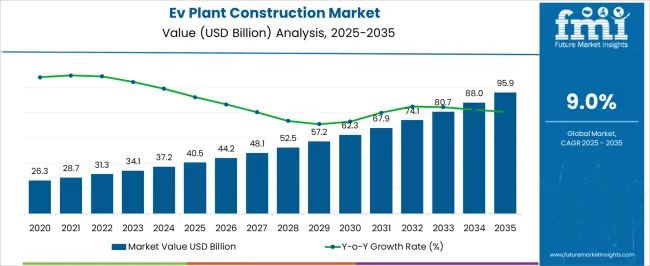

The EV plant construction market is expected to grow from USD 40.5 billion in 2025 to USD 95.9 billion by 2035, at a CAGR of 9.0%. During the early adoption phase (2020–2024), the market grew from USD 26.3 billion to USD 37.2 billion as automakers and industrial players began investing in electric vehicle manufacturing facilities. Initial growth was driven by government incentives, emission regulations, and increasing consumer demand for EVs. However, adoption was limited by high capital expenditure, technology uncertainties, and supply chain challenges. Early adopters focused on building pilot plants and establishing strategic partnerships to demonstrate scalable production capabilities and validate return on investment.

From 2025 to 2030, the market entered a scaling phase, with value rising from USD 40.5 billion to USD 62.3 billion. Accelerated investments were fueled by growing EV sales, the expansion of battery manufacturing capacities, and improved infrastructure readiness. Companies increasingly standardized plant designs and optimized operations to reduce costs, while new entrants and technology providers contributed to ecosystem expansion. Between 2030 and 2035, the market transitions into consolidation, reaching USD 95.9 billion. Major players strengthened positions through mergers, acquisitions, and technology integration. Market growth stabilizes as construction processes mature, supply chains become more efficient, and global production aligns with rising EV demand. Innovation focuses on plant efficiency, sustainability, and modular expansions, reflecting a mature and structured market environment.

| Metric | Value |

|---|---|

| EV Plant Construction Market Estimated Value in (2025 E) | USD 40.5 billion |

| EV Plant Construction Market Forecast Value in (2035 F) | USD 95.9 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The EV plant construction market is witnessing accelerated growth due to rapid electrification of mobility, increasing investments in EV manufacturing infrastructure, and strong policy backing across major automotive economies. Governments and private players are jointly allocating capital toward capacity expansion, localization of battery and drivetrain production, and integration of smart, sustainable factory models.

Demand is further elevated by the global transition away from internal combustion vehicles, which has triggered a race to scale up dedicated EV facilities. Increased funding through green bonds, government subsidies, and public-private partnerships is supporting faster project timelines and modular plant rollouts.

Emphasis on vertical integration and the shift toward in-house production of core EV components are expected to create further momentum in new plant developments. As OEMs move to secure supply chain resilience and regional production hubs, the market is poised for long-term, strategic expansion driven by capacity diversification and low-emission manufacturing priorities.

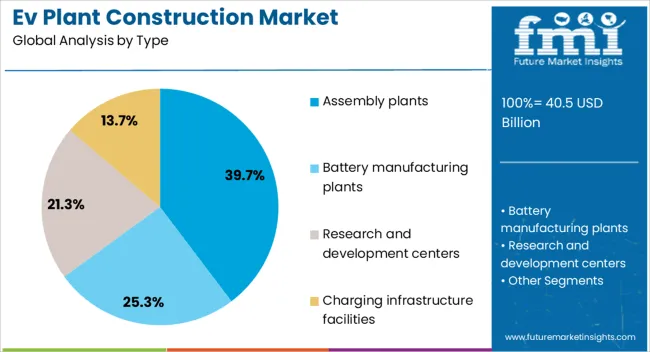

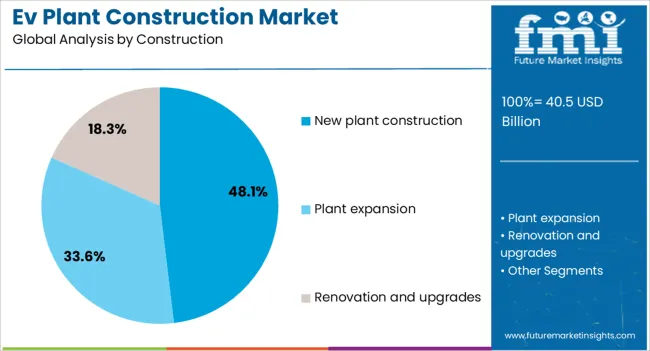

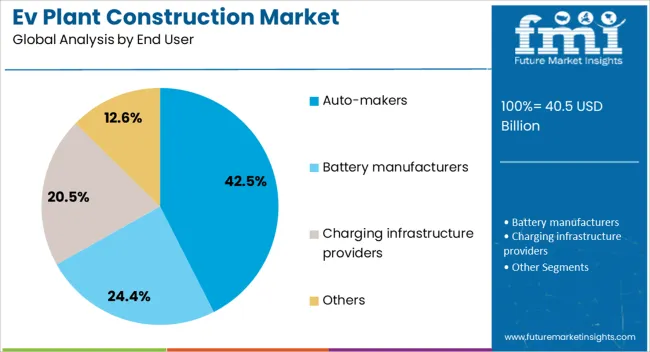

The EV plant construction market is segmented by type, construction, end user, and geographic regions. By type, the market is divided into Assembly Plants, Battery Manufacturing Plants, Research & Development Centers, and Charging Infrastructure Facilities. In terms of construction, the market is classified into New Plant Construction, Plant Expansion, and Renovation & Upgrades. Based on end user, the market is segmented into Automakers, Battery Manufacturers, Charging Infrastructure Providers, and Others. Regionally, the EV plant construction industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Assembly plants are projected to hold 39.70% of total revenue in the EV plant construction market by 2025, making them the leading facility type. Their dominance is being driven by heightened demand for integrated final assembly lines tailored to electric vehicles, enabling seamless coordination between battery packs, electric drivetrains, and advanced electronic control systems.

The need to redesign layouts to accommodate modular EV platforms and reduce production cycles has further increased focus on constructing dedicated assembly infrastructure. Automation readiness, flexibility to scale across vehicle variants, and compatibility with just-in-time production strategies are also contributing to this segment’s sustained investment attractiveness.

Additionally, energy-efficient construction designs and the integration of renewable power sources within these facilities are aligning with OEM sustainability mandates and ESG targets.

New plant construction is forecast to account for 48.10% of overall revenue in 2025, positioning it as the top construction category. This leadership is being shaped by the global surge in greenfield investments aimed at setting up future-ready, digitally connected EV production facilities.

New construction enables adoption of Industry 4.0 principles, such as real-time automation, predictive maintenance, and energy optimization. Manufacturers are leveraging the opportunity to design plants from the ground up with carbon-neutral materials, optimized layouts, and fully electrified utility infrastructure.

As brownfield limitations and retrofitting costs rise, companies are prioritizing greenfield projects to ensure long-term operational flexibility and technology integration. Strategic site selection based on proximity to raw materials, ports, and EV demand centers is also influencing the continued dominance of new plant construction in the market.

Automakers are expected to contribute 42.50% of total revenue in 2025, making them the dominant end-user segment in the EV plant construction market. This lead is being driven by major vehicle manufacturers transitioning their core production capabilities from internal combustion engine (ICE) to electric vehicle platforms.

Automakers are increasingly committing to full electrification roadmaps, requiring purpose-built facilities for battery integration, lightweight material handling, and precision robotic assembly. The strategic need for production autonomy, brand-specific EV architectures, and reduction of third-party dependency is pushing OEMs to invest directly in plant development.

Furthermore, in-house construction control allows alignment with corporate sustainability goals, localized employment generation, and alignment with regional compliance standards. As competition intensifies, automakers continue to lead investments in dedicated EV production infrastructure to retain market share and technology leadership.

The EV plant construction market is growing rapidly as automakers and governments invest in electric vehicle production facilities. Increasing demand for electric vehicles, supportive policies, and the need for modern manufacturing plants drive the expansion. Focus is on modular plant designs, efficient assembly lines, and integration of advanced manufacturing processes for batteries and powertrains. Strategic partnerships and turnkey solutions help companies accelerate production readiness. Regional investments in Asia-Pacific, Europe, and North America highlight the global push toward electrification and infrastructure development.

Automakers are investing heavily in building new EV production plants to meet surging consumer demand. These facilities require large-scale infrastructure, advanced assembly lines, and space for battery and powertrain production. Governments provide incentives such as tax breaks and grants to support plant construction, particularly in regions aiming to reduce carbon emissions. The expansion of EV plants enables automakers to localize production, reduce logistics costs, and accelerate time-to-market for electric models. Strategic site selection and integration with supply chain hubs further enhance operational efficiency, making plant construction a critical component of the EV industry’s growth.

Modern EV plants increasingly combine vehicle assembly with battery and powertrain manufacturing to streamline operations. This integration reduces transportation needs, lowers costs, and improves production flexibility. Facilities incorporate specialized equipment for cell assembly, module integration, and battery testing. Efficient layouts and workflows are designed to accommodate high-volume production while maintaining quality standards. Companies investing in integrated plants gain a competitive advantage by controlling critical components in-house, ensuring supply security, and meeting increasing production targets. This approach also allows faster adoption of new battery chemistries and EV models.

Plant constructors are focusing on modular and scalable layouts to accommodate future EV production growth. Modular designs allow manufacturers to expand capacity quickly without major overhauls. Scalable plants reduce initial capital expenditures and provide flexibility to adjust production based on market demand. These designs also support technological upgrades, such as automation in assembly lines and advanced testing stations, without disrupting operations. Modular and scalable construction approaches enhance operational efficiency, enable phased investment strategies, and ensure facilities remain adaptable as EV technology and production requirements evolve globally.

Automakers often collaborate with construction firms, equipment suppliers, and technology providers to expedite EV plant construction. Partnerships enable turnkey solutions, combining civil engineering, manufacturing setup, and production automation. These collaborations ensure compliance with safety and environmental regulations while meeting strict timelines. Joint ventures and alliances also allow sharing of best practices, reducing risks associated with high-capital projects. By leveraging external expertise, companies can achieve faster operational readiness, maintain cost efficiency, and ensure plants are equipped with advanced production capabilities, supporting the rapid scaling of electric vehicle manufacturing worldwide.

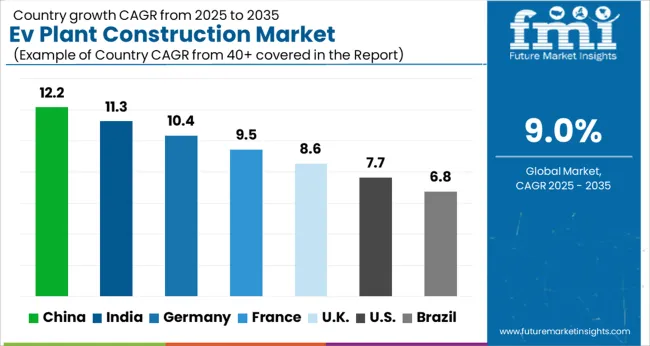

The global EV plant construction market is projected to grow at a CAGR of 9.0%, driven by the rapid expansion of electric vehicle manufacturing and supporting infrastructure worldwide. China leads the market with a growth rate of 12.2%, fueled by government incentives and large-scale EV production initiatives. India follows at 11.3%, supported by increasing domestic EV demand and investments in green manufacturing. Germany shows steady growth at 10.4%, leveraging its advanced automotive sector and transition toward sustainable mobility. The UK and USA record growth rates of 8.6% and 7.7%, respectively, reflecting expansion in EV manufacturing and charging infrastructure. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the EV plant construction market with a growth rate of 12.2%, driven by government incentives, renewable energy policies, and a booming electric vehicle industry. The focus is on expanding manufacturing facilities, battery production plants, and supporting infrastructure. Rising demand for EVs in both domestic and international markets encourages investments in large-scale production facilities. Advanced technologies, automation, and sustainable construction practices are being integrated into new plants. Collaboration with global EV manufacturers and suppliers further enhances the market. Urbanization, government subsidies, and green energy initiatives accelerate plant development. Strategic location planning near supply chains reduces operational costs and boosts efficiency.

India’s EV plant construction market grows at 11.3%, supported by rising electric vehicle adoption and government schemes. Investments focus on battery manufacturing, assembly lines, and charging infrastructure. Companies prioritize sustainable, energy-efficient plant designs to meet environmental regulations. Expansion of domestic EV production aims to reduce import dependency. Public-private partnerships and foreign collaborations drive technology transfer and innovation. Urban industrial zones and renewable energy integration enhance plant feasibility. Increasing consumer demand and government subsidies accelerate new plant developments. Manufacturers focus on modular, scalable, and flexible designs to adapt to future EV market growth.

EV plant construction market in Germany grows at 10.4%, driven by the nation’s focus on electric mobility and green industrial policies. Expansion of battery manufacturing, vehicle assembly, and charging infrastructure is a key focus. Companies integrate automation, Industry 4.0 technologies, and sustainable construction practices. Collaboration with European EV manufacturers and suppliers strengthens production capabilities. The government supports EV plant growth through subsidies and tax incentives. Urban industrial hubs and renewable energy adoption improve operational efficiency. Innovation in modular and scalable plant design ensures adaptability for future EV technologies. Branding and strategic investments boost the competitiveness of German EV plants.

The UK market grows at 8.6%, fueled by government incentives for EV manufacturing and infrastructure development. Focus areas include battery production, assembly lines, and renewable energy integration. Sustainable construction methods and energy-efficient designs are prioritized. Collaborations with international EV companies strengthen technology adoption. Urban industrial zones and logistics accessibility improve operational efficiency. Increasing consumer EV adoption drives demand for larger production capacities. Modular and scalable plant designs allow flexibility for future expansion. Government funding and subsidies encourage private investments in green manufacturing facilities.

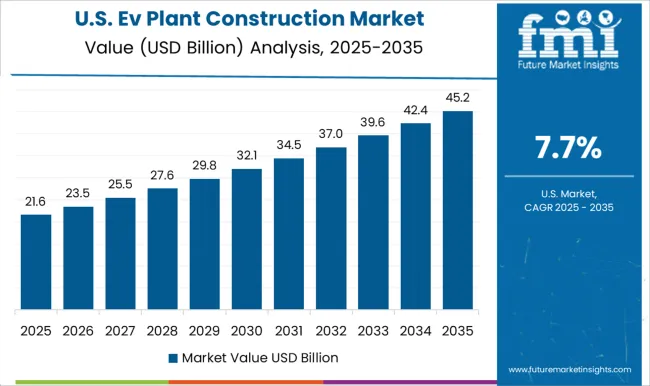

The USA EV plant construction market grows at 7.7%, driven by rising electric vehicle adoption and federal support for green energy initiatives. Investment focuses on battery production, assembly facilities, and charging infrastructure. Sustainable and energy-efficient designs are implemented to meet environmental regulations. Collaborations with global EV manufacturers enhance technology transfer and production efficiency. Urban industrial hubs and renewable energy integration improve operational performance. Modular and scalable plant layouts ensure adaptability for future EV technologies. Federal grants, tax incentives, and strategic partnerships further accelerate plant construction projects.

The Electric Vehicle (EV) Plant Construction Market is witnessing significant growth, fueled by the global transition toward sustainable mobility and the rapid adoption of electric vehicles. Governments worldwide are implementing stringent emission regulations and offering incentives to promote EV manufacturing, driving investments in dedicated EV production facilities.

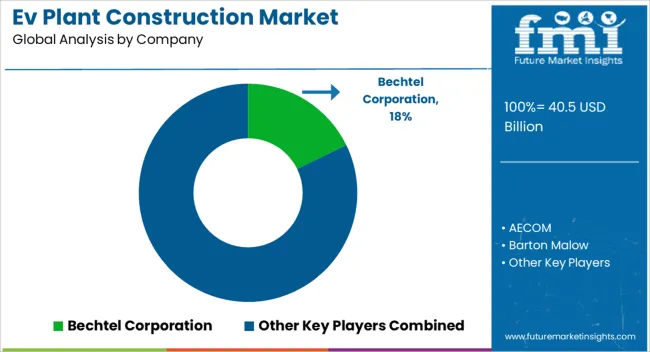

Key players in the market include Bechtel Corporation, renowned for large-scale industrial and manufacturing projects; AECOM, offering engineering, design, and project management solutions; and Fluor Corporation, specializing in turnkey construction for complex industrial facilities.

Jacobs Engineering and Turner Construction provide comprehensive planning, engineering, and construction management services, while Shimizu Corporation and Skanska bring expertise in sustainable and modular construction methods. Barton Malow, WSP, and Yates Construction are also prominent, contributing to the design and delivery of flexible, high-capacity EV manufacturing plants that meet evolving production requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.5 Billion |

| Type | Assembly plants, Battery manufacturing plants, Research and development centers, and Charging infrastructure facilities |

| Construction | New plant construction, Plant expansion, and Renovation and upgrades |

| End User | Automakers, Battery manufacturers, Charging infrastructure providers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bechtel Corporation, AECOM, Barton Malow, Fluor Corporation, Jacobs Engineering, Shimizu Corporation, Skanska, Turner Construction, WSP, Yates Construction |

| Additional Attributes | Dollar sales by type including battery manufacturing plants, electric vehicle assembly plants, and charging infrastructure facilities, application across passenger vehicles, commercial vehicles, and two-wheelers, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing electric vehicle adoption, government incentives, and rising investments in sustainable manufacturing infrastructure. |

The global EV plant construction market is estimated to be valued at USD 40.5 billion in 2025.

The market size for the EV plant construction market is projected to reach USD 95.9 billion by 2035.

The EV plant construction market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in EV plant construction market are assembly plants, battery manufacturing plants, research and development centers and charging infrastructure facilities.

In terms of construction, new plant construction segment to command 48.1% share in the EV plant construction market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-Based Protein Beverages Market Trends – Growth & Forecast 2025 to 2035

Implantable Drug Eluting Devices Market Size and Share Forecast Outlook 2025 to 2035

Knee Reconstruction Devices Market Growth – Trends & Forecast 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Spinal Implants and Devices Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

Mastectomy Reconstruction Implants Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

EV Charger Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA