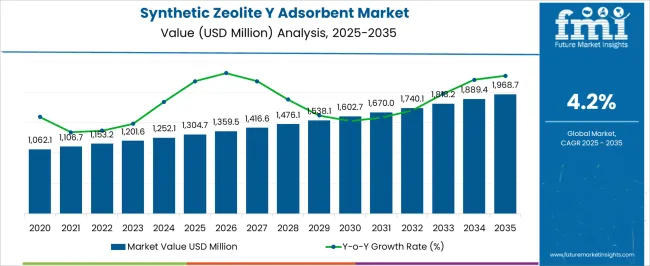

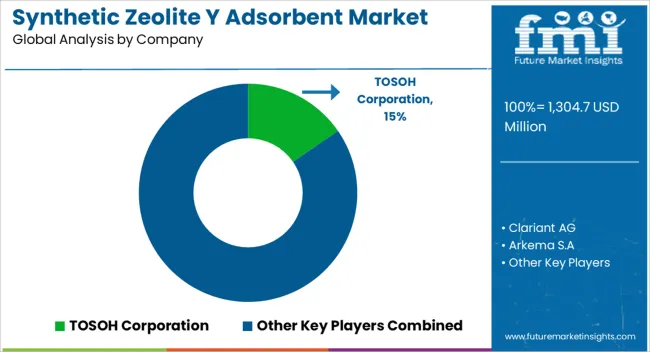

The Synthetic Zeolite Y Adsorbent Market is estimated to be valued at USD 1304.7 million in 2025 and is projected to reach USD 1968.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Synthetic Zeolite Y Adsorbent Market Estimated Value in (2025 E) | USD 1304.7 million |

| Synthetic Zeolite Y Adsorbent Market Forecast Value in (2035 F) | USD 1968.7 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The synthetic zeolite Y adsorbent market is witnessing sustained growth, driven by its critical role in catalysis, adsorption, and separation processes across industries. High demand from the petrochemical, refining, and chemical sectors has strengthened its positioning, supported by its uniform pore structure, ion-exchange capacity, and thermal stability.

The current market scenario is characterized by increasing replacement of traditional adsorbents with zeolite-based solutions due to higher efficiency and selectivity. Hydrocarbon processing and fluid catalytic cracking remain key growth drivers, while emerging applications in environmental remediation and gas purification are broadening the scope of adoption.

Continuous advancements in synthesis methods and material engineering are further enhancing product performance. The market outlook remains favorable, with rising energy demand, refinery capacity expansions, and environmental regulations supporting long-term growth.

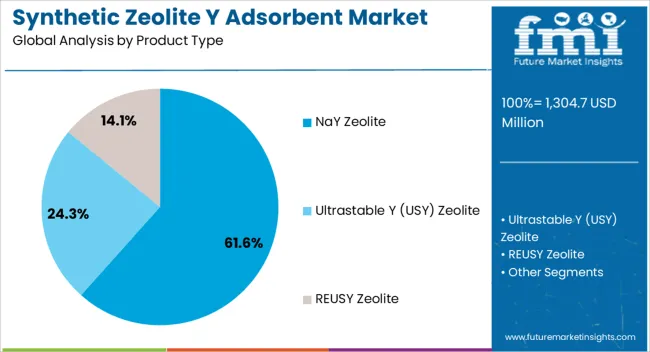

The NaY zeolite segment dominates the product type category, holding approximately 61.6% share in the synthetic zeolite Y adsorbent market. Its dominance is attributed to its superior ion-exchange properties and structural adaptability, which make it a preferred material in catalytic cracking and hydrocarbon processing.

NaY zeolite’s cost-effectiveness and scalability in production further contribute to its widespread use in large-scale industrial applications. Demand for this product type has been reinforced by its proven performance in extending catalyst lifespans and improving refinery throughput.

With ongoing expansion in petrochemical and refining industries, the NaY zeolite segment is expected to sustain its leadership in the coming years.

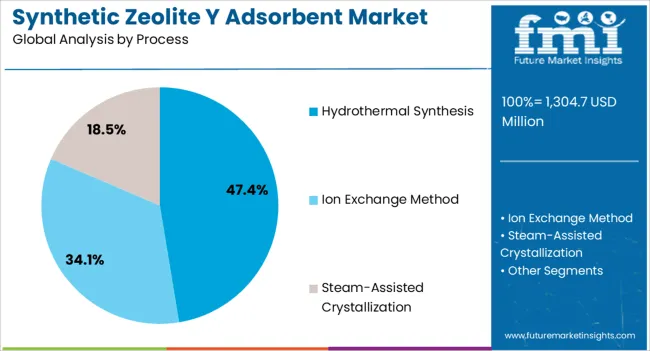

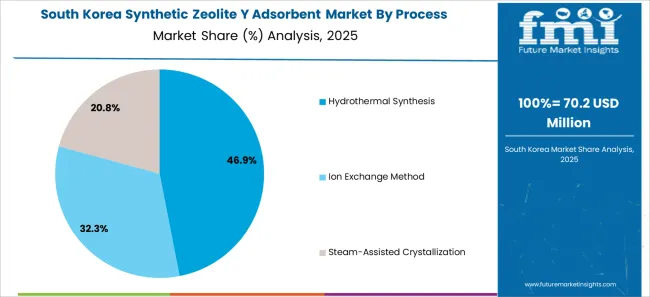

The hydrothermal synthesis segment leads the process category with approximately 47.4% share, driven by its reliability in producing high-purity zeolite structures with consistent quality. This process allows for controlled crystallization, ensuring uniform pore sizes and structural stability, which are critical for industrial performance.

Hydrothermal methods are well-established, enabling large-scale production aligned with refinery and chemical sector demands. The segment benefits from ongoing innovations aimed at optimizing synthesis parameters to reduce costs and energy consumption.

With the increasing requirement for efficiency in adsorbents and catalysts, hydrothermal synthesis is expected to maintain its position as the preferred manufacturing route in the synthetic zeolite Y adsorbent market.

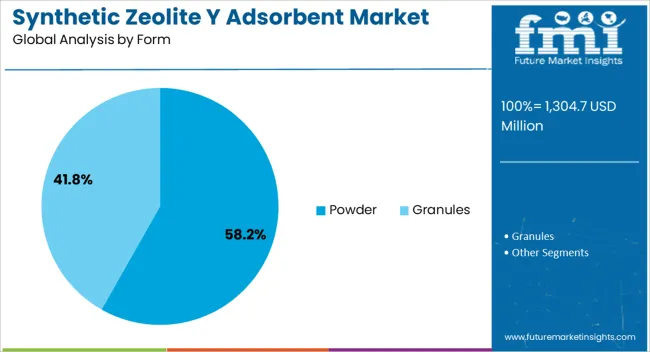

The powder segment dominates the form category, holding approximately 58.2% share of the market. Powdered synthetic zeolite Y adsorbents are highly valued for their versatility, ease of dispersion, and effectiveness in various catalytic and adsorption processes.

Their widespread use in refining, chemical synthesis, and gas separation has solidified their dominance. The segment benefits from simple handling, compatibility with different formulations, and high surface area exposure, which enhances performance efficiency.

Ongoing demand from industrial and environmental applications is expected to reinforce the powder segment’s leading position, ensuring continued market relevance over the forecast horizon.

Market to Expand Over 1.5X through 2035

The global synthetic zeolite Y adsorbent market is predicted to expand over 1.5x through 2035, amid a 1.4% increase in expected CAGR compared to the historical one. This is due to the growing demand for gas separation and purification in a wide range of applications such as oxygen (O2) enrichment, carbon dioxide (CO2) separation, and more.

Global sales of synthetic zeolite Y adsorbents are expected to rise due to increasing government initiatives for developing water infrastructure and high demand for advanced gas separation technologies. By 2035, the total market revenue is set to reach USD 1,888.2 million.

North America Continues to Dominate Synthetic Zeolite Y Adsorbent Market

North America is expected to dominate the global synthetic zeolite Y adsorbent market during the forecast period. It is set to hold around 25.7% of the worldwide market share in 2035. This is attributed to the following factors:

Technological advancements in synthetic zeolite Y adsorbent and expanding applications across diverse regions are set to propel market expansion. Growing reliance on synthetic zeolite Y adsorbents for precise gas separation further amplifies market demand and significance.

Increasingly stringent water quality regulations worldwide are projected to augment the adoption of synthetic zeolite Y in water treatment processes. As governments and industries prioritize compliance with strict standards, the adsorbents play a vital role in effectively removing pollutants, safeguarding water quality, and meeting regulatory requirements.

The growing industrial use of water and heightened environmental awareness are expected to fuel the demand for synthetic zeolite Y in water treatment. Industries seeking efficient and sustainable wastewater treatment and purification solutions contribute to the market's growth, reflecting a shared commitment to addressing global water challenges.

Substantial investments are being made in research & development to advance manufacturing processes and meet the escalating demand for zeolite adsorbents in diverse applications, reinforcing industry growth. This strategic focus underscores a commitment to advancing technology and meeting evolving demands for efficient water treatment and gas purification solutions.

Global sales of synthetic zeolite Y adsorbents grew at a CAGR of 2.8% from 2020 to 2025. The market reached a valuation of USD 1,208.4 million in 2025. In the forecast period, the worldwide synthetic zeolite Y adsorbent industry is set to thrive at a CAGR of 4.2%.

| Historical CAGR (2020 to 2025) | 2.8% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.2% |

The global synthetic zeolite Y adsorbent market witnessed steady growth between 2020 and 2025. This was due to the increased demand for clean drinking water and a high focus on improving product quality in a wide range of applications and end-use industries.

The synthetic zeolite Y adsorbent market faced disruptions during the COVID-19 pandemic, witnessing supply chain challenges and delayed projects. However, the increasing focus on environmental solutions has since spurred recovery and resilience in the industry.

An increasing number of sectors, such as petrochemicals, refining, gas separation, catalysis, and environmental protection, use synthetic zeolite Y adsorbents. These adsorbents' adaptability has aided in their use in several industrial applications.

The petrochemical sector has been the leading user of synthetic zeolite Y adsorbents. Their application in the petrochemical industry's separation and purification processes has been a key factor in the market's expansion.

Future Scope of the Synthetic Zeolite Y Adsorbent Market

Over the forecast period, the global synthetic zeolite Y adsorbent market is poised to exhibit healthy growth. This is due to several factors, including increasing demand for technological advancements in production processes, a shift toward sustainability, and the robust expansion of end-use industries.

The future outlook for the synthetic zeolite Y adsorbent market foresees a heightened demand for cutting-edge gas separation technologies. The imperative shift toward clean energy and eco-friendly industrial processes fuels this surge.

Zeolite-based solutions are gaining increased recognition, particularly in CO2 separation, oxygen enrichment, and natural gas treatment applications. As industries prioritize reducing their carbon footprint and optimizing operational efficiency, zeolite adsorbents are pivotal in meeting the evolving requirements for advanced gas separation and purification technologies.

Growing Competition from Alternative Adsorbents

Alternative adsorbents, including activated carbon and silica gel, challenge the synthetic zeolite Y market. Industries exploring diverse options are set to choose alternative materials based on specific application requirements, hindering the sustained growth of zeolite Y in a competitive landscape.

Rapid advancements in adsorption technologies, such as graphene-based materials and advanced polymers, threaten the conventional dominance of synthetic zeolite Y. Emerging technologies often offer improved adsorption capacities and selectivity, diverting attention and investments away from traditional zeolite Y applications.

Increasing Regulatory Requirements for Environmental Safety

Due to heightened regulatory requirements, obtaining approvals for synthetic zeolite Y adsorbents in several applications is set to become resource-intensive. Industries may need help securing the necessary certifications, impeding the smooth adoption of zeolite Y in water treatment, nuclear waste remediation, and VOC treatment processes.

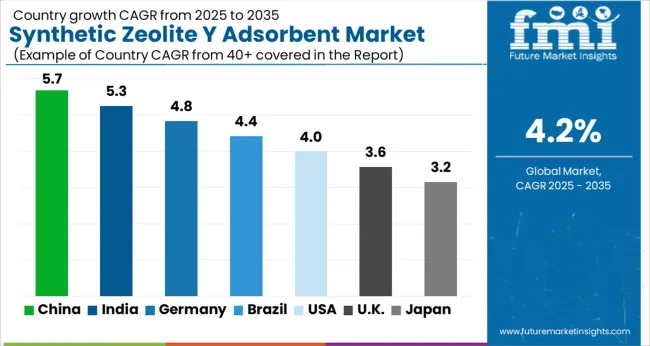

The table below highlights key countries’ synthetic zeolite Y adsorbent market revenues. The United States, China, and Canada are expected to remain the top three consumers of synthetic zeolite Y adsorbents, with expected valuations of USD 1968.7.0 million, USD 222 million, and USD 125 million, respectively, in 2035.

The table below shows the estimated growth rates of the top six countries. South Africa, Turkiye, and South Korea are set to record high CAGRs of 6.9%, 6.3%, and 6.2%, respectively, through 2035.

The United States synthetic zeolite Y adsorbent market is projected to reach USD 1968.7.0 million by 2035. The factors responsible for this growth are as follows:

Sales of synthetic zeolite Y adsorbents in China are anticipated to reach USD 222 million by 2035. The factors driving the market growth are as follows:

Canada's synthetic zeolite Y adsorbent market value is anticipated to reach USD 125 million by 2035. Emerging patterns in Canada’s market are as follows:

South Korea’s synthetic zeolite Y adsorbent market is assessed to register a CAGR of 6.2% through 2035. The deployment of synthetic zeolite Y adsorbents is increasing on account of the following:

Key players are significantly investing in Turkiye, as the country is offering several growth opportunities. Through 2035, Turkiye is projected to expand at a CAGR of 6.3%, driven by the following factors:

The section below shows the NaY zeolite segment dominating based on product type. It is forecast to thrive at a 3.8% CAGR between 2025 and 2035. Based on application, the water treatment segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 3.5% during the forecast period.

| Top Segment (Product Type) | NaY Zeolite |

|---|---|

| Predicted CAGR (2025 to 2035) | 3.8% |

NaY zeolite is a sodium-based zeolite known for its exceptional ion exchange capacity and high thermal stability. NaY zeolite is set to exhibit superior adsorption properties for water treatment, selectively removing contaminants widely employed in catalysis and gas separation applications.

Its unique crystal structure and chemical composition make it a versatile choice for several industrial processes, reflecting its significance in addressing water purification challenges. Rising usage of NaY zeolite in the synthetic Y adsorbent market in gas separation and purification is set to boost the target segment.

It is anticipated to hold a significant volume share of 61.6% in 2025. Demand for NaY zeolite is forecast to rise at a CAGR of 3.8% over the period.

| Top Segment (Application) | Water Treatment |

|---|---|

| Projected CAGR (2025 to 2035) | 3.5% |

Based on application, the water treatment segment is projected to thrive at a 3.5% CAGR during the forecast period. Water treatment emerges as a paramount application within the dynamic landscape of the synthetic zeolite Y adsorbent market.

The adsorbents are pivotal in removing contaminants and ensuring access to clean & safe water featuring NaY, USY, and REUSY zeolites. From municipal water purification to industrial wastewater treatment, zeolite adsorbents significantly enhance water quality and support sustainable resource management practices.

The global synthetic zeolite Y adsorbent market is fragmented, with leading players accounting for a significant share. The report lists TOSOH Corporation, Clariant AG, Arkema S.A, Ecovyst Inc., W.R. Grace & Co., and Honeywell International Inc. as the leading manufacturers and suppliers of synthetic zeolite Y adsorbents.

Key synthetic zeolite Y adsorbent companies are investing in continuous research to produce new solutions and increase their production capacity to meet end-user demand. To increase their presence, key players are displaying a propensity to implement growth strategies such as collaborations, acquisitions, mergers, and facility expansions.

Recent Developments

The global synthetic zeolite Y adsorbent market is estimated to be valued at USD 1,304.7 million in 2025.

The market size for the synthetic zeolite Y adsorbent market is projected to reach USD 1,968.7 million by 2035.

The synthetic zeolite Y adsorbent market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in synthetic zeolite Y adsorbent market are nay zeolite, ultrastable Y (usy) zeolite and reusy zeolite.

In terms of process, hydrothermal synthesis segment to command 47.4% share in the synthetic zeolite Y adsorbent market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Synthetic Lubricants and Functional Fluids Market - Growth & Demand 2025 to 2035

Synthetic Cinnamaldehyde Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA