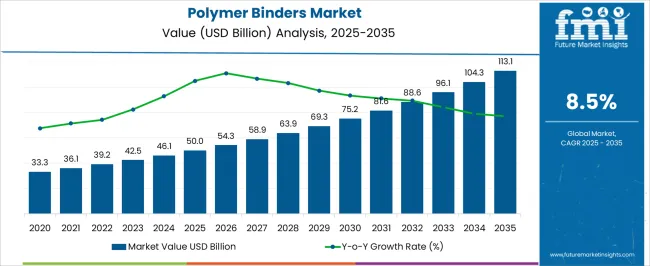

The polymer binders market is estimated to be valued at USD 50.0 billion in 2025 and is projected to reach USD 113.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. The year-on-year (YoY) growth analysis of the polymer binders market highlights a robust expansion, with values expected to rise from USD 50 billion in 2025 to USD 113.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5%.

Over the initial years, steady growth is anticipated, with market value increasing from USD 50 billion in 2025 to USD 54.3 billion in 2026 and reaching USD 58.9 billion by 2027. This pattern indicates a rising adoption of polymer binders across industries such as construction, adhesives, coatings, and composites, where the need for strong, durable, and versatile binding solutions is intensifying. By 2035, the polymer binders market is projected to exceed USD 113 billion, driven by growing demand for high-performance materials capable of improving product reliability and manufacturing efficiency. The YoY growth trajectory suggests that manufacturers and suppliers are likely to benefit from the continuous expansion of end-use applications.

As industrial sectors prioritize efficiency, consistency, and performance in materials, polymer binders are expected to play an increasingly critical role in production processes. This growth outlook highlights that the market is well-positioned to provide value across multiple segments, reinforcing its importance in modern industrial operations and manufacturing workflows.

| Metric | Value |

|---|---|

| Polymer Binders Market Estimated Value in (2025 E) | USD 50.0 billion |

| Polymer Binders Market Forecast Value in (2035 F) | USD 113.1 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The polymer binders market is a specialized segment within the broader adhesives and sealants market, where it holds approximately 5-6% share due to its role in providing cohesion, adhesion, and durability across diverse applications. In the paints and coatings market, polymer binders account for around 4-5% share, serving as essential components that improve film formation, flexibility, and weather resistance. Within the construction materials market, polymer binders represent roughly 3-4% share, supporting applications such as mortars, concrete additives, and surface coatings that enhance structural integrity and longevity. In the composite materials market, their share is estimated at 2-3%, as binders are critical in combining fibers and resins to produce lightweight yet strong materials for aerospace, automotive, and industrial applications.

In the industrial chemicals market, polymer binders capture close to 3% share, driven by demand in specialty formulations for adhesives, coatings, and functional materials. Collectively, these parent markets highlight the versatile role of polymer binders in enhancing the performance, durability, and processability of materials across industries. With rising emphasis on high-performance construction, industrial, and specialty materials, the polymer binders market is expected to expand steadily, increasing its penetration in each of these parent sectors. As manufacturers continue to innovate and formulate binders tailored for specific applications, the market’s relevance and share are poised to grow across these critical industries over the coming decade.

The polymer binders market is witnessing steady expansion, driven by growing demand across paints, adhesives, and construction materials. Rising infrastructural investments, growth in housing renovation, and the transition toward water-based, environmentally friendly formulations are boosting the need for high-performance binders.

Manufacturers are prioritizing low-VOC and sustainable solutions, supported by regulatory frameworks favoring eco-conscious chemistry. Continuous innovation in polymer technology, such as enhanced bonding strength, durability, and surface compatibility, has increased adoption across industrial and consumer sectors.

Additionally, urbanization and the revival of the automotive and furniture industries are creating long-term demand visibility for polymer binder applications worldwide.

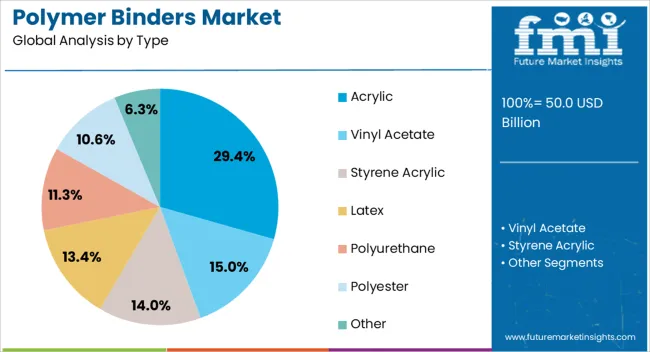

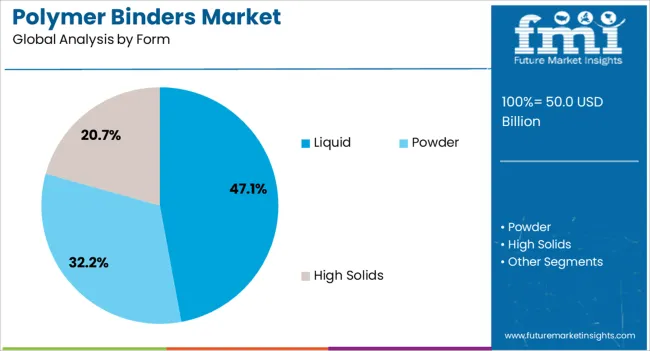

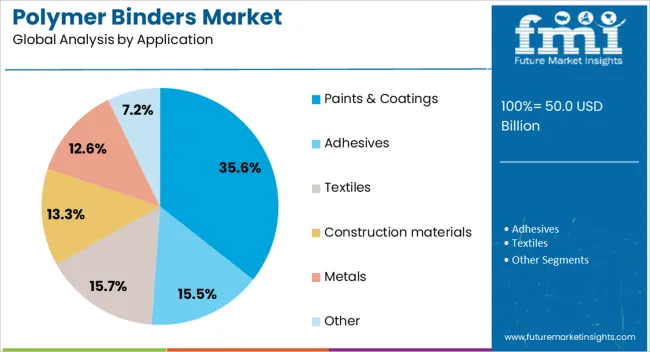

The polymer binders market is segmented by type, form, application, and geographic regions. By type, polymer binders market is divided into Acrylic, Vinyl Acetate, Styrene Acrylic, Latex, Polyurethane, Polyester, and Other. In terms of form, polymer binders market is classified into Liquid, Powder, and High Solids. Based on application, polymer binders market is segmented into Paints & Coatings, Adhesives, Textiles, Construction materials, Metals, and Other.

Regionally, the polymer binders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Acrylic binders are expected to lead the market with a 29.40% share in 2025, owing to their excellent water resistance, adhesion, and UV stability. Widely used in both indoor and outdoor applications, acrylics offer a strong balance of performance and cost-efficiency, making them suitable across paints, sealants, and construction products.

Their compatibility with a wide range of pigments and fillers has further encouraged uptake in coatings and decorative finishes.

Additionally, technological advancements enabling low-VOC acrylic emulsions are positioning them favorably in green building materials and sustainable manufacturing.

Liquid polymer binders are projected to capture 47.10% of the market share by 2025, emerging as the dominant form segment. Their ease of handling, consistent dispersion, and adaptability to automated processes make them highly suitable for mass-scale production environments.

Liquid formulations are also increasingly preferred in waterborne coatings and adhesives, aligned with the industry’s shift away from solvent-based systems.

The growing availability of liquid binders with improved shelf-life, viscosity control, and crosslinking capabilities is further boosting demand, especially in paints & coatings, textiles, and sealants.

The paints & coatings segment is forecast to contribute 35.60% of total revenue in 2025, leading the application landscape. This prominence is underpinned by increased consumption in residential, commercial, and automotive sectors.

Polymer binders play a crucial role in film formation, adhesion, color retention, and durability of coatings, aligning with modern requirements for aesthetics and performance. With governments and consumers favoring eco-friendly, water-based coatings, demand for compatible polymer binders, especially acrylic and vinyl variants, is surging.

Continued construction activity, refurbishment trends, and environmental compliance standards will sustain growth in this segment.

The polymer binders market is expanding, driven by demand from coatings, construction, and adhesives sectors. Opportunities arise from eco-friendly and specialty formulations, while trends emphasize advanced functional properties and high-performance applications. Challenges include raw material cost volatility and supply chain disruptions. Despite these hurdles, the market outlook remains positive, supported by continuous product innovation, growing infrastructure projects, and industrial expansion across developed and emerging economies.

The polymer binders market is experiencing growth due to rising demand from coatings, adhesives, and construction sectors. Binders are essential for enhancing adhesion, durability, and flexibility in paints, concrete, and sealants. Expanding construction projects globally, coupled with increased industrial production, are boosting consumption. In the coatings segment, polymer binders improve resistance to corrosion, weathering, and chemical exposure, which drives adoption in both residential and industrial projects. As urban development and infrastructure investments continue, the reliance on high-performance polymer binders is expected to strengthen steadily.

Significant opportunities exist in the development of eco-friendly and specialty polymer binders. Waterborne, low-VOC, and bio-based binders are gaining traction due to stricter environmental regulations and sustainability commitments by manufacturers. Specialty binders tailored for high-performance applications, including automotive coatings, advanced adhesives, and flexible concrete formulations, are expanding market potential. Companies investing in research to improve binder properties, compatibility, and durability are better positioned to capture these opportunities. Emerging markets with growing construction and industrial sectors also provide avenues for market expansion.

The market is witnessing trends toward advanced binder formulations with enhanced functional properties. Innovations focus on improving chemical resistance, adhesion to diverse substrates, and weathering performance. Nano-modified binders, self-healing formulations, and high-temperature resistant variants are increasingly adopted across industrial coatings and specialty applications. Additionally, the integration of polymer binders in 3D printing materials and composite applications is gaining traction. These trends indicate a shift toward high-value, performance-oriented binders that meet evolving industrial and environmental requirements, fostering market differentiation.

The polymer binders market faces challenges due to the volatility of raw material prices, especially petroleum-based monomers and specialty polymers. Fluctuating costs impact production expenses and end-product pricing, which can limit adoption in cost-sensitive applications. Supply chain disruptions, particularly in regions dependent on imported chemicals, create further uncertainty. Additionally, stringent environmental compliance requirements increase production complexity and investment needs. Manufacturers must adopt cost-optimization strategies, diversify sourcing, and focus on innovative, lower-cost alternatives to address these challenges effectively.

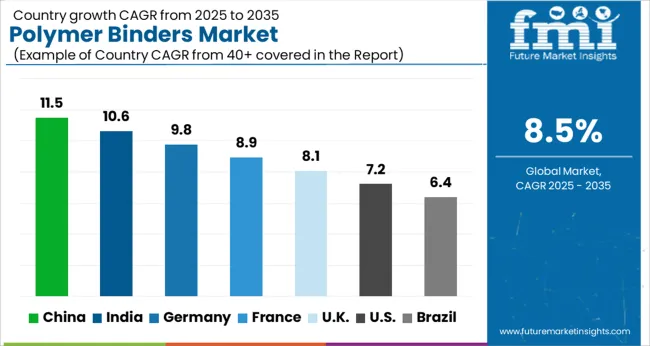

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The global polymer binders market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads with a growth rate of 11.5%, followed by India at 10.6% and France at 8.9%. The United Kingdom records a growth rate of 8.1%, while the United States shows the slowest growth at 7.2%. Expansion is supported by increasing demand in coatings, adhesives, construction, and emerging additive manufacturing applications. Emerging economies such as China and India benefit from rapid industrialization and construction growth, while developed economies like the USA, UK, and France focus on high-performance applications, regulatory compliance, and product innovation. This report includes insights on 40+ countries; the top markets are shown here for reference.

The polymer binders market in China is expanding at 11.5% CAGR, the highest among leading nations. Growth is fueled by rising construction activities, industrial coatings, and automotive manufacturing. The adoption of waterborne and high-performance binders is increasing due to environmental standards and quality requirements. Chinese manufacturers are expanding capacity and introducing innovative binder chemistries for adhesives, paints, and specialty applications. Domestic demand is further strengthened by infrastructure development, urban housing projects, and industrial coatings for machinery and electronics.

The polymer binders market in India is advancing at 10.6% CAGR, driven by rapid urbanization, construction projects, and increasing industrial coatings consumption. The country’s adhesives, paints, and coatings sectors rely heavily on binder innovations to improve performance and durability. Government investments in housing and infrastructure development further boost demand. Collaborations with global suppliers are enabling technology transfer and high-performance binder availability. Adoption is also rising in automotive, packaging, and additive manufacturing applications, reinforcing steady market growth.

The polymer binders market in France is growing at 8.9% CAGR, supported by strong automotive, construction, and industrial coatings sectors. French manufacturers are increasingly adopting specialty binders for enhanced durability, environmental compliance, and efficiency. Paints, adhesives, and surface coatings for industrial machinery contribute to steady demand. Investments in sustainable construction materials and premium automotive coatings further fuel market growth. France also sees gradual expansion in 3D printing and additive manufacturing applications using high-performance polymer binders.

The polymer binders market in the United Kingdom is expanding at 8.1% CAGR, influenced by construction, industrial, and specialty coatings demand. Adhesives, paints, and packaging applications are increasing adoption of high-performance binders. Regulatory requirements on emissions and VOC content encourage the shift toward waterborne and eco-friendly binders. The UK also focuses on high-value applications in automotive coatings, aerospace components, and industrial machinery. Collaborations with global technology providers support product innovation and adoption across sectors.

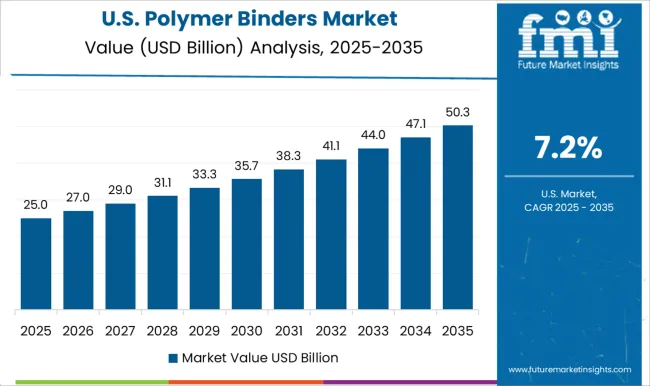

The polymer binders market in the United States is growing at 7.2% CAGR, the slowest among the top countries but still significant. Demand is driven by industrial coatings, adhesives, and specialty applications in automotive, aerospace, and packaging sectors. Waterborne and eco-friendly binders are increasingly adopted to meet environmental regulations. Replacement of aging infrastructure and ongoing industrial expansion further support the market. Collaborations with global suppliers enhance availability of high-performance binders for advanced applications, ensuring steady growth.

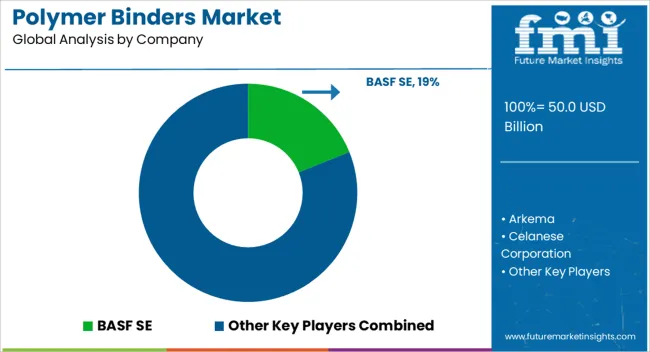

Leading companies in the polymer binders market, such as BASF SE, Arkema, and Celanese Corporation, are competing by offering high-performance resins that improve adhesion, durability, and chemical resistance across industries like construction, coatings, and adhesives. BASF promotes binders with tailored formulations for architectural coatings and industrial applications, emphasizing long-term reliability and regulatory compliance in its brochures. Arkema focuses on specialty acrylic and polyurethane binders, highlighting flexibility and environmental performance. Celanese and Dow target industrial-scale applications, showcasing thermal stability and chemical resistance as differentiators. Chemrez, Dairen Chemical, and OMNOVA Solutions emphasize cost-effective solutions for regional markets, presenting their binders as versatile and scalable for large-volume operations. Other key players, including Synthomer PLC, Toagosei Co., and Trinseo, highlight customized polymer solutions that meet sector-specific requirements, from adhesives to automotive coatings.

Wacker Chemie AG and Zydex Group market binders with unique properties such as high strength, water resistance, and eco-friendly characteristics. DCC positions its portfolio around specialty applications, emphasizing rapid curing and ease of processing. Product brochures consistently frame binders as critical performance enablers, showcasing technical data, compliance certifications, and case studies to illustrate effectiveness. Strategies revolve around product differentiation, application-specific performance, and regional support, ensuring that companies maintain competitive advantage while addressing the evolving demands of coatings, construction, and specialty chemical sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.0 Billion |

| Type | Acrylic, Vinyl Acetate, Styrene Acrylic, Latex, Polyurethane, Polyester, and Other |

| Form | Liquid, Powder, and High Solids |

| Application | Paints & Coatings, Adhesives, Textiles, Construction materials, Metals, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Arkema, Celanese Corporation, Chemrez, Dairen Chemical Corporation, DCC, Dow, OMNOVA Solutions Inc., Synthomer PLC, Toagosei Co., Ltd., Trinseo, Wacker Chemie AG, and Zydex Group |

| Additional Attributes | Dollar sales by binder type (synthetic, natural, modified) and application (construction, adhesives, coatings, ceramics) are key metrics. Trends include rising demand for high-performance, durable binders, growth in construction and industrial applications, and preference for environmentally friendly formulations. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global polymer binders market is estimated to be valued at USD 50.0 billion in 2025.

The market size for the polymer binders market is projected to reach USD 113.1 billion by 2035.

The polymer binders market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in polymer binders market are acrylic, vinyl acetate, styrene acrylic, latex, polyurethane, polyester and other.

In terms of form, liquid segment to command 47.1% share in the polymer binders market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Polymer Vials Market Insights & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA