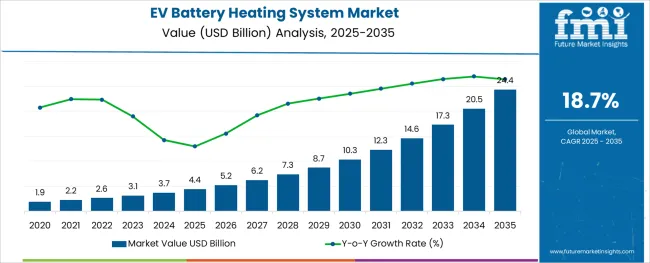

The EV Battery Heating System Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 24.4 billion by 2035, registering a compound annual growth rate (CAGR) of 18.7% over the forecast period.

The EV battery heating system market is gaining significant momentum as electric vehicle adoption accelerates globally, and the need for efficient thermal management becomes critical for performance and longevity. Increased consumer demand for higher driving ranges, faster charging times, and improved battery safety has placed battery heating and cooling systems at the center of innovation in the automotive sector.

Advancements in material science and integration of smart controls are enhancing the efficiency and reliability of these systems, ensuring consistent battery performance even in extreme temperatures. Future growth is expected to be shaped by stricter energy efficiency regulations, rising investments in electric mobility infrastructure, and continuous development of next-generation battery chemistries.

Collaborative efforts between automakers and thermal system suppliers are paving the way for innovative solutions that align with sustainability and operational efficiency objectives.

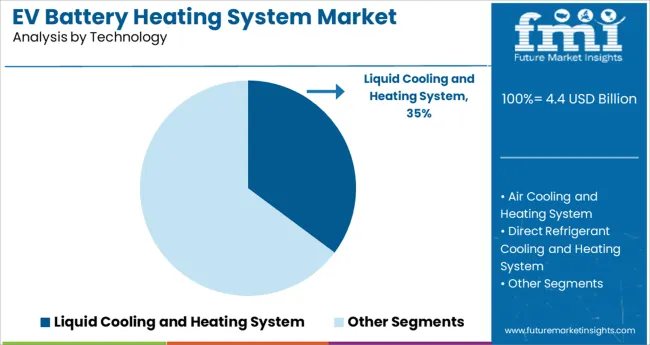

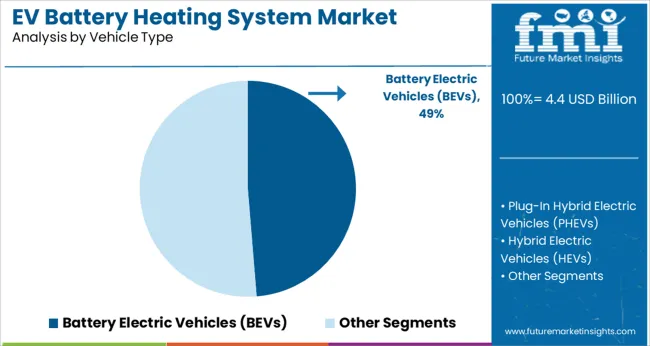

The market is segmented by Technology and Vehicle Type and region. By Technology, the market is divided into Liquid Cooling and Heating System, Air Cooling and Heating System, Direct Refrigerant Cooling and Heating System, Phase Change Material (PCM) System, Thermo-Electric System, and Others. In terms of Vehicle Type, the market is classified into Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Technology and Vehicle Type and region. By Technology, the market is divided into Liquid Cooling and Heating System, Air Cooling and Heating System, Direct Refrigerant Cooling and Heating System, Phase Change Material (PCM) System, Thermo-Electric System, and Others. In terms of Vehicle Type, the market is classified into Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by technology, the liquid cooling and heating system is projected to account for 35.2﹪ of the total market revenue in 2025, making it the leading technology segment. This leadership is attributed to its superior ability to maintain uniform temperature distribution across battery cells, thereby enhancing battery efficiency, safety, and lifespan.

The liquid medium’s high thermal conductivity has been leveraged to achieve rapid heat dissipation during high-load operations and effective heating in cold environments. Automakers have increasingly integrated liquid-based systems due to their compatibility with fast charging and high energy density batteries, both of which generate substantial thermal loads.

Compact designs and advancements in coolant formulations have also facilitated easier integration into vehicle architectures, reinforcing this segment’s dominance as the preferred solution for next-generation electric vehicles.

Segmented by vehicle type, battery electric vehicles BEVs are expected to command 48.7﹪ of the market revenue in 2025, sustaining their position as the leading vehicle type segment. This prominence has been driven by the global shift toward fully electric mobility, supported by government incentives, stringent emission regulations, and growing consumer preference for zero-emission vehicles.

BEVs have relied heavily on efficient battery heating systems to ensure optimal performance and reliability across diverse climatic conditions. Manufacturers have prioritized the integration of advanced thermal management solutions in BEVs to enable faster charging, reduce degradation, and enhance driving range, which are key purchasing factors for consumers.

The absence of internal combustion engines in BEVs has further underscored the critical role of dedicated heating systems, solidifying this segment’s leadership as the primary application area for battery heating technologies.

Despite the rising popularity of electric vehicles, many people who are in the market for a new car still have doubts about whether an EV would meet their everyday transportation needs. Vehicle manufacturers have responded to consumers' concerns about the range by developing electric vehicles with greater range.

The long-range Nexon EV introduced by Tata Motors on April 20, 2025, which features a larger 40kWh battery pack and a range of 400km, is a key example of the change in the market outlook. Battery heat management is necessary to keep the temperature of an electric car within a safe and functioning range due to the enormous amount of heat that larger battery packs in electric vehicles emit. The International Energy Agency (IEA) released a report in 2024 stating that the average range of electric vehicles has increased year over year.

As of 2024, the new battery-powered electric vehicle had an estimated average range of 350 kilometers, up from just 200 in 2020. As a result, the market for EV battery heating systems is anticipated to grow as more long-range vehicles are produced to meet the growing demand for better electric vehicle performance and safety. In addition, fast-charging infrastructure is rapidly expanding and improving, allowing for the quick recharging of electric vehicles. In January 2025, Voltempo, a major innovator in EV technology, released Hyper Charging, the fastest charging system in the world.

Fast-charging infrastructure is already being built by companies like Tesla and EVgo in many cities across North America. For instance, EVgo, the largest public fast-charging network for Electric Vehicles (EVs) in the USA, added more fast-charging stations across the country in February 2024 so that Tesla drivers could charge at more EVgo stations.

Hyundai, a South Korean global automaker, announced a partnership with retail giant Lotte Group and KB Asset Management in April 2025 to develop Korea's ultra-fast charging infrastructure.

Numerous national governments have launched programs to encourage the rollout of fast-charging infrastructure. In 2020, the government of India revised guidelines for EV charging stations to allow for greater flexibility in terms of charging infrastructure technology selection by project developers.

Public charging stations for electric vehicles are likely to soon support the faster charging standards of CHAdeMO and the Combined Charging System (CCS), in addition to the already-present Bharat standard.

Due to variations in the temperature distribution within the battery module, individual battery cells deteriorate at various rates, which might shorten the module's total lifespan. As lithium-ion batteries generate enormous heat at high current charge rates, the fast-charging technology is to blame for the battery's rapid degradation.

Owing to this, a thermal management system for batteries is necessary for effective heat removal and consistent temperature management. As a result, the EV battery heating system market is expanding owing to the increasing popularity of high-capacity batteries and rapid charging. [AB1]The information is not entirely related to the market. Try and add substantial information.

The global EV battery heating system market is expected to expand as a result of rising demand for high-tech alternative vehicles, such as lightweight ones. Lithium-ion battery technology, commonly utilized in vehicles, is widely favored by industry leaders and customers. The greater energy density, longer battery life, and increased resilience contribute to this. Similarly, such batteries are often used by businesses in thermal battery management systems to guarantee reliable performance and security.

Electronics, electric vehicles (EVs), and industrial machines are just some of the uses that automakers have found for these batteries. Furthermore, these batteries are vulnerable to dangers and can detect various malfunctions, including overheating, electric leaks, and the state of charge at temperatures in the charging/discharging environment.

Many developing nations, notably India, have been prompted by the COVID-19 crisis to prioritize domestic production of li-ion batteries and car battery heat management systems. As EV demand rises, nations are looking to produce their own Li-ion batteries, electronic components, and other necessities rather than relying on China to provide them.

Vehicle design and battery capacity dictate the thermal battery management system. As a result, there is a larger price tag attached to both the labor and materials required to install and produce new units for hybrid vehicles. Furthermore, the thermal components confront challenges, including confirming the thermal designs of components, developing the appropriate flow channels, decreasing power requirements, decreasing the overall vehicle weight and cost, the battery-specific coolant system, the complexity of the model and flow, etc.

High power also increases temperature, which increases the risk of fire and short circuits due to the increasing number of components present. The implementation of a thermal battery management system can also significantly increase the final cost of a product or application, which may diminish demand among price-conscious consumers. Accordingly, such difficulties in the rudimentary design of the vehicle battery thermal management system may impede the development of the global market.

By 2025, the passive system type is projected to have captured more than 78% of the global market's revenue share. As passive systems continue to be in high demand due to their ability to provide hundreds of watts of cooling and heating power, the demand for EV battery heating systems is predicted to maintain its dominance in the coming years.

In addition, the materials used in passive thermal management systems are less expensive than those used in active cooling systems. It is expected that the active type of market is expected to grow at the fastest rate during the forecast time frame because of the rising popularity of systems that use air or liquid to cool or heat the battery cells. The use of a BTMS (battery thermal management system) in a battery pack improves its performance and service life.

Over 87% of the market is projected to pertain to the passenger vehicle subsegment by 2025. Passenger EVs are widely available throughout the world. Hence this EV battery heating system segment is expected to maintain its dominant position and grow at the greatest CAGR during the forecast period. The expansion of the demand for EV battery heating systems is being fueled by numerous government programs promoting the adoption of electric vehicles.

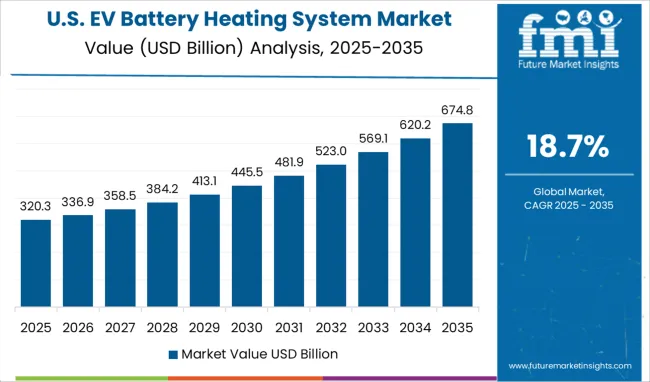

It is anticipated that the USA is likely to gain traction over the course of the forecast period due to broader and more ambitious initiatives by the state governments to migrate to electric vehicles. This is the primary factor driving the demand for EV battery heating systems in the North American region.

Significant tax benefits assisted in the early adoption of electric Light-duty Vehicles (LDVs) and assisted in the establishment of the electric vehicle manufacturing industry as well as the battery industry. Rebates on registration taxes and purchasing subsidies for electric vehicles were developed with the goal of narrowing the price gap between these types of vehicles and conventional ones. The expansion of the sales of EV battery heating systems in the country is being sped up by the many initiatives being taken by the government.

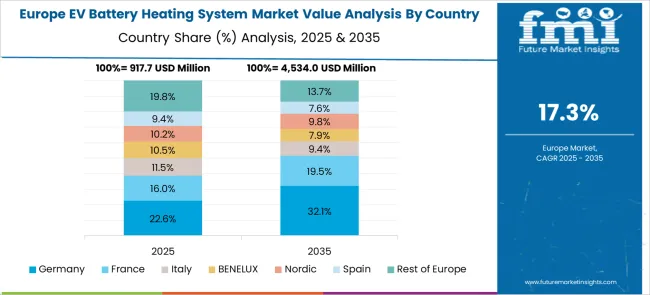

It is projected that Europe's regional market would experience considerable expansion over the course of the projection period due to the presence of numerous prominent alternative vehicles and component producers in the region. These manufacturers include BMW, Fiat, Daimler AG, Volkswagen, Mercedes, and Volvo. Countries such as Norway, Germany, France, and the Netherlands, as well as the United Kingdom, are among the most important contributors to the European market.

The percentage of households that have electric vehicles in Norway is the highest in the world, and the country is also third in terms of the total number of EVs sold worldwide. It is anticipated that Germany would hold the leading position in the European market with a global EV battery heating system market share of 10.2%.

The Asia-Pacific industry for EV battery heating systems is transitioning from its infancy into a period of rapid growth.

Figures show that in 2025, the number of electrically powered two-wheelers sold in China hit 53.375 million, an increase of 16.5% year over year; likewise, the number of lithium-powered two-wheelers sold hit 9.287 million, an increase of 22.6% year over year, with a penetration rate of 17.4%.

Other two-wheelers and battery swapping markets are expected to grow rapidly in 2025, driving the overall EV battery heating system market forward, but the growth rate of lithium two-wheelers is expected to be slower, primarily because the falling cost of lithium batteries and the dwindling competitive advantage of lead-acid batteries have enabled the rapid growth of the EV battery heating system market.

However, India has been aggressively testing the practicality of interchangeable batteries and pursuing battery switching on a national scale. The implementation of a battery swap policy and the creation of interoperability standards to support the electric vehicle (EV) ecosystem in India were announced in this year's budget. Degree.

Niti Aayog unveiled the preliminary Battery Swap Policy in April 2025. It's encouraging to see signals like this being sent in favor of the expansion of the battery swap ecosystem. The development of battery-swapping infrastructure has been given less attention at the national level than the creation of a widespread network of charging stations for EVs.

Battery-swapping solutions are becoming more common and have been successfully piloted, which creates an opening to create a solution-independent environment that levels the playing field for competing technologies and makes certain there is a selection of alternatives for people who use electric cars.

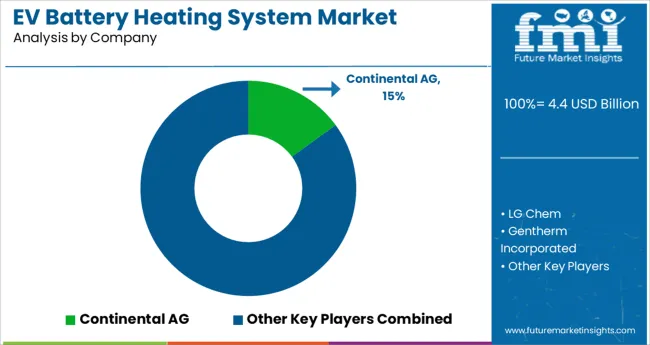

The EV battery heating system market is moderately fragmented due to the existence of multiple enterprises based in the same region. These market participants are implementing methods to increase their market shares, such as investments, collaborations, acquisitions, and mergers. Additionally, companies are investing in the research and development of enhanced battery cooling systems in order to support the increased and long-lasting performance of the battery systems. In addition to that, one of their primary focuses is on keeping their prices competitive.

Strategies for Business Expansion Employed by Principal Players in Order to Improve Their Positions in the Market

Hanon System is the world's leading automotive supplier and a firm that specializes in the supply of solutions for EV battery heating systems. The company was an industry pioneer when it came to offering a diverse product portfolio that specialized in thermal and energy management. In order to assist car manufacturers in selling electric, fuel cell, hybrid, and autonomous vehicles to markets all over the world, the firm began offering its comprehensive portfolio of solutions, which includes thermal battery management.

In a similar manner, Continental AG, the most significant participant in the automotive sector, kept expanding its product line to include e-mobility components while operating in the Chinese EV battery heating system market. The intelligent thermal management system for alternative vehicles is going to get its first run in volume production at the company soon.

Modine Manufacturing Company, continental ag, gentherm, Dana Limited, Hanon Systems, Valeo, MAHLE GmbH, Robert Bosch GmbH, Grayson, VOSS Automotive GmbH

The global ev battery heating system market is estimated to be valued at USD 4.4 billion in 2025.

It is projected to reach USD 24.4 billion by 2035.

The market is expected to grow at a 18.7% CAGR between 2025 and 2035.

The key product types are liquid cooling and heating system, air cooling and heating system, direct refrigerant cooling and heating system, phase change material (pcm) system, thermo-electric system and others.

battery electric vehicles (bevs) segment is expected to dominate with a 48.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Charger Converter Module Market Forecast Outlook 2025 to 2035

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

EV Coolants Market Analysis by Coolant Type, Category, Vehicle Type, and Region through 2025 to 2035

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA