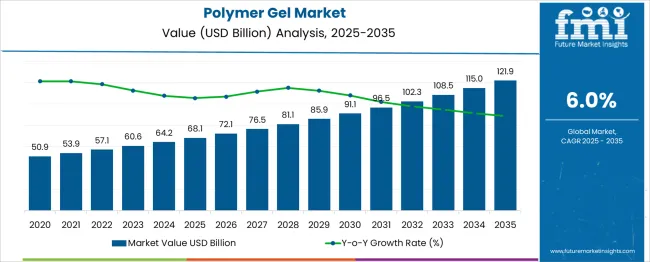

The Polymer Gel Market is estimated to be valued at USD 68.1 billion in 2025 and is projected to reach USD 121.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. From 2025 to 2030, the market is expected to expand from USD 68.1 billion to USD 91.1 billion, driven by growing applications in personal care, medical devices, and advanced manufacturing. Year-on-year analysis indicates steady growth, reaching USD 72.1 billion in 2026 and USD 76.5 billion in 2027, supported by increasing demand for hydrogels in wound care and drug delivery, along with their rising use in hygiene products. By 2028, the market is forecasted to hit USD 81.1 billion, advancing to USD 85.9 billion in 2029 and USD 91.1 billion by 2030. Growth will likely be reinforced by technological advancements in polymer chemistry, enabling higher absorption capacity, improved biocompatibility, and environmental responsiveness. Expansion in applications such as energy storage gels for batteries and smart materials in robotics is expected to further boost adoption. These dynamics position polymer gels as a versatile material category, offering significant opportunities for innovation in healthcare, industrial, and consumer sectors over the next decade.

| Metric | Value |

|---|---|

| Polymer Gel Market Estimated Value in (2025 E) | USD 68.1 billion |

| Polymer Gel Market Forecast Value in (2035 F) | USD 121.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The polymer gel market holds a focused share within multiple advanced material segments. In the Advanced Materials Market, it accounts for about 3%, as the segment also includes composites, ceramics, and nanomaterials. Within the Superabsorbent Polymers Market, its share is approximately 12%, since polymer gels are widely used for high-capacity absorption in diapers and hygiene products. For the Medical and Healthcare Materials Market, its share stands around 4%, driven by applications in wound care, drug delivery systems, and tissue engineering. In the Personal Care and Hygiene Products Market, polymer gels contribute nearly 6%, owing to their role in moisture retention and texturizing formulations. Within the Electronics and Energy Storage Materials Market, its share is close to 2%, as polymer gels are integrated into flexible batteries, sensors, and electronic encapsulation. Growth is driven by their high water absorption, biocompatibility, and ability to form stable structures for multifunctional use. Expanding applications in biomedical fields, agricultural water retention, and next-generation flexible electronics are further accelerating adoption. Innovations in stimuli-responsive gels and eco-friendly formulations are also enhancing market potential. With increasing demand across diverse industries, polymer gels are emerging as a key enabling material for advanced performance, versatility, and sustainability-driven applications.

The polymer gel market is witnessing strong momentum fueled by rising demand across hygiene products, agriculture, and biomedical applications. The ability of polymer gels to absorb and retain large volumes of water has made them indispensable in personal care products such as diapers and adult incontinence items. In agriculture, they are increasingly used to enhance soil moisture retention, improve crop yields, and manage irrigation efficiency.

Continued research into stimuli-responsive and bio-compatible gels is opening avenues in drug delivery and wound care systems. The market is further supported by developments in eco-friendly and biodegradable gel formulations that meet regulatory standards across Europe, North America, and Asia. Manufacturers are focusing on process innovation and raw material optimization to enhance product performance while maintaining cost efficiency.

Demand is also being driven by the growing middle-class population in emerging economies, leading to increased consumption of sanitary products and medical disposables. With such multifaceted utility and continued R&D, the polymer gel market is expected to sustain long-term growth across both industrial and consumer verticals.

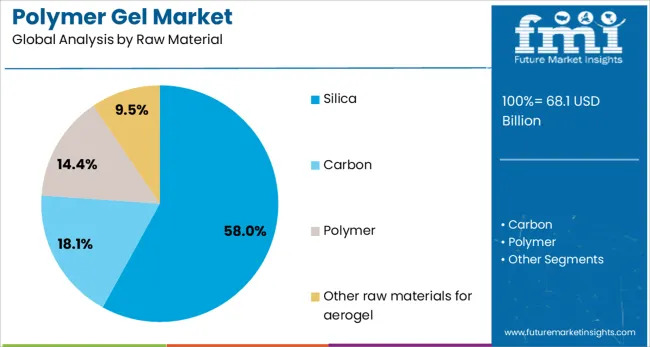

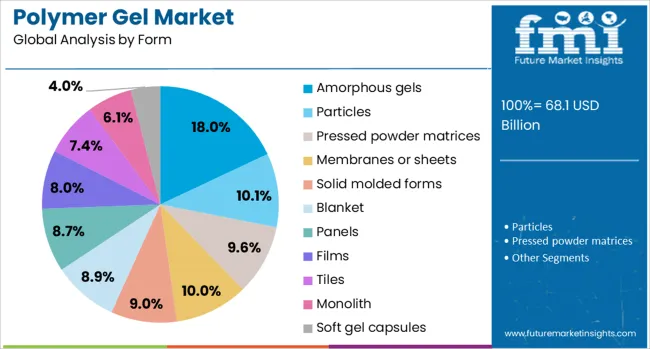

The polymer gel market is segmented by raw material, form, and geographic regions. The raw materials of the polymer gel market are divided into polyacrylic acid, polyvinyl alcohol, and Other raw materials for hydrogel. In terms of raw materials, the polymer gel market is classified into Silica, Carbon, Polymer, and Other raw materials for aerogel. The polymer gel market is segmented into Amorphous gels, Particles, pressed powder matrices, Membranes or sheets, Solid molded forms, blankets, Panels, Films, Tiles, monoliths, and Soft gel capsules. Regionally, the polymer gel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Poly acrylic acid is forecasted to lead the raw material segment with a 43.0% revenue share in 2025, largely due to its superabsorbent properties and broad-spectrum application. Its strong affinity for water allows it to absorb and retain hundreds of times its weight, making it highly suitable for hygiene products such as baby diapers, adult incontinence pads, and feminine hygiene products.

In the medical field, it is used in hydrogels for wound care due to its ability to create moist healing environments and deliver active compounds. The cosmetic industry favors poly acrylic acid for its gelling and emulsifying qualities, particularly in creams and lotions. Additionally, its compatibility with pH-sensitive formulations has enabled its use in controlled drug delivery systems.

The compound’s low toxicity and high versatility have also extended its reach into agricultural applications, especially in water retention for arid soils. As demand rises for absorbent and functional polymer solutions in everyday products, poly acrylic acid is expected to maintain its leading position due to performance, affordability, and ease of chemical modification.

Silica is anticipated to dominate the raw material category with a commanding 58.0% share in 2025, owing to its structural stability, particle uniformity, and widespread use in reinforcing polymer matrices. Amorphous silica in particular is favored in gel formulations for its thixotropic properties and ability to enhance texture, viscosity, and mechanical strength.

In the industrial sector, silica-based polymer gels are used extensively in coatings, insulation, and electronics due to their thermal resistance and durability. Silica’s capacity to function as a desiccant makes it a critical ingredient in moisture-control gels used in packaging, medical diagnostics, and food preservation.

Additionally, silica is increasingly integrated into smart materials and responsive gels for emerging applications such as flexible electronics and wearable sensors. Its synergy with organic polymers enhances dispersibility and enables hybrid gel systems with targeted performance characteristics. Given its inert nature and regulatory acceptance in sensitive environments, silica continues to see robust adoption in pharmaceutical and cosmetic gels. With ongoing R&D focused on nano-silica and functionalized derivatives, its relevance in high-performance polymer gels is expected to strengthen further in the coming years.

Amorphous gels are expected to hold an 18.0% share of the polymer gel market in 2025, supported by their smooth consistency, spreadability, and biocompatibility. Unlike structured or crystalline gels, amorphous gels offer uniform application across skin and tissue, which is particularly valued in medical and cosmetic products.

In wound care, amorphous polymer gels provide moisture balance, aid autolytic debridement, and offer a soothing, non-adherent application. Their transparent nature allows clinicians to visually inspect wound progression without removal, reducing disruption to healing tissue.

The cosmetic industry prefers amorphous gels for their aesthetic appeal, lightweight texture, and compatibility with active ingredients such as vitamins and botanical extracts. These gels are also favored for delivering cooling and hydrating effects in dermatological formulations and sun-care products. From an industrial perspective, amorphous gels are finding application in coatings and optical devices where clarity and flexibility are required. Continued demand for clear, residue-free, and user-friendly formulations across healthcare and personal care will support the expansion of amorphous gels, particularly as consumers prioritize comfort, appearance, and usability in topical products.

The polymer gel market is expanding as demand for advanced absorbent and flexible materials grows across multiple sectors. Growth in 2024 and 2025 was fueled by increasing applications in personal care, wound dressings, and oilfield water management. Opportunities are evident in drug delivery systems, soft robotics, and energy storage technologies. Key trends include the use of stimuli-responsive gels, biodegradable variants, and integration into wearable devices. However, high production costs, performance limitations under extreme conditions, and challenges in large-scale manufacturing remain major barriers to widespread adoption in global markets.

The primary growth driver is the rising use of polymer gels in personal care products and medical applications. In 2024 and 2025, hydrogel-based wound dressings gained traction for their moisture retention and healing properties. Absorbent gels became standard in hygiene products, enhancing comfort and safety. Cosmetics brands increasingly adopted polymer gels for premium skincare formulations offering hydration and textural appeal. Oilfield operators also implemented polymer gels for water shutoff operations to improve extraction efficiency. These factors confirm that versatility and functional benefits are sustaining strong demand for polymer gels globally.

Significant opportunities are present in pharmaceutical and energy applications requiring controlled performance and adaptability. In 2025, polymer gels were explored in drug delivery platforms for precision dosing and extended-release therapies. Battery developers adopted gel electrolytes to enhance safety and conductivity in advanced energy storage devices. Demand for shape-morphing gels in soft robotics further opened niche markets. These examples indicate that companies innovating for high-value sectors such as healthcare and renewable energy will secure competitive advantages, as specialty gels deliver unique properties for critical applications worldwide.

Emerging trends include the evolution of stimuli-responsive gels and integration into wearable electronics. In 2024, gels capable of responding to temperature, pH, or electrical signals were commercialized for smart textiles and biomedical sensors. Flexible gel-based components became integral to next-generation wearable devices requiring adaptability and skin compatibility. Development of biodegradable and bio-based polymer gels also gained momentum among manufacturers aiming to reduce material disposal challenges. These advancements highlight a decisive market shift toward intelligent and multifunctional materials capable of meeting performance requirements in both consumer and industrial domains.

Market restraints arise from elevated manufacturing costs, structural fragility under mechanical stress, and storage complexities. In 2024 and 2025, cost pressures limited adoption in price-sensitive hygiene and consumer goods sectors. Inconsistent gel stability in extreme temperature conditions hindered large-scale implementation in industrial environments. Limited recyclability and specialized handling needs further contributed to operational challenges. These factors underline the importance of cost-optimized formulations, improved crosslinking techniques, and durability enhancements to enable wider penetration of polymer gels across diverse application areas without compromising functional performance.

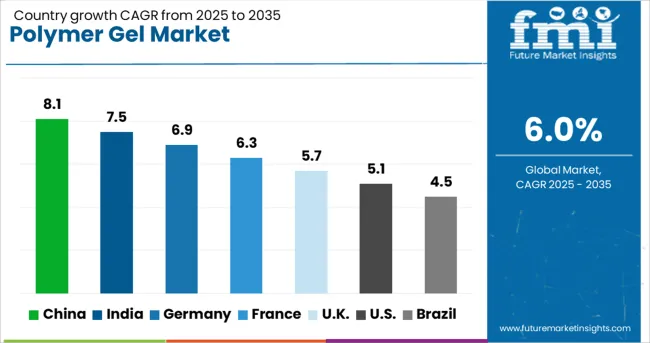

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

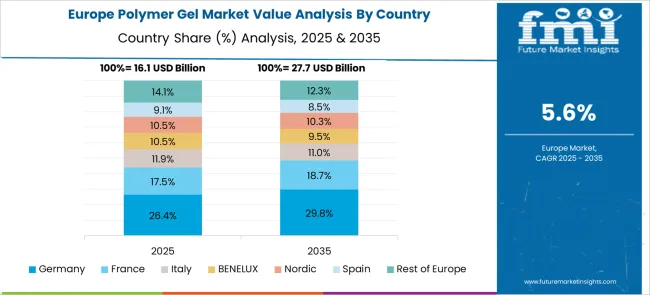

| France | 6.3% |

| UK | 5.7% |

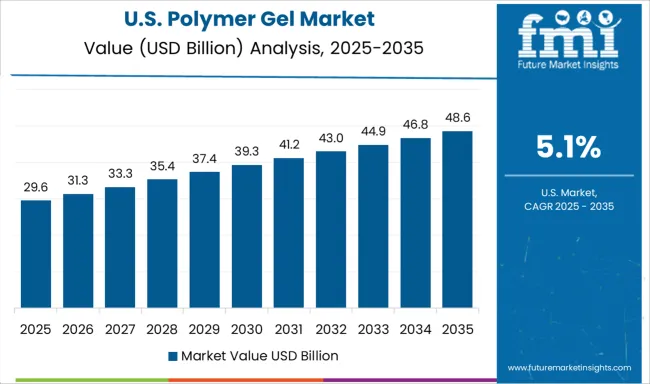

| USA | 5.1% |

| Brazil | 4.5% |

The global polymer gel market is projected to grow at 6% CAGR between 2025 and 2035. China leads at 8.1% CAGR, driven by rising demand for polymer gels in healthcare, electronics, and personal care. India follows at 7.5%, supported by expanding pharmaceutical and cosmetic industries. Germany records 6.9% CAGR, emphasizing eco-friendly gels in medical and industrial applications. The United Kingdom grows at 5.7%, while the United States posts 5.1%, reflecting steady demand in mature markets for advanced gels in electronics, energy storage, and wound care. Asia-Pacific dominates due to low-cost manufacturing and rapid R&D adoption, while Europe and North America focus on high-performance and biodegradable polymer gels. This report includes insights on 40+ countries; the top markets are shown here for reference.

The polymer gel market in China is forecasted to grow at 8.1% CAGR, driven by its widespread use in personal care products, wound dressings, and flexible electronics. Rapid industrial growth and healthcare advancements fuel demand for hydrogel-based solutions in medical implants and drug delivery systems. Domestic players increase production of low-cost polymer gels, while global brands introduce premium gels with controlled-release functionalities. Growth in wearable electronics further strengthens LCP and polymer gel integration for energy storage applications.

The polymer gel market in India is expected to grow at 7.5% CAGR, driven by increasing use in pharmaceutical, cosmetic, and agricultural sectors. Hydrogels dominate applications in wound care, controlled-release drug systems, and skincare products. Manufacturers focus on cost-effective, biodegradable gels catering to sustainability-conscious consumers. Expansion of cold-chain logistics for medical applications strengthens demand for temperature-sensitive polymer gels. Advanced research in superabsorbent gels for agriculture promotes water conservation and improves crop yield.

The polymer gel market in Germany is forecasted to grow at 6.9% CAGR, supported by innovation in smart gels for medical, industrial, and energy storage applications. Manufacturers develop thermosensitive and pH-responsive gels for targeted drug delivery and diagnostic devices. Increased demand for bio-based gels aligns with EU green manufacturing directives. Research initiatives in gel electrolytes enhance battery performance for electric vehicles and renewable energy storage systems. Adoption of high-tech gel solutions in personal care and hygiene segments further strengthens market growth.

The polymer gel market in the United Kingdom is projected to grow at 5.7% CAGR, driven by rising use in advanced wound care, personal care products, and electronics. Hydrogels integrated with antimicrobial properties gain popularity in healthcare applications. Sustainability initiatives push adoption of recyclable and eco-friendly gel formulations in cosmetic and industrial markets. Manufacturers explore responsive gels for robotics and soft actuator technologies, aligning with automation trends. Digital healthcare systems encourage polymer gel adoption in biosensors and diagnostic patches.

The polymer gel market in the United States is projected to grow at 5.1% CAGR, reflecting stable adoption in medical, electronics, and energy sectors. Gels with tunable mechanical properties are widely used in prosthetics, implants, and wearable sensors. Adoption of polymer gels as electrolytes in lithium-ion batteries accelerates under renewable energy programs and EV adoption. Consumer preference for high-performance gels in skincare and hygiene products supports steady demand. Innovation focuses on stimuli-responsive gels for medical robotics and smart textiles.

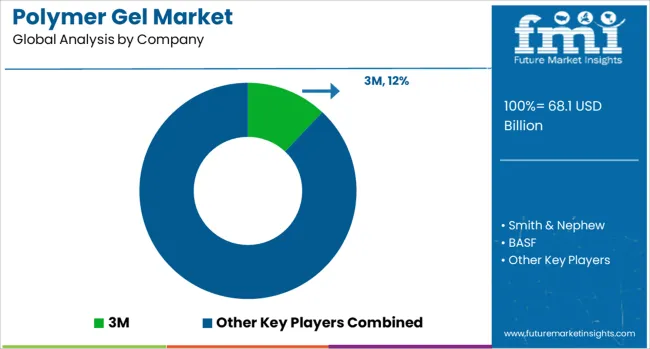

The polymer gel market is dominated by 3M, which secures its leadership through a diverse portfolio of medical-grade and industrial gel solutions used in wound care, diagnostics, and advanced healthcare applications. 3M’s dominance is reinforced by strong R&D investments, global distribution, and product reliability across therapeutic and protective solutions. Key players such as Smith & Nephew, BASF, Medtronic Inc., Coloplast, Cardinal Health, and B. Braun Melsungen AG hold significant shares by offering specialized hydrogel and polymer-based products tailored for clinical, pharmaceutical, and personal care applications.

These companies prioritize innovation in biocompatible materials, superior moisture retention, and antimicrobial properties to meet stringent safety standards and enhance patient comfort. Emerging players including KAO Corporation, LG Chem Ltd, Sanyo, Alliqua Biomedical Inc., Medline Industries Inc., and Formosa Plastics Corporation are expanding their presence by introducing advanced gel formulations with improved durability and functionality. Additionally, niche players like SILIPOS Holding LLC and Cooper Company target customized wound care and orthopedic applications. Parallel to healthcare, aerogel innovators such as Aspen Aerogels, Aerogel Technologies, Svenska Aerogel, and Cabot Corporation are creating hybrid solutions blending aerogel properties with polymer gels for thermal insulation and energy storage markets.

Growth is driven by the increasing demand for advanced wound care products, expanding applications in cosmetics, and the growing trend of multifunctional gels in electronics and energy sectors. Continuous R&D in bioactive gels and smart gel systems is expected to shape competitive strategies globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 68.1 Billion |

| Raw Material | Poly acrylic acid, Poly vinyl alcohol, and Other raw materials for hydrogel |

| Raw Material | Silica, Carbon, Polymer, and Other raw materials for aerogel |

| Form | Amorphous gels, Particles, Pressed powder matrices, Membranes or sheets, Solid molded forms, Blanket, Panels, Films, Tiles, Monolith, and Soft gel capsules |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Smith & Nephew, BASF, Coloplast, Cardinal Health, KAO Corporation, Hydrogel Healthcare Ltd, SILIPOS Holding LLC, B. Braun Melsungen AG, Medtronic Inc, LG Chem Ltd, Sanyo, Alliqua Biomedical Inc, Formosa Plastics Corporation, Medline Industries Inc, Cooper Company, Ashland, Hollister, Aspen Aerogels, Aerogel Technologies, Aerogel UK Ltd, Active Aerogels, Cabot Corporation, Svenska Aerogel, JIOS Aerogel, Bluesift, Active Space Technologies, Empa, and ENERSENS |

| Additional Attributes | Dollar sales by formulation type (thermo‑reversible, photo‑responsive, self‑healing) and industry application (personal care, biomedicine, pharma, oil & gas). Segmentation by channel (direct, distributors, online). Asia‑Pacific fastest-growing; North America strong base. Innovations include hybrid polymer composites, biodegradable gels, and applications in soft robotics, controlled-release systems, and advanced medical devices. |

The global polymer gel market is estimated to be valued at USD 68.1 billion in 2025.

The market size for the polymer gel market is projected to reach USD 121.9 billion by 2035.

The polymer gel market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in polymer gel market are poly acrylic acid, poly vinyl alcohol and other raw materials for hydrogel.

In terms of raw material, silica segment to command 58.0% share in the polymer gel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA