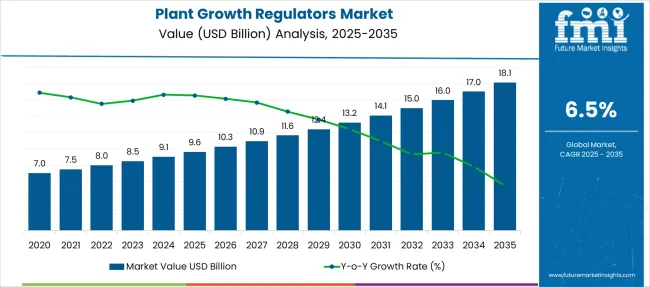

The Plant Growth Regulators Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Plant Growth Regulators Market Estimated Value in (2025E) | USD 9.6 billion |

| Plant Growth Regulators Market Forecast Value in (2035F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The plant growth regulators (PGRs) market is experiencing steady expansion, driven by the need to increase crop productivity, improve quality, and manage abiotic stress in high-value agricultural systems. Increased awareness regarding plant physiology and hormonal balance has influenced growers to adopt precise input management practices, especially in horticulture and specialty crops.

Policy support for sustainable agriculture and reduced reliance on synthetic inputs has further accelerated the adoption of PGRs across key cultivation zones. Major agribusiness companies are investing in bio-based and hybrid formulations that offer enhanced efficacy with minimal residue, aligning with regulatory compliance and food safety standards.

As climate variability intensifies and arable land becomes constrained, demand for plant growth solutions that support flowering, fruit setting, and overall plant vigor is expected to grow. The integration of PGRs into precision farming and controlled-environment agriculture is anticipated to shape future innovation and scale..

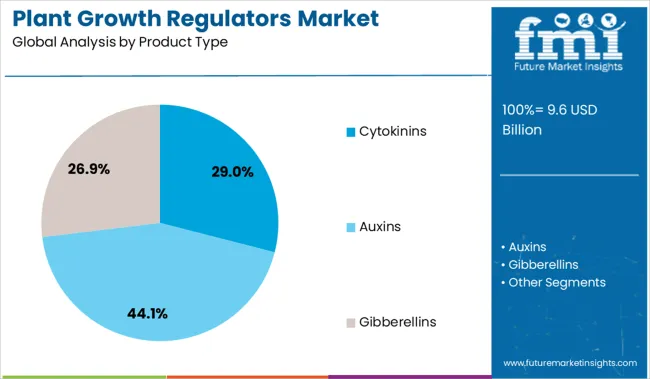

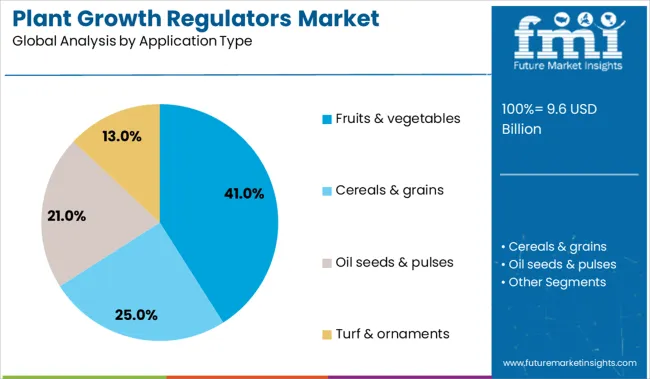

The plant growth regulators market is segmented by product type, application type, and geographic regions. The plant growth regulators market is divided by product type into Cytokinins, Auxins, Gibberellins, Ethylene, and Others. The plant growth regulators market is classified by application type into Fruits & vegetables, Cereals & grains, Oil seeds & pulses, and Turf & ornaments. Regionally, the plant growth regulators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cytokinins are anticipated to account for 29.0% of total revenue in the plant growth regulators market by 2025, positioning them as the leading product type segment. This leadership is being driven by their critical role in promoting cell division, delaying senescence, and enhancing shoot differentiation.

The increasing cultivation of high-value crops such as fruits, vegetables, and ornamental plants has heightened the demand for cytokinin-based formulations due to their ability to improve yield and visual appeal. Their compatibility with integrated crop management practices, including tissue culture and foliar nutrition programs, has further strengthened adoption.

Additionally, advancements in water-soluble cytokinin blends and micro-dosing technologies are improving precision and efficacy, making them highly suitable for both open-field and greenhouse operations..

The fruits and vegetables segment is projected to hold 41.0% of the total market share in 2025, making it the dominant application segment within the plant growth regulators market. This growth is being supported by rising consumer demand for quality produce with enhanced shelf life, uniform ripening, and better size consistency.

Growers in horticulture-intensive regions are increasingly incorporating PGRs to manage flowering, fruit drop, and maturation cycles. The sensitivity of these crops to environmental fluctuations has created a strong need for hormonal regulation to maintain productivity and reduce post-harvest losses.

Furthermore, export-driven markets are emphasizing cosmetic quality and compliance with residue limits, encouraging the use of regulated PGR formulations. As controlled-environment farming and high-density planting gain traction, the relevance of PGRs in fruits and vegetables is expected to deepen further..

Demand for plant growth regulators is accelerating in high-value crop segments, while sales of synthetic and biostimulant PGRs keep expanding as growers seek yield optimization, stress resilience, and harvest uniformity—especially in fruit, vegetables, and ornamental nurseries.

Demand for plant growth regulators in fruit orchards rose 23% YoY in 2025, especially in apples, citrus, and grapes across the USA, Spain, and Chile. Use of gibberellin inhibitors and cytokinin-based sprays improved fruit set by up to 18% and enhanced size uniformity by 22%. Commercial growers adopted ultra-low-volume PGR sprayer systems that cut application rates by 29%, saving on labor and active ingredient costs. Regulatory approvals in key markets allowed visible residue reduction, helping premium export growers reduce rejection rates by 14%. Uniformity gains also helped boost packhouse throughput by 19%.

Sales of biostimulant-based plant growth regulators surged 31% in 2025, driven by demand for abiotic stress tolerance as heat and drought events increased in major growing zones. Microbial-based PGRs containing seaweed extracts and microbial elicitors helped reduce plant water stress by 26% and extend root depth by 12%. Greenhouse tomato and cucumber growers in the Netherlands and California reported 17% higher yields when combining PGRs with controlled irrigation. Usage of organic market-approved PGRs in export vegetable lines rose 28%, as they supported residue-compliance in EU and Middle East markets. Growers also reported 21% lower unplanned quality sorting due to improved size and color uniformity.

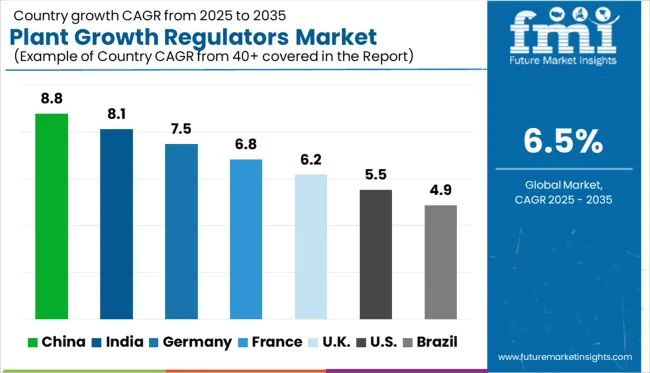

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

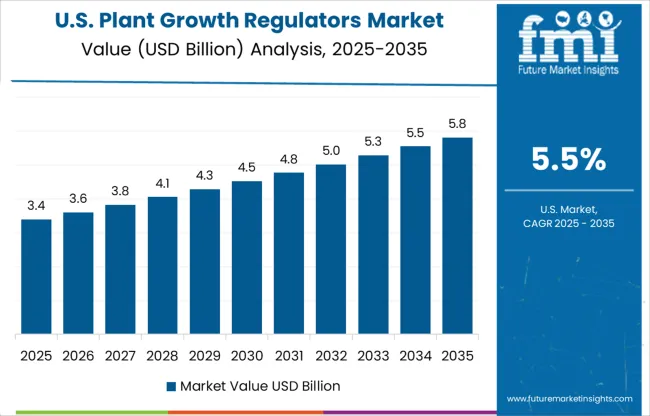

| USA | 5.5% |

| Brazil | 4.9% |

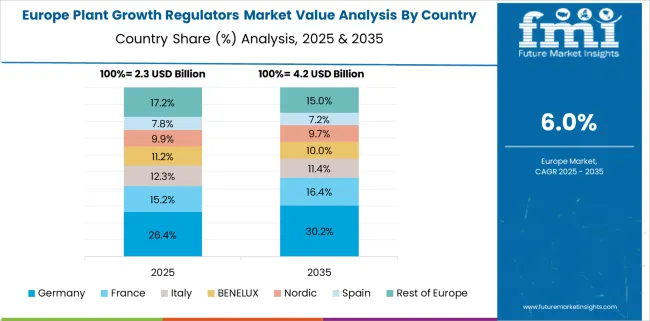

The global plant growth regulators market is forecast to grow at a CAGR of 6.5% between 2025 and 2035. China leads with a projected CAGR of 8.8%, exceeding the global average by 2.3 percentage points, fueled by advancements in precision agriculture and high-yield crop varieties. India follows at 8.1% (+1.6 pp), driven by increased horticultural activity and government-backed initiatives for sustainable farming. Germany shows steady growth at 7.5% (+1.0 pp), supported by expanding organic farming and greenhouse cultivation. The UK is expected to grow at 6.2% (–0.3 pp), slightly under the global baseline due to slower adoption among traditional farming sectors. The USA lags with a CAGR of 5.5% (–1.0 pp), constrained by regulatory hurdles and a plateau in demand for conventional growth enhancers. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is anticipated to witness a robust CAGR of 8.8% between 2025 and 2035, continuing its shift toward regulated crop yield optimization seen during 2020–2024. Rising focus on sustainable agriculture and high-value horticultural crops has elevated demand for auxins and cytokinins. Regional governments are supporting precision farming initiatives, integrating biostimulants and PGRs into agritech frameworks. The adoption is expanding in rice, fruits, and vegetables to enhance productivity and improve plant resistance.

India is projected to grow at a CAGR of 8.1% from 2025 to 2035, building upon the increased awareness among farmers during 2020–2024. Demand is strongest across sugarcane, cotton, and fruit segments, where ethylene and gibberellins are showing consistent performance improvements. The government’s focus on doubling farmer income and adopting climate-resilient practices is further accelerating the use of plant growth regulators. Rural retail channels and agro-dealers are expanding their PGR portfolios.

Germany is expected to expand at a CAGR of 7.5% through 2035, supported by sustainability-driven crop management reforms launched during 2020–2024. Horticulture remains a core application segment, particularly in vineyards and vegetable farming. The organic farming community is gradually adopting bio-based PGRs as alternatives to synthetic agents. Research institutes and cooperatives are conducting field trials to improve regulatory compliance and dose efficiency across crop varieties.

The UK is forecast to register a CAGR of 6.2% from 2025 to 2035, following a moderate base established between 2020 and 2024. Expansion will be fueled by the need to optimize yields without synthetic fertilizers. Urban vertical farming and protected agriculture are increasing their use of growth regulators to manage plant architecture and flowering cycles. Regulatory approvals of newer formulations have also made high-efficiency products accessible across smallholder farms.

The USA market is projected to grow at a CAGR of 5.5% during 2025–2035, maintaining a steady pace compared to the 2020–2024 period. Adoption remains high in turf management, fruit production, and row crops. With growing environmental regulations, demand for eco-friendly PGRs is gaining traction across commercial agriculture and landscaping segments. Universities and ag-tech startups are also contributing to formulation refinement and precision delivery technologies.

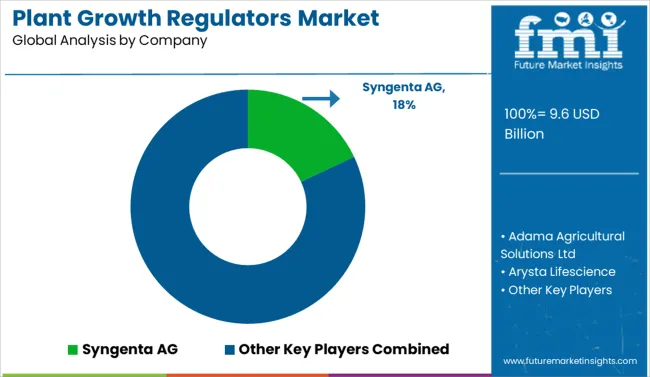

As of 2025, Syngenta AG leads the plant growth regulators market with a significant share, driven by robust sales across Asia Pacific and Latin America. Bayer AG and BASF SE follow closely, together accounting for approximately 26% of global revenues. North America contributes over 28% of total market demand, with cereals and grains comprising 41% of application volume. The global market is expected to grow at a CAGR of 5.7% through 2030, fueled by the rising use of auxins and gibberellins in precision farming. Arysta Lifescience and Valent Biosciences are expanding their biobased PGR portfolios, targeting a combined revenue increase of 12.3% year-over-year in 2025. Meanwhile, Nufarm and Adama are gaining share in horticulture segments, with projected regional growth in India and Brazil exceeding 8.5%.

In July 2024, Syngenta Biologicals partnered with Intrinsyx Bio to introduce seaweed‑based biostimulants across key markets, enhancing nutrient use efficiency and crop stress tolerance via natural plant activators.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Billion |

| Product Type | Cytokinins, Auxins, Gibberellins, Ethylene, and Others |

| Application Type | Fruits & vegetables, Cereals & grains, Oil seeds & pulses, and Turf & ornaments |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Syngenta AG, Adama Agricultural Solutions Ltd, Arysta Lifescience, BASF SE, Bayer AG, Dow, Nippon Soda Co Ltd, Nufarm Limited, Tata Chemicals Ltd, and Valent Biosciences LLC |

| Additional Attributes | Dollar sales by regulator type (auxins, cytokinins, gibberellins) and crop category, demand dynamics across conventional and organic farming, regional trends in Europe’s dominance and rapid Asia‑Pacific growth, innovation in bio-based and precision-delivery formulations, environmental impact of soil health and chemical residue regulation, and emerging use cases in stress-resilience and post-harvest quality enhancement. |

The global plant growth regulators market is estimated to be valued at USD 9.6 billion in 2025.

The market size for the plant growth regulators market is projected to reach USD 18.1 billion by 2035.

The plant growth regulators market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in plant growth regulators market are cytokinins, _fruits & vegetables, _cereals & grains, _oil seeds & pulses, _turf & ornaments, auxins, _fruits & vegetables, _cereals & grains, _oil seeds & pulses, _turf & ornaments, gibberellins, _fruits & vegetables, _cereals & grains, _oil seeds & pulses, _turf & ornaments, ethylene, _fruits & vegetables, _cereals & grains, _oil seeds & pulses, _turf & ornaments, others, _fruits & vegetables, _cereals & grains, _oil seeds & pulses and _turf & ornaments.

In terms of application type, fruits & vegetables segment to command 41.0% share in the plant growth regulators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Growth Hormone Inhibiting Hormone Drugs Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA