The Synthetic Polymer Wax Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Synthetic Polymer Wax Market Estimated Value in (2025 E) | USD 1.7 billion |

| Synthetic Polymer Wax Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Synthetic Polymer Wax market is experiencing steady growth driven by its versatile applications across plastics, coatings, adhesives, and lubricants. The current market scenario reflects increasing demand for high-performance synthetic waxes that offer consistent molecular weight, thermal stability, and compatibility with a wide range of polymers. In 2025, the market is largely shaped by rising industrial production, expansion of plastics and packaging industries, and the growing requirement for improved processing aids and surface finishing agents.

The ability of synthetic polymer waxes to enhance product performance, including scratch resistance, gloss, and flow properties, has been a key factor supporting market expansion. Increasing investments in manufacturing infrastructure, research into high-purity waxes, and environmental regulations encouraging the replacement of natural waxes are expected to drive future growth.

Additionally, innovations in low-emission and bio-compatible wax formulations are creating new opportunities for adoption in automotive, packaging, and industrial applications As end-use industries continue to expand, synthetic polymer wax is expected to remain a critical additive, with sustained demand across commercial and industrial sectors.

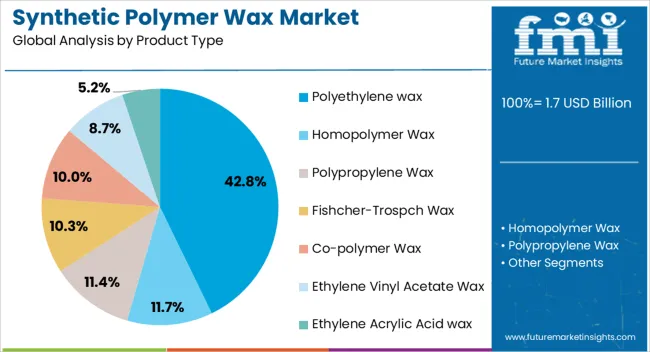

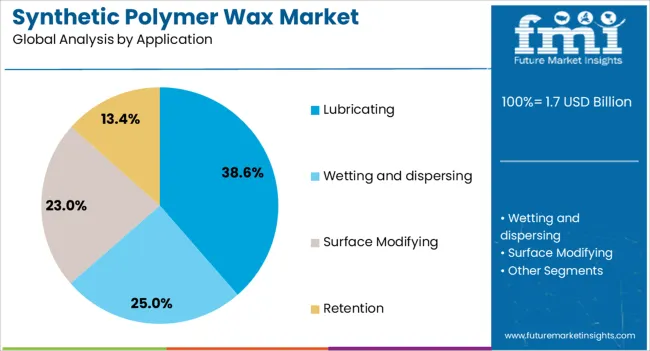

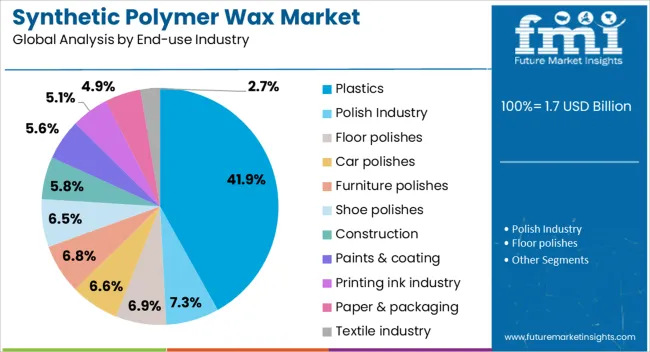

The synthetic polymer wax market is segmented by product type, application, end-use industry, and geographic regions. By product type, synthetic polymer wax market is divided into Polyethylene wax, Homopolymer Wax, Polypropylene Wax, Fishcher-Trospch Wax, Co-polymer Wax, Ethylene Vinyl Acetate Wax, and Ethylene Acrylic Acid wax. In terms of application, synthetic polymer wax market is classified into Lubricating, Wetting and dispersing, Surface Modifying, and Retention. Based on end-use industry, synthetic polymer wax market is segmented into Plastics, Polish Industry, Floor polishes, Car polishes, Furniture polishes, Shoe polishes, Construction, Paints & coating, Printing ink industry, Paper & packaging, and Textile industry. Regionally, the synthetic polymer wax industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polyethylene wax product type is projected to hold 42.80% of the Synthetic Polymer Wax market revenue share in 2025, making it the leading product type. This dominance is being attributed to its excellent thermal stability, chemical resistance, and compatibility with a wide range of polymers and additives.

Polyethylene wax is extensively used as a processing aid in plastics manufacturing, providing improved flow properties, reduced friction, and enhanced surface finish in molded and extruded products. The growth of this segment has been reinforced by the increasing production of polyethylene-based products, rising adoption in coatings and adhesives, and the demand for consistent quality in high-performance industrial applications.

Its ability to improve scratch resistance and gloss in finished products, along with ease of handling and low volatility, has strengthened its position in the market Furthermore, the trend toward lightweight and high-durability plastics has accelerated adoption, while ongoing developments in specialized grades continue to expand its use across multiple industries.

The lubricating application segment is expected to account for 38.60% of the market revenue in 2025, emerging as the most significant application area. This growth is being driven by the increasing demand for high-performance lubricants in industrial, automotive, and metalworking applications. Synthetic polymer waxes are used in lubricating formulations to reduce friction, improve surface protection, and extend machinery life.

The adoption of these waxes has been favored due to their uniform particle size, thermal stability, and chemical inertness, which ensure consistent lubrication under extreme conditions. Rising industrial automation, the expansion of manufacturing plants, and stricter maintenance and efficiency standards have further fueled demand.

In addition, the compatibility of synthetic polymer waxes with oil- and water-based formulations has enabled their integration into a wide range of lubricants, enhancing overall performance As industrial operations continue to focus on efficiency and equipment longevity, the lubricating application segment is expected to maintain strong growth.

The Plastics end-use industry segment is projected to hold 41.90% of the Synthetic Polymer Wax market revenue in 2025, positioning it as the largest consumer among all sectors. This leadership is being driven by the extensive use of synthetic polymer waxes as processing aids, slip agents, and surface finish enhancers in plastic manufacturing.

The growth of this segment has been reinforced by increasing production of polyethylene, polypropylene, and other polymer-based materials, coupled with the need for improved mold release properties, scratch resistance, and enhanced gloss in finished products. Synthetic polymer waxes facilitate smoother processing and uniform material flow, which reduces defects and improves product quality.

Demand has also been supported by rising packaging, automotive, and consumer goods production, which rely on high-performance plastics with consistent appearance and performance As manufacturers increasingly adopt specialized wax grades to meet evolving technical and environmental requirements, the Plastics end-use industry segment is expected to continue its dominant position and remain a key driver of market growth.

A wax is a composition of long chain fatty acids, alcohols, and sterols that melt at a slightly higher temperature. Generally, on the basis of source waxes are of two types - natural and synthetic. Synthetic wax has exceptional characteristics such as strong bonding as well as is relatively cheap than the natural wax. Synthetic wax derived from the synthetic process such as polymerization is referred to as synthetic polymer wax.

Exceptional characteristics of synthetic polymer wax include better abrasion resistance, high melting point, bright translucent shine, and offers better durability. These properties of synthetic polymer wax depend on the production process of synthetic polymer wax. Synthetic polymer wax is generally utilized to modify the surface texture, appearance, hardness and viscosity of wax blends. Moreover, synthetic polymer wax acts as an anti-slip agent, dispersant, lubricant, blinding agent, shining agent across the end-use applications. Furthermore, synthetic polymer wax is mainly applicable in the automotive, rubber and chemical industries.

Strategic developments at regional level have increased the demand for raw materials. The infrastructural development worldwide generates demand for paints, coatings, and inks, which is positively expected to impact the growth of the global synthetic polymer market during the forecast period. Moreover, the FDA (Food and Drug Administration) has approved the use of synthetic polymer wax in the food packaging industry, which is the major factor projected to surge the growth of the global synthetic polymer wax market over the forecast period.

Growing usage of natural waxes such as carnauba wax owing to the strict regulations by government authorities is expected restrain the growth of the global synthetic polymer wax market in the coming years. However, the moderate price of synthetic polymer wax compared to natural waxes and its notable properties are encouraging investors to invest in the global synthetic polymer wax market.

Population growth, coupled with the increasing per capita consumption of products and demographic changes will drive the growth of the automotive, pharmaceutical and food & beverage industries across the world. Synthetic polymer wax act as a raw material in these industries, which is expected to contribute to the growth of the synthetic polymer wax market.

Geographically, the global synthetic polymer wax market is segmented into seven key regions includes Middle East & Africa, Western Europe, North America, South East & Asia Pacific, Japan, Latin America, and Eastern Europe. The growing demand for cars in Europe and North America is expected to boost the growth of the synthetic polymer wax market in the regions during the forecast period. Moreover, growing industrialization in emerging economies such as China, India, Hungary, and Morocco is expected to surge the growth of the synthetic polymer wax market over the forecast period.

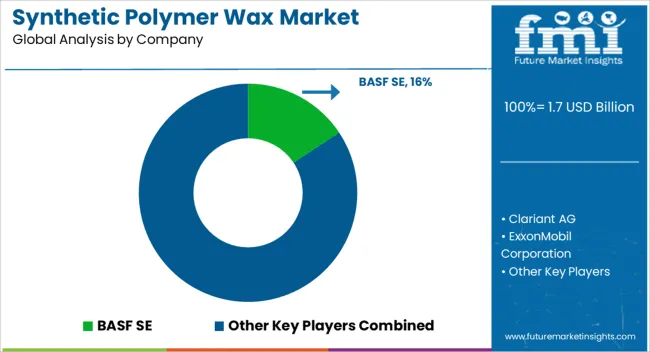

Examples of some of the key participants identified across the value chain of the global synthetic polymer wax market include BASF, Innospec, The DuPont, Honeywell, ZSCHIMMER & SCHWARZ, SCG Chemicals Co., Ltd, Trecora Chemical, Baker Hughes, Zell Chemie International, and Clariant, among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

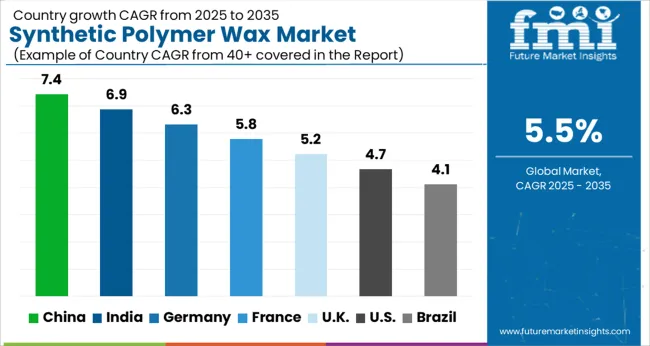

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Synthetic Polymer Wax Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Synthetic Polymer Wax Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Synthetic Polymer Wax Market is estimated to be valued at USD 628.6 million in 2025 and is anticipated to reach a valuation of USD 992.6 million by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 91.1 million and USD 55.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Product Type | Polyethylene wax, Homopolymer Wax, Polypropylene Wax, Fishcher-Trospch Wax, Co-polymer Wax, Ethylene Vinyl Acetate Wax, and Ethylene Acrylic Acid wax |

| Application | Lubricating, Wetting and dispersing, Surface Modifying, and Retention |

| End-use Industry | Plastics, Polish Industry, Floor polishes, Car polishes, Furniture polishes, Shoe polishes, Construction, Paints & coating, Printing ink industry, Paper & packaging, and Textile industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant AG, ExxonMobil Corporation, Sasol Limited, Mitsui Chemicals, Inc., Honeywell International Inc., The Lubrizol Corporation, Evonik Industries AG, Michelman, Inc., Westlake Chemical Corporation, Trecora Resources, IGI Wax, Paramelt B.V., and Hexion Inc. |

The global synthetic polymer wax market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the synthetic polymer wax market is projected to reach USD 2.9 billion by 2035.

The synthetic polymer wax market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in synthetic polymer wax market are polyethylene wax, homopolymer wax, polypropylene wax, fishcher-trospch wax, co-polymer wax, ethylene vinyl acetate wax and ethylene acrylic acid wax.

In terms of application, lubricating segment to command 38.6% share in the synthetic polymer wax market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Waxed Paper Market Size and Share Market Forecast and Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Waxing Base Paper Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wax Injector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA