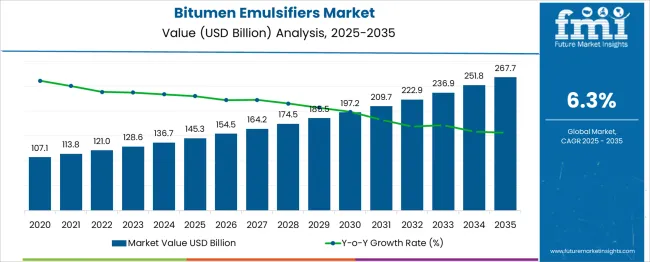

The Bitumen Emulsifiers Market is estimated to be valued at USD 145.3 billion in 2025 and is projected to reach USD 267.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. This reflects a growth multiplier of 1.84x, supported by a steady CAGR of 6.3%, driven by increasing road construction, maintenance projects, and demand for cold mix asphalt in developing economies. During the first five-year phase (2025–2030), the market is anticipated to reach around USD 196.7 billion, adding USD 51.4 billion, which accounts for 42% of total incremental growth, fueled by infrastructure development and sustainable pavement technologies. The second half (2030–2035) contributes USD 71.0 billion, representing 58% of incremental growth, indicating stronger momentum as advanced emulsifier formulations and eco-friendly road-building materials gain adoption globally. Annual additions increase from USD 10 billion in the early years to nearly USD 14 billion by the end of the forecast period, reflecting consistent investment in transportation infrastructure. Companies focusing on high-performance cationic and anionic emulsifiers, regional production facilities, and partnerships with government road agencies will capture the greatest share of this USD 122.4 billion growth opportunity, particularly in Asia-Pacific, Africa, and Latin America.

| Metric | Value |

|---|---|

| Bitumen Emulsifiers Market Estimated Value in (2025 E) | USD 145.3 billion |

| Bitumen Emulsifiers Market Forecast Value in (2035 F) | USD 267.7 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The bitumen emulsifiers market occupies a focused yet essential role in several construction-related segments. Within the Asphalt and Bitumen Market, it accounts for approximately 6%, as emulsifiers are key in producing stable bitumen emulsions for paving applications. In the Road Construction Materials Market, its share is around 4%, considering the dominance of aggregates and asphalt in total material consumption. For the Construction Chemicals Market, bitumen emulsifiers represent about 3%, as this category includes admixtures, sealants, and waterproofing chemicals. In the Pavement Maintenance Solutions Market, its share is roughly 8%, given its application in surface dressing, patch repairs, and micro-surfacing treatments. Within the Infrastructure Development Materials Market, it contributes close to 2%, since it serves as a specialized additive for road projects rather than a primary material. Growth is driven by rising demand for cold mix technologies, cost-effective road maintenance solutions, and environmental benefits associated with emulsified bitumen compared to hot-mix asphalt. Increased adoption in rural road development, highway upgrades, and airport runways further strengthens market potential. Formulation advancements, including cationic and anionic emulsifiers tailored for different aggregate types, have enhanced performance and durability. These factors position bitumen emulsifiers as a critical enabler for sustainable, economical, and high-performance road construction globally.

The bitumen emulsifiers market is witnessing robust expansion, driven by infrastructure modernization programs, rising urbanization, and sustainability goals in road-building practices. Increased demand for cold-mix technologies and environmentally friendly paving materials has catalyzed the adoption of bitumen emulsions.

Government investments in rural connectivity, smart city projects, and climate-resilient roadways have further amplified the need for high-performance emulsifiers that offer better adhesion and workability under varying climatic conditions. Advancements in formulation chemistry and customization based on regional aggregate types are supporting performance consistency across diverse geographies.

Future growth is expected to be steered by the integration of bio-based surfactants, regulatory push toward green construction standards, and the proliferation of micro surfacing and chip seal techniques in pavement maintenance.

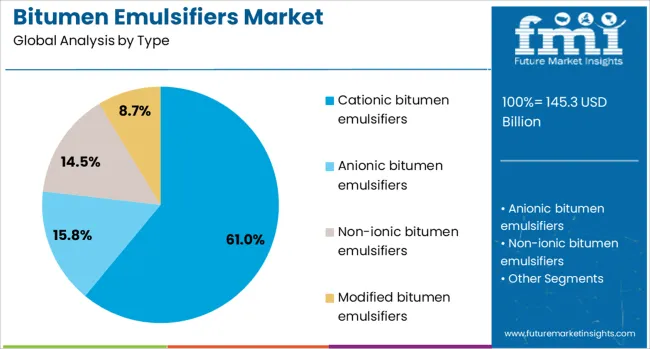

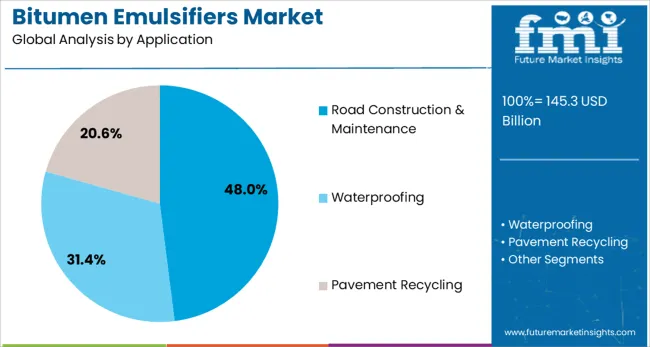

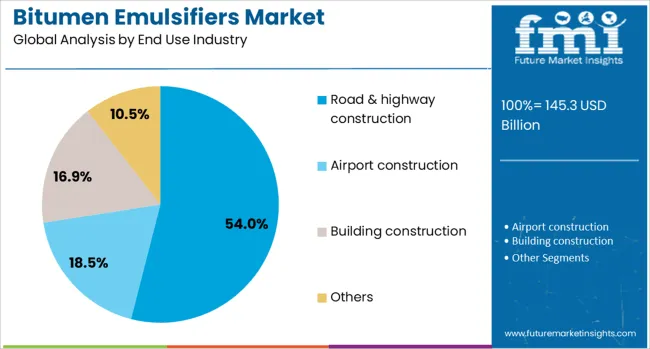

The bitumen emulsifiers market is segmented by type, application, end use industry, and manufacturing process and geographic regions. By type of the bitumen emulsifiers market is divided into Cationic bitumen emulsifiers, Anionic bitumen emulsifiers, Non-ionic bitumen emulsifiers, and Modified bitumen emulsifiers. In terms of application of the bitumen emulsifiers market is classified into Road Construction & Maintenance, Waterproofing, Pavement Recycling, and Others. Based on end use industry of the bitumen emulsifiers market is segmented into Road & highway construction, Airport construction, Building construction, and Others. By manufacturing process of the bitumen emulsifiers market is segmented into Continuous process, Batch process, and Semi-continuous process. Regionally, the bitumen emulsifiers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cationic bitumen emulsifiers are projected to account for 61.0% of total market revenue by 2025, making them the dominant product type. Their prevalence is being driven by superior adhesion to negatively charged aggregate surfaces, compatibility with a broad range of road base materials, and strong performance under variable climatic and traffic conditions.

Their usage is being reinforced by their proven effectiveness in surface dressing, patch repair, and tack coat applications. Additionally, cationic emulsifiers allow for lower temperature processing, which reduces energy consumption and enhances on-site worker safety.

Their reliability in rapid-setting and medium-setting grades continues to favor their adoption in both new road construction and rehabilitation projects.

The road construction and maintenance segment is anticipated to contribute 48.0% of the market share by 2025, leading the application category. Growth in this segment is underpinned by sustained investments in national highways, rural roads, and expressway networks globally.

Bitumen emulsifiers offer operational efficiency and environmental advantages in cold-mix and recycling-based construction processes, which are increasingly being specified in government tenders. Their role in extending pavement life through micro surfacing and fog sealing is gaining recognition, especially in cost-sensitive and high-traffic regions.

The shift toward sustainable road maintenance practices is further expected to anchor demand in this segment.

Road and highway construction is forecast to lead the end-use industry segment with a 54.0% revenue share by 2025. This dominance is driven by ongoing expansions in arterial infrastructure, growing vehicular traffic, and the rising need for all-weather durable pavements.

Governments across emerging and developed economies are prioritizing asphalt-based road networks due to their cost-efficiency, recyclability, and shorter project timelines. Bitumen emulsifiers are preferred for their compatibility with these infrastructure goals, enabling faster project turnaround with lower carbon emissions.

Additionally, the increasing adoption of performance-based specifications in public infrastructure contracts is boosting demand for tailored emulsifier solutions that enhance bitumen dispersion and mix stability.

The bitumen emulsifiers market is growing as demand for cold mix applications and cost-efficient road construction materials increases. In 2024 and 2025, governments accelerated investments in rural connectivity and highway resurfacing projects, supporting adoption of bitumen emulsions. Opportunities are evident in modified emulsifiers for high-performance pavements and low-temperature applications. Key trends include the shift toward cationic emulsifiers, improved additive formulations, and portable emulsion plants. However, volatility in crude-derived raw materials, limited contractor expertise, and stringent environmental norms for chemical additives remain major restraints affecting large-scale implementation globally.

The primary growth driver is the extensive use of bitumen emulsifiers in road maintenance and cold mix paving. In 2024 and 2025, national highway expansion projects in Asia and Africa relied on emulsified bitumen for surface dressing and patch repairs, reducing energy consumption during application. Cold mix technology gained traction for remote locations, where traditional hot mix asphalt was impractical due to logistics challenges. These developments underline that cost efficiency, operational flexibility, and reduced energy usage are strengthening the role of emulsifiers in modern road infrastructure projects worldwide.

Significant opportunities exist in the development of polymer-modified emulsifiers and customized formulations for challenging environments. In 2025, manufacturers introduced specialty emulsifiers for chip sealing, slurry sealing, and micro-surfacing applications, catering to high-traffic corridors and airport runways. Demand for low-temperature curing emulsions expanded in colder regions, where rapid set times are critical. The increasing preference for high-performance surface treatments in urban roads also created niche segments for advanced cationic emulsifiers. These opportunities signal that companies prioritizing product differentiation and performance consistency will capture new growth avenues in infrastructure modernization initiatives.

Emerging trends highlight the adoption of cationic emulsifiers for better adhesion and durability in bituminous applications. In 2024, portable emulsion production units were deployed near large projects to minimize transportation costs and maintain product stability. Formulation advancements focused on faster breaking time and compatibility with recycled aggregates, improving overall pavement performance. Additionally, the development of bio-based additives for emulsifier blends gained early interest among regional suppliers. These trends confirm a gradual shift toward enhanced formulation science and operational agility, aligning with evolving requirements of large-scale and remote road construction projects.

Market restraints are driven by crude oil price fluctuations, which directly affect the cost of bitumen and related chemicals. In 2024 and 2025, raw material cost instability created pricing challenges for contractors, leading to delayed adoption of premium emulsifier solutions. Strict regulatory norms on volatile organic compounds and hazardous chemicals in emulsifier production further increased compliance expenses. Limited awareness among small contractors regarding correct application methods also contributed to uneven market penetration. These constraints indicate that cost-control strategies, regulatory alignment, and training initiatives will be essential for ensuring market stability.

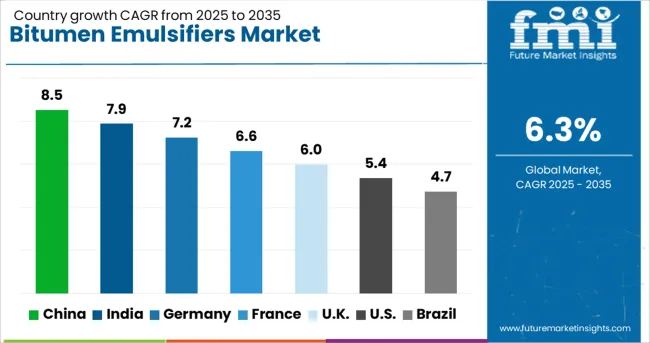

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global bitumen emulsifiers market is forecasted to grow at 6.3% CAGR between 2025 and 2035. China leads with 8.5% CAGR, fueled by major road construction programs and growing adoption of cold-mix technologies. India follows at 7.9%, supported by national highway expansion and rural connectivity projects. Germany records 7.2% CAGR, emphasizing eco-friendly emulsifiers under stringent EU environmental regulations. The United Kingdom grows at 6.0%, while the United States posts 5.4%, reflecting steady demand in a mature market driven by road maintenance and smart paving solutions. Asia-Pacific dominates growth through large-scale infrastructure investments, while Europe and North America focus on sustainable formulations and advanced polymer-modified emulsifiers.

The bitumen emulsifiers market in China is expected to grow at 8.5% CAGR, supported by massive investments in transportation infrastructure and green road technologies. The adoption of cold-mix emulsions in expressways, rural roads, and urban paving projects accelerates demand for high-performance emulsifiers. Domestic manufacturers introduce cost-efficient cationic emulsifiers, while international players launch polymer-modified formulations for premium applications. Regulatory emphasis on reducing VOC emissions drives innovation in water-based emulsifiers, ensuring compliance with sustainability mandates. Strategic focus on Belt and Road Initiative projects further increases market penetration.

The bitumen emulsifiers market in India is projected to grow at 7.9% CAGR, driven by government programs such as Bharatmala and Pradhan Mantri Gram Sadak Yojana. Increasing use of bitumen emulsions in rural and highway construction projects ensures cost-effective, eco-friendly road development. Rising demand for rapid-curing and slow-setting emulsifiers supports diverse applications in patchwork, slurry sealing, and chip sealing. Local producers focus on enhancing emulsifier formulations for hot and humid climates, while global firms target the premium segment with performance-modified grades.

The bitumen emulsifiers market in Germany is forecasted to grow at 7.2% CAGR, supported by strict EU sustainability regulations and emphasis on circular economy practices. Advanced emulsifier formulations integrated with polymers and latex improve road surface performance and longevity. Germany’s investments in green mobility corridors and road maintenance projects strengthen adoption of cationic and anionic emulsifiers in cold-mix asphalt applications. Manufacturers prioritize biodegradable emulsifiers and low-energy mixing solutions to meet environmental compliance. Increased R&D spending focuses on enhancing adhesion properties for recycled asphalt pavement (RAP).

The bitumen emulsifiers market in the United Kingdom is expected to grow at 6.0% CAGR, driven by growing adoption of cold-mix technologies in maintenance and repair operations. Infrastructure renewal programs and smart city projects increase demand for high-quality emulsifiers that enable fast, cost-efficient construction. Manufacturers develop advanced emulsifier systems compatible with reclaimed asphalt materials, ensuring sustainability compliance. Digital solutions integrated into road construction processes optimize the application of emulsions, reducing waste and enhancing performance. Partnerships between road authorities and chemical companies drive large-scale adoption.

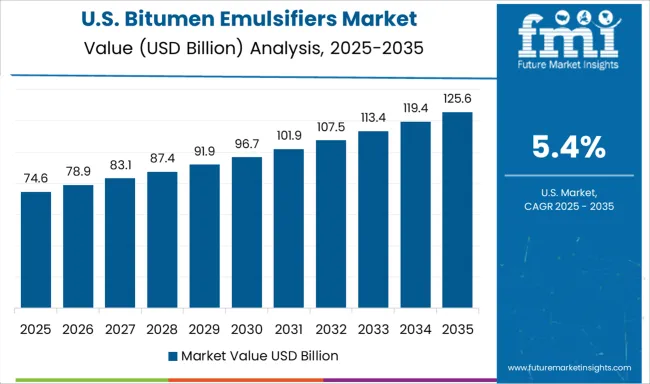

The bitumen emulsifiers market in the United States is forecasted to grow at 5.4% CAGR, reflecting steady demand in maintenance-intensive road networks. Adoption of rapid-curing emulsifiers for emergency repairs and airport runway resurfacing accelerates. Federal highway funding programs support investments in advanced emulsifier technologies with superior adhesion and durability properties. Sustainability initiatives promote use of low-VOC and bio-based emulsifier systems, aligning with state-level green infrastructure mandates. Increased adoption of polymer-modified emulsions in premium paving projects ensures improved road life cycles.

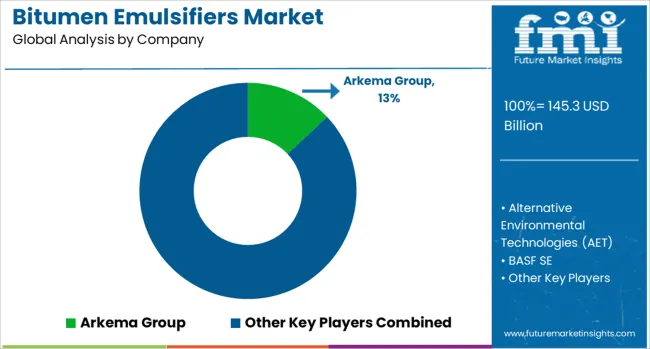

The bitumen emulsifiers market is dominated by Arkema Group, which leads through its extensive range of high-performance emulsifying agents designed for road construction and maintenance applications. Arkema secures its leadership by leveraging advanced chemical formulations, strong global distribution, and technical expertise that support diverse climate conditions and pavement requirements. Key players such as BASF SE, Dow Chemical Company, Evonik Industries AG, Nynas AB, and Royal Dutch Shell plc hold significant shares by offering cationic, anionic, and non-ionic emulsifiers for applications such as surface dressing, tack coats, and cold mix technologies. These companies emphasize consistent quality, compliance with road safety standards, and integration of emulsifiers with performance-grade bitumen for extended pavement life. Emerging players including Alternative Environmental Technologies (AET), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Hindustan Colas Limited (HINCOL), Ingevity Corporation, Marathon Petroleum Asphalt & Emulsions, Jey Oil Refining Company, Nouryon, Tiki Tar Industries, Petro Naft, BTBA, Pro‑Road Global, GlobeCore, and Kao Corporation are strengthening their market presence through specialized emulsifier blends, regional production facilities, and solutions focused on cost efficiency and environmental adaptability. Market growth is being driven by the rising demand for durable road infrastructure, increased adoption of cold paving technologies, and government-backed initiatives for highway upgrades. Continuous innovation in bio-based emulsifiers and performance-enhancing additives is expected to influence competitive dynamics and create opportunities for both established and emerging players globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 145.3 Billion |

| Type | Cationic bitumen emulsifiers, Anionic bitumen emulsifiers, Non-ionic bitumen emulsifiers, and Modified bitumen emulsifiers |

| Application | Road Construction & Maintenance, Waterproofing, Pavement Recycling, and Others |

| End Use Industry | Road & highway construction, Airport construction, Building construction, and Others |

| Manufacturing Process | Continuous process, Batch process, and Semi-continuous process |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arkema Group, Alternative Environmental Technologies (AET), BASF SE, Bharat Petroleum Corporation Limited (BPCL), BTBA, Dow Chemical Company, Evonik Industries AG, GlobeCore, Hindustan Colas Limited (HINCOL), Hindustan Petroleum Corporation Limited (HPCL), Ingevity Corporation, Jey Oil Refining Company, Kao Corporation, Marathon Petroleum Asphalt & Emulsions, Nouryon, Nynas AB, Petro Naft, Pro‑Road Global, Royal Dutch Shell plc, and Tiki Tar Industries |

| Additional Attributes | Dollar sales split by emulsifier type (cationic, anionic, nonionic) and application (surface dressing, cold mix, slurry seal), with OEM, distributor, and contractor channels shaping distribution. Regional dynamics highlight Asia-Pacific as fastest growing. Key trends involve polymer-modified emulsions, VOC-compliant surfactants, low-temperature formulations, OEM collaborations, and biodegradable eco-friendly emulsifier innovations. |

The global bitumen emulsifiers market is estimated to be valued at USD 145.3 billion in 2025.

The market size for the bitumen emulsifiers market is projected to reach USD 267.7 billion by 2035.

The bitumen emulsifiers market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in bitumen emulsifiers market are cationic bitumen emulsifiers, _rapid setting (crs), _medium setting (cms), _slow setting (css), anionic bitumen emulsifiers, _rapid setting (rs), _medium setting (ms), _slow setting (ss), non-ionic bitumen emulsifiers, modified bitumen emulsifiers, _polymer modified, _latex modified and _others.

In terms of application, road construction & maintenance segment to command 48.0% share in the bitumen emulsifiers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bitumen Modifier Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Bitumen Sprayer Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsion Plants Market Size and Share Forecast Outlook 2025 to 2035

Bitumen and Asphalt Testing Services Market

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Squalane-Based Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Demand for Food Emulsifiers in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA