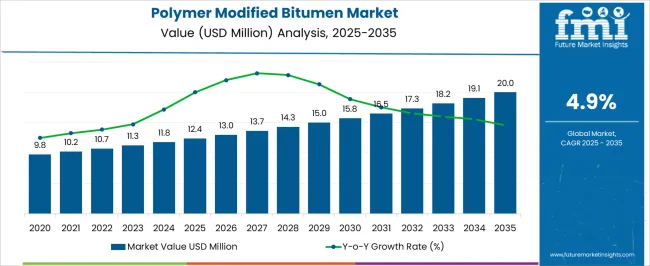

The Polymer Modified Bitumen Market is estimated to be valued at USD 12.4 million in 2025 and is projected to reach USD 20.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The polymer modified bitumen (PMB) market is witnessing steady expansion, fueled by rising infrastructure development activities and the need for long-lasting road materials that withstand diverse climatic conditions. Industry updates and construction sector reports have emphasized the shift toward advanced bitumen formulations that improve elasticity, durability, and resistance to deformation.

Government investments in national highway expansion programs, along with stringent standards for pavement quality, have led to increased adoption of PMB across both developed and emerging economies. Technological enhancements in polymer blending and on-site mixing techniques have also improved application efficiency and cost optimization.

Moreover, sustainability considerations have led authorities and contractors to favor PMB for its ability to extend pavement life and reduce maintenance cycles, lowering lifecycle emissions. Looking ahead, growth in the PMB market is expected to be anchored by rapid urbanization, rising vehicular traffic, and greater demand for performance-based road materials. Product demand is expected to be led by thermoplastic elastomers, with road construction continuing to be the primary application driver.

| Metric | Value |

|---|---|

| Polymer Modified Bitumen Market Estimated Value in (2025 E) | USD 12.4 million |

| Polymer Modified Bitumen Market Forecast Value in (2035 F) | USD 20.0 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

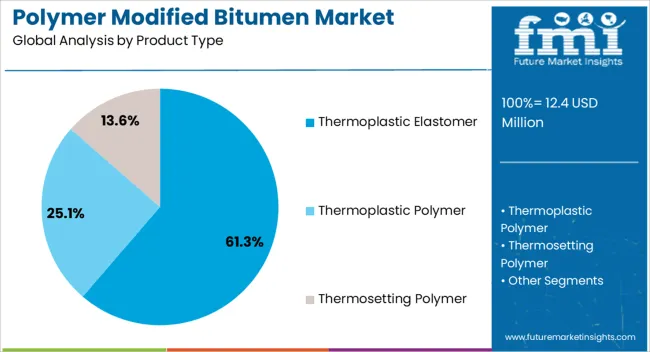

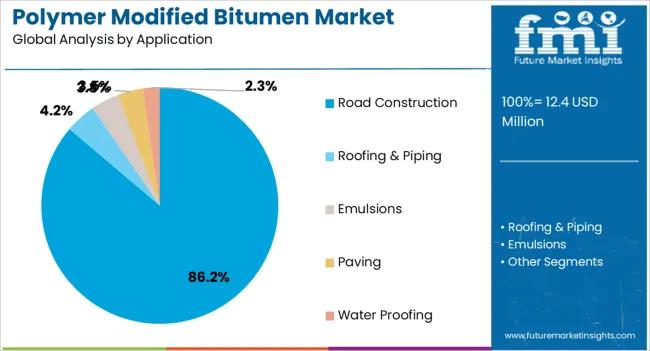

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Thermoplastic Elastomer, Thermoplastic Polymer, and Thermosetting Polymer. In terms of Application, the market is classified into Road Construction, Roofing & Piping, Emulsions, Paving, and Water Proofing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermoplastic elastomer segment is projected to hold 61.3% of the polymer modified bitumen market revenue in 2025, maintaining its lead among product types. Growth of this segment has been supported by the material’s ability to significantly enhance the flexibility, fatigue resistance, and temperature performance of bitumen.

Industry sources have reported that thermoplastic elastomers such as SBS and SIS are widely used in road surfacing due to their compatibility with bitumen and their efficiency in improving viscoelastic behavior under stress. This performance advantage has been particularly valued in regions with extreme weather fluctuations and heavy traffic loads, where pavement resilience is critical.

Additionally, advancements in polymer blending technology have improved the homogeneity and stability of thermoplastic elastomer-modified mixtures, allowing for more reliable application outcomes. With regulatory authorities endorsing high-performance materials in public infrastructure projects, the thermoplastic elastomer segment is expected to sustain its dominance in the PMB market.

The road construction segment is projected to account for 86.2% of the polymer modified bitumen market revenue in 2025, positioning it as the dominant application area. This growth has been driven by the widespread use of PMB in highways, expressways, and urban road projects, where durability and load-bearing performance are essential.

Civil engineering reports and infrastructure policy updates have highlighted that PMB enhances resistance to rutting, thermal cracking, and aging, making it the material of choice for long-term road performance. Additionally, road agencies have increasingly specified the use of polymer modified bitumen in national tenders to ensure compliance with modern pavement standards.

Public and private sector investment in smart city infrastructure, logistics corridors, and rural connectivity projects has further boosted demand. As governments continue to expand and modernize road networks globally, the road construction segment is expected to maintain its dominant position in the market, supported by both regulatory mandates and performance benefits.

Demand for Durablilty and Performance to be a Key Trend

Researchers and engineers are looking for polymers that can blend with bitumen to improve its rutting, cracking, and fatigue resistance. Modification of bitumen with polymers makes more durable and long-lasting against weathering and traffic.

The use of PMB in sustainable pavement construction, warm mix polymer modified bitumen is a trend toward reducing mixing and compaction temperatures. In addition to highways with high traffic volumes, runways at airports can also be equipped with PMB to meet their specific requirements.

After polymer modification, bitumen gains greater resistance to oxidation age and overall durability. The presence of polymers in bitumen increases its adhesive properties, which reduces the possibility of delamination and improves pavement performance. As PMB uses expand beyond road construction, roofing and underground structures are also waterproofed with this material.

Innovative Technologies to Push Demand for Polymer Modified Bitumen

With the rapid development of infrastructure and government regulations on infrastructure spending and road construction projects, revenues will increase for the polymer modified bitumen market.

In the polymer modified bitumen industry, companies have the chance to gain market share and differentiate themselves from the competition by launching new products.

Bitumen prices are expected to rise due to advances in PMB technology, which manufacturers are utilizing in order to increase fatigue performance and resistance to deformation.

Regulations and rules that enhance sustainability and quality in infrastructure projects can lead to more widespread use of polymeric modified bitumen. Eco-friendly building materials such as polymer-modified bitumen are becoming more popular due to the increasing interest in eco-friendly building materials.

Increasing Costs to Hamper Demand

Polymer additions make PMB more expensive than ordinary bitumen. The rising cost of crude oil, impacting the price of bitumen, is expected to hamper the market. The lack of compatibility can lead to phase separation or decrease the effectiveness of modifiers. Maintaining quality and uniformity throughout the production process can be challenging when mixing bitumen and polymer.

Compared to conventional bitumen, PMBs may require handling and storage methods that are different. Premature curing or degradation of the product may require the use of specific temperature controls.

Policies promoting sustainable construction practices and use of recycled materials in asphalt will drive the market. Mix designs for specific applications can take a long time to determine and may involve extensive testing.

The global market registered a CAGR of 3.3% during the historical period between 2020 and 2025. The market for polymer modified bitumens grew positively and reached a value of USD 11,407 million in 2025.

Construction materials such as bitumen have been used for centuries and remain a valuable engineering material. Bitumen's performance in the field has been improved through a lot of studies.

Polymer additions to bitumen have produced desirable results, especially in road repair capacities. The use of polymers in bitumen-based applications enhances the elasticity of bitumen, thereby providing numerous benefits.

According to certain studies, bitumen treated with polymers may lead to financial savings in specific applications. Due to their improved mechanical qualities, PMBs can be placed in thinner layers than bitumen that hasn't been changed without sacrificing performance.

Even with strong binders, improvements in binder strength, flexibility, and toughness greatly increase the asphalt's resilience to fatigue. Industry growth is expected to reach a CAGR of 4.9% CAGR during the forecast period.

The following section provides country-level forecasts for polymer modified bitumen. Global information is provided on several key countries, including those in North America, Asia Pacific, and Europe.

With a CAGR of 3% through 2035, Canada is projected to remain the leader in North America. By 2035, India is anticipated to witness a CAGR of 7.4% in the South Asian and Pacific region.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.8% |

| Canada | 3% |

| Germany | 2.3% |

| United Kingdom | 1.9% |

| China | 5.5% |

| India | 7.4% |

India's polymer modified bitumen industry is expected to present incremental opportunities over the forecast period. A significant portion of the region's value share is projected to be held by the country by 2035, making the dominant player.

Since the government has focused on infrastructure development, including roads and highways, India's polymer-modified bitumen market has seen substantial growth.

The Bharatmala Project and other initiatives have led to an increase in road construction across the country. In India, polymer-modified bitumen is used for road construction as its durability, cracking resistance, and weather resistance are improved.

The focus on carbon footprint reduction has facilitated the transition from conventional bitumen to polymer-modified bitumen as a sustainable material. A CAGR of 1.9% is predicted during the evaluation period for the country.

For economic growth and efficient mobility in the United Kingdom, the current road network is being upgraded and maintained. Road development and repair are among the ambitious projects included in the National Infrastructure Strategy of the government.

The United Kingdom has seen significant growth in the use of polymer modified bitumen (PMB), especially for roofing, road pavements, and waterproofing. A range of products, including PMB, are manufactured and developed in the United Kingdom by companies with advanced testing and manufacturing facilities.

Road networks are extensive throughout North America, primarily in the United States and Canada. Economic and population growth often requires expansion. Federal Highway Trust Fund funding facilitates the use of polymer-modified bitumen in construction and rehabilitation projects. Canada has recently seen an increase in federal and provincial investments in infrastructure.

AASHTO and CCIL are two organizations that set standards and regulations for the industry, which ensure compliance and product performance. To ensure compliance and product quality, stakeholders must follow those standards and regulations.

An overview of the industry's top segments is provided in this section. In terms of product type, the thermoplastic elastomer segment has a share of 61.3% by 2025. By application, the road construction category is projected to hold a market share of 86.2% in 2025.

| Segment | Thermoplastic Elastomer (Product Type) |

|---|---|

| Value Share (2025) | 61.3% |

Thermoplastic elastomer are predicted to lead the industry over the forecast period. The market share for thermoplastic elastomers is expected to reach 61.3% in 2025. Developing thermoplastic elastomers (TPEs) over the past couple of decades, especially through advances in supramolecular chemistry, polymerizations, and macromolecular structures.

These developments are being driven by the steady demand for sophisticated TPEs with adaptable properties, which are used in a variety of applications, such as adhesives, elastomers, coatings, fibers, and additive manufacturing processes such as 3D printing.

Compared to other materials, TPEs can stretch moderately and return to their nearly original shape, giving them longer lifespans and a broader physical range. Plastic and rubbery materials share these properties. Injection molded plastics combine thermoplastic processing advantages with elastomeric performance attributes and are relatively simple to fabricate with injection molding.

| Segment | Road Construction (Application) |

|---|---|

| Value Share (2025) | 86.2% |

The polymer modified bitumen industry is estimated to be led by the road construction segment. A value share of 86.2% is expected for the segment in 2025. Using PMB improves the safety and quality of road surfaces.

Enhanced adhesion and resistance to water-induced degradation, such as stripping and sinkholes, make a better choice for aggregates than conventional cement. The improved skid resistance on PMB surfaces also makes roadways safer for drivers by reducing collisions.

As far as longevity and durability are concerned, PMB-built roads are better than bitumen-built roads. Due to its resistance to deformation and temperature variations, PMB roads remain structurally sound for a long time. As governments and businesses seek sustainable infrastructure solutions, PMB's benefits contribute to its popularity.

Traditional bitumen may be effective, but may not always meet the demands of contemporary road construction. Various climatic conditions, high traffic volumes, and the need for improved durability all influence the choice of PMB. The new qualities of the material are proving to be attractive to engineers since is more durable and resistant to rutting, cracking, and aging.

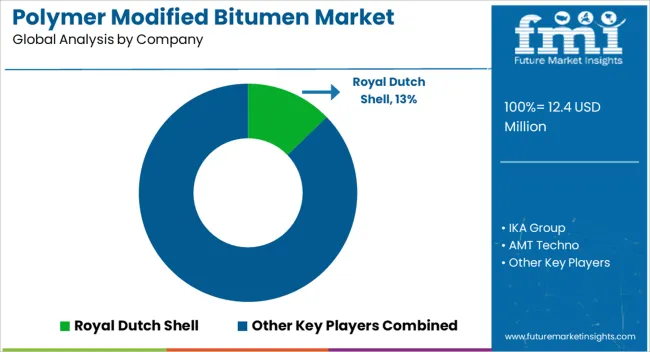

Leading PMB manufacturers focus on the product quality and distribution networks of companies with a large market share. Strategies for new entrants to specialize in niche markets likely contribute to their maintaining significant market shares in the energy and petrochemical sectors. Recent mergers and acquisitions in the PMB industry are becoming increasingly popular.

With infrastructure demands on the rise and technological advancements, the polymer-modified bitumen industry is experiencing a surge in competitiveness. A commitment to sustainable practices and innovative polymer formulations is important to startups in order to succeed in their endeavors to gain traction in the ecosystem.

While established players pose significant competition, startups are able to invest heavily in research and development and are very well established on the market.

Access to capital, compliance with regulations, and strategic partnerships are vital to startup success in this competitive environment. Innovation and niche carving are plentiful opportunities for incumbents and newcomers in the industry, as the industry is on the rise.

Industry Updates

The industry is segregated into thermoplastic polymer, thermoplastic elastomer, and thermosetting polymer. Thermoplastic polymer are further divided into ethylene vinyl acetate (EVA), ethylene methacrylate (EMA), ethylene butyl acrylate copolymer (EBA), atactic polypropylene (APP), polyethylene (PE), polypropylene (PP), others.

Thermoplastic elastomer are sub-segmented into natural rubber, styrene butadiene styrene (SBS), styrene butadiene rubber (SBR), styrene isoprene copolymer (SIS), styrene ethylene butlylene styrene (SEBS), butyl rubber (IIR), others. Lastly, thermosetting polymer are fractionated into epoxy resin, polyurethane resin, acrylic resin, phenolic resin.

In terms of application, the industry is classified into roofing & piping, emulsions, paving, water proofing, and road construction.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa are covered.

The global polymer modified bitumen market is estimated to be valued at USD 12.4 million in 2025.

The market size for the polymer modified bitumen market is projected to reach USD 20.0 million by 2035.

The polymer modified bitumen market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in polymer modified bitumen market are thermoplastic elastomer, thermoplastic polymer, _ethylene vinyl acetate (eva), _ethylene methacrylate (ema), _ethylene butyl acrylate copolymer (eba), _atactic polypropylene (app), _polyethylene (pe), _polypropylene (pp), _ others, thermosetting polymer, _epoxy resin, _polyurethane resin, _acrylic resin and _phenolic resin.

In terms of application, road construction segment to command 86.2% share in the polymer modified bitumen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA