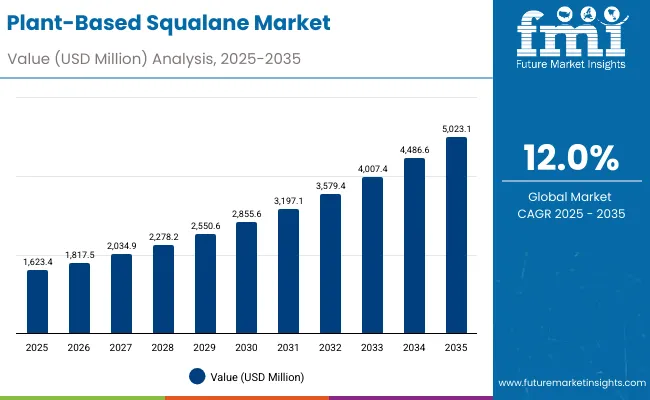

The Plant-Based Squalane Market is expected to record a valuation of USD 1,623.4 million in 2025 and USD 5,023.1 million in 2035, with an increase of USD 3,399.7 million, which equals a growth of 209% over the decade. The overall expansion represents a CAGR of 12.0% and a little over a threefold increase in market size.

Plant-Based Squalane Market Key Takeaways

| Metric | Value |

|---|---|

| Plant-Based Squalane Market Estimated Value in (2025E) | USD 1,623.4 million |

| Plant-Based Squalane Market Forecast Value in (2035F) | USD 5,023.1 million |

| Forecast CAGR (2025 to 2035) | 12.0% |

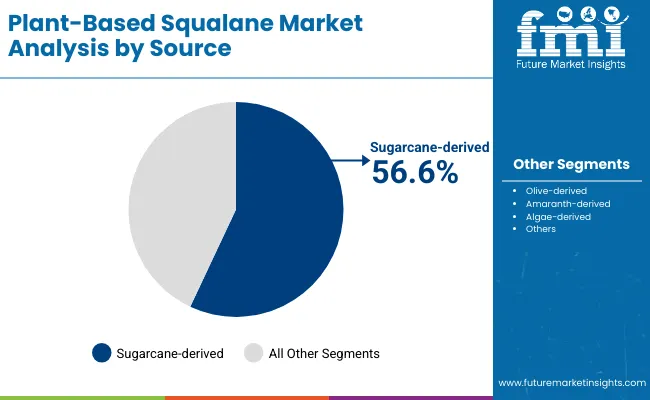

During the first five-year period from 2025 to 2030, the market increases from USD 1,623.4 million to USD 2,855.6 million, adding USD 1,232.2 million, which accounts for 36% of the total decade growth. This phase records steady adoption in skincare formulations, cosmetic serums, and sunscreens, driven by the rising demand for natural emollients and safer alternatives to petrochemical-derived moisturizers. Sugarcane-derived squalane dominates this period as it caters to over 56% of ingredient demand, supported by sustainable production and secure supply chains from Brazil and the USA

The second half from 2030 to 2035 contributes USD 2,167.5 million, equal to 64% of total growth, as the market jumps from USD 2,855.6 million to USD 5,023.1 million. This acceleration is powered by widespread deployment of B2B ingredient supply chains, digital-first distribution models, and strong uptake in Asia-Pacific personal care industries. Algae- and amaranth-derived squalane begin gaining share in the latter half due to biotech innovation and premium branding in niche cosmetics. Finished products marketed via e-commerce and specialty beauty stores also expand, capturing urban millennial and Gen-Z consumer demand for sustainable skincare.

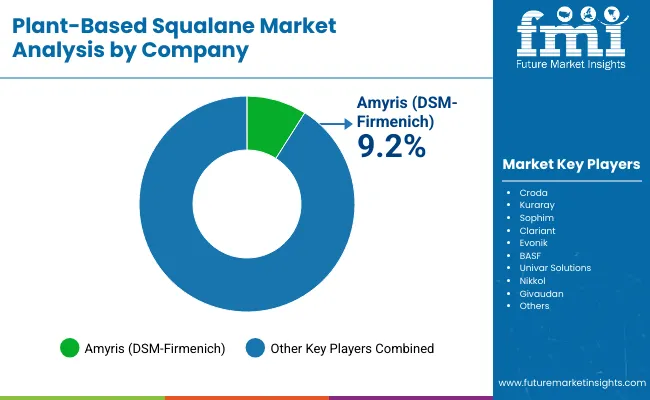

From 2020 to 2024, the Plant-Based Squalane Market grew from under USD 1,200 million to nearly USD 1,600 million, driven largely by sugarcane-based production and rising adoption in cosmetic moisturizers. During this period, the competitive landscape was dominated by Amyris, holding around 9% global share, alongside European companies such as Croda, Sophim, and BASF leveraging olive-derived sources. Differentiation relied on purity, natural positioning, and price stability, while algae-derived squalane was still in early development stages. Service-led models, such as customized formulations and biotech licensing, contributed minimally, representing less than 10% of value.

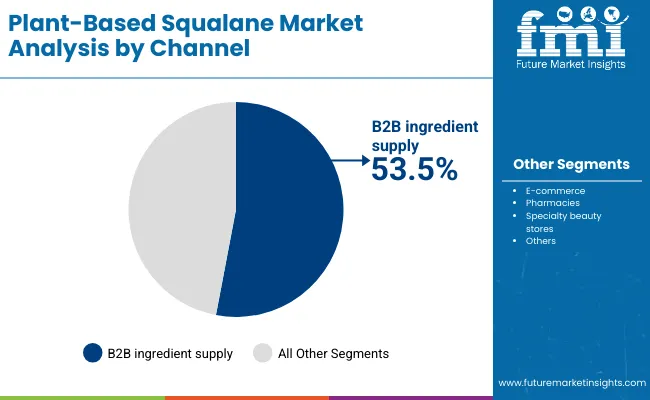

Demand for plant-based squalane will expand to USD 1,623.4 million in 2025, and the revenue mix will shift as B2B ingredient supply grows to over 53% share. Traditional players face rising competition from biotech firms introducing algae-based squalane, marketed as carbon-neutral and premium grade. Global leaders are pivoting towards hybrid models that combine ingredient supply with branded finished products through digital-first channels. E-commerce-focused entrants, particularly in Asia, are capturing consumer-facing segments. The competitive advantage is moving away from raw material efficiency alone to ecosystem integration, sustainability certification, and consumer brand strength.

Advances in fermentation-based production and sugarcane bio-refining have improved scalability, allowing secure ingredient supply chains at lower cost. Sugarcane-derived squalane has gained popularity due to its sustainability credentials, low volatility, and compatibility with cosmetic formulations. The rise of natural skincare and "clean beauty" movements has contributed to enhanced demand across moisturizers, serums, sunscreens, and oils. Industries such as pharmaceuticals, personal care, and premium cosmetics are driving demand for squalane that can integrate seamlessly into dermatological formulations.

Expansion of vegan-certified cosmetics and sustainable sourcing regulations has fueled market growth. Innovations in algae-derived biotechnology and amaranth oil processing are expected to open new premium segments. Growth is expected to be led by sugarcane-derived sources in the early decade, while B2B ingredient supply dominates the channel mix. By 2030 and beyond, consumer-facing segments via e-commerce and specialty beauty stores will expand rapidly, making digital-native distribution a critical growth driver.

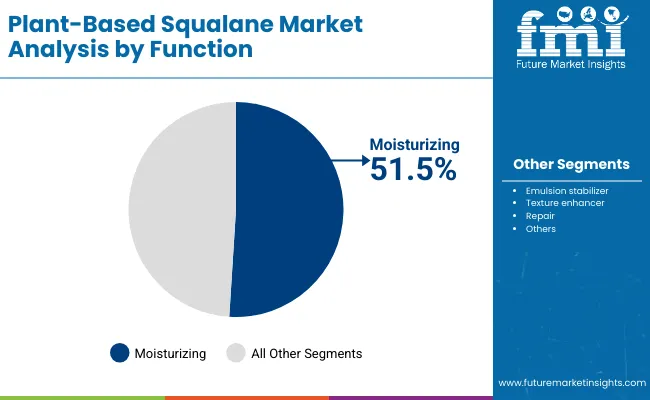

The market is segmented by source, function, product type, channel, and region. Sources include sugarcane-derived, olive-derived, amaranth-derived, and algae-derived squalane, highlighting the diverse raw material base driving adoption. Functional segmentation covers moisturizing, emulsion stabilizer, texture enhancer, and repair, catering to core cosmetic and personal care applications. By product type, the market is classified into creams/lotions, serums, oils, and sunscreens, reflecting the end-consumer focus of squalane usage.

Channels of distribution include B2B ingredient supply, e-commerce (finished products), pharmacies, and specialty beauty stores, addressing both industrial and retail demand. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with major growth concentrated in Asia.

| Source | Value Share% 2025 |

|---|---|

| Sugarcane-derived | 56.6% |

| Others | 43.4% |

The sugarcane-derived segment is projected to contribute 56.6% of the Plant-Based Squalane Market revenue in 2025, maintaining its lead as the dominant source category. This is driven by the scalability of sugarcane cultivation, strong sustainability credentials, and efficient conversion processes. Brazil and the USA provide stable raw material supply, allowing cost competitiveness against olive-derived alternatives.

The segment’s growth is also supported by consumer preference for plant-based, renewable, and eco-certified ingredients that align with clean beauty and vegan product standards. As algae-based fermentation technologies gain traction, sugarcane-derived squalane continues to hold the largest share due to proven industrial scaling. The source segment is expected to retain sugarcane as the backbone of global squalane supply.

| Function | Value Share% 2025 |

|---|---|

| Moisturizing | 51.5% |

| Others | 48.5% |

The moisturizing function segment is forecasted to hold 51.5% of the market share in 2025, led by its central role in cosmetic and skincare formulations. Squalane is favored for its non-greasy texture, emollient properties, and ability to mimic natural sebum, making it ideal for hydrating creams, serums, and lotions.Its compatibility with sensitive skin types has facilitated widespread adoption in premium beauty, dermatological, and personal care ranges. The segment’s growth is further bolstered by rising demand for anti-aging and hydration-focused products across North America, Europe, and Asia-Pacific.As industries increasingly require multi-functional actives that provide both hydration and formulation stability, the moisturizing function of plant-based squalane is expected to continue its dominance in the global market.

| Channel | Value Share% 2025 |

|---|---|

| B2B ingredient supply | 53.5% |

| Others | 46.5% |

The B2B ingredient supply segment is projected to account for 53.5% of the Plant-Based Squalane Market revenue in 2025, establishing it as the leading distribution channel. This is driven by strong demand from multinational cosmetic manufacturers, contract formulators, and pharmaceutical companies requiring high-purity ingredients at scale.Its suitability for bulk procurement, compliance with international cosmetic standards, and integration into large-scale personal care production have made it the backbone of global distribution. Meanwhile, e-commerce and specialty beauty stores are gaining traction in consumer-facing sales, particularly in Asia-Pacific, where premium skincare brands highlight squalane as a hero ingredient.Given its balance of industrial scale and global reach, B2B ingredient supply is expected to maintain its leading role in the Plant-Based Squalane Market.

Dominance of Sugarcane-Derived Squalane in Global Supply

Sugarcane-derived squalane already contributes 56.6% of market revenue in 2025 (USD 905.1 Mn), making it the most commercially viable source. Its dominance stems from higher yield, cost efficiency, and scalability compared to olive-derived squalane, which is constrained by agricultural volatility in Mediterranean regions. Multinational cosmetic players prefer sugarcane-based sourcing due to stable feedstock availability in Brazil and the USA and reduced reliance on seasonal olive harvests. This consistent supply advantage directly supports growth in B2B ingredient distribution, which holds over 53% share in 2025.

Asia-Pacific Surge Led by China, India, and Japan

Regional CAGR data highlights extraordinary growth in India (23.3%), China (19.5%), and Japan (16.6%) compared to the USA (8.9%) and Germany (9.9%). These markets are not just expanding in consumer demand but are rapidly scaling ingredient manufacturing and e-commerce-based finished product distribution. Domestic beauty brands in China and Japan increasingly highlight squalane as a "hero ingredient" for hydration and anti-aging, while India’s nutraceutical and personal care industries are embracing squalane as a premium natural alternative. This regional momentum is critical for global value expansion beyond 2030.

Over-Concentration on Sugarcane Feedstock

Although sugarcane is the market’s leading source, heavy dependence on it poses risk. Any disruption in Brazil’s bio-refinery ecosystem whether due to drought, sugarcane disease outbreaks, or bioethanol policy shifts could create a supply bottleneck. This concentration risk makes pricing volatile and could limit diversification, especially as global demand triples by 2035. Olive, algae, and amaranth-derived sources are not yet scaled enough to offset sudden shortfalls.

High Price Sensitivity in Emerging Markets

Despite growing CAGR in India and China, plant-based squalane remains a premium-priced emollient, making it less accessible for mass-market brands. Domestic cosmetic manufacturers often substitute with cheaper alternatives like mineral oils or synthetic emollients when targeting middle-income consumers. This price barrier limits penetration in high-volume but cost-sensitive personal care categories such as shampoos, body lotions, and soaps, restricting the pace of adoption outside premium skincare.

Shift Toward Algae-Derived and Amaranth-Based Premium Segments

While sugarcane currently dominates, algae- and amaranth-derived squalane are gaining share due to their marketing appeal in ultra-premium skincare. Algae-derived squalane is being positioned as carbon-neutral, biotech-driven, and luxury-grade, attracting high-margin brands in Japan, Europe, and North America. Amaranth-based sources, though niche, are marketed around antioxidant-rich narratives, enhancing consumer willingness to pay a premium. These shifts indicate a future bifurcation: sugarcane for bulk supply, algae/amaranth for differentiation.

B2B Ingredient Supply Consolidation Coupled with E-Commerce Boom

In 2025, B2B ingredient supply holds 53.5% share, reflecting bulk demand from multinationals. However, a parallel trend is the rapid rise of direct-to-consumer channels, especially via e-commerce and specialty beauty stores. Asian markets, particularly China, showcase how ingredient suppliers are increasingly forward-integrating moving from ingredient distribution to branded finished skincare lines on digital platforms. This dual-channel evolution will reshape competitive strategies, where ingredient suppliers (e.g., Amyris, Croda, Evonik) may compete directly with consumer-facing beauty brands.

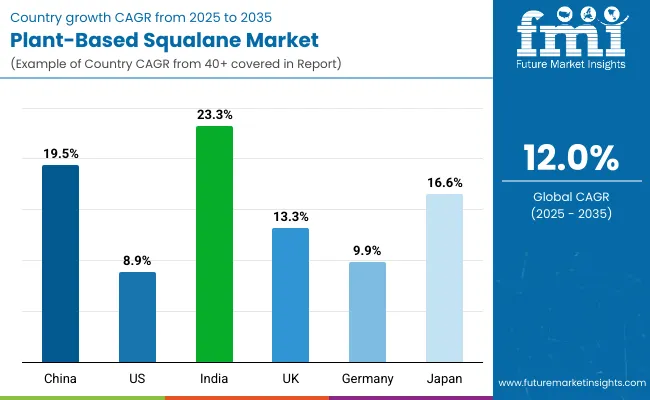

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.5% |

| USA | 8.9% |

| India | 23.3% |

| UK | 13.3% |

| Germany | 9.9% |

| Japan | 16.6% |

Between 2025 and 2035, the Plant-Based Squalane Market will see its fastest growth in India (23.3% CAGR), followed closely by China (19.5%) and Japan (16.6%). These countries are driving regional expansion in Asia-Pacific, with rising disposable incomes, expanding personal care and nutraceutical sectors, and consumer preference for natural, plant-based formulations. India’s exceptionally high growth reflects the increasing adoption of premium skincare in urban centers and the scaling of domestic ingredient manufacturing for export.

In China, squalane demand is driven by both domestic beauty brands and multinational players setting up local sourcing channels, while Japan’s strong anti-aging and functional cosmetic market continues to position squalane as a hero ingredient. Collectively, Asia-Pacific not only leads in CAGR but also reshapes global demand patterns as ingredient supply and consumer-facing channels integrate.

In contrast, developed markets such as the USA (8.9%) and Germany (9.9%) are growing at a steadier pace, reflecting maturity rather than early-stage adoption. Both markets are characterized by established clean beauty regulations, widespread availability of plant-based products, and high brand concentration. However, their growth is comparatively slower due to market saturation and price-sensitive competition from alternative emollients.

The UK (13.3%) sits mid-range, reflecting strong demand from premium skincare and cosmetic innovation but also regulatory shifts post-Brexit that add complexity to ingredient imports. Overall, developed regions contribute stable but moderate expansion, while Asia-Pacific accounts for the largest share of incremental growth, setting the future competitive battleground for plant-based squalane suppliers.

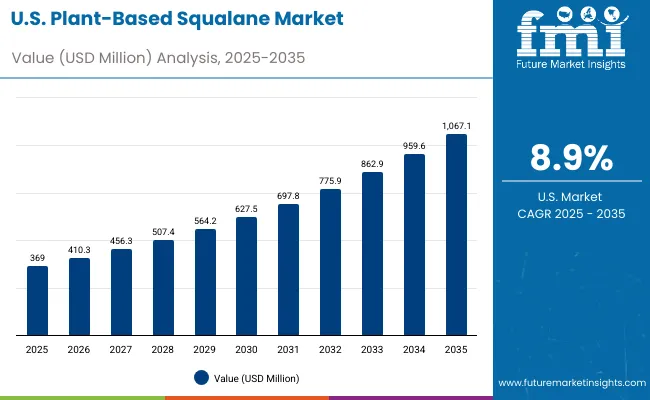

| Year | USA Plant-Based Squalane Market (USD Million) |

|---|---|

| 2025 | 369.0 |

| 2026 | 410.3 |

| 2027 | 456.3 |

| 2028 | 507.4 |

| 2029 | 564.2 |

| 2030 | 627.5 |

| 2031 | 697.8 |

| 2032 | 775.9 |

| 2033 | 862.9 |

| 2034 | 959.6 |

| 2035 | 1,067.1 |

The Plant-Based Squalane Market in the United States is projected to grow at a CAGR of 8.9%, led by consistent demand for sustainable skincare and cosmetic formulations. Reverse substitution away from shark-derived squalane is nearly complete, making the USA a mature market characterized by sugarcane-derived dominance (57.8% share in 2025). Growth is steady in moisturizers, serums, and sunscreens, with dermatological and pharmaceutical usage adding incremental demand. E-commerce expansion of clean beauty brands has further widened access, while multinational cosmetic firms continue to import large ingredient volumes through B2B contracts. However, the market’s pace is moderated by high saturation levels compared to Asia.

The Plant-Based Squalane Market in the United Kingdom is expected to grow at a CAGR of 13.3%, supported by applications in premium skincare, dermatological research, and sustainable cosmetics innovation. London and Manchester-based independent beauty labels have accelerated uptake of olive- and amaranth-derived squalane, positioning them as niche premium actives in serums and oils. Regulatory alignment post-Brexit has driven stronger emphasis on sustainability labeling, giving plant-based squalane a competitive edge over synthetic substitutes. Pharmacies and specialty beauty stores are also key distribution hubs, particularly as clean beauty penetration rises in the mid-premium segment.

India is witnessing rapid growth in the Plant-Based Squalane Market, forecast to expand at a CAGR of 23.3% through 2035, the highest globally. Rising adoption of vegan-certified skincare and clean beauty in metro cities is complemented by growing awareness in tier-2 markets. Domestic cosmetic brands are beginning to integrate squalane in affordable serums and sunscreens, though price sensitivity remains a challenge. On the B2B side, ingredient demand from nutraceutical and ayurvedic product manufacturers is accelerating. India’s market also benefits from pharmaceutical formulations, with dermatology-led usage rising in hospitals and private clinics.

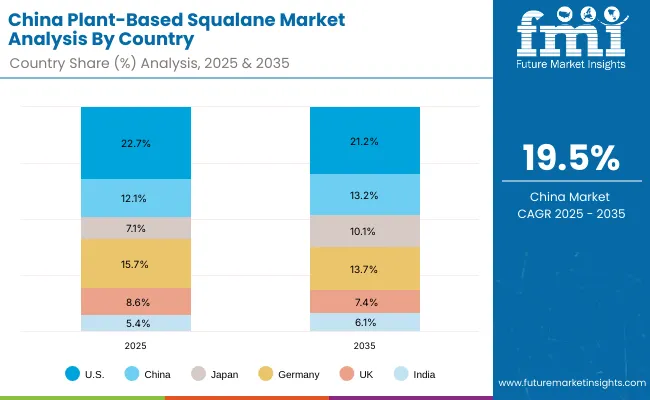

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.7% |

| China | 12.1% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

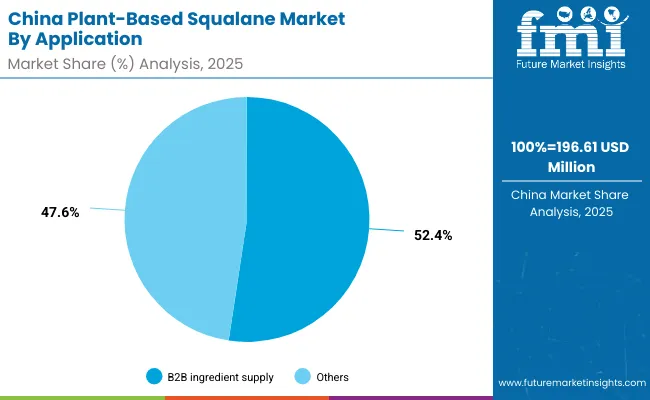

The Plant-Based Squalane Market in China is expected to grow at a CAGR of 19.5%, among the fastest worldwide. This momentum is driven by B2B ingredient demand (52.4% share in 2025), as domestic beauty and skincare manufacturers expand production. Large-scale urbanization and middle-class income growth are fueling consumption of serums, creams, and sunscreens featuring squalane as a key moisturizing ingredient. Domestic biotech firms are experimenting with algae-derived squalane, supported by government innovation programs, making China a hub for alternative sourcing technologies. E-commerce platforms such as Tmall and JD.com are critical to distribution, accelerating consumer access to both local and global brands.

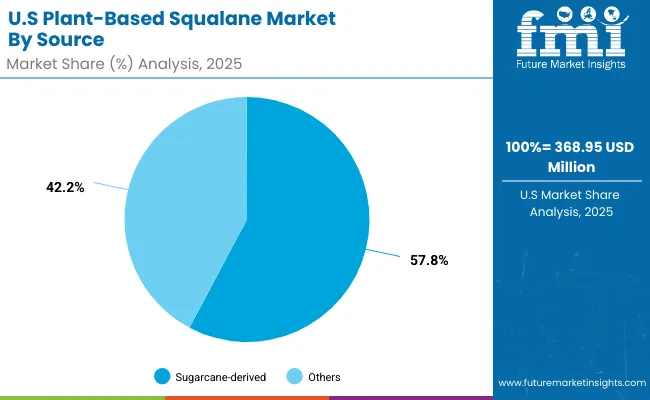

| US by Source | Value Share% 2025 |

|---|---|

| Sugarcane-derived | 57.8% |

| Others | 42.2% |

The Plant-Based Squalane Market in the United States is valued at USD 368.95 million in 2025, with sugarcane-derived squalane leading at 57.8%, followed by other sources (olive, amaranth, algae) at 42.2%. Leadership of sugarcane-based supply reflects mature, secure feedstock chains, consistent purity, and documented sustainability credentials favored by dermatology-backed brands. Moisturizing-led use cases dominate serums, creams, and sunscreens, while pharmacies and specialty beauty stores expand premium shelf space.

B2B contracts with multinationals sustain bulk demand, and clinical skincare continues to integrate squalane for barrier repair and sensitive skin. Near-term opportunity lies in value-added positioning (SPF + squalane hybrids, Rx-adjacent dermocosmetics) and private-label launches for large retailers. As price competition intensifies, suppliers that pair ingredient supply with formulation services and verified eco-labels will capture incremental share across mid-premium tiers.

| China by Application | Value Share% 2025 |

|---|---|

| B2B ingredient supply | 52.4% |

| Others | 47.6% |

The Plant-Based Squalane Market in China is valued at USD 196.61 million in 2025, with B2B ingredient supply leading at 52.4%, followed by consumer-facing channels (e-commerce, pharmacies, specialty beauty) at 47.6%. Dominance of B2B reflects scaling by domestic beauty manufacturers and ODMs serving fast-cycle brand launches on Tmall/JD. Moisturizing remains the hero function in serums and lotions, while algae-derived pilots gain traction for premium-tier positioning and carbon-neutral branding.

Opportunities concentrate in OEM/ODM partnerships, localized compliance support, and SKU acceleration via social commerce. Suppliers that guarantee consistent sensory profiles, offer micro-encapsulation for actives pairing, and co-develop China-specific claims (hydration + barrier care) can outpace market growth as the country advances toward double-digit CAGRs through 2035.

The market is moderately fragmented: leaders such as Amyris (DSM-Firmenich), Croda, Evonik, BASF, Clariant, Kuraray, Sophim, Givaudan, Nikkol, and Univar Solutions compete on feedstock strategy (sugarcane vs. olive vs. algae), purity, and verified sustainability. Top players leverage fermentation or highly efficient hydrogenation to secure consistent sensory feel and oxidative stability, while expanding B2B programs that bundle regulatory dossiers, claim support, and rapid sampling to shorten brand development cycles in the USA, China, and Japan.

Established mid-sized innovators emphasize application engineeringco-formulating moisturizing systems (squalane + humectants/ceramides), texture optimization for light-feel serums, and stability in high-SPF formats. Differentiation increasingly comes from traceability (RSPO/VEGAN/ISO), LCA disclosures, and allergen-free compliance, enabling premium pricing in dermocosmetics and pharmacy channels.

Specialists and distributors focus on route-to-market: curated ingredient portfolios, low MOQs, and regional warehousing to serve indie brands and cross-border e-commerce. With algae- and amaranth-derived supply scaling, competitive advantage is shifting from commodity emollient pricing to ecosystem capabilitiesco-development toolkits, clinical data for hydration/barrier endpoints, and digital commerce enablementthat lock in recurring volumes and faster launch velocity across priority markets.

Key Developments in Plant-Based Squalane Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,623.4 million |

| Source | Sugarcane-derived, Olive-derived, Amaranth-derived, and Algae-derived |

| Function | Moisturizing, Emulsion stabilizer, Texture enhancer, and Repair |

| Product Type | Creams/lotions, Serums, Oils, and Sunscreens |

| Channel | B2B ingredient supply, E-commerce (finished products), Pharmacies, and Specialty beauty stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amyris (DSM- Firmenich), Croda, Kuraray, Sophim, Clariant, Evonik, BASF, Univar Solutions, Nikkol, Givaudan |

| Additional Attributes | Dollar sales by source, function, and distribution channel; adoption trends in moisturizing and repair-focused formulations; rising demand for sugarcane-derived squalane; sector-specific growth in cosmetics, pharmaceuticals, and nutraceuticals; channel segmentation across B2B and e-commerce; regional growth driven by Asia-Pacific; innovation in algae and amaranth biotechnology; sustainability certification and traceability trends shaping competitive differentiation. |

The Plant-Based Squalane Market is estimated to be valued at USD 1,623.4 million in 2025.

The market size for the Plant-Based Squalane Market is projected to reach USD 5,023.1 million by 2035.

The Plant-Based Squalane Market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in the Plant-Based Squalane Market are creams/lotions, serums, oils, and sunscreens.

In terms of source, the sugarcane-derived segment will command 56.6% share in the Plant-Based Squalane Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Squalane-Based Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA