The synthetic dye market is experiencing steady growth, supported by rising demand from the textile, leather, paper, and plastics industries. Synthetic dyes offer superior colorfastness, cost efficiency, and a wide spectrum of shades compared to natural alternatives, ensuring consistent performance across large-scale industrial applications.

The market is shaped by the increasing use of eco-friendly dye formulations that comply with environmental regulations. Technological advancements in chemical synthesis and improved wastewater treatment systems have reduced environmental impact, further supporting market acceptance.

Emerging economies continue to drive consumption growth due to expanding textile and apparel manufacturing bases. As fashion cycles shorten and consumer preference for vibrant colors intensifies, the synthetic dye market is expected to maintain its positive trajectory with continued innovation in sustainable dye technologies..

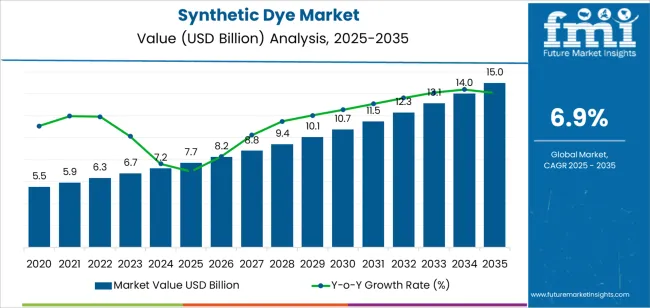

| Metric | Value |

|---|---|

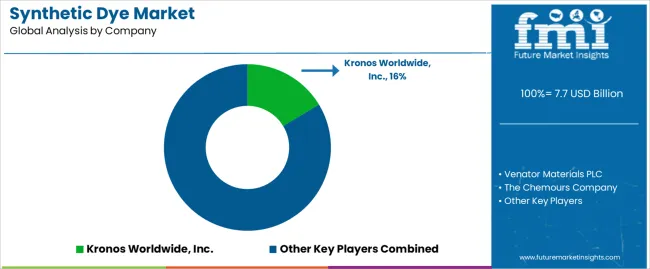

| Synthetic Dye Market Estimated Value in (2025 E) | USD 7.7 billion |

| Synthetic Dye Market Forecast Value in (2035 F) | USD 15.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

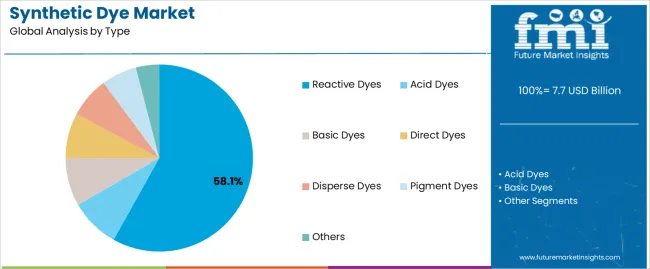

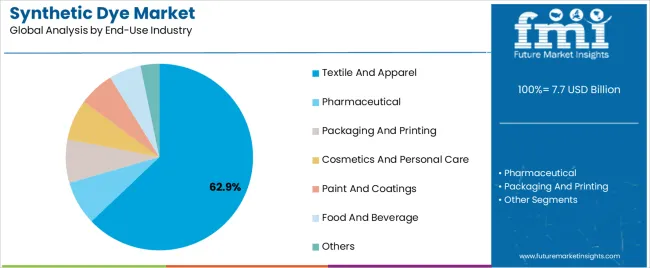

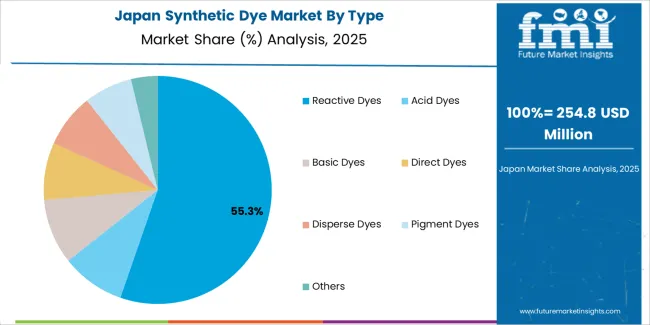

The market is segmented by Type and End-Use Industry and region. By Type, the market is divided into Reactive Dyes, Acid Dyes, Basic Dyes, Direct Dyes, Disperse Dyes, Pigment Dyes, and Others. In terms of End-Use Industry, the market is classified into Textile And Apparel, Pharmaceutical, Packaging And Printing, Cosmetics And Personal Care, Paint And Coatings, Food And Beverage, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reactive dyes segment dominates the type category, accounting for approximately 58.10% share of the synthetic dye market. This leadership is due to their strong covalent bonding with cellulose fibers, offering excellent wash and light fastness properties.

Reactive dyes are preferred in cotton and viscose textile processing, where high color yield and application versatility are critical. The segment benefits from a broad color range, cost-effectiveness, and compatibility with modern dyeing technologies.

Continuous research into low-salt and high-exhaustion formulations has improved environmental compliance, reinforcing their position in the global market. With textile manufacturers prioritizing durability and vibrant color retention, the reactive dyes segment is projected to sustain its dominance in the forecast period..

The textile and apparel segment holds approximately 62.90% share in the end-use industry category, representing the largest consumer base for synthetic dyes. This dominance is driven by the constant demand for fashion, home furnishings, and industrial textiles.

Rapid urbanization, rising disposable incomes, and fast fashion trends have fueled the need for cost-efficient and high-performance coloring solutions. Manufacturers are increasingly adopting automated dyeing processes to improve consistency and reduce resource consumption.

Furthermore, the expansion of textile production in Asia-Pacific has strengthened segment growth, supported by large-scale manufacturing capabilities and export-oriented industries. As sustainability initiatives gain momentum, the textile and apparel segment will continue to anchor the synthetic dye market’s overall growth..

Acid dyes are the predominant type of dye in the market. On the other hand, the textile and apparel industry is the sector that utilizes synthetic dyes most frequently.

Acid dyes are expected to advance at a CAGR of 6.7% over the forecast period based on type. Some of the factors influencing the progress of acid dyes are:

| Attributes | Details |

|---|---|

| Top Type | Acid Dyes |

| Forecasted CAGR (2025 to 2035) | 6.7% |

The textile and apparel application is expected to progress at a CAGR of 6.5% in the end-use industry segment throughout the forecast period. Some of the reasons for the progress of the textile and apparel application of synthetic dyes are:

| Attributes | Details |

|---|---|

| Top End-use Industry | Textile and Apparel |

| Forecasted CAGR (2025 to 2035) | 6.5% |

The Asia Pacific is a fertile region for the market owing to its enormous population and its significant demand for clothing. The food requirements of the region are also substantial, and there is a high demand for colored food and beverages. North America and Europe are prominent regions for luxurious apparel. Thus, the market is also gaining significant attention in these two regions.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

| United Kingdom | 8.1% |

| China | 7.9% |

| Japan | 8.5% |

| South Korea | 9.0% |

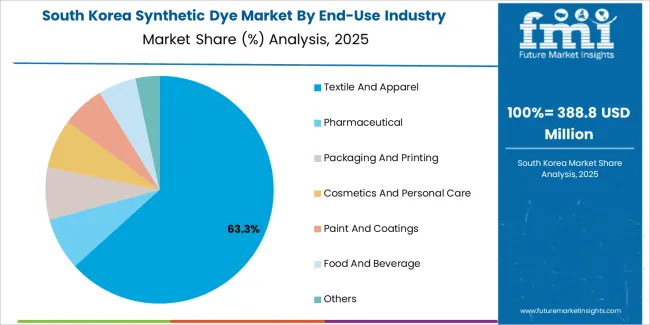

The CAGR of the synthetic dye market in South Korea during the forecast period is anticipated to be 9.0%. Some of the factors influencing the healthy growth of the market in the country are:

The synthetic dye market is expected to register a CAGR of 8.5% in Japan over the forecast period. Some of the factors contributing to the growth of the market in Japan are:

The synthetic dye market is expected to exhibit a CAGR of 7.9% in China through 2035. Some of the factors responsible for the growth of the market are:

The synthetic dye market is expected to progress at a CAGR of 8.1% in the United Kingdom through 2035. Some factors influencing the progress are:

The market is expected to register a CAGR of 7.2% in the United States between 2025 and 2035. Some factors influencing the growth of the market in the country are:

To capitalize on the opportunities present in developing countries, such as cheap labor and the availability of raw materials, Western companies are forming partnerships with outfits in these regions. The Asia Pacific is specifically a region where this practice is flourishing.

The synthetic dyes market has enough room for both established multinational giants and local players. Improving the manufacturing process, for example, by obtaining raw materials more quickly, is a focus for market players.

Recent Developments in the Synthetic Dye Market

The global synthetic dye market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the synthetic dye market is projected to reach USD 15.0 billion by 2035.

The synthetic dye market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in synthetic dye market are reactive dyes, acid dyes, basic dyes, direct dyes, disperse dyes, pigment dyes and others.

In terms of end-use industry, textile and apparel segment to command 62.9% share in the synthetic dye market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Aperture Radar (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA