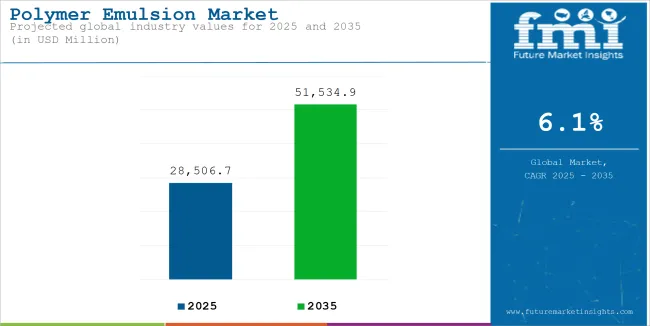

The global polymer emulsion market is projected to reach USD 28,506.7 million by 2025 and is forecast to grow to USD 51,534.9 million by 2035, registering a CAGR of 6.1% during the forecast period. The demand for water-based, low-VOC (volatile organic compound) coatings and adhesives is driving growth, especially in industries like construction, automotive, textiles, and packaging. Regulatory mandates on solvent-based chemicals, coupled with increasing consumer preference for environmentally friendly solutions, are contributing to the shift toward emulsion polymers.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 28,506.7 million |

| Projected Size, 2035 | USD 51,534.9 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

In 2024, polymer emulsion demand surged in China and India, driven by growth in construction, automotive, and textile sectors. According to the China National Coatings Industry Association, architectural coatings output increased by 12.5% in 2023 due to aggressive urban development and green building mandates. This rise significantly boosted the consumption of water-based acrylic emulsions in decorative and protective coatings.

In Europe, particularly in Germany and France, public renovation projects and compliance with low-VOC emission standards accelerated the shift toward eco-friendly emulsion polymers. The European Paint Federation (CEPE) reported a sharp rise in the demand for vinyl acetate and hybrid emulsions in indoor paints and floor coatings, reflecting strong sustainability adoption across residential and commercial spaces.

Innovations in polymer emulsion technologies, particularly in acrylics, vinyl acetate, and styrene-butadiene emulsions, are significantly enhancing product performance across various applications. These emulsions are engineered to deliver improved durability, elasticity, chemical resistance, and water repellency, making them highly suitable for demanding end-use sectors such as construction, automotive, and textiles. Advancements in copolymer formulations and cross-linking agents are allowing manufacturers to tailor emulsions to meet specific substrate requirements, enhancing adhesion and finish quality while maintaining environmental compliance.

Polymer emulsions are increasingly favored due to their low VOC content, recyclability, and energy-efficient water-based production processes. These characteristics align with global regulatory frameworks and the growing emphasis on green building materials and sustainable packaging solutions. As companies and governments adopt stricter emissions regulations and circular economy goals, polymer emulsions are becoming the preferred alternative to solvent-based systems, particularly in architectural coatings, paper, and packaging applications.

The table below presents the annual growth rates of the global polymer emulsion market from 2025 to 2035. With a base of 2024 and extended to the current year 2025, the report studied how the industry growth trajectory moves from the first half of the year-that is, January to June, (H1)-to the second half comprising July to December, (H2).

This is an absolute comparison to offering the stakeholder's idea of how the sector has performed over time, with hints on developments that may possibly emerge.

These figures indicate the growth of the sector in each half-year, between the years 2024 and 2025. The market is expected to grow at a CAGR of 5.6% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 5.6% |

| H2(2024 to 2034) | 5.8% |

| H1(2025 to 2035) | 5.9% |

| H2(2025 to 2035) | 6.1% |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 5.9% in the first half and relatively increase to 6.1% in the second half. In the first half (H1), the sector saw an increase of 30 BPS while in the second half (H2), there was a slight increase of 30 BPS.

Acrylic emulsions are expected to account for approximately 44% of the global polymer emulsion market share in 2025 and grow at a CAGR of 5.9% through 2035. These emulsions are widely adopted in architectural coatings, pressure-sensitive adhesives, and construction materials due to their excellent UV resistance, weather ability, and adhesion to various substrates.

The shift from solvent-based to water-based systems across decorative and industrial coatings is driving widespread adoption. Additionally, acrylic emulsions offer low odor and fast drying, making them ideal for indoor applications. Innovation in modified acrylic systems for improved scrub resistance and stain blocking is also helping expand their use across value-added product categories.

The paints and coatings sector is projected to hold around 40% of the polymer emulsion market share in 2025, growing at a CAGR of 6.0% through 2035. Emulsion polymers serve as binders in both interior and exterior water-based paints, primers, and protective finishes. Demand is being fueled by rapid urban development, rising disposable income, and increasing awareness of low-VOC products.

Countries in Asia-Pacific and Latin America are investing heavily in construction and infrastructure, pushing up the need for cost-effective, durable coatings. Furthermore, stringent emission standards in Europe and the USA are accelerating the adoption of green coatings powered by emulsion technology. Specialty emulsions tailored for anti-microbial, elastomeric, and dirt-pickup resistant coatings are gaining popularity among manufacturers and contractors.

A Rise in the Use of Polymer Emulsion with Bio-Based Supplements

It is projected that emulsions made up of bio-based polymers and water will offer tremendous development prospects. Over the forecast period, rising consumer awareness of green construction is expected to fuel demand globally.

The development of paints and coatings with low VOC content or no VOCs is likely to be supported by the movement in consumer preference toward the use of environmentally friendly paints and coatings and the favourable regulatory environment.

High molecular weight polymers with negligible viscosity are created using the emulsion polymerization process. However, polymers can also be customised based on how they will be used.

Increasing Usage of Polymer Emulsion in the Automotive Industry

Automotive industry is expected to boost the demand for polymer emulsions as it is used in LASD coatings and can be tailored for flexibility, adhesion, and filler content. Another excellent feature for manufacturers is that they attach to metal components without difficulty. Utilizing polymer emulsions has additional benefits, such as less expensive application and improved consistency and repeatability of placement.

The automotive industry increasingly utilizes emulsion-based adhesives for various applications, including bonding components and assembling parts. These adhesives offer strong bonding capabilities while being easier to apply compared to traditional solvent-based adhesives. The growing trend towards electric vehicles (EVs) further drives the demand for innovative adhesive solutions that support lightweight designs

Styrene-butadiene polymer emulsions are used to formulate these coatings. This is due to its ability to accommodate high filler loadings, compatibility with anti-corrosion pigments, and its range of strength and flexibility to meet the demands of harsh operating environments. With all these above-mentioned facts it is expected that growth in the automotive industry drives the demand for polymer emulsion.

Growing Demand for Polymer Emulsions in the Construction Industry

The construction industry plays a significant role in the increasing demand for polymer emulsions, particularly for use in paints, coatings, and adhesives. Polymer emulsions are used in these applications because they provide excellent durability, resistance to weather, and long-lasting finishes. As urbanization continues to grow worldwide, particularly in developing regions, there is an increasing need for high-quality materials in construction.

Infrastructure development, such as the building of roads, bridges, and residential areas, further boosts the demand for construction-related products. Polymer emulsions help improve the performance of various construction materials, such as concrete and sealants, ensuring better strength and longevity.

The shift towards more sustainable and eco-friendly products in the construction industry also favors the use of polymer emulsions. These water-based emulsions are environmentally friendly, releasing fewer harmful emissions compared to traditional solvent-based alternatives. As the construction industry continues to expand globally, the reliance on polymer emulsions is expected to increase.

Competition from Solvent-Based Alternatives in the Polymer Emulsion Market

Polymer emulsions are under considerable competition from solvent-based alternatives and other synthetic binders, especially in cost-sensitive markets. The solvent-based products have been favored due to their fast-drying properties and excellent performance in some applications. Such alternatives may sometimes offer a lower upfront cost, which appeals to manufacturers keen on reducing their expenses.

However, some businesses that deal with industries such as paints, coatings, and adhesives, for which performance and price are more critical, prefer to use the solvent-based alternatives, even if they are linked to environmental hazards. Such alternatives provide specific benefits, such as faster curing time and improved resistance to certain conditions.

Although solvent-based products are relatively cheaper, the long-term benefits of polymer emulsions, such as enhanced environmental and health advantages, increasingly gain importance with ever-growing regulations to control VOC emissions.

The relevance of eco-friendly practices will raise demand for polymer emulsions but manufacturers will still compete with cheaper-priced alternatives in highly price-sensitive markets.

Tier 1 companies include industry leaders with annual revenues exceeding USD 500-1000 million. These companies are currently capturing a significant share of 40-45% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of products to meet regulatory standards. Prominent companies within Tier 1 include: Asahi Kasei, Financiera Maderera, Wacker Chemie, and others.

Tier 2 companies encompass mid-sized participants with revenues ranging from USD 100-500 million, holding a presence in specific regions and exerting significant influence in local economies. These firms are distinguished by their robust presence overseas and in-depth industry expertise.

They possess strong technology capabilities and adhere strictly to regulatory requirements. However, while they may not always possess the latest cutting-edge technologies or maintain an extensive global reach. Noteworthy entities in Tier 2 include Trinseo, BASF, Celanese, OMillionova Solutions.

Tier 3 encompasses most of the small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues below USD 50-100 million. These businesses are notably focused on meeting local demand and are hence categorized within the Tier 3 segment.

They are small-scale participants with limited geographical presence. In this context, Tier 3 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one. Tier 3 Arkema, DIC, BATF Industrial and others.

The section below covers assessments of polymer emulsion sales across key countries. Countries from East Asia, and Latin America, are anticipated to exhibit promising double-digit growth over the forecast period. All the below-listed countries are collectively set to reflect a CAGR of around 6.1% through the forecast period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

| USA | 6.3% |

| Germany | 5.8% |

| India | 8.3% |

| Japan | 5.4% |

China is the largest producer and consumer of polymer emulsions, making it a key player in the global market. The country’s fast-growing urbanization and ongoing infrastructure development are major factors driving demand for polymer emulsions. These emulsions are used in a variety of industries, including construction, automotive, textiles, and coatings.

The rapid expansion of cities and large construction projects in China create a high need for polymer emulsions in paints, coatings, adhesives, and other building materials. Additionally, government policies supporting environmentally friendly products are encouraging the use of water-based polymer emulsions over traditional solvent-based products, which are harmful to the environment.

China’s strong manufacturing sector, especially in automotive and packaging, further increases the demand for polymer emulsions. The growing need for eco-friendly and durable solutions in these industries helps maintain a steady rise in the consumption of polymer emulsions. As urbanization and industrialization continue, China’s role in the global polymer emulsion market is expected to remain dominant.

The United States market is the biggest consumer in this regard of polymer emulsions for uses involving paints, coatings, adhesives, and construction materials. Strong demand exists in the sector due to its growth path in green and sustainable products.

Solvent-free water-based polymer emulsions are increasingly becoming preferred in wide applications, which emit fewer free harmful chemicals than solvent-based products. Key drivers of its growth include high demand in the construction and automotive sectors. In construction, there is a need for strong eco-friendly paints and coatings, while in the automotive industry, polymer emulsions are used for manufacturing advanced coatings and adhesives.

Also, regulatory pressure is pushing industries to adopt low-VOC (volatile organic compound) products, which is further accelerating the shift toward water-based emulsions. The growing focus on sustainability in the USA also supports the demand for polymer emulsions, ensuring continued market expansion in the coming years.

Germany is one of the leading countries in Europe when it comes to the polymer emulsion market, thanks to its strong industrial base and advanced manufacturing and construction sectors.

The country has a long history of producing high-quality products, and this extends to the use of polymer emulsions in a wide range of applications such as paints, coatings, adhesives, and construction materials.

Germany market is known for its commitment to producing top-notch products, and polymer emulsions are no exception. The demand for durable and reliable materials in various industries drives the growth of this market.

here is a growing emphasis on eco-friendly solutions in Germany, which has led to a preference for water-based polymer emulsions over traditional solvent-based products. This shift is supported by both consumer demand and government regulations.

Innovations in polymer emulsion formulations have improved their performance, making them suitable for a wide range of applications, contributing to the market's continued growth in the country.

The Polymer Emulsion Market is marked by intense competition as companies aim to strengthen their product offerings through formulation innovation and sustainability focus. Leading players are investing in low-VOC and bio-based emulsions, while exploring new polymerization methods such as mini-emulsion and hybrid technology.

Strategic partnerships and acquisitions are helping companies expand their geographical reach and production capacity. R&D efforts are increasingly directed at applications in advanced textiles, pressure-sensitive adhesives, and industrial coatings. In emerging economies, expansion of local production facilities is enabling firms to meet growing demand efficiently. Market growth is supported by environmental regulations, rising construction spending, and the global push for sustainable materials in consumer and industrial sectors.

Key Developments

In terms of Product Type, the industry is divided into Acrylic Styrene Butadiene Latex, Vinyl Acetate Polymers, Polyurethane Dispersions, Others (hybrid epoxy, silicon etc.)

In terms of application, the industry is divided into segmented Adhesive & Sealants Paints & Coatings, Paper & Paperboard, Others

In terms of End-Use Industry, the industry is divided into Building & Construction, Chemicals, Automotive, Textile & Coatings, Others

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA), have been covered in the report.

The global market was valued at USD 26,867.8 million in 2024.

The global market is set to reach USD 28,506.7 million in 2025.

Global demand is anticipated to rise at 6.1% CAGR.

The industry is projected to reach USD 51,534.9 million by 2035.

Asahi Kasei, Financiera Maderera, Wacker Chemie, Trinseo, BASF, Celanese, OMillionova Solutions, Arkema, DIC, BATF Industrial. are prominent companies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

UK Polymer Emulsion Market Insights – Size, Share & Industry Growth 2025-2035

USA Polymer Emulsion Market Report – Trends, Demand & Industry Forecast 2025-2035

Japan Polymer Emulsion Market Outlook – Share, Growth & Forecast 2025-2035

ASEAN Polymer Emulsion Market Analysis – Demand, Size & Trends 2025-2035

Germany Polymer Emulsion Market Analysis – Growth, Trends & Outlook 2025-2035

Styrene Acrylic Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Emulsion Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA