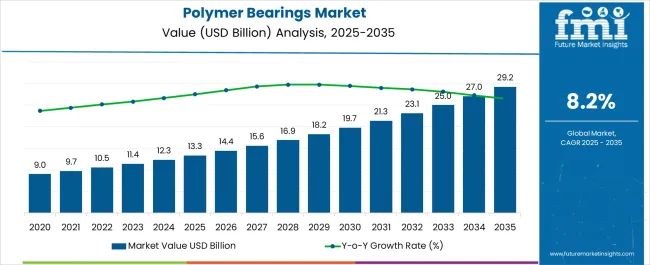

The Polymer Bearings Market is estimated to be valued at USD 13.3 billion in 2025 and is projected to reach USD 29.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Polymer Bearings Market Estimated Value in (2025 E) | USD 13.3 billion |

| Polymer Bearings Market Forecast Value in (2035 F) | USD 29.4 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The polymer bearings market is witnessing steady expansion, driven by the demand for lightweight, durable, and cost-effective alternatives to traditional metal bearings. Industry reports and automotive sector updates have emphasized the advantages of polymer bearings, including their resistance to corrosion, reduced lubrication needs, and superior performance in harsh environments. These attributes have positioned them as a preferred choice across diverse end-use sectors such as automotive, industrial machinery, medical devices, and consumer goods.

Recent advancements in polymer formulations have further enhanced their load-bearing capacity and thermal stability, widening the application base. Additionally, the trend toward energy efficiency and sustainable material use has accelerated their adoption, especially in industries focusing on reducing carbon footprints and extending product lifecycles.

Strategic collaborations between material science companies and manufacturers have also supported the development of specialized polymer bearing solutions. Looking ahead, the market is expected to benefit from the integration of advanced composite materials, ongoing innovations in tribology, and the continued growth of electric vehicles, which require high-performance and maintenance-free components.

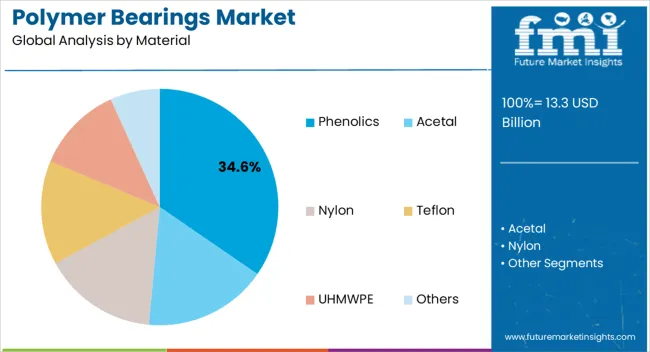

The Phenolics segment is projected to account for 34.6% of the polymer bearings market revenue in 2025, maintaining its leadership due to its excellent strength-to-weight ratio and resistance to chemical and thermal degradation. Growth in this segment has been supported by the widespread use of phenolic resins in demanding applications where high compressive strength and dimensional stability are critical.

Industry assessments have noted that phenolic-based polymer bearings perform reliably under heavy load conditions while offering superior wear resistance compared to conventional plastics. Their ability to withstand high temperatures without compromising mechanical performance has made them essential in automotive and industrial machinery applications.

Furthermore, advancements in resin processing techniques have enhanced the consistency and performance of phenolic composites, reinforcing their adoption. With industries increasingly prioritizing durability and cost-efficiency, the Phenolics segment is expected to sustain its market dominance.

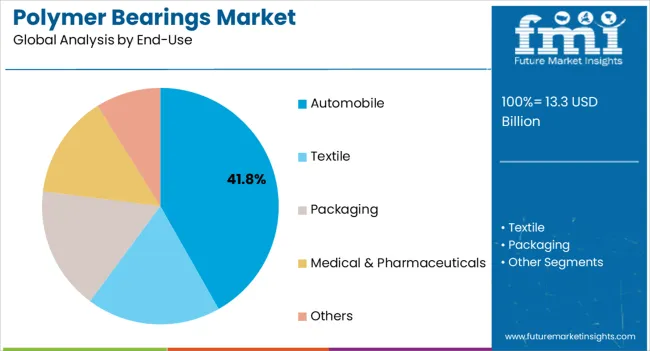

The Automobile segment is projected to hold 41.8% of the polymer bearings market revenue in 2025, securing its position as the leading end-use industry. Growth in this segment has been driven by the rising adoption of polymer bearings in vehicles to reduce weight, improve fuel efficiency, and minimize maintenance requirements.

Automotive manufacturers have integrated polymer bearings into steering systems, pedals, and gear mechanisms, capitalizing on their self-lubricating properties and resistance to noise and vibration. Reports from the automotive sector have highlighted that polymer bearings are particularly valuable in electric vehicles, where efficiency and lightweighting are critical to extending driving range.

Additionally, stringent emission regulations have encouraged automakers to replace metal components with polymer alternatives to achieve efficiency gains. As the global automotive industry continues to transition toward electric and hybrid vehicles, supported by expanding production capacities and consumer demand, the Automobile segment is expected to remain the largest contributor to polymer bearing adoption.

The global polymer bearings market is poised to extend at 8.6% CAGR over the forecast period. During the historical period between 2020 and 2025, sales had escalated at 10.1% CAGR. In the base year, revenue stood at USD 10.3 billion.

The remarkable performance of polymer bearings under harsh working circumstances is one of the key motivations behind their recent emergence. Polymer bearings are ideal for a variety of sectors, including automotive, aerospace, and food processing. This is because they exhibit exceptional resistance to corrosion, chemicals, and high temperatures.

The affordability of polymer bearings as opposed to their metal equivalents is another important consideration. They are self-lubricating, thus no additional lubrication systems are required, and maintenance is reduced. These bearings also have lower friction and wear, which leads to increased energy efficiency and quiet operation.

The growing emphasis on sustainability and awareness of the environment is one of the primary themes driving the growth of polymer bearings. They have developed as an eco-friendly alternative to traditional metal bearings, as firms attempt to decrease their carbon footprint and adopt greener practices. Polymer bearings are comprised of lightweight, recyclable materials, which reduce energy consumption during manufacture and make for a long lifespan.

The rising need for high-performance materials in diverse sectors has driven the demand for polymer bearings. They have great corrosion, chemical, and temperature resistance, making them ideal for usage in harsh settings. These bearings have become the industry standard due to their improved performance and longevity in areas such as automotive, aerospace, and food processing.

Polymer bearings outperform traditional metal bearings in several ways, making them a popular choice across diverse sectors. First of all, polymer bearings self-lubricate, removing the need for extra lubrication systems and lowering maintenance needs. This minimizes the price of lubrication while also saving time and labor.

Sustainability-focused:

With an increasing emphasis on sustainability and environmental concerns, polymer bearings have been gaining traction. They can be manufactured using recycled materials and are generally more energy-efficient.

Growing Use in Manufacturing:

As manufacturing operations rise worldwide, polymer bearings are being adopted for use on several processing line systems. This is largely due to their lightweight nature, low friction, and resistance to chemicals.

Shift towards Maintenance-free Solutions:

End-users prefer maintenance-free bearings to reduce downtime and operating costs. It will likely lead to a rise in the adoption of polymer bearings

High Competition from Alternative Materials:

Polymer bearings face competition from traditional materials such as metal, which can still offer superior performance in certain operations.

Limited Temperature and Load Capacities:

Polymer bearings might have restrictions in extreme temperature and heavy load environments, limiting their use in some industrial applications.

Material Compatibility and Chemical Resistance:

Ensuring compatibility with various chemicals and substances is crucial for polymer bearings' reliability in different sectors.

Perceived Reliability Compared to Metal Bearings:

Potential customers might be hesitant to adopt polymer bearings due to concerns about their long-term reliability compared to metal bearings.

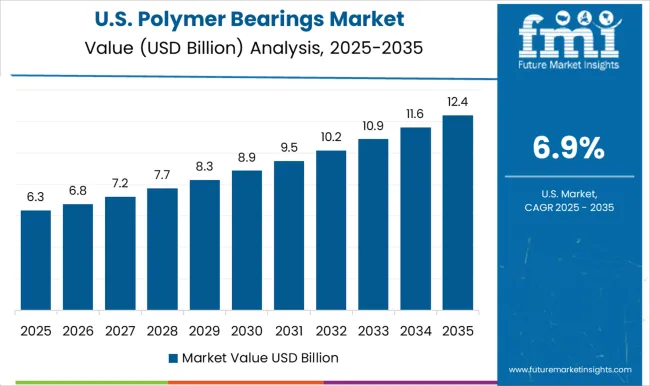

| Country | United States |

|---|---|

| Value-based CAGR (2025 to 2035) | 10.1% |

| Historical CAGR (2020 to 2025) | 8.5% |

| Projected Valuation | USD 29.4 billion |

The United States market for polymer bearings is set to hold a total of around USD 29.4 billion by 2035. It is predicted to expand at 8.5% CAGR during the forecast period 2025 to 2035.

The United States is set to be at the forefront of polymer bearing research during the forecast period. This is expected to lead to innovative technologies that improve performance and efficiency.

The country's well-developed manufacturing capabilities have allowed for large-scale production and distribution of polymer bearings. Significant investments in research and development have fostered continuous improvements in polymer bearing materials and designs.

The United States has a wide network of distributors and sales channels, enabling global market penetration for its polymer bearings. The United States has dominated key sectors, such as automotive, aerospace, and industrial equipment, where polymer bearings find extensive applications.

The country's adherence to stringent quality standards has enhanced customer trust and confidence in United States made polymer bearings. Collaborations with leading Original Equipment Manufacturers (OEMs) and global businesses have facilitated the integration of United States polymer bearings into diverse products worldwide.

| Country | China |

|---|---|

| Value-based CAGR (2025 to 2035) | 8.5% |

| Historical CAGR (2020 to 2025) | 9.9% |

| Projected Valuation | USD 5.6 billion |

China polymer bearings industry is poised to exhibit a CAGR of 8.5% during the assessment period. By 2035, China is expected to reach USD 5.6 billion.

China's polymer bearing manufacturers have adopted efficient production methods, allowing them to offer competitive pricing while maintaining quality. Chinese companies invested in research and development, leading to innovative polymer bearing materials and designs, giving them an edge in the market.

China's manufacturing capacity and scale allowed them to produce polymer bearings in large quantities, meeting global demand. China's strong export capabilities have facilitated the distribution of polymer bearings to international markets, further expanding their dominance. Due to low labor and production costs, Chinese polymer bearings were often more cost-effective compared to counterparts from other countries.

| Category | Phenolics |

|---|---|

| Value-based CAGR (2025 to 2035) | 8.5% |

| Historical CAGR (2020 to 2025) | 9.9% |

| Category | Automobile |

|---|---|

| Value-based CAGR (2025 to 2035) | 8.4% |

| Historical CAGR (2020 to 2025) | 9.7% |

Based on material, the phenolics segment is set to be in the forefront in the global market during the assessment period. From 2025 to 2035, sales are poised to expand at 8.5% CAGR. Phenolics offer excellent load-carrying capabilities, making them suitable for heavy-duty applications in various industries.

Phenolic polymer bearings exhibit low friction, leading to reduced wear and energy consumption. These bearings possess inherent self-lubricating properties, reducing the need for additional lubrication. Phenolics maintain their shape and size under varying temperatures and environmental conditions, ensuring consistent performance.

The material's resistance to chemicals and corrosion enhances its durability and reliability. Phenolic polymer bearings find applications in automotive, industrial, aerospace, and other sectors due to their versatile properties. Compared to some alternative materials, phenolics offer a cost-effective solution without compromising performance.

The automobile segment is expected to register 8.4% CAGR from 2025 to 2035. The target segment is likely to take center stage in the global polymer bearings industry. Automotive segment is using polymer bearings in high quality due to its different applications in vehicle components. These components include steering systems, suspensions, and engines.

In comparison to metal ball bearings, polymer bearings are highly lightweight. This results in decreased fuel consumption and an extended range. Polymer bearings possess different qualities such as excellent wear resistance and low fiction. It will likely help in improving the performance and durability of a vehicle.

It also helps in providing quiet and smooth driving experience to the drivers by reducing noise and dampening vibrations. Polymer bearings are more effective in comparison with the metal bearings. This quality makes them an attractive solution for automobile sector to reduce the cost of production.

Polymer bearings are resistance to corrosion, which make them suitable for different weather condition. The trend of using electric vehicle is growing which lead to increasing demand for lightweight and high performance bearings. These are used in the battery component and electric drivetrains.

Key manufacturers were investing in research and development to introduce innovative polymer bearing materials and designs. They are aiming to enhance performance and durability. They a were expanding their production capacities and geographical presence to cater to the growing demand for polymer bearings worldwide.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 13.3 billion |

| Projected Market Valuation (2035) | USD 29.4 billion |

| Value-based CAGR (2025 to 2035) | 8.2% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD billion) |

| Segments Covered | Material, End-Use, Region |

| Regions Covered | North America; Latin America; East Asia; South Asia Pacific; Western Europe; Eastern Europe; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, GCC Countries, India, China, Japan and Australia |

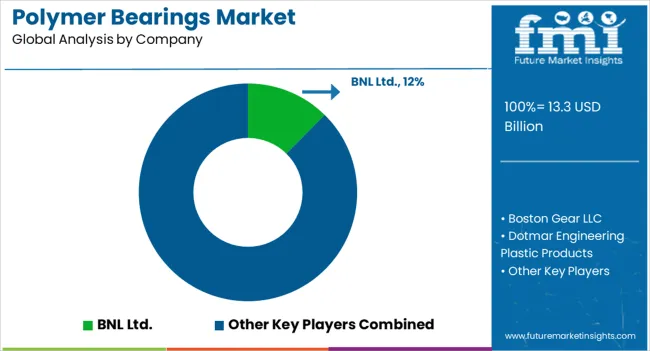

| Key Companies Profiled | BNL Ltd.; Boston Gear LLC; Dotmar Engineering Plastic Products; Igus Inc.; Kashima Bearings, Inc. |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global polymer bearings market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the polymer bearings market is projected to reach USD 29.4 billion by 2035.

The polymer bearings market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in polymer bearings market are phenolics, acetal, nylon, teflon, uhmwpe and others.

In terms of end-use, automobile segment to command 41.8% share in the polymer bearings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA