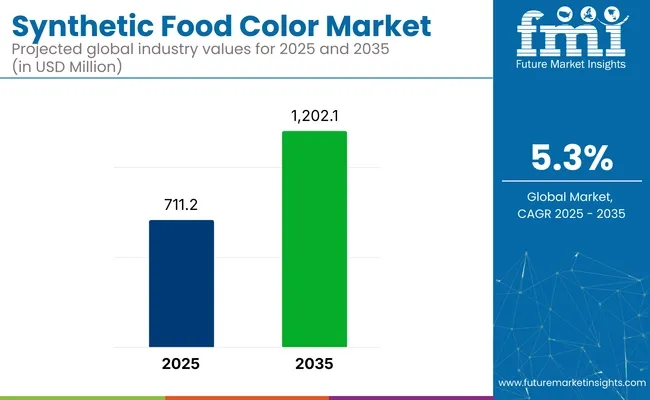

The synthetic food color market is on a growth trajectory, with a projected increase of USD 1202.1 million in market value by 2035. A key driver of this expansion is the growing demand for vibrant, visually appealing products across a range of industries. In particular, the beverage sector, projected to account for 28% of the market share in 2025, will continue to be a major application for synthetic food colors.

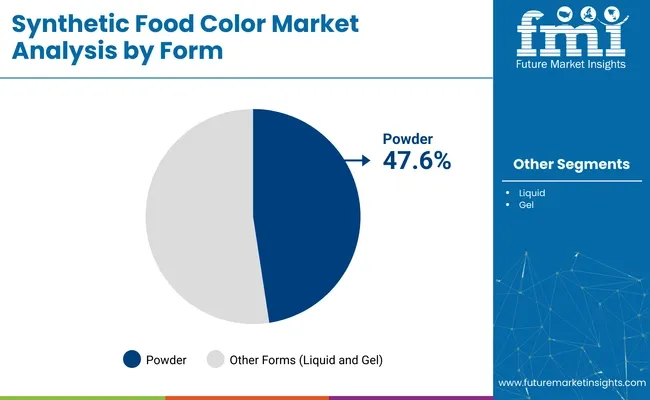

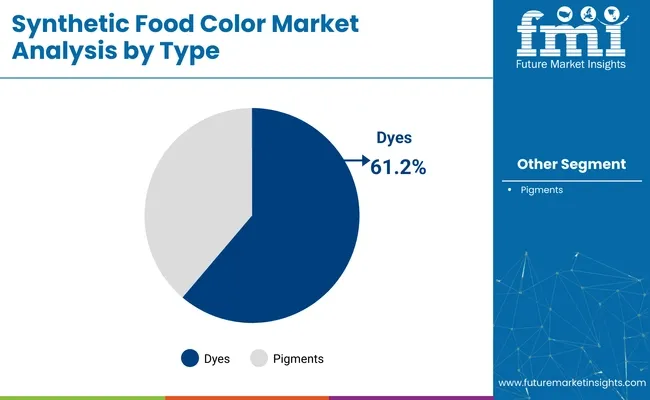

Powder form synthetic food colors, expected to dominate the market in 2025, are highly favored due to their ease of use and storage stability. Dyes, which are anticipated to capture 61.2% of the market share, will remain the preferred type for most applications, including food and beverage.

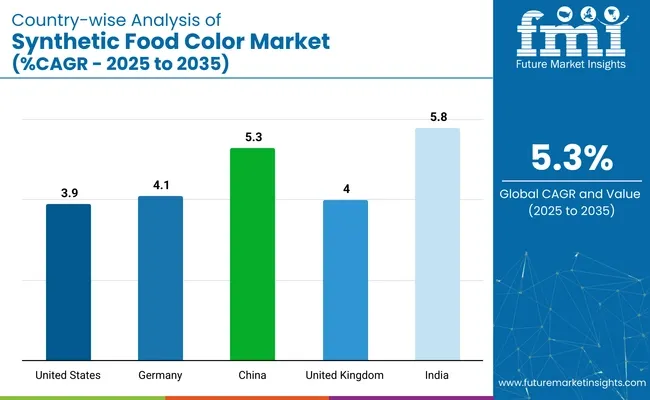

Among the various colors, yellow is expected to lead, driven by its wide usage in beverages and processed foods. India, with a projected CAGR of 5.8%, will be the fastest-growing market for synthetic food colors, reflecting the country's rising demand for processed and packaged food products.

Market Attribute Table

| Market Attribute | Value |

|---|---|

| Market Size in 2025 | USD 711.2 million |

| Market Size in 2035 | USD 1202.1 million |

| CAGR (2025-2035) | 5.3% |

In December 2023, DIC Corporation introduced DAILUBE™ KS-519, an algae oil-based high-performance colorant offering superior lubricating performance, additional benefits such as a light color and low odor, and a reduced environmental footprint. In July 2023, Döhler Group acquired SVZ, a Dutch supplier of fruit and vegetable ingredients, to enhance its portfolio of natural red fruit and vegetable ingredients.

The global synthetic food color market is projected to grow through 2035. In 2025, powder form will hold 47.6%, dyes will capture 61.2%, yellow will dominate with 38.0%, and beverages will lead with 28.0% market share.

Powder form is projected to hold 47.6% of the market share in 2025. This form is popular due to its easy incorporation into a wide range of products, offering vibrant and stable colors.

Dyes are expected to capture 61.2% of the market share in 2025, making them the leading type of synthetic food coloring. Dyes are highly favored in beverages, dairy products, and candies due to their strong coloring ability and ease of use.

The yellow color segment is expected to hold 38.0% of the market share in 2025. Yellow is widely used in food coloring due to its association with fresh, appetizing products like citrus, cheese, and snacks.

The beverages segment is expected to dominate with 28.0% of the market share in 2025. Synthetic food colors are extensively used in the beverage industry to provide visually appealing colors and differentiate product offerings.

The synthetic food color market is expanding due to increased demand for vibrant, consistent food products. However, concerns about health risks and regulatory scrutiny are hindering market growth.

Growing demand for vibrant, visually appealing food products

Health concerns and regulatory scrutiny hinder market growth

The synthetic food color market is growing steadily, driven by the increasing demand for visually appealing and vibrant food products. Factors like rising disposable income, innovation in food processing, and the expanding food and beverage industry are contributing to market growth in countries like the USA, Germany, China, the UK, and India.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Germany | 4.1% |

| China | 5.3% |

| United Kingdom | 4.0% |

| India | 5.8% |

The synthetic food color market in the United States is expected to grow at a CAGR of 3.9% from 2025 to 2035, driven by increasing demand for food products with vibrant colors. The USA market is heavily influenced by consumer preferences for visually appealing food, especially in beverages, candies, and processed foods.

Germany’s synthetic food color market is projected to grow at a CAGR of 4.1% through 2035, with demand driven by the country’s strong food and beverage industry. The German market is characterized by a high demand for food colorants in confectionery, dairy, and soft drinks, where vibrant colors are crucial for consumer appeal.

China’s synthetic food color market is expected to grow at a CAGR of 5.3% from 2025 to 2035, driven by the rapid expansion of its food and beverage industry. The increasing consumer preference for colorful, attractive food is boosting the demand for synthetic food colors in snacks, beverages, and processed foods.

The UK’s synthetic food color market is projected to grow at a CAGR of 4.0% from 2025 to 2035, fueled by innovations in food coloring technology and rising consumer interest in processed foods. The market is driven by the use of synthetic colors in confectionery, beverages, and bakery products, where color is a key factor in consumer choice.

India’s synthetic food color market is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by the increasing demand for visually appealing food and beverages. India’s food industry is seeing a rise in the use of synthetic food colors in snacks, soft drinks, and sweets, where vibrant colors are essential for consumer attraction.

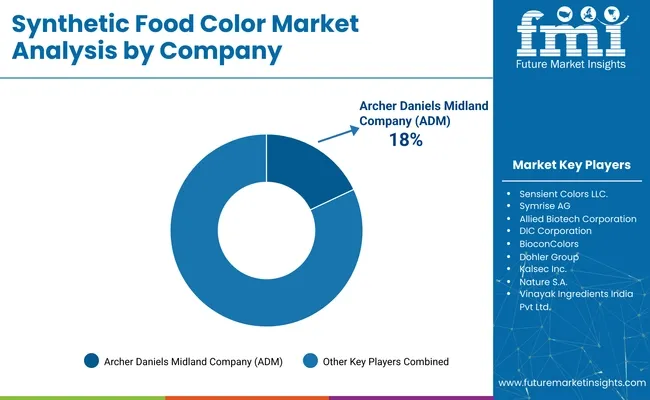

The synthetic food color market is characterized by a blend of global leaders and specialized regional players. Tier 1 includes multinational corporations such as Archer Daniels Midland Company, Sensient Colors LLC, Symrise AG, Allied Biotech Corporation, DIC Corporation, and Vinayak Ingredients India Pvt Ltd, which dominate with extensive production capabilities and a wide range of applications across food, beverages, and dietary supplements.

Tier 2 comprises companies like BioconColors, Dohler Group, Kalsec Inc., and Nature S.A., offering specialized color solutions and catering to specific market needs. Despite the dominance of Tier 1 suppliers, the market remains moderately fragmented, driven by the increasing demand for customized and region-specific products.

Recent Synthetic Food Color Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 711.2 million |

| Projected Market Value (2035) | USD 1202.1 million |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| Form | Liquid, Powder, Gel |

| Type | Pigment, Dyes |

| Color | Yellow, Blue, Red, Green, Others |

| Applications | Beverages, Bakery, Snacks & Cereals, Candy/Confectionery, Dairy, Fruit Preparations/Filling, Meat/Poultry/Fish/Eggs, Potatoes/Pasta/Rice, Sauces/Soups/Dressings, Seasonings, Pet Food |

| Region | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Archer Daniels Midland Company, Sensient Colors LLC, Symrise AG, Allied Biotech Corporation, DIC Corporation, BioconColors, Dohler Group, Kalsec Inc., Nature S.A., Vinayak Ingredients India Pvt Ltd. |

| Additional Attributes | Dollar sales driven by demand for vibrant food colors, CAGR growth reflects adoption in packaging, increasing product type diversification, premium demand for clean-label solutions, rising investment in regional demand. |

Liquid, powder, and gel.

Pigment and dyes.

Yellow, blue, red, green and others.

Beverages; bakery, snacks, and cereals; candy/ confectionery; dairy; fruit preparations/ fillings; meat, poultry, fish, and eggs; potatoes, pasta, and rice; sauces, soups, and dressings; seasonings; and pet food.

North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Synthetic Food Color Market is projected to reach USD 711.2 million in 2025.

The market is expected to grow to USD 1202.1 million by 2035.

The market is forecasted to grow at a CAGR of 5.3% from 2025 to 2035.

Powder form synthetic food colors are expected to dominate with a 47.6% market share in 2025.

Yellow is projected to be the leading color, capturing 38.0% of the market share in 2025.

India is expected to be the fastest-growing market with a projected CAGR of 5.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Synthetic Lubricants and Functional Fluids Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA