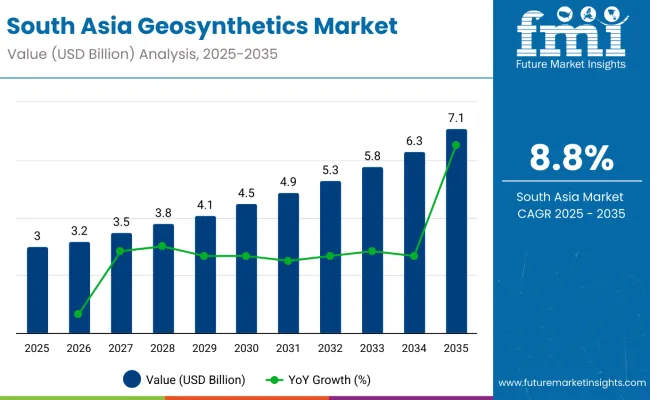

The South Asia geosynthetics market is expected to grow from USD 3 billion in 2025 to USD 7.1 billion by 2035. The market is poised to expand at an 8.8% CAGR during the forecast period. The market is experiencing robust growth as geosynthetics become integral to modern infrastructure development across the region.

Governments and private sectors are investing heavily in roads, railways, airports, and coastal protection projects to support urbanization and economic growth. Geosynthetics, such as geotextiles, geomembranes, and geogrids, offer advantages in soil stabilization, drainage enhancement, and life-cycle extension of civil structures. Their cost-effectiveness and sustainability profile are driving widespread adoption in public infrastructure and environmental protection initiatives across countries like India, Bangladesh, and Sri Lanka.

Additionally, the market is being driven by rising innovation and tailored product development. Manufacturers are introducing advanced geosynthetics with superior UV resistance, chemical stability, and mechanical performance to suit South Asia’s diverse climatic and geotechnical conditions. The growing focus on climate resilience has also positioned geosynthetics as vital components in flood control, erosion prevention, and landfill containment projects.

Increasing investments in renewable energy infrastructure, such as solar farms and wind energy installations, are further accelerating demand for geosynthetics, particularly in ground reinforcement and erosion control applications. As regional construction activities diversify, geosynthetics are becoming essential for improving durability and reducing environmental impacts.

Furthermore, the South Asia geosynthetics market is likely to witness continued momentum beyond 2035, driven by growing demand for climate-resilient infrastructure and sustainable construction materials. Applications in emerging sectors such as renewable energy, smart infrastructure, and industrial projects are likely to expand. Evolving government regulations are fostering a compliance-driven market landscape.

In India, the Ministry of Road Transport and Highways (MoRTH) mandates geotextile use in road and slope stabilization projects, while the Central Pollution Control Board (CPCB) promotes geomembranes in landfill liners. Similar regulatory frameworks in Bangladesh and Sri Lanka are encouraging adoption in coastal protection and flood management. As infrastructure resilience and sustainability become top priorities, the South Asia geosynthetics market is poised to remain a critical enabler of next-generation construction and environmental protection initiatives.

Geosynthetics are subject to various government regulations and certifications to ensure quality, safety, and environmental compliance in infrastructure projects across South Asia. These regulations encompass manufacturing standards, material specifications, and usage guidelines to promote the effective application of geosynthetics in civil engineering and construction.

The trade of geosynthetics in South Asia is growing steadily, driven by expanding infrastructure development, urbanization, and increasing adoption of sustainable construction practices. Countries in the region both import and produce geosynthetics to meet rising demand across sectors such as road construction, erosion control, wastewater management, and landfills.

The market is segmented based on product type, application, material type, primary function, and country. By product type, the market is divided into geogrids, geotextiles, geocells, geonets, geocomposites, geomembranes, geosynthetic clay liners, and others (geofoam, geopipes, geospacers, geobags). Based on application, the market is categorized into road construction, civil engineering, environmental protection, hydraulic, construction, and others (railway construction, landfill capping, coastal protection, erosion control).

In terms of material type, it is segmented into polypropylene, polyethylene, polyester, polyvinyl chloride, natural fibers, and others (rubber, bitumen, fiberglass, polystyrene). Based on primary function, the market is classified into stabilisation, reinforcement, drainage, erosion control, filtration, separation, and barrier & protection. Regionally, the market is analyzed across India, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Australia, New Zealand, and the Rest of South Asia.

The geocomposites segment is projected to grow at the fastest CAGR of 7.8% from 2025 to 2035. This growth is being fueled by rising demand for multi-functional geosynthetics that deliver combined benefits such as drainage, separation, filtration, and barrier protection.

Major infrastructure projects in India, Indonesia, and Vietnam including highways, railways, and landfills are adopting geocomposites to enhance structural integrity and reduce construction costs. Their ability to streamline installation and improve long-term performance in erosion control, canal lining, and landfill capping applications is driving rapid uptake across the region.

Meanwhile, geotextiles continue to dominate by volume and value, thanks to their versatility across road construction, hydraulic engineering, and civil works. The geomembranes segment is seeing robust demand in waste containment and waterproofing applications, particularly with tightening environmental regulations.

Geogrids remain critical for soil reinforcement and slope stabilization, supporting extensive use in transportation infrastructure. Geocells and geonets serve niche yet growing applications in erosion control and drainage. The geosynthetic clay liners segment is gaining relevance in hazardous waste containment. The others category including geofoam, geopipes, geospacers, and geobags continues to find specialized applications in coastal protection and lightweight embankments.

The barrier & protection segment is projected to grow at the fastest CAGR of 7.4% between 2025 and 2035. Increasing focus on environmental sustainability and hazardous waste containment across South Asia is driving demand for geomembranes, geosynthetic clay liners, and geocomposites with barrier properties.

Governments in countries such as India and Malaysia are enforcing stricter guidelines for landfill engineering, industrial waste containment, and canal lining, accelerating adoption of advanced geosynthetics designed to prevent contaminant migration and safeguard groundwater resources.

Meanwhile, the reinforcement segment continues to dominate in road construction and slope stabilization, where geogrids and geotextiles enhance structural durability. Drainage and filtration functions are seeing stable demand in hydraulic engineering, landfills, and sub-surface drainage systems, supported by ongoing urban development and infrastructure renewal programs.

The erosion control segment is gaining traction in coastal protection and riverbank stabilization, particularly in Bangladesh and Vietnam, where climate resilience is a national priority. Separation and stabilisation functions remain fundamental across transport and civil engineering works, ensuring sustained demand for versatile geosynthetic solutions.

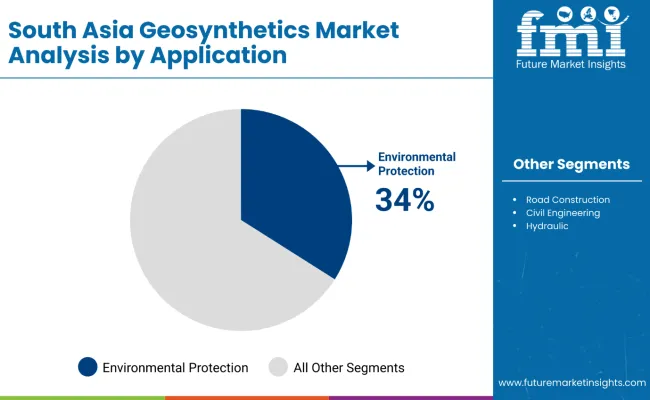

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Environmental Protection | 7.6% |

The environmental protection segment is expected to grow at the fastest CAGR of 7.6% from 2025 to 2035. This growth is fueled by increasing investments in sustainable waste management, landfill engineering, and water resource protection across South Asia. National policies in countries such as India, Vietnam, and Malaysia are prioritizing hazardous waste containment, groundwater protection, and erosion control in line with global environmental commitments.

Geosynthetics especially geomembranes, geosynthetic clay liners, and geocomposites are integral to the design of modern landfill caps, industrial waste ponds, and canal linings that meet stringent regulatory requirements. Their lightweight, durable, and cost-effective properties enable rapid deployment while delivering long-term protection against environmental contamination.

Meanwhile, road construction continues to dominate overall geosynthetics demand, driven by massive investments in highway expansion, rural connectivity, and urban mobility projects. Geotextiles and geogrids remain essential for soil stabilization and pavement reinforcement in these applications.

The civil engineering and hydraulic segments maintain robust demand for erosion control, drainage, and structural reinforcement applications in bridges, tunnels, and canal networks. The construction segment also leverages geosynthetics for foundation stabilization and ground improvement in residential and commercial buildings.

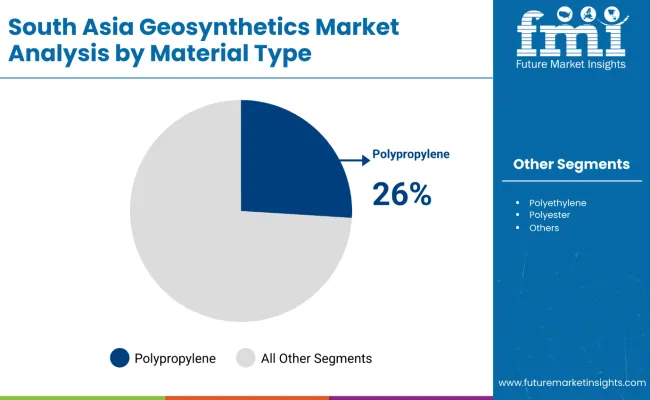

| Material Type Segment | CAGR (2025 to 2035) |

|---|---|

| Polypropylene | 7.2% |

The polypropylene segment is projected to grow at the fastest CAGR of 7.2% between 2025 and 2035. Its rise is driven by the material’s superior chemical resistance, mechanical strength, and cost-efficiency across a broad spectrum of geosynthetics.

Polypropylene-based geotextiles, geogrids, and geocomposites are highly preferred in road construction, civil engineering, and erosion control due to their lightweight, UV resistance, and durability under harsh environmental conditions. In South Asia, polypropylene geosynthetics are increasingly used in highway projects, coastal defenses, and landfill engineering, where performance and lifecycle cost are critical considerations.

Meanwhile, polyethylene remains vital in the geomembranes segment, particularly in waterproofing, canal lining, and hazardous waste containment. Its excellent flexibility and chemical resistance drive continued demand. Polyester is widely used in high-strength geotextiles and reinforcement applications, offering superior creep resistance for long-term soil stabilization. Polyvinyl chloride (PVC) maintains niche demand in flexible membranes and temporary containment solutions.

Natural fibers, though limited in large-scale infrastructure, are finding applications in bioengineering, temporary erosion control, and low-impact construction. The others category including rubber, bitumen, fiberglass, and polystyrene supports specialized applications such as lightweight fills, acoustic barriers, and energy dissipation layers.

Lack of Standardization and Skilled Implementation

Despite rising demand, the South Asia geosynthetics market faces a key obstacle in the absence of uniform quality standards and limited expertise in field application. In many developing economies, awareness among contractors and project planners remains low, resulting in underutilization or misuse of geosynthetic materials.

Variability in product specifications, poor construction practices, and limited third-party testing can compromise the effectiveness of installed systems. Lack of skilled technicians for correct installation and maintenance remains a major bottleneck for market scalability.

Industry bodies and governments must work together to establish performance-based specifications, provide training programs, and create quality assurance frameworks to build trust and ensure long-term adoption.

High Cost Sensitivity in Budget-Constrained Projects

Many infrastructure projects in South Asia and parts of ASEAN are publicly funded with strict cost ceilings, which makes it difficult to integrate advanced geosynthetic solutions despite their long-term benefits. Traditional materials like stone pitching and concrete are still preferred in budget-sensitive applications, especially in rural areas.

The perception of higher upfront costs discourages decision-makers from choosing geosynthetics, even when lifecycle savings and performance enhancements are evident. Limited local manufacturing in certain countries inflates prices due to import dependency.

To address this challenge, the industry must highlight total cost of ownership (TCO) benefits, build scalable local production capacities, and provide modular geosynthetic options that fit into phased infrastructure development plans.

Infrastructure Modernization and Climate Resilience Initiatives

Major infrastructure projects-ranging from highways, airports, and ports to flood control embankments and renewable energy parks-are providing strong tailwinds for geosynthetics. The need for resilient and low-maintenance infrastructure amid rising climate risks is creating a long-term opportunity for these materials across SAARC, ASEAN, and Oceania.

Governments are increasingly embedding climate adaptation strategies into infrastructure design, where geosynthetics offer measurable performance in soil stabilization, water containment, and structural reinforcement. International funding bodies (ADB, World Bank) are also prioritizing sustainable engineering solutions, driving procurement of environmentally approved geosynthetic systems.

Rapid Adoption in Water Resource Management and Mining

The rising pressure on freshwater conservation, irrigation efficiency, and mine safety is accelerating demand for geomembranes, geotextiles, and drainage composites. These are crucial in canal lining, tailings dam construction, mine slope stabilization, and storm water harvesting.

SAARC countries like India and Pakistan are modernizing irrigation infrastructure with seepage control systems, while Indonesia, Australia, and the Philippines are deploying geosynthetics in open-pit and underground mining operations to ensure containment and prevent contamination.

The ability of geosynthetics to offer quick installation, lower maintenance, and improved durability in harsh environments makes them a preferred solution in these sectors.

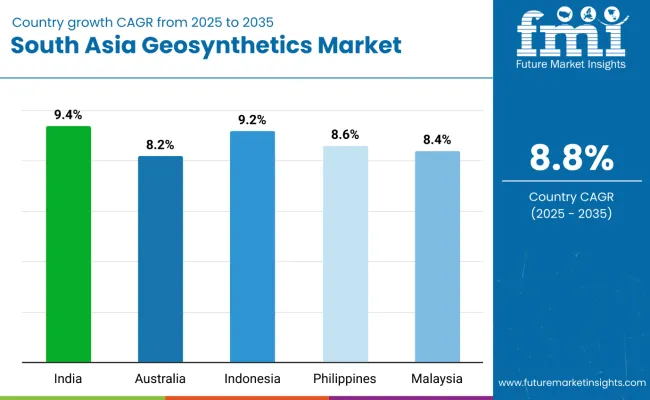

The geosynthetics market in India is experiencing exponential growth, primarily due to the government-initiated construction, new urban developments, and a change towards environmental-friendly construction methods. The ongoing road projects like Bharatmala, Smart Cities Mission, and river linking schemes have greatly contributed to the use of geotextiles, geomembranes, and geogrids in construction of road, canal lining, and erosion control.

Geosynthetics are experiencing high demand in ongoing investment railway modernization and landfills. Government's aim to provide inexpensive and yet long-lasting solutions through geosynthetics in soil stabilization and slope protection has dedicated the material to the public construction field while also making them popular in the private.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.4% |

The Australia geosynthetics market is growing steadily due to demand for climate-resilient infrastructure, mining sector expansion, and coastal protection needs. Geosynthetics are largely used in tailings dam construction, mine closure planning, and water management within mining operations.

Australia’s ecological erosion, bushfires, and floods are the key-state drivers of using stabilization and reinforcement mats, geocells, and geotextiles in public infrastructure and private land rehabilitation. Government focus on pursuing the circular economy and geosynthetics recycling is also creating innovation opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 8.2% |

The Indonesia geosynthetics market is undergoing a huge expansion, primarily as a result of various infrastructure projects, land reclamation, and port expansion. Some of the most significant initiatives like creating the new capital city (Nusantara) and Trans-Sumatra toll roads are behind the marked spike in the use of geotextiles and geogrids for subgrade stabilization, soil separation, and drainage.

Indonesia's fragile position against soil liquefaction and erosion, which is more pronounced in coastal along with seismically active areas, has made geosynthetics a vital component in slope reinforcement and embankment protection. The increase in private investments in maritime and airport infrastructures is contributing to the overall growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Indonesia | 9.2% |

The Philippines geosynthetics market is seeing consistent growth, driven by climate-resilient infrastructure needs, disaster recovery programs, and urban expansion. The country’s Build Better More program emphasizes road, bridge, and flood control projects, many of which involve the deployment of geotextiles, geomembranes, and geocells.

The archipelago's frequent typhoons and landslides create strong demand for erosion control solutions, particularly in vulnerable hillside communities. Urban drainage systems and landfill upgrades in Metro Manila are boosting the use of geosynthetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Philippines | 8.6% |

The geosynthetics market in Malaysia is quite stable, primarily due to urban infrastructural development, projects like flood mitigation, and the setting up of industrial parks and the expansion of landfill sites. The country's coastal vulnerability and increasing rainfall are resulting in the drainage system and slope protection coming under the priority list which is mostly where geotextiles, geonets, and geocomposites are widely used.

Malaysia's palm oil industry which has been associated with the waste containment issues has caused the use of geomembranes and liners. As a part of the government's plan for the promotion of smart cities and sustainable infrastructure with further use of geosynthetics, the railroad construction is assumed to develop.

| Country | CAGR (2025 to 2035) |

|---|---|

| Malaysia | 8.4% |

The South Asia geosynthetics market is experiencing robust growth, driven by infrastructure development, highway expansion, mining, and water resource management initiatives across countries like India, Bangladesh, Sri Lanka, Nepal, and Pakistan. Geosynthetics, including geotextiles, geomembranes, geogrids, geonets, and geofoam, are essential in applications such as soil reinforcement, erosion control, drainage, separation, and containment.

Government-backed projects like India's Bharatmala and Smart Cities Mission, Bangladesh’s Padma Bridge development, and Pakistan’s CPEC (China-Pakistan Economic Corridor) infrastructure expansion are significantly contributing to the rising demand for geosynthetic solutions in the region.

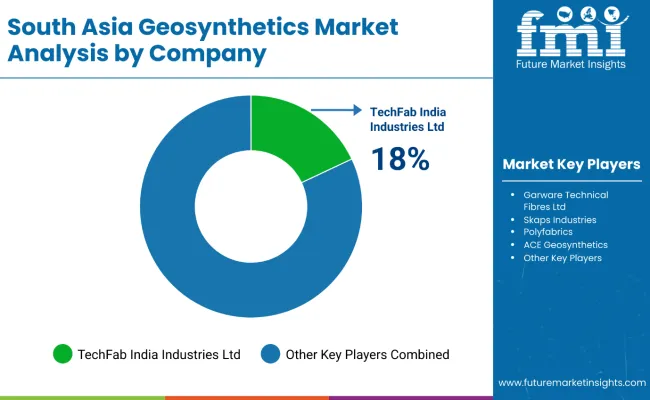

The market is characterized by a mix of regional manufacturers and global players with local manufacturing bases, focusing on cost-effective, durable, and environment-friendly materials. Local players are gaining ground due to proximity to key projects, competitive pricing, and customization capabilities. The top five regional companies together account for approximately 25-28% of the total market share, while the rest is fragmented among small to mid-sized producers and distributors.

TechFab India Industries Ltd.

TechFab India is an Indian company that stands at the forefront of geosynthetics manufacturing and boasts a strong range of woven and nonwoven geotextiles, geogrids, and geocomposites. It has provided products for several railways, highway, and irrigation canal projects amongst the other major Indian infrastructure projects. The competitive edge that the company possesses is due to the in-house testing facilities and R&D center that allow it to meet any customized requirements. It also exports to neighboring South Asian markets.

Garware Technical Fibres Ltd.

Garware is celebrated for its exclusive geotextiles and erosion control systems, which are extensively used in coastal, riverbank, and slope protection. The company has the capacity to produce durable, UV-resistant, and high-tensile geosynthetic products by utilizing its know-how in technical textiles. With manufacturing facilities in Pune and an expanding footprint in Bangladesh and Sri Lanka, Garware is gaining ground as a preferred supplier in infrastructure and water conservation projects.

Terram Geosynthetics Pvt. Ltd.

Under the banner of Berry Global, Terram India produces nonwoven geotextiles, geocells, geonets, and drainage products. The company offers solutions for a wide range of civil and environmental engineering projects, such as highways, landfill lining systems, and retaining walls. Terram’s products are appreciated for their filtration performance, chemical resistance, and dimensional stability that cater to the needs of diverse geographies in South Asia.

Skaps Industries

Skaps runs manufacturing units in Gujarat, India, where it fabricates HDPE and LLDPE geomembranes, geonets, and composite materials. These are extensively employed at landfills, aquaculture ponds, canals, and mining containment systems. The company is handling projects in Nepal and Sri Lanka, leveraging its competitive manufacturing base while sticking to international quality standards.

Strata Geosystems (India) Pvt. Ltd.

Strata Geosystems is oriented on reinforcement and stabilization systems primarily using the patented StrataGrid® geogrids and StrataWeb® geocells. These are utilized in constructions of retaining walls, embankments, and applications related to load support. Strata has partnered with the National Highway Authority of India (NHAI) and is looking for new PPP projects in the region as well.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3 Billion |

| Projected Market Size (2035) | USD 7.1 Billion |

| CAGR (2025 to 2035) | 8.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square meters for volume |

| Products Analyzed (Segment 1) | Geogrids, Geotextiles, Geocells, Geonets, Geocomposites, Geomembranes, Geosynthetic Clay Liners, Others |

| Applications Analyzed (Segment 2) | Road Construction, Civil Engineering, Environmental Protection, Hydraulic Construction, Others |

| Materials Analyzed (Segment 3) | Polypropylene, Polyethylene, Polyester, Polyvinyl Chloride, Natural Fibers, Others |

| Primary Functions Analyzed (Segment 4) | Stabilisation, Reinforcement, Drainage, Erosion Control, Filtration, Separation, Barrier & Protection |

| Countries Covered | India, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Australia, New Zealand, Rest of South Asia |

| Key Players influencing the South Asia Geosynthetics Market | Polyfabrics, Maccaferri Environmental Solutions Pvt. Ltd., Maharshee Geomembrane, Megaplast India Pvt. Ltd., Siddhi Vinayak Engineering & Fabricators, GEO & ENVIRONMENTAL SERVICES, ACE Geosynthetics, Techno Fabrics Pvt. Ltd., Parsons Geosynthetics, Naue Geosynthetics, Others |

| Additional Attributes | Market size in dollar sales and CAGR, share by product type (geotextiles, geomembranes, geogrids), application trends (roadways, waste management, waterworks), country-wise dollar sales, competitive dollar sales, raw material trends, regulatory and infrastructure developments. |

Geogrids, Geotextiles, Geocells, Geonets, Geocomposites, Geomembranes, Geosynthetic clay liners, Others

Road Construction, Civil Engineering, Environmental Protection, Hydraulic, Construction, Others

Polypropylene, Polyethylene, Polyester, Polyvinyl Chloride, Natural Fibers, Others

Stabilisation, Reinforcement, Drainage, Erosion control, Filtration, Separation, Barrier & Protection

India, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Australia, New Zealand, Rest of South Asia

The South Asia market is expected to reach USD 7.1 billion by 2035, growing from USD 3 billion in 2025, at a CAGR of 8.8% during the forecast period.

The polypropylene segment is projected to dominate the market, driven by its cost-effectiveness, superior chemical resistance, and widespread adoption in soil stabilization, erosion control, and landfill liner applications across infrastructure and environmental projects.

The transportation infrastructure segment is the leading contributor, supported by significant investments in highway, railway, and airport construction projects, where geosynthetics are used to improve soil performance and structural stability.

Key drivers include rapid urbanization, rising investments in infrastructure development, increasing focus on sustainable construction, growing environmental regulations, and the expanding use of geosynthetics for soil reinforcement and water management solutions.

Top companies include TenCate Geosynthetics, GSE Environmental, NAUE GmbH & Co. KG, Fibertex Nonwovens, and Garware Technical Fibres, known for their advanced product offerings, innovative solutions, and strong regional distribution networks.

Table 01: South Asia Industry Volume (million Sq. Meter), Historical 2018 to 2022 by Product Type

Table 02: South Asia Industry Volume (million Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 03: South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 04: South Asia Industry Volume (million Sq. Meter), Historical 2018 to 2022 by Material Type

Table 05: South Asia Industry Volume (million Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 06: South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 07: South Asia Industry Volume (million Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 08: South Asia Industry Volume (million Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 09: South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 10: South Asia Industry Volume (million Sq. Meter), Historical 2018 to 2022 by Application

Table 11: South Asia Industry Volume (million Sq. Meter), Forecast 2023 to 2033 by Application

Table 12: South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 13: South Asia Industry Volume (million Sq. Meter), Historical 2018 to 2022 by Country

Table 14: South Asia Industry Volume (million Sq. Meter), Forecast 2023 to 2033 by Country

Table 15: South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Country

Table 16: India Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Region

Table 17: India Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Region

Table 18: India Industry Value (US$ million), Forecast 2023 to 2033 by Region

Table 19: India Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 20: India Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 21: India Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 22: India Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 23: India Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 24: India Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 25: India Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 26: India Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 27: India Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 28: India Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 29: India Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 30: India Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 31: Indonesia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 32: Indonesia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 33: Indonesia Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 34: Indonesia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 35: Indonesia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 36: Indonesia Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 37: Indonesia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 38: Indonesia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 39: Indonesia Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 40: Indonesia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 41: Indonesia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 42: Indonesia Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 43: Malaysia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 44: Malaysia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 45: Malaysia Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 46: Malaysia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 47: Malaysia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 48: Malaysia Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 49: Malaysia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 50: Malaysia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 51: Malaysia Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 52: Malaysia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 53: Malaysia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 54: Malaysia Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 55: Thailand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 56: Thailand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 57: Thailand Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 58: Thailand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 59: Thailand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 60: Thailand Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 61: Thailand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 62: Thailand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 63: Thailand Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 64: Thailand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 65: Thailand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 66: Thailand Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 67: Vietnam Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 68: Vietnam Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 69: Vietnam Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 70: Vietnam Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 71: Vietnam Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 72: Vietnam Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 73: Vietnam Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 74: Vietnam Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 75: Vietnam Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 76: Vietnam Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 77: Vietnam Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 78: Vietnam Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 79: Philippines Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 80: Philippines Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 81: Philippines Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 82: Philippines Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 83: Philippines Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 84: Philippines Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 85: Philippines Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 86: Philippines Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 87: Philippines Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 88: Philippines Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 89: Philippines Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 90: Philippines Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 91: Australia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Region

Table 92: Australia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Region

Table 93: Australia Industry Value (US$ million), Forecast 2023 to 2033 by Region

Table 94: Australia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 95: Australia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 96: Australia Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 97: Australia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 98: Australia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 99: Australia Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 100: Australia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 101: Australia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 102: Australia Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 103: Australia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 104: Australia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 105: Australia Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 106: New Zealand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 107: New Zealand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 108: New Zealand Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 109: New Zealand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 110: New Zealand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 111: New Zealand Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 112: New Zealand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 113: New Zealand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 114: New Zealand Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 115: New Zealand Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 116: New Zealand Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 117: New Zealand Industry Value (US$ million), Forecast 2023 to 2033 by Application

Table 118: Rest of South Asia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Product Type

Table 119: Rest of South Asia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Product Type

Table 120: Rest of South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Product Type

Table 121: Rest of South Asia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Material Type

Table 122: Rest of South Asia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Material Type

Table 123: Rest of South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Material Type

Table 124: Rest of South Asia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Primary Function

Table 125: Rest of South Asia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Primary Function

Table 126: Rest of South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Primary Function

Table 127: Rest of South Asia Industry Volume (Th Sq. Meter), Historical 2018 to 2022 by Application

Table 128: Rest of South Asia Industry Volume (Th Sq. Meter), Forecast 2023 to 2033 by Application

Table 129: Rest of South Asia Industry Value (US$ million), Forecast 2023 to 2033 by Application

Figure 01: South Asia Industry Historical Volume (million Sq. Meter), 2018 to 2022

Figure 02: South Asia Industry Current and Forecast Volume (million Sq. Meter), 2023 to 2033

Figure 03: South Asia Industry Historical Value (US$ million), 2018 to 2022

Figure 04: South Asia Industry Current and Forecast Value (US$ million), 2023 to 2033

Figure 05: South Asia Industry Incremental $ Opportunity (US$ million), 2023 to 2033

Figure 06: South Asia Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 07: South Asia Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 08: South Asia Industry Attractiveness by Product Type, 2023 to 2033

Figure 09: South Asia Industry Absolute $ Opportunity by Geogrids Segment

Figure 10: South Asia Industry Absolute $ Opportunity by Geotextiles Segment

Figure 11: South Asia Industry Absolute $ Opportunity by Geocells Segment

Figure 12: South Asia Industry Absolute $ Opportunity by Geonets Segment

Figure 13: South Asia Industry Absolute $ Opportunity by Geocomposites Segment

Figure 14: South Asia Industry Absolute $ Opportunity by Geomembranes Segment

Figure 15: South Asia Industry Absolute $ Opportunity by clay liners Segment

Figure 16: South Asia Industry Absolute $ Opportunity by Others Segment

Figure 17: South Asia Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 18: South Asia Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 19: South Asia Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 20: South Asia Industry Absolute $ Opportunity by Polypropylene Segment

Figure 21: South Asia Industry Absolute $ Opportunity by Polyethylene Segment

Figure 22: South Asia Industry Absolute $ Opportunity by Polyester Segment

Figure 23: South Asia Industry Absolute $ Opportunity by Polyvinyl Chloride Segment

Figure 24: South Asia Industry Absolute $ Opportunity by Natural Fibers Segment

Figure 25: South Asia Industry Absolute $ Opportunity by Others Segment

Figure 26: South Asia Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 27: South Asia Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 28: South Asia Industry Attractiveness by Primary Function, 2023 to 2033

Figure 29: South Asia Industry Absolute $ Opportunity by Stabilization Segment

Figure 30: South Asia Industry Absolute $ Opportunity by Reinforcement Segment

Figure 31: South Asia Industry Absolute $ Opportunity by Drainage Segment

Figure 32: South Asia Industry Absolute $ Opportunity by Erosion control Segment

Figure 33: South Asia Industry Absolute $ Opportunity by Filtration Segment

Figure 34: South Asia Industry Absolute $ Opportunity by Separation Segment

Figure 35: South Asia Industry Absolute $ Opportunity by Barrier & Protection Segment

Figure 36: South Asia Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 37: South Asia Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 38: South Asia Industry Attractiveness Index By Application, 2023 to 2033

Figure 39: South Asia Industry Absolute $ Opportunity by Road Construction Segment

Figure 40: South Asia Industry Absolute $ Opportunity by Civil Engineering Segment

Figure 41: South Asia Industry Absolute $ Opportunity by Environmental Protection Segment

Figure 42: South Asia Industry Absolute $ Opportunity by Hydraulic Construction Segment

Figure 43: South Asia Industry Absolute $ Opportunity by Others Segment

Figure 44: South Asia Industry Share and BPS Analysis by Country– 2023 & 2023

Figure 45: South Asia Industry Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 46: South Asia Industry Attractiveness by Country, 2023 to 2033

Figure 47: South Asia Industry Absolute $ Opportunity by India Segment

Figure 48: South Asia Industry Absolute $ Opportunity by Bangladesh Segment

Figure 49: South Asia Industry Absolute $ Opportunity by Indonesia Segment

Figure 50: South Asia Industry Absolute $ Opportunity by Malaysia Segment

Figure 51: South Asia Industry Absolute $ Opportunity by Thailand Segment

Figure 52: South Asia Industry Absolute $ Opportunity by Philippines Segment

Figure 53: South Asia Industry Absolute $ Opportunity by Australia Segment

Figure 54: South Asia Industry Absolute $ Opportunity by Rest of South Asia Segment

Figure 55: India Industry Share and BPS Analysis by Region– 2023 & 2023

Figure 56: India Industry Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 57: India Industry Attractiveness by Region, 2023 to 2033

Figure 58: India Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 59: India Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 60: India Industry Attractiveness by Product Type, 2023 to 2033

Figure 61: India Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 62: India Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 63: India Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 64: India Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 65: India Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 66: India Industry Attractiveness by Primary Function, 2023 to 2033

Figure 67: India Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 68: India Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 69: India Industry Attractiveness Index By Application, 2023 to 2033

Figure 70: Indonesia Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 71: Indonesia Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 72: Indonesia Industry Attractiveness by Product Type, 2023 to 2033

Figure 73: Indonesia Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 74: Indonesia Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 75: Indonesia Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 76: Indonesia Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 77: Indonesia Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 78: Indonesia Industry Attractiveness by Primary Function, 2023 to 2033

Figure 79: Indonesia Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 80: Indonesia Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 81: Indonesia Industry Attractiveness Index By Application, 2023 to 2033

Figure 82: Malaysia Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 83: Malaysia Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 84: Malaysia Industry Attractiveness by Product Type, 2023 to 2033

Figure 85: Malaysia Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 86: Malaysia Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 87: Malaysia Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 88: Malaysia Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 89: Malaysia Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 90: Malaysia Industry Attractiveness by Primary Function, 2023 to 2033

Figure 91: Malaysia Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 92: Malaysia Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 93: Malaysia Industry Attractiveness Index By Application, 2023 to 2033

Figure 94: Thailand Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 95: Thailand Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 96: Thailand Industry Attractiveness by Product Type, 2023 to 2033

Figure 97: Thailand Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 98: Thailand Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 99: Thailand Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 100: Thailand Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 101: Thailand Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 102: Thailand Industry Attractiveness by Primary Function, 2023 to 2033

Figure 103: Thailand Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 104: Thailand Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 105: Thailand Industry Attractiveness Index By Application, 2023 to 2033

Figure 106: Vietnam Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 107: Vietnam Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 108: Vietnam Industry Attractiveness by Product Type, 2023 to 2033

Figure 109: Vietnam Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 110: Vietnam Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 111: Vietnam Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 112: Vietnam Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 113: Vietnam Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 114: Vietnam Industry Attractiveness by Primary Function, 2023 to 2033

Figure 115: Vietnam Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 116: Vietnam Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 117: Vietnam Industry Attractiveness Index By Application, 2023 to 2033

Figure 118: Philippines Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 119: Philippines Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 120: Philippines Industry Attractiveness by Product Type, 2023 to 2033

Figure 121: Philippines Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 122: Philippines Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 123: Philippines Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 124: Philippines Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 125: Philippines Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 126: Philippines Industry Attractiveness by Primary Function, 2023 to 2033

Figure 127: Philippines Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 128: Philippines Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 129: Philippines Industry Attractiveness Index By Application, 2023 to 2033

Figure 130: Australia Industry Share and BPS Analysis by Region– 2023 & 2023

Figure 131: Australia Industry Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 132: Australia Industry Attractiveness by Region, 2023 to 2033

Figure 133: Australia Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 134: Australia Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 135: Australia Industry Attractiveness by Product Type, 2023 to 2033

Figure 136: Australia Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 137: Australia Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 138: Australia Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 139: Australia Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 140: Australia Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 141: Australia Industry Attractiveness by Primary Function, 2023 to 2033

Figure 142: Australia Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 143: Australia Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 144: Australia Industry Attractiveness Index By Application, 2023 to 2033

Figure 145: New Zealand Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 146: New Zealand Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 147: New Zealand Industry Attractiveness by Product Type, 2023 to 2033

Figure 148: New Zealand Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 149: New Zealand Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 150: New Zealand Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 151: New Zealand Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 152: New Zealand Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 153: New Zealand Industry Attractiveness by Primary Function, 2023 to 2033

Figure 154: New Zealand Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 155: New Zealand Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 156: New Zealand Industry Attractiveness Index By Application, 2023 to 2033

Figure 157: Rest of South Asia Industry Share and BPS Analysis by Product Type– 2023 & 2023

Figure 158: Rest of South Asia Industry Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 159: Rest of South Asia Industry Attractiveness by Product Type, 2023 to 2033

Figure 160: Rest of South Asia Industry Share and BPS Analysis By Material Type – 2023 & 2023

Figure 161: Rest of South Asia Industry Y-o-Y Growth Projection By Material Type, 2023 to 2033

Figure 162: Rest of South Asia Industry Attractiveness Index By Material Type, 2023 to 2033

Figure 163: Rest of South Asia Industry Share and BPS Analysis by Primary Function– 2023 & 2023

Figure 164: Rest of South Asia Industry Y-o-Y Growth Projections by Primary Function, 2023 to 2033

Figure 165: Rest of South Asia Industry Attractiveness by Primary Function, 2023 to 2033

Figure 166: Rest of South Asia Industry Share and BPS Analysis By Application– 2023 & 2023

Figure 167: Rest of South Asia Industry Y-o-Y Growth Projection By Application, 2023 to 2033

Figure 168: Rest of South Asia Industry Attractiveness Index By Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Geosynthetics Market Growth - Trends & Forecast 2025 to 2035

Demand for Geosynthetics in South Asia Size and Share Forecast Outlook 2025 to 2035

Reinforcement Geosynthetics Market Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA