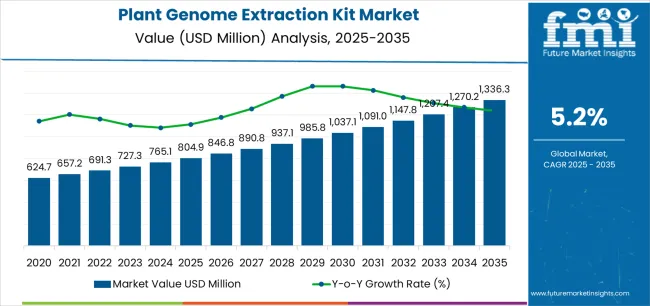

The global plant genome extraction kit market is valued at USD 804.9 million in 2025. It is slated to reach USD 1,336.3 million by 2035, recording an absolute increase of USD 531.5 million over the forecast period. This translates into a total growth of 66.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035. The overall market size is expected to grow by approximately 1.66 times during the same period, supported by increasing demand for plant genomics research and molecular breeding programs, growing adoption of precision agriculture and crop improvement technologies, and rising emphasis on food security and sustainable agriculture across diverse research institutions, agricultural biotechnology companies, and food testing laboratories.

Between 2025 and 2030, the plant genome extraction kit market is projected to expand from USD 804.9 million to USD 1,037.2 million, resulting in a value increase of USD 232.3 million, which represents 43.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing investment in plant genomics research and crop improvement initiatives, rising demand for high-quality DNA extraction solutions in molecular breeding programs, and growing emphasis on genetic diversity studies and trait identification. Agricultural biotechnology companies and research institutions are expanding their plant genome extraction capabilities to address the growing demand for reliable and efficient solutions that ensure DNA quality and experimental reproducibility.

From 2030 to 2035, the market is forecast to grow from USD 1,037.2 million to USD 1,336.3 million, adding another USD 299.2 million, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of next-generation sequencing applications and CRISPR-based plant editing technologies, the development of automated extraction systems and high-throughput processing capabilities, and the growth of specialized applications for phenotyping studies and climate-resilient crop development. The growing adoption of genomic selection strategies and digital agriculture integration will drive demand for plant genome extraction kits with enhanced efficiency and sample processing capabilities.

Between 2020 and 2025, the plant genome extraction kit market experienced steady growth, driven by increasing plant genomics research activities and growing recognition of genome extraction kits as essential tools for advancing crop improvement and understanding plant biology in diverse agricultural biotechnology and food security applications. The market developed as plant scientists and molecular biologists recognized the potential for extraction kit technology to obtain high-quality DNA, enable genomic studies, and support breeding objectives while meeting stringent quality requirements. Technological advancement in extraction chemistry and kit design began emphasizing the critical importance of maintaining DNA integrity and removing contaminants in challenging plant tissue samples.

| Phase | Period | Key Growth Driver | Tech Focus | Market Impact |

|---|---|---|---|---|

| Acceleration | 2025–2030 | Rising genomic research and crop improvement projects | Shift to semi-automated extraction kits | Rapid market expansion across agri-biotech hubs |

| Optimization | 2030–2035 | Adoption of NGS and precision breeding tools | Automation + contamination-resistant chemistries | Value-driven growth via efficiency and accuracy |

| Consolidation | Post-2035 | Integration of digital and molecular platforms | AI-enabled workflow monitoring | Mature market with focus on standardization and sustainability |

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 804.9 million |

| Forecast Value in (2035F) | USD 1,336.4 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

Market expansion is being supported by the increasing global demand for plant genomics research tools driven by food security challenges and climate change adaptation requirements, alongside the corresponding need for specialized extraction solutions that can enhance DNA quality, enable advanced genomic applications, and maintain experimental reliability across various plant genome research, molecular breeding, food testing, and agricultural biotechnology applications. Modern plant scientists and molecular biologists are increasingly focused on implementing genome extraction kit solutions that can handle complex plant tissues, deliver high-purity DNA, and provide consistent performance in demanding research conditions.

The growing emphasis on precision breeding and genomic selection is driving demand for extraction kits that can support high-throughput workflows, enable next-generation sequencing applications, and ensure comprehensive genetic analysis. Research institutions' preference for extraction systems that combine DNA quality with processing efficiency and cost-effectiveness is creating opportunities for innovative genome extraction kit implementations. The rising influence of gene editing technologies and synthetic biology is also contributing to increased adoption of genome extraction kits that can provide superior DNA preparation without compromising purity or downstream application compatibility.

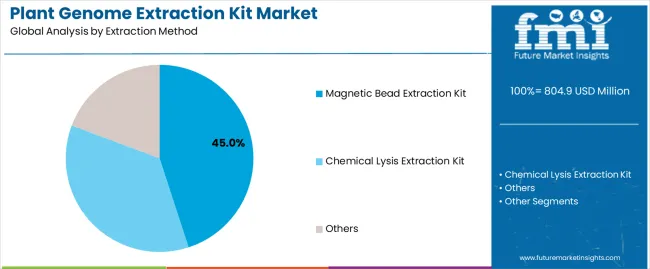

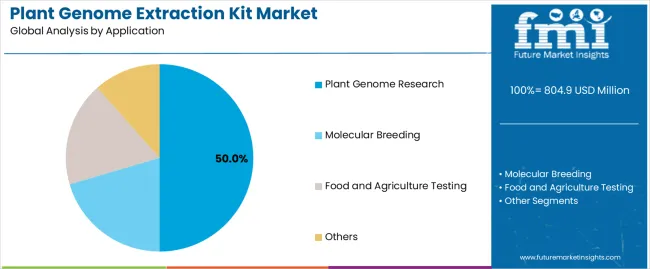

The market is segmented by extraction method, application, and region. By extraction method, the market is divided into magnetic bead extraction kit, chemical lysis extraction kit, and others. Based on application, the market is categorized into plant genome research, molecular breeding, food and agriculture testing, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

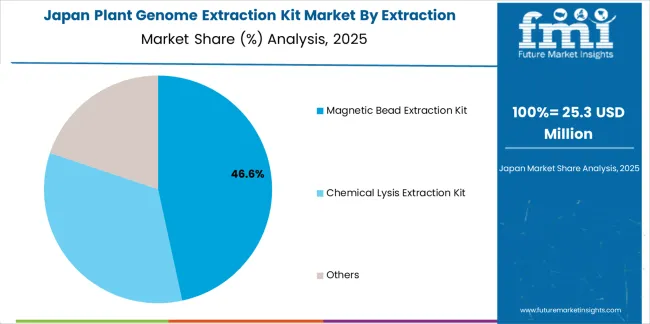

The magnetic bead extraction kit segment is projected to maintain its leading position in the plant genome extraction kit market with 45% market share in 2025, reaffirming its role as the preferred extraction technology for high-throughput genomics and automated processing applications. Plant genomics researchers and molecular breeding laboratories increasingly utilize magnetic bead extraction kits for their superior scalability, automation compatibility, and proven effectiveness in delivering high-quality DNA while maintaining processing efficiency. Magnetic bead technology's proven effectiveness and automation potential directly address the industry requirements for high-throughput DNA extraction and efficient laboratory workflows across diverse research platforms and sample types.

This extraction method forms the foundation of modern plant genomics research, as it represents the technology with the greatest contribution to laboratory efficiency and established performance record across multiple genomic applications and plant species. Agricultural biotechnology investments in genomic technologies continue to strengthen adoption among research institutions and breeding companies. With throughput pressures requiring efficient processing and consistent quality, magnetic bead extraction kits align with both performance objectives and operational requirements, making them the central component of comprehensive genomics laboratory strategies.

The plant genome research application segment is projected to represent the 50% market share of plant genome extraction kit demand in 2025, underscoring its critical role as the primary driver for extraction kit adoption across functional genomics studies, evolutionary biology research, and genetic diversity investigations. Plant genomics researchers prefer specialized extraction kits for DNA isolation due to their exceptional purity levels, downstream compatibility benefits, and ability to handle diverse plant tissues while supporting sequencing and genotyping objectives. Positioned as essential consumables for modern plant science, genome extraction kits offer both technical advantages and research enablement benefits.

The segment is supported by continuous innovation in extraction technologies and the growing availability of specialized kits that enable superior DNA quality with enhanced contaminant removal and reduced processing time requirements. Additionally, biotechnology companies are investing in comprehensive product development programs to support increasingly complex genomic applications and researcher requirements for reliable DNA preparation solutions. As plant genomics research expands and sequencing costs decline, the plant genome research application will continue to dominate the market while supporting advanced genomic utilization and scientific discovery optimization strategies.

The plant genome extraction kit market is advancing steadily due to increasing demand for plant genomics tools driven by crop improvement needs and growing adoption of molecular breeding practices that require specialized extraction systems providing enhanced DNA quality and processing efficiency benefits across diverse plant genome research, molecular breeding, food testing, and agricultural biotechnology applications. However, the market faces challenges, including high reagent costs and budget constraints in academic institutions, competition from in-house extraction protocols and alternative methods, and technical limitations related to sample complexity and contaminant removal from certain plant tissues. Innovation in extraction chemistry and automation technologies continues to influence product development and market expansion patterns.

The growing adoption of genomic selection strategies is driving demand for high-throughput DNA extraction solutions that address breeding program requirements including marker-assisted selection, trait identification, and genetic diversity assessment. Modern breeding programs require advanced extraction kit solutions that deliver superior DNA quality across multiple sample types while maintaining cost-effectiveness and processing speed. Agricultural biotechnology companies are increasingly recognizing the competitive advantages of genome extraction kit integration for breeding efficiency enhancement and genetic gain acceleration, creating opportunities for innovative extraction systems specifically developed for next-generation breeding applications.

Modern plant genomics laboratories are incorporating next-generation sequencing platforms and multi-omics strategies to enhance research capabilities, support systems biology investigations, and address comprehensive genomic questions through optimized DNA preparation and quality control. Leading biotechnology companies are developing extraction kits optimized for sequencing applications, implementing quality verification systems, and advancing purification technologies that improve sequencing success rates and data quality. These technologies improve research capabilities while enabling new scientific opportunities, including pangenome studies, epigenetic investigations, and comparative genomics. Advanced extraction kit integration also allows researchers to support comprehensive genomic objectives and scientific excellence beyond traditional gel-based genotyping methods.

The expansion of genomic screening programs, large-scale breeding initiatives, and phenotyping studies is driving demand for automated extraction systems with precisely engineered protocols and exceptional throughput capabilities. These advanced systems require specialized kit formulations with optimized magnetic bead characteristics that address automation requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in advanced liquid handling compatibility and robotic system integration to serve emerging high-throughput applications while supporting innovation in plant genomics and agricultural biotechnology industries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| United States | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

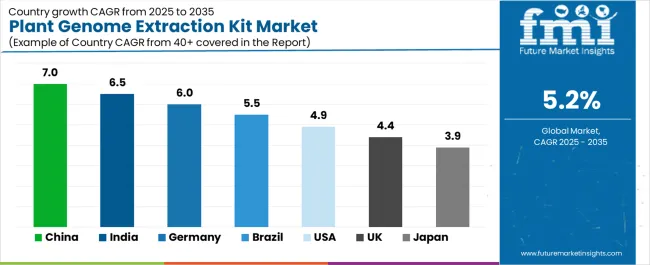

The plant genome extraction kit market is experiencing solid growth globally, with China leading at a 7.0% CAGR through 2035, driven by expanding agricultural biotechnology research capacity, growing investment in crop improvement programs, and increasing adoption of genomic technologies in breeding and research institutions. India follows at 6.5%, supported by agricultural research expansion, government crop improvement initiatives, and growing molecular breeding adoption. Germany shows growth at 6.0%, emphasizing plant science excellence, agricultural biotechnology leadership, and advanced breeding program integration. Brazil demonstrates 5.5% growth, supported by agricultural research investments, tropical crop genomics studies, and breeding program modernization. The United States records 4.9%, focusing on agricultural genomics innovation, crop improvement research, and food security initiatives. The United Kingdom exhibits 4.4% growth, emphasizing plant science research and agricultural biotechnology development. Japan shows 3.9% growth, supported by precision agriculture research and crop improvement technology adoption.

The report covers an in-depth analysis of 20 countries top-performing countries are highlighted below.

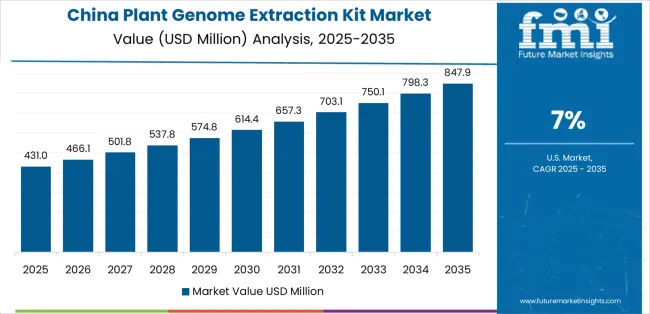

Revenue from plant genome extraction kits in China is projected to exhibit exceptional growth with a CAGR of 7.0% through 2035, driven by expanding agricultural biotechnology research capacity and rapidly growing investment in crop improvement programs supported by government food security initiatives and agricultural modernization policies. The country's massive agricultural research sector transformation and increasing focus on genomic technologies are creating substantial demand for plant genome extraction kit solutions. Major biotechnology companies and research institutions are establishing comprehensive genomics capabilities to serve both domestic research needs and international collaborations.

Revenue from plant genome extraction kits in India is expanding at a CAGR of 6.5%, supported by the country's agricultural research expansion, government crop improvement initiatives, and increasing demand for molecular breeding tools driven by food security objectives and agricultural productivity requirements. The country's comprehensive agricultural development programs and growing genomics capacity are driving extraction kit adoption throughout diverse research sectors. Leading biotechnology suppliers and international companies are establishing distribution and technical support facilities to address growing domestic demand.

Revenue from plant genome extraction kits in Germany is expanding at a CAGR of 6.0%, supported by the country's leadership in plant science research, strong agricultural biotechnology sector, and emphasis on precision breeding and genomic technologies. The nation's scientific excellence and research infrastructure are driving sophisticated extraction kit capabilities throughout academic and commercial sectors. Leading biotechnology companies and research institutes are investing extensively in advanced genomic technologies and specialized applications.

Revenue from plant genome extraction kits in Brazil is expanding at a CAGR of 5.5%, supported by the country's agricultural research investments, extensive tropical crop genomics programs, and growing modernization of breeding operations. The nation's comprehensive agricultural sector and crop diversity are driving demand for specialized extraction solutions. Research institutions and agricultural companies are investing in genomic capability development to serve tropical agriculture and export crop sectors.

Revenue from plant genome extraction kits in the United States is expanding at a CAGR of 4.9%, supported by the country's leadership in agricultural genomics innovation, extensive crop improvement research programs, and growing emphasis on food security and sustainable agriculture initiatives. The nation's comprehensive research infrastructure and biotechnology excellence are driving demand for advanced extraction solutions. Research universities and agricultural biotechnology companies are investing in genomic technology development and breeding program enhancement.

Revenue from plant genome extraction kits in the United Kingdom is expanding at a CAGR of 4.4%, driven by the country's plant science research excellence, agricultural biotechnology development programs, and growing emphasis on crop resilience and sustainable agriculture research. The nation's scientific infrastructure and research quality are supporting investment in advanced genomic technologies. Research institutions and biotechnology companies are establishing capabilities for crop genomics and breeding program support.

Revenue from plant genome extraction kits in Japan is expanding at a CAGR of 3.9%, supported by the country's precision agriculture research emphasis, crop improvement technology sophistication, and strong focus on quality and innovation in agricultural biotechnology. Japan's scientific excellence and technological sophistication are driving demand for high-quality extraction products. Research institutions and agricultural technology companies are investing in genomic approaches for crop improvement.

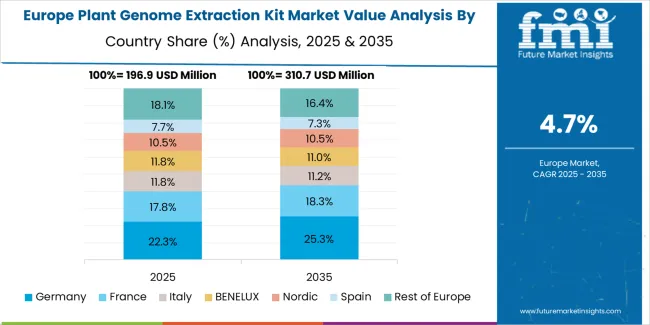

The plant genome extraction kit market in Europe is projected to grow from USD 299.7 million in 2025 to USD 482.1 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain leadership with a 26.8% market share in 2025, moderating to 26.5% by 2035, supported by plant science excellence, agricultural biotechnology strength, and strong research infrastructure.

France follows with 19.4% in 2025, projected at 19.6% by 2035, driven by agricultural research institutions, crop genomics programs, and breeding company presence. The United Kingdom holds 16.7% in 2025, rising to 16.9% by 2035 on the back of plant science research excellence and agricultural biotechnology innovation. Netherlands commands 12.3% in 2025, increasing to 12.5% by 2035, while Spain accounts for 9.2% in 2025, reaching 9.4% by 2035 aided by agricultural research expansion and crop genomics initiatives. Italy maintains 7.6% in 2025, up to 7.8% by 2035 due to agricultural biotechnology development and crop improvement programs. The Rest of Europe region, including Nordic countries, Belgium, Switzerland, and other markets, is anticipated to hold 8.0% in 2025 and 7.3% by 2035, reflecting steady development in plant genomics research, breeding programs, and agricultural biotechnology applications.

The plant genome extraction kit market is characterized by competition among established life science companies, specialized molecular biology suppliers, and regional biotechnology manufacturers. Companies are investing in extraction chemistry development, automation compatibility enhancement, product portfolio expansion, and application-specific kit optimization to deliver high-performance, reliable, and cost-effective plant genome extraction solutions. Innovation in magnetic bead technologies, buffer formulations, and high-throughput processing capabilities is central to strengthening market position and competitive advantage.

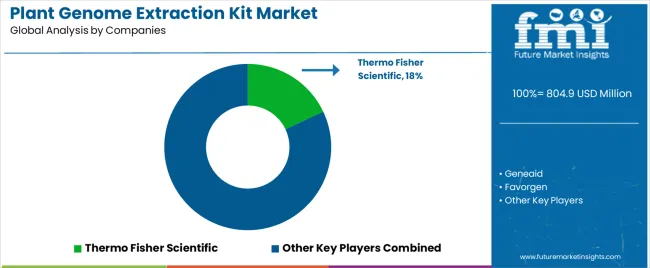

Thermo Fisher Scientific leads the market with 18% share with comprehensive life science solutions with a focus on research applications, quality assurance, and global distribution across diverse plant genomics and molecular biology applications. Geneaid provides innovative extraction kits with emphasis on cost-effectiveness and regional market service. Favorgen delivers reliable DNA extraction solutions with focus on plant tissue processing and downstream compatibility. Qiagen offers premium extraction systems with emphasis on automation integration and quality consistency. Bioneer provides molecular biology products with comprehensive kit offerings for genomics applications. Sigma-Aldrich specializes in research reagents and extraction solutions. Promega delivers molecular biology tools with advanced extraction technologies. ELK Biotechnology focuses on genomic DNA extraction systems. Beijing TIANGEN Biotech provides nucleic acid extraction products for Chinese markets. Shenzhen MGI Tech offers genomics solutions with extraction kit integration. Suzhou Beaver Biomedical specializes in molecular biology reagents. Shanghai Sangon Biotech provides comprehensive genomics products. Nanjing AccuBioMed focuses on DNA extraction technologies. Hangzhou Bioer Technology delivers molecular biology equipment and reagents. Guangzhou ACE Biotechnology specializes in genomic tools. Beijing Tsingke Biotech provides genomics services and reagents.

Plant genome extraction kits represent a specialized molecular biology product segment within agricultural biotechnology and plant science applications, projected to grow from USD 804.9 million in 2025 to USD 1,336.4 million by 2035 at a 5.2% CAGR. These specialized reagent kits primarily serve DNA isolation requirements in plant genomics research, molecular breeding programs, food testing laboratories, and agricultural biotechnology facilities where high-quality DNA extraction, experimental reproducibility, and downstream application compatibility are essential. Market expansion is driven by increasing plant genomics research investment, growing molecular breeding adoption, expanding next-generation sequencing applications, and rising demand for crop improvement solutions across diverse research and agricultural sectors.

How Research Funding Agencies Could Strengthen Plant Genomics Infrastructure?

How Industry Associations Could Advance Standardization and Best Practices?

How Genome Extraction Kit Manufacturers Could Drive Innovation and Market Leadership?

How Research Institutions Could Optimize Genomic Research Quality?

How Agricultural Biotechnology Companies Could Accelerate Crop Improvement?

How Academic Institutions Could Enable Scientific Discovery?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 804.9 million |

| Extraction Method | Magnetic Bead Extraction Kit, Chemical Lysis Extraction Kit, Others |

| Application | Plant Genome Research, Molecular Breeding, Food and Agriculture Testing, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 20 countries |

| Key Companies Profiled | Thermo Fisher Scientific, Geneaid, Favorgen, Qiagen, Bioneer, Sigma-Aldrich |

| Additional Attributes | Dollar sales by extraction method and application category, regional demand trends, competitive landscape, technological advancements in extraction chemistry, automation integration, high-throughput processing development, and DNA quality optimization |

The global plant genome extraction kit market is estimated to be valued at USD 804.9 million in 2025.

The market size for the plant genome extraction kit market is projected to reach USD 1,336.3 million by 2035.

The plant genome extraction kit market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in plant genome extraction kit market are magnetic bead extraction kit, chemical lysis extraction kit and others.

In terms of application, plant genome research segment to command 50.0% share in the plant genome extraction kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA