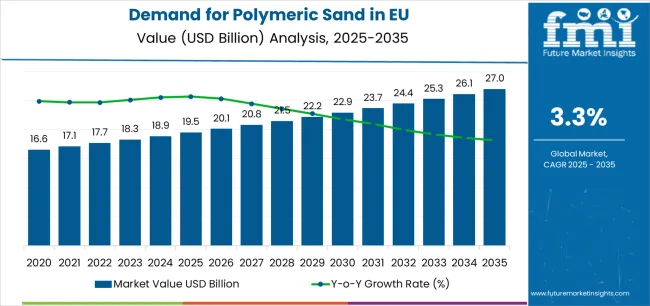

The demand for polymeric sand in the European Union is projected to grow from USD 19.5 billion in 2025 to USD 27.0 billion by 2035, at a CAGR of 3.3%. This reflects an absolute increase of USD 7.5 billion, with the industry expected to expand by nearly 1.4X during the period. Growth will be supported by rising demand for durable hardscaping materials, expanding applications in residential and commercial outdoor living spaces, and wider use in infrastructure paving projects across European construction and landscaping sectors. Based on FMI’s verified global materials database, covering industrial resins, coatings, and additives, the market is gaining momentum from residential renovation trends requiring low-maintenance jointing solutions, increasing awareness of weed-resistant and erosion-proof stabilization methods, and stronger adoption of polymeric sand as a reliable replacement for conventional sand in patio, walkway, and driveway installations.

Between 2025 and 2030, demand is forecast to grow from USD 19.5 billion to USD 22.9 billion, adding USD 3.4 billion in value and contributing 45.9% of the total decade-long expansion. This phase will be shaped by rising demand for residential landscaping upgrades, growing commercial property development with outdoor leisure and entertainment areas, and wider acceptance of polymeric sand in renovation projects replacing deteriorated conventional joints. Manufacturers are expected to expand portfolios with eco-friendly formulations, rapid-setting systems, and color-matched jointing options to meet evolving consumer preferences and stricter European performance standards.

From 2030 to 2035, sales are projected to rise from USD 22.9 billion to USD 27.0 billion, contributing an additional USD 4.1 billion, or 54.1% of total forecast growth. This phase will see stronger adoption of environmentally responsible polymeric sands, wider use of permeable jointing technologies supporting sustainable drainage systems, and innovations designed for specific applications such as pool decks and heavy-use parking areas. Greater homeowner willingness to invest in premium hardscaping materials, combined with industry focus on circular economy principles, will support demand for advanced polymeric sand products that deliver long-lasting durability with reduced environmental impact.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 19.5 billion |

| Forecast Value in (2035F) | USD 27 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

Between 2020 and 2025, EU polymeric sand demand expanded moderately from USD 17.6 billion to USD 19.5 billion at a CAGR of 2.0%. Growth in this phase was supported by steady residential landscaping demand, consistent commercial hardscaping development, and recognition of polymeric sand’s performance advantages over traditional jointing options. Industry players, including material suppliers and contractors, capitalized on its benefits for paver stabilization, weed prevention, and joint integrity. Advancements in polymer formulations, improved application techniques, and enhanced durability features helped establish strong acceptance and reinforced customer confidence across residential and commercial projects.

EU polymeric sand sales are advancing steadily due to increasing residential and commercial hardscaping activity across European countries and the corresponding demand for durable, low-maintenance, and aesthetically superior jointing materials with proven effectiveness in paver stabilization, weed resistance, and erosion prevention applications. Modern homeowners and contractors rely on polymeric sand as an essential hardscaping material for consistent installation performance, long-term joint integrity, and visual appeal, driving demand for products that deliver superior binding strength, weather resistance, and color stability compared to conventional sand offering inadequate durability and requiring frequent replacement.

The growing awareness of outdoor living space enhancement and increasing recognition of polymeric sand's functional superiority are driving demand for polymeric sand products from certified manufacturers with appropriate quality credentials and performance validation documentation. Regulatory authorities and industry standards organizations are increasingly establishing clear guidelines for jointing material specifications, installation procedures, and quality control requirements to maintain paving system integrity and ensure application consistency throughout European hardscaping operations. Scientific research studies and field performance testing are providing evidence supporting polymeric sand's durability advantages and application benefits, requiring standardized installation methods, curing protocols, and quality specifications for optimal joint stability, appropriate weed resistance, and consistent performance across diverse hardscaping applications including patios, walkways, driveways, and commercial paving projects.

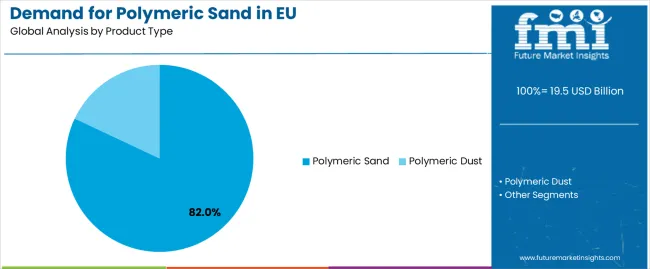

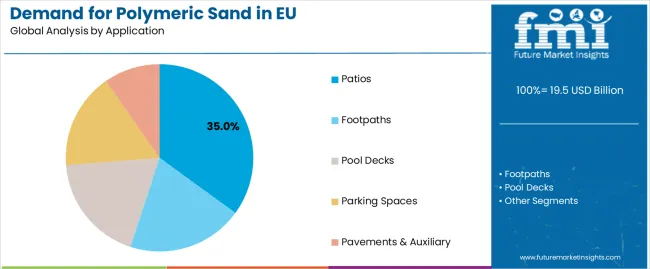

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into polymeric sand and polymeric dust. Based on application, sales are categorized into patios, footpaths, pool decks, parking spaces, and pavements and auxiliary spaces. In terms of distribution channel, demand is segmented into direct B2B sales, distributors, and online marketplace platforms. By nature, sales are classified into eco-friendly and conventional formulations. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The polymeric sand segment is projected to account for 82% of EU polymeric sand sales in 2025, declining slightly to 81% by 2035, establishing itself as the dominant product category across European hardscaping and landscaping applications. This commanding position is fundamentally supported by polymeric sand's standard joint depth capability, comprehensive paver compatibility, and proven performance for typical residential and commercial installations requiring joints between 1/4 inch and 1.5 inches wide. The polymeric sand format delivers exceptional functional appeal, providing contractors and homeowners with a product category that facilitates effective paver stabilization, reliable weed prevention, and long-term joint integrity essential for durable outdoor hardscaping. This segment benefits from mature formulation technologies, well-established installation methods, and extensive adoption by hardscaping contractors and landscaping professionals who maintain confidence in product performance for mainstream paving applications. The polymeric sand segment's slight declining share reflects growing adoption of polymeric dust, which expands from 18% in 2025 to 19% in 2035, capturing market share through narrow joint applications and specialty installations throughout the forecast period.

Key advantages:

Patios applications are strategically positioned to represent 35% of total European polymeric sand sales in 2025, declining slightly to 34% by 2035, reflecting the segment's dominance as the primary consumption category within the overall market. This substantial share directly demonstrates that residential patio construction represents the dominant application, with polymeric sand utilized extensively in backyard patio installations, outdoor entertainment areas, and residential hardscaping projects requiring aesthetic appeal and durable jointing solutions. Modern homeowners increasingly view polymeric sand as an essential patio installation material, driving demand for products optimized for joint stability, weed resistance, and color matching that supports residential outdoor living space enhancement and property value improvement. The segment benefits from continuous residential renovation activity, expanding outdoor living trends increasing patio construction, and homeowner preference for low-maintenance hardscaping materials delivering professional-quality results. The segment's slight declining share reflects diversification into other applications including footpaths and parking spaces expanding throughout the forecast period.

Success factors:

Footpaths applications are strategically estimated to control 20% of total European polymeric sand sales in 2025, expanding to 21% by 2035, reflecting the established importance of polymeric sand for walkway construction and pedestrian pathway installations. European footpath operations consistently demonstrate steady polymeric sand consumption delivering essential jointing functionality for residential walkways, commercial pedestrian areas, and municipal pathway systems requiring durable and safe walking surfaces. The segment provides critical hardscaping capabilities through stable joint formation, trip hazard reduction, and consistent surface maintenance supporting pedestrian safety and pathway longevity. Major commercial property developers and municipal infrastructure projects systematically utilize polymeric sand for footpath installations, often requiring specific performance characteristics including rapid setting, heavy foot traffic resistance, and long-term stability that facilitate safe pedestrian access and reduced maintenance requirements. The segment's expanding share reflects growing urban walkability initiatives and commercial property development featuring extensive pedestrian pathway networks throughout the forecast period.

Development factors:

Direct B2B sales channels are strategically estimated to control 48% of total European polymeric sand sales in 2025, declining to 45% by 2035, reflecting the critical importance of supplier-to-contractor direct relationships for professional hardscaping companies and commercial construction firms. European direct sales operations consistently demonstrate strong customer retention delivering bulk purchasing options, technical support services, and competitive contractor pricing to professional customers requiring consistent polymeric sand supply. The segment provides essential customer service through dedicated technical assistance, installation training, and application consultation supporting professional hardscaping operations and commercial construction projects. Major polymeric sand manufacturers systematically supply products directly to hardscaping contractors, landscaping companies, and commercial builders, often providing volume discounts, project-specific formulations, and technical consultation that facilitate adoption and installation optimization. The segment's declining share reflects faster growth in online marketplace channels, which expand from 8% to 15%, capturing market share through convenience and residential DIY purchasing platforms serving homeowner buyers throughout the forecast period.

Growth enablers:

Conventional polymeric sand products are strategically positioned to contribute 70% of total European sales in 2025, declining dramatically to 50% by 2035, representing products formulated with traditional polymer chemistry without eco-friendly additives or sustainable material certifications. These conventional products successfully deliver proven jointing performance and established durability while ensuring broad commercial availability across all distribution channels that prioritize functional reliability and pricing accessibility over environmental credentials. Conventional formulations serve cost-conscious contractors, traditional hardscaping professionals, and value-oriented homeowners that require effective polymeric sand at competitive price points without premium sustainability positioning. The segment's dramatic declining share through 2035 reflects the category's rapid evolution toward eco-friendly products, which grow from 30% in 2025 to 50% in 2035, as sustainability-focused homeowners and environmentally conscious contractors increasingly prioritize eco-friendly formulations and permeable jointing alternatives aligned with green building practices and sustainable landscaping principles.

Competitive advantages:

EU polymeric sand sales are advancing steadily due to increasing residential renovation activity in European properties, growing commercial property development requiring hardscaping installations, and rising homeowner preference for low-maintenance outdoor living spaces. The industry faces challenges, including installation expertise requirements limiting DIY adoption, environmental concerns regarding non-permeable jointing materials affecting stormwater management, and premium pricing compared to conventional sand restricting budget-conscious project adoption. Continued innovation in permeable formulations and eco-friendly polymer technologies remains central to industry development throughout the forecast period.

The rapidly accelerating development of eco-friendly and permeable polymeric sand formulations is fundamentally transforming hardscaping materials from traditional non-permeable jointing systems to environmentally responsible alternatives enabling effective paver stabilization with enhanced water drainage capabilities, delivering sustainability credentials and stormwater management benefits previously unattainable through conventional polymeric sand products. Advanced formulation platforms featuring bio-based polymers, permeable binding agents, and sustainable additives allow manufacturers to create eco-friendly polymeric sand with effective joint stability, weed resistance, and water permeability comparable to conventional products while meeting increasingly stringent environmental regulations and green building certification requirements including LEED standards. These sustainability innovations prove particularly transformative for environmentally conscious homeowners, green-certified commercial developments, and municipal projects where stormwater management proves essential for regulatory compliance and environmental stewardship supporting sustainable urban development objectives. Major polymeric sand manufacturers invest heavily in green chemistry research, permeable polymer development, and environmental impact assessment programs, recognizing that eco-friendly formulations represent breakthrough solutions for environmental demands driving hardscaping industry transformation and sustainable construction adoption.

Modern polymeric sand manufacturers systematically incorporate advanced polymer binding systems, rapid-setting chemistries, and performance-enhanced formulations that deliver superior joint hardening, reduced installation time, and enhanced weather resistance comparable to traditional extended-cure polymeric sand products. Strategic integration of high-performance polymers, accelerated curing agents, and nano-particle technologies optimized for hardscaping applications enables producers to position advanced polymeric sand as legitimate professional-grade solutions where installation efficiency directly determines contractor acceptance and project economics among time-sensitive commercial installations. These performance improvements prove essential for premium market positioning, as commercial hardscaping and professional contractors demand rapid project completion, immediate traffic readiness, and installation reliability supporting tight construction schedules and client satisfaction requirements. Companies implement extensive performance testing programs including joint strength validation, weather exposure simulation, and accelerated aging studies targeting superior durability, including freeze-thaw resistance, UV stability, and long-term color retention throughout product lifecycle and environmental exposure conditions.

European homeowners and commercial property developers increasingly prioritize polymeric sand as an essential aesthetic component featuring color customization capabilities, paver-matching formulations, and visual enhancement properties that differentiate premium hardscaping installations through seamless appearance and professional finishing quality. This aesthetic trend enables manufacturers to drive product differentiation through extensive color palettes including beige, gray, black, and custom blends resonating with design-conscious customers seeking cohesive outdoor aesthetics without compromising jointing performance. Color-matched polymeric sand applications prove particularly important for high-end residential projects where visual perfection drives material selection and installation standards, with color consistency serving as a critical specification for luxury patio and commercial plaza installations. The development of specialized color formulations, fade-resistant pigment technologies, and paver-specific matching services expands manufacturers' abilities to create customized products delivering consistent aesthetic performance with validated color stability through UV exposure resistance and weathering durability.

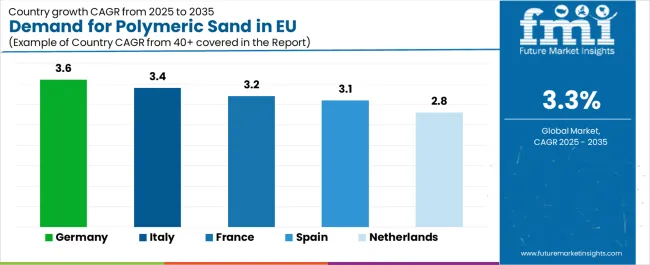

| Country | CAGR 2025-2035 |

|---|---|

| Germany | 3.6 |

| Italy | 3.4 |

| France | 3.2 |

| Spain | 3.1 |

| Netherlands | 2.8 |

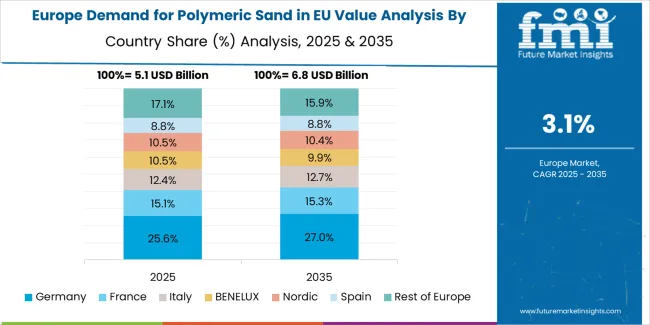

EU polymeric sand sales demonstrate steady growth across major European economies, with Germany leading expansion at 3.6% CAGR through 2035, driven by hardscaping industry sophistication and residential renovation strength. Italy shows strong growth at 3.4% CAGR through outdoor living trends and commercial development. France demonstrates 3.2% CAGR with consistent urban beautification and municipal project activity. Spain records 3.1% CAGR reflecting tourism-related landscaping and residential property development. Netherlands demonstrates 2.8% CAGR with mature hardscaping market characteristics. Rest of Europe shows 2.5% CAGR with emerging market adoption patterns. Overall, sales show moderate regional development reflecting EU-wide trends toward premium hardscaping materials and residential outdoor living enhancement.

Revenue from polymeric sand in Germany is projected to exhibit the strongest growth with a CAGR of 3.6% through 2035, driven by well-developed hardscaping industry, comprehensive contractor expertise, and strong homeowner commitment to quality outdoor installations throughout the country. Germany's sophisticated hardscaping standards and internationally recognized construction quality are creating substantial demand for premium polymeric sand across residential and commercial applications. Major hardscaping contractors and landscaping professionals, combined with extensive residential renovation activity throughout German regions, systematically utilize polymeric sand for paver installations, often prioritizing premium formulations to maintain quality positioning and long-term performance. German demand benefits from stringent quality standards requiring validated jointing materials, substantial DIY culture supporting homeowner adoption, and technical sophistication that naturally supports advanced polymeric sand utilization across residential operations.

Growth drivers:

Revenue from polymeric sand in Italy is growing at a robust CAGR of 3.4%, fundamentally driven by expanding outdoor living culture, residential property renovation trends, and quality-focused hardscaping practices. Italy's traditionally aesthetic-conscious construction culture naturally accommodates premium jointing materials as homeowners and contractors recognize visual benefits and performance advantages. Major landscaping companies and hardscaping contractors strategically invest in polymeric sand utilization for installation quality and client satisfaction supporting Italian construction excellence standards. Italian sales particularly benefit from patio and outdoor entertainment area development creating natural adoption among residential renovators, combined with commercial property hardscaping in Rome, Milan, and tourist regions contributing to expansion through hospitality-driven consumption.

Development factors:

Revenue from polymeric sand in France is expanding at a CAGR of 3.2%, supported by France's substantial urban beautification programs, residential renovation activity, and established landscaping industry practices throughout major French regions. France's strong construction economy and sophisticated design standards are driving steady demand for quality polymeric sand across residential and municipal applications. Major landscaping companies and municipal contractors maintain comprehensive polymeric sand utilization to serve urban pathway projects and residential patio installations across diverse hardscaping applications. French sales particularly benefit from municipal pedestrian area development demanding durable jointing materials and aesthetic landscaping supporting urban quality of life initiatives, driving product adoption within the polymeric sand category.

Success factors:

Demand for polymeric sand in Spain is projected to grow at a CAGR of 3.1%, substantially supported by tourism-related property development, residential construction activity, and expanding commercial hardscaping throughout Spanish coastal and urban regions. Spanish construction modernization and hospitality infrastructure expansion positions polymeric sand as essential for outdoor space development strategies supporting property differentiation. Major contractors and property developers systematically expand polymeric sand utilization, with tourism-related hospitality projects and residential outdoor living installations proving particularly successful in driving mainstream adoption supporting Spanish property market development. Spain's growing residential construction and renovation activity supports polymeric sand demand among contractors providing hardscaping installations to domestic and international property buyers throughout integrated construction supply chains.

Growth enablers:

Demand for polymeric sand in the Netherlands is expanding at a CAGR of 2.8%, fundamentally driven by mature hardscaping market, quality-focused construction standards, and established residential renovation practices supporting specialty jointing material adoption. Dutch construction operations demonstrate receptivity to premium polymeric sand and performance-optimized products meeting stringent quality standards. Netherlands sales benefit from well-developed landscaping industry, professional hardscaping contractors facilitating quality installations, and homeowner preference for low-maintenance solutions driving polymeric sand adoption across Dutch residential operations. The country's quality focus and construction expertise support consistent polymeric sand demand across residential and commercial hardscaping applications.

Innovation drivers:

EU polymeric sand sales are projected to grow from USD 19.5 billion in 2025 to USD 26,974.8 million by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with a 3.6% CAGR, supported by an advanced hardscaping industry, stringent quality standards, and extensive residential renovation activity requiring premium jointing materials. Italy follows with a 3.4% CAGR attributed to expanding residential outdoor living trends and commercial property development. France shows 3.2% CAGR, reflecting steady urban beautification initiatives and landscaping project growth. Germany maintains the largest share at 29.3% in 2025, driven by hardscaping excellence and quality-focused construction culture supporting advanced polymeric sand adoption.

EU polymeric sand sales are defined by competition among specialized jointing material manufacturers, construction material suppliers, and hardscaping product distributors serving diverse residential and commercial applications. Companies are investing in eco-friendly formulation technologies, rapid-setting polymer systems, color customization capabilities, and technical installation support to deliver high-quality, performance-validated, and environmentally responsible polymeric sand solutions meeting stringent European quality standards. Strategic partnerships with hardscaping contractors and distribution network expansion initiatives, along with technical support programs emphasizing installation training and application optimization are central to strengthening competitive position throughout European hardscaping markets.

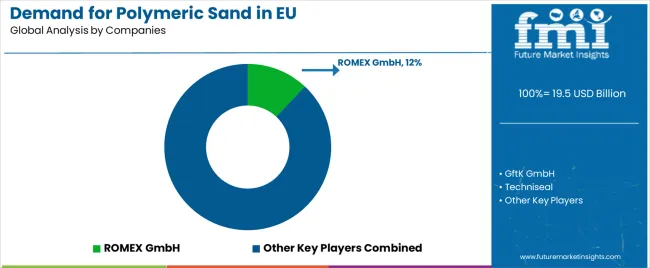

Major participants include ROMEX GmbH with an estimated 12% share, leveraging its European jointing sands specialization, comprehensive product portfolio, and established presence through professional contractor channels across multiple countries. ROMEX benefits from specialized jointing material expertise, deep hardscaping application knowledge, and ability to serve diverse segments from residential to commercial installations, supporting contractor requirements through technical service excellence and comprehensive polymeric sand programs. GftK GmbH holds approximately 9% share, emphasizing resin jointing technology, European distribution strength, and product innovation supporting professional contractor positioning. Techniseal accounts for roughly 8% share through its position as pan-European professional dealer network leader with strong brand recognition, providing diverse polymeric sand grades through contractor expertise and application support. Alliance Designer Products represents approximately 7% share, supporting growth through contractor channel focus, professional-grade product portfolio, and European market expansion.

Other companies collectively hold 64% share, reflecting competitive dynamics within European polymeric sand sales, where numerous regional manufacturers, international construction material suppliers, private-label distributors, and emerging eco-friendly jointing product developers serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through eco-friendly formulations, rapid-setting technologies, color-matched solutions, and permeable alternatives resonating with contractors and homeowners seeking high-quality polymeric sand aligned with installation requirements and sustainability objectives.

| Item | Value |

|---|---|

| Quantitative Units | USD 26,974.8 million |

| Product Type | Polymeric Sand, Polymeric Dust |

| Application | Patios, Footpaths, Pool Decks, Parking Spaces, Pavements & Auxiliary |

| Distribution Channel | Direct (B2B), Distributors, Online/Marketplace |

| Nature | Eco-friendly, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | ROMEX, GftK, Techniseal, Alliance Designer Products, Specialized manufacturers |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established jointing material manufacturers and hardscaping product suppliers; customer preferences for various polymer formulations and color specifications; integration with eco-friendly technologies and permeable jointing systems; innovations in rapid-setting formulations and bio-based polymer chemistry; adoption across residential renovation, commercial property development, and municipal infrastructure channels; quality framework analysis for jointing material standards, installation specifications, and performance requirements. |

The global demand for polymeric sand in EU is estimated to be valued at USD 19.5 billion in 2025.

The market size for the demand for polymeric sand in EU is projected to reach USD 27.0 billion by 2035.

The demand for polymeric sand in EU is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in demand for polymeric sand in EU are polymeric sand and polymeric dust.

In terms of application, patios segment to command 35.0% share in the demand for polymeric sand in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Silica Sand for Glass Making Market Analysis for 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA