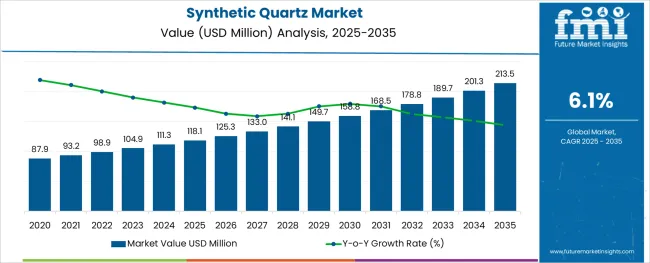

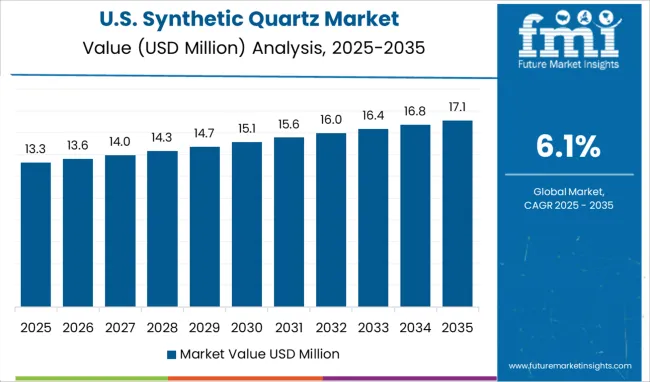

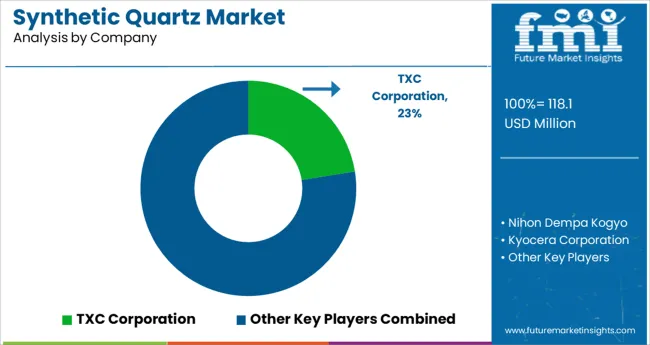

The Synthetic Quartz Market is estimated to be valued at USD 118.1 million in 2025 and is projected to reach USD 213.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The synthetic quartz market is expanding steadily, propelled by growing demand from the electronics and electrical industries. Synthetic quartz is valued for its exceptional piezoelectric and optical properties, making it a key component in devices requiring precise frequency control and signal processing. Technological advancements and miniaturization in consumer electronics, telecommunications, and industrial equipment have driven the adoption of synthetic quartz components.

Additionally, the need for reliable and stable materials in harsh operating environments has increased its use. The electronics and electrical sectors have shown sustained investment in research and development, supporting continuous demand for high-quality synthetic quartz.

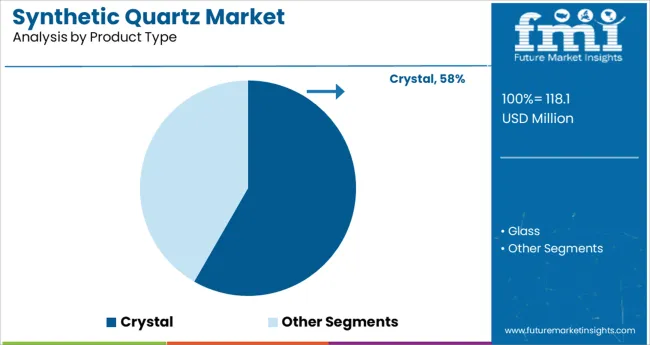

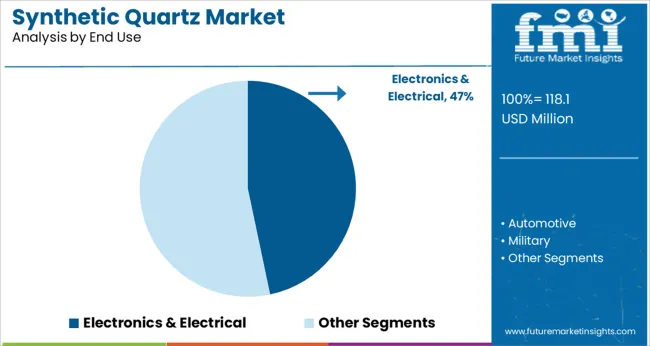

Future growth is expected to be shaped by increasing applications in next-generation communication devices, sensors, and wearable technology. Segment growth is anticipated to be led by the Crystal product type and the Electronics & Electrical sector as the primary end use.

The market is segmented by Product Type and End Use and region. By Product Type, the market is divided into Crystal and Glass. In terms of End Use, the market is classified into Electronics & Electrical, Automotive, Military, Medical, Construction, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Crystal segment is projected to hold 58.3% of the synthetic quartz market revenue in 2025, retaining its leadership as the dominant product type. This segment benefits from the material’s high purity and consistent crystallographic structure, which are essential for achieving precise resonant frequencies and minimizing signal loss.

Synthetic quartz crystals are widely used in oscillators, filters, and timing devices, particularly in consumer electronics and telecommunications. Advances in crystal growth techniques have improved yield and quality, reinforcing the segment’s position.

The ability to customize crystal shapes and sizes for specific applications has further expanded their use. With ongoing innovation and growing device complexity, the Crystal segment is expected to maintain its dominant share in the synthetic quartz market.

The Electronics & Electrical segment is forecasted to contribute 46.7% of the synthetic quartz market revenue in 2025, establishing itself as the largest end-use sector. The widespread adoption of synthetic quartz in semiconductors, circuit boards, and precision electronic components has driven demand.

This segment benefits from increasing consumer electronics production, expansion in telecommunications infrastructure, and the growing prevalence of IoT devices. The electrical industry also utilizes synthetic quartz in sensors and precision instrumentation where stability and reliability are critical.

Investments in smart technologies and connected devices continue to fuel market growth in this sector. As electronic devices become more sophisticated and performance-driven, the Electronics & Electrical segment is expected to sustain its leading role in the synthetic quartz market.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 6.0% |

| H1,2025 Projected (P) | 6.3% |

| H1,2025 Outlook (O) | 6.1% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (-) 20 ↓ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 10 ↑ |

Future Market Insights predict a comparison and review analysis of the dynamics of the synthetic quartz market. Certain key factors influencing the demand for synthetic quartz include consumption increment in various end-use industries such as electronics, automotive, medical, etc.

In addition, the rise in technological development, consumer spending, smartphone usage, and the need for high-performance electronic devices are propelling the market. Some key trends witnessed in the market include top manufacturers' collaborations with electronics market leaders for the rapid deployment of new IoT products which are also contributing to the growth of the market.

According to FMI analysis, variation between the bps values observed in the synthetic quartz market in H1, 2025 - Outlook over H1, 2025 Projected reflects a decline of 20 units., compared to H1, 2024, the market is expected to spike by 10 BPS in H1 -2025.

Key reasons for these certain decreased expectations include the low withstanding ability of heat after a certain threshold, burnt and damaged after a certain temperature. Further rise in the pricing of raw materials and quartz particles is also expected to impact the market growth.

With these negative prospects, the market is influenced by certain positive factors, which include a rise in the adoption of new technology in the electronics industry that solely relies on electronics components such as semiconductors, optical fiber, and solar cells which majorly utilize synthetic quartz.

An increasing trend in the innovative research and development of the customized product of synthetic quartz is likely to contribute to growth in the synthetic quartz Market.

Sales of synthetic quartz increased at 5.8% CAGR, between 2020 and 2024, owing to high growth in certain key end-use industries like electronics and electrical, the military sector, the construction sector, and others. The pandemic crisis reduced demand for synthetic quartz, and impacted sales projections in the year 2024, although growth is expected to resume in the coming quarters.

The key driver for the growth of the market is the utilization of synthetic quartz in electronics, automotive & military end-use sectors. Increasing applications of synthetic quartz in a variety of other end-use industries like construction, automotive, and others are expected to propel sales in the forecast period. Electronics and automotive are the key industries that are pushing the demand for synthetic quartz.

Global synthetic quartz and its component market are driven by the electronics and automotive industries. Rise in technological developments, consumer spending, mobile phone usage, and the need for high-performance electronic equipment have propelled the market of synthetic quartz. The electronics segment accounted for a prominent share of more than three-fourths of the global market, followed by the automotive sector.

The rising adoption of technology has led to the significant growth of the electronics industry that solely relies on electronic components such as semiconductors, optical fibers, and solar cells. These electronic components utilize synthetic quartz crystals due to their important intrinsic properties. Mobile phones hold a prominent share of synthetic quartz usage in the electronic industry.

Synthetic quartz components are also useful for the installation of communication systems. Major manufacturers of synthetic quartz have developed synthetic quartz components suitable for 5G technology. The high growth of 5G technology is expected in near future. The electronics segment is anticipated to account for about 79% of the overall consumption share.

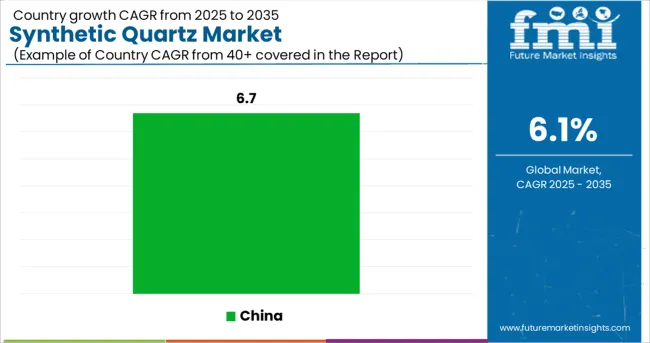

China is projected to grow with a 6.7% CAGR over the forecast period of 2025 and 2035. Synthetic quartz plays an important role in the manufacturing of consumer electronics. Besides, a large number of mobile, television, lenses, and automotive manufacturers are also based in China, which makes it the most attractive target location for synthetic quartz sales.

Most synthetic quartz is consumed as an electronic component, and used in different sectors such as automotive, military, medical, construction, and other applications. China is one of the major producers and exporters of electronics. Moreover, it has good production-to-sales ratio for electronics. All these factors are boosting the demand for synthetic quartz in the country.

According to FMI, the USA is expected to account for a substantial share of the global market. Over the forecast period, the United States is expected to dominate the North American market with a significant value share in terms of consumption.

High demand for electronics, especially consumer electronics, including mobile phones, watches, clocks, GPS, lasers, sensors, television sets, laptops, and games has played an important role in the growth of electronics, and this is expected to push the demand for synthetic quartz as well. Increasing capital investments by key players in the USA are also expected to push for significant growth in the near future. The USA market of synthetic quartz is expected to reach a value of about USD 213.5 Million by the year 2035.

The synthetic quartz crystal segment is expected to grow at a prominent value of 6.2% CAGR over the forecast period of 2025 to 2035. Quartz is one of the most commonly found minerals in the earth’s crust. Although quartz is available in abundance, it is also processed in an autoclave through a hydrothermal process.

Synthetic quartz is widely used in the manufacturing of electronic components that are necessary for end-use industries like electrical & electronics, automotive, military, construction, medical, and petroleum. Synthetic quartz crystal holds a prominent share in the global market of synthetic quartz.

Quartz crystal also poses piezoelectric property, thus, force applied in any direction causes electrical charge. All these application segments' growth can enhance the demand for quartz crystals.

The automotive segment is projected to create an absolute dollar opportunity of more than USD 118.1 Million during the period of 2025 to 2035. The automotive industry has been one of the key end-use industries for the market of synthetic quartz.

Synthetic quartz has been proven to be the choice of manufacturers for making frequency control oscillators as they help in the smooth operations of various equipment. Thus, the increasing automotive production is expected to positively impact the global market in the assessment period.

Automotive is a key application segment for synthetic quartz. Synthetic quartz is used in various automotive electronic applications like sensors, displays, and others. The automobile industry is entering a new era of electronics with new safety and connectivity system solutions that are expected to give a boost to ‘pervasion’.

Synthetic quartz is used in automotive, significantly for electronic applications like engine control, advanced safety vehicle (ASV), audio/navigation, GPS, watch, car camera, communication, controller (battery, inverter, converter), and satellite radio. The rising need for electro-mobility and the development of driverless cars are expected to drive synthetic quartz demand in the coming years.

In recent years, manufacturers have shifted their focus to emerging countries in order to meet the growing demand for synthetic quartz. Several major players are also focusing on improving their manufacturing capabilities, Research and Development investments, collaborations, and mergers and acquisitions.

For Instance:

The latest study conducted by Future Market Insights covers all the strategies and success factors of key manufacturers of the market.

The list is not exhaustive, and is only for representational purposes. Full competitive intelligence with SWOT analysis is available in the report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Tons for Volume |

| Key Regions Covered | North America, Latin America Middle East & Africa, Europe, South Asia, East Asia, Oceania |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, Thailand, Vietnam, Singapore, Malaysia, Indonesia, Australia, New Zealand, Brazil, Mexico, GCC Countries, South Africa |

| Key Segments Covered | Product Type, End Use, and Region |

| Key Companies Profiled | TXC Corporation; Nihon Dempa Kogyo; Kyocera; Murata Manufacturing; Seiko Epson; Daishinku Corp. - KDS; Hubei Feilihua Quartz Glass Co., Ltd.; Taihan Fiberoptics; Heraeus Group; Yuzhnouralsk Plant Kristall; Coorstek; Impex HighTech |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global synthetic quartz market is estimated to be valued at USD 118.1 million in 2025.

It is projected to reach USD 213.5 million by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are crystal and glass.

electronics & electrical segment is expected to dominate with a 46.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

UK Synthetic Quartz Market Trends – Demand & Industry Outlook 2025-2035

USA Synthetic Quartz Market Report – Size, Share & Trends 2025-2035

ASEAN Synthetic Quartz Market Analysis – Size, Share & Forecast 2025-2035

Germany Synthetic Quartz Market Insights – Size, Trends & Growth 2025-2035

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA