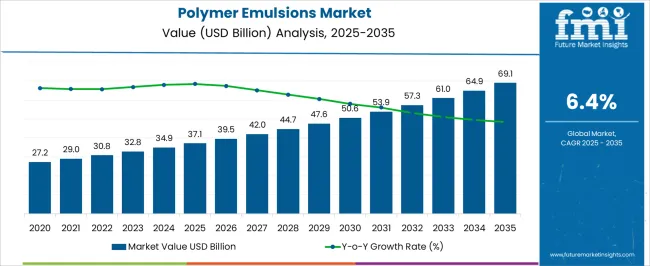

The Polymer Emulsions Market is estimated to be valued at USD 37.1 billion in 2025 and is projected to reach USD 69.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. This growth indicates an absolute dollar opportunity of USD 32 billion over the assessment period. In the first half, from 2025 to 2030, the market is projected to rise to around USD 50.7 billion, contributing USD 13.6 billion or about 42.5% of the total growth.

The increase in the early phase will be driven by higher adoption in paints, coatings, adhesives, and textile applications due to cost efficiency, strong adhesion properties, and low volatile organic compound content. The second half, from 2030 to 2035, will add USD 18.4 billion, accounting for approximately 57.5% of the total dollar opportunity.

This accelerated growth will be influenced by expanding infrastructure activities, rising demand in automotive coatings, and a shift toward water-based formulations in industrial applications. Advances in polymer chemistry enabling enhanced durability, chemical resistance, and performance across varied climatic conditions will further support expansion.

The strong pull from emerging economies and stricter environmental regulations favoring eco-friendly formulations will also play a critical role in sustaining double-digit billion-dollar gains in the later phase.

| Metric | Value |

|---|---|

| Polymer Emulsions Market Estimated Value in (2025 E) | USD 37.1 billion |

| Polymer Emulsions Market Forecast Value in (2035 F) | USD 69.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The polymer emulsions market is witnessing steady growth, driven by increasing environmental regulations, shifting demand toward water-based formulations, and expanding industrial application scope. As solvent-based systems face growing scrutiny for their VOC content, manufacturers are accelerating the transition toward low-emission, waterborne polymers.

Technological advancements in emulsion polymerization have enabled performance parity with traditional systems, allowing for broader adoption across paints, adhesives, textiles, and paper coatings. In parallel, infrastructure development and renovation in emerging economies are boosting demand for durable and eco-compliant coatings, where polymer emulsions are increasingly preferred.

Sustainability targets across end-user industries are expected to drive further innovation in bio-based and hybrid emulsions. Future opportunities are anticipated from smart coatings and nanotechnology-enhanced formulations, which continue to expand the functional utility of emulsions across high-value applications.

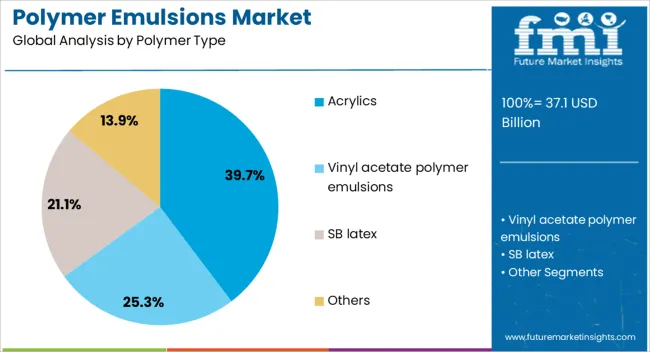

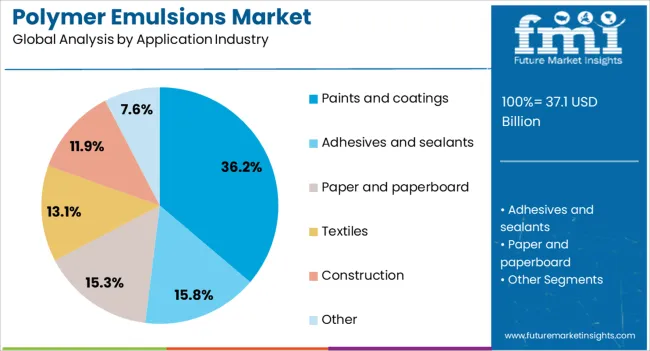

The polymer emulsions market is segmented by polymer type, application, industry, and geographic regions. By polymer type, the polymer emulsions market is divided into Acrylics, Vinyl acetate polymer emulsions, SB latex, and Others. In terms of the application industry, the polymer emulsions market is classified into Paints and coatings, Adhesives and sealants, Paper and paperboard, Textiles, Construction, and Other.

Regionally, the polymer emulsions industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Acrylics are projected to account for 39.70% of the total market revenue in 2025, positioning them as the dominant polymer type within the polymer emulsions landscape. Their leadership stems from high weatherability, chemical resistance, and color retention properties that are well-suited for architectural coatings and adhesives.

Acrylic-based emulsions have also benefited from strong compatibility with low-VOC formulations, aligning with regulatory and sustainability goals across the coatings industry. Continuous innovations in self-crosslinking acrylic emulsions and core-shell morphologies have enhanced durability and film performance, driving their adoption across both interior and exterior applications.

The versatility of acrylic emulsions in balancing cost, performance, and environmental compliance has reinforced their market share across construction, automotive, and packaging industries.

The paints and coatings industry is expected to contribute 36.20% of the total market share in 2025, making it the leading application segment. This segment’s growth is supported by rising construction and infrastructure investments globally, coupled with consumer demand for sustainable and odor-free indoor coatings.

Polymer emulsions offer superior adhesion, flexibility, and abrasion resistance, meeting the evolving performance expectations of both decorative and protective coatings. The ability to support waterborne formulations with reduced VOC content aligns with global environmental directives, particularly in North America and Europe.

Additionally, ongoing innovation in anti-microbial, anti-fouling, and self-cleaning coatings is enhancing the strategic importance of polymer emulsions in high-performance architectural and industrial applications.

The polymer emulsions market is expanding due to the growing demand in construction, automotive, and coatings industries. In 2024 and 2025, growth drivers include increased applications in architectural coatings and adhesives. Opportunities exist in the development of eco-friendly, low-VOC emulsions, responding to stricter environmental regulations. Emerging trends involve the integration of polymer emulsions in advanced materials for improved performance. However, market restraints include fluctuating raw material prices and challenges in meeting evolving regulatory standards, which hinder broader market accessibility.

The major growth driver is the rising demand for polymer emulsions in the construction, adhesives, and coatings industries. In 2024 and 2025, the construction industry increasingly adopted polymer emulsions in paints and coatings due to their superior binding properties and environmental benefits. In architectural coatings, emulsions provide durability and enhance paint quality, thus boosting their use in residential and commercial construction. This widespread adoption across construction and coatings segments remains a key factor fueling the growth of the polymer emulsions market.

Significant opportunities are arising in the development of eco-friendly, low-VOC polymer emulsions. As regulatory pressures around volatile organic compounds (VOCs) increase, demand for sustainable, low-emission emulsions surged. In 2025, manufacturers began offering water-based and bio-based polymer emulsions, meeting stringent environmental regulations while maintaining performance standards. The trend towards using renewable resources in polymer emulsions suggests continued growth potential for eco-friendly products in both consumer and industrial markets, catering to growing environmental concerns and shifting consumer preferences.

Emerging trends in the polymer emulsions market include the increasing use of advanced materials in high-performance applications. In 2024, polymer emulsions were integrated into automotive coatings and specialty adhesives, offering superior adhesion, durability, and resistance to harsh conditions. These trends highlight a shift toward higher-performing, multifunctional emulsions that cater to demanding applications. As industries such as automotive and electronics require more robust materials, the focus on developing advanced, high-quality emulsions is expected to drive market innovation and growth.

Key restraints in the market include fluctuating raw material costs and regulatory challenges. In 2024 and 2025, the prices of key feedstocks such as acrylates and styrene showed volatility, impacting the pricing of polymer emulsions. Moreover, evolving environmental regulations, particularly concerning the use of harmful chemicals, required constant adaptation by manufacturers. Compliance with stringent standards for product safety and performance in different regions added complexity, limiting the ability of smaller manufacturers to enter the market. These challenges underscore the need for innovation and efficient production techniques.

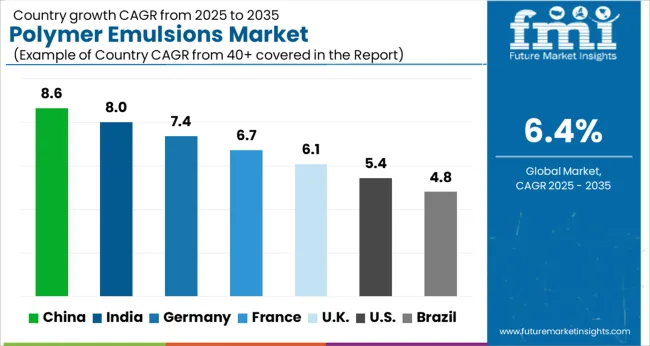

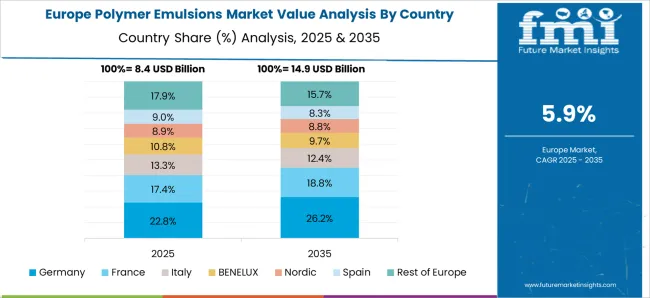

The global polymer emulsions market is projected to grow at 6.4% CAGR from 2025 to 2035. China leads with 9% CAGR, driven by the rapid expansion of the construction and automotive industries, coupled with the country’s focus on eco-friendly polymer solutions. India follows at 8%, supported by the rising demand for polymer emulsions in paints, adhesives, and coatings industries.

Germany records 7% CAGR, reflecting strong demand for high-performance emulsions in the automotive and construction sectors. The United Kingdom grows at 6%, while the United States posts 5%, reflecting steady demand in mature markets with a focus on sustainability and high-performance coatings. Asia-Pacific leads in market growth due to industrial demand and urbanization, while Europe and North America emphasize innovation and environmental compliance.

The polymer emulsions market in China is forecasted to grow at 9% CAGR, supported by the country's booming construction, automotive, and textile industries. With urbanization and industrialization driving demand for paints, coatings, and adhesives, China’s strong manufacturing base increases the demand for high-performance emulsions. Additionally, the government’s focus on environmental sustainability and the adoption of eco-friendly emulsions further accelerates market growth.

The polymer emulsions market in India is projected to grow at 8% CAGR, driven by rising demand for environmentally friendly and high-performance coatings, adhesives, and paints in the automotive, construction, and packaging industries. The expanding infrastructure and increasing urbanization contribute to the need for efficient and durable polymer emulsions. As the country moves toward sustainable solutions, eco-friendly polymer emulsions continue to gain traction in various sectors.

The polymer emulsions market in Germany is expected to grow at 7% CAGR, driven by the country’s strong automotive and construction sectors. Germany’s focus on sustainability and the development of eco-friendly emulsions further strengthens market growth. The demand for polymer emulsions in high-performance paints, coatings, and adhesives is growing, especially with the increase in automotive production and infrastructure projects. Additionally, Germany's emphasis on environmental standards boosts the use of water-based and low-VOC emulsions.

The polymer emulsions market in the United Kingdom is projected to grow at 6% CAGR, supported by growing demand in the construction and automotive industries. The UK’s commitment to reducing carbon footprints and environmental impact encourages the adoption of eco-friendly polymer emulsions in paints, coatings, and adhesives. Additionally, rising construction activity, combined with the increasing trend toward sustainable construction, further drives the demand for polymer emulsions.

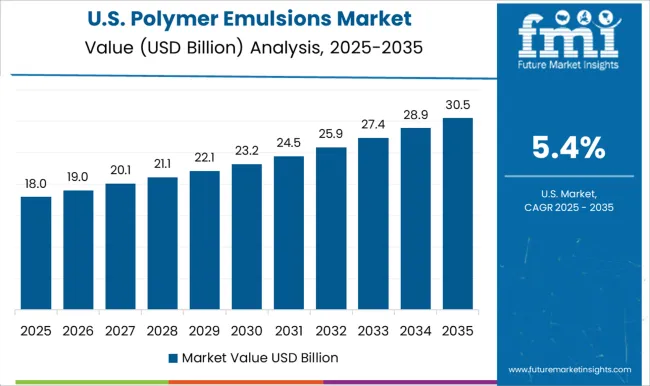

The polymer emulsions market in the United States is projected to grow at 5% CAGR, reflecting steady demand for sustainable and high-performance polymer emulsions in the construction, automotive, and consumer goods industries. As the demand for low-VOC and water-based emulsions rises in response to environmental concerns, manufacturers are increasingly turning to eco-friendly alternatives. Moreover, the USA focus on industrial applications and coatings for both residential and commercial buildings accelerates market growth.

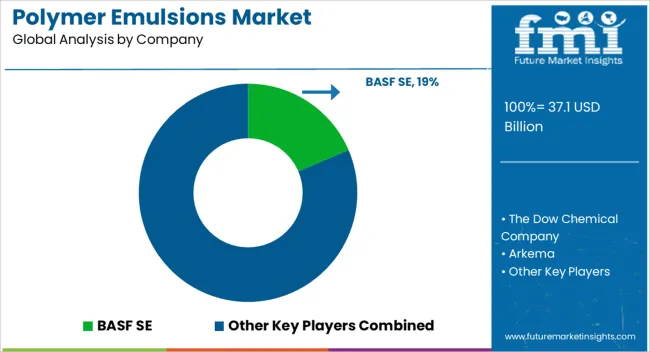

The polymer emulsions market is dominated by BASF SE, which secures its leadership through a broad portfolio of water-based polymer dispersions catering to coatings, adhesives, construction, and textile industries. BASF’s dominance is reinforced by its global manufacturing capabilities, strong R&D focus, and ability to deliver customized solutions that meet performance, environmental, and regulatory requirements.

Key players such as The Dow Chemical Company, Arkema, Wacker Chemie AG, and Celanese Corporation maintain significant market shares by offering high-performance emulsions, including acrylics, vinyl acetate, and styrene-butadiene types, optimized for durability, adhesion, and application versatility. These companies prioritize product innovation, low-VOC formulations, and strategic partnerships to expand their reach across end-user industries.

Emerging players including Synthomer PLC and Trinseo S.A. are expanding their market presence through targeted acquisitions, regional production expansion, and the introduction of specialty emulsions designed for niche applications such as functional coatings and specialty adhesives. Their strategies include enhancing product properties like chemical resistance, flexibility, and weatherability to meet evolving industry demands.

Market growth is being driven by increasing adoption of waterborne technologies as alternatives to solvent-based systems, rising construction activity, and the demand for environmentally friendly formulations. Continuous advancements in emulsion polymerization techniques and tailored performance solutions are expected to shape competitive dynamics in the global polymer emulsions market.

Manufacturers are increasingly focused on developing bio-based and low-VOC (volatile organic compounds) polymer emulsions to meet the rising demand for eco-friendly solutions. These products are used in a variety of applications, particularly in paints and coatings, where sustainability is a key concern. Companies are investing heavily in research and development (R&D) to enhance the functional properties of polymer emulsions. These innovations focus on improving thermal stability, chemical resistance, and UV protection, which are crucial for applications in the automotive, electronic, and industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.1 Billion |

| Polymer Type | Acrylics, Vinyl acetate polymer emulsions, SB latex, and Others |

| Application Industry | Paints and coatings, Adhesives and sealants, Paper and paperboard, Textiles, Construction, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, The Dow Chemical Company, Arkema, Wacker Chemie AG, Celanese Corporation, Synthomer PLC, and Trinseo S.A. |

| Additional Attributes | Dollar sales by polymer type and application, demand dynamics across paints, coatings, and adhesives, regional trends in polymer emulsion consumption, innovation in low-VOC and high-performance formulations, environmental impact of production and disposal, and emerging use cases in textiles, paper, and construction materials. |

The global polymer emulsions market is estimated to be valued at USD 37.1 billion in 2025.

The market size for the polymer emulsions market is projected to reach USD 69.1 billion by 2035.

The polymer emulsions market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in polymer emulsions market are acrylics, vinyl acetate polymer emulsions, sb latex and others.

In terms of application industry, paints and coatings segment to command 36.2% share in the polymer emulsions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA