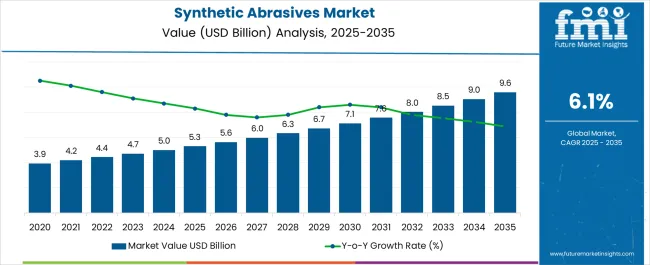

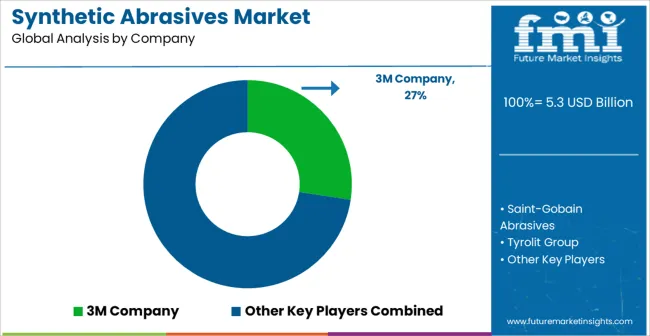

The Synthetic Abrasives Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Synthetic Abrasives Market Estimated Value in (2025 E) | USD 5.3 billion |

| Synthetic Abrasives Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Synthetic Abrasives market is experiencing robust growth due to increasing demand for high-performance materials in industrial and manufacturing applications. Advancements in material engineering and production techniques have enabled the development of synthetic abrasives that offer superior hardness, consistency, and longevity compared to natural alternatives. The market is being driven by the expanding automotive, aerospace, and electronics industries, where precision and efficiency in material removal are critical.

Rising adoption of automated manufacturing processes, particularly in precision grinding, polishing, and cutting, is supporting increased consumption of synthetic abrasives. Further, the growing focus on reducing production costs while enhancing product quality has favored the use of engineered abrasives that provide predictable performance and reduced tool wear.

With ongoing research into novel abrasive compositions and enhanced bonding technologies, the market is expected to offer significant growth opportunities Increasing investments in industrial infrastructure in emerging economies and the emphasis on sustainable manufacturing practices are also contributing to the long-term expansion of the synthetic abrasives market.

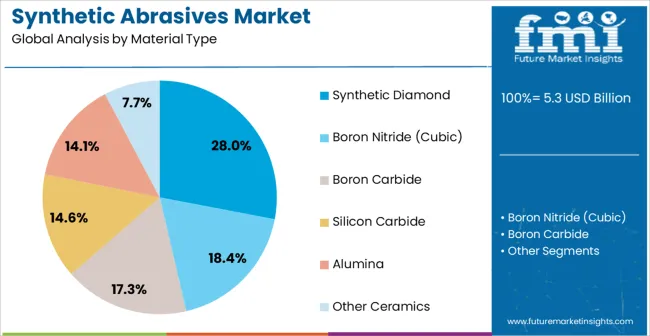

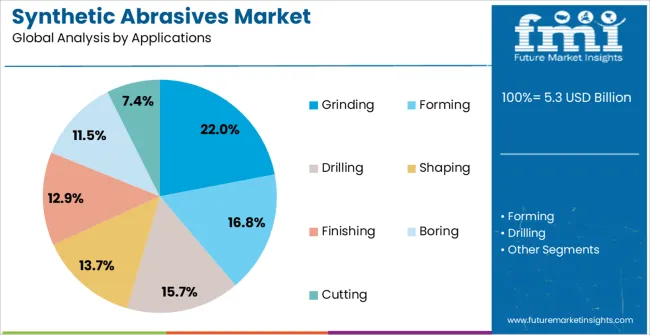

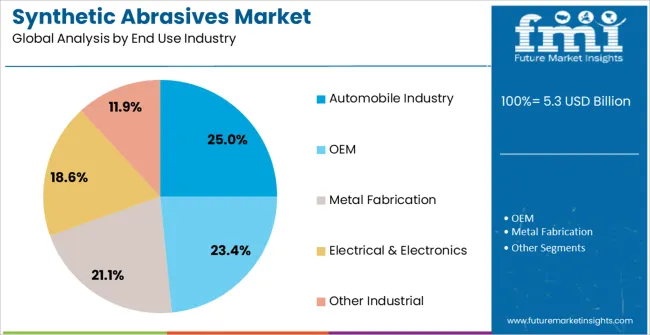

The synthetic abrasives market is segmented by material type, applications, end use industry, and geographic regions. By material type, synthetic abrasives market is divided into Synthetic Diamond, Boron Nitride (Cubic), Boron Carbide, Silicon Carbide, Alumina, and Other Ceramics. In terms of applications, synthetic abrasives market is classified into Grinding, Forming, Drilling, Shaping, Finishing, Boring, and Cutting. Based on end use industry, synthetic abrasives market is segmented into Automobile Industry, OEM, Metal Fabrication, Electrical & Electronics, and Other Industrial. Regionally, the synthetic abrasives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Synthetic Diamond material type is projected to account for 28.00% of the Synthetic Abrasives market revenue in 2025, making it the leading segment. This dominance is attributed to its exceptional hardness, thermal conductivity, and resistance to wear, which are critical for high-precision and high-efficiency applications.

Growth has been accelerated by the increasing demand for synthetic diamonds in cutting, grinding, and polishing applications across industries where material consistency and longevity are essential. The ability to produce synthetic diamonds in controlled conditions has reduced dependency on natural diamond supplies, ensuring stable availability and cost predictability.

In addition, the integration of synthetic diamonds into automated and high-speed manufacturing processes has enhanced productivity and reduced tool replacement frequency As industries continue to prioritize quality, efficiency, and operational cost reduction, the Synthetic Diamond segment is expected to maintain its leading position, supported by ongoing technological improvements in synthesis methods and bonding techniques that expand its application scope.

The Grinding application segment is expected to account for 22.00% of the Synthetic Abrasives market revenue in 2025, emerging as the leading application. The growth of this segment is being driven by the critical role of grinding in precision manufacturing, surface finishing, and dimensional accuracy across multiple industrial sectors. Synthetic abrasives used in grinding processes offer consistent performance, higher material removal rates, and improved tool life compared to natural abrasives.

The segment’s expansion is further supported by the rise of automated and CNC-controlled grinding equipment, which allows efficient utilization of advanced abrasives in high-volume production environments. Increased adoption in sectors such as automotive, aerospace, and metalworking has reinforced the prominence of grinding applications.

The ability to deliver superior surface finishes, maintain tight tolerances, and reduce overall production costs has positioned grinding as a key growth driver in the synthetic abrasives market As industrial modernization continues, the demand for grinding applications utilizing high-performance synthetic abrasives is expected to remain strong.

The Commercial end-use industry, represented here by the Automobile Industry, is projected to hold 25.00% of the Synthetic Abrasives market revenue in 2025, establishing it as the largest end-use sector. This leadership is being driven by the growing complexity of automotive components, which require precision machining, surface finishing, and polishing at scale. Synthetic abrasives are extensively used in the production of engine parts, transmission components, and body panels, where durability and dimensional accuracy are paramount.

The segment has benefited from increasing global automobile production, the adoption of electric vehicles, and the push for lightweight and high-strength materials, all of which necessitate high-performance abrasive solutions. Further, the integration of synthetic abrasives into automated manufacturing processes has reduced production downtime and enhanced overall efficiency.

Rising investments in automotive R&D and industrial automation are expected to sustain demand for synthetic abrasives in this segment The ability to consistently deliver high-quality surfaces and precise component tolerances continues to support the segment’s dominant position in the market.

Abrasives are hard materials which can withstand any damage when rubbed with any other surface. Abrasives can be segmented into two types: natural and synthetic abrasives. Synthetic abrasives are materials which are synthetically manufactured for the purpose of abrasion.

Synthetic abrasives include synthetic diamond, boron nitride (cubic), boron carbide, silicon carbide, alumina and other ceramics. Synthetic abrasives are used in grinding, forming, drilling, shaping, finishing, boring, cutting and other industrial processes.

These abrasives can be used in block or powdered form to manufacture various tools. That apart, these abrasives are also used as a coating material during the manufacturing of industrial tools. The choice of abrasive material depends on the application object.

The strength of the object decides the selection of the synthetic abrasives. The synthetic abrasive used must be stronger than the object on which it is going to be used. Various developments in material technologies are pushing the demand for synthetic abrasives in different applications.

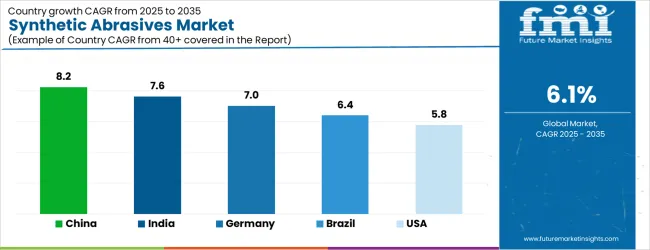

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The Synthetic Abrasives Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Synthetic Abrasives Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Synthetic Abrasives Market is estimated to be valued at USD 1.9 billion in 2025 and is anticipated to reach a valuation of USD 1.9 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 245.4 million and USD 162.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.3 Billion |

| Material Type | Synthetic Diamond, Boron Nitride (Cubic), Boron Carbide, Silicon Carbide, Alumina, and Other Ceramics |

| Applications | Grinding, Forming, Drilling, Shaping, Finishing, Boring, and Cutting |

| End Use Industry | Automobile Industry, OEM, Metal Fabrication, Electrical & Electronics, and Other Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Saint-Gobain Abrasives, Tyrolit Group, Mirka Ltd., Klingspor AG, Abrasive Technology, Inc., Fujimi Incorporated, and Robert Bosch GmbH |

The global synthetic abrasives market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the synthetic abrasives market is projected to reach USD 9.6 billion by 2035.

The synthetic abrasives market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in synthetic abrasives market are synthetic diamond, boron nitride (cubic), boron carbide, silicon carbide, alumina and other ceramics.

In terms of applications, grinding segment to command 22.0% share in the synthetic abrasives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA