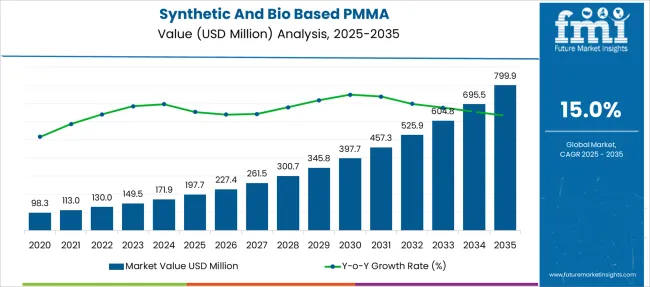

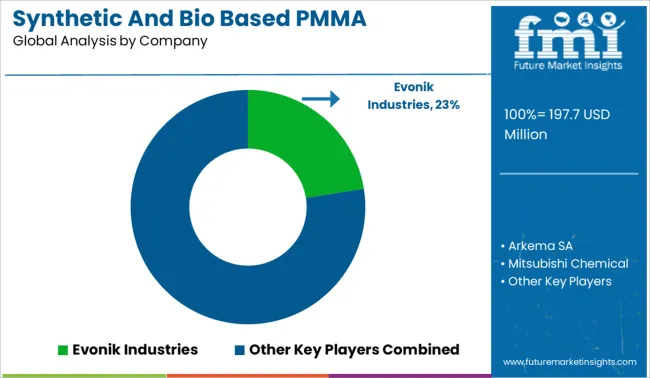

The Synthetic and Bio Based PMMA Polymethyl Methacrylate Size Market is estimated to be valued at USD 197.7 million in 2025 and is projected to reach USD 799.9 million by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Estimated Value in (2025 E) | USD 197.7 million |

| Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Forecast Value in (2035 F) | USD 799.9 million |

| Forecast CAGR (2025 to 2035) | 15.0% |

The synthetic and bio based PMMA size market is progressing steadily, supported by the growing demand for lightweight and durable materials in various industries. Advances in polymer science have led to enhanced PMMA formulations that provide improved clarity, UV resistance, and mechanical strength.

These developments have driven adoption across sectors such as automotive, construction, and electronics. The automotive industry has emerged as a significant consumer due to the need for materials that reduce vehicle weight and improve fuel efficiency.

Additionally, sustainability trends have fueled interest in bio based PMMA, aligning with global efforts to reduce carbon footprints. Increased investment in research and development has facilitated the creation of innovative extrusion processes and product formats that improve manufacturability and performance. The market outlook remains positive as manufacturers continue to focus on balancing performance with environmental considerations.

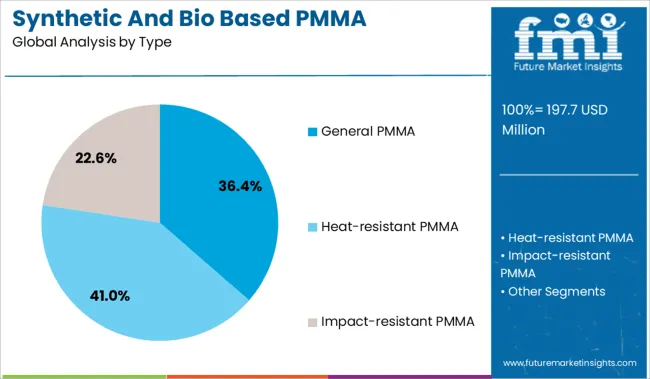

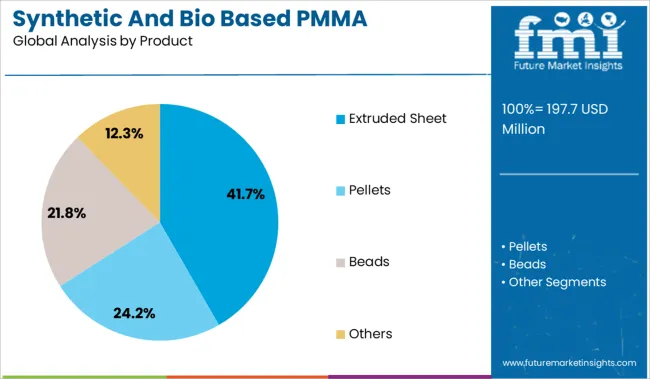

The synthetic and bio-based PMMA polymethyl methacrylate size market is segmented by type, product, and application and geographic regions. By type of the synthetic and bio-based PMMA polymethyl methacrylate size market is divided into General PMMA, Heat-resistant PMMA, and Impact-resistant PMMA. In terms of the product of the synthetic and bio-based PMMA polymethyl methacrylate size market, it is classified into Extruded Sheet, Pellets, Beads, and Others.

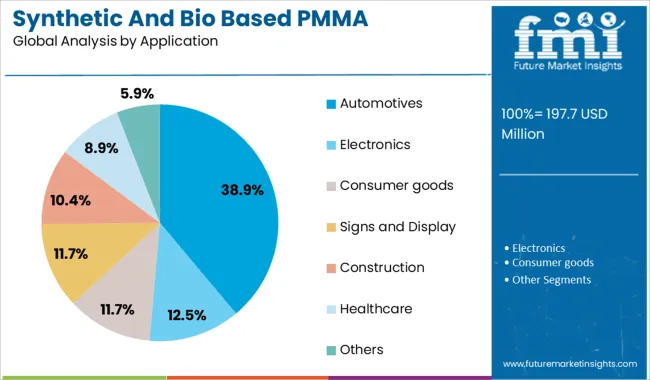

Based on the application of the synthetic and bio-based PMMA polymethyl methacrylate size market is segmented into Automotive, Electronics, Consumer Goods, Signs and Display, Construction, Healthcare, and Others. Regionally, the synthetic and bio-based PMMA Polymethyl Methacrylate size industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The General PMMA segment is projected to represent 36.4% of the market revenue in 2025, maintaining its position as the leading type category. This segment has been favored due to its proven versatility and well-established performance characteristics in a wide range of applications. It offers reliable optical clarity, weather resistance, and ease of processing, making it suitable for both traditional and emerging uses.

The availability of cost-effective general PMMA grades has supported its widespread adoption. Moreover, this segment benefits from mature supply chains and established manufacturing processes that ensure consistent quality.

As industries continue to prioritize material properties alongside cost efficiency, General PMMA is expected to remain dominant in the market.

The Extruded Sheet product segment is projected to account for 41.7% of the market revenue in 2025, establishing itself as the leading product format. Its growth has been driven by the ease of fabrication, uniform thickness, and smooth surface finish that suit various end uses.

Extruded sheets are widely used in automotive components, signage, and construction panels due to their lightweight and durable properties. Manufacturers prefer this format because it can be produced efficiently at scale with consistent quality.

Additionally, the versatility of extruded sheets allows for customization in thickness and size, meeting specific application requirements. As demand for versatile plastic sheets grows, this segment is expected to sustain its market leadership.

The Automotive application segment is projected to hold 38.9% of the market revenue in 2025, maintaining its position as the largest end-use sector. This growth is attributed to the ongoing shift towards lightweight materials that improve vehicle efficiency and performance.

PMMA’s durability, optical clarity, and UV resistance make it ideal for automotive lighting, interior components, and glazing. The automotive sector’s focus on sustainability and fuel economy has accelerated the integration of PMMA products, especially bio based variants, into vehicle designs.

Additionally, expanding production of electric and hybrid vehicles has opened new opportunities for innovative material applications. As automotive manufacturers continue to enhance vehicle aesthetics and functionality, the demand for PMMA in this sector is expected to rise consistently.

Demand for synthetic and bio-based PMMA is rising across automotive lighting, medical devices, and architectural glazing. Sales of bio-derived PMMA and premium optical-grade formulations are expanding rapidly in Asia Pacific and North America, where sustainability goals and product differentiation are accelerating market development.

Synthetic PMMA demand rose sharply in 2025, particularly for automotive headlamps, display backlit modules, and decorative façade panels. Lighting and optics now account for 40 to 45% of total volume, driven by high clarity, UV resistance, and temperature stability up to 100 °C. Automotive OEMs increasingly use optical-grade PMMA in premium models, replacing lower-performance polycarbonate. Manufacturers in Asia Pacific scaled production, helping synthetic PMMA reach over USD 5.2 billion in annual revenue. High-transmission variants, offering up to 92% light transmittance, are also supporting energy-efficient EV and display lighting systems.

Sales of bio-based PMMA grew sharply in 2025. Formulations containing at least 50% renewable carbon now contribute 8 to 12% of global PMMA demand. Sustainability regulations in Europe and North America are driving adoption for medical and consumer applications. Bio-PMMA is increasingly used in dental appliances, medical tubing, and automotive interiors, where lower carbon intensity and lifecycle certification influence procurement. Sales reached nearly USD 250 million in 2025, more than double 2023 levels. Bio-based PMMA is projected to represent over 20% of new product launches by 2027.

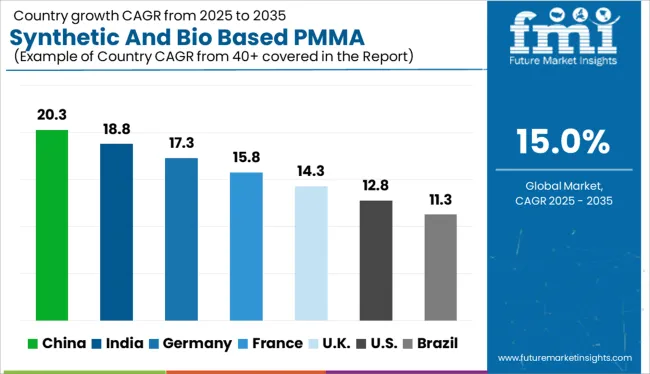

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The global market is set to grow at a robust CAGR of 15.0% between 2025 and 2035, supported by expanding demand in automotive, electronics, and green building materials. China is leading with a 20.3% CAGR due to large-scale infrastructure expansion, robust LED display manufacturing, and rapid adoption of bio-based PMMA for sustainable construction.

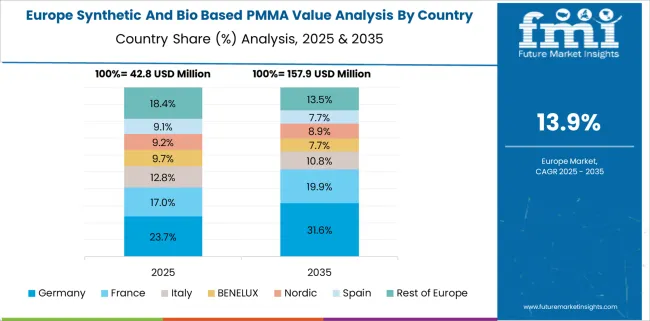

India follows with an 18.8% CAGR, driven by industrialization, surging automotive component demand, and policy support for biopolymer manufacturing. Germany’s 17.3% CAGR is underpinned by its strong automotive coatings sector and investments in transparent thermoplastics for EV components.

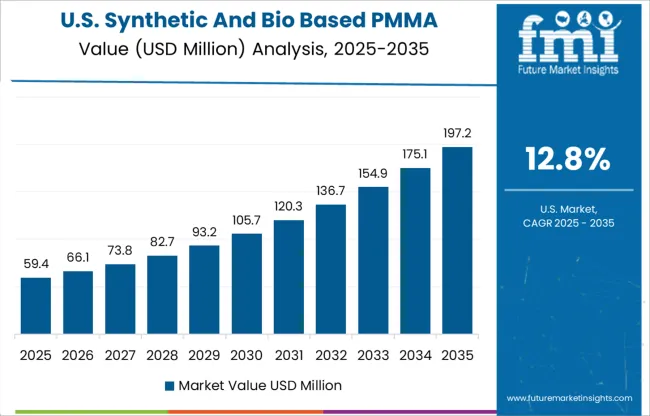

The UK, growing at 14.3%, benefits from demand in high-end medical devices and lightweight optical materials. The USA market, with a 12.8% CAGR, is prioritizing bio-based PMMA in green building certifications and aerospace applications. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 20.3% CAGR, driven by large-scale infrastructure projects and the rapid expansion of LED display manufacturing. Demand for PMMA is strong in architectural panels, automotive glazing, and signage applications due to its clarity and durability. Bio-based PMMA adoption is rising in the construction sector, where polymer alternatives are replacing traditional glass for energy efficiency and lightweight benefits. Domestic producers are investing in capacity expansion to support electronics and lighting applications, particularly for high-resolution screens and advertising panels. Strategic partnerships with global resin suppliers aim to advance high-purity PMMA grades suitable for medical and precision optics.

India is forecast to grow at an 18.8% CAGR, fueled by expanding automotive component production and infrastructure development. PMMA is gaining traction in headlamp lenses, interior trims, and transparent panels for vehicles due to its durability and optical clarity.

Demand for bio-based PMMA is increasing as manufacturers explore alternatives to petroleum-based polymers, supported by policy incentives for biopolymer production. Growth in signage and display applications across retail, airports, and metro stations further strengthens demand. Domestic players are forming alliances with global technology providers to scale high-performance PMMA manufacturing for medical and industrial applications.

Germany is expected to post a 17.3% CAGR, driven by its strong automotive coatings industry and innovation in transparent thermoplastics for electric vehicle components. PMMA’s properties, such as impact resistance and surface gloss, make it essential for car interiors and lighting systems. Demand in architectural panels and industrial glazing applications is supported by growing requirements for lightweight and durable materials. Investments in high-performance PMMA formulations are aligning with trends in advanced electronics and medical devices. German manufacturers emphasize extrusion-grade PMMA sheets for precision engineering sectors, while collaborations with chemical firms enhance the supply of bio-derived raw materials.

The United Kingdom is projected to grow at a 14.3% CAGR, supported by rising demand in medical devices, optical components, and architectural applications. Lightweight and shatter-resistant PMMA materials are increasingly favored for high-end diagnostic equipment and surgical instruments. Growth in optical-grade PMMA is notable in sectors producing lenses and light guides for automotive and lighting solutions.

Industrial players are investing in advanced processing methods, including injection molding and precision machining, to cater to performance-critical applications. Partnerships between local manufacturers and research institutes are encouraging development of innovative PMMA grades designed for enhanced clarity and dimensional stability.

The United States is forecast to grow at a 12.8% CAGR, driven by adoption in aerospace, automotive, and green-certified construction applications. PMMA’s durability and resistance to UV degradation make it suitable for aircraft windows, glazing, and protective shields. In construction, its usage in panels and skylights is increasing due to the material’s light transmission and weather resistance.

Demand for bio-based PMMA is gaining momentum among manufacturers focused on reducing environmental impact while meeting performance standards. Leading players are investing in R&D for high-purity PMMA grades for medical and electronics sectors, ensuring compliance with stringent safety regulations.

Evonik Industries leads with a significant market share due to its broad PMMA portfolio across automotive, medical, and building applications. The company is also advancing bio-based PMMA under its circular chemistry roadmap. Arkema SA maintains strong global sales with its Altuglas brand for high-durability PMMA.

Mitsubishi Chemical and Altuglas International operate large PMMA facilities in Asia and Europe, serving optical and display segments. Kuraray, Asahi Kasei, and Sumitomo Chemical are focusing on low-carbon PMMA through microbial synthesis and solvent-free processing. SABIC, RTP Company, and Makevale Group offer specialty PMMA grades for 3D printing, healthcare molding, and industrial coatings.

| Item | Value |

|---|---|

| Quantitative Units | USD 197.7 Million |

| Type | General PMMA, Heat-resistant PMMA, and Impact-resistant PMMA |

| Product | Extruded Sheet, Pellets, Beads, and Others |

| Application | Automotives, Electronics, Consumer goods, Signs and Display, Construction, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik Industries, Arkema SA, Mitsubishi Chemical, Altuglas International Sas, Kuraray Group, Asahi Kasei Corp., Sumitomo Chemical Co., Ltd, Sabic, Makevale Group, and RTP Company |

| Additional Attributes | Dollar sales by PMMA type (synthetic vs bio‑based) and application segment (automotive lighting, signage & display, healthcare devices), demand dynamics across electronics, construction, and automotive industries, regional leadership in Asia‑Pacific and North America, innovation in renewable-feedstock chemistry and bio‑derived extrusion, and environmental impact via carbon footprint reduction and circular material sourcing. |

The global synthetic and bio based pmma polymethyl methacrylate size market is estimated to be valued at USD 197.7 million in 2025.

The market size for the synthetic and bio based pmma polymethyl methacrylate size market is projected to reach USD 799.9 million by 2035.

The synthetic and bio based pmma polymethyl methacrylate size market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in synthetic and bio based pmma polymethyl methacrylate size market are general pmma, heat-resistant pmma and impact-resistant pmma.

In terms of product, extruded sheet segment to command 41.7% share in the synthetic and bio based pmma polymethyl methacrylate size market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Synthetic Cinnamaldehyde Market Growth - Trends & Forecast 2025 to 2035

Synthetic Rubber Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA