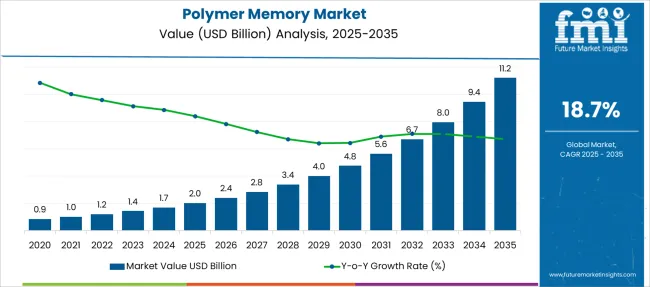

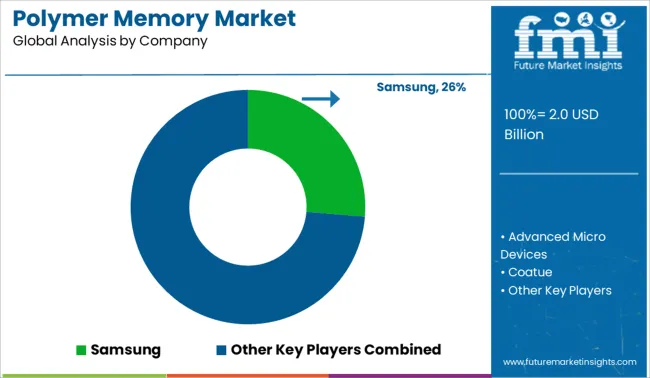

The Polymer Memory Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 18.7% over the forecast period.

| Metric | Value |

|---|---|

| Polymer Memory Market Estimated Value in (2025 E) | USD 2.0 billion |

| Polymer Memory Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 18.7% |

The polymer memory market is advancing steadily, propelled by growing demand for flexible, lightweight, and cost-effective memory devices. Industry insights reveal increasing interest from commercial sectors, including consumer electronics, wearable devices, and smart packaging, where polymer memory offers unique advantages over traditional silicon-based memory.

The ability to produce memory devices on flexible substrates supports emerging applications requiring bendable and stretchable electronics. Technological progress in polymer materials and fabrication techniques has enhanced data storage capabilities and device durability.

Expanding investments in research and development have led to the commercialization of improved polymer memory products, supporting wider market adoption. The commercial sector is particularly driving demand due to the need for compact, energy-efficient memory components in modern electronics. The market outlook remains positive, with innovations and growing use cases expected to fuel further growth.

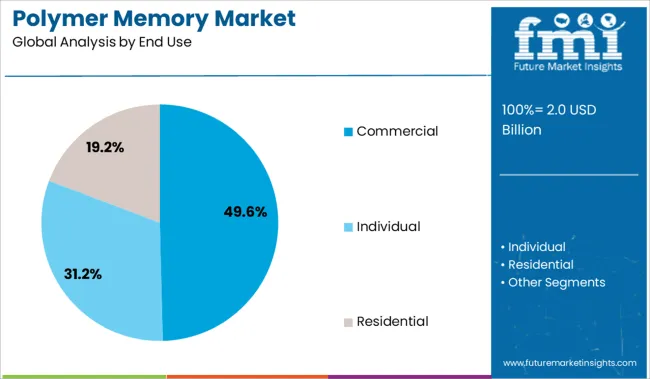

The market is segmented by End Use and region. By End Use, the market is divided into Commercial, Individual, and Residential. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial segment is projected to account for 49.6% of the polymer memory market revenue in 2025, leading the end-use categories. This segment’s expansion has been driven by applications in consumer electronics that require flexible and lightweight memory solutions. Commercial users benefit from polymer memory’s adaptability to diverse form factors, enabling integration into devices such as flexible displays, wearable technology, and portable gadgets.

The demand for energy-efficient memory with rapid data access has further reinforced polymer memory adoption in this segment. Additionally, commercial applications often require scalable manufacturing processes, which polymer memory technologies support through solution-based fabrication methods.

As commercial electronics continue to evolve towards miniaturization and flexibility, the polymer memory market is expected to see sustained growth in this end-use segment.

Increasing demand for faster memory devices with a high storage capacity of information is likely to scale up the adoption of polymer memory to a considerable extent. The rising demand for polymer memory can also be attributed to its simple manufacturing and low power consumption.

Additionally, polymer memory has the advantage of retaining data even after the power is turned off, unlike the memory in your computer, which greatly influences the polymer memory demand analysis.

Many from around the world are encouraged to opt for the same; in turn, surging the adoption of polymer memory as such non-volatile memory has potential benefits, not the least of which is the possibility of never having to wait for a PC to boot up.

Several researchers are working on various methods to implement this type of memory. Compared to other non-volatile options, polymer memory may be able to store a lot more data, expanding the overall polymer memory market size. The spike in demand for polymer memory can also be owed to its durable nature, and the polymer memory created by Thin Film has been put through rigorous reliability tests at temperatures ranging from - 40 to 110°C.

The outcomes highlight the polymer memory's exceptional stability and compliance with both military and industrial standard tests, auguring well for the polymer memory market. However, it won't be simple to commercialize polymer memory as memory technologies compete not only on storage capacity but also on speed, energy usage, and reliability.

Meeting all of the specifications for the silicon memory chips of today is one of the challenges that the polymer memory market is confronted with. New memory materials will probably only be used in specialized applications until they can rival silicon's high performance.

One potential application is in disposable electronics, where cost rather than performance is the deciding factor. Polymer memory devices for use in identification tags are being developed by researchers at Bell Laboratories, a subsidiary of Lucent Technologies.

Bell Labs' polymer memory is still relatively slow by silicon standards, and its maximum capacity is only a few kilobits. The same is likely to have an impact on the polymer memory market share to an extent.

As emerging trends in the polymer memory market are brought about, and polymer memory technology develops, it may eventually lead to the creation of computers with only plastic electronic parts, from the display to the logic chip.

Although that may be decades away, as researchers continue to push the boundaries of polymers, the vision seems less far-fetched, as per the polymer memory market report. Moreover, prolonged and continuous research over this technology which delays its launch in the market, is dwindling the polymer memory market size.

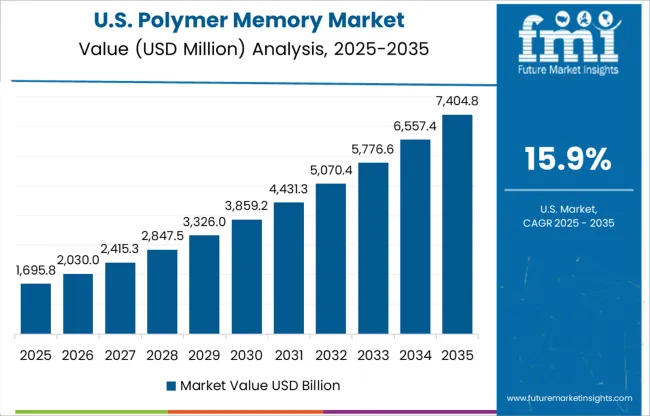

By 2025, North America is expected to control 37.6% of the global memory polymer market share, attributed to the presence of several polymer memory manufacturers in the region. The large memory polymer market in North America is highlighted by the presence of several significant end users and product producers.

The developed healthcare sector in the United States is complemented by expanding biomedical research, which is expected to facilitate the memory polymer market key trends & opportunities over the forecast period.

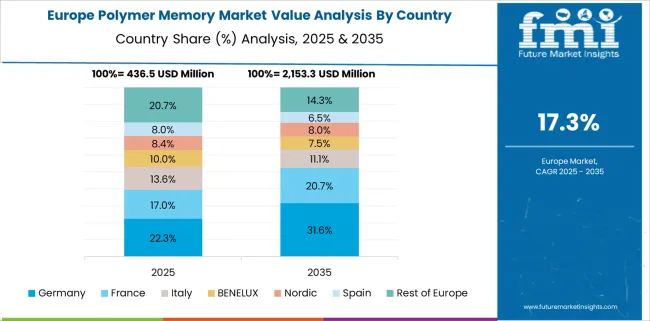

A strong position is anticipated for the growth of the memory polymer market in the European region as a result of the industrialization of this region and its advanced manufacturing techniques. The market share of polymer memory in the region is expected to be 22 percent in 2025 as a result of all these factors.

To create chips that store data in polymers rather than silicon, Advanced Micro Devices of Sunnyvale, California, is collaborating with Coatue, a start-up in Woburn, Massachusetts. In the words of Coatue CEO Andrew Perlman, the innovation could result in a less expensive and denser replacement for flash memory chips, the kind of memory found in digital cameras and MP3 players.

This collaboration is to create memory chips that store data in electronic polymers rather than silicon Opticom polymer memory. Coatue is a research and development company at the forefront of a new generation of memory chips based on polymers.

Businesses involved in the polymer memory market are now more engaged with launching strategies like targeted marketing, CSR programs, etc., as a way to increase their global prominence. The fact that these companies are now aiming to manage a specific business-related activity in a nation that offers advantageous policies is a clearly discernible polymer memory market trend that is being observed across the board.

By doing so, it enables the companies to reduce expenses while retaining industry experts for each crucial stage of their respective organizations. A similar high-capacity polymer memory is being developed by Thin Film Technologies in Linköping, Sweden, in partnership with Intel, the largest manufacturer of computer processors and flash memory chips. This is considered one of the recent developments in the polymer memory market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 18.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Japan; The Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Intel; Thin Film Technologies; Advanced Micro Devices of Sunnyvale, CA |

| Customization | Available Upon Request |

The global polymer memory market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the polymer memory market is projected to reach USD 11.2 billion by 2035.

The polymer memory market is expected to grow at a 18.7% CAGR between 2025 and 2035.

The key product types in polymer memory market are commercial, individual and residential.

In terms of , segment to command 0.0% share in the polymer memory market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shape Memory Polymer Market Size and Share Forecast Outlook 2025 to 2035

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA