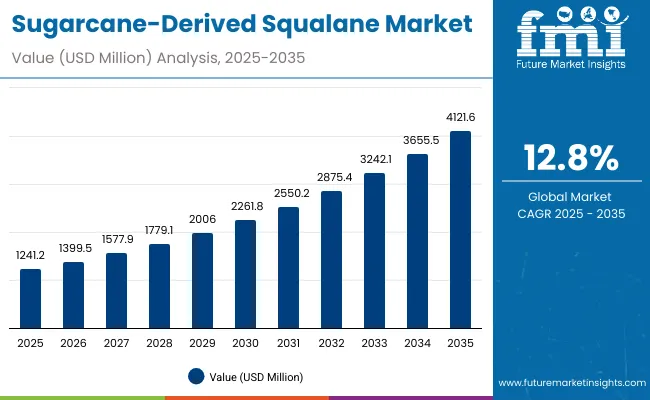

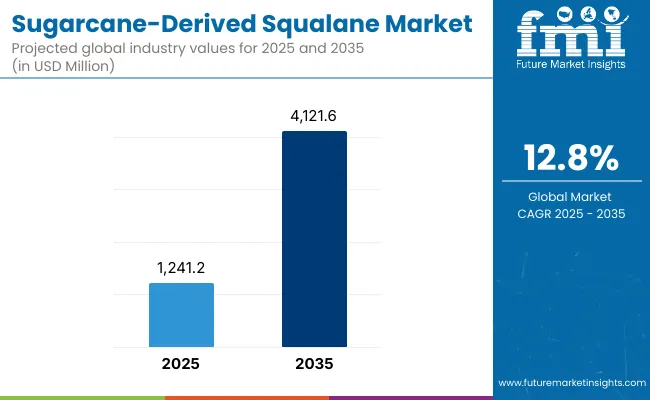

The Global Sugarcane-Derived Squalane Market is expected to record a valuation of USD 1,241.2 million in 2025 and USD 4,121.6 million in 2035, with an increase of USD 2,880.4 million, which equals a growth of 232% over the decade. The overall expansion represents a CAGR of 12.8% and more than a 3X increase in market size.

Global Sugarcane-Derived Squalane Market Key Takeaways

| Metric | Value |

|---|---|

| Global Sugarcane-Derived Squalane Estimated Value in (2025E) | USD 1,241.2 million |

| Global Sugarcane-Derived Squalane Forecast Value in (2035F) | USD 4,121.6 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,241.2 million to USD 2,261.8 million, adding USD 1,020.6 million, which accounts for 35% of the total decade growth. This phase records steady adoption in moisturizing and anti-aging applications, driven by consumer awareness of skin hydration and repair. Oils and serums dominate this period as they cater to more than 70% of functional skincare applications demanding lightweight textures and high bioavailability.

The second half from 2030 to 2035 contributes USD 1,859.8 million, equal to 65% of total growth, as the market jumps from USD 2,261.8 million to USD 4,121.6 million. This acceleration is powered by the expansion of sustainable beauty products, vegan-certified claims, and growing adoption of bio-based ingredients in mass retail and e-commerce. Creams, lotions, and hybrid formulations capture a larger share above 60% by the end of the decade. Clean-label and sustainable sourcing certifications add recurring brand loyalty, increasing their share beyond 50% in total value.

From 2020 to 2024, the Global Sugarcane-Derived Squalane Market grew steadily as clean beauty trends gained momentum. During this period, the competitive landscape was dominated by niche natural skincare brands controlling nearly 60% of revenue, with leaders such as Biossance and Indie Lee focusing on sugarcane-sourced squalane positioned as a sustainable alternative to shark-derived squalane.

Competitive differentiation relied on eco-claims, texture performance, and bio-compatibility, while distribution leaned heavily on online channels. Service-based models and custom formulations had minimal traction, contributing less than 10% of the total market value.

Demand for sugarcane-derived squalane will expand to USD 1,241.2 million in 2025, and the revenue mix will shift as serums, creams, and lotions grow to over 55% share. Traditional premium beauty leaders face rising competition from new digital-first players offering AI-driven skin diagnostics, personalized formulations, and subscription-based clean beauty solutions.

Major global companies such as L’Oréal and Unilever are pivoting to hybrid models, integrating sustainable sourcing transparency and e-commerce engagement to retain relevance. Emerging entrants specializing in vegan positioning, ayurvedic-inspired blends, and bio-fermentation techniques are gaining share. The competitive advantage is moving away from product marketing alone to supply chain traceability, claim validation, and consumer trust-building.

Advances in sugarcane-based biotechnology have improved extraction efficiency, allowing for large-scale production of plant-derived squalane at lower costs and higher purity. Moisturizing benefits continue to dominate adoption due to the ingredient’s ability to mimic skin’s natural sebum and maintain hydration balance.

Oils and serums have gained popularity due to their light texture and fast absorption, making them suitable for both daily skincare and targeted treatments. The rise of sustainable sourcing has contributed to enhanced consumer trust, while clean-label positioning aligns with the growing demand for transparency and eco-conscious formulations.

Expansion of anti-aging and skin barrier repair applications has fueled market growth, supported by clinical studies highlighting squalane’s antioxidant and protective properties. Innovations in multipurpose skincare such as hybrid balms and soothing creams are opening new application areas across dermatology and premium beauty. Segment growth is expected to be led by moisturizing functions, oils in product type categories, and e-commerce distribution due to their accessibility and strong consumer loyalty drivers.

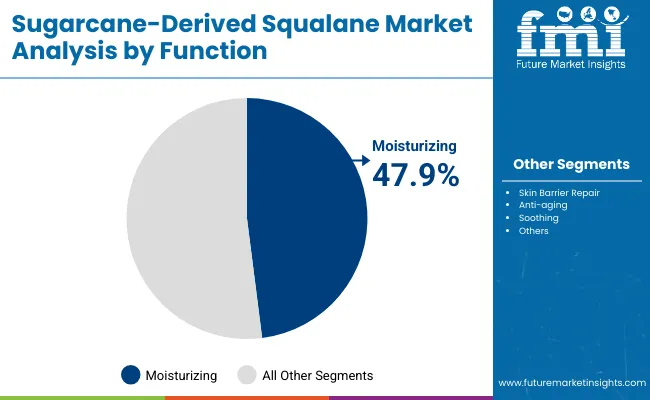

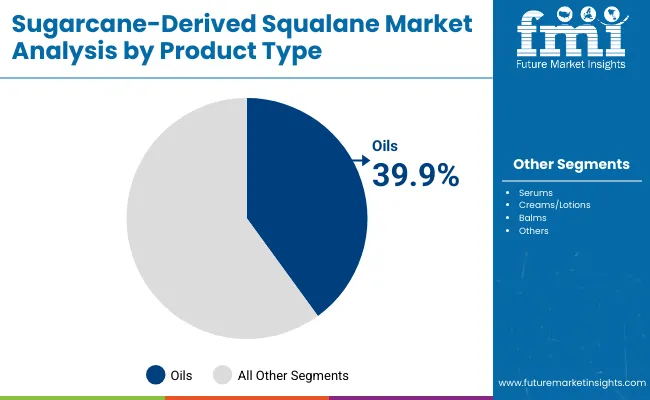

The market is segmented by function, product type, channel, claim, and geography. Functions include moisturizing, skin barrier repair, anti-aging, and soothing, highlighting the diverse roles of squalane in skincare. Product type classification covers oils, serums, creams/lotions, and balms to address multiple consumer preferences.

Based on channel, the segmentation includes e-commerce, pharmacies, mass retail, and specialty beauty stores, each capturing distinct purchase behaviors. In terms of claim, categories encompass vegan, clean-label, natural/organic, and sustainable sourcing, reflecting the rise of conscious consumerism. Regionally, the scope spans North America, Latin America, East Asia, South Asia & Pacific, Europe, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Moisturizing | 47.9% |

| Others | 52.1% |

The moisturizing segment is projected to contribute 47.9% of the Global Sugarcane-Derived Squalane Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by consumer preference for hydration-based products, where squalane’s emollient and skin-compatible properties are unmatched.

Demand is also supported by its ability to prevent transepidermal water loss, making it essential in both daily-use creams and advanced skincare routines.Growth in this segment is reinforced by the trend of minimalistic routines, where multifunctional moisturizers that combine hydration, soothing, and anti-aging benefits are highly sought after. As brands continue to highlight clinical hydration claims, moisturizing formulations will remain the backbone of sugarcane-derived squalane adoption worldwide.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Oils | 39.9% |

| Others | 60.1% |

The oils segment is forecasted to hold 39.9% of the market share in 2025, led by its versatility across facial care, body care, and haircare. Oils are favored for their lightweight texture, non-greasy finish, and ability to blend seamlessly with serums and creams. This makes them particularly appealing to consumers seeking natural alternatives to synthetic emollients.

Their simple formulation, transparency in labeling, and adaptability across both premium and mass-market products have facilitated widespread adoption. The segment’s growth is also bolstered by consumer demand for multipurpose beauty oils that deliver hydration, barrier repair, and antioxidant protection. Oils are expected to remain a staple product type in the market, especially in East Asia and North America, where beauty oils have become part of mainstream routines.

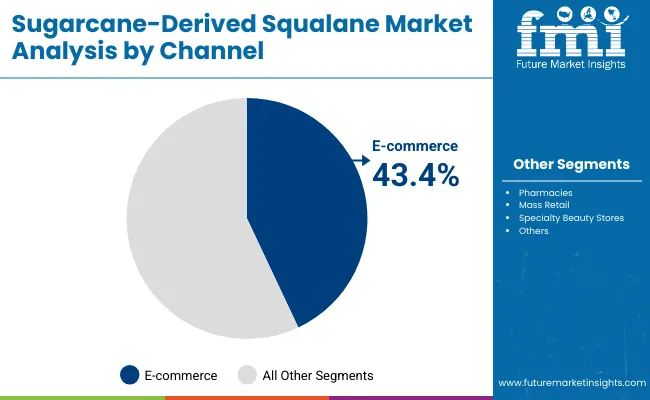

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 43.4% |

| Others | 56.6% |

The e-commerce segment is projected to contribute 43.4% of the Global Sugarcane-Derived Squalane Market revenue in 2025, establishing itself as the leading distribution channel. Online platforms have become the dominant purchasing hub for clean beauty, vegan, and natural skincare brands, with younger consumers preferring digital-first shopping journeys.

This segment’s growth is fueled by direct-to-consumer models, subscription-based replenishment services, and the rise of influencer-driven product launches. In addition, e-commerce allows for greater transparency in ingredient sourcing and claim validation, which resonates strongly with eco-conscious buyers. As global beauty consumers increasingly rely on online research and reviews before purchase, e-commerce is expected to retain its leadership role across the forecast period.

Rising Demand for Sustainable and Plant-Derived Ingredients

One of the strongest growth drivers in the global sugarcane-derived squalane market is the shift from animal-based to plant-derived ingredients. Consumers are increasingly rejecting shark-derived squalane due to ethical and environmental concerns. Sugarcane-based squalane offers a renewable, sustainable, and cruelty-free alternative that resonates with vegan, clean-label, and natural/organic claims.

Global beauty consumers, especially millennials and Gen Z, actively seek brands that promote ethical sourcing, traceable supply chains, and eco-friendly practices. This demand is further amplified by regulatory pressure in Europe and North America on animal-sourced cosmetic ingredients. As a result, sugarcane-derived squalane is positioned as both a functional emollient and a sustainability badge for brands, helping them differentiate in a crowded marketplace.

Expansion of Premium and Mass-Market Skincare Applications

Sugarcane-derived squalane’smultifunctionalitymoisturizing, anti-aging, skin barrier repair, and soothinghas made it a versatile ingredient across oils, serums, creams, and balms. Initially confined to premium skincare lines, its scalability and improved production processes have enabled penetration into mass retail and pharmacy-based skincare.

With consumer awareness about hydration, barrier protection, and skin health growing rapidly, both luxury brands and mass-market players are introducing squalane-infused products. Additionally, the ingredient’s biocompatibility and lightweight texture allow it to be included in hybrid skincare-makeup products and haircare, widening its application base. This cross-category integration is accelerating volume growth and pushing global adoption across regions like East Asia, the USA, and Europe.

High Production Costs and Supply Chain Challenges

Although sugarcane-derived squalane is more sustainable, its extraction and refinement process remains cost-intensive compared to synthetic alternatives. Fluctuations in global sugarcane productionaffected by climate change, regional supply shocks, and agricultural constraintscreate volatility in raw material availability.

This leads to pricing pressures for manufacturers and limits widespread adoption in price-sensitive markets. Smaller brands often find it challenging to compete with established players who have secured long-term supplier contracts. In addition, ensuring traceability and compliance with sustainable sourcing certifications adds further cost layers, making scalability a challenge for new entrants.

Market Saturation and Competition from Alternatives

The growing popularity of plant-derived emollients has led to rising competition from alternative natural oils such as jojoba, argan, and almond oil. While sugarcane-derived squalane offers distinct advantages in terms of texture and skin absorption, consumer education is still required to differentiate it from these well-established oils.

Additionally, synthetic squalane, produced through bio-engineering and fermentation techniques, is emerging as a lower-cost competitor. The availability of these substitutes, combined with the crowded clean-beauty market, creates brand dilution and slows the pace of premium pricing adoption in certain geographies.

Clean Beauty and Vegan Claims Driving Mainstream Adoption

The global squalane market is being shaped by consumer preference for clean-label, vegan, and sustainable sourcing claims. Brands that prominently highlight “sugarcane-derived squalane” on packaging and digital campaigns are gaining trust and visibility.

E-commerce platforms, especially in East Asia and the USA, are seeing surging demand for such claims, amplified by influencer-driven product discovery. This trend is not limited to niche indie brandsglobal leaders like L’Oréal and Unilever are pivoting toward plant-based squalane portfolios to align with consumer values. By 2030, vegan-certified formulations are projected to hold a majority share of global launches.

Surge in E-commerce and Subscription-Based Beauty Models

With 43.4% of global value sales in 2025 already coming from e-commerce, digital platforms have become the leading growth driver for squalane-based products. Subscription models offering monthly deliveries of serums, oils, and creams are gaining popularity, particularly in North America and Europe. Consumers prefer direct-to-consumer (DTC) channels that emphasize transparency, ingredient traceability, and personalized skincare regimens.

This trend is strengthening the market presence of digitally native brands like Biossance and The Ordinary while also pushing traditional beauty giants to upgrade their digital retail strategies. In China, oils dominate demand, while in India, rapid urbanization and increasing disposable income are driving the adoption of moisturizing and anti-aging products. Asian beauty consumers prioritize hydration and natural formulations, making sugarcane-derived squalane a perfect fit for K-beauty and Ayurveda-inspired brands. This regional surge is expected to balance slower but steady growth in mature markets like the USA and Europe.

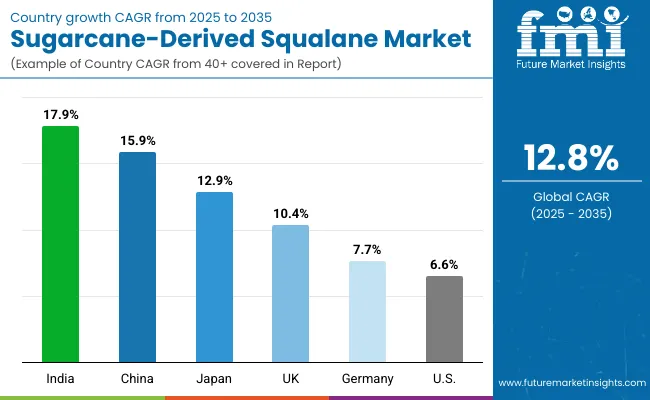

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.9% |

| USA | 6.6% |

| India | 17.9% |

| UK | 10.4% |

| Germany | 7.7% |

| Japan | 12.9% |

The country-wise CAGR outlook for the global sugarcane-derived squalane market (2025 to 2035) highlights significant regional differences in growth momentum. India is expected to lead with the highest CAGR of 17.9%, followed closely by China at 15.9% and Japan at 12.9%, reflecting Asia’s growing dominance in sustainable and natural skincare adoption. India’s rapid expansion is linked to rising disposable incomes, the shift from traditional oils to modern skincare, and the growing presence of clean-label and vegan beauty brands.

China’s strong CAGR is supported by its large consumer base, e-commerce dominance, and preference for lightweight oils and serums that suit local skin needs. Japan, meanwhile, benefits from its established beauty culture, where innovation and multifunctional products incorporating sugarcane-derived squalane are gaining popularity.

In comparison, mature markets such as the USA (6.6%), Germany (7.7%), and the UK (10.4%) are expected to grow at a slower pace due to market saturation and intense competition from alternative plant-based emollients. However, these countries will continue to represent important value contributors, as consumer demand for sustainable sourcing and clean-label skincare strengthens across premium and mass-market segments.

In the USA, the adoption is driven by established players like Biossance and The Ordinary, while in Europe, regulatory emphasis on natural formulations and sustainable sourcing will support steady growth. This balance between Asia’s rapid expansion and the West’s stable but slower adoption ensures that the market maintains a healthy global CAGR of 12.8% over the decade.

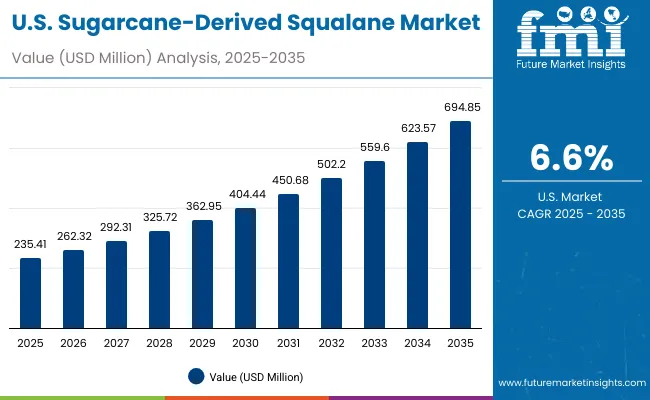

| Year |

USA Market (USD Million) |

|---|---|

| 2025 | 235.4 |

| 2026 | 262.3 |

| 2027 | 292.3 |

| 2028 | 325.7 |

| 2029 | 363.0 |

| 2030 | 404.4 |

| 2031 | 450.7 |

| 2032 | 502.2 |

| 2033 | 559.6 |

| 2034 | 623.6 |

| 2035 | 694.9 |

The Sugarcane-Derived Squalane Market in the United States is projected to grow at a CAGR of 6.6%, led by rising demand for clean-label moisturizing and anti-aging products. Premium skincare brands such as Biossance and The Ordinary have expanded their online and pharmacy-based presence, driving adoption.

Dermatology clinics are increasingly recommending plant-derived squalane as a sustainable replacement for synthetic and shark-based variants. Mass retail distribution has also expanded, with Unilever and L’Oréal integrating squalane into affordable formulations. E-commerce channels continue to amplify penetration, supported by influencer-led campaigns and subscription-based models.

The Sugarcane-Derived Squalane Market in the United Kingdom is expected to grow at a CAGR of 10.4%, supported by expanding applications in premium beauty, dermatology, and sustainable retail. Indie brands are leveraging squalane’s vegan and eco-friendly claims to differentiate in competitive segments.

Pharmacies and health & beauty chains are integrating sugarcane-derived squalane in moisturizers and soothing creams. Heritage skincare brands are adopting squalane to modernize formulations while maintaining clean-label standards. Online specialty stores and subscription services are also gaining traction, particularly among younger demographics seeking transparency and sustainability.

India is witnessing rapid growth in the Sugarcane-Derived Squalane Market, which is forecast to expand at a CAGR of 17.9% through 2035. The surge is fueled by rising disposable incomes, urbanization, and increased awareness of natural and vegan skincare.

Tier-2 and tier-3 cities are emerging as new demand hubs as cost-effective squalane-infused oils and creams enter the retail market. Ayurvedic and herbal skincare companies are integrating sugarcane-derived squalane to meet consumer demand for hybrid traditional-modern solutions. Online platforms are educating consumers on ingredient benefits, expanding adoption across younger audiences.

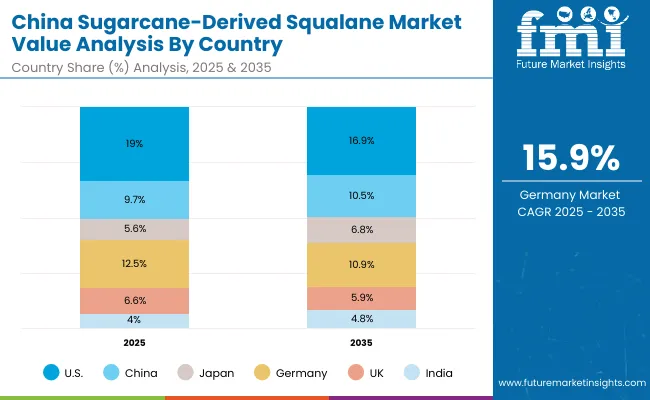

The Sugarcane-Derived Squalane Market in China is expected to grow at a CAGR of 15.9%, the highest among leading economies. Growth is driven by e-commerce dominance, K-beauty influence, and consumer preference for lightweight oils and serums. Domestic beauty brands are aggressively promoting sustainable sourcing and clean-label claims, positioning sugarcane-derived squalane as a premium yet affordable ingredient.

Online platforms like Tmall and JD.com have become central to distribution, while cross-border e-commerce is accelerating exposure to global brands. Regional manufacturing clusters are producing affordable squalane oils, enabling adoption across premium skincare, mass-market ranges, and hybrid cosmetics.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.0% |

| China | 9.7% |

| Japan | 5.6% |

| Germany | 12.5% |

| UK | 6.6% |

| India | 4.0% |

| Country | 2035 Share (%) |

|---|---|

| USA | 16.9% |

| China | 10.5% |

| Japan | 6.8% |

| Germany | 10.9% |

| UK | 5.9% |

| India | 4.8% |

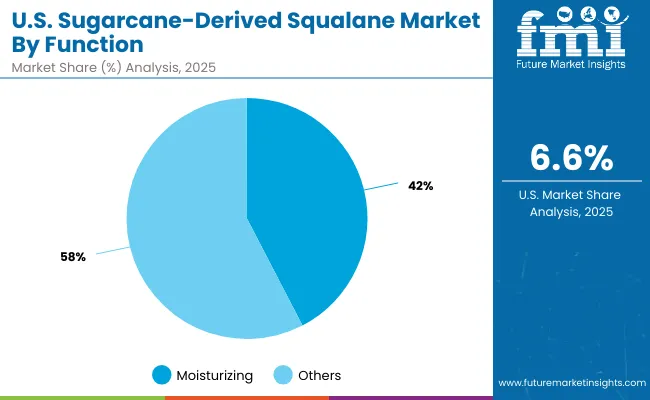

| Function Segment | Market Value Share, 2025 |

|---|---|

| Moisturizing | 42.4% |

| Others | 57.6% |

The Sugarcane-Derived Squalane Market in the United States is valued at USD 235.41 million in 2025, with moisturizing leading at 42.4%. The dominance of moisturizing benefits is a direct outcome of USA consumer routines that prioritize lightweight hydration, barrier support, and compatibility with active-rich regimens (retinoids, acids, vitamin C).

Sugarcane-derived squalane’s biomimetic profile helps reduce transepidermal water loss without occlusion, making it ideal for daily-use serums, creams/lotions, and facial oils. Dermatology channels and premium beauty retailers have reinforced adoption through clinician guidance and clean-beauty education, while mass retail’s growing shelf space for vegan and clean-label products has accelerated trial among first-time buyers.

The category’s success is also tied to clear sustainability narrativessourcing transparency and cruelty-free positioningwhich amplify repeat purchases in e-commerce subscriptions and pharmacy chains.

This advantage positions moisturizing-led formats as an essential base across skin types, seasons, and age groups. Barrier-repair and anti-aging claims expand the addressable market by pairing squalane with ceramides, niacinamide, and peptides, enhancing regimen compatibility for sensitive and mature skin.

Soothing-led blends target irritation from actives and procedures (peels, lasers), further widening medical-aesthetic use. As brand portfolios diversify, cross-category launches in body care and hybrid care (skin + hair + scalp) will scale basket sizes. Oils keep a loyal core, while creams/lotions and serums add frequency and depth. E-commerce remains a growth engine for discovery and replenishment, with influencer education and dermatology-led content converting high-intent shoppers into subscribers.

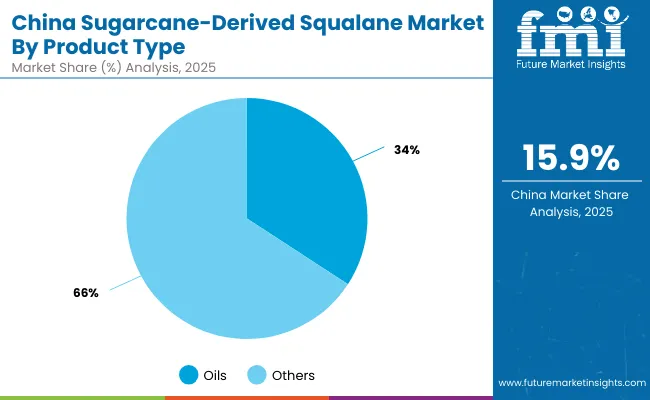

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Oils | 34.2% |

| Others | 65.8% |

The Sugarcane-Derived Squalane Market in China is valued at USD 120.32 million in 2025, with oils leading the product-type opportunity at 34.2%. The prominence of oils reflects consumer preference for fast-absorbing, featherlight textures that layer cleanly within multi-step routines. Sugarcane-derived squalane’s compatibility with sensitive and combination skin types fits local needs for breathable hydration under humid conditions and urban lifestyles.

Domestic and cross-border brands leverage squalane to headline “clean, mild, effective” messages across facial oils, essence-oils, and serum-in-oil hybrids. In parallel, serums and creams/lotions are scaling quickly via platforms such as Tmall and JD, where ingredient-led search, KOL/KOC education, and clinical storytelling accelerate conversion.

This advantage positions oils as the “gateway” format for ingredient trial, with rapid up-trade into serums and creams for regimen anchoring. Sophisticated bundling (cleansers + squalane oils + repair serums) and dermatology-partnered claims (barrier + soothing) are expanding use among sensitive-skin cohorts.

As clean-label and vegan certifications become more visible in product pages and live-commerce streams, sugarcane sourcing and traceability stories will differentiate SKUs within crowded price bands. Expect localized innovationsqualane paired with TCM botanicals and biomimetic lipidsto strengthen resonance with Chinese consumers, while mini/travel sizes and refillable packaging further improve entry points and retention.

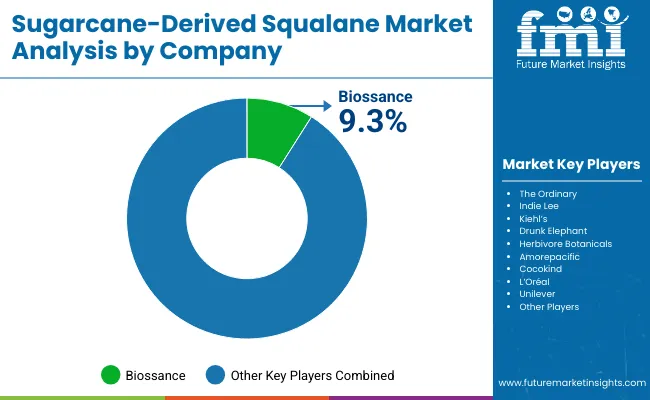

| Company | Global Value Share 2025 |

|---|---|

| Biossance | 9.3% |

| Others | 90.7% |

The Sugarcane-Derived Squalane Market is moderately fragmented, with global leaders, premium clean-beauty specialists, and regional champions competing across functions and formats. Biossance holds the leading individual brand share on the strength of science-forward positioning, sustainability storytelling, and regimen-centric assortments spanning oils, serums, and creams/lotions.

Its omnichannel footprintrobust DTC, specialty beauty retail, and select pharmacy presencesupports high repeat rates via subscriptions and bundle-led promotions. Surrounding Biossance, The Ordinary, Kiehl’s, Drunk Elephant, and Herbivore Botanicals drive substantial volume by pairing squalane with hero actives and clear claims (hydration, barrier, soothing), while Amorepacific leverages East Asia innovation cycles to seed texture and hybrid-format trends that diffuse globally.

L’Oréal and Unilever amplify category growth through scale distribution, manufacturing, and portfolio breadth, bringing sugarcane-derived squalane into accessible price tiers and adjacent categories (body care, hair/scalp). Their strategies increasingly emphasize traceable sourcing, eco-design packaging, and clinical validation, reinforcing credibility with both premium and mass consumers.

Regional and indie brandssuch as Cocokind and a long tail of digital-first entrantscompete through niche propositions (vegan, microbiome-friendly, ayurveda-/TCM-inspired) and agile content marketing. In this environment, competitive differentiation is shifting away from ingredient access alone toward integrated ecosystems: lifecycle transparency (farm-to-flask), e-commerce personalization, clinic and dermatologist partnerships, and subscription-led retention.

As claims scrutiny intensifies, brands that pair sustainability with measurable outcomes (TEWL reduction, barrier scores, user-perceived hydration) will consolidate loyalty and expand internationally.

Key Developments in Global Sugarcane-Derived Squalane Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,241.2 million |

| Function | Moisturizing, Skin barrier repair, Anti-aging, and Soothing |

| Product Type | Oils, Serums, Creams/lotions, and Balms |

| Channel | E-commerce, Pharmacies, Mass retail, and Specialty beauty stores |

| Claim | Vegan, Clean-label, Natural/organic, and Sustainable sourcing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Biossance , T he Ordinary, Indie Lee, Kiehl’s , Drunk Elephant, Herbivore Botanicals, Amorepacific , Cocokind , L’Oréal, and Unilever |

| Additional Attributes | Dollar sales by function and product type, adoption trends in moisturizing and anti-aging skincare, rising demand for vegan and clean-label claims, segment-specific growth in oils, serums, and creams, e-commerce and specialty beauty store channel expansion, integration of sustainable sourcing and eco-friendly packaging, regional trends influenced by K-beauty and Ayurveda, and innovations in clean beauty formulations with plant-derived squalane . |

The Global Sugarcane-Derived Squalane Market is estimated to be valued at USD 1,241.2 million in 2025.

The market size for the Global Sugarcane-Derived Squalane Market is projected to reach USD 4,121.6 million by 2035.

The Global Sugarcane-Derived Squalane Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in the Global Sugarcane-Derived Squalane Market are oils, serums, creams/lotions, and balms.

In terms of function, the moisturizing segment is projected to command 47.9% share in the Global Sugarcane-Derived Squalane Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Squalane-Based Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA