The Plant Based Meat Packaging Market is estimated to be valued at USD 502.6 billion in 2025 and is projected to reach USD 1168.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Plant Based Meat Packaging Market Estimated Value in (2025 E) | USD 502.6 billion |

| Plant Based Meat Packaging Market Forecast Value in (2035 F) | USD 1168.2 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The plant based meat packaging market is experiencing accelerated growth due to the surge in consumer preference for sustainable protein alternatives and the parallel demand for eco friendly and durable packaging solutions. Rising health consciousness, ethical consumption trends, and government backed sustainability initiatives are driving packaged plant based food sales across retail and food service channels.

Packaging innovations such as recyclable plastics, compostable films, and modified atmosphere trays are being increasingly adopted to enhance shelf life and maintain product integrity. Brands are also leveraging packaging as a differentiator through advanced labeling, tamper resistance, and convenience features that align with consumer expectations.

The market outlook remains robust as both established food producers and new entrants prioritize packaging solutions that not only safeguard product quality but also reinforce their sustainability commitments in an evolving global food ecosystem.

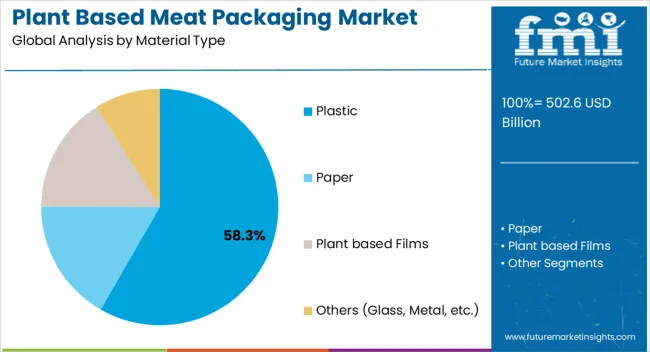

The plastic material type segment is projected to account for 58.30% of total market revenue by 2025, making it the most dominant material in use. This growth is attributed to its superior barrier properties, cost effectiveness, and wide availability, which are essential for maintaining freshness and preventing contamination in plant based meat products.

Lightweight characteristics and versatility across packaging formats have supported its strong presence in distribution channels. In addition, ongoing advancements in recyclable and bio based plastics are addressing environmental concerns, ensuring continued adoption.

As demand rises for durable and scalable packaging solutions, plastic remains the leading choice across the material type category.

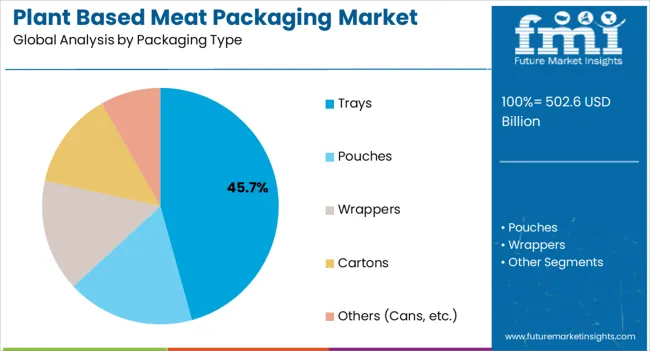

The trays packaging type segment is expected to hold 45.70% of the overall market revenue by 2025, positioning it as the leading packaging format. Trays are widely favored for their structural integrity, ability to maintain product shape, and compatibility with modified atmosphere packaging technologies that extend shelf life.

Their ease of stacking, storage, and retail presentation further supports widespread adoption. Consumer preference for clear visibility of products has also made trays the preferred option for plant based meats across retail shelves.

With continuous enhancements in recyclable and compostable tray materials, this packaging format continues to dominate due to its blend of practicality, safety, and consumer appeal.

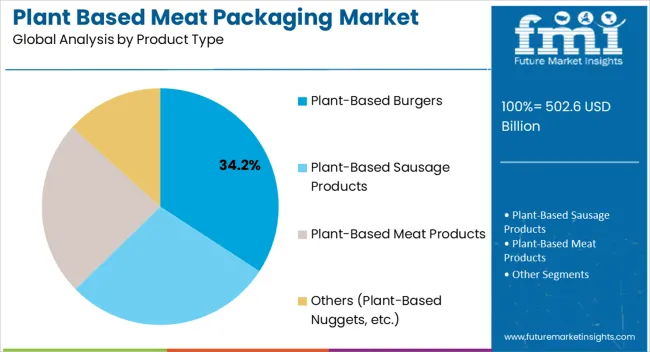

The plant based burgers product type segment is anticipated to capture 34.20% of total revenue by 2025, establishing itself as the most significant product application in this market. The segment’s leadership is underpinned by the popularity of plant based burger patties as flagship products within alternative protein offerings.

Their mainstream acceptance across quick service restaurants, retail, and home consumption has intensified the need for robust and attractive packaging. Trays and sealed film combinations are extensively used to preserve freshness, ensure hygiene, and appeal to consumers seeking convenience.

The strong brand positioning of plant based burgers as symbolic alternatives to conventional meat has reinforced their market share, making them the leading product type driving growth in the plant based meat packaging market.

From 2020 to 2025, the global plant based meat packaging market experienced a CAGR of 3.7%, reaching a market size of USD 502.6 million in 2025.

From 2020 to 2025, with the rise in the demand for packaged food, the growth of the market is observed. Also with the rise in concern towards healthy and hygienic foods, the growth of the plant based meat packaging can be seen. Additionally, the implementation of regulations by the government propelled the market growth during this period.

Looking ahead, the global plant based meat packaging industry is expected to rise at a CAGR of 8.8% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 987.0 million.

The plant based meat packaging industry is expected to continue its growth trajectory from 2025 to 2035, driven by increasing concerns over rising health issues with the consumption of animal based meat.

The North-America holds the largest market share, and also dominates the growth of the market. However, the growth of the market can be hindered by the high manufacturing cost of the plant based meat packaging manufacturing.

| Country | United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 13.8 million |

| CAGR % 2025 to End of Forecast (2035) | 1.8% |

The plant based meat packaging industry in the United Kingdom is expected to reach a market share of USD 13.8 million, expanding at a CAGR of 1.8% during the forecast period. The United Kingdom market is projected to experience growth owing to the rising popularity for the flexitarian diet.

The rise in the plant based meat will eventually rise the packaging market. Most of the consumers think that plant based diet are healthier, which is boosting the growth of the market in the country.

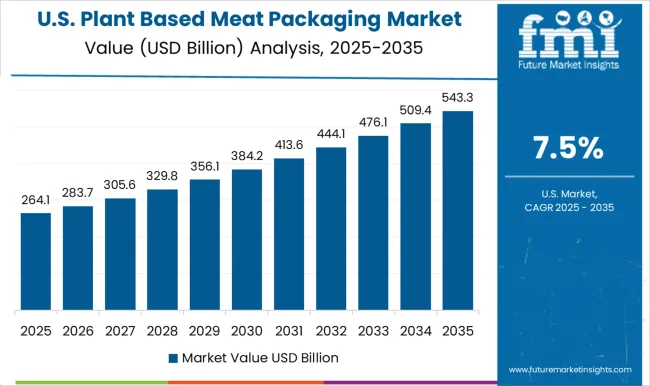

| Country | United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 1168.2 million |

| CAGR % 2025 to End of Forecast (2035) | 4.6% |

The plant based meat packaging industry in the United States is expected to reach a market share of USD 1168.2 million by 2035, expanding at a CAGR of 4.6%.

The plant based meat packaging industry in the United States is expected to dominate the growth of the market, with the highest number of consumers. Additionally, the presence of large number of manufacturers is also the reason for United States to hold the largest market share.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 131.3 million |

| CAGR % 2025 to End of Forecast (2035) | 6.0% |

The plant based meat packaging industry in China is anticipated to reach a market share of USD 131.3 million, moving at a CAGR of 6.0% during the forecast period. The rise of the market in the country is seen due to the companies investing in research and development, to manufacture products which can be 100% recycled.

The plastic segment is expected to dominate the plant based meat packaging industry with a CAGR of 5.4% from 2025 to 2035. This segment captures a significant market share in 2025 due to its cost-effectiveness, high efficiency, and low maintenance requirements.

The plastic segment comes under various types of products, which can be chosen according to the need of the manufacturer. With the good barrier property, the plastic segment dominates the growth of the market.

The pouch segment is expected to dominate the plant based meat packaging industry with a CAGR of 5.1% from 2025 to 2035. This segment captures a significant market share in 2025 due to the high demand for foods like meat, poultry, etc. Pouches helps to prevent the food from spoiling and combat food waste.

The plant based meat packaging industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Strategic Partnerships and Collaborations

Key players in the market collaborate and form partnership in order to gain market share; which can help companies to gain access to new technologies and markets.

Product Innovation

Companies are currently investing in research and development, which can help in enhancing efficiency and reduce cost of the product. It can help in competing with their competitors in the market.

Expansion into Emerging Markets

India and China are the emerging markets, which are growing at a significant rate. Top players are trying to contribute in the market, which can eventually help in company’s growth.

The global plant based meat packaging market is estimated to be valued at USD 502.6 billion in 2025.

The market size for the plant based meat packaging market is projected to reach USD 1,168.2 billion by 2035.

The plant based meat packaging market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in plant based meat packaging market are plastic, paper, plant based films and others (glass, metal, etc.).

In terms of packaging type, trays segment to command 45.7% share in the plant based meat packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Care Services Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Plant Milk Market Size and Share Forecast Outlook 2025 to 2035

Plant Growth Regulators Market Size and Share Forecast Outlook 2025 to 2035

Plant Activators Market Size and Share Forecast Outlook 2025 to 2035

Plant Phenotyping Market Size, Growth, and Forecast 2025 to 2035

Plant Sterol Esters Market Outlook – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA