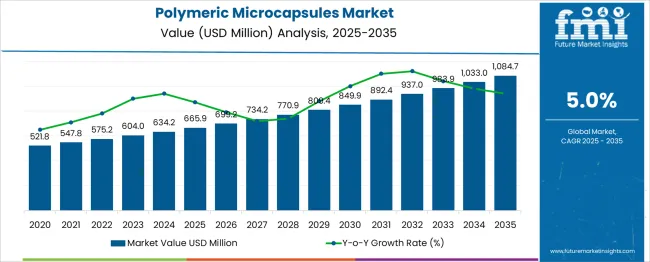

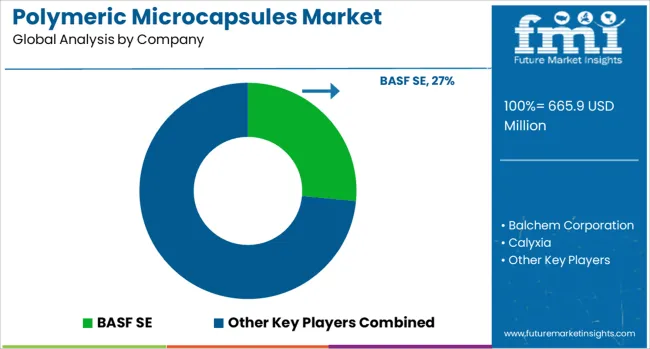

The Polymeric Microcapsules Market is estimated to be valued at USD 665.9 million in 2025 and is projected to reach USD 1084.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Between 2025 and 2030, the market will steadily rise to USD 849.9 million, driven by growing applications across the pharmaceuticals, agriculture, food, and personal care industries. Starting at USD 665.9 million in 2025, it increases to USD 699.2 million in 2026, USD 734.2 million in 2027, and USD 770.9 million in 2028. The upward trend continues with USD 809.4 million in 2029 and USD 849.9 million in 2030. Polymeric microcapsules are widely used for controlled release, targeted delivery, and protection of active ingredients. In pharmaceuticals, they support timed drug release, while in agriculture they allow gradual pesticide or nutrient dispersal. The food and cosmetic industries use them for flavor, fragrance, and ingredient stability. The market's consistent growth is supported by advancements in encapsulation techniques and material innovation, enabling better performance and wider application. As industries focus on precision delivery, extended product life, and reduced waste, demand for microencapsulation continues to rise. This sustained need for functional materials positions the polymeric microcapsules market for healthy expansion through 2030 and beyond.

| Metric | Value |

|---|---|

| Polymeric Microcapsules Market Estimated Value in (2025 E) | USD 665.9 million |

| Polymeric Microcapsules Market Forecast Value in (2035 F) | USD 1084.7 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

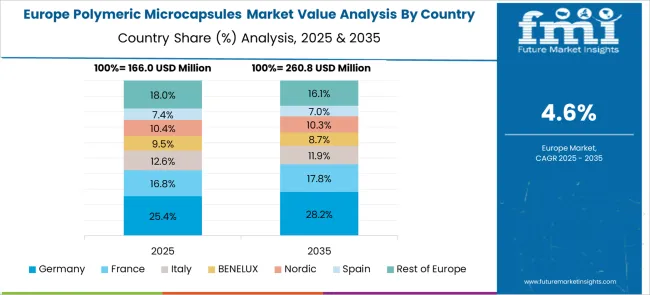

The polymeric microcapsules market is a significant subsegment of the broader microencapsulation and microcapsule markets. These capsules, which use synthetic or natural polymers as shell materials, are widely used across industries due to their controlled-release capabilities and ability to protect sensitive core substances. Within the larger microcapsule market, polymeric types account for approximately 40% of the total volume, with synthetic variants alone representing nearly 35% due to their durability and compatibility with pharmaceutical and industrial applications. In terms of end-use, the pharmaceutical and healthcare sector leads with around 30% to 32% of market share, where polymeric microcapsules are used for drug delivery, taste masking, and prolonged release formulations. The food and beverage industry follows with a share of approximately 20%, leveraging these systems for flavor and nutrient protection. Personal care and household products hold around 18%, agrochemicals 12%, and textiles about 10%. Structurally, medium-walled microcapsules (5–20 µm) dominate with over 45% share, while liquid-core variants are most widely used due to their ability to encapsulate volatile substances. Geographically, Asia-Pacific leads with around 35% share, followed by North America at 30%, and Europe at 25%. The market continues to expand, supported by increasing demand across both consumer and industrial product categories.

The polymeric microcapsules market is experiencing steady growth driven by increasing demand for controlled release and targeted delivery systems across industries. Rising adoption in pharmaceuticals, agriculture, food and personal care sectors is being observed as companies seek to enhance product efficacy and stability.

This growth is further supported by technological advancements in encapsulation techniques and material science, which are enabling superior performance and cost efficiency. Investor presentations and corporate announcements have highlighted that sustainability concerns and the need for reducing active ingredient wastage are encouraging industries to adopt microencapsulation solutions.

Future outlook remains favorable as regulatory pressures for safer and more efficient delivery methods intensify and as research into biodegradable and functional polymers advances. Press releases and industry journals have also emphasized that innovation in core and shell materials is expanding application possibilities, laying a strong foundation for the sustained expansion of the market globally.

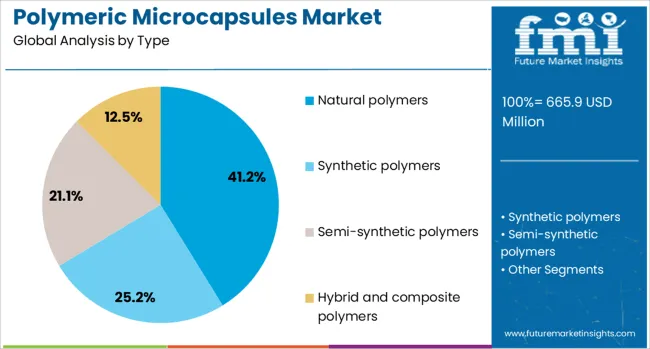

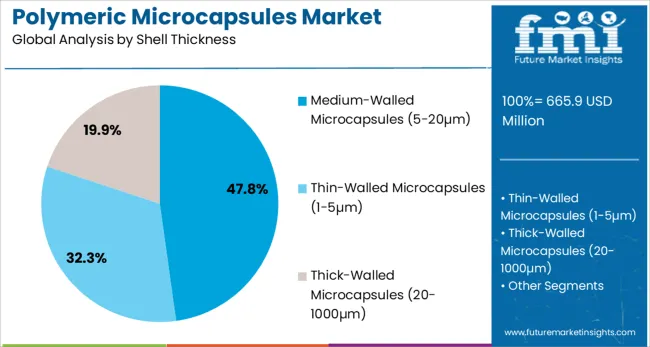

The polymeric microcapsules market is segmented by type, shell thickness, core material, and end use and geographic regions. The polymeric microcapsules market is divided by type into Natural polymers, Synthetic polymers, Semi-synthetic polymers, Hybrid and composite polymers, and emerging polymer materials. In terms of shell thickness, the polymeric microcapsules market is classified into Medium-Walled Microcapsules (5-20µm), Thin-Walled Microcapsules (1-5µm), and Thick-Walled Microcapsules (20-1000µm).

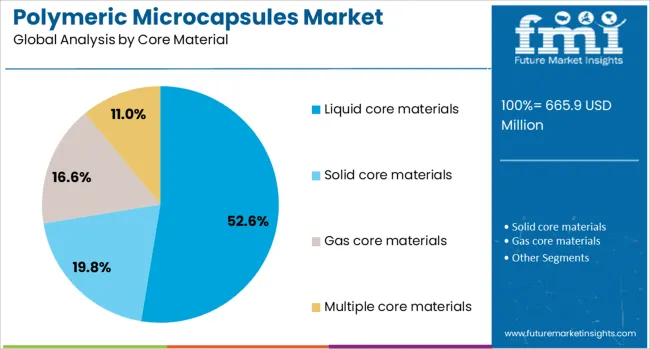

The polymeric microcapsules market is segmented into Liquid core materials, Solid core materials, Gas core materials, and Multiple core materials. The polymeric microcapsules market is segmented by end use into Pharmaceutical and healthcare, Food and beverage, Cosmetics and personal care, Agriculture, Textile, Construction and building materials, and Others. Regionally, the polymeric microcapsules industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural polymers type segment is projected to hold 41.2% of the Polymeric Microcapsules market revenue share in 2025, making it the leading type segment. This dominance is being attributed to the biocompatibility, biodegradability, and regulatory acceptance of natural polymers as encapsulating materials, as reported in technical publications and product announcements.

Natural polymers are being preferred due to their non-toxic nature and suitability for food, pharmaceutical, and cosmetic applications where stringent safety standards are enforced. Corporate disclosures have indicated that their ability to form stable and protective shells without adverse reactions has supported their adoption in sensitive formulations.

Furthermore, natural polymers are being favored in line with growing sustainability goals as they reduce the environmental impact compared to synthetic alternatives. Industry journals have highlighted that advancements in processing methods have improved the functional properties of natural polymers, making them highly competitive and reliable for diverse encapsulation needs, which has reinforced their market leadership.

The medium-walled microcapsules with shell thickness between 5 and 20µm are expected to account for 47.8% of the Polymeric Microcapsules market revenue share in 2025, establishing it as the leading shell thickness segment. This prominence has been shaped by the optimal balance they provide between protection and controlled release, as highlighted in technical datasheets and scientific publications.

Medium-walled structures are being chosen because they effectively shield core materials from environmental degradation while enabling predictable and efficient release profiles. Investor communications and product literature have indicated that industries favor this segment for its versatility in handling a wide range of core materials under diverse storage and usage conditions.

Furthermore, medium-walled microcapsules have been observed to offer favorable mechanical strength and cost effectiveness, contributing to their widespread preference. These advantages, combined with their compatibility with both natural and synthetic polymers, have ensured the segment’s sustained dominance in the overall market.

The liquid core materials segment is forecasted to capture 52.6% of the Polymeric Microcapsules market revenue share in 2025, maintaining its position as the largest core material segment. This growth has been supported by the extensive use of liquid actives in pharmaceuticals, agrochemicals, flavors, and fragrances, as evidenced in corporate statements and industry updates.

Liquid cores are being preferred because they allow encapsulation of volatile and sensitive ingredients, ensuring their stability and controlled release. Technology news and investor briefings have highlighted that liquid cores enhance product functionality by maintaining activity over extended periods, which is critical in applications such as drug delivery and crop protection.

Additionally, liquid core microcapsules have been observed to improve dosing precision and reduce material wastage, aligning with efficiency and sustainability objectives. These factors, together with advancements in encapsulation techniques that improve liquid retention, have strengthened the segment’s leadership in the market.

The polymeric microcapsules market is expanding as industries adopt encapsulation technologies for controlled delivery of active ingredients in pharmaceuticals, personal care, food, agriculture, and textiles. These microcapsules protect sensitive compounds and enable tailored release based on environmental triggers such as temperature or pH. Driven by demand for enhanced shelf life, precision dosing, and functional consumer products, the market gains momentum across regions. Advancements in shell materials and encapsulation techniques support scalability and product customization, while regulatory and cost constraints shape adoption across sectors with diverse end‑use requirements.

Differences in regional regulations are a major challenge for companies operating in the polymeric microcapsules market. Regulatory bodies impose varying standards on material safety, biodegradability, and potential environmental risks, especially for microplastic-based shells. This makes it difficult for manufacturers to develop a single, globally accepted formulation. Some regions enforce stricter environmental compliance and require premarket safety testing, which increases product development timelines. For companies targeting food, drug, or cosmetic sectors, compliance becomes even more complex, as the level of scrutiny for ingestible or topical products is high. These regulatory gaps often force manufacturers to create localized variants, increasing operational cost and delaying product launches. Smaller players find it particularly difficult to navigate certification processes and meet documentation demands, limiting their participation in global markets. Until regulatory harmonization improves, especially around synthetic and biodegradable polymers, the fragmented framework will remain a key barrier for innovation and commercial expansion in this space.

The ability to deliver active compounds precisely over time creates a wide range of opportunities for polymeric microcapsules across sectors. In the pharmaceutical industry, microcapsules are used to protect sensitive ingredients and release them gradually, improving therapeutic outcomes. In agriculture, they support slow-release fertilizers and pesticides, increasing efficacy while minimizing runoff and environmental impact. Food and beverage companies use them to encapsulate flavors, probiotics, and vitamins, extending shelf life and masking unpleasant tastes. In personal care, they enable time-based fragrance or skincare actives, enhancing product performance and consumer satisfaction. Textile applications are emerging as well, with capsules embedded in fabrics for long-lasting effects like fragrance release or antimicrobial protection. This versatility makes microcapsules a sought-after solution for brands seeking differentiated products with added value. Companies that can customize shell material, payload, and release triggers are better positioned to serve this growing, cross-industry demand for smart and efficient delivery systems.

One of the key trends in the polymeric microcapsules market is the shift toward smart and biodegradable shell materials. Biodegradable polymers such as polylactic acid, chitosan, and cellulose derivatives are gaining preference due to increasing restrictions on synthetic microplastics and rising consumer demand for environmentally responsible products. Additionally, smart capsules that respond to environmental stimuli like pH, temperature, or moisture are finding use in pharmaceuticals, agriculture, and personal care. These responsive systems improve performance by delivering active ingredients at the right place and time, reducing waste and enhancing efficacy. As environmental concerns grow, companies are under pressure to replace traditional shell materials with compostable or naturally derived alternatives that do not accumulate in ecosystems. The growing interest in clean-label and eco-friendly products is pushing R&D toward next-generation encapsulation technologies. Manufacturers investing in scalable, smart, and biodegradable microcapsule platforms are likely to gain a competitive edge in both established and emerging application areas.

Despite their technical benefits, polymeric microcapsules face challenges related to cost-intensive manufacturing. The encapsulation process often requires advanced equipment, precise control over temperature and agitation, and high-purity materials, making production expensive. Achieving uniform capsule size and consistent shell thickness adds to the complexity, especially for applications demanding high performance and safety. Specialized handling and storage conditions are also needed to maintain capsule integrity, further increasing logistical costs. For many low-margin applications, such as conventional food products or commodity chemicals, these added expenses may outweigh the benefits. Additionally, developing smart or biodegradable capsule variants usually involves even higher R&D and material costs, restricting their usage to premium or regulated markets. Without breakthroughs in process optimization and material sourcing, it remains difficult to bring down costs at scale. Cost-sensitive sectors are likely to delay adoption until proven economic value can be demonstrated, limiting market penetration for mass-market applications in the short term.

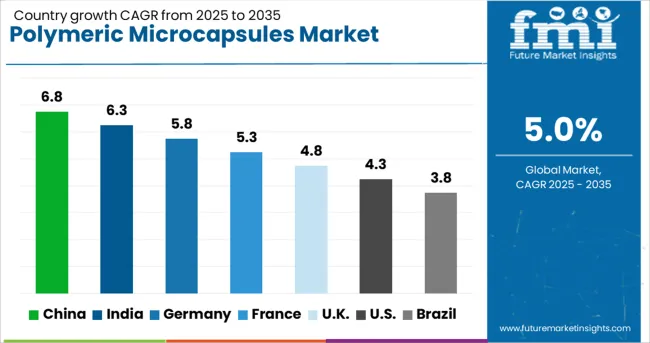

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global polymeric microcapsules market is expected to grow at a CAGR of 5% through 2035, supported by expanding use in controlled release systems across sectors. China leads with 6.8% growth, driven by high production of microencapsulated compounds for agriculture and textiles. India follows at 6.3%, where increased use has been observed in pharmaceutical coatings and cosmetic formulations. Germany reports 5.8% growth, supported by consistent adoption in industrial applications and specialty materials. The United Kingdom, at 4.8%, continues to use microcapsules across hygiene products and odor control systems. The United States, at 4.3%, remains a stable market with product development guided by encapsulation performance and release efficiency. Market growth has been shaped by particle size standards, wall material regulations, and dispersibility requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Rapid expansion of the healthcare, cosmetics, and agrochemical industries has accelerated the adoption of polymeric microcapsules across China, driving a market CAGR of 6.8 percent. Preference has been shown for sustained and targeted delivery systems, especially in drug formulation and crop protection. Manufacturers have scaled up production of microcapsules featuring biodegradable polymer shells and tailored release profiles. Collaborations with pharmaceutical companies have supported the development of customized encapsulation technologies. Demand has also risen for microcapsules used in personal care products and functional textiles, where controlled ingredient release is critical. Infrastructure for R&D and testing has been improved, facilitating innovation and faster deployment of new formulations. Investments in pilot plants and commercial-scale facilities have enhanced supply capabilities to meet growing industrial demand.

A rising need for effective delivery mechanisms in pharmaceuticals, agro-inputs, and personal care applications has increased demand for polymeric microcapsules in India, with the market growing at 6.3 percent CAGR. Use of polymeric encapsulation to enhance product shelf life and performance has been steadily embraced by both domestic producers and multinationals. Encapsulation technologies have been integrated into crop sprays, skincare formulas, and nutraceuticals to enable controlled and sustained release. Microcapsules formulated with natural or bio-compatible polymers have seen increased adoption due to regulatory preferences. Educational institutes and contract research organizations have supported local innovation by offering material testing and formulation design. Additionally, low-cost manufacturing capabilities have made the country a strategic export base for polymeric microcapsules.

Within Germany, a well-established pharmaceutical and chemical industry has favored consistent growth of the polymeric microcapsules market, maintaining a CAGR of 5.8 percent. Demand has focused on advanced encapsulation for controlled release in medical and cosmetic applications. Equipment supporting high-precision coating and uniform particle formation has been installed in pilot and commercial facilities. Regulations guiding the safety of encapsulated substances have influenced material choices, especially for food and medical use. Manufacturers have developed solvent-free processes and temperature-sensitive encapsulation suited for bioactive ingredients. Partnerships between research institutes and specialty chemical firms have enabled co-development of microcapsule formulations tailored to niche industrial needs. Increasing emphasis on reduced waste and material efficiency has also contributed to growth.

The United Kingdom has observed growing interest in polymeric microcapsules across pharmaceutical and cosmetic sectors, with a CAGR of 4.8 percent. Application has expanded into oral drug delivery systems, skincare formulations, and textile treatments. The use of encapsulated actives for time-controlled release has supported improved product efficacy and consumer experience. Start-ups and innovation hubs have been involved in developing green encapsulation methods using bio-based polymers. Laboratory testing and contract manufacturing services have allowed small-scale brands to access encapsulation capabilities without high capital investment. Academic spin-offs and collaborative innovation have further encouraged tailored microcapsule design for high-value markets. Additionally, flexible regulatory pathways have accelerated product development in cosmetics and consumer health.

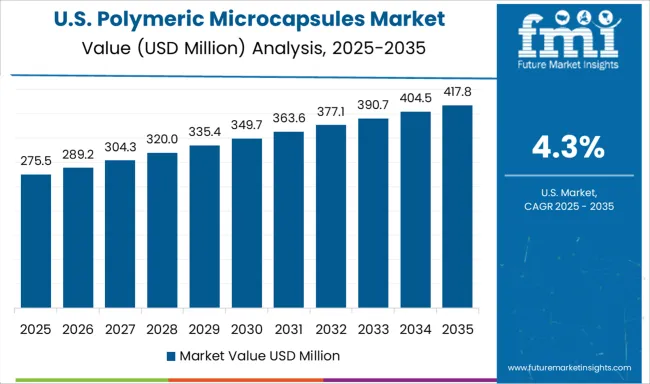

In the United States, the polymeric microcapsules market has advanced steadily with a CAGR of 4.3 percent, supported by innovation in drug delivery, food ingredients, and specialty materials. Application diversity has enabled consistent demand from pharmaceutical companies, food processors, and fragrance formulators. Microcapsules designed to improve shelf life and controlled ingredient release have seen widespread implementation. Equipment for spray drying, fluidized bed coating, and interfacial polymerization has been deployed in both R&D and commercial production settings. Start-ups and university-led initiatives have contributed novel encapsulation techniques targeting biodegradable and smart-release capsules. Regulatory clarity around Generally Recognized As Safe (GRAS) substances has further eased market expansion in food and nutraceutical sectors.

The polymeric microcapsules market is shaped by companies engineering advanced encapsulation technologies for controlled release, enhanced stability, and targeted delivery across industries such as pharmaceuticals, personal care, agriculture, and food. BASF SE leads with a broad range of functional microencapsulation solutions tailored for crop protection, cosmetics, and industrial applications, offering robust performance under diverse environmental conditions. Balchem Corporation specializes in encapsulated nutrients and bioactives for food, pharmaceutical, and animal nutrition markets, leveraging polymeric systems to improve ingredient stability, shelf life, and bioavailability.

Calyxia, a rising innovator, develops high-performance polymeric microcapsules for use in electronics, coatings, and sustainable packaging, emphasizing environmental safety and precision release profiles. Evonik Industries AG offers a wide spectrum of biodegradable and functional polymeric encapsulation technologies, with applications in drug delivery, agrochemicals, and personal care, known for their efficiency and scalability. Givaudan SA utilizes encapsulation in its fragrance and flavor portfolios, providing polymeric capsules that enable long-lasting sensory experiences in home and personal care products.

IFF (International Flavors & Fragrances) integrates advanced microencapsulation techniques to protect and deliver volatile or sensitive compounds in flavors, fragrances, and health ingredients, ensuring controlled release and product performance. Lonza Group provides polymer-based microencapsulation platforms with a focus on targeted drug delivery, dietary supplements, and dermal applications, emphasizing clinical reliability and customization. Microtek Laboratories is a key contract manufacturer offering custom polymeric microencapsulation services for industrial, cosmetic, and agricultural clients, known for flexibility and precision in formulation. Mikrocaps, based in Europe, delivers tailored encapsulation solutions using polymeric shells for fragrances, agrochemicals, and cleaning agents, focusing on environmental safety and controlled diffusion.

Milliken leverages its expertise in specialty chemicals and materials science to produce microcapsules for performance textiles, coatings, and color-change technologies, delivering durability and responsiveness. Tagra Biotechnologies is a specialist in polymeric encapsulation for the cosmetics and dermatological sectors, offering patented delivery systems that enhance stability, bioavailability, and aesthetic appeal of active ingredients. Together, these suppliers advance the polymeric microcapsules market by enhancing product stability, targeting, and controlled release, enabling innovation across a wide range of high-performance, consumer-driven, and industrial applications.

As mentioned in Evonik's Official Press Release, dated September 28, 2023, Evonik announced the strengthening of its RESOMER® polymer platform by adding new PLA‑PEG di‑block copolymers and introducing a continuous nanosonication formulation process, specifically designed for polymeric microparticles (microcapsules) aimed at parenteral drug delivery. This aligns with their goal to provide integrated drug delivery system solutions across the pharmaceutical lifecycle. As mentioned in Lonza’s official announcement, dated December 3, 2024, Lonza expanded its service offering to support developers of smart oral biologic capsule technologies. This includes bespoke Capsugel® Enprotect® bi-layer capsule designs and tailored formulation development, delivered through the Innovaform™ Accelerator at its Colmar, France, facility. This initiative is designed to accelerate the development of oral delivery systems for biologics by offering precision-designed capsule solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 665.9 Million |

| Type | Natural polymers, Synthetic polymers, Semi-synthetic polymers, Hybrid and composite polymers, and Emerging polymer materials |

| Shell Thickness | Medium-Walled Microcapsules (5-20µm), Thin-Walled Microcapsules (1-5µm), and Thick-Walled Microcapsules (20-1000µm) |

| Core Material | Liquid core materials, Solid core materials, Gas core materials, and Multiple core materials |

| End Use | Pharmaceutical and healthcare, Food and beverage, Cosmetics and personal care, Agriculture, Textile, Construction and building materials, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Balchem Corporation, Calyxia, Evonik Industries AG, Givaudan SA, IFF, Lonza Group, Microtek Laboratories, Mikrocaps, Milliken, and Tagra Biotechnologies |

| Additional Attributes | Dollar sales by polymeric microcapsule type including synthetic, natural, semi-synthetic, hybrid, and composite polymers; by application in pharmaceuticals, healthcare, food, cosmetics, agriculture, and textiles; by geographic region including North America, Europe, and Asia‑Pacific; demand driven by precise controlled-release needs, functional foods, and cosmetic stability; innovation in smart responsive capsules, biodegradable shells, and strain-engineered encapsulation; costs influenced by material sourcing, regulatory compliance, and encapsulation complexity. |

The global polymeric microcapsules market is estimated to be valued at USD 665.9 million in 2025.

The market size for the polymeric microcapsules market is projected to reach USD 1,084.7 million by 2035.

The polymeric microcapsules market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in polymeric microcapsules market are natural polymers, _polysaccharide-based polymers, _protein-based polymers, _other natural polymers, synthetic polymers, _biodegradable synthetic polymers, _non-biodegradable synthetic polymers, semi-synthetic polymers, _cellulose derivatives, _modified starches, _other semi-synthetic polymers, hybrid and composite polymers, _polymer blends, _polymer-inorganic hybrids, _multi-layer polymer systems, emerging polymer materials, _smart and stimuli-responsive polymers, _bio-inspired polymeric materials and _nanocomposite polymers.

In terms of shell thickness, medium-walled microcapsules (5-20µm) segment to command 47.8% share in the polymeric microcapsules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Polymeric Optical Fiber Market

Demand for Polymeric Sand in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA