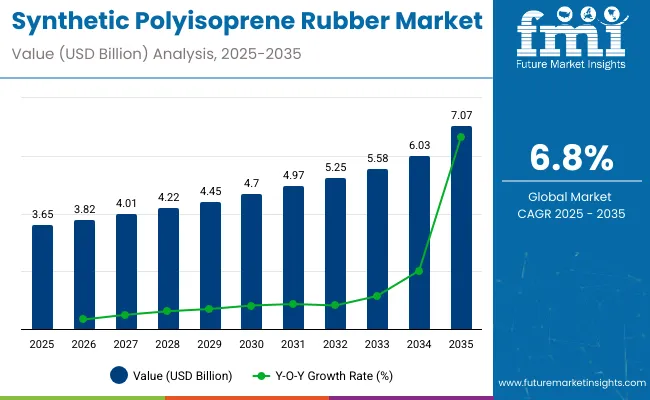

The global synthetic polyisoprene rubber (SPR) market is projected to advance from USD 3.65 billion in 2025 to USD 7.07 billion by 2035 at a 6.8% CAGR. Demand momentum follows a 6.5% year-on-year jump in 2024 and is supported by three structural forces medical-grade elastomer substitution for latex, EV-ready tire compounds requiring low rolling resistance, and sustainability-driven R&D that blends bio-based monomers with petro-derived feedstock.

Medical and healthcare dominate near-term growth. Surgical gloves, catheters and condoms now account for roughly 45% of SPR offtake. A Rubber Chemistry and Technology study (2024) showed polyisoprene gloves retain tensile strength 18% longer than comparable nitrile after repeated sterilisation cycles, driving hospital conversions. USA Medical Glove Company’s 2024 acquisition of a domestic polyisoprene facility signals on-shoring momentum and tighter supply-chain control.

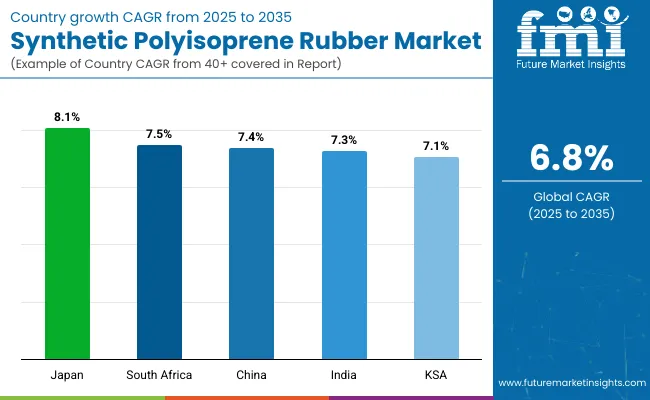

Automotive demand accelerates with EV adoption. OEM specifications for low-noise, high-grip tires favour solution-polymerised isoprene blends. Japan’s SPR consumption is forecast to climb at 8.1 % CAGR through 2035 on the back of high-performance tire exports. Sustainability reshapes the competitive landscape. ARLANXEO, Kraton and Goodyear are piloting bio-isoprene routes using sugar-fermentation or lignocellulosic feedstocks to cut cradle-to-gate CO₂ by up to 70%. At India Rubber Expo 2024, ARLANXEO unveiled a portfolio of drop-in sustainable elastomers aimed at medical and consumer goods.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 3.65 billion |

| Projected Size (2035) | USD 7.07 billion |

| Value-based CAGR (2025 to 2035) | 6.8% |

North America and Europe will maintain quality-critical medical share, yet Asia-Pacific remains the volume engine. China’s shift toward high-value synthetic elastomers, incentivised by its 2026 “New Materials” tax credits, and India’s growing surgical-glove export base drive regional CAGR above 7.5%.

Reflecting expansion ambitions, Donald Chen, then-CEO of ARLANXEO, stated during a Saudi plant announcement: “This project is an important part of our growth plans and is expected to reinforce ARLANXEO’s leadership position in high-performance rubbers.” As per Tyre Trends. With hospitals phasing out allergenic latex, EV manufacturers tightening tire specs, and producers scaling bio-isoprene, SPR is set for durable, innovation-led growth. Capacity additions in Asia, paired with stricter ASTM/EN medical standards and greener procurement mandates, will sustain a healthy mid-single-digit expansion through the decade.

The synthetic polyisoprene (SPI) rubber market operates under strict regulatory frameworks to ensure chemical safety, environmental compliance, and product integrity across industries like medical devices, food packaging, and industrial goods. Manufacturers must comply with multiple standards governing production, handling, and application to maintain market access.

The synthetic polyisoprene rubber (SPI) market is supported by a robust global trade network dominated by manufacturing hubs and high-demand regions. Exports are concentrated in countries with advanced chemical industries, while imports are driven by sectors such as automotive, medical devices, and industrial goods in both mature and emerging economies.

The following table is a graphical illustration of the annual growth rates of the synthetic polyisoprene rubber sales from 2025 to 2035. This report starts with the base year of 2024 and extends into the present year, studying how the industry growth curve shifts between the first half of the year, namely January through June (H1) to the second half comprising July through December (H2). This will give stakeholders a great perspective of how the sector has evolved and possible development directions.

The table below illustrates the growth of the sector for each half-year period between 2024 and 2025. In the first half (H1) of 2024, the industry was expected to grow at a CAGR of 6.2%. However, in the second half (H2), there is an evident rise in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.2% (2024 to 2034) |

| H2 2024 | 6.3% (2024 to 2034) |

| H1 2025 | 6.5% (2025 to 2035) |

| H2 2025 | 6.7% (2025 to 2035) |

Moving into the next period, from H1 2025 to H2 2025, the CAGR is expected to be 6.5% in the first half and rise to 6.7% in the second half. In the first half (H1) and the second half (H2), the demand saw an increase of 30 and 40 BPS respectively.

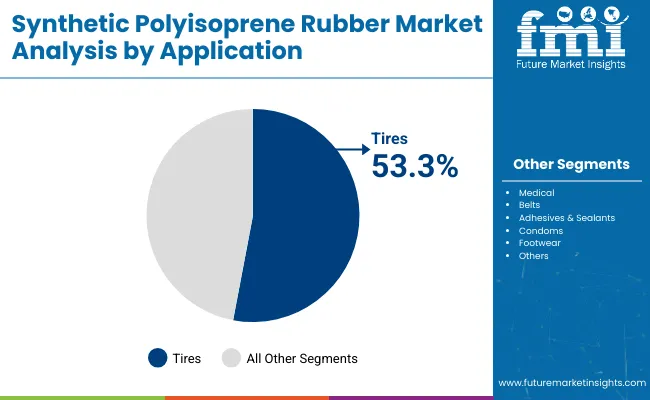

The tires segment is projected to dominate the synthetic polyisoprene rubber market, holding a significant share of approximately 53.3% in 2025. This growth is driven by increasing usage of synthetic polyisoprene rubber in advanced tire manufacturing. Its properties, closely matching natural rubber such as excellent elasticity, high tensile strength, and superior abrasion resistance make it ideal for durable, efficient, and high-performance tire production. The accelerating adoption of electric vehicles (EVs) has further boosted demand for specialized tires.

According to the International Energy Agency (IEA), electric car sales reached nearly 14 million units globally in 2023, comprising 18% of total global car sales, up significantly from 14% in 2022. Electric vehicles demand tires that handle higher torque and provide reduced rolling resistance to maximize battery efficiency, making synthetic polyisoprene an essential material.

Prominent tire manufacturers like Goodyear invest substantially in developing EV-specific tires using synthetic polyisoprene rubber, enhancing durability and efficiency. Such initiatives reinforce the critical role of synthetic polyisoprene in meeting the automotive industry's evolving demands, supporting sustained growth in tire applications globally.

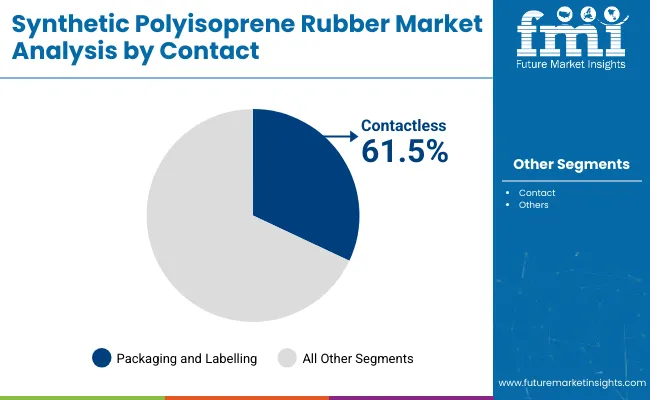

The contactless segment of synthetic polyisoprene rubber is expected to dominate with approximately 61.5% market share by 2024. Significant global growth in contactless applications, particularly within medical and healthcare sectors, drives this dominance. Synthetic polyisoprene is widely preferred for medical gloves, stoppers, and seals due to its hypoallergenic, sterile, and safe properties. With increasing latex allergies and stringent global standards for medical safety, the adoption of synthetic polyisoprene in gloves and medical disposables continues to rise.

Additionally, the material is increasingly utilized in pharmaceutical packaging for airtight seals and closures, offering strong resistance to chemicals and ensuring contamination-free storage. The COVID-19 pandemic significantly amplified global awareness and demand for contactless solutions, enhancing synthetic polyisoprene's position in health and hygiene applications.

Leading healthcare manufacturers such as Ansell and Medline have accelerated the transition to synthetic polyisoprene gloves, ensuring superior protection, patient safety, and regulatory compliance, cementing its role in healthcare and pharmaceutical markets worldwide.

The increasing adoption of synthetic polyisoprene rubber (SPR) in condom manufacturing is significantly driving the growth in its demands. SPR offers hypoallergenic properties, eliminating the risk of latex allergies, which enhances user acceptance and broadens the consumer base.

Several condoms based on SPR have been authorized by the USA Food and Drug Administration for their durability and safety. An excellent illustration of the SKYN Original Polyisoprene Lubricated Male Condom, a male condom and preventative tool made of synthetic rubber polyisoprene latex that helps ward off STIs and pregnancy.

The FDA has acknowledged that SPR condoms meet national and international voluntary standards, including ASTM D3492-03 and ISO 4074:2002, that require physical testing of natural rubber latex condoms. Because of this compliance, SPR condoms are guaranteed to be of the highest quality and safety, which increases consumer preference and stimulates the demand.

High-performance adhesives and sealants are significantly driving the synthetic polyisoprene rubber (SPR) sales as demand continues to increase. SPR exhibits superior elasticity and tensile strength and superior adhesion properties, which make it a prime option for applications in the construction, automotive, and packaging industries.

The construction industry utilizes SPR-based sealants on an extensive scale for expansion joints, glazing, and waterproofing purposes due to their strength and flexibility. BLS stands for USA Bureau of Labor Statistics, classified construction as one of the fastest-growing industries that supports this rise in demand for high-end sealants.

SPR-based pressure-sensitive adhesives also find wide use in the packaging industry in tapes and labels because of their resistance to chemicals and flexibility. The EPA has pointed out that rubber-based adhesives are increasingly used due to their reliability in packaging applications.

Synthetic polyisoprene rubber (SPR) is manufactured using petroleum-derived feeds, and therefore it remains extremely volatile to episodes of changes in crude oil prices. Such changes are sometimes frequent owing to crude oil price fluctuations caused by factors like geopolitics, demand-supply haggles, and changes in global energy policies.

According to the US Energy Information Administration, crude oil prices have fluctuated up and down in recent years. For example, back in 2020, West Texas Intermediate crude oil was pegged at less than USD 20 per barrel due to the Covid crisis.

In 2022, political unrest within countries of the G7 was pushing the price up to USD 120 per barrel. These unpredictable price swings affected the cost of procurement of Synthetic Polyisoprene Rubber, and that creates uncertainty for the manufacturers and affects their profit margins.

These price volatilities not only raise the costs of production but also influence the supply chain management of synthetic rubber producers. The companies react to the challenge of adjustment in the pricing approaches that bring cost-sensitive competition, especially in the sectors of automobiles and construction, thereby raising complexity in procuring raw materials due to the increased global attention on renewable energy sources, which subsequently puts greater regulatory pressures on products derived from petroleum.

The increasing demand for green and high-performance materials has triggered interest in biocomposites with synthetic polymers bonded with natural reinforcements like fibers or fillers. With its unique properties, such as a superior elasticity level, high durability, and excellent compatibility with other materials, synthetic polyisoprene rubber is gaining momentum as a strong factor in this sector.

According to research supported by the USA Department of Energy, an agenda toward sustainable material innovations, biocomposites have found their uses for lightweight and high-strength applications, especially in aerospace, sports equipment, and construction. SPR-based biocomposites can help to meet these requirements without dependency on traditional, less sustainable materials.

These advanced SPR-based biocomposites are attractive, particularly in sectors that require versatility and sustainability of materials. For example, the aerospace industry seeks lightweight materials for efficient fuel consumption, whereas construction requires durable and flexible materials for infrastructure development. SPR's elasticity and resilience can also be used to develop sports equipment.

This increasing adoption goes along with the global move toward reducing carbon footprints through the integration of natural and synthetic materials, which will present an enormous growth opportunity for SPR in the biocomposites industry.

Between 2020 and 2024, the industry registered a growth rate of 2.9% by attaining a figure of USD 3,429.9 million in 2024 from USD 2,763.6 million in 2020. The growth of synthetic polyisoprene rubber was dominated by growing automotive, textile, and & partnerships.

Synthetic polyisoprene rubber has been immensely popular in the textile sector because of its use across footwear and protective gear. Stretchability and comfort are the properties due to which synthetic polyisoprene rubber is in increased demand within the textile sector. A lot of key brands such as Nike, Adidas, and Reebok have amplified the usage of synthetic polyisoprene rubber within their athletic wear and footwear.

The demand is expected to grow faster looking ahead to 2025 to 2035. Synthetic polyisoprene has a homogeneous polymer structure, which provides excellent purity, processability, and consistency. These properties help to simplify manufacturing and quality control, making synthetic polyisoprene an efficient choice for manufacturing.

Synthetic polyisoprene is particularly compatible to dip molding. The production efficiency of polyisoprene can make it a more cost-effective option than other materials. It is estimated that the need for synthetic polyisoprene rubber will grow with growing healthcare, automotive, and other sectors.

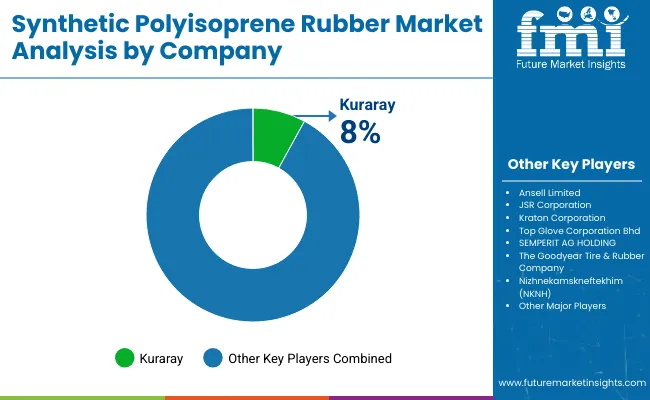

Tier 1 companies capture 40-45% of the value share, reflecting their substantial influence in the synthetic polyisoprene rubber demands. These firms boast annual revenues exceeding USD 300-350 million, supported by high production capacities, advanced technology integration, and extensive product portfolios.

They present value share at the global level of around 20-25%. Key players consist of KURARAY CO., LTD., The Goodyear Tire & Rubber Company, JSR Corporation, Zeon Corporation, Nizhnekamskneftekhim (NKNH), Hartalega Holdings Berhad, and Kraton Corporation.

Tier 2 companies comprise 30-35% of the value share and have revenues in the range of USD 10-100 million. These mid-size players usually have a significant presence in specific regions and wield substantial influence on the local economy.

Firms in this tier, such as Rubberex Corporation (M) Bhd, Supermax Corp. Bhd, Bangkok Synthetics Co., Ltd. (BST), Kent Elastomers, and Elastomer Inc., excel in specialized applications and overseas operations. While they possess strong technological capabilities, they generally lack the extensive global reach of Tier 1 leaders.

Tier 3 companies represent 20-25% value share, with annual revenues below USD 10 million. These small-scale enterprises operate primarily within regional spheres, catering to niche demands and localized needs. Examples include Globus (Shetland) Ltd., Puyang Linshi Chemical & New Material, Cariflex, ISOPRENE INDUSTRIES (M) SDN BHD, CHEMSPEC, LTD., and Vip Rubber and Plastic Company. This segment is characterized by limited geographical reach and less formalized structures, focusing on meeting the specific requirements of regional consumers.

The section below highlights the industry assessments of synthetic polyisoprene rubber demand across key regions. Japan, South Africa, China, India, and KSA are anticipated to experience robust growth, driven by increasing demand for high-performance rubber materials in various industries.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

| South Africa | 7.5% |

| China | 7.4% |

| India | 7.3% |

| KSA | 7.1% |

The synthetic Polyisoprene Rubber sales in the forecast period of 2025 to 2035 in Japan is expected to thrive with a CAGR of 8.1% and value at USD 406.7 Million by the end of the year 2035. This is driven significantly by high-performance synthetic rubbers demanded in consumer goods. It encompasses mechanical properties such as elasticity, and resilience, which makes it a suitable choice for quality-conscious consumers in Japan.

Japan's consumer goods sector plays a crucial role in the increased adoption of synthetic polyisoprene rubber in a wide range of applications like sportswear, and household products. The ASICS corporation has employed it in its footwear products to increase performance and comfort.

In fact, the Japanese government allocated a total of USD 220 million in the FY2024 budget towards capital investment in transforming the process of manufacturing, particularly for new material innovation adoption in the chemical and materials sectors (JETRO). Thus, such policies are having positive impacts on sustainable uses, and also propelling the use of advanced materials like synthetic polyisoprene in Japan's consumer goods industry.

The synthetic polyisoprene rubber market in China is expected to grow at 7.4 % during the period of 2025 to 2035, with strong industrial growth and increasing demand for innovative packaging solutions. Synthetic polyisoprene, due to its greater durability, elasticity, and chemical resistance, is gradually becoming a preferred material for the packaging sector to assure product safety and quality across a wide range of industries.

China possesses a population of around 1.4 billion as of 2023. Its growing urbanization and rising disposable incomes are fueling consumerism, which makes up for the huge demand for packaging. The packaging industry in China is estimated to be about USD 500 billion as of 2023.

Government initiatives, such as the Green Packaging Policy, encourage sustainable and recyclable materials, which also increases the adoption of synthetic polyisoprene in seals, closures, and stoppers. Companies such as China National Packaging Corporation are investing in advanced technologies that integrate synthetic polyisoprene, addressing both performance and sustainability concerns.

The Saudi Arabian sales for synthetic polyisoprene rubber are expected to expand at a compound annual growth rate (CAGR) of 7.1 % between 2025 and 2035, propelled by the nation's strategic emphasis on industrial diversification and innovation.

The oil and gas industry in Saudi Arabia, the largest oil producer in the world, continues to play a significant role in the country's economy, and synthetic polyisoprene rubber is becoming more and more crucial to guarantee the effectiveness and longevity of the machinery utilized in this sector.

Saudi Arabia hosts 17% of the proven petroleum reserves in the world and is the largest exporter of crude oil in the world, with annual oil revenue reaching USD 326 billion in 2022. Capital spending on infrastructure development by Saudi Aramco has also been increasing continuously, reaching more than USD 37 billion in 2023, as the company aims to enhance operational efficiency and equipment durability in oil exploration and refining.

The country is also progressing in petrochemical production with new investments in downstream processing, which further amplifies the demand for synthetic polyisoprene rubber in pipelines, valves, and safety equipment.

The key players involved in the production of synthetic polyisoprene rubber are focusing on enhancing their capacity and resources to meet the growing demand across diverse applications. These companies are investing in cutting-edge technologies, expanding their services, and optimizing operational efficiencies. By bolstering their resource base, these firms can provide high-quality, reliable products that cater to the evolving needs of the industry, ensuring they stay competitive.

Leading companies are also forming strategic partnerships and joint ventures to co-develop innovative products and solutions. These collaborations often lead to developments and innovation, as companies leverage each other’s expertise and resources. Such partnerships enable manufacturers to expand their product portfolios, tap into new industries, and better address the specific requirements of various end-use sectors, such as automotive, medical, and consumer goods.

In addition, major players are pursuing geographic expansion to seize new growth opportunities. By entering new industries and expanding their presence in existing ones, these companies can reach broader customer bases, diversify their revenue streams, and mitigate risks associated with market saturation. Expanding geographically allows these firms to capture emerging industries potential while ensuring continued growth in established regions.

| Report Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 3.65 billion |

| Projected Size (2035) | USD 7.07 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Applications | Medical, Tires, Belts, Adhesives & Sealants, Condoms, Footwear, Others |

| Contact Types | Contact, Contactless |

| End Use Industries | Hospitals, Clinics, Blood & Organ Banks, Teaching Hospitals, Consumer Goods, Industrial, Automotive & Transportation |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia; Middle East and Africa (MEA) |

| Key Players | Ansell Limited, JSR Corporation, Kraton Corporation, Top Glove Corporation Bhd, SEMPERIT AG HOLDING, The Goodyear Tire & Rubber Company, KURARAY CO., LTD, Nizhnekamskneftekhim (NKNH), SIBUR, Cariflex, Other Major Players |

| Additional Attributes | Surge in demand from medical applications post-pandemic, expansion in automotive component manufacturing, shift toward synthetic alternatives to natural rubber, innovation in condom and glove production technologies, regional industrialization driving tire and footwear demand |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of application, the industry is divided into Medical, Tires, Belts, Adhesives & Sealants, Condoms, Footwear, and Others.

In terms of contact, the industry is divided into Contact and Contactless.

In terms of end-use industry, the industry is divided into Hospitals, Clinics, Blood & Organ Banks, Teaching Hospitals, Consumer Goods, Industrial, Automotive & Transportation.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The synthetic polyisoprene rubber sales are anticipated to reach a valuation of USD 3.65 billion in 2025.

The synthetic polyisoprene rubber industry is projected to attain a valuation of USD 7.07 billion by 2035.

The synthetic polyisoprene rubber sales are anticipated to witness a growth of 6.8% over the forecast period of 2025 and 2035 in terms of value.

The top countries driving the synthetic polyisoprene rubber demand are Japan, China, and the Kingdom of Saudi Arabia.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA