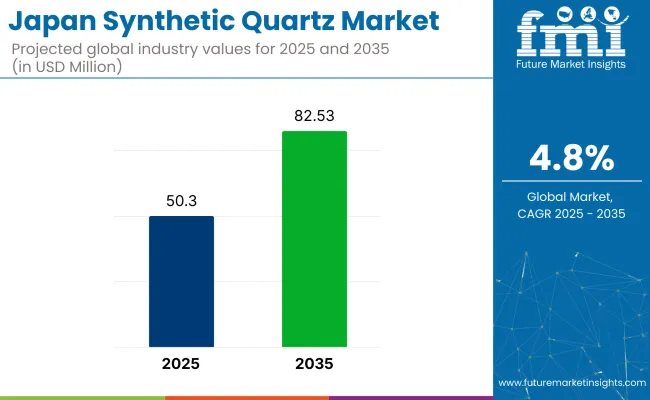

The Japan synthetic quartz market is estimated to rise from USD 50.3 million in 2025 to reach USD 82.53 million by 2035 at a CAGR of 4.8% over the forecast period. The industry growth is primarily driven by increasing demand in high-precision electronics, telecommunications, and renewable energy sectors.

Synthetic quartz is highly valued for its superior purity, thermal stability, and optical clarity, making it essential in semiconductor manufacturing, optical components, and 5G infrastructure. Japan’s position as a technology and manufacturing hub further supports the rising demand both domestically and for export.

The industry is benefiting from Japan’s strong innovation ecosystem and government-backed initiatives aimed at advancing the scientific materials sector. These efforts are fueling technological developments and encouraging the replacement of older materials with synthetic quartz, which offers better performance and reliability. .

The expanding 5G network and increasing investments in renewable energy infrastructure, such as solar panels and energy-efficient sensors, are also key factors propelling industry growth. As Japan continues to prioritize technological advancement and sustainability, synthetic quartz remains a vital component across multiple industries.

Industry experts emphasize that the continued focus on high-purity materials and precision manufacturing will ensure the synthetic quartz industry’s steady growth through 2035. The combination of strong domestic demand, export potential, and ongoing innovation underlines Japan’s leadership in this space. Additionally, advancements in production technology and quality control methods are enhancing the material’s applications, further solidifying its importance in Japan’s high-tech and energy sectors in the years ahead.

Moreover, the industry is poised to benefit from increased collaborations between industry leaders and research institutions, fostering innovation in material science and manufacturing processes. The rising adoption of automation and smart manufacturing techniques further enhances production efficiency and quality consistency.

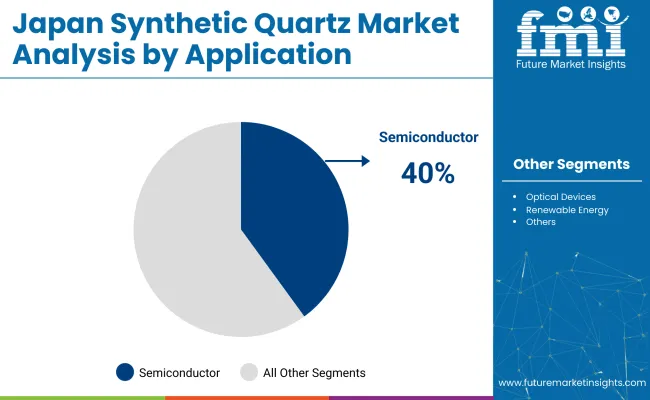

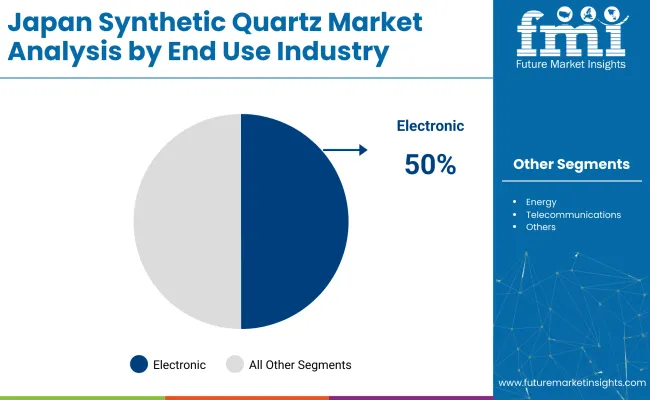

The semiconductors segment and the electronics end-use industry are set to dominate the industry in 2025, driven by the critical role of synthetic quartz in advanced microchip manufacturing and the growing demand for high-performance electronic components.

The semiconductors segment dominates the industry, with a 40% share in 2025.This growth is driven by synthetic quartz’s essential role in photomask substrates, wafer carriers, and etching systems used in advanced microchip manufacturing. Japan’s leadership in semiconductor innovation and production fuels strong demand for high-purity synthetic quartz.

The electronics segment dominates the industry, accounting for approximately 50% of the industry share in 2025 and is expected to grow to around 55% by 2035.

The industry is expanding steadily, driven by rapid technological advancements in semiconductor manufacturing and telecommunications. As Japan continues to lead in microchip innovation and 5G infrastructure development, synthetic quartz has become essential for high-precision applications such as photomasks, wafer carriers, and communication components due to its exceptional purity, thermal stability, and chemical resistance.

Technological Innovations in High-Tech Applications

The industry is driven by continuous technological advancements in semiconductor manufacturing and telecommunications. Synthetic quartz’s superior purity, thermal stability, and chemical resistance make it indispensable for high-precision applications like photomasks, wafer carriers, and 5G components. Innovations in microchip technology and the expansion of 5G infrastructure are key factors fueling demand. These developments ensure that synthetic quartz remains a critical material in Japan’s evolving high-tech industries, supporting steady industry growth through 2035.

Government Policies and Green Manufacturing Driving Demand

Government-backed initiatives aimed at promoting scientific material innovation and sustainable manufacturing are significant drivers of industry expansion. Japan’s focus on reducing carbon emissions and investing in renewable energy infrastructure, such as solar panels, boosts the demand for synthetic quartz in energy applications. Additionally, stricter environmental regulations encourage the adoption of eco-friendly production methods. This supportive regulatory environment, combined with strong domestic demand and export opportunities, underpins the industry’s robust growth trajectory over the next ten years.

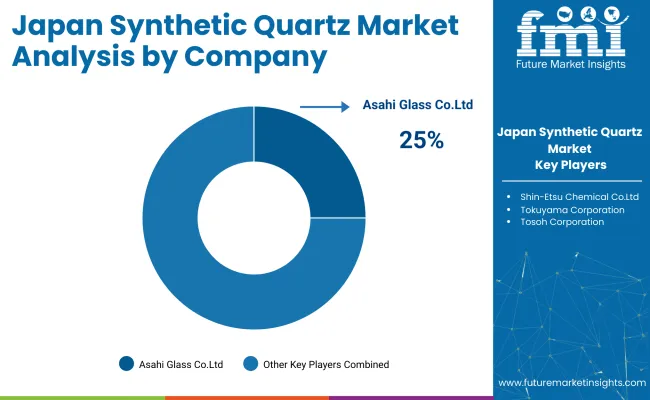

The market is characterized by a competitive landscape with several key players contributing to its growth. Leading companies like Asahi Glass Co., Ltd. (AGC) dominate the industry through advanced manufacturing technologies, high-purity quartz production, and strong domestic and international distribution networks. AGC’s focus on innovation and quality control enables it to cater to high-demand sectors such as semiconductors and telecommunications, solidifying its position as anindustry leader in synthetic quartz within Japan.

Recent Japan Synthetic Quartz Market Development

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 50.3 million |

| Projected Industry Size (2035) | USD 82.5 million |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and tons for volume |

| Application Analyzed (Segment 1) | Semiconductors, Optical Devices, Telecommunications, Renewable Energy, and Others |

| End Use Industry Analyzed (Segment 2) | Electronics, Telecommunications, Energy, Aerospace & Defense |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Industry | Asahi Glass Co., Ltd. (AGC), Shin-Etsu Chemical Co., Ltd., Tokuyama Corporation, Tosoh Corporation, and Heraeus Quartz Japan Co., Ltd. |

| Additional Attributes | Dollar sales, industry share, growth trends, key applications, competitive landscape, capacity expansions, technological advancements, regional demand, end-user industries, and future industry forecasts. |

In terms of application, the industry is classified into semiconductors, optical devices, telecommunications, renewable energy, and others.

With respect to end use industry, the industry is divided into electronics, telecommunications, energy, and aerospace & defense

The industry is valued at USD 50.3 million in 2025.

The industry is forecast to reach USD 82.53 million by 2035, growing at a CAGR of 4.8%.

Asahi Glass Co., Ltd is leading with an industry share of 25%.

The industry is projected to grow at a CAGR of 4.8%.

The electronics segment holds 50% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

UK Synthetic Quartz Market Trends – Demand & Industry Outlook 2025-2035

Geosynthetics Industry Analysis in South Asia Growth - Trends & Forecast 2025 to 2035

USA Synthetic Quartz Market Report – Size, Share & Trends 2025-2035

ASEAN Synthetic Quartz Market Analysis – Size, Share & Forecast 2025-2035

Germany Synthetic Quartz Market Insights – Size, Trends & Growth 2025-2035

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Mezcal Industry Analysis in Japan - Consumer Demand & Industry Trends in 2025

Taurine Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA