The EV charger converter module market is experiencing robust expansion driven by the rapid electrification of transportation, increasing investments in charging infrastructure, and the growing adoption of high-efficiency power conversion technologies. Current market conditions reflect the surge in demand for fast and ultra-fast charging systems that ensure optimal energy transfer, thermal stability, and performance reliability.

Manufacturers are focusing on compact, modular, and high-power-density designs to enhance scalability and integration across diverse charging platforms. The future outlook is marked by government-backed incentives, technological advancements in silicon carbide (SiC) and gallium nitride (GaN) components, and the expansion of commercial charging networks.

Growth rationale is centered on improving charging speed, optimizing energy utilization, and extending equipment lifespan through advanced converter solutions With increasing deployment of electric vehicles across both personal and fleet segments, the market is set to witness consistent capacity additions, stronger standardization efforts, and enhanced interoperability across global charging ecosystems.

| Metric | Value |

|---|---|

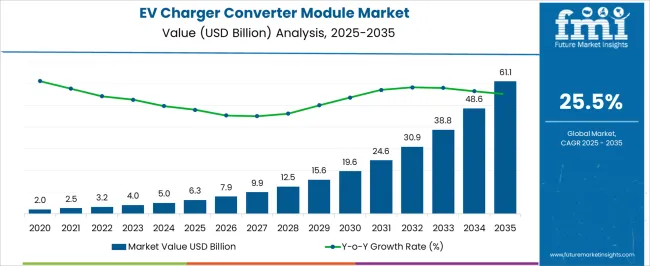

| EV Charger Converter Module Market Estimated Value in (2025 E) | USD 6.3 billion |

| EV Charger Converter Module Market Forecast Value in (2035 F) | USD 61.1 billion |

| Forecast CAGR (2025 to 2035) | 25.5% |

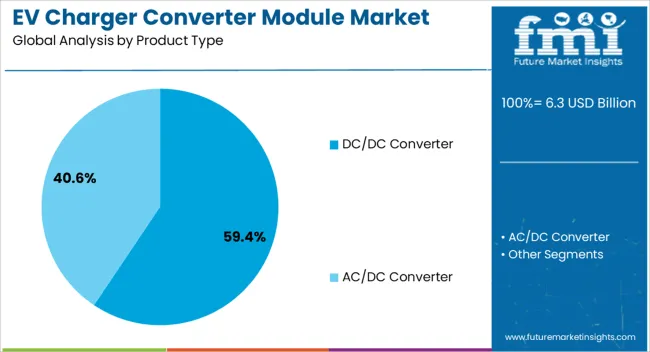

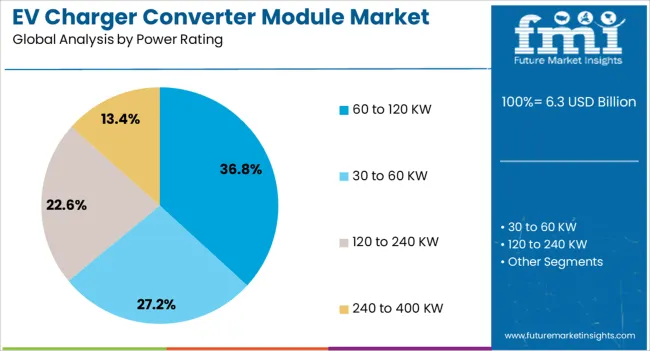

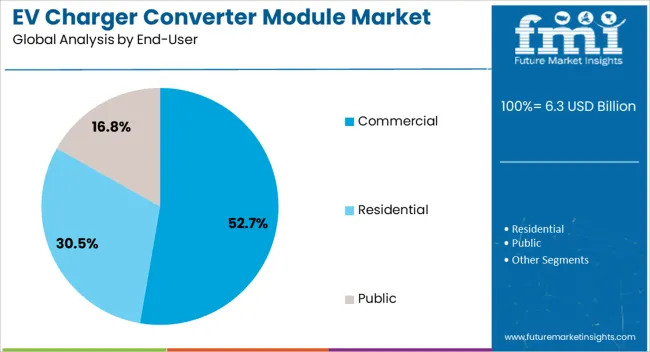

The market is segmented by Product Type, Power Rating, and End-User and region. By Product Type, the market is divided into DC/DC Converter and AC/DC Converter. In terms of Power Rating, the market is classified into 60 to 120 KW, 30 to 60 KW, 120 to 240 KW, and 240 to 400 KW. Based on End-User, the market is segmented into Commercial, Residential, and Public. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

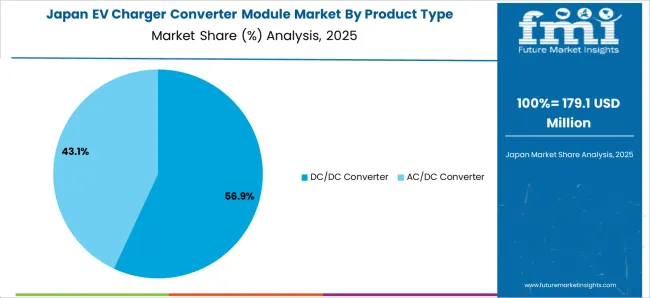

The DC/DC converter segment, holding 59.40% of the product type category, has established dominance due to its critical role in regulating voltage levels between different components within electric vehicle charging systems. The segment’s prominence is being driven by its efficiency in managing bidirectional power flow and ensuring stable energy delivery during high-load operations.

Continuous innovation in converter architecture and thermal management systems has improved power density and reduced losses. The segment’s scalability across various charger configurations, from residential units to high-capacity commercial stations, has strengthened adoption rates.

Manufacturers are increasingly leveraging wide bandgap semiconductor technologies to achieve compact design, faster switching, and superior thermal performance These technological upgrades are expected to maintain the DC/DC converter’s leadership position as charging infrastructure continues to expand globally.

The 60 to 120 kW power rating segment, representing 36.80% of the power rating category, has been leading the market owing to its balanced suitability for both urban public charging networks and highway fast-charging stations. Demand has been fueled by increasing deployment of medium-capacity chargers that offer optimal cost-performance balance for fleet and passenger EVs.

The segment benefits from widespread compatibility with current-generation vehicles and infrastructure standards. Manufacturers are emphasizing modular converter designs that can scale up to meet future higher-power requirements.

Integration of advanced cooling systems and improved conversion efficiency has further enhanced system reliability With rapid installation of commercial charging hubs and semi-public stations, this power class is expected to retain its dominance and contribute significantly to overall market growth.

The commercial segment, accounting for 52.70% of the end-user category, has emerged as the leading consumer base due to extensive adoption of EV charger converter modules in fleet operations, parking facilities, and retail charging stations. Growth has been supported by public-private partnerships and investments aimed at building nationwide charging infrastructure.

Demand from logistics operators and mobility service providers has increased, emphasizing reliability, fast turnaround times, and operational efficiency. Standardization in connector types and interoperability between different network providers has improved scalability and utilization.

The commercial segment’s prominence is further reinforced by the integration of energy management systems and dynamic load balancing solutions that optimize electricity consumption Continued expansion of charging networks across highways, urban centers, and commercial complexes is expected to sustain its leading market share over the forecast period.

Market to Expand Nearly 9.7X through 2035

The global EV charger converter module market is set to expand around 9.7X through 2035, amid an 8.7% rise in estimated CAGR compared to the historical one. Rapid penetration of electrification in the automotive sector is a prominent factor expected to drive demand for EV charger converter modules.

Key Factors Propelling EV Charger Converter Module Market Growth include

Latest EV Charger Converter Module Industry Trends

East Asia Remains Hub for EV Charger Converter Module Manufacturers

As per the latest analysis, East Asia is expected to retain its dominance in the global industry during the forecast period. It will likely hold around 36.4% of the global EV charger converter module market share in 2025. This is attributed to the following factors:

Government Support and Policies: East Asian countries like China, Japan, and South Korea have implemented ambitious policies and incentives to promote electric vehicles (EVs) and charging infrastructure. Substantial government investments, tax incentives, and subsidies for EV adoption and charging infrastructure development are stimulating market growth. China's "New Energy Vehicle" subsidy program, Japan's 'Electric Vehicle Road Map' initiative, and South Korea's 'Green New Deal' are prime examples of government support driving market expansion.

Technological Advancements: East Asia, particularly China, Japan, and South Korea, is renowned for its technological innovation in the automotive and electronics sectors. Continuous advancements in EV technology, including improvements in battery efficiency, charging speeds, and converter module performance, have bolstered market growth.

Rapid Urbanization and Infrastructure Development: East Asia's rapid urbanization, particularly in cities like Beijing, Tokyo, and Seoul, is increasing the need for sustainable transportation solutions. Governments and local authorities in these regions are investing heavily in building charging infrastructure, including public charging stations and fast-charging networks, to support the growing population of electric vehicles. This infrastructural development, coupled with the region's dense urban environment, creates a conducive market environment for EV charger converter modules, contributing to robust market growth in East Asia.

DC/DC Converters Witnessing Significant Demand

As per the report, DC/DC converter segment is expected to dominate the global EV charger converter module market with a volume share of about 61.3% in 2025. DC/DC converters are directly compatible with the DC output of electric vehicle batteries. This direct compatibility streamlines the charging process and enhances efficiency, making DC/DC converters indispensable in electric vehicle charging systems.

DC/DC converters typically exhibit higher efficiency and performance than AC/DC converters. They minimize energy losses during charging, resulting in faster charging times and reduced energy consumption, thereby attracting more users with fewer conversion stages involved.

DC/DC converters play a crucial role in fast-charging infrastructure, enabling high-power DC charging directly to the vehicle's battery. The dominance of DC/DC converters is expected to strengthen further as the demand for fast-charging solutions grows.

Global sales of EV charger converter modules grew at a CAGR of 16.8% between 2020 and 2025. Total market revenue reached about USD 4,054.3 million at the end of 2025. In the forecast period, the worldwide EV charger converter module industry is set to thrive at a CAGR of 25.5%.

| Historical CAGR (2020 to 2025) | 16.8% |

|---|---|

| Forecast CAGR (2025 to 2035) | 25.5% |

The global electric vehicle charger converter module market witnessed steady growth between 2020 and 2025. This was due to gradual adoption of electric vehicles, charging infrastructure expansion, evolving regulations, and technological advancements.

Over the forecast period, the global market for EV charger converter modules is set to register stupendous growth, totaling a valuation of USD 48,605.2 million by 2035. The future scope of the EV charger converter module industry looks promising owing to increasing environmental concerns and advancements in electric vehicle technology.

As more countries and consumers embrace electric vehicles, there will be a surge in demand for charging infrastructure, including converter modules, to support the growing EV ecosystem. This is expected to foster sales growth during the assessment period.

Continued innovations in converter module technology, such as improved power electronics and advanced charging algorithms, will enhance charging efficiency and reduce charging times. The development of wireless charging technology and bidirectional charging capabilities will open up new opportunities and further propel market growth, catering to evolving consumer preferences and requirements in the electric vehicle market.

Innovations in Fast Charging Technology Propelling Market Growth

Innovations in fast charging technology stand out as a unique driver propelling the growth of EV charger converter module market. Fast charging technology enables rapid charging of electric vehicles, significantly reducing charging times and enhancing convenience for EV owners.

As advancements in fast charging technology continue, converter modules capable of supporting higher charging speeds and power outputs will be in high demand. This demand is driven by the increasing preference for fast charging solutions among electric vehicle users, especially for long-distance travel and urban commuting.

The development of ultrafast charging stations capable of delivering high power outputs, such as 350 kW or more, demonstrates the market's shift toward faster and more efficient charging solutions. Innovations in fast charging technology will play a crucial role in driving the growth of the EV charger converter module industry in the future.

Integration of Renewable Energy Sources to Support Market Expansion

The integration of renewable energy sources is set to support expansion of the EV charger converter module market. The synergy between electric vehicles and renewable energy becomes increasingly prominent as the world transitions toward sustainable energy solutions.

Converter modules play a vital role in managing the interface between renewable energy sources such as solar and wind power and electric vehicle charging infrastructure. They contribute to reducing carbon emissions and promoting environmental sustainability by enabling the integration of renewable energy into charging networks.

Advancements in smart grid technology facilitate dynamic energy management, optimizing the utilization of renewable energy for electric vehicle charging. This driver is expected to gain momentum as governments and organizations worldwide prioritize clean energy initiatives, resulting in a surge in demand for converter modules tailored for renewable energy integration.

Emergence of V2G (Vehicle-To-Grid) Technology Boosting Global Market

The emergence of V2G (Vehicle-to-Grid) technology presents a unique driver propelling the EV charger converter module market growth. V2G technology allows electric vehicles to not only consume energy from the grid but also to return excess energy back to the grid when needed.

Converter modules play a crucial role in enabling bidirectional power flow between electric vehicles and the grid, facilitating V2G functionality. This technology offers several benefits, including grid stabilization, peak demand management, and revenue generation for EV owners through grid services.

As V2G adoption increases, the demand for converter modules capable of supporting bidirectional power flow will grow, driving market expansion. Regulatory support and pilot projects demonstrating the feasibility and benefits of V2G technology contribute to its adoption, further fueling the growth of the EV charger converter module market.

Supply Chain Disruptions

Supply chain disruptions, including material shortages, transportation challenges, and manufacturing delays, adversely affect the production and distribution of converter modules. The semiconductor shortage, in particular, impacts the availability of crucial components used in converter module manufacturing, leading to production bottlenecks and increased lead times.

The deployment of charging infrastructure, essential for electric vehicle adoption, may experience delays, hindering market growth. Automotive manufacturers have faced production cuts and delays due to semiconductor shortages, affecting the supply of electric vehicle components, including converter modules. Hence, the combination of supply chain disruptions and semiconductor shortages poses significant risks to the growth trajectory of the EV charger converter module market.

The table below shows the estimated growth rates of the top key countries. China, the United States, and Germany are set to record high CAGRs of 24.3%, 23.0%, and 21.6%, respectively, through 2035.

| Countries | Projected EV Charger Converter Module Market CAGR (2025 to 2035) |

|---|---|

| China | 24.3% |

| United States | 23.0% |

| Germany | 21.6% |

| Japan | 20.3% |

| India | 19.2% |

As per the latest analysis, China is set to remain a lucrative market for EV charger converter module manufacturing companies. This can be attributed to booming electric vehicle sector. Sales of EV charger converter modules in China are projected to soar at a CAGR of 24.3% during the forecast period.

The United States EV charger converter module market is poised to exhibit steady growth, with overall demand rising at 23.0% CAGR. This is attributable to rising adoption of electric and hybrid vehicles in the nation.

The EV charger converter module market in India is poised to thrive at a robust CAGR of 19.2% throughout the forecast period. It will likely hold a significant share of the South Asia Pacific industry by 2035.

Japan’s EV charger converter module market is projected to rise at 20.3% CAGR during the forecast period. This can be attributed to rising popularity of electric mobility in the country and favorable government support.

The section below shows the DC/DC converter segment leading the EV charger converter module industry. It is projected to thrive at 21.5% CAGR during the forecast period. Based on end-users, the commercial segment will likely exhibit a CAGR of 23.1% through 2035.

| Top Segment (Product Type) | DC/DC Converter |

|---|---|

| Predicted CAGR (2025 to 2035) | 21.5% |

Based on product type, the global electric vehicle (EV) charger converter module market is segmented into DC/DC converter and AC/DC converter. Among these, demand is expected to remain high for DC/DC converter modules.

As per the latest analysis, the DC/DC converter segment is expected to grow at a CAGR of 21.5% during the forecast period. Hence, it will continue to remain a key revenue-generation category in the market.

| Top Segment (End-user) | Commercial |

|---|---|

| Projected CAGR (2025 to 2035) | 23.1% |

As per the latest report, the commercial segment will likely maintain its leading position during the forecast period. It is anticipated to grow at a CAGR of 23.1% from 2025 to 2035. This can be attributed to several factors.

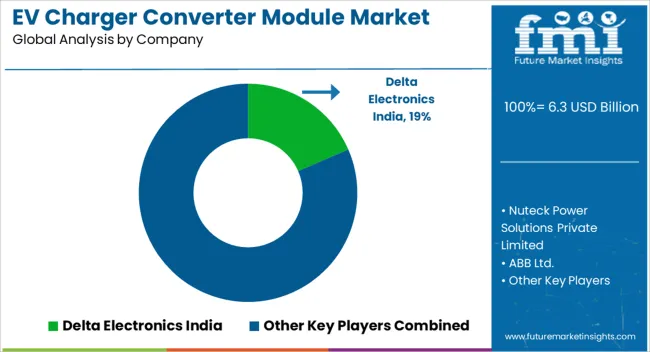

The global market for EV charger converter modules is fragmented, with leading players accounting for about 30% to 35% of the share. Nuteck Power Solutions Private Limited, Delta Electronics India, ABB Ltd., Shenzhen Mida EV Power Co., Ltd., Dana Limited, Axiom Energy Conversion, Siemens AG, Infineon Technologies AG, Robert Bosch GmbH, Toyota Industries Corporation, Denso Corporation, Shenzhen Infypower Co., Ltd., Mass-Tech, BHEL, and Phoenix Contact India Pvt. Ltd. leading manufacturers of EV charger converter modules listed in the report.

Key EV charger converter module companies are heavily investing in research and development to create innovative EV charger converter modules. They are also implementing strategies like facility expansions, acquisitions, distribution agreements, partnerships, and mergers to strengthen their footprint.

Recent Developments in EV Charger Converter Module Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 5,019.0 million |

| Projected Market Size (2035) | USD 48,605.2 million |

| Anticipated Growth Rate (2025 to 2035) | 25.5% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (unit) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Market Segments Covered | Product Type, Power Rating, End-user, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Chile, Germany, Italy, France, United Kingdom, Spain, BENELUX, NORDICS, Russia, Poland, Hungary, Balkan and Baltics, India, Association of Southeast Asian Nations, Australia and New Zealand, China, Japan, South Korea, Kingdom of Saudi Arabia, Other GCC Countries, Turkiye, South Africa, Other African Union |

| Key Companies Profiled | Nuteck Power Solutions Private Limited; Delta Electronics India; ABB Ltd.; Shenzhen Mida EV Power Co., Ltd.; Dana Limited; Axiom Energy Conversion; Siemens Ag; Infineon Technologies Ag; Robert Bosch GmbH; Toyota Industries Corporation; Denso Corporation; Shenzhen Infypower Co., Ltd.; Mass-Tech; BHEL; PHOENIX Contact India Pvt. Ltd. |

The global EV charger converter module market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the EV charger converter module market is projected to reach USD 61.1 billion by 2035.

The EV charger converter module market is expected to grow at a 25.5% CAGR between 2025 and 2035.

The key product types in EV charger converter module market are dc/dc converter and ac/dc converter.

In terms of power rating, 60 to 120 kw segment to command 36.8% share in the EV charger converter module market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA