The synthetic data generation market is expanding rapidly due to increasing demand for high-quality, privacy-compliant datasets across artificial intelligence, machine learning, and analytics applications. Rising data privacy regulations and limitations on real-world data accessibility are prompting enterprises to adopt synthetic data solutions that replicate statistical accuracy without compromising confidentiality. The market is also benefiting from advancements in generative AI, deep learning, and computer vision technologies that enhance data realism and usability.

Growing investments in AI infrastructure and the need to reduce data bias and improve model performance are further accelerating adoption. Vendors are focusing on scalable generation platforms and integration capabilities with enterprise workflows.

The future outlook remains strong as industries including healthcare, finance, and autonomous systems increasingly depend on synthetic datasets for model training, testing, and validation This demand, combined with regulatory alignment and cost efficiency, is expected to sustain double-digit growth and strengthen the market’s strategic importance in the broader AI ecosystem.

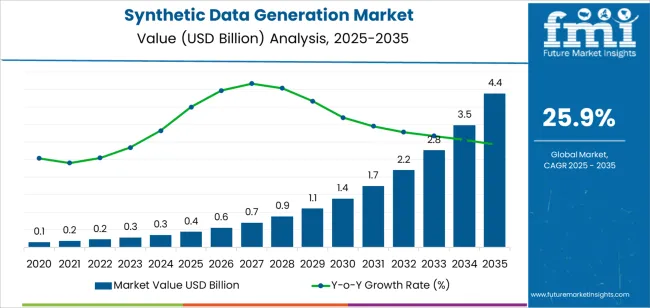

| Metric | Value |

|---|---|

| Synthetic Data Generation Market Estimated Value in (2025 E) | USD 0.4 billion |

| Synthetic Data Generation Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 25.9% |

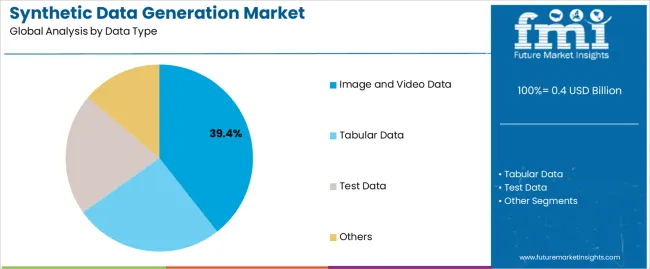

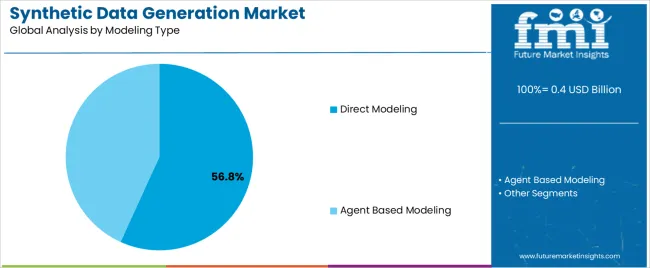

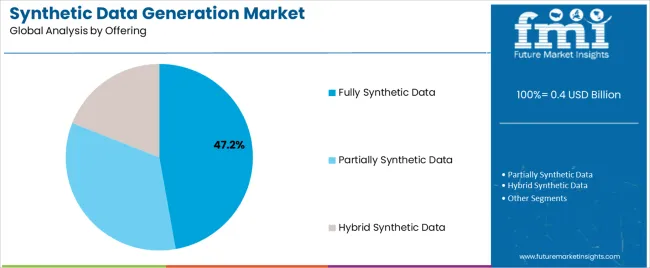

The market is segmented by Data Type, Modeling Type, Offering, Application, and End Use and region. By Data Type, the market is divided into Image and Video Data, Tabular Data, Test Data, and Others. In terms of Modeling Type, the market is classified into Direct Modeling and Agent Based Modeling. Based on Offering, the market is segmented into Fully Synthetic Data, Partially Synthetic Data, and Hybrid Synthetic Data. By Application, the market is divided into Predictive Analytics, Data Protection, Data Sharing, Natural Language Processing, Computer Vision Algorithms, and Others. By End Use, the market is segmented into Healthcare And Life Sciences, BFSI, Transportation And Logistics, IT And Telecommunication, Retail And E-Commerce, Manufacturing, Consumer Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The image and video data segment, accounting for 39.40% of the data type category, has maintained its lead due to the rising use of computer vision and deep learning algorithms across industries. The demand for synthetic visual data is being driven by applications in autonomous vehicles, surveillance systems, robotics, and medical imaging.

The segment’s dominance is supported by the ability of synthetic generation tools to create large-scale, annotated datasets that are difficult and costly to obtain through real-world collection. Enhanced simulation environments and improved generative adversarial network (GAN) architectures are ensuring greater data realism and diversity.

These developments have improved model training accuracy and operational safety for visual recognition systems As AI models continue to require more complex visual scenarios, the image and video data segment is expected to retain its leadership, supported by strong industrial demand and ongoing technological advancements.

The direct modeling segment, holding 56.80% of the modeling type category, has emerged as the dominant approach due to its efficiency in replicating real-world data structures without extensive intermediary modeling processes. This method allows for faster generation of accurate datasets that reflect true data distributions.

Adoption is being driven by enterprises seeking scalable solutions to accelerate AI model development and deployment. The approach is also benefiting from continuous improvements in generative algorithms, which are enhancing fidelity, reducing computational costs, and minimizing error propagation.

Regulatory compliance requirements that restrict the use of sensitive real-world data have further encouraged the shift toward direct modeling With broader applicability across industries and superior performance in training complex algorithms, this segment is expected to maintain its leading position throughout the forecast period.

The fully synthetic data segment, representing 47.20% of the offering category, is leading the market due to its comprehensive privacy protection and flexibility in use across diverse analytical and AI-driven applications. Organizations are increasingly relying on fully synthetic datasets to replace or supplement real data in model testing and validation.

The segment’s growth is supported by the ability to eliminate personal identifiers while maintaining data utility. Its scalability, cost-effectiveness, and compatibility with existing AI pipelines are enhancing adoption among enterprises focused on compliance and innovation.

Technological advancements enabling higher data accuracy and contextual integrity have further strengthened its appeal As synthetic data becomes integral to AI lifecycle management and responsible data governance, the fully synthetic data segment is expected to continue its upward trajectory and remain the preferred offering within the synthetic data generation market.

Organizations across industries are increasingly relying on data driven decision making processes to gain insights, improve operations, and drive innovation. Synthetic data generation enables organizations to access diverse datasets for analysis and decision making, empowering them to derive actionable insights and stay competitive in the market.

The scope for synthetic data generation rose at a 50.5% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 45.9% over the forecast period 2025 to 2035.

The market experienced significant growth during the historical period, driven by increasing adoption of artificial intelligence and machine learning technologies across various industries.

Factors such as growing concerns about data privacy and security, advancements in AI and ML algorithms, and the need for diverse and high quality datasets for model training and testing contributed to the expansion of the market.

Organizations recognized the benefits of synthetic data generation in addressing data scarcity, reducing data labeling costs, and accelerating the development and deployment of AI powered applications and services.

The forecast period is expected to witness continued growth and evolution of the market, driven by emerging trends, technological advancements, and evolving business requirements.

Factors such as the proliferation of edge computing and Internet of Things devices, the integration of synthetic data with emerging technologies like quantum computing and blockchain, and the rise of vertical specific solutions are likely to shape the market landscape.

Increased emphasis on real time data generation, cross platform compatibility, and integration with simulation technologies are anticipated to drive demand for synthetic data generation solutions across industries.

Regulatory compliance, ethical considerations, and data governance will remain critical factors influencing market dynamics, as organizations strive to ensure transparency, accountability, and trustworthiness in synthetic data generation processes.

Synthetic data offers a solution by generating data that mirrors real data but contains no personally identifiable information or sensitive data, with increasing concerns about data privacy and security. Organizations seek alternatives to handle data safely, fueling the demand for synthetic data, as regulations like GDPR and CCPA become more stringent.

Despite advancements in synthetic data generation techniques, ensuring the quality and realism of synthetic datasets remains a challenge. Synthetic data may not always accurately reflect the complexity and variability of real world data, leading to limitations in model performance and generalization.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and the United Kingdom. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 46.2% |

| The United Kingdom | 47.2% |

| China | 46.8% |

| Japan | 47.0% |

| Korea | 47.3% |

The synthetic data generation market in the United States expected to expand at a CAGR of 46.2% through 2035. Organizations in the United States are seeking alternative solutions to protect sensitive information while still being able to innovate and leverage data for various applications, with increasing concerns about data privacy and security.

Synthetic data generation offers a privacy preserving approach to data management, allowing organizations to generate synthetic datasets that mirror real data without exposing personally identifiable information or sensitive data.

The country is a global leader in artificial intelligence and machine learning research and development. There is a growing demand for diverse and high quality datasets to train and validate models, as organizations in various industries continue to adopt AI and ML technologies for data driven decision making. Synthetic data generation techniques enable the creation of large scale, diverse datasets for AI and ML applications, driving the adoption of synthetic data solutions in the United States.

The synthetic data generation market in the United Kingdom is anticipated to expand at a CAGR of 47.2% through 2035. The country is home to a thriving technology sector with significant investments in artificial intelligence, machine learning, and data analytics.

Technological advancements in synthetic data generation techniques, including generative adversarial networks and variational autoencoders, enable the creation of realistic and diverse synthetic datasets. The advancements drive the adoption of synthetic data solutions across industries in the country.

Various industries in the country, including finance, healthcare, retail, and automotive, leverage synthetic data generation for a wide range of applications. In finance, synthetic data is used for risk modeling, fraud detection, and algorithmic trading. In healthcare, synthetic data facilitates research, drug discovery, and clinical trials. Industry specific applications drive the demand for synthetic data solutions tailored to the unique requirements of each sector.

Synthetic data generation trends in China are taking a turn for the better. A 46.8% CAGR is forecast for the country from 2025 to 2035. The Chinese government has prioritized investments in AI, big data, and digital technologies as part of its national development strategies.

Government initiatives, funding programs, and policies support the development and adoption of synthetic data generation technologies in China. Government support creates a conducive environment for innovation, research, and market growth in the synthetic data generation sector.

Chinese industries are undergoing digital transformation and embracing Industry 4.0 principles to enhance efficiency, productivity, and competitiveness. Synthetic data generation plays a crucial role in digital transformation initiatives by enabling data driven decision making, predictive analytics, and automation. The demand for synthetic data solutions is expected to grow in China, as industries adopt advanced technologies and embrace data driven approaches.

The synthetic data generation market in Japan is poised to expand at a CAGR of 47.0% through 2035. Japan is home to renowned research institutions, universities, and technology companies that prioritize research and development initiatives.

Synthetic data generation enables researchers and innovators to access and analyze diverse datasets for experimentation, modeling, and hypothesis testing. The availability of synthetic data accelerates innovation and fosters collaboration across academia, industry, and government sectors.

Collaboration among industry stakeholders, research institutions, and government agencies fosters innovation and accelerates the adoption of synthetic data solutions in Japan. Cross industry partnerships enable knowledge sharing, technology transfer, and collaborative research and development efforts focused on synthetic data generation techniques and applications.

The collaborative ecosystem promotes the development and commercialization of synthetic data solutions tailored to Japanese market needs.

The synthetic data generation market in Korea is anticipated to expand at a CAGR of 47.3% through 2035. Korea has a vibrant startup ecosystem with a thriving community of entrepreneurs, innovators, and technology startups. Startup companies specializing in artificial intelligence, data analytics, and digital technologies develop innovative solutions and services in synthetic data generation.

The presence of startups contributes to the growth and diversification of the synthetic data generation market, fostering competition, innovation, and entrepreneurship in Korea.

Korea is increasingly focusing on precision medicine and healthcare innovation, leveraging advanced technologies such as genomics, bioinformatics, and personalized medicine. Synthetic data generation plays a crucial role in generating synthetic patient data for research, drug discovery, and clinical trials in precision medicine. The integration of synthetic data solutions with healthcare innovation initiatives drives advancements in medical research, patient care, and disease management in Korea.

The below table highlights how tabular data segment is projected to lead the market in terms of product type, and is expected to account for a CAGR of 45.7% through 2035.

Based on technique, the sandwich assays segment is expected to account for a CAGR of 45.5% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Tabular Data | 45.7% |

| Sandwich Assays | 45.5% |

Based on data type, the tabular data segment is expected to continue dominating the synthetic data generation market. Organizations across industries are increasingly concerned about data privacy and regulatory compliance. Tabular data, which often includes personally identifiable information and sensitive data, presents challenges in terms of privacy protection and compliance with regulations such as GDPR and CCPA.

Synthetic data generation offers a solution by generating privacy preserving synthetic tabular datasets that mimic the statistical properties of real data without exposing sensitive information.

Tabular data is ubiquitous in various domains, including finance, healthcare, retail, and marketing. Synthetic data generation techniques enable the creation of diverse and representative tabular datasets that capture the underlying patterns, correlations, and distributions present in real world data. Organizations can augment their datasets, address data scarcity issues, and improve the robustness and generalization of machine learning models, by generating synthetic tabular data.

In terms of modeling type, the direct modeling segment is expected to continue dominating the synthetic data generation market, attributed to several key factors. Direct modeling techniques offer flexibility and customization options for generating synthetic data.

Organizations can specify the underlying data distributions, correlations, and relationships directly through modeling algorithms and parameters. The flexibility allows users to tailor synthetic datasets to specific use cases, domains, and analytical requirements, enhancing the relevance and applicability of generated data.

Direct modeling techniques enable the generation of synthetic data for complex data types and structures, including images, videos, time series, and 3D models. The techniques leverage advanced algorithms such as generative adversarial networks, variational autoencoders, and deep learning architectures to model the underlying data distributions and generate realistic synthetic samples.

Direct modeling facilitates the creation of high fidelity synthetic data that closely resembles real world data, enabling applications in computer vision, natural language processing, and other domains.

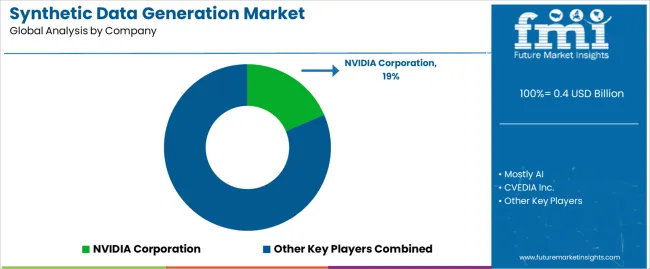

The competitive landscape of the synthetic data generation market is characterized by intense competition among established players, emerging startups, and technology giants offering a diverse range of synthetic data generation solutions and services.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 0.4 billion |

| Projected Market Valuation in 2035 | USD 4.4 billion |

| Value-based CAGR 2025 to 2035 | 25.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD Billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Data Type, Modeling Type, Offering, Application, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Mostly AI; CVEDIA Inc.; Gretel Labs; Datagen; NVIDIA Corporation; Synthesis AI; Amazon.com, Inc.; Microsoft Corporation; IBM Corporation; Meta |

The global synthetic data generation market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the synthetic data generation market is projected to reach USD 4.4 billion by 2035.

The synthetic data generation market is expected to grow at a 25.9% CAGR between 2025 and 2035.

The key product types in synthetic data generation market are image and video data, tabular data, test data and others.

In terms of modeling type, direct modeling segment to command 56.8% share in the synthetic data generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA