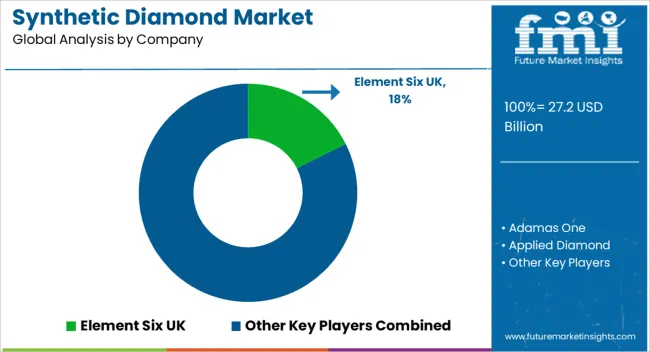

The Synthetic Diamond Market is estimated to be valued at USD 27.2 billion in 2025 and is projected to reach USD 44.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. From 2025 to 2030, the market will steadily rise from USD 27.2 billion to approximately USD 33.2 billion, supported by increasing use in industrial applications such as cutting, grinding, and drilling. The demand for durable and cost-effective diamond alternatives in manufacturing and electronics drives growth during this period. Moving beyond 2030, the market continues its upward trajectory, reaching USD 44.8 billion by 2035.

This phase sees expanded adoption in sectors like healthcare, optical components, and jewelry due to improved production techniques and broader acceptance of synthetic diamonds. The gradual increase in market size reflects a consistent preference for synthetic diamonds as reliable substitutes for natural diamonds, driven by cost efficiency and material performance requirements across multiple industries. Overall, the market shows a solid and sustained growth pattern from 2020 through 2035.

| Metric | Value |

|---|---|

| Synthetic Diamond Market Estimated Value in (2025 E) | USD 27.2 billion |

| Synthetic Diamond Market Forecast Value in (2035 F) | USD 44.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The synthetic diamond market is witnessing consistent growth, supported by advancements in production technologies and increasing demand across jewelry, electronics, and industrial applications. Enhanced scalability and cost efficiency of synthetic manufacturing processes are accelerating adoption among both luxury and technical-grade buyers.

Strategic investments by leading manufacturers in lab-grown gemstone branding and supply chain transparency are reshaping consumer perception. Furthermore, rising concerns around the environmental and ethical implications of natural diamond mining have fueled the shift toward lab-created alternatives.

Regulatory support for conflict-free sourcing, coupled with technological progress in high-quality crystal synthesis, is expected to drive future expansion. Growing demand for ultra-hard materials in semiconductor fabrication, quantum computing, and precision tooling continues to reinforce market development across industrial sectors.

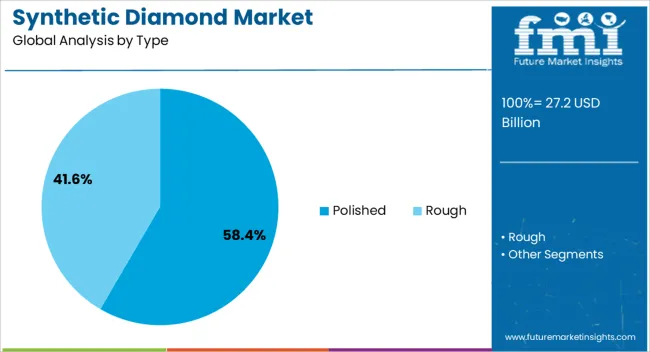

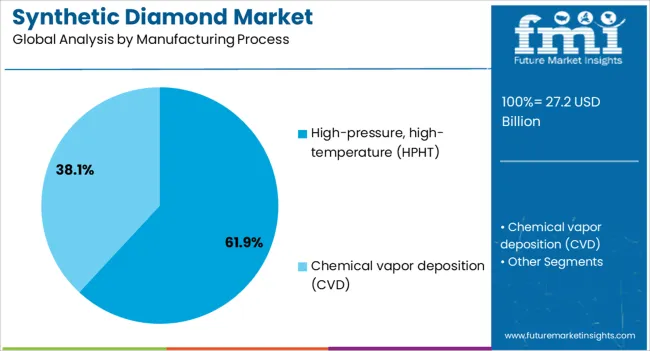

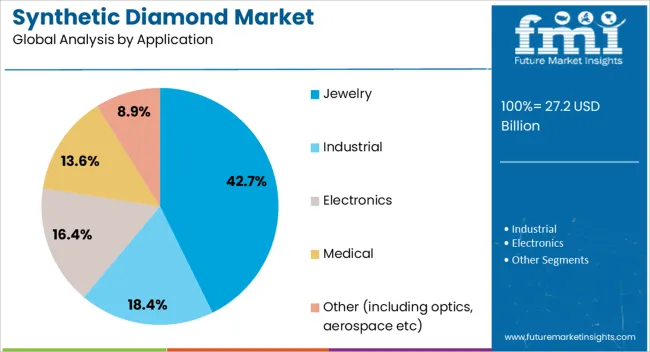

The synthetic diamond market is segmented by type, manufacturing process, application, and geographic regions. The synthetic diamond market is divided by type into Polished and Rough. In terms of the manufacturing process, the synthetic diamond market is classified into High-pressure, high-temperature (HPHT) and Chemical vapor deposition (CVD). The application of the synthetic diamond market is segmented into Jewelry, Industrial, Electronics, Medical, and Other (including optics, aerospace, etc). Regionally, the synthetic diamond industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polished synthetic diamonds are projected to account for 58.40% of the total revenue share in 2025, making this the dominant product type. This segment’s leadership is attributed to the surge in consumer acceptance of lab-grown gems in the luxury jewelry market.

Enhanced clarity, controlled color grading, and near-identical chemical composition to mined diamonds have strengthened their appeal. Polished stones offer supply consistency, traceability, and significantly lower production costs, which align with retailer sustainability mandates.

Branding campaigns focused on ethical sourcing and environmental stewardship have further bolstered demand for polished synthetic stones. Their availability in a wide variety of carats and cuts continues to position them favorably for mainstream and bespoke jewelry applications.

The high-pressure, high-temperature (HPHT) process is expected to contribute 61.90% of the total synthetic diamond market revenue in 2025, making it the leading production method. This dominance is driven by the process’s ability to produce high-purity diamonds at scale and relatively lower costs compared to chemical vapor deposition (CVD).

HPHT technology supports the production of larger crystals with consistent internal structure, making them suitable for both gem-quality and industrial applications. Improved thermal conductivity and structural integrity achieved through HPHT are highly valued in electronics, machining, and optical industries.

Continuous equipment upgrades and process optimization are further enhancing output efficiency, solidifying the position of HPHT as the manufacturing method of choice for high-volume suppliers.

The jewelry segment is projected to represent 42.70% of the synthetic diamond market’s total revenue in 2025, making it the top application area. This segment’s growth is being driven by the increasing popularity of lab-grown diamonds as ethical and cost-effective alternatives to mined stones.

Retailers and designers are actively promoting lab-grown diamonds for engagement rings, fashion jewelry, and custom collections, targeting a sustainability-conscious millennial and Gen Z demographic. Certification by leading gemological institutes and the use of blockchain for transparency have enhanced consumer confidence in synthetic offerings.

Additionally, strong demand during peak gifting seasons and expanding availability through online and direct-to-consumer platforms are expected to maintain the segment’s momentum.

The synthetic diamond market is growing steadily as these lab-created gems gain acceptance across industrial and jewelry sectors. Synthetic diamonds offer cost-effective and ethical alternatives to natural diamonds, appealing to environmentally conscious consumers and industries requiring durable materials. Advances in manufacturing techniques have improved quality and scalability, expanding their applications from cutting tools and electronics to luxury accessories. Market growth is driven by rising demand in electronics, automotive, and healthcare industries. However, challenges remain in consumer perception and regulatory frameworks. Innovation in production processes and growing awareness continue to enhance market penetration globally.

Synthetic diamonds are prized in industrial sectors for their exceptional hardness, thermal conductivity, and wear resistance. They are widely used in cutting, grinding, drilling, and polishing tools, especially in manufacturing, mining, and construction industries. Their precision and durability improve tool life and operational efficiency. Additionally, emerging applications in electronics, such as heat sinks and semiconductor substrates, are expanding demand. The ability to produce synthetic diamonds with tailored properties makes them valuable for specialized industrial uses. These factors ensure steady growth in industrial markets, supported by ongoing investments in manufacturing technologies.

While synthetic diamonds are recognized for their ethical and cost benefits, consumer preference for natural diamonds still influences market dynamics, especially in luxury jewelry. Misconceptions about synthetic diamonds’ quality and value persist, requiring education and transparent marketing by manufacturers and retailers. Certification standards and disclosure regulations are essential to building trust. Some consumers associate synthetic diamonds with lower prestige, which impacts pricing and brand positioning. Overcoming these perceptions is crucial for expanding jewelry applications. Collaboration between industry bodies and marketing initiatives aimed at highlighting the environmental and economic advantages of synthetic diamonds helps shift consumer attitudes.

Continuous improvements in production technologies like High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD) are enhancing the quality, size, and cost-efficiency of synthetic diamonds. These methods allow precise control over crystal properties, enabling customization for specific industrial and gem-quality needs. Automation and process optimization reduce production times and costs, making synthetic diamonds more competitive with natural stones. Innovations also focus on reducing environmental impact by improving energy efficiency and minimizing waste. Research collaborations between manufacturers and academic institutions are accelerating technological breakthroughs, fostering innovation that supports broader adoption across various industries.

The synthetic diamond market is experiencing notable growth in emerging regions driven by industrial expansion and increasing consumer awareness. Asia-Pacific, particularly China and India, is a key growth area due to rapid industrialization and rising disposable incomes fueling jewelry demand. Expanding electronics and automotive sectors also contribute to industrial demand. Regional governments’ focus on sustainable manufacturing and eco-friendly products further supports market development. To capitalize on these opportunities, companies are establishing local production facilities and partnerships to serve regional markets better. Customized products and pricing strategies tailored to local preferences help capture market share in diverse economic landscapes.

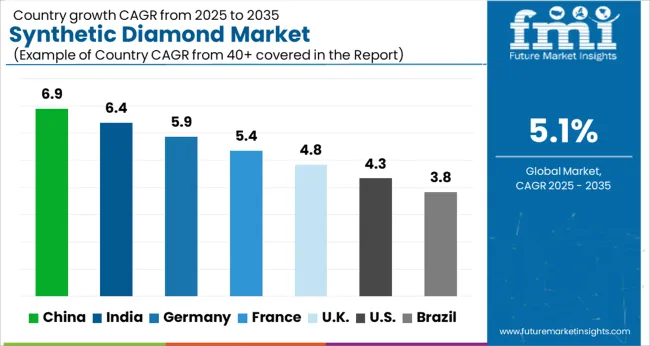

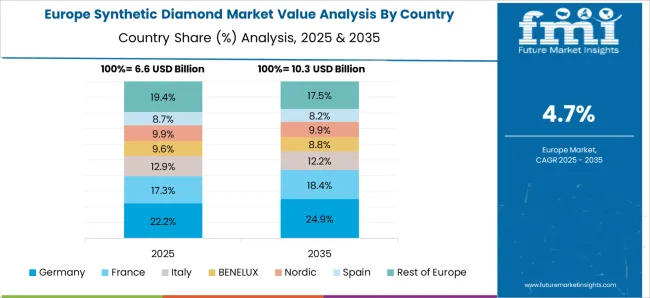

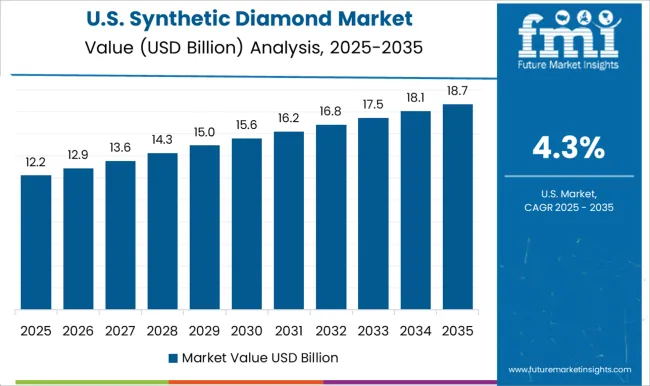

The global synthetic diamond market is growing at a 5.1% CAGR, driven by increasing demand in industrial applications and jewelry. China leads with 6.9% growth, supported by strong manufacturing capabilities and technological advancements. India follows at 6.4%, fueled by expanding gemstone processing and rising consumer interest. Germany records 5.9% growth, reflecting stringent quality standards and innovation. The United Kingdom grows at 4.8%, driven by specialty markets and research investments. The United States, a mature market, shows 4.3% growth, shaped by regulatory compliance and established industry presence. These countries collectively influence market trends through improvements in production techniques, sustainability, and market penetration. This report includes insights on 40+ countries; the top countries are shown here for reference.

China synthetic diamond market is advancing at a strong 6.9% CAGR driven by rising industrial applications and technological innovation. China is a global leader in manufacturing synthetic diamonds used in cutting tools, electronics, and jewelry. Compared to Western countries, China benefits from large-scale production facilities and lower manufacturing costs, enabling competitive pricing. The expanding automotive and aerospace sectors fuel demand for industrial-grade diamonds with superior hardness and thermal conductivity. Additionally, growing consumer interest in lab-grown diamond jewelry supports market expansion. Investments in research and development focus on improving quality and reducing production cycles. Government incentives aimed at boosting high-tech manufacturing also positively influence market growth. With increasing exports and a growing domestic customer base, China is poised to sustain leadership in the synthetic diamond market globally.

India synthetic diamond market is growing at a 6.4% CAGR, fueled by increasing industrial demand and emerging jewelry applications. India is developing capabilities in producing synthetic diamonds for cutting, grinding, and polishing tools across manufacturing sectors. Compared to China, India is focusing on niche applications and quality improvements to gain market share. The growing automotive and electronics industries drive demand for durable synthetic diamonds that enhance product performance. Lab-grown diamond jewelry is also gaining traction among environmentally conscious consumers, contributing to market growth. Investments in advanced manufacturing technologies and collaborations with research institutions support innovation. Expansion of export channels and rising domestic awareness about synthetic diamond benefits further stimulate the market. The market outlook remains positive as India strengthens its position in both industrial and consumer segments.

Germany synthetic diamond market grows at a steady 5.9% CAGR, supported by strong industrial demand and innovation in manufacturing technologies. German companies emphasize high-quality synthetic diamonds for precision cutting, machining, and semiconductor applications. Compared to Asian markets, Germany focuses more on premium products with stringent quality standards and certifications. The automotive and aerospace sectors are key drivers, requiring synthetic diamonds that ensure durability and precision. Germany’s advanced R&D infrastructure fosters development of synthetic diamond variants with enhanced thermal and electrical properties. The demand for synthetic diamonds in scientific research and medical devices also contributes to growth. Environmental regulations favor synthetic diamonds over mined stones for jewelry, aligning with sustainable consumption trends. Germany maintains a balanced market with a strong industrial base and growing consumer interest.

United Kingdom synthetic diamond market is expanding at a 4.8% CAGR, driven by increasing applications in manufacturing, electronics, and jewelry sectors. UK manufacturers focus on producing high-purity synthetic diamonds for cutting tools and semiconductor wafers. Compared to Germany, the UK market places greater emphasis on innovation in lab-grown diamond jewelry, catering to ethical and environmentally aware consumers. Collaborative research projects with universities advance production methods and quality enhancement. The rising adoption of synthetic diamonds in optical and quantum computing technologies opens new growth avenues. Retailers and jewelry brands promote synthetic diamond products as sustainable alternatives, supporting consumer demand. The combined effect of industrial and consumer segments ensures steady market growth. Regulatory support for green technologies and sustainable products further boosts confidence among manufacturers and buyers.

United States synthetic diamond market is growing at a 4.3% CAGR, supported by robust industrial demand and technological advancements. The USA leads in developing synthetic diamonds for semiconductor, aerospace, and medical applications requiring high precision and reliability. Compared to European markets, the USA shows a faster pace of innovation with extensive investment in research and startup ventures. Consumer awareness about sustainable and ethical diamond alternatives propels lab-grown diamond jewelry sales. The growing use of synthetic diamonds in next-generation electronics and cutting-edge technologies further drives market expansion. Partnerships between industry and academic institutions accelerate breakthroughs in production techniques and quality control. Regulatory frameworks encourage environmentally friendly manufacturing practices, supporting market sustainability. Overall, the USA maintains a competitive position through innovation and strong industrial demand.

The synthetic diamond market is rapidly evolving, driven by technological advancements in High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD) methods. Element Six UK, a De Beers subsidiary, dominates the industrial segment with its cutting-edge synthetic diamond solutions used across electronics, automotive, and cutting tools industries. Sumitomo Electric Industries also holds a strong position, specializing in ultra-hard synthetic diamonds for precision industrial applications.

Henan Huanghe Whirlwind and Iljin Diamond further reinforce the market with competitive manufacturing capabilities focused on abrasive and cutting tools. In the consumer-facing segment, companies such as Blue Nile, James Allen, and Ritani leverage online platforms to offer a broad selection of ethically sourced synthetic diamond jewelry. Pure Grown Diamonds (PGD) and Diamond Foundry emphasize sustainability and eco-conscious production processes, appealing to environmentally aware consumers.

Clean Origin and Adamas One differentiate themselves with transparent supply chains and commitment to conflict-free stones, gaining traction among millennials and Gen Z buyers. Swarovski’s entry into the synthetic diamond jewelry space further diversifies options for consumers seeking branded luxury alternatives. Innovation is central to maintaining competitive advantage, with firms like New Diamond Technology and Vibranium Lab pushing the boundaries of diamond quality and production efficiency.

Meanwhile, Rahi Impex and Applied Diamond focus on niche markets, supplying specialized synthetic diamonds for industrial and technological applications. This blend of established leaders and emerging challengers fosters dynamic market growth, emphasizing sustainability, transparency, and advanced manufacturing to meet evolving customer and industrial demands.

Manufacturers are working on reducing production costs and increasing market penetration by improving manufacturing scale and supply chain management. This is making synthetic diamonds more accessible to a broader market, including small and medium-sized businesses that require diamonds for industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.2 Billion |

| Type | Polished and Rough |

| Manufacturing Process | High-pressure, high-temperature (HPHT) and Chemical vapor deposition (CVD) |

| Application | Jewelry, Industrial, Electronics, Medical, and Other (including optics, aerospace etc) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Element Six UK, Adamas One, Applied Diamond, Blue Nile, Clean Origin, Diamond Foundry, Henan Huanghe Whirlwind, Iljin Diamond, James Allen, New Diamond Technology, Pure Grown Diamonds (PGD), Rahi Impex, Ritani, Sumitomo Electric Industries, Swarovski, and Vibranium Lab |

| Additional Attributes | Dollar sales in the Synthetic Diamond Market vary by type (HPHT, CVD), application (industrial, electronics, jewelry), end-use industries (automotive, healthcare), and region (North America, Europe, Asia-Pacific). Growth is driven by rising demand for affordable diamonds, technological advances, industrial uses, and environmental concerns over natural diamond mining. |

The global synthetic diamond market is estimated to be valued at USD 27.2 billion in 2025.

The market size for the synthetic diamond market is projected to reach USD 44.8 billion by 2035.

The synthetic diamond market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in synthetic diamond market are polished and rough.

In terms of manufacturing process, high-pressure, high-temperature (hpht) segment to command 61.9% share in the synthetic diamond market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Diamond and CBN Micron Powder Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Diamond Tool Grinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Diamond Wall Saw Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Diamond-like Carbon Coatings market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Diamond Like Carbon (DLC) Coating Market Size and Share Forecast Outlook 2025 to 2035

Diamond Jewelry Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA