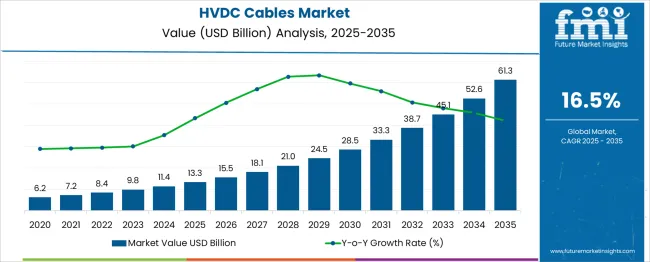

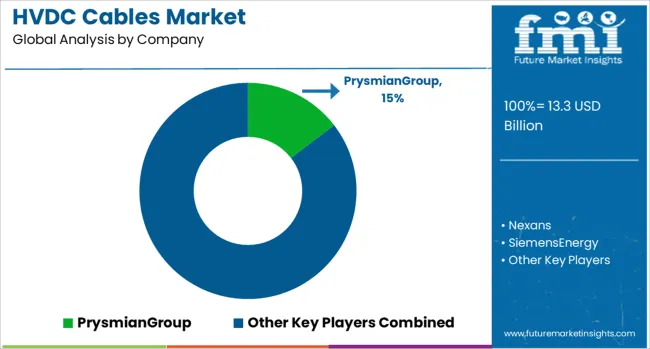

The HVDC Cables Market is estimated to be valued at USD 13.3 billion in 2025 and is projected to reach USD 61.3 billion by 2035, registering a compound annual growth rate (CAGR) of 16.5% over the forecast period.

The HVDC cables market is projected to create an absolute dollar opportunity of USD 48 billion over the forecast period, supported by a robust CAGR of 16.5%. Phase-wise analysis shows a distinct acceleration pattern, with the first five-year period (2025-2030) contributing an addition of USD 15.2 billion, taking the market from USD 13.3 billion to 28.5 billion, which accounts for 31.6% of the total growth opportunity.

Investments in offshore wind connections, regional interconnectors, and grid modernization initiatives will characterize this initial phase. The subsequent phase from 2030 to 2035 exhibits a far steeper trajectory, adding USD 32.8 billion and representing 68.3% of incremental growth, driven by mega HVDC projects designed for intercontinental power trade and ultra-high-voltage installations of ±800 kV and above.

By 2030, the market is projected to more than double its 2025 size, reaching USD 28.5 billion, before accelerating toward USD 61.3 billion as demand for large-scale renewable integration, long-distance bulk transmission, and stable interregional power flows intensifies. This back-loaded growth indicates a strategic opportunity for cable manufacturers, converter suppliers, and EPC contractors to align capacity expansions with the surge in multi-gigawatt transmission corridor projects globally.

| Metric | Value |

|---|---|

| HVDC Cables Market Estimated Value in (2025 E) | USD 13.3 billion |

| HVDC Cables Market Forecast Value in (2035 F) | USD 61.3 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

The HVDC cables market holds a specialized but significant position within its parent categories, largely due to its role in long-distance and high-efficiency power transmission. In the power transmission infrastructure market, HVDC cables account for approximately 6-8%, as most infrastructure investment still focuses on HVAC systems. Within the renewable energy grid integration market, their share is higher, around 10-12%, because HVDC technology is critical for connecting offshore wind farms and large solar parks to the main grid.

In the submarine power cable market, the contribution is substantial at 15-18%, given the preference for HVDC in undersea interconnectors and cross-border links. For the electro-energy systems market, the share stands near 4-5%, as this market includes multiple electrical transmission and distribution technologies. In the smart grid and utility infrastructure market, HVDC cables represent about 3-4%, since most smart grid investments are still focused on digital controls and monitoring solutions.

Despite the relatively moderate share in broader infrastructure markets, demand for HVDC cables is accelerating due to renewable energy expansion, growing interconnectivity of power grids, and the need for reduced transmission losses. These factors position HVDC technology as a strategic component for future-ready, sustainable, and high-capacity electricity networks worldwide.

The HVDC cables market is experiencing robust growth due to the increasing need for long-distance, high-efficiency power transmission systems. As nations intensify their transition toward renewable energy, the integration of offshore wind farms, solar parks, and inter-regional power grids has created a surge in demand for HVDC technology. Unlike AC systems, HVDC offers lower transmission losses over extended distances, making it a preferred solution for cross-border energy trade and subsea interconnectors.

This trend is being supported by strategic investments in grid modernization, particularly across Europe, Asia-Pacific, and parts of North America. Additionally, regulatory mandates focused on decarbonization and energy security are accelerating grid interconnection projects, often requiring submarine and underground HVDC links.

Technological advancements in cable insulation, thermal performance, and high-voltage handling have enhanced operational reliability, enabling broader use across rugged terrains and deepwater routes. With countries emphasizing energy resilience and cross-border power flow, the HVDC cables market is poised for continued expansion through large-scale infrastructure upgrades and multilateral energy cooperation agreements.

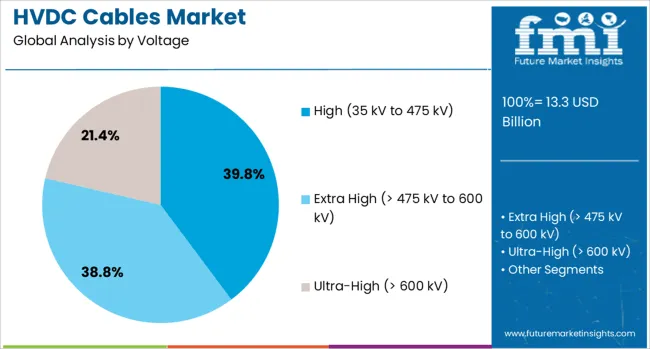

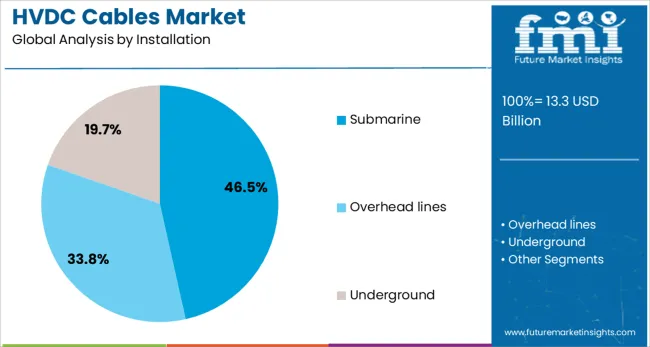

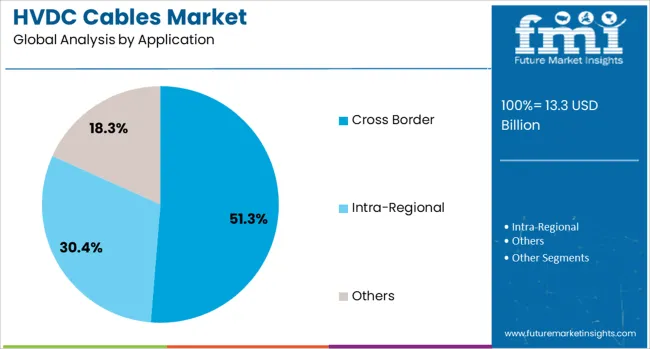

The HVDC cables market is segmented by voltage, installation, and application and geographic regions. By voltage, the HVDC cables market is divided into High (35 kV to 475 kV), Extra High (> 475 kV to 600 kV), and Ultra-High (> 600 kV). In terms of installation of the HVDC cables, the market is classified into Submarine, Overhead lines, and Underground. Based on the application of the HVDC cables, the market is segmented into Cross Border, Intra-Regional, and Others. Regionally, the HVDC cables industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high voltage range between 35 kV and 475 kV is projected to account for 39.8% of the HVDC cables market revenue in 2025. This voltage class has been widely adopted due to its suitability for a broad range of transmission distances while maintaining system stability and cost efficiency.

High voltage HVDC cables offer the optimal balance between current-carrying capacity and insulation performance, making them ideal for regional grid interconnections, urban network extensions, and offshore wind integration. Their ability to handle increased load without excessive thermal stress has made them a reliable choice for projects requiring moderate to long-distance transmission.

Advances in cross-linked polyethylene insulation and conductor materials have further enhanced the durability and current efficiency of cables within this voltage band. As utilities and grid operators aim to optimize power flow between distributed renewable generation sources and load centers, this segment continues to play a critical role in supporting mid-range HVDC projects while maintaining flexibility and cost-effectiveness.

The submarine installation segment is expected to capture 46.5% of the HVDC cables market share in 2025. This dominance has been driven by the rapid expansion of offshore wind projects and the increasing number of subsea interconnectors linking national power grids. Submarine HVDC cables have emerged as a key infrastructure component for transmitting electricity over vast oceanic distances with minimal losses.

Their deployment has been supported by innovations in deep-sea cable laying techniques, pressure-resistant sheathing materials, and long-term corrosion protection systems. These cables are being used extensively in projects where geographical barriers prevent overhead or underground cable routes.

Additionally, the shift toward energy import-export agreements between coastal nations has further emphasized the importance of submarine links in ensuring energy flow stability and regional cooperation. The capacity of submarine HVDC systems to integrate renewable power from remote sources and reduce transmission congestion in land-based grids continues to drive their uptake in both developed and emerging economies.

The cross-border segment is projected to contribute 51.3% of the HVDC cables market revenue in 2025, marking it as the leading application area. The rising demand for international electricity trading and grid interconnection initiatives across Europe, Asia, and Africa has underpinned this growth. HVDC technology has become central to cross border applications due to its ability to stabilize asynchronous grids and deliver power across long distances with minimal losses.

Governments and utilities are increasingly investing in cross border infrastructure to improve energy security, diversify supply sources, and balance renewable energy surpluses between nations. Large-scale projects such as intercontinental transmission corridors and regional grid synchronization efforts have heavily relied on HVDC cables.

Furthermore, the resilience of these systems in terms of load balancing and fault isolation makes them particularly well-suited for geopolitical energy exchange agreements. As multilateral partnerships expand and regional energy markets mature, the cross border application of HVDC cables is expected to remain a key growth driver in the global power infrastructure landscape.

HVDC cables are widely used for long distance and high capacity power transmission, ensuring efficient interconnection between grids and renewable energy sources. These systems are essential for submarine links, offshore wind integration and cross border electricity exchange where alternating current networks face higher losses. Their deployment improves stability and reduces transmission losses across extended distances. Increasing adoption has been observed in large renewable projects and interregional grid connectivity initiatives. Manufacturers developing advanced insulation and modular cable solutions are positioned to lead in high voltage direct current infrastructure expansion.

HVDC cables have been applied to achieve efficient energy transfer in projects requiring long distance transmission with minimal power loss. Their role in linking isolated grids, integrating offshore wind farms and supporting large scale renewable connections has reinforced demand. Unlike alternating current systems, HVDC technology offers reduced line losses, stable voltage control and improved dynamic response in interconnected grids. Underground and submarine installations have been executed for intercontinental and regional power sharing where space or environmental limits restrict overhead lines. Deployment has been prioritized in markets with rising offshore renewable activity and need for bulk electricity transfer, as utilities and operators focus on cost efficiency, system reliability and enhanced energy security through robust power links.

The market has faced limitations due to high upfront investment needed for cable production, converter stations and specialized installation vessels. Laying cables in deep water or challenging terrain demands precise engineering and advanced trenching systems, increasing overall project cost and time. Regulatory compliance across multiple jurisdictions complicates approval processes for cross border connections and submarine routes. Technical issues related to jointing, insulation integrity and system testing add further complexity during commissioning. Limited availability of trained workforce and specialized ships for large scale HVDC deployment creates scheduling delays. Project developers and utilities often experience financing difficulties as cost recovery depends on extended payback periods, making early stage adoption slower in emerging and remote regions.

Significant opportunities have emerged due to large-scale deployment of offshore wind farms and remote solar projects that require efficient long-distance transmission. Development of transnational interconnectors is creating strong potential for cross-border energy trade and grid stability solutions. Regional initiatives to link renewable resources with major consumption centers have accelerated adoption of submarine and underground HVDC cable systems. Manufacturing expansion is being prioritized to increase localized production capacity and reduce dependency on imports. Investments in modernizing aging power infrastructure and developing super-grid networks in emerging economies are driving the requirement for high-capacity HVDC systems. These developments are reinforcing the market outlook for long-term growth across industrialized and developing regions.

Prevailing trends indicate rapid expansion of submarine HVDC links to connect offshore wind energy projects with mainland grids, ensuring high-efficiency transmission over long distances. Adoption of Voltage Source Converter technology is becoming standard in multi-terminal and ultra-high-voltage configurations for improved flexibility. Overhead HVDC corridors are being implemented for cost-effective solutions in interregional transmission projects. Demand for higher voltage levels beyond 475 kV is increasing to reduce energy losses during transmission. Integration of digital monitoring systems, predictive maintenance tools, and advanced automation is being prioritized for reliable operation and reduced downtime. These technological improvements are expected to enhance network resilience and system efficiency globally.

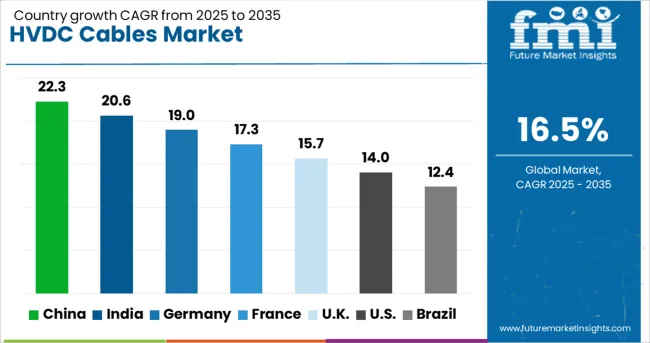

| Country | CAGR |

|---|---|

| China | 22.3% |

| India | 20.6% |

| Germany | 19.0% |

| France | 17.3% |

| UK | 15.7% |

| USA | 14.0% |

| Brazil | 12.4% |

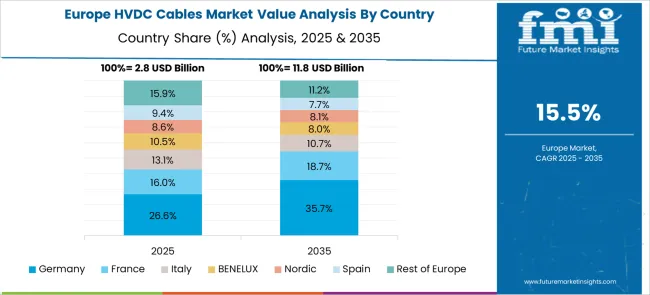

The global HVDC cables market is projected to grow at a 16.5% CAGR from 2025 to 2035, driven by rising demand for long-distance power transmission and interconnection of renewable energy grids. China leads with 22.3%, backed by large-scale offshore wind projects and regional grid integration. India follows at 20.6%, driven by national grid upgrades and cross-border power transmission initiatives.

Germany posts 19.0%, focusing on high-capacity links for offshore wind farms and inter-European power corridors. France records 17.3%, propelled by modernization of transmission infrastructure and export-oriented energy projects. The United Kingdom at 15.7% is emphasizing subsea interconnectors and offshore grid connections. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at 22.3% CAGR, driven by major investments in UHVDC projects and grid interconnection programs. Extensive deployment of HVDC lines supports integration of renewable energy from western regions to eastern industrial hubs. Subsea HVDC links are being developed for offshore wind farms in provinces like Jiangsu and Guangdong. Domestic cable manufacturers are investing in advanced insulation technologies and high-capacity extruded cables for long-distance applications. Strategic partnerships with European technology providers accelerate innovation in voltage rating and efficiency. Policy-driven incentives for transmission upgrades further position China as a leader in HVDC adoption.

India is forecast to grow at 20.6% CAGR, supported by large-scale grid modernization and cross-border interconnection projects with neighboring countries. National programs focus on high-capacity HVDC corridors to reduce transmission losses over long distances. Offshore renewable projects in Gujarat and Tamil Nadu drive demand for subsea HVDC systems. Leading domestic players collaborate with global firms to introduce polymeric-insulated cables for enhanced performance and safety. Power sector reforms and financial incentives under national energy policies encourage adoption of HVDC infrastructure. Rapid industrial expansion and regional power trade initiatives amplify the need for efficient long-distance transmission solutions.

Germany is anticipated to post a 19.0% CAGR, driven by interconnection of offshore wind farms and integration of renewable-heavy grids across Europe. Large-scale HVDC projects like SuedLink and NordLink strengthen the country’s position in regional power exchange. Manufacturers prioritize development of high-voltage extruded cables with low dielectric losses to optimize transmission efficiency. Subsea and underground HVDC links gain momentum due to land-use constraints and environmental considerations. Regulatory frameworks under European energy directives incentivize deployment of advanced HVDC technologies in both domestic and intercontinental projects.

The United Kingdom is forecast to post 15.7% CAGR, with strong focus on subsea HVDC interconnectors and offshore wind grid integration. Projects like the Eastern Link and Viking Link represent key milestones in expanding HVDC infrastructure. Leading global manufacturers are investing in UK-based facilities to support local demand for high-voltage subsea cables. Increased emphasis on grid reliability and cross-border power trade supports adoption of HVDC solutions for energy security. Innovations in flexible extruded cable technology further enhance performance for deep-sea installations.

France is projected to grow at a 17.3% CAGR, supported by demand for interconnectors linking European grids and reinforcement of domestic transmission systems. Offshore wind energy development in the English Channel and Atlantic coast drives subsea HVDC installations. French cable manufacturers are focusing on advanced insulation and conductor materials to enhance performance under deep-water conditions. Cross-border projects with the UK and Spain create significant opportunities for high-capacity HVDC solutions. Government-backed energy transition programs further accelerate funding for high-voltage transmission infrastructure across strategic zones.

The HVDC cables market is dominated by global leaders such as Prysmian Group, Nexans, Siemens Energy, Hitachi Energy Ltd., and NKT AS, supported by Asian players like Sumitomo Electric, LS Cable & System, Taihan Cable, and Mitsubishi Electric, all competing in a highly capital-intensive and technologically demanding industry with significant entry barriers due to certification requirements and specialized installation expertise.

Buyer power is limited to large utilities and governments awarding long-term transmission projects, while supplier power remains moderate owing to dependence on high-grade conductors and advanced insulation materials like XLPE. Substitution risk is negligible as HVDC technology remains critical for long-distance and subsea power transmission, especially for renewable integration and cross-border interconnectors.

Competitive differentiation is driven by proprietary insulation technologies, ultra-high-voltage performance, and turnkey EPC solutions, with European firms leading offshore wind and interconnector projects, and Asian companies focusing on regional infrastructure expansion. Strategic advantages stem from vertical integration, R&D investment in low-loss systems, and digital monitoring capabilities for reliability in deep-sea deployments.

Industry rivalry is intense as players compete for mega-projects requiring cost optimization and rapid execution. Future competition will revolve around innovations in ultra-high-voltage cables, thermal performance improvements, and sustainable materials to meet global decarbonization goals, while performance benchmarking will prioritize capacity expansion, project delivery efficiency, and technological leadership in renewable energy transmission solutions.

In March 2025, Sumitomo was awarded a framework contract by National Grid UK to supply 525 kV HVDC submarine cables from its new manufacturing facility at Nigg, Highlands. This facility is set to become the UK’s first HVDC cable factory and aims to support offshore wind and grid interconnector projects under the UK’s Clean Power 2030 strategy.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.3 Billion |

| Voltage | High (35 kV to 475 kV), Extra High (> 475 kV to 600 kV), and Ultra-High (> 600 kV) |

| Installation | Submarine, Overhead lines, and Underground |

| Application | Cross Border, Intra-Regional, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PrysmianGroup, Nexans, SiemensEnergy, HitachiEnergyLtd., NKTAS, SumitomoElectricIndustries,Ltd., LSCable&SystemLtd., MitsubishiElectricCorporation, TaihanCable&SolutionCo.,Ltd., GeneralElectric, GuptaPowerInfrastructureLimited, TOSHIBACORPORATION, AlfanarGroup, ILJINELECTRIC, and ZMSCABLE |

| Additional Attributes | Dollar sales by installation type (submarine, underground, overhead) and insulation technology (mass impregnated, extruded), with demand driven by renewable integration, cross-border power transmission, and offshore wind projects. Regional trends highlight Europe’s dominance with strong interconnector development, while Asia-Pacific accelerates growth in grid expansion. Innovations focus on high-capacity XLPE insulation, real-time monitoring, and cable-laying vessels to support deep-sea projects. |

The global hvdc cables market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the hvdc cables market is projected to reach USD 61.3 billion by 2035.

The hvdc cables market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in hvdc cables market are high (35 kv to 475 kv), extra high (> 475 kv to 600 kv) and ultra-high (> 600 kv).

In terms of installation, submarine segment to command 46.5% share in the hvdc cables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Converter Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

India HVDC Transmission Systems Market Trends – Growth & Demand 2025-2035

Australia HVDC Transmission Systems Market Analysis – Size, Share & Trends 2025-2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Brake Cables Market Size and Share Forecast Outlook 2025 to 2035

Aircraft cables Market Size and Share Forecast Outlook 2025 to 2035

Overhead Cables Market Size, Growth, and Forecast 2025 to 2035

Flexible Cables Market

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Multicore Cables Market

Fire Rated Cables Market Trends - Demand, Innovations & Forecast 2025 to 2035

LASER Light Cables Market Growth – Trends & Forecast 2025 to 2035

Fiber Optic Cables Market

Single Core Cables Market

Power And Signal Cables Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA