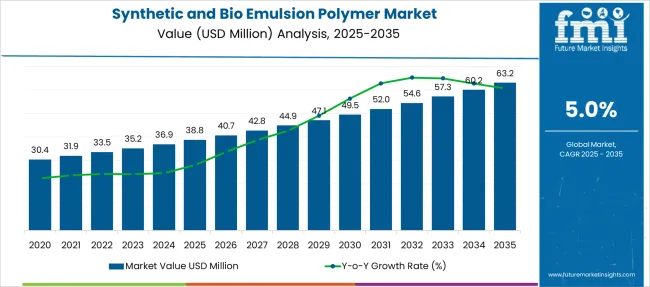

The Synthetic and Bio Emulsion Polymer Market is estimated to be valued at USD 38.8 million in 2025 and is projected to reach USD 63.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Synthetic and Bio Emulsion Polymer Market Estimated Value in (2025 E) | USD 38.8 million |

| Synthetic and Bio Emulsion Polymer Market Forecast Value in (2035 F) | USD 63.2 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The synthetic and bio-emulsion polymer market is witnessing steady expansion, driven by increased demand for advanced materials in various industrial applications. Innovations in polymer chemistry have improved the performance characteristics of emulsion polymers, such as enhanced adhesion, flexibility, and environmental resistance.

These polymers have gained prominence due to their versatility and suitability for water-based formulations, aligning with growing regulatory pressures to reduce volatile organic compounds. The paints and coatings industry is one of the largest consumers, driven by construction, automotive, and industrial maintenance sectors seeking durable and eco-friendly coating solutions.

Growing urbanization and infrastructure development have supported market growth, along with increasing consumer preference for sustainable and high-performance products. Future prospects include the development of bio-based polymers and smart coatings that respond to environmental changes. Segmental growth is expected to be led by vinyl acetate polymers and the paints and coatings application segment.

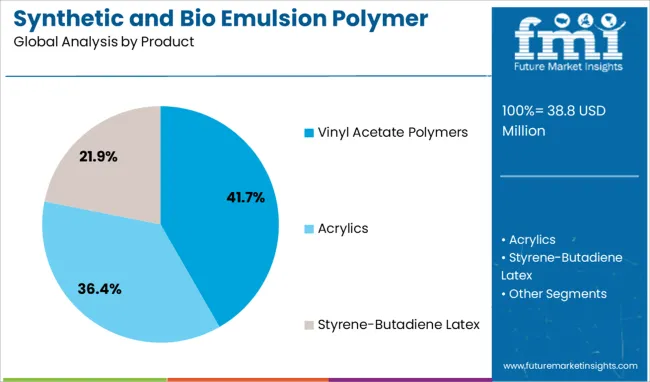

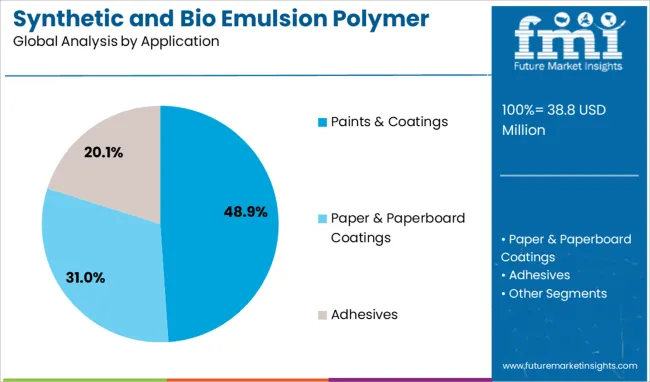

The synthetic and bio-emulsion polymer market is segmented by product and application, and geographic regions. The product of the synthetic and bio-emulsion polymer market is divided into Vinyl Acetate Polymers, Acrylics, and Styrene-Butadiene Latex. In terms of application, the synthetic and bio-emulsion polymer market is classified into Paints & Coatings, Paper & Paperboard Coatings, and Adhesives. Regionally, the synthetic and bio-emulsion polymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vinyl acetate polymers segment is expected to hold 41.7% of the market revenue in 2025, maintaining its position as the leading product category. This segment has benefited from its broad application range and favorable properties such as strong adhesion and film formation. Vinyl acetate polymers are widely used in paints, adhesives, and textile coatings, contributing to their high demand.

Their compatibility with water-based formulations has aligned well with environmental regulations and industry trends toward sustainable materials. The segment’s growth is further supported by continuous improvements in polymer synthesis and formulation techniques that enhance durability and performance.

As industries increasingly seek versatile and eco-conscious polymer solutions, vinyl acetate polymers are poised to sustain their market dominance.

The paints and coatings application segment is projected to account for 48.9% of the market revenue in 2025, solidifying its role as the primary end-use area. This segment’s growth is propelled by rising construction and automotive production worldwide, both of which demand high-quality coatings with superior protective and aesthetic properties.

Emulsion polymers provide excellent film-forming abilities, chemical resistance, and weather durability, making them ideal for coating formulations. The shift toward low-VOC and waterborne coatings has increased the adoption of emulsion polymers within this sector. Infrastructure upgrades and maintenance projects in both developed and developing regions have increased the volume of paint and coating applications. As regulatory frameworks continue to favor environmentally friendly products, the paints and coatings segment is expected to remain a significant driver of demand in the synthetic and bio-emulsion polymer market.

The synthetic and bio emulsion polymer sector is being driven by regulatory shifts favoring water‑borne formulations in paints, adhesives and coatings. Market expansion in 2024 and 2025 is supported by adoption of bio‑based polymer chemistries and growing demand in automotive, construction and textile applications. Opportunities in emerging economies are being seized by firms expanding capacity of bio‑emulsion grades. Notable trends include tailoring acrylic, styrene‑butadiene and vinyl acetate emulsions for high‑performance use. Growth is being restrained by the higher cost of bio batches, feedstock supply variability and compliance overheads across regions.

Demand has surged due to the growing preference for water-based coatings and adhesives over solvent-based alternatives. In 2024 and 2025, increased usage of acrylic and styrene-butadiene emulsion polymers in industrial finishes and construction adhesives has strengthened market growth. This demand was largely supported by regulations targeting low-VOC formulations and higher durability in paints and sealants. Applications in packaging and textiles have also expanded, driven by the need for performance coatings that meet strict environmental norms. This trend reflects the move toward safer, efficient, and adaptable materials across industrial and consumer segments.

Significant opportunities have been created by the rising adoption of bio-based emulsion polymers across industries. In 2025, interest in sustainable material alternatives supported the rapid development of bio-based grades for coatings and adhesives. These formulations have become integral to packaging and specialty coatings where performance requirements are evolving. Collaboration between polymer manufacturers and end-users has increased, resulting in product innovations for adhesion, chemical stability, and durability. This shift signals strong potential for bio-based emulsions to capture a larger share of the market, especially as consumer awareness and regulatory incentives gain momentum globally.

The market has shown a strong preference for polymer customization to suit specific performance standards. Acrylic emulsions have maintained their leadership position, attributed to superior weather resistance and adhesion properties. Styrene-butadiene emulsions continue to dominate in high-volume applications, while vinyl acetate-based formulations have gained traction in flexible packaging and construction adhesives. Bio-based variants are being developed with advanced additives to match the mechanical and chemical characteristics of synthetic grades. The emphasis on specialized formulations for targeted end-uses highlights the competitive edge of suppliers offering tailored polymer solutions for industrial applications.

The growth of bio-emulsion polymers is being restricted by their high production costs and inconsistent supply of raw materials such as plant oils and specialty monomers. Synthetic emulsion manufacturing is also facing cost pressure due to fluctuating petrochemical feedstock prices. Certification and regulatory compliance requirements have further increased operational complexity, making it challenging for smaller firms to scale production efficiently. These constraints have intensified pricing pressure and reduced adoption rates in cost-sensitive regions, requiring manufacturers to explore alternative sourcing strategies and optimize production technologies for long-term market competitiveness.

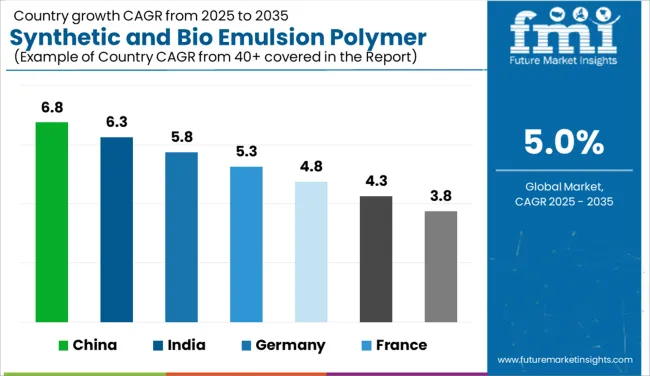

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

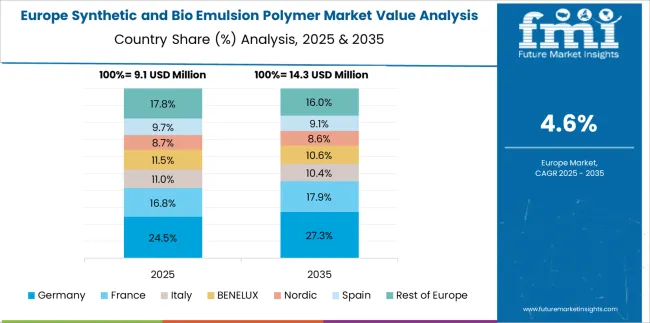

The global synthetic and bio emulsion polymer market is projected to grow at a 5.0% CAGR from 2025 to 2035. China leads with 6.8% CAGR, supported by strong demand in coatings, adhesives, and packaging sectors. India follows at 6.3%, driven by infrastructure development, waterborne coatings, and construction chemicals. France posts 5.3%, reflecting increasing compliance with eco-friendly formulations and sustainable packaging trends. The UK grows at 4.8%, while the United States records 4.3%, signaling slower but steady demand in mature industrial markets focusing on low-VOC and bio-based polymers. Asia-Pacific continues to dominate due to its dynamic construction and automotive industries, whereas Western countries concentrate on green formulations and advanced functional coatings.

China remains the largest market for synthetic and bio emulsion polymers with a forecasted 6.8% CAGR. Growth is propelled by rapid expansion in construction coatings, paper coatings, and adhesives. Rising demand for waterborne systems, aligned with stricter environmental regulations, accelerates adoption of eco-compliant polymer formulations. The packaging sector also consumes significant volumes due to increased e-commerce activity and flexible packaging applications. Domestic producers scale up production of styrene-acrylic and vinyl acetate-based emulsions, while international firms invest in R&D for bio-based polymer blends. Government initiatives on low-VOC emissions sustain long-term market demand.

India is projected to grow at 6.3% CAGR, supported by infrastructure expansion, increasing automotive production, and demand for decorative paints. The rise in water-based coatings for residential and commercial projects underpins emulsion polymer usage. Packaging and adhesives applications also witness significant growth, driven by the FMCG and e-commerce sectors. Domestic manufacturers emphasize cost-competitive production of vinyl acetate and acrylic emulsions, while global suppliers cater to premium coatings and high-performance formulations. Regulatory alignment toward green building standards accelerates the transition to environmentally safe emulsion polymers.

France registers a 5.3% CAGR, benefiting from regulatory mandates promoting low-VOC and waterborne coating systems. Demand is robust in automotive refinishing, industrial coatings, and sustainable packaging sectors. The construction industry favors high-durability coatings based on acrylic and vinyl emulsions for enhanced weather resistance. The country also emphasizes innovation in bio-based polymers to align with EU sustainability directives. Leading chemical firms are investing in advanced latex and hybrid emulsions to meet application-specific performance requirements across packaging and specialty coatings.

The United Kingdom market is forecast to grow at 4.8% CAGR, primarily fueled by coatings for residential construction, automotive aftercare, and packaging industries. Demand is shifting toward environmentally friendly formulations, particularly for architectural paints and adhesives. Manufacturers focus on acrylic and vinyl acetate emulsions compatible with low-VOC standards. Imports from European and Asian suppliers dominate premium-grade polymers, while local producers serve general-purpose applications. Innovation in functional coatings, such as stain-resistant and antimicrobial finishes, drives additional polymer usage.

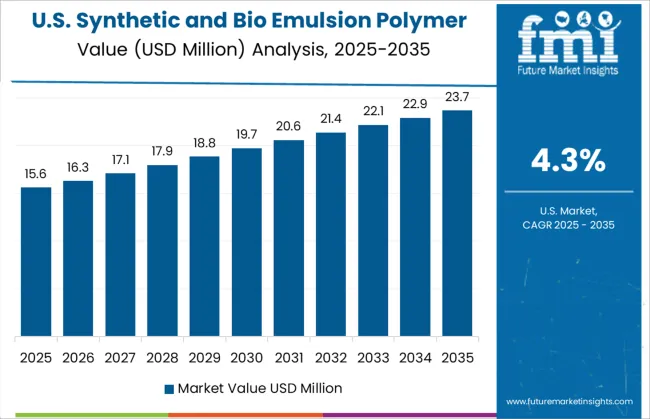

The United States records a 4.3% CAGR, reflecting moderate growth in a mature market. However, rising interest in bio-based and low-VOC emulsions creates fresh opportunities across industrial coatings, packaging, and construction segments. Investments in R&D for sustainable polymers are increasing to align with EPA standards and consumer expectations. Growth in protective coatings for infrastructure projects and energy-efficient building materials supports demand. Key players focus on advanced styrene-acrylic emulsions and hybrid latex systems for improved durability and performance in harsh environments.

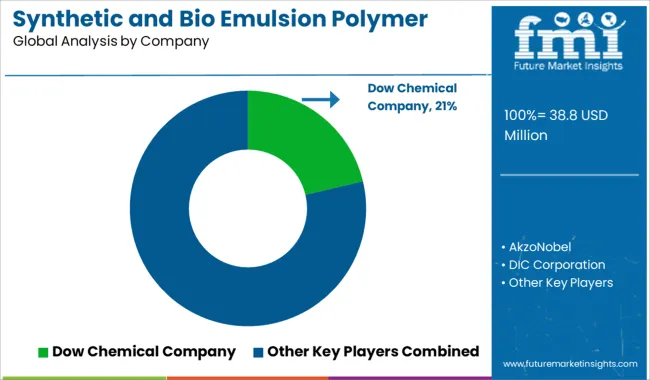

The synthetic and bio emulsion polymer market is moderately consolidated, with Dow Chemical Company recognized as a leading player owing to its advanced portfolio of water-based emulsion polymers designed for coatings, adhesives, sealants, and textile applications.

Dow’s innovation in bio-based and low-VOC formulations positions it strongly in markets demanding sustainable and performance-driven solutions. Key players include AkzoNobel, DIC Corporation, Celanese, Arkema S.A., BASF, Omnova Solution, Nuplex Industry, Synthomer, Styron, Wacker Chemie, STI Polymer, Clariant International Limited, Asahi Kasei, Momentive Performance Materials Holdings LLC, Cytec Industries Inc., The Lubrizol Corporation, Financiera Maderera, Trinseo S.A., and Asian Paints Ltd.

These companies focus on delivering high-performance polymers for diverse industries, emphasizing properties like superior adhesion, durability, water resistance, and flexibility. Market growth is driven by increasing demand from paints and coatings, packaging, construction chemicals, and automotive sectors, supported by regulatory trends favoring waterborne over solvent-based systems. Manufacturers are investing in bio-based raw materials, advanced polymerization techniques, and functional additives to enhance performance characteristics.

Emerging trends include the development of hybrid synthetic-bio polymers for reduced carbon footprint and adoption of smart polymer solutions in specialty coatings. Asia-Pacific dominates production and consumption due to strong manufacturing bases in China and India, while North America and Europe lead in technology adoption and high-performance applications.

In February 2024, Lion Elastomers and Emulco NV formed a strategic partnership to produce water-based EPDM (ethylene propylene diene monomer) emulsions branded as Aquapol®. Utilizing Lion’s Trilene® 65 L‑EPDM, the bio-friendly dispersions target applications such as roof coatings and sealants, reducing VOCs and promoting sustainable coating solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.8 Million |

| Product | Vinyl Acetate Polymers, Acrylics, and Styrene-Butadiene Latex |

| Application | Paints & Coatings, Paper & Paperboard Coatings, and Adhesives |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dow Chemical Company, AkzoNobel, DIC Corporation, Celanese, Arkema S.A., BASF, Omnova Solution, Nuplex Industry, Synthomer, Styron, Wacker Chemie, STI Polymer, Clariant International Limited, Asahi Kasei, Momentive Performance Materials Holdings LLC, Cytec Industries Inc, The Lubrizol Corporation, Financiera Maderera, Trinseo S.A., and Asian Paints Ltd. |

| Additional Attributes | Dollar sales by polymer source (synthetic vs bio-based) and functionality (acrylic, styrene-butadiene, vinyl acetate, polyurethane). North America holds \~35% share, driven by environmental compliance, while Asia-Pacific records the fastest growth. Buyers seek low-VOC, durable binders for coatings, adhesives, and packaging. Innovations feature surfactant-free bio-latex, enzymatic synthesis, and nanostructured emulsion systems. |

The global synthetic and bio emulsion polymer market is estimated to be valued at USD 38.8 million in 2025.

The market size for the synthetic and bio emulsion polymer market is projected to reach USD 63.2 million by 2035.

The synthetic and bio emulsion polymer market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in synthetic and bio emulsion polymer market are vinyl acetate polymers, acrylics and styrene-butadiene latex.

In terms of application, paints & coatings segment to command 48.9% share in the synthetic and bio emulsion polymer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Synthetic Cinnamaldehyde Market Growth - Trends & Forecast 2025 to 2035

Synthetic Rubber Market

Synthetic Genomics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA