End-Use. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal segment, accounting for 63.40% of the material type category, has maintained dominance owing to its superior load-bearing capacity, high durability, and suitability for heavy-duty industrial applications. Its widespread adoption is supported by reliability under high-temperature and corrosive environments, making it a preferred choice for power plants, manufacturing facilities, and commercial complexes.

Manufacturers are leveraging galvanization, stainless steel, and aluminum variants to improve performance and extend service life. Installation flexibility and compatibility with diverse structural frameworks have strengthened its presence in both retrofit and new construction projects.

Continuous innovation in coating technologies and sustainability-focused material sourcing is expected to sustain its market share and reinforce the segment’s leadership within the cable tray industry.

The ladder cable trays segment, holding 42.70% of the product type category, has emerged as the leading design configuration due to its ability to provide superior ventilation, structural rigidity, and easy cable maintenance. It is extensively used in high-voltage power transmission and industrial control applications, where efficient heat dissipation is critical for operational safety.

The segment’s growth has been reinforced by ongoing industrial expansion and the increasing complexity of power distribution systems. Lightweight construction, standardized fittings, and ease of modification during installation have further contributed to market acceptance.

With manufacturers focusing on product customization and corrosion-resistant finishes, ladder cable trays are expected to retain their dominance and continue supporting high-performance electrical infrastructure across various industries.

The energy and power segment, representing 39.80% of the end use category, has remained the largest consumer of cable tray systems due to the extensive wiring infrastructure required in power generation, transmission, and distribution projects. Rapid expansion of renewable energy facilities, coupled with grid modernization efforts, has amplified demand for efficient and durable cable management solutions.

The segment benefits from long-term capital investments and stringent regulatory standards promoting operational safety and reliability. Adoption of metal-based and modular tray systems has optimized installation and reduced downtime during maintenance activities.

With ongoing capacity additions in thermal, hydro, and solar power projects, the energy and power sector is projected to sustain its market leadership, driving consistent growth in global cable tray deployment.

| Historical CAGR | 1.9% |

|---|---|

| Forecast CAGR | 2.5% |

The historical performance of the cable tray market indicates a modest CAGR of 1.9%. This growth rate signifies a steady but relatively sluggish expansion of the market over the specified period. Factors contributing to this historical growth include:

Looking ahead, the forecasted CAGR for the cable tray market is 2.5%, indicating a slight increase in growth rate compared to historical performance. Several factors are expected to contribute to this projected growth:

Expansion of Renewable Energy Projects

The rise in renewable energy installations, such as solar and wind farms, necessitates efficient cable management systems like cable trays to support the transmission and distribution of power.

Growth in Data Centers and Telecommunications Infrastructure

The proliferation of data centers and expansion of telecommunications networks require robust cable management solutions to organize and protect a multitude of cables, boosting demand for cable trays.

Emphasis on Workplace Safety and Compliance

Stringent safety regulations and standards mandate the use of reliable cable management systems to prevent hazards such as cable overheating and electrical fires, prompting industries to invest in high-quality cable trays.

Adoption of Smart Building Technologies

The integration of smart building technologies, including IoT devices and building automation systems, requires structured cable management solutions like cable trays to support connectivity and facilitate data transmission.

Increased Investment in Industrial and Manufacturing Facilities

The expansion of industrial and manufacturing facilities, coupled with the need for reliable power distribution systems, fuels the demand for cable trays to organize and protect electrical wiring in complex environments.

Shift towards Prefabricated Construction Methods

The growing adoption of prefabricated construction methods in building projects favors the use of pre-engineered cable tray systems, offering time and cost savings during installation and maintenance.

This section provides detailed insights into specific segments in the cable tray industry.

| Dominant Material Type | Metal |

|---|---|

| Market Share in 2025 | 62.3% |

Metal cable trays are projected to capture a substantial 62.3% market share in 2025.

| Dominating Product Type | Perforated Cable Trays |

|---|---|

| Market Share in 2025 | 32.2% |

Perforated cable trays, featuring strategically placed holes are anticipated to hold a significant 32.2% market share in 2025, demonstrating their widespread use.

The section analyzes the cable tray market across key countries, including the United States, United Kingdom, China, Japan, and Germany. The analysis discusses various factors driving the demand for cable trays in these countries.

| Countries | CAGR |

|---|---|

| United States | 1.0% |

| United Kingdom | 0.8% |

| China | 4.4% |

| Japan | 1.9% |

| Germany | 0.7% |

The cable tray industry in the United States is anticipated to rise at a CAGR of 1.0% through 2035.

While the United States market exhibits slower growth due to its maturity, ongoing infrastructure projects, data center expansion, and evolving technologies ensure its continued relevance in the cable tray industry.

The cable tray industry in the United Kingdom is projected to rise at a CAGR of 0.8% through 2035.

China’s cable tray industry is likely to witness expansion at a CAGR of 4.4% through 2035.

Japan's cable tray industry is projected to rise at a CAGR of 1.9% through 2035.

Germany's cable tray market is expected to rise at a sluggish 0.7% CAGR through 2035.

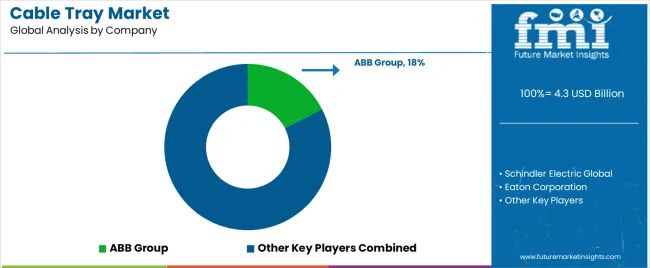

The cable tray industry presents a competitive environment where established players and aspiring challengers vie for market share. Leading manufacturers like Panduit, Legrand, and ABB dominate the landscape, leveraging their extensive product portfolios, well-established distribution networks, and brand recognition. However, this landscape is not without its disruptors.

Emerging players are making their mark by offering niche cable tray solutions, such as those catering to specific industries or environmental requirements. Additionally, they often leverage online marketplaces and direct-to-consumer sales models to reach new customer segments and potentially undercut established players on price. Furthermore, strategic partnerships and acquisitions are shaping the competitive landscape.

Established players are collaborating with raw material suppliers and technology companies to optimize production processes, improve product offerings, and expand their reach into new markets. Mergers and acquisitions can allow larger companies to acquire specialized expertise and production capabilities from smaller players, further intensifying competition.

Recent Developments in the Cable Tray Industry

The global cable tray market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the cable tray market is projected to reach USD 5.4 billion by 2035.

The cable tray market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in cable tray market are metal and plastic.

In terms of product type, ladder cable trays segment to command 42.7% share in the cable tray market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Cable Detector Market

Cable Flange Market

LED Cable Market

HVDC Cables Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA