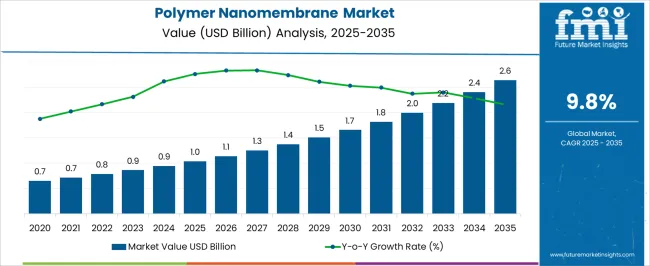

The polymer nanomembrane market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

This rise translates into an absolute dollar opportunity of USD 1.6 billion over the decade. Growth milestones indicate a steady upward curve, with the market reaching USD 1.3 billion in 2028, USD 1.7 billion in 2031, and USD 2.4 billion in 2034 before hitting USD 2.6 billion in 2035. Such progress highlights strong potential for producers to expand manufacturing, optimize supply networks, and cater to diverse industries requiring advanced separation and filtration solutions.

The absolute dollar opportunity underscores the revenue potential for stakeholders in the polymer nanomembrane market. From USD 1.0 billion in 2025 to USD 2.6 billion in 2035, the USD 1.6 billion cumulative gain signals expanding demand. Intermediate levels like USD 1.5 billion in 2029 and USD 2.0 billion in 2032 point toward consistent adoption across applications. This incremental growth provides manufacturers, distributors, and end-users with opportunities to capture significant value through strategic product development, increased availability, and wider adoption, ensuring they participate meaningfully in the decade-long expansion of the polymer nanomembrane market.

| Metric | Value |

|---|---|

| Polymer Nanomembrane Market Estimated Value in (2025 E) | USD 1.0 billion |

| Polymer Nanomembrane Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The polymer nanomembrane market is part of the larger global membrane separation market, which also includes reverse osmosis, ultrafiltration, microfiltration, and nanofiltration systems. In 2025, polymer nanomembranes are expected to contribute about 3% of the overall membrane separation market valued at nearly USD 33.0 billion. By 2035, with the parent market forecast to reach approximately USD 69.0 billion, the polymer nanomembrane segment expanding from USD 1.0 billion in 2025 to USD 2.6 billion in 2035 at a CAGR of 9.8% will increase its contribution to nearly 4% of the parent market, showing an improving share. Within the parent market, reverse osmosis systems dominate with around 35% of total value, ultrafiltration accounts for nearly 25%, and nanofiltration contributes about 20%.

While polymer nanomembranes currently occupy a smaller portion, their CAGR of 9.8% outpaces several established segments, making them one of the fastest-growing categories. The absolute dollar increase of USD 1.6 billion between 2025 and 2035 will account for roughly 4% of total incremental growth in the parent market. This rising share indicates expanding relevance in advanced water treatment, pharmaceuticals, and industrial processes, positioning polymer nanomembranes as a critical driver within the membrane separation industry.

The polymer nanomembrane market is experiencing accelerated growth, driven by the rising demand for advanced filtration, separation, and purification technologies across multiple industries. Increasing concerns over water scarcity, environmental pollution, and stringent regulations on industrial effluent discharge are creating strong demand for high-performance membranes with nanoscale precision. These membranes offer superior permeability, selectivity, and chemical resistance compared to conventional filtration materials, making them highly effective for complex applications.

Technological advancements in membrane fabrication, surface functionalization, and scalable production methods are enabling improved performance and cost efficiency. Expanding adoption in sectors such as water and wastewater treatment, biotechnology, pharmaceuticals, and electronics manufacturing is broadening market opportunities.

Additionally, the growing emphasis on sustainable and energy-efficient processes is promoting the integration of polymer nanomembranes into next-generation filtration systems As industries continue to prioritize operational efficiency, quality control, and environmental compliance, the market is expected to witness sustained growth, with manufacturers focusing on product innovation, material optimization, and expansion into high-potential application areas across both developed and emerging regions.

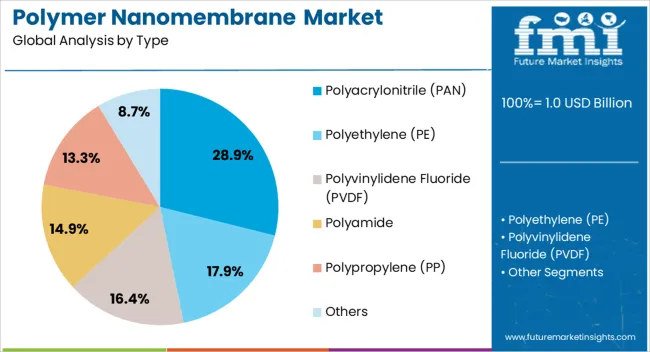

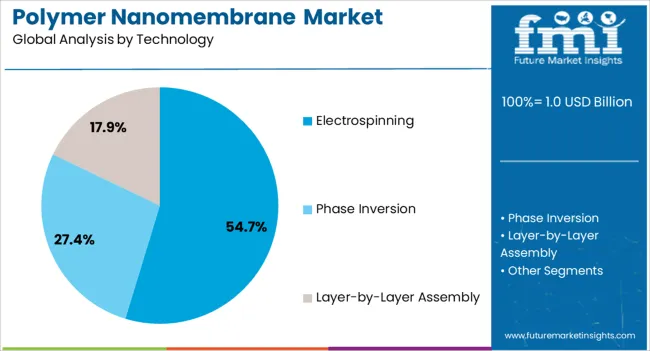

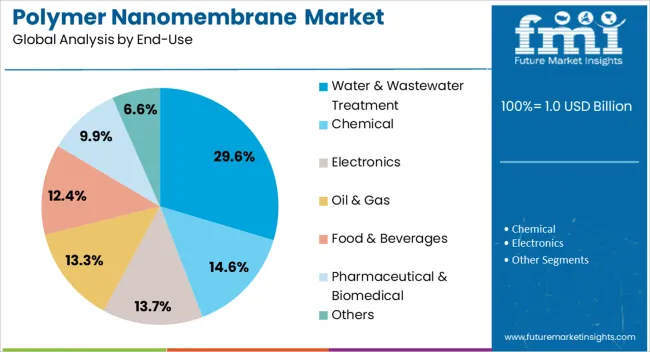

The polymer nanomembrane market is segmented by type, technology, end-use, and geographic regions. By type, polymer nanomembrane market is divided into polyacrylonitrile (PAN), polyethylene (PE), polyvinylidene fluoride (PVDF), polyamide, polypropylene (PP), and others. In terms of technology, polymer nanomembrane market is classified into electrospinning, phase inversion, and layer-by-layer assembly. Based on end-use, polymer nanomembrane market is segmented into water & wastewater treatment, chemical, electronics, oil & gas, food & beverages, pharmaceutical & biomedical, and others. Regionally, the polymer nanomembrane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyacrylonitrile (PAN) type segment is projected to account for 28.9% of the polymer nanomembrane market revenue share in 2025, positioning it as a leading material choice. This dominance is supported by PAN’s excellent chemical stability, mechanical strength, and resistance to a wide range of solvents, making it suitable for demanding filtration environments.

Its ability to form uniform and stable nanofiber structures through established production methods allows for precise control over pore size and distribution, enhancing separation efficiency. PAN membranes are highly adaptable for both aqueous and organic filtration applications, which increases their versatility in industries such as water treatment, pharmaceuticals, and biotechnology.

The segment’s growth is also being driven by the material’s compatibility with advanced surface modification techniques, enabling improved hydrophilicity, fouling resistance, and functionalization for specific applications Widespread industrial acceptance, combined with favorable production scalability and cost-effectiveness, further reinforces the role of PAN as a preferred polymer in nanomembrane fabrication, ensuring its continued strong presence in the market.

The electrospinning technology segment is expected to hold 54.7% of the polymer nanomembrane market revenue share in 2025, making it the dominant fabrication method. Its leadership is attributed to the ability to produce nanofibers with controlled diameter, high porosity, and interconnected pore structures, which significantly enhance membrane performance. Electrospinning allows for the creation of membranes with large surface area-to-volume ratios, improving permeability and selectivity while maintaining mechanical stability.

The technology’s versatility enables the use of a wide range of polymers, including high-performance materials, to meet specific application requirements. Continuous advancements in electrospinning equipment and process automation are improving production scalability and cost efficiency, making it more accessible for commercial-scale manufacturing.

The technique also supports functionalization of nanofibers with antimicrobial, catalytic, or hydrophilic properties, expanding the range of industrial applications As demand grows for high-efficiency filtration systems, electrospinning’s proven ability to deliver consistent and customizable nanomembranes is expected to sustain its dominance in the global market.

The water and wastewater treatment segment is anticipated to represent 29.6% of the polymer nanomembrane market revenue share in 2025, making it a leading end-use category. This prominence is being driven by the increasing global need for clean water, stricter environmental regulations, and growing urbanization, which are intensifying demand for advanced treatment solutions. Polymer nanomembranes offer exceptional removal efficiency for contaminants, pathogens, and dissolved solids while enabling high throughput and reduced energy consumption compared to traditional filtration methods.

Their nanoscale pore structure provides superior selectivity, making them ideal for desalination, industrial wastewater treatment, and potable water production. The segment’s growth is also supported by the rising adoption of modular and decentralized treatment systems, where compact and high-performance membranes are essential.

Advancements in membrane durability, fouling resistance, and cleaning protocols are further enhancing operational reliability As water scarcity challenges escalate and governments prioritize sustainable water management, the role of polymer nanomembranes in this sector is expected to strengthen, ensuring continued leadership in market share.

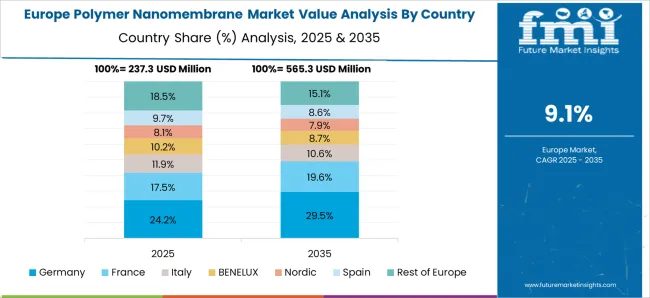

The polymer nanomembrane market is growing steadily, fueled by demand in water purification, biomedical devices, pharmaceuticals, and gas separation. North America and Europe lead with advanced R&D, strong regulatory compliance, and adoption in healthcare and environmental applications. Asia-Pacific is expanding rapidly due to water scarcity issues, industrial demand, and government-backed clean technology initiatives. Manufacturers differentiate through membrane selectivity, durability, and scalability. Regional differences in industrial infrastructure, environmental regulations, and technology adoption strongly influence performance requirements, application suitability, and global competitiveness.

Polymer nanomembranes play a vital role in advanced water purification by offering high selectivity, permeability, and resistance to fouling. North America and Europe adopt these membranes in desalination, wastewater treatment, and industrial water recycling, driven by strict environmental regulations and sustainability initiatives. Asia-Pacific markets prioritize nanomembranes to address water scarcity, population growth, and industrial pollution, often supported by government funding. Differences in water quality challenges, regulatory frameworks, and infrastructure investment influence material selection, pore size, and operational lifespan. Leading suppliers develop durable, energy-efficient membranes with anti-fouling properties, while regional players focus on affordable, scalable solutions for municipal systems. Water treatment contrasts drive adoption, public trust, and global competitiveness across the polymer nanomembrane market.

Biomedical and pharmaceutical industries are expanding the use of polymer nanomembranes for applications such as drug delivery, dialysis, and tissue engineering. North America and Europe lead adoption with strong clinical research, regulatory approval processes, and integration into advanced medical devices. Asia-Pacific markets focus on cost-effective biomedical solutions and expanding access to healthcare innovations, driving regional growth. Differences in healthcare infrastructure, funding, and clinical research capacity strongly impact product adoption, testing standards, and scale of commercialization. Leading suppliers invest in developing biocompatible membranes with precise pore structures, while regional manufacturers deliver affordable products for emerging markets. Biomedical application contrasts influence adoption speed, innovation pipelines, and global competitiveness in the polymer nanomembrane sector.

Polymer nanomembranes are increasingly adopted for industrial gas separation, including CO₂ capture, hydrogen recovery, and natural gas purification. North America and Europe focus on membranes that support decarbonization goals, carbon capture utilization and storage (CCUS), and hydrogen energy transitions. Asia-Pacific markets adopt nanomembranes in petrochemical and industrial sectors where cost-efficiency and scalability are prioritized. Differences in energy policies, emission reduction mandates, and industrial investment affect membrane adoption, selectivity requirements, and durability. Leading suppliers develop membranes with high permeability and resistance to harsh conditions, while regional producers offer scalable solutions for large industrial facilities. Gas separation contrasts shape adoption, energy sustainability, and competitiveness in the global polymer nanomembrane market.

Advances in polymer nanomembrane design and manufacturing scalability strongly influence adoption. North America and Europe prioritize membranes with enhanced mechanical strength, anti-fouling coatings, and tunable pore sizes to meet diverse industrial and healthcare applications. Asia-Pacific markets emphasize cost-effective scalability to meet growing demand in water treatment and industrial processing. Differences in R&D funding, manufacturing infrastructure, and patent landscapes shape innovation speed, production scale, and market entry. Leading suppliers invest in nanofabrication techniques and pilot-scale plants to improve performance consistency, while regional players focus on high-volume, affordable production. Design and scalability contrasts drive adoption, innovation strategies, and global competitiveness across the polymer nanomembrane market.

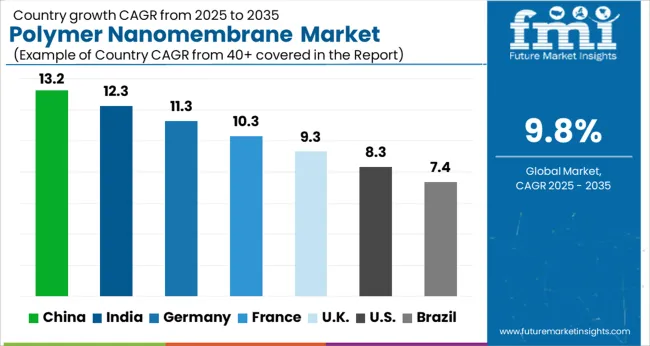

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

The global polymer nanomembrane market is projected to expand at a 9.8% CAGR through 2035, driven by demand in water purification, medical applications, and industrial filtration. Among BRICS nations, China led with 13.2% growth as large-scale innovation and deployment advanced in water treatment and healthcare sectors, while India at 12.3% expanded production capacity and adoption across industrial and municipal applications. In the OECD region, Germany at 11.3% maintained steady use of nanomembrane technology under strict EU environmental and healthcare regulations, while the United Kingdom at 9.3% pursued moderate-scale deployment in both wastewater management and biomedical research. The USA, growing at 8.3%, supported consistent adoption across water purification and pharmaceutical applications, guided by federal and state-level safety and environmental standards. This report includes insights on 40+ countries; the top countries are shown here for reference.

The polymer nanomembrane market in China is expected to grow at a CAGR of 13.2%, fueled by rising industrial filtration applications, water treatment needs, and advanced separation technologies. Adoption is being encouraged for membranes that provide high selectivity, durability, and chemical resistance. Local manufacturers are being urged to deliver cost effective, efficient, and technologically advanced solutions. Distribution through industrial suppliers, water treatment companies, and research institutions is being strengthened. Research in high performance polymer materials, membrane longevity, and energy efficient processes is being conducted. Expansion of wastewater treatment, industrial filtration, and chemical processing applications are considered key drivers of the polymer nanomembrane market in China.

In India, the polymer nanomembrane market is projected to grow at a CAGR of 12.3%, driven by demand from water purification, industrial processing, and pharmaceutical applications. Adoption is being promoted for membranes that ensure high efficiency, reliability, and low maintenance. Domestic manufacturers are being encouraged to provide affordable, durable, and high quality solutions. Distribution through water treatment providers, industrial suppliers, and research laboratories is being expanded. Government initiatives for clean water, industrial modernization, and technological adoption are recognized as major factors fueling the polymer nanomembrane market in India.

Germany is witnessing steady growth in the polymer nanomembrane market at a CAGR of 11.3%, supported by adoption in wastewater treatment, chemical processing, and laboratory filtration. Adoption is being encouraged for membranes that provide energy efficiency, long lifespan, and high selectivity. Manufacturers are being urged to supply advanced, eco friendly, and high performance solutions. Distribution through industrial suppliers, research institutes, and water treatment companies is being strengthened. Research into polymer innovations, energy saving processes, and chemical compatibility is being conducted. Industrial modernization, wastewater management, and advanced filtration requirements are considered key factors driving the polymer nanomembrane market in Germany.

The polymer nanomembrane market in the United Kingdom is projected to grow at a CAGR of 9.3%, driven by demand from water treatment plants, industrial filtration, and research applications. Adoption is being promoted for membranes that ensure reliability, efficiency, and chemical resistance. Manufacturers are being encouraged to provide durable, high quality, and cost effective solutions. Distribution through industrial suppliers, water treatment companies, and research laboratories is being optimized. Pilot projects and demonstration studies are being conducted to promote the advantages of polymer nanomembranes. Expansion of clean water initiatives, industrial modernization, and research adoption are recognized as major factors driving the polymer nanomembrane market in the United Kingdom.

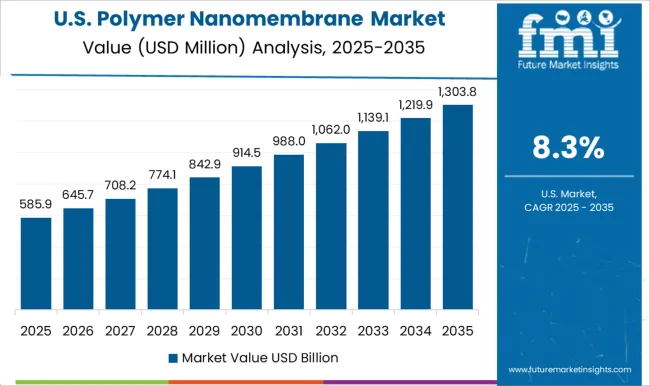

The polymer nanomembrane market in the United States is projected to grow at a CAGR of 8.3%, influenced by adoption in industrial filtration, wastewater management, and pharmaceutical processes. Adoption is being encouraged for membranes that provide energy efficiency, long life, and high separation performance. Manufacturers are being urged to supply advanced, durable, and cost effective solutions. Distribution through industrial suppliers, water treatment companies, and research institutes is being maintained. Research in polymer materials, membrane efficiency, and chemical resistance is being pursued. Expansion of industrial filtration, water purification programs, and pharmaceutical processing are considered key drivers of the polymer nanomembrane market in the United States.

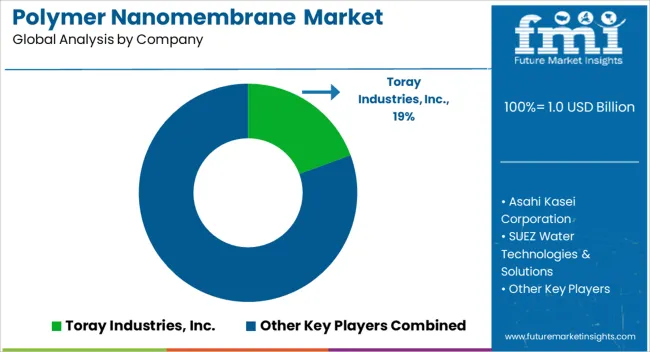

The polymer nanomembrane market is driven by several globally recognized suppliers that provide advanced membrane technologies for water treatment, desalination, gas separation, and other industrial applications. Toray Industries, Inc. stands out with its innovative membrane solutions, widely adopted for reverse osmosis and ultrafiltration applications. Asahi Kasei Corporation has also made significant contributions by developing high-performance polymer membranes that deliver efficiency and durability in various industrial and environmental processes. SUEZ Water Technologies & Solutions brings extensive expertise in water purification and separation technologies, offering reliable and scalable membrane systems to meet diverse customer requirements.

Other key market participants include DuPont de Nemours, Inc., which has been instrumental in advancing polymer membrane materials for industrial and municipal applications. Their focus on high flux and fouling-resistant membranes has positioned them as a trusted supplier worldwide. LG Chem is another important player, contributing with specialized polymer membranes tailored for energy storage, chemical separation, and water treatment sectors. Merck KGaA (EMD Millipore) and Hydranautics further strengthen the market by providing cutting-edge nanomembrane technologies with enhanced selectivity, permeability, and longevity, which are critical for industrial processes and environmental sustainability.

Collectively, these suppliers are at the forefront of driving innovation and adoption in the polymer nanomembrane market. Their products help industries achieve better separation efficiency, lower operational costs, and improved environmental compliance. By offering a range of high-quality membranes and continuous technological advancements, these companies are ensuring that the global demand for advanced polymer nanomembrane solutions continues to grow across water treatment, energy, and industrial applications. Their leadership and expertise play a crucial role in shaping the future of the polymer nanomembrane market, providing reliable and sustainable solutions for both industrial and municipal needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 billion |

| Type | Polyacrylonitrile (PAN), Polyethylene (PE), Polyvinylidene Fluoride (PVDF), Polyamide, Polypropylene (PP), and Others |

| Technology | Electrospinning, Phase Inversion, and Layer-by-Layer Assembly |

| End-Use | Water & Wastewater Treatment, Chemical, Electronics, Oil & Gas, Food & Beverages, Pharmaceutical & Biomedical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray Industries, Inc., Asahi Kasei Corporation, SUEZ Water Technologies & Solutions, DuPont de Nemours, Inc., LG Chem, Merck KGaA (EMD Millipore), and Hydranautics |

| Additional Attributes | Dollar sales vary by membrane type, including ultrafiltration, nanofiltration, and reverse osmosis membranes; by material, such as polyamide, polysulfone, and composite polymers; by application, spanning water & wastewater treatment, gas separation, medical devices, and food & beverage processing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by clean water demand, medical innovations, and energy-efficient separation technologies. |

The global polymer nanomembrane market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the polymer nanomembrane market is projected to reach USD 2.6 billion by 2035.

The polymer nanomembrane market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in polymer nanomembrane market are polyacrylonitrile (pan), polyethylene (pe), polyvinylidene fluoride (pvdf), polyamide, polypropylene (pp) and others.

In terms of technology, electrospinning segment to command 54.7% share in the polymer nanomembrane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA