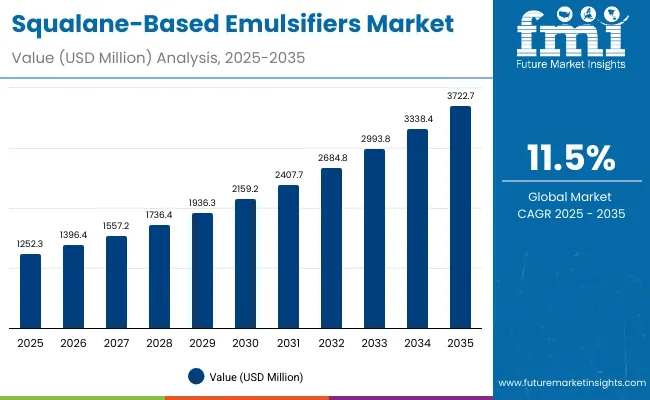

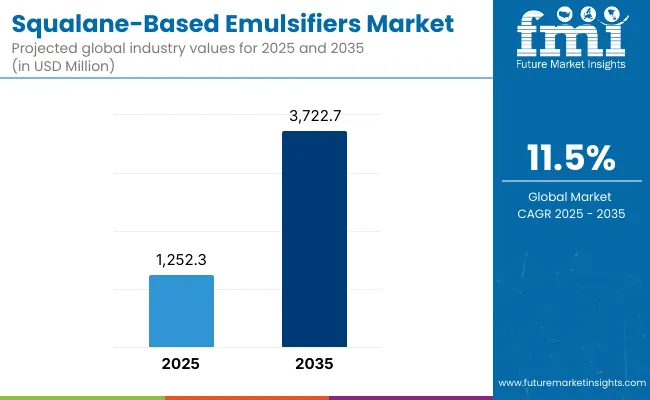

The global Squalane-Based Emulsifiers Market is projected to attain a valuation of USD 1,252.3 million in 2025 and is expected to expand to USD 3,722.7 million by 2035. This expansion reflects an absolute increase of USD 2,470.4 million over the decade, translating into a growth of nearly 193%. The growth trajectory corresponds to a compound annual growth rate (CAGR) of 11.5%, signaling more than a twofold rise in market size across the forecast horizon.

Squalane-Based Emulsifiers Market Key Takeaways

| Metric | Value |

|---|---|

| Squalane -Based Emulsifiers Market Estimated Value in (2025E) | USD 1,252.3 million |

| Squalane -Based Emulsifiers Market Forecast Value in (2035F) | USD 3,722.7 million |

| Forecast CAGR (2025 to 2035) | 11.5% |

During the initial phase between 2025 and 2030, market value is set to climb from USD 1,252.3 million to USD 2,159.2 million, adding approximately USD 906.9 million. This represents close to 37% of the overall forecast-period growth, highlighting the early adoption momentum as sustainable and bio-based cosmetic ingredients gain mainstream recognition.

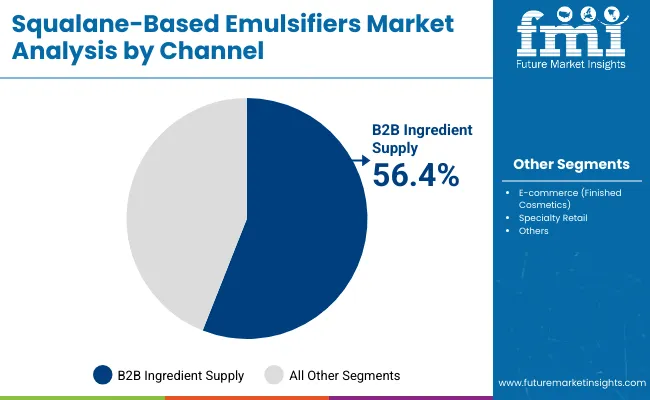

Demand during this phase is expected to be powered by premium skincare formulations where emulsification, moisturization, and sensory enhancement remain critical differentiators. The channel dynamics are likely to be dominated by B2B ingredient supply, which is positioned to capture the largest share as cosmetic brands increasingly depend on trusted raw material providers.

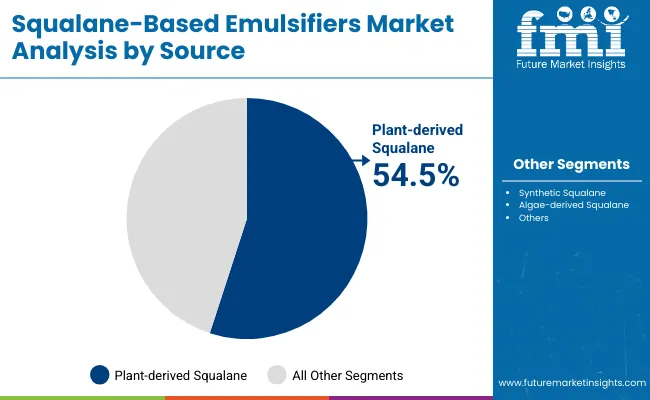

The second half of the period from 2030 to 2035 is forecast to add USD 1,563.5 million, equivalent to nearly 63% of the decade’s expansion. Growth in this stage is anticipated to accelerate as plant-derived squalane consolidates its position, supported by investments in sugarcane and olive-based sourcing, alongside innovation in algae-derived alternatives. By 2035, plant-derived emulsifiers are projected to command over half of total value, while Asia’s contribution to global demand is expected to surge, driven by China and India’s rapid cosmetic sector growth.

From 2020 to 2024, the Squalane-Based Emulsifiers Market expanded steadily as plant-derived ingredients gained wider adoption in skincare and personal care formulations. By 2025, the market reached USD 1,252.3 million, supported by growing demand for clean-label, bio-based emulsifiers. During this period, leading players such as Amyris (DSM-Firmenich) consolidated positions through innovation in fermentation-based squalane and strong sustainability branding.

Competitive differentiation was increasingly shaped by traceability, certifications, and ability to meet regulatory standards, rather than price-driven competition. Service models centered on co-formulation and technical support accounted for a rising share, reinforcing supplier-brand collaborations. By 2035, revenues are projected to reach USD 3,722.7 million, with ecosystem strength, supply chain resilience, and bio-fermentation technologies expected to define the next wave of competitive advantage.

Growth in the Squalane-Based Emulsifiers Market is being driven by rising demand for bio-based and sustainable cosmetic ingredients, which are increasingly preferred over synthetic alternatives. The multifunctional properties of squalane emulsifiers, including moisturization, emulsion stabilization, and texture enhancement, are being recognized as key differentiators in premium formulations.

The shift toward clean-label and plant-derived ingredients is being reinforced by consumer awareness around safety, transparency, and environmental responsibility. Growing adoption of B2B ingredient supply channels is being supported by brands seeking consistency, compliance, and formulation expertise from specialized suppliers.

Expansion of personal care and skincare consumption in emerging economies, particularly across Asia, is being observed as a major driver of accelerated uptake. Innovations in algae-derived squalane and advancements in fermentation processes are being positioned as solutions to overcome feedstock volatility and supply chain risks. These combined factors are expected to sustain double-digit growth and reinforce long-term competitiveness across global markets.

The Squalane-Based Emulsifiers Market has been segmented across three critical dimensions: channel, source, and product type. Each of these segments reflects distinct growth drivers shaped by sustainability preferences, distribution patterns, and application priorities in the global cosmetics and personal care sector. By channel, the emphasis is placed on the role of B2B ingredient supply, which continues to dominate due to its ability to deliver scalability, compliance, and consistent quality.

In terms of source, plant-derived squalane has emerged as the leading category, backed by its alignment with natural, eco-friendly, and traceable supply chains that resonate strongly with evolving consumer demands. Product type segmentation highlights the dominance of creams and lotions, where the functional attributes of squalane-based emulsifiers in moisturization, texture enhancement, and absorption have secured their wide-scale adoption.

Together, these segments outline the structural foundation of market expansion and indicate where strategic opportunities will emerge through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| B2B ingredient supply | 56.4% |

| Others | 43.6% |

The B2B ingredient supply segment is projected to contribute 56.4% of the Squalane-Based Emulsifiers Market revenue in 2025, equivalent to USD 705.9 million. Growth in this segment is being supported by strong partnerships between ingredient suppliers and cosmetic brands that prioritize consistency, compliance, and quality assurance.

The scalability of distribution networks and technical support services provided by ingredient manufacturers are expected to ensure sustained dominance. With the rising demand for traceability and sustainability in cosmetic supply chains, B2B suppliers are being positioned as preferred partners.

This channel is also being strengthened by its ability to offer customized formulations and claims validation, which are critical for regulatory approval and brand credibility. Continued reliance on professional suppliers is expected to maintain B2B ingredient supply as the leading channel throughout the forecast period.

| Segment | Market Value Share, 2025 |

|---|---|

| Plant-derived squalane | 54.5% |

| Others | 45.6% |

The plant-derived squalane segment is forecasted to hold 54.5% of market share in 2025, valued at USD 681.1 million. Preference for renewable and bio-based raw materials is being emphasized as consumers increasingly demand safe, natural, and eco-friendly cosmetic ingredients. This segment’s expansion is expected to be reinforced by sugarcane and olive-derived supply chains that align with global sustainability commitments.

With regulatory support for green chemistry and rising adoption of ethical sourcing practices, plant-derived squalane is being positioned as the trusted option for high-performance emulsifiers. Its stability, compatibility with diverse formulations, and favorable perception in premium skincare categories are projected to secure its long-term dominance. Continuous investments in agricultural innovation and extraction efficiency are expected to strengthen the value proposition of this segment.

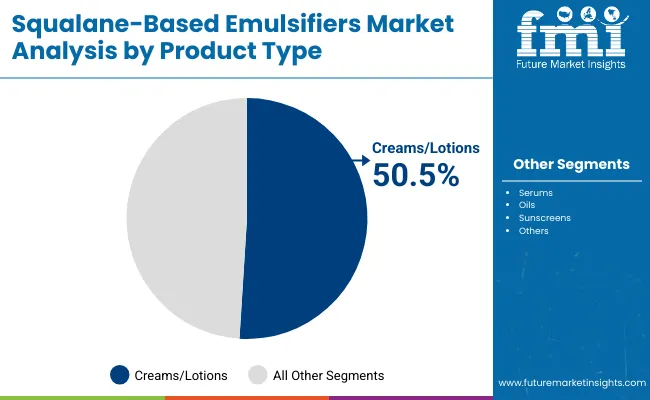

| Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 50.5% |

| Others | 49.5% |

The creams and lotions segment is anticipated to account for 50.5% of the Squalane-Based Emulsifiers Market revenue in 2025, representing USD 631.6 million. This leadership is being driven by widespread use of emulsifiers in hydrating, anti-aging, and protective skincare formulations. The role of squalane-based emulsifiers in improving texture, absorption, and moisture retention is being recognized as a core differentiator in cream and lotion applications.

Rising global interest in dermocosmetics, alongside demand for multifunctional daily care products, is projected to sustain segment strength. The segment’s growth is further expected to be propelled by the increasing inclusion of squalane in masstige and premium ranges targeting skin barrier restoration. Expanding adoption across both developed and emerging markets will ensure that creams and lotions continue to anchor product demand within the emulsifiers landscape.

Squalane-Based Emulsifiers Market growth is being influenced by evolving sustainability mandates and innovation in bio-based sourcing, though challenges around feedstock volatility and regulatory scrutiny continue to shape adoption dynamics across global cosmetic and personal care industries.

Regulatory Alignment with Green Chemistry

The market is being propelled by the increasing alignment of international cosmetic regulations with green chemistry principles. Regulatory agencies in Europe, the United States, and Asia are progressively embedding sustainability metrics into compliance frameworks, emphasizing lifecycle assessments, biodegradability, and verified natural content claims.

This alignment is expected to elevate demand for squalane-based emulsifiers derived from sugarcane and olives, as they fulfill both performance and traceability requirements. Companies are being incentivized to invest in certifications, such as COSMOS and ECOCERT, to secure competitive positioning.

In turn, regulatory convergence is expected to streamline cross-border commercialization, encouraging ingredient suppliers to expand production capacity and innovate more transparent sourcing models. Such frameworks are reinforcing long-term trust between manufacturers and consumers, ensuring growth trajectories remain resilient.

Integration of Algae-Derived Alternatives

A notable trend shaping the competitive landscape is the integration of algae-derived squalane as a supplementary feedstock pathway. While still nascent, this approach is being positioned as a solution to agricultural supply volatility and rising climate pressures on sugarcane cultivation. Advances in marine biotechnology are enabling scalable production, where microalgae platforms are engineered to yield higher lipid content for emulsifier extraction.

This diversification not only mitigates supply risks but also strengthens the sustainability profile of finished formulations, appealing to eco-conscious consumers and brands. Additionally, algae-derived emulsifiers are being explored for their potential compatibility with next-generation sunscreen and multifunctional products, creating fresh opportunities in premium cosmetic categories. If commercialized at scale, algae sourcing is expected to recalibrate the balance of supply and stimulate a wave of product differentiation across global markets.

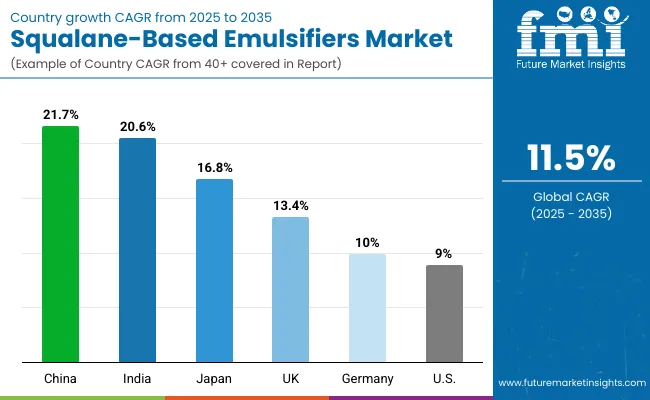

| Country | CAGR |

|---|---|

| China | 21.7% |

| USA | 9.0% |

| India | 20.6% |

| UK | 13.4% |

| Germany | 10.0% |

| Japan | 16.8% |

The global Squalane-Based Emulsifiers Market is projected to expand unevenly across regions, with adoption patterns influenced by sustainability priorities, consumer awareness, and regulatory enforcement. Asia is expected to lead growth, with China recording the highest CAGR of 21.7% between 2025 and 2035. This trajectory is being supported by large-scale investments in bio-based cosmetic ingredients, expansion of domestic personal care brands, and government-backed incentives promoting green chemistry.

India follows closely with a CAGR of 20.6%, where growth is being fueled by an expanding middle-class consumer base, rising skincare awareness, and increasing reliance on global ingredient suppliers to support mass-market and premium formulations. Japan, with a CAGR of 16.8%, is expected to benefit from aging demographics and premium skincare innovation, where squalane emulsifiers are being utilized to improve texture and efficacy.

In Europe, the UK (13.4% CAGR) and Germany (10.0% CAGR) are projected to sustain steady demand, supported by stringent cosmetic regulations and consumer emphasis on transparency and natural sourcing. North America is expected to display more moderate expansion, with the USA at a 9.0% CAGR, reflecting a mature market where growth will be driven by product differentiation and sustainability positioning rather than rapid volume gains.

This regional divergence highlights Asia’s role as the growth engine while established Western markets consolidate around premium and regulatory-driven adoption.

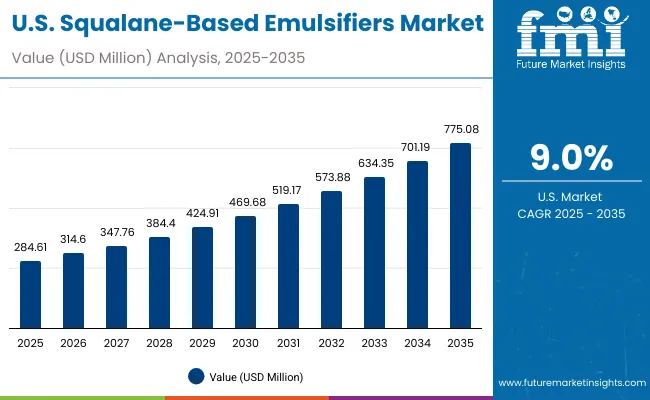

| Year | USA Squalane-Based Emulsifiers Market (USD Million) |

|---|---|

| 2025 | 284.61 |

| 2026 | 314.60 |

| 2027 | 347.76 |

| 2028 | 384.40 |

| 2029 | 424.91 |

| 2030 | 469.68 |

| 2031 | 519.17 |

| 2032 | 573.88 |

| 2033 | 634.35 |

| 2034 | 701.19 |

| 2035 | 775.08 |

The Squalane-Based Emulsifiers Market in the United States is projected to grow at a CAGR of 9.0% between 2025 and 2035, increasing from USD 284.6 million in 2025 to USD 775.1 million by the end of the forecast period. This steady expansion is being reinforced by the rising integration of bio-based ingredients into premium and dermocosmetic formulations, where performance, sustainability, and compliance with FDA cosmetic safety standards remain critical. The ability of squalane emulsifiers to deliver moisturization, emulsion stability, and improved texture is being recognized as a differentiating factor in skincare innovation pipelines.

Market progression is expected to be driven by growing collaboration between USA cosmetic brands and global suppliers offering certified plant-derived squalane. Sustainability certifications and transparent sourcing practices are anticipated to remain essential to consumer trust and brand differentiation. Alongside this, the rapid expansion of e-commerce and direct-to-consumer channels is enabling broader accessibility of emulsifier-based skincare products.

The Squalane-Based Emulsifiers Market in the United Kingdom is projected to expand at a CAGR of 13.4% between 2025 and 2035, reflecting steady growth underpinned by regulatory alignment and premium skincare adoption. Market value is expected to rise as domestic and multinational brands embed natural and plant-derived emulsifiers into their formulations to meet consumer demand for transparency and eco-labeling. Strict cosmetic compliance under UK and EU standards is anticipated to encourage suppliers to invest in traceability and certifications.

Growth will also be driven by the country’s strong dermocosmetic and premium skincare categories, which are increasingly marketed on sustainability credentials. Retail chains and e-commerce platforms are likely to accelerate distribution, while innovative formulations that emphasize skin barrier protection are expected to gain share.

The Squalane-Based Emulsifiers Market in India is projected to grow at a CAGR of 20.6% between 2025 and 2035, making it one of the fastest-expanding national markets. Expansion is expected to be powered by rising skincare consumption among a growing middle class and increasing awareness of clean-label cosmetic ingredients. Domestic brands are anticipated to integrate emulsifiers more deeply into product portfolios, while multinational companies are expected to scale operations in India to capture rising demand.

Government support for sustainable sourcing and growing consumer trust in plant-derived solutions are expected to reinforce demand momentum. The development of urban retail infrastructure and the proliferation of digital marketplaces are anticipated to expand access to premium skincare formulations, including emulsifier-based products.

The Squalane-Based Emulsifiers Market in China is forecast to achieve the highest regional CAGR at 21.7% between 2025 and 2035. This acceleration is expected to be driven by large-scale adoption of clean beauty trends, government support for bio-based industries, and rapid urbanization shaping consumer preferences. Domestic manufacturers are anticipated to expand squalane sourcing and production capacity to reduce reliance on imports, while international suppliers are expected to strengthen partnerships with Chinese brands.

Demand is likely to be anchored in premium skincare, sunscreen, and multifunctional formulations, which are increasingly marketed as safe, natural, and performance-oriented. Investments in algae-based squalane technologies are also being observed as part of China’s strategy to reduce agricultural dependency and strengthen supply resilience.

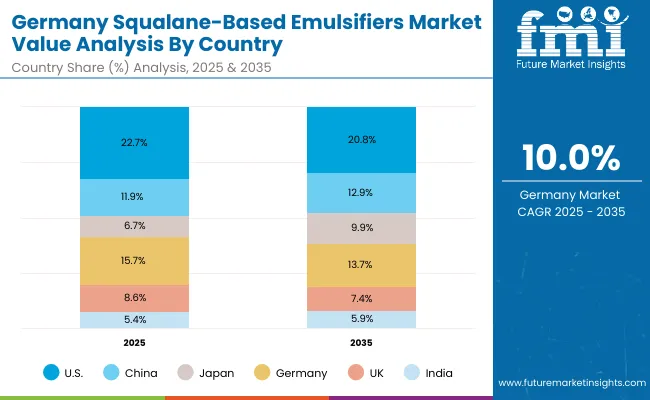

| Country | 2025 |

|---|---|

| USA | 22.7% |

| China | 11.9% |

| Japan | 6.7% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Country | 2035 |

|---|---|

| USA | 20.8% |

| China | 12.9% |

| Japan | 9.9% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 5.9% |

The Squalane-Based Emulsifiers Market in Germany is projected to grow at a CAGR of 10.0% between 2025 and 2035, reflecting steady expansion supported by strong regulatory frameworks and advanced cosmetic innovation. The market is expected to remain anchored in premium skincare, dermocosmetics, and sustainability-driven formulations, with German consumers prioritizing transparency, safety, and eco-certifications.

Industry compliance with stringent EU and German cosmetic standards is anticipated to reinforce supplier accountability and elevate demand for plant-derived squalane. Multinational players operating in Germany are expected to prioritize innovation in texture, stability, and multifunctionality, aligning with consumer demand for high-performance formulations. Growth in online beauty retail and strong brand positioning around green-label claims are also likely to underpin adoption.

| Segment | Market Value Share, 2025 |

|---|---|

| B2B ingredient supply | 59.30% |

| Others | 40.70% |

The Squalane-Based Emulsifiers Market in Japan is projected at USD 83.9 million in 2025. B2B ingredient supply contributes 59.3%, while other channels account for 40.7%, which highlights a strong reliance on professional ingredient suppliers. This channel dominance is being shaped by the premium positioning of Japanese skincare, where performance, safety, and regulatory compliance require advanced formulations supported by trusted partners. The market’s growth outlook is further reinforced by Japan’s CAGR of 16.8% between 2025 and 2035, one of the highest globally, underscoring its importance within Asia’s premium skincare segment.

Formulation innovation in Japan is expected to be driven by demand for emulsifiers that enhance skin hydration, barrier protection, and lightweight textures suited to local consumer preferences. Adoption of plant-derived squalane is likely to intensify, with algae-based alternatives also emerging as strategic options. As dermocosmetic and anti-aging categories expand, suppliers are expected to capitalize on partnerships with Japanese brands known for R&D-intensive approaches.

| Segment | Market Value Share, 2025 |

|---|---|

| B2B ingredient supply | 59.30% |

| Others | 40.70% |

The Squalane-Based Emulsifiers Market in South Korea is projected at USD 70.1 million in 2025. B2B ingredient supply contributes 59.3%, while other channels represent 40.7%, highlighting a strong reliance on ingredient suppliers for premium formulations. This channel preference is being shaped by South Korea’s globally recognized cosmetics industry, where K-beauty trends emphasize multifunctional, lightweight, and skin-friendly emulsifiers. The market is expected to expand significantly as South Korea leverages its role as a global innovation hub in skincare exports.

Growth is anticipated to be reinforced by increasing consumer preference for plant-derived squalane, with algae-derived alternatives also being considered to strengthen sustainability positioning. The CAGR for South Korea over 2025 to 2035 is expected to remain among the strongest in Asia, driven by product innovation, export competitiveness, and continuous R&D investments by local beauty giants.

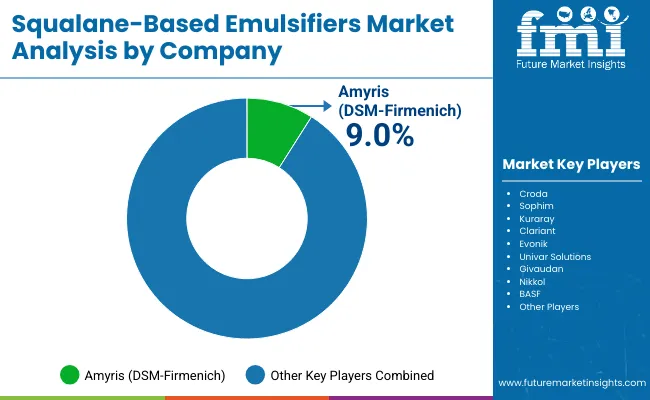

| Companies | Global Value Share 2025 |

|---|---|

| Amyris (DSM- Firmenich ) | 9.0% |

| Others | 91.0% |

The Squalane-Based Emulsifiers Market is moderately fragmented, with global leaders, mid-sized innovators, and niche suppliers competing across a wide range of applications. Large international companies such as Amyris (DSM-Firmenich), Croda, and Evonik are recognized as key leaders due to their advanced sourcing capabilities, bio-based innovation pipelines, and global distribution reach. Their strategies are increasingly focused on expanding plant-derived and fermentation-based squalane portfolios, while leveraging sustainability certifications and partnerships with multinational cosmetic brands to reinforce credibility.

Mid-sized players including Sophim, Kuraray, and Nikkol are active contributors, catering to demand for specialty emulsifiers in dermocosmetic and personal care applications. These companies are expected to strengthen adoption by emphasizing product purity, regional adaptability, and formulation support for lightweight, skin-friendly products. Their agility allows them to serve specific consumer demands in both premium and masstige segments.

Specialist ingredient providers such as Clariant, Givaudan, BASF, and Univar Solutions are positioned as versatile suppliers, integrating emulsifiers within broader ingredient portfolios. Their strength lies in value-chain synergies, enabling them to provide end-to-end formulation solutions and reliable supply models to global and regional cosmetic manufacturers.

Competitive differentiation is shifting away from commodity availability toward integrated value propositions that highlight traceability, eco-certifications, and technical co-development with cosmetic brands. Innovation in algae-derived squalane and expanded B2B ingredient supply is expected to define future competitive intensity.

Key Developments in Squalane-Based Emulsifiers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,252.3 million in 2025; projected USD 3,722.7 million by 2035 |

| Source | Plant-derived squalane , Synthetic squalane , Algae-derived squalane |

| Function | Emulsion stabilizer, Moisturizing, Texture enhancer |

| Product Type | Creams/lotions, Serums, Oils, Sunscreens, Others |

| Channel | B2B ingredient supply, E-commerce, Specialty retail, Others |

| End-use Industry | Skincare, Personal care, Cosmetics, Dermocosmetics , Sun care, Haircare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, China, Japan, India, South Korea, Brazil, Mexico, Australia, Thailand |

| Key Companies Profiled | Amyris (DSM- Firmenich ), Croda , Sophim , Kuraray, Clariant , Evonik , Univar Solutions, Givaudan , Nikkol , BASF |

| Additional Attributes | Market size by channel and source, consumer preference for plant-derived squalane , adoption trends in clean-label skincare, expansion of bio-fermentation technologies, supply chain resilience through algae-derived alternatives, regional growth driven by Asia-Pacific, regulatory alignment with green chemistry, and premium positioning in dermocosmetics and personal care. |

The global Squalane-Based Emulsifiers Market is estimated to be valued at USD 1,252.3 million in 2025.

The market size for the Squalane-Based Emulsifiers Market is projected to reach USD 3,722.7 million by 2035.

The Squalane-Based Emulsifiers Market is expected to grow at a CAGR of 11.5% between 2025 and 2035.

The key product types in the Squalane-Based Emulsifiers Market are creams/lotions, serums, oils, sunscreens, and others.

In terms of channel, the B2B ingredient supply segment is projected to command 56.4% share in the Squalane-Based Emulsifiers Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Demand for Food Emulsifiers in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA