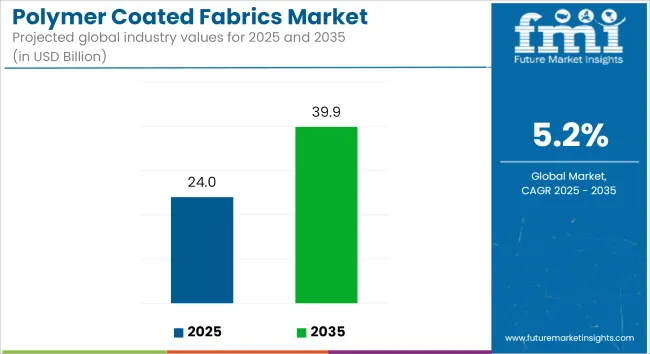

The global polymer coated fabrics market is valued at USD 24.0 billion in 2025 and is expected to reach USD 39.9 billion by 2035, reflecting a CAGR of 5.2% over the forecast period. The expansion is being supported by rising demand across transportation, industrial safety, construction, and healthcare sectors, where mechanically resilient and chemically resistant materials are prioritized for long-term use.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 24.0 billion |

| Industry Value (2035F) | USD 39.9 billion |

| CAGR (2025 to 2035) | 5.2% |

Polymer coated fabrics are being applied in automotive seating, airbags, interior trims, and tarpaulin covers to ensure moisture resistance, abrasion protection, and thermal stability. The expected increase in global vehicle production to 100 million units annually by 2030, as reported by the International Organization of Motor Vehicle Manufacturers (OICA), is projected to elevate fabric consumption in automotive applications.

In the protective clothing sector, polymer-coated textiles are being utilized to meet performance standards related to flame retardancy and hazardous material resistance. Coating innovations using nanocomposites are facilitating the manufacture of lightweight, breathable, and high-barrier gear, which is being adopted in industries such as oil & gas, chemical processing, and emergency response services.

Demand from the construction industry is being influenced by the growing use of coated fabrics in tensile structures, roofing membranes, scaffolding covers, and geotextiles. Their ability to resist UV radiation, extreme temperatures, and environmental degradation is being favored in infrastructure projects where long service life and minimal maintenance are required.

Medical and healthcare sectors are adopting polymer coated fabrics for use in surgical gowns, mattress covers, and medical curtains. Research published in Textile Research Journal (2024) demonstrated that antimicrobial polymer coatings can reduce hospital-acquired infection rates by up to 40%, supporting their application in clinical settings.

Market participants are focusing on durable coatings using polyurethane, PVC, and silicone, with additional R&D exploring recyclable and solvent-free formulations to align with evolving regulatory frameworks. Continuous investments are being made in surface functionalization technologies and advanced lamination processes to improve mechanical properties and expand the range of end-use applications. The outlook for polymer coated fabrics remains favorable as sectors prioritize performance, hygiene, and durability in material selection.

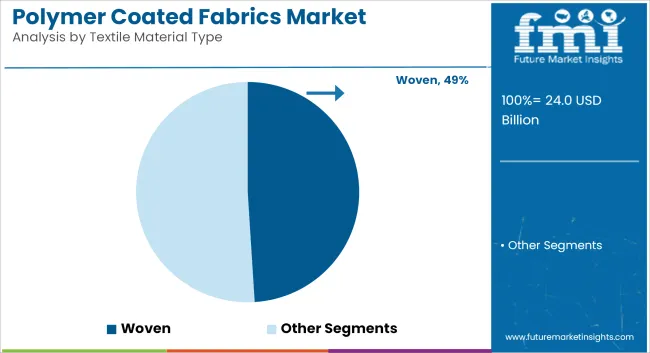

Woven fabrics are estimated to account for approximately 49% of the global polymer coated fabrics market share in 2025 and are projected to grow at a CAGR of 5.3% through 2035. These fabrics offer superior dimensional stability, abrasion resistance, and tensile strength, making them ideal for high-performance coated applications.

Common substrates such as polyester and nylon are coated with polymers like PVC, PU, or silicone to produce materials used in tarpaulins, airbags, tents, conveyor belts, and industrial curtains. Their widespread adoption in infrastructure, automotive, and heavy-duty protective equipment segments supports consistent demand. Manufacturers are also focusing on eco-friendly coating chemistries to align with sustainability goals and regulatory compliance across Europe and North America.

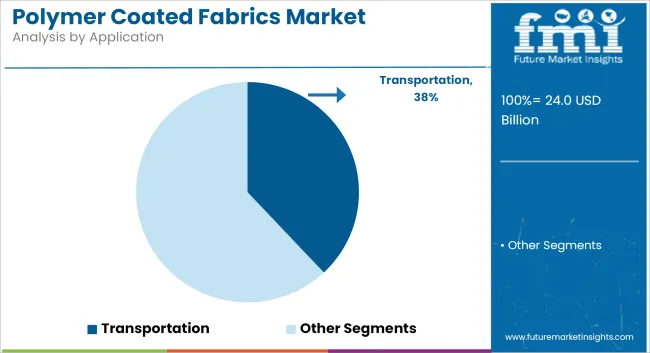

The transportation segment is projected to hold approximately 38% of the global polymer coated fabrics market share in 2025 and is expected to grow at a CAGR of 5.4% through 2035. Coated fabrics are extensively used in automotive, rail, marine, and aviation sectors due to their water resistance, flame retardancy, UV protection, and easy cleanability.

In vehicle interiors, these materials serve as upholstery, headliners, sun visors, and door panels, offering durability and design flexibility. The rise of electric vehicles and lightweight materials is further boosting adoption. Additionally, polymer coated textiles are replacing traditional leather and vinyl in seating applications as OEMs shift toward sustainable, cost-efficient alternatives that enhance comfort and aesthetics.

Environmental and Regulatory Pressures on PVC-Based Coatings

Vinyl (PVC) coated fabrics have long since been recognized as ruggedly durable andcost-effective; they now face increasing scrutiny over phthalate plasticizer content, VOC emissions, and end-of-life disposal issues. Environmental regulators in North American and European countries are increasingly limiting the use of halogenated polymers and solvent-based coatings, thereby further drivingthe manufacturers towards PU, PE & bio-based alternatives.

As of 2023, some EU member countries have enforced their waste management regulations, limiting landfilldisposal of PVC-coated textiles, particularly in the construction and awning sectors. These can include costly formulation adjustments and equipment upgrades required for transitioning away from PVC, a challenge particularly for smaller andmid-sized coating operations. The industry must invest in sustainable chemistry and closed-loop systems to maintain compliance and public trust.

Balancing Performance, Flexibility, and Cost in Diverse Applications

Designing coated fabrics that deliver uniform mechanical strength, flexibility, UV stability, chemical resistance, and fire retardancy across diverse sectors remains a technical challenge. Roofing membranes, automotive seats, protective clothing: each of theseapplications have unique performance profiles and require the custom formulations of coatings and combinations of substrates.

The trade-off between performance, lightweight design, and cost efficiency results in implementations that may not beuniversally applicable. In 2023, several industrial purchasing or engineering executives in Asia and Europe told us that they had problems with coating delaminating or with material fatigue, whenexposed to very high levels of UV or cyclic stress, particularly with low-cost imports.

Though economies have slowly moved to a near full-century of processing and enterprise clout come the world of performance coatings, tempered for change in high-performance coating systems.

Sustainable Coated Fabrics for Green Construction and Mobility

As theworld moves towards more sustainable infrastructure and eco-friendly transportation, there is a growing need for low-VOC, recyclable and bio-based polymer coatings. Green building certifications like LEED and BREEAM now emphasize the use of non-toxic roofing membranes, shading structures, and interior fabrics, increasing interest in PUand thermoplastic olefin (TPO) coated substrates.

Within the mobilitysector, OEMs are trying to balance their circular economy targets within the cabin, including lightweight, recyclable coated fabrics for seating and interior panels. For example,in 2023, a European OEM introduced an automotive interior package with PU-coated recycled PET fabric which marks a shift in the market.

Sustainable coated fabric is a must, and companies that have performance-tested sustainable coated textile solutions are well-placed to shine in green-certified initiatives for growingindustries.

High-Performance Textiles for Industrial and Protective Applications

Need for durable textiles with fire retardancy, abrasion resistant, and chemical shielding properties for chemical, oil & gas, electrical and construction sectors and increasing industrial safety regulations would boost demandfor PU and specialty-coated fabrics.

New PU-coated textiles gained momentum in the European and North American markets in 2023 with EN ISO 11612 flame resistance and ASTMF903 chemical barrier ratings. As demand for multi-layer coated protective gear, and high-performance containment materials continues to grow, so too dothe electrical utility and petrochemical segments.

A shift in focus indeed, but the emphasis on high-performance formulations and industry specific certifications will certainly reward suppliers withhigh-performance, compliant coated fabric solutions for utilization in hazardous environments.

Smart and Functional Coatings Unlocking Next-Gen Applications

Polymer coated fabrics are traversingnew frontiers through the development of smart textiles, antimicrobial coatings, and responsive materials. Medical, hospitality, military, and public transportapplications require such surfaces which offering antibacterial activity or odor control or temperature responsiveness or EMI shielding.

In 2023, hospital bedding and mass transit upholstery typical began adopting coated fabrics with silver-ion antimicrobial PUlayers. There is an increasing interest in military/aerospaceindustries in PU coated textiles that offer infrared suppression and radar resistance.

Finally, thecompanies that invest now in the development of multifunctional polymer coatings that incorporate nanotechnology or embedded sensors will dominate high-end premium niches of the market where functionality provides significant advantages over more traditional coatings that serve only durability or aesthetic purposes.

The USA polymer coatedfabrics market is growing steadily, driven by demand form the transportation, protective apparel, and industrial sectors. PU and vinyl coated fabrics are predominantly used in automobile interiors, seating,and protective clothing. The book also covers the growth of roofing and awnings applications due to theexpansion of the infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

The polymer coated fabrics market in the UK is experiencing a moderategrowth. PU and vinyl coating are used on woven and non-woven fabrics for automotive, furniture, andawnings products. Sustainability initiatives are driving demand for longer-lasting,low-emission coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.1% |

The European Union polymer coated fabrics marketis advancing due to demand across transportation, construction, and protective clothing sectors. Germany, Italy, and France are key markets where vinyl and PU coated fabrics are widely adopted for automotive, roofing, and industrial textile applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

Japan’s polymer coated fabrics market is driven by demand for high-performance textiles in automotive, electronics cleanrooms, and protective clothing sectorsTransportation and industrial applications are increasingly favored with lightweight, precision-coated wovenfabrics. Market trends are also being shapedby innovation in eco-friendly PU coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

South Korea Polymer Coated Fabrics Market is growing at a fast pace owing to the growing applicationin automotive seating, outdoor canopies, and industrial textiles. Vinyl and PU coated fabrics are favored for their durability, chemical resistance,and ease of maintenance. Exports of coated technical textiles to world markets alsofuel growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

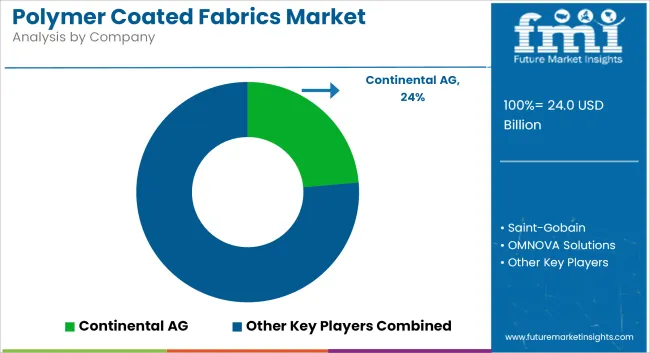

The polymer coated fabrics market features a mix of global giants and specialized manufacturers, with the top five players controlling approximately 40% of market share. Companies are competing through material innovation, sustainability initiatives, and strategic acquisitions.

Vinyl Coated Fabrics, PU Coated Fabrics, PE Coated Fabrics, Others

Knitted, Woven, Non-Woven

Transportation, Protective Clothing, Industrial, Roofing, Awnings & Canopies, Furniture & Seating, Others

North America,Latin America,Western Europe,South Asia,East Asia,Eastern Europe,Middle East & Africa

The overall market size for the Polymer Coated Fabrics Market was USD 24.0 billion in 2025.

The Polymer Coated Fabrics Market is expected to reach USD 39.9 billion in 2035.

Demand will be driven by expanding transportation infrastructure, demand for lightweight and durable materials, and adoption in protective and architectural applications.

The top 5 countries driving the development of the Polymer Coated Fabrics Market are the USA, China, Germany, India, and Japan.

Vinyl Coated Fabrics are expected to lead due to their widespread use in transportation, furniture, and industrial coverings.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Polymer Vials Market Insights & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA