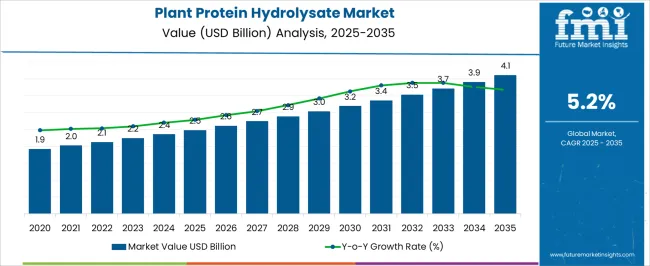

The plant protein hydrolysate market is projected to grow from USD 2.5 billion in 2025 to USD 4.1 billion in 2035, reflecting a CAGR of 5.2%. During the early adoption phase (2020–2024), the market expanded gradually from USD 1.9 billion to USD 2.5 billion as food manufacturers, nutraceutical companies, and beverage producers began exploring hydrolyzed plant proteins for improved digestibility and functional properties. This phase focused on small-scale trials, validating performance in formulations, and addressing production consistency.

By 2025, the market will reach USD 2.5 billion, signaling readiness for broader adoption and increasing integration into a variety of nutritional and food products. Between 2025 and 2035, the market transitions through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market surpasses USD 3.0 billion, driven by wider acceptance across protein-enriched foods, functional beverages, and dietary supplements. During the consolidation phase, growth moderates toward USD 4.1 billion by 2035 as leading suppliers strengthen their market presence and smaller players align or exit. The 5.2% CAGR underscores steady, consistent growth, reflecting a shift from experimental usage to mainstream integration, with hydrolyzed plant proteins becoming a standard ingredient for enhancing nutrition, taste, and texture across multiple product categories.

| Metric | Value |

|---|---|

| Plant Protein Hydrolysate Market Estimated Value in (2025 E) | USD 2.5 billion |

| Plant Protein Hydrolysate Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The plant protein hydrolysate market is shaped by multiple parent markets, each contributing to overall growth. The global plant-based protein market drives roughly 30%, as rising demand for plant-derived proteins directly influences hydrolysate adoption. Functional foods and beverages account for 20%, providing applications where hydrolyzed proteins improve digestibility, solubility, and nutritional value. The global soybean, pea, and other legume markets contribute 15%, supplying raw material for protein extraction. Nutritional supplements represent 10%, as hydrolysates are incorporated into powders, shakes, and fortified products.

Food processing equipment and enzyme solutions account for 8%, enabling controlled hydrolysis and consistent product quality. Dairy alternative products influence 7%, as hydrolysates enhance taste, texture, and performance in non-dairy applications. Health and wellness consumer trends contribute 5%, reflecting interest in protein-enriched diets. Finally, regulatory and quality assurance services make up 5%, ensuring compliance with labeling, safety, and manufacturing standards. Collectively, these parent markets form an ecosystem supporting growth across food, beverage, and nutrition sectors. Understanding the relative weight of each sector helps producers optimize sourcing, production, and marketing strategies, ensuring the hydrolysate market scales efficiently while meeting evolving consumer and industry demands.

The Plant Protein Hydrolysate market is experiencing robust growth due to the increasing global demand for plant-based nutrition and functional food ingredients. Rising health awareness and the adoption of protein-rich diets are driving the consumption of hydrolyzed plant proteins across food and beverage applications. The market is being shaped by advancements in extraction and enzymatic hydrolysis technologies, which improve digestibility, solubility, and functional properties of plant proteins.

Growing consumer preference for sustainable and vegan protein sources has further accelerated market adoption. The demand is also supported by the expanding sports nutrition, dietary supplement, and fortified food segments, where rapid absorption and high bioavailability are key considerations.

Increasing investments in plant-based product development and the expansion of health-conscious product portfolios by food manufacturers are creating new avenues for growth As consumers continue to prioritize clean-label, allergen-friendly, and high-quality protein sources, the market for plant protein hydrolysates is expected to maintain steady growth and expand into emerging regions over the coming years.

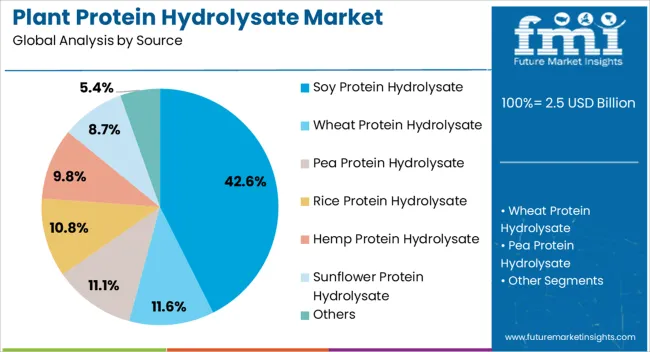

The plant protein hydrolysate market is segmented by source, form, application, and geographic regions. By source, plant protein hydrolysate market is divided into Soy Protein Hydrolysate, Wheat Protein Hydrolysate, Pea Protein Hydrolysate, Rice Protein Hydrolysate, Hemp Protein Hydrolysate, Sunflower Protein Hydrolysate, and Others.

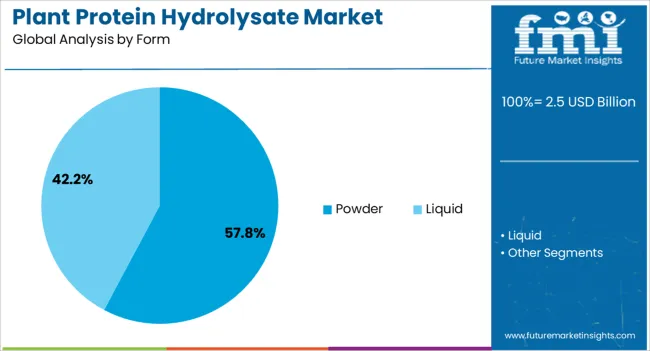

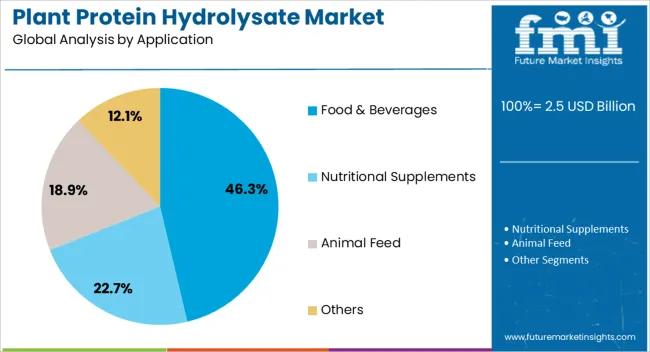

In terms of form, plant protein hydrolysate market is classified into Powder and Liquid. Based on application, plant protein hydrolysate market is segmented into Food & Beverages, Nutritional Supplements, Animal Feed, and Others. Regionally, the plant protein hydrolysate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Soy Protein Hydrolysate is projected to account for 42.60% of the Plant Protein Hydrolysate market revenue in 2025, making it the leading source segment. This prominence is being attributed to the high protein content, favorable amino acid profile, and functional versatility offered by soy proteins.

Adoption has been reinforced by the increasing consumer demand for plant-based protein alternatives in food and beverage formulations, where soy protein hydrolysates are valued for their solubility, emulsifying properties, and ability to enhance texture. Growth has been supported by the rising use of protein hydrolysates in sports nutrition, dietary supplements, and fortified foods, where digestibility and rapid absorption are essential.

The expansion of vegan and vegetarian product lines globally has further bolstered demand for soy protein hydrolysates. Future growth is expected to be driven by technological innovations in hydrolysis processes that improve sensory and functional properties while reducing allergenicity, making soy protein hydrolysates a preferred choice for manufacturers and consumers alike.

The Powder form segment is estimated to hold 57.80% of the Plant Protein Hydrolysate market revenue in 2025, positioning it as the leading form type. This leadership is being attributed to the convenience, stability, and versatility offered by powdered protein hydrolysates in various food and beverage applications. Powders allow precise formulation and easy incorporation into beverages, nutritional bars, meal replacements, and bakery products.

The growth of this segment is reinforced by the increasing consumer preference for ready-to-use, high-protein solutions that are shelf-stable and easy to transport. Powdered hydrolysates also facilitate accurate dosing, consistent functional properties, and extended shelf life, which are critical factors for both manufacturers and consumers.

With rising adoption of protein-enriched formulations in functional foods, dietary supplements, and health-oriented beverages, powder forms are becoming the most widely used format. Continuous improvements in processing technologies that enhance solubility, taste, and mixability are expected to sustain the dominance of powder forms in the plant protein hydrolysate market.

The Food and Beverages application segment is expected to contribute 46.30% of the Plant Protein Hydrolysate market revenue in 2025, making it the largest application sector. This leadership is being driven by the growing demand for functional, protein-fortified foods and beverages that cater to health-conscious consumers.

Hydrolyzed plant proteins are increasingly incorporated into sports drinks, meal replacement beverages, protein bars, bakery products, and dairy alternatives due to their high digestibility, solubility, and nutritional value. The expansion of the health and wellness food sector, combined with consumer preference for plant-based and allergen-friendly ingredients, has reinforced the use of plant protein hydrolysates in food and beverage formulations.

Manufacturers benefit from the ability to enhance texture, emulsification, and flavor while maintaining nutritional integrity. As the trend of protein enrichment and functional foods continues to gain momentum, the Food and Beverages segment is expected to retain its market dominance and drive further adoption of plant protein hydrolysates globally.

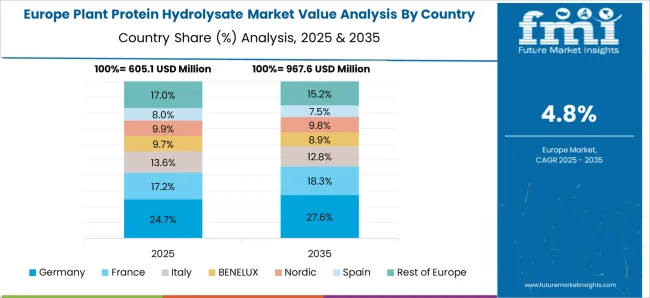

The plant protein hydrolysate market is growing due to rising demand for functional, easily digestible proteins in food, beverages, sports nutrition, and clinical nutrition applications. North America and Europe dominate with high-purity, specialty hydrolysates for infant formula, protein supplements, and clean-label products. Asia-Pacific shows rapid growth driven by increasing plant-based diets, protein-fortified foods, and health-conscious consumers. Manufacturers differentiate through enzymatic hydrolysis methods, amino acid profile optimization, solubility, and flavor masking. Regional variations in dietary habits, regulations, and processing technology influence adoption and competitive positioning globally.

Enzymatic hydrolysis is central to producing plant protein hydrolysates with superior solubility, bioavailability, and flavor profiles. North America and Europe focus on precise enzymatic processes for high-quality hydrolysates suitable for infant nutrition, functional beverages, and sports supplements. Asia-Pacific adoption emphasizes cost-effective hydrolysis methods for protein-enriched foods, snacks, and beverages, balancing performance and affordability. Differences in enzymatic techniques impact peptide size distribution, digestibility, and sensory characteristics. Leading suppliers invest in proprietary enzyme blends and process optimization for premium applications, while regional producers prioritize scalable, economical hydrolysis approaches. Processing technique contrasts drive adoption, product differentiation, and application versatility in global food, beverage, and nutrition sectors.

The amino acid composition, protein quality, and digestibility of hydrolysates are critical for market adoption. Europe and North America demand high-purity, balanced amino acid profiles and low allergenicity for clinical nutrition, sports supplements, and specialized diets. Asia-Pacific markets increasingly adopt hydrolysates to enhance protein content in mass-market foods and beverages. Differences in nutritional profile influence formulation flexibility, labeling claims, and end-use suitability. Suppliers providing hydrolysates with optimized bioavailability and digestibility gain premium adoption, while regional producers supply cost-efficient options meeting general dietary needs. Nutritional and digestibility contrasts shape product development, consumer preference, and competitiveness across functional foods, supplements, and medical nutrition globally.

Regulatory frameworks, allergen labeling, and food safety certifications significantly affect hydrolysate deployment. North America and Europe enforce strict guidelines for protein purity, allergen disclosure, and infant formula standards, influencing product approval and market entry. Asia-Pacific markets show diverse regulatory environments; developed regions adhere to global standards, while emerging markets focus on local compliance. Differences in regulatory requirements affect certification, labeling, and marketing strategies. Suppliers providing certified, compliant hydrolysates gain credibility and higher adoption, while regional producers focus on affordable, locally approved solutions. Regulatory contrasts determine adoption speed, market penetration, and strategic positioning across global plant protein hydrolysate markets.

Plant protein hydrolysates are applied across beverages, dairy alternatives, nutrition bars, supplements, and clinical nutrition. North America and Europe emphasize high-value applications requiring high solubility, neutral taste, and stability for functional and specialty nutrition. Asia-Pacific adoption is driven by fortified snacks, beverages, and plant-based products, balancing cost and functional performance. Differences in application versatility affect R&D priorities, production planning, and product segmentation. Suppliers offering specialized hydrolysates tailored to premium applications capture higher margins, while regional producers provide multipurpose, cost-effective solutions. Functional and application contrasts shape adoption, competitive differentiation, and growth across global food, beverage, and health markets.

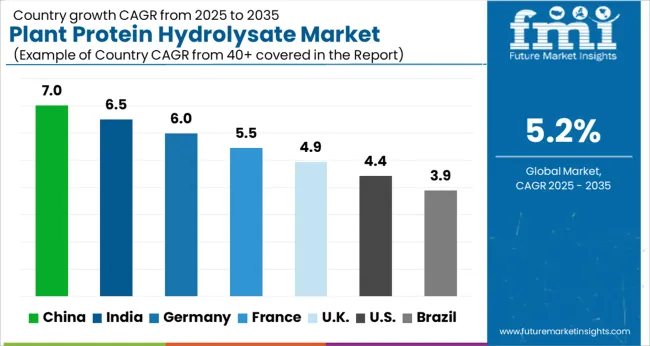

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global plant protein hydrolysate market was projected to grow at a 5.2% CAGR through 2035, driven by demand in food and beverage, nutritional supplements, and functional ingredient applications. Among BRICS nations, China recorded 7.0% growth as large-scale production and processing facilities were commissioned and compliance with food and safety standards was enforced, while India at 6.5% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 6.0% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 4.9% relied on moderate-scale operations for food, supplement, and ingredient applications. The USA, expanding at 4.4%, remained a mature market with steady demand across commercial and functional ingredient segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The plant protein hydrolysate market in China is growing at a CAGR of 7.0% due to rising demand from the food, beverage, and nutritional supplement industries. Manufacturers are producing hydrolyzed proteins from soy, pea, and other plant sources to improve solubility, digestibility, and functional properties in protein beverages, snacks, and meat alternatives. Growing awareness about health and plant based nutrition is driving adoption. Food processing companies are integrating hydrolysates to enhance protein quality and meet consumer expectations for functional and protein enriched products. Distribution through food ingredient suppliers, health stores, and e commerce platforms ensures wide accessibility. Research and development in enzymatic hydrolysis techniques is supporting innovation. China’s expanding food and beverage sector, combined with increasing interest in functional nutrition, makes it a key market for plant protein hydrolysates.

Plant protein hydrolysate market in India is expanding at a CAGR of 6.5% driven by increasing consumer interest in functional foods, protein enriched diets, and plant based nutrition. Manufacturers are producing hydrolyzed proteins from soy, pea, and other plant sources for protein powders, beverages, snacks, and bakery products. Urban populations are adopting protein rich and functional foods due to growing health consciousness. Food processors are investing in enzymatic hydrolysis technologies to improve protein quality, solubility, and digestibility. Distribution through ingredient suppliers, health stores, and online channels enhances accessibility. Rising demand for protein fortified products in the growing health and wellness sector is supporting market expansion. India’s increasing plant based food consumption and interest in functional nutrition are key drivers for growth in the hydrolyzed plant protein segment.

Plant protein hydrolysate market in Germany is growing at a CAGR of 6.0% due to rising demand for functional foods and plant based nutrition. Manufacturers are producing hydrolyzed proteins to improve digestibility, solubility, and functional properties in beverages, protein powders, and meat alternatives. Consumer preference for plant based diets, health focused nutrition, and natural ingredients is driving adoption. Food ingredient suppliers and retailers provide widespread access to hydrolyzed protein products. Companies are investing in enzymatic hydrolysis technologies to enhance protein quality and product performance. Germany remains a key European market due to strong interest in functional, natural, and plant derived protein solutions. Adoption is supported by awareness campaigns, health trends, and growing plant based food consumption.

The United Kingdom market is expanding at a CAGR of 4.9% with increasing adoption of plant based and functional protein products. Consumers are seeking protein enriched beverages, snacks, bakery items, and meat alternatives. Manufacturers are producing hydrolyzed plant proteins to improve digestibility, solubility, and functional performance. Distribution through food ingredient suppliers, health stores, and e commerce platforms ensures accessibility. Rising health consciousness and interest in plant based diets are driving demand. Food companies are incorporating protein hydrolysates to enhance product quality and meet consumer preferences. The United Kingdom continues to witness steady adoption of plant protein hydrolysates across functional and protein enriched food products.

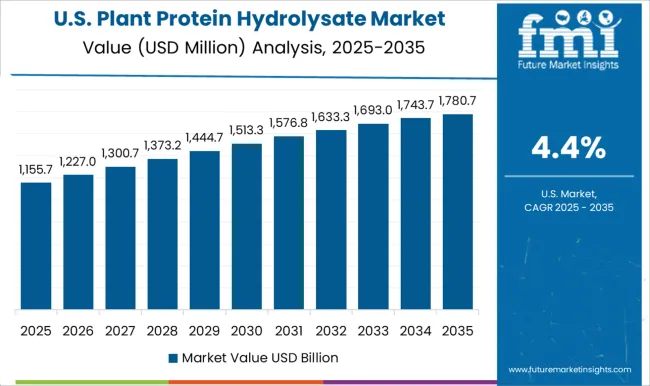

The United States market is growing at a CAGR of 4.4% due to increasing consumption of plant based and functional protein products. Manufacturers are producing hydrolyzed proteins from soy, pea, and other plant sources to improve digestibility, solubility, and application in beverages, snacks, and meat alternatives. Distribution through food ingredient suppliers, retail stores, and e commerce platforms ensures widespread availability. Health conscious consumers, vegetarians, and vegans are driving adoption. Food processing companies are integrating protein hydrolysates to enhance functionality and nutritional content. Growing demand for plant based nutrition and protein enriched foods continues to support market growth in the United States.

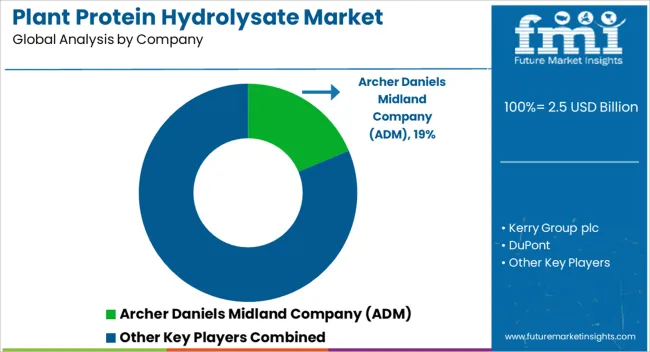

The plant protein hydrolysate market is expanding rapidly, driven by increasing consumer demand for plant-based nutrition, functional foods, and sports nutrition products. Key suppliers leading this market include Archer Daniels Midland Company (ADM), Kerry Group plc, DuPont, Ingredion Incorporated, Cargill, Evonik Industries AG, Koninklijke DSM N.V., Glanbia plc, Tate & Lyle plc, Bunge Limited, Roquette Frères, Brenntag AG, Associated British Foods plc, Novozymes A/S, and Givaudan. These companies specialize in developing high-quality hydrolyzed plant proteins that enhance digestibility, improve bioavailability, and offer functional benefits in beverages, nutrition bars, and dietary supplements.

Archer Daniels Midland (ADM) and Kerry Group focus on advanced protein extraction and enzymatic hydrolysis processes to deliver proteins with optimal amino acid profiles. DuPont and Ingredion Incorporated provide hydrolysates tailored for specialized applications, including infant formula, medical nutrition, and weight management products. Cargill and Evonik Industries AG emphasize sustainable sourcing of plant proteins and innovation in flavor-masking techniques, ensuring palatable and functional protein ingredients for end consumers. Global players such as Koninklijke DSM N.V., Glanbia plc, Tate & Lyle plc, and Bunge Limited invest in research to develop novel protein hydrolysates derived from soy, pea, rice, and other plant sources, catering to the growing vegan and health-conscious population. Roquette Frères, Brenntag AG, Associated British Foods plc, Novozymes A/S, and Givaudan focus on bioactive peptides, enzymatic hydrolysis efficiency, and ingredient formulation expertise.

Market growth is fueled by increasing consumer preference for plant-based diets, the rise of functional and fortified foods, and the demand for clean-label, allergen-free protein ingredients.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Source | Soy Protein Hydrolysate, Wheat Protein Hydrolysate, Pea Protein Hydrolysate, Rice Protein Hydrolysate, Hemp Protein Hydrolysate, Sunflower Protein Hydrolysate, and Others |

| Form | Powder and Liquid |

| Application | Food & Beverages, Nutritional Supplements, Animal Feed, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company (ADM), Kerry Group plc, DuPont, Ingredion Incorporated, Cargill, Evonik Industries AG, Koninklijke DSM N.V., Glanbia plc, Tate & Lyle plc, Bunge Limited, Roquette Frères, Brenntag AG, Associated British Foods plc, Novozymes A/S, and Givaudan |

| Additional Attributes | Dollar sales vary by protein source, including soy, pea, rice, and wheat; by product type, such as hydrolysates, concentrates, and isolates; by application, spanning sports nutrition, functional foods, infant formula, and dietary supplements; by end-use industry, including food & beverages, nutraceuticals, and pharmaceuticals; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for digestible plant-based proteins and functional nutrition products. |

The global plant protein hydrolysate market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the plant protein hydrolysate market is projected to reach USD 4.1 billion by 2035.

The plant protein hydrolysate market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in plant protein hydrolysate market are soy protein hydrolysate, wheat protein hydrolysate, pea protein hydrolysate, rice protein hydrolysate, hemp protein hydrolysate, sunflower protein hydrolysate and others.

In terms of form, powder segment to command 57.8% share in the plant protein hydrolysate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA