The HVDC Converter Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 96.4 billion by 2035, registering a compound annual growth rate (CAGR) of 35.9% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded from USD 1.0 billion to USD 3.3 billion, driven by pilot projects in renewable energy integration, long-distance power transmission, and interconnection grids. Key breakpoints included technological validation, grid compatibility testing, and government incentives for clean energy infrastructure. Early adopters focused on reducing conversion losses and ensuring reliability, establishing benchmarks for large-scale deployments in the following years.

From 2025 to 2035, the market entered a scaling phase 2025 and 2030, growing from USD 4.5 billion to USD 20.8 billion as utilities worldwide invested in HVDC systems to address energy demand and renewable integration. Breakpoints during this period involved cost reduction through standardized components, cross-border energy projects, and increased adoption by emerging markets. From 2030 to 2035, the market reached USD 96.4 billion and shifted to consolidation, characterized by strategic partnerships, mergers, and technology standardization. Market leaders solidified their share while innovations in voltage source converters and multi-terminal HVDC systems drove efficiency, marking the maturation of the HVDC converter landscape.

| Metric | Value |

|---|---|

| HVDC Converter Market Estimated Value in (2025 E) | USD 4.5 billion |

| HVDC Converter Market Forecast Value in (2035 F) | USD 96.4 billion |

| Forecast CAGR (2025 to 2035) | 35.9% |

The HVDC converter market is experiencing sustained momentum due to rising investments in grid infrastructure and the growing need for efficient long-distance electricity transmission. With the global energy mix shifting toward renewables, grid operators are under increasing pressure to enhance transmission reliability and reduce line losses. HVDC converters have gained prominence in this landscape, offering minimal transmission losses, improved grid stability, and support for asynchronous interconnections.

Technological advancements in converter topologies and materials have enabled greater operational efficiency and reduced footprint. Policy support for cross-border electricity trade and offshore wind integration has further accelerated the deployment of high-capacity HVDC systems.

Additionally, the modernization of existing grid networks in advanced economies and electrification projects in developing regions are paving the way for increased HVDC infrastructure. Over the forecast period, market growth is expected to be reinforced by private and public sector collaboration, strategic investments in utility-scale renewable energy projects, and advancements in voltage level handling capabilities of converter systems.

The HVDC converter market is segmented by capacity, configuration, converter type, and geographic regions. By capacity, the HVDC converter market is divided into > 1,000 MW - 3,000 MW, 500 MW, ≥ 500 MW - 1,000 MW, and > 3,000 MW. In terms of configuration, the HVDC converter market is classified into Bipolar, Monopolar, Back-to-Back, and Others. Based on converter type, the HVDC converter market is segmented into LCC, VSC, and Others. Regionally, the HVDC converter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The capacity range of greater than 1,000 MW and up to 3,000 MW is projected to hold 35.8% of the HVDC converter market revenue share in 2025. This segment's dominance is being driven by the increasing deployment of large-scale transmission projects designed to carry bulk power over long distances with minimal losses.

The adoption of this capacity range has been favored due to its suitability for connecting remote renewable energy sources to demand centers and enabling intercontinental grid links. The enhanced power handling capability within this range supports voltage balancing and frequency stability across regions, especially in countries undertaking grid expansion and load balancing initiatives.

Converter systems in this capacity range have also benefitted from technological improvements that allow for better control, reduced harmonics, and improved thermal management Their scalability and cost-effectiveness in terms of power per unit of infrastructure investment have made them a practical choice for high-volume, long-distance transmission corridors.

The bipolar configuration segment is expected to account for 54.2% of the HVDC converter market share in 2025, establishing it as the leading configuration. This preference is being influenced by the enhanced operational reliability, fault tolerance, and flexibility provided by bipolar systems. Bipolar converters allow independent operation of each pole, which ensures continued transmission in case of a fault in one pole, thereby enhancing grid resilience.

Their capacity to manage higher voltage levels and reduce land usage for transmission corridors has supported their widespread adoption in inter-regional power transfer projects. The balanced voltage characteristic of bipolar configurations also reduces electromagnetic interference and ground return currents, contributing to environmental compliance and regulatory acceptance.

The segment’s growth is further supported by increased deployment in densely populated regions where transmission reliability and compact infrastructure are prioritized The ability to deliver power stably across varied terrain and long distances has made bipolar configurations a preferred design choice in modern HVDC systems.

The line commutated converter or LCC segment is projected to represent 57.6% of the HVDC converter market’s revenue share in 2025. The continued dominance of this converter type is being attributed to its maturity, high efficiency, and suitability for high-power bulk transmission. LCC systems have a long-established presence in large-scale infrastructure and are recognized for their ability to handle gigawatt-level transfers with minimal energy losses.

Their compatibility with existing AC grids and ability to support power transfer over thousands of kilometers have maintained their relevance in both point-to-point and back-to-back configurations. Despite the emergence of voltage source converters, LCCs are still preferred in projects where high voltage and cost optimization are critical.

Their robust design, lower cost per megawatt, and proven operational track record in intercontinental and offshore installations have reinforced their position in utility-scale applications Technological refinements in thyristor-based control systems and harmonic mitigation have further enhanced their performance, ensuring continued deployment in grid expansion programs.

The HVDC (High Voltage Direct Current) converter market is growing due to increasing demand for efficient long-distance power transmission, grid interconnections, and renewable energy integration. HVDC converters enable minimal transmission losses, enhanced grid stability, and flexible power control.

Expansion of offshore wind farms, inter-regional electricity trade, and modernization of aging transmission infrastructure drive adoption. Europe and Asia-Pacific lead deployment due to renewable energy targets, while North America invests in modernizing legacy grids. Manufacturers focus on voltage-source and line-commutated converters with higher capacity, reliability, and digital control features.

HVDC converters are critical for connecting remote renewable energy sources, such as offshore wind, solar farms, and hydropower, to main grids. They allow efficient long-distance transmission with minimal losses and enable precise power flow control. Integration with variable renewable energy requires converters with fast dynamic response and robust voltage regulation. Technological advancements in voltage-source converters (VSC) and modular multilevel converters (MMC) support bidirectional power flow, black-start capability, and grid stability. Companies developing converters tailored for high renewable penetration gain a competitive edge. Until energy storage and grid balancing technologies improve, HVDC converters remain pivotal in enabling large-scale renewable integration.

The need for modern, interconnected grids drives HVDC converter demand. Aging AC infrastructure struggles with congestion, voltage fluctuations, and transmission losses. HVDC systems provide efficient cross-border electricity transfer, interconnecting national grids and enabling energy trading. High-capacity converters allow multi-terminal networks and asynchronous interconnections, enhancing flexibility and reliability. Investments in smart grids and real-time monitoring complement HVDC deployment. Companies offering turnkey converter solutions, integrated control systems, and predictive maintenance services strengthen their market position. Until international grid harmonization and standardization progress, HVDC converters are essential for modernizing transmission networks and supporting cross-border energy flow.

HVDC converters are evolving with advanced semiconductor technologies, digital control systems, and modular designs. Use of IGBTs and IGCTs in VSCs improves efficiency, reduces harmonic distortion, and allows compact, scalable converter stations. Digital control enables precise reactive power management, fault ride-through capability, and improved system stability. Modular designs simplify maintenance, reduce downtime, and allow incremental capacity expansion. Companies investing in next-generation converter topologies, high-temperature components, and predictive analytics achieve differentiation. Until ultra-high-voltage and multi-terminal systems become more cost-effective, innovation in converter technology remains a key driver for reliability, efficiency, and adoption in complex transmission networks.

The HVDC converter market is competitive, with global electrical equipment manufacturers, specialized engineering firms, and regional players vying for projects. Differentiation relies on system efficiency, reliability, digital integration, and service support. Asia-Pacific, Europe, and North America dominate deployment due to renewable energy expansion and grid modernization projects. Supply chain stability for high-performance semiconductors, transformers, and control systems is critical for project execution. Strategic partnerships with utilities, EPC contractors, and renewable developers enhance market access. Until regional manufacturing and component standardization improve, competitive advantage will depend on technological innovation, project execution capabilities, and long-term service offerings.

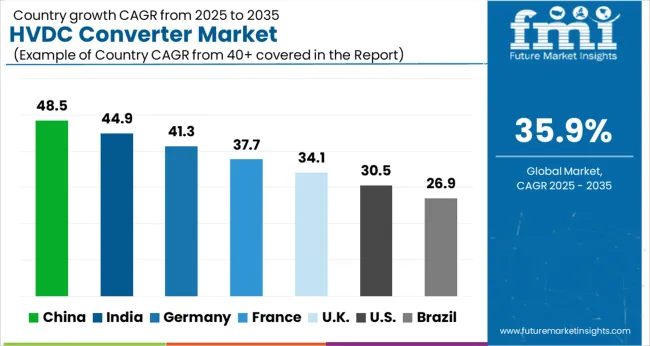

| Country | CAGR |

|---|---|

| China | 48.5% |

| India | 44.9% |

| Germany | 41.3% |

| France | 37.7% |

| UK | 34.1% |

| USA | 30.5% |

| Brazil | 26.9% |

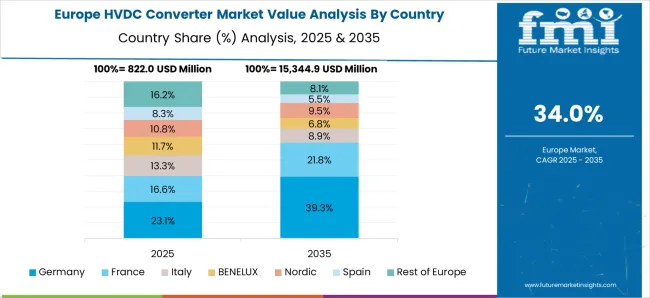

The global HVDC Converter Market is projected to grow at a CAGR of 35.9% through 2035, supported by increasing demand across high-voltage power transmission, renewable energy integration, and grid stabilization applications. Among BRICS nations, China has been recorded with 48.5% growth, driven by large-scale production and deployment in transmission networks and renewable energy projects, while India has been observed at 44.9%, supported by rising utilization in grid modernization and high-voltage infrastructure. In the OECD region, Germany has been measured at 41.3%, where production and adoption for high-voltage transmission and renewable energy integration have been steadily maintained.

The United Kingdom has been noted at 34.1%, reflecting consistent deployment in power transmission and grid applications, while the USA has been recorded at 30.5%, with production and utilization across renewable integration and high-voltage infrastructure being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The HVDC converter market in China is expanding rapidly at a CAGR of 48.5%, driven by increasing investments in renewable energy, long-distance electricity transmission, and grid modernization projects. China is focusing on integrating wind, solar, and hydro power into the national grid efficiently, which requires advanced HVDC converter technology. The country’s emphasis on energy transition, decarbonization, and smart grid deployment fuels demand for high-capacity, reliable, and efficient converter stations. Local manufacturers are innovating to provide modular and scalable solutions to support growing transmission needs. Government initiatives promoting renewable energy adoption and grid optimization further drive market growth. Strategic partnerships between utilities, technology providers, and infrastructure developers enhance technology integration. The increasing demand for stable, efficient, and long-distance power transmission ensures strong growth prospects for HVDC converters across China.

The HVDC converter market in India is growing at a CAGR of 44.9%, fueled by the rapid expansion of renewable energy and the need for long-distance power transmission. India is investing heavily in wind, solar, and hydroelectric power projects, creating demand for high-capacity and efficient HVDC converters. Grid modernization, inter-state electricity transfer, and smart grid initiatives are further driving adoption. Local manufacturers and international technology providers collaborate to deliver scalable and cost-effective solutions suitable for India’s evolving transmission infrastructure. Government policies promoting clean energy, decarbonization, and infrastructure development reinforce market growth. Increasing electricity demand from industrial, commercial, and residential sectors also contributes to the expansion of HVDC systems. The market benefits from technological innovations, such as voltage-source converters and multi-terminal HVDC systems, enabling better energy efficiency, grid stability, and operational reliability across India.

The HVDC converter market in Germany is expanding at a CAGR of 41.3%, driven by renewable energy integration, especially wind and solar, and the need for reliable long-distance power transmission. Germany’s energy transition strategy, Energiewende, emphasizes the reduction of carbon emissions, leading to increased deployment of HVDC systems. Advanced converter technologies, including voltage-source converters and multi-terminal solutions, are adopted to enhance grid stability and transmission efficiency. The country’s strong focus on smart grid infrastructure, industrial electricity consumption, and sustainable energy storage supports market growth. German manufacturers are investing in R&D to improve converter efficiency and reliability. Export opportunities to neighboring European countries and cross-border transmission projects further boost market expansion. Government incentives and regulations promoting renewable energy and grid modernization ensure steady adoption of HVDC converter technologies in Germany.

The HVDC converter market in the United Kingdom is growing at a CAGR of 34.1%, driven by renewable energy projects, long-distance transmission needs, and grid modernization initiatives. Offshore wind farms, interconnection projects, and integration of solar energy increase demand for HVDC systems. UK utilities and technology providers focus on deploying modular, scalable, and efficient converter solutions. Government policies supporting low-carbon energy, decarbonization, and smart grid development strengthen market growth. The market is also influenced by investments in cross-border power links with Europe, enhancing system reliability. Technological innovations such as voltage-source converters and enhanced control systems improve transmission efficiency. Increasing electricity demand, industrial energy consumption, and renewable energy targets ensure steady adoption of HVDC converters in the UK, providing reliable, efficient, and long-term power transmission solutions.

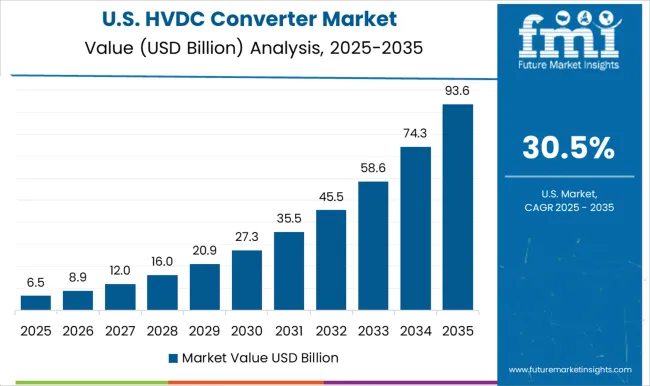

The HVDC converter market in the United States is expanding at a CAGR of 30.5%, driven by renewable energy integration, modernization of transmission infrastructure, and the growing need for efficient long-distance electricity delivery. The US is investing in large-scale wind, solar, and hydro projects, necessitating high-capacity HVDC converter deployment. Technological advancements, such as voltage-source converters and multi-terminal HVDC systems, enhance energy efficiency, grid stability, and operational reliability. Government initiatives supporting clean energy, decarbonization, and modernization of aging transmission networks further fuel market growth. Industrial and residential electricity demand is increasing, leading utilities to adopt efficient transmission solutions. Collaborations between manufacturers, utilities, and technology providers ensure scalable, reliable, and cost-effective HVDC converter solutions. Continuous innovation and adoption of smart grid infrastructure strengthen the US market, positioning it for steady growth in renewable energy transmission and grid modernization projects.

The high-voltage direct current (HVDC) converter market is a critical segment of modern power transmission, enabling efficient long-distance electricity transfer, grid interconnections, and integration of renewable energy sources. HVDC converters are essential for minimizing transmission losses, enhancing grid stability, and supporting smart grid and renewable energy initiatives.

Key players in this market include ABB, a global leader in HVDC technology, known for its extensive portfolio of converter solutions for utility and industrial applications. Siemens Energy offers advanced HVDC systems with high efficiency and reliability, catering to large-scale transmission projects. Hitachi and General Electric provide robust converter solutions with modular designs for flexible deployment in diverse power networks.

Toshiba delivers HVDC converters with high power ratings and reliability for both intercontinental and regional transmission systems. CG Power and Industrial Solutions and Hyosung Heavy Industries focus on delivering HVDC technology for emerging markets, combining cost-effectiveness with technological innovation. Bharat Heavy Electricals Limited (BHEL) and Rongxin Power are prominent players in Asia, providing locally manufactured solutions for large-scale power projects. Power Grid Corporation of India plays a dual role as a key operator and technology integrator for HVDC systems in India.

The market is witnessing growth due to the increasing demand for long-distance power transmission, renewable energy integration, and interconnection of national grids. Advances in voltage source converter (VSC) technology, modular multi-level converters (MMC), and improved control systems are driving the adoption of HVDC solutions globally, making these converters a cornerstone of next-generation power infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Capacity | > 1,000 MW - 3,000 MW, 500 MW, ≥ 500 MW - 1,000 MW, and > 3,000 MW |

| Configuration | Bipolar, Monopolar, Back to back, and Others |

| Converter Type | LCC, VSC, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, SiemensEnergy, Hitachi, GeneralElectric, Toshiba, CGPowerandIndustrialSolutions, HyosungHeavyIndustries, BharatHeavyElectricals, RongxinPower, and PowerGridCorporationofIndia |

| Additional Attributes | Dollar sales vary by converter type, including line-commutated converters (LCC) and voltage-source converters (VSC); by application, such as long-distance power transmission, renewable energy integration, and grid interconnections; by voltage class, spanning ±100 kV to ±800 kV and above; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by increasing renewable energy deployment, grid modernization, and demand for efficient long-distance power transmission. |

The global HVDC converter market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the HVDC converter market is projected to reach USD 96.4 billion by 2035.

The HVDC converter market is expected to grow at a 35.9% CAGR between 2025 and 2035.

The key product types in HVDC converter market are > 1,000 mw - 3,000 mw, 500 mw, ≥ 500 mw - 1,000 mw and > 3,000 mw.

In terms of configuration, bipolar segment to command 54.2% share in the HVDC converter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Cables Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

India HVDC Transmission Systems Market Trends – Growth & Demand 2025-2035

Australia HVDC Transmission Systems Market Analysis – Size, Share & Trends 2025-2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Converter Aluminum Foil Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Converter Aluminum Foil Manufacturers

Converter Transformer Market

Data Converters Market

DC-DC Converter Market Insights – Size, Demand & Forecast 2023-2033

Video Converter Software Market

Torque Converters Market Report - Growth, Demand & Forecast 2025 to 2035

Frequency Converter Market Growth – Trends & Forecast 2024-2034

EV Charger Converter Module Market Growth – Trends & Forecast 2024-2034

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

Aircraft DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA