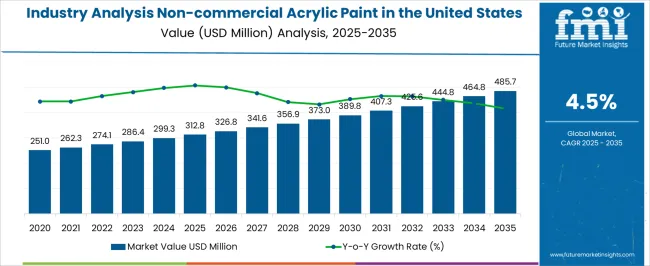

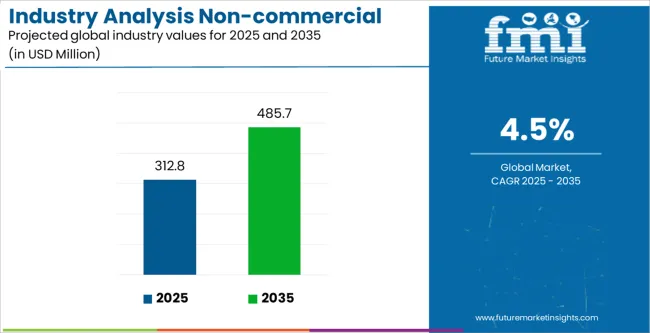

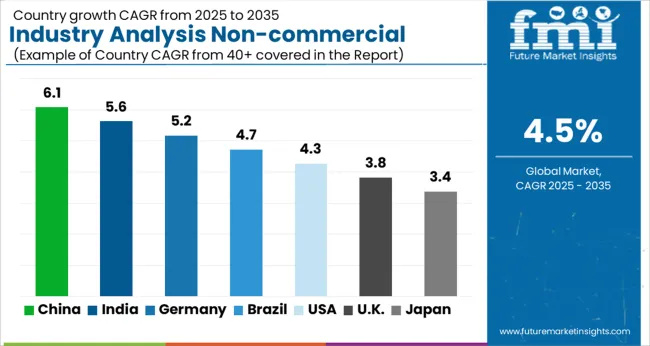

The Industry Analysis Non-commercial Acrylic Paint in the United States is estimated to be valued at USD 312.8 million in 2025 and is projected to reach USD 485.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Industry Analysis Non-commercial Acrylic Paint in the United States Estimated Value in (2025 E) | USD 312.8 million |

| Industry Analysis Non-commercial Acrylic Paint in the United States Forecast Value in (2035 F) | USD 485.7 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The non-commercial acrylic paint market in the United States is demonstrating strong performance, supported by rising demand for premium art supplies and the growth of creative practices across professional and recreational segments. Industry publications and company press releases have highlighted increasing consumer spending on art materials, driven by trends in home décor, art education, and hobbyist activities.

Heavy investments by manufacturers in pigment innovation and eco-friendly formulations have expanded the appeal of acrylic paints to both established artists and emerging creators. Additionally, sustainability-focused initiatives, such as low-VOC and water-based formulations, are shaping product portfolios, aligning with consumer preferences for safe and environmentally responsible art materials.

The accessibility of acrylic paints through diverse retail channels, including art supply stores and online platforms, has further broadened market reach. Future growth is expected to be sustained by product innovations that enhance texture, drying time, and color vibrancy, alongside continued promotion of art programs and workshops across educational and community settings.

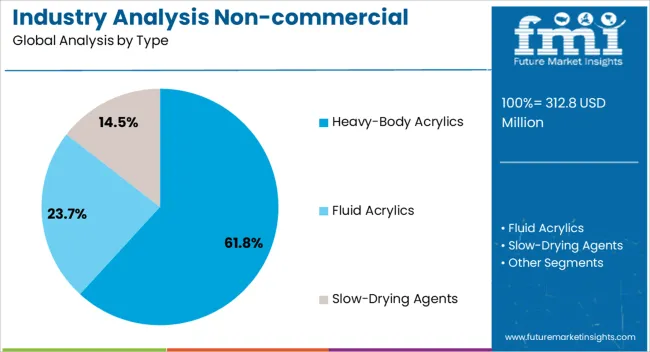

The Heavy-Body Acrylics segment is projected to contribute 61.8% of the non-commercial acrylic paint market revenue in the United States in 2025, maintaining its dominant position in type usage. Growth in this segment has been driven by the high viscosity and pigment load of heavy-body paints, which provide superior texture, opacity, and blending capabilities valued by professional and advanced hobbyist artists.

Reports from art supply manufacturers have emphasized the segment’s popularity for its ability to replicate traditional oil painting effects while offering faster drying times. Additionally, the flexibility of heavy-body acrylics across multiple techniques, including impasto and layering, has reinforced their market strength.

The segment has also benefited from the expansion of artist communities and art education programs that prioritize heavy-body acrylics for advanced instruction. As creative professionals continue to favor materials that allow expressive depth and long-lasting finishes, the Heavy-Body Acrylics segment is expected to retain its leadership.

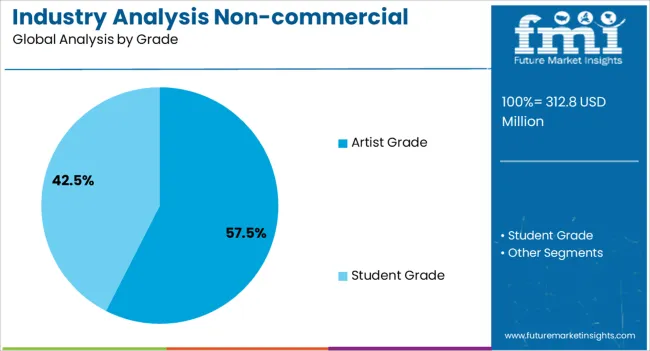

The Artist Grade segment is projected to account for 57.5% of the non-commercial acrylic paint market revenue in the United States in 2025, securing its position as the leading grade category. This dominance has been supported by the segment’s superior pigment concentration, archival quality, and extensive color range, which have been consistently favored by professional and semi-professional users.

Industry updates have indicated that artist-grade paints are preferred for their durability, lightfastness, and ability to maintain vibrancy over time, essential for works displayed in galleries or sold in the art market. Manufacturers have continued to introduce expanded palettes and specialty colors in the artist-grade range, enhancing creative possibilities.

Furthermore, the segment’s growth has been strengthened by art institutions and higher education programs that recommend or require the use of artist-grade materials. As consumer willingness to invest in high-quality art supplies increases, the Artist Grade segment is expected to remain the benchmark for serious art creation.

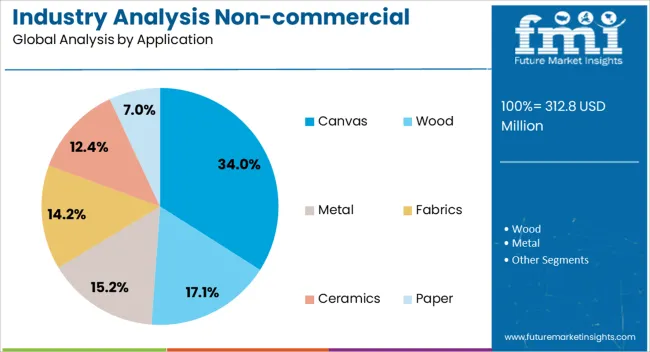

The Canvas segment is projected to contribute 34.0% of the non-commercial acrylic paint market revenue in the United States in 2025, leading the application category. This growth has been driven by the long-standing tradition of canvas as the primary surface for acrylic painting in both professional and recreational settings.

Canvas provides durability, texture, and compatibility with heavy applications of paint, making it the preferred medium for showcasing acrylic artworks. Industry announcements and academic art programs have consistently emphasized canvas as the standard platform for instruction and exhibition, reinforcing its market prominence.

Additionally, the availability of pre-stretched, primed, and eco-friendly canvas options has expanded adoption across different consumer groups. The canvas application segment has also been bolstered by demand in community art workshops, galleries, and at-home creative practices. With its ability to highlight the depth, vibrancy, and permanence of acrylic paints, the Canvas segment is expected to continue leading market applications.

More Americans are Getting their Hands Dirty with the Rise of DIY Culture

More people are enjoying doing things themselves, like painting, to express themselves. Acrylic paints are getting more attention because they are easy to use and also versatile. People like to use non-commercial acrylic paints because they are affordable. This is good for trying out painting without spending too much.

The trend shows that more individuals in the United States want to be creative and make things their own way. They also sell their painted products. So, the DIY art supplies industry, especially acrylic paints, is getting bigger as more people want to express themselves through art.

eCommerce Boom Boosts Sales in the United States

The way people buy art supplies, like non-commercial acrylic paints, has changed because of online shopping. Online stores offer many options and good prices, and you can shop whenever you want. This makes it easier for acrylic paint brands to reach more customers, not just those who go to stores.

Many young people shop online, so this is why the demand for non-commercial acrylic paints is growing in the United States. This shows that people like the convenience and choices of online shopping, which helps both customers and acrylic paint brands.

Sustainability is being Prioritized in the Industry

More people are concerned about the environment. They want to buy things that are good for the Earth. Non-commercial acrylic paint brands are listening to this and making changes. They use safer materials and packaging that can be recycled. This helps make less waste.

Since people want to support eco-friendly products, the demand for these paints is growing. It is a positive change because it shows that people care about the planet and want to make better choices. Like, in April 2025, Up PaintTM, an upcycled paint company, launched Up Box.

It is a first-of-its-kind solution for responsible recycling of post-consumer water-based paint. It offers a sustainable alternative to conventional paint disposal methods.

Launch of new art galleries, museums, and exhibitions can be opportunistic. Increased sales can be achieved by partnering with brands in these avenues. Implementing collaborative public art projects that engage local communities in creative expression can lead to more recognition.

Inviting people of all ages and backgrounds can foster pride and unity. This can lead to more sales of non-commercial acrylic paints in the United States.

Offering virtual painting experiences through digital platforms or mobile apps can be opportunistic. Tutorials from professional artists can attract more customers. Providing artisanal craft kits can lead to more revenues.

Businesses can provide these paints with other materials like stencils, brushes, and instructional guides. These kits can be themed around specific art styles or techniques. Offering customizable paint sets can be opportunistic. This can cater to the various needs of artists and hobbyists.

This section analyzes the demand for non-commercial acrylic paints in key regions as given in the table below. The industry is led by sales of non-commercial acrylic paints in the Northeast area. The Western part of the United States closely follows in terms of growth.

The remaining areas are likely to witness substantial growth. The Southwest United States is set to, however, proceed with a lower CAGR than the other areas.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Northeast United States | 26.3% |

| Southeast United States | 19.7% |

| Southwest United States | 14.5% |

| Midwest United States | 17.2% |

| West United States | 22.3% |

The demand for non-commercial acrylic paints in the Northeast United States is on the way to progress at a 26.3% CAGR through 2035. Cities like New York City and Boston are more interested in art again.

This is because they're fixing up old parts of these cities and making them creative areas. People want more art supplies, like acrylic paints, to help local artists and art projects.

Schools and hospitals are using art to help people feel better, so they need more paint, too. People care more about the environment now, so they want sustainable paints, too. And it's easier to buy paint online now, so more people are buying them online, leading to more sales in this region.

Sales of non-commercial acrylic paints in the Southeast United States are on track to increase at a 19.7% CAGR through 2035. In the Southeast, places like Asheville, Georgia, and North Carolina are becoming popular for young artists and creative people.

These cities are seeing more demand for non-commercial acrylic paints as artists try out new ideas and styles. The art communities and hubs in these cities are helping artists work together and start businesses, which is making the demand for non-commercial acrylic paints grow.

The Southeast also gets lots of tourists who come to see its history and art. People visiting want to try things like painting workshops or visit art studios, which means more demand for acrylic paints.

As more tourists come to the Southeast for its culture, the demand for art supplies and experiences that showcase the region's art traditions and diversity keeps growing.

The demand for non-commercial acrylic paints in the Southwest United States could develop at a 14.5% CAGR through 2035. Santa Fe, Sedona, and Taos are the rising hubs for galleries and artists in the Southwest. Albuquerque and Tucson are famous for local artworks.

The government helps here by funding for arts. Like, in June 2025, Arizona received a USD 5 million allocation for the Arizona Commission on the Arts. More funds mean more demand for art supplies, which translates to more sales in the Southwest United States.

The sales of non-commercial acrylic paints in the Midwest United States will amplify at a 17.2% CAGR through 2035. Minnesota holds first place in the nation for per capita expenditure on state arts agencies. Cities like Chicago and Detroit are getting more creative. This means there's a growing interest in art and community projects.

People are using non-commercial acrylic paints for things like painting murals in public places or joining craft fairs to sell their artwork. Also, the government is allocating more funds to arts in the region. All this activity is increasing the demand for non-commercial acrylic paints in the Midwest.

The demand for non-commercial acrylic paints in the West United States is going to surge at a 22.3% CAGR through 2035. In the western United States, cities like Los Angeles and San Francisco are full of artists and creative places where people share ideas and work together.

Cities here are also big on technology and innovation, so artists often use both traditional paints and digital tools to make their art. With so many different cultures, artists mix all kinds of influences into their paintings, making them very diverse and interesting. These factors propel the sales in the Western United States.

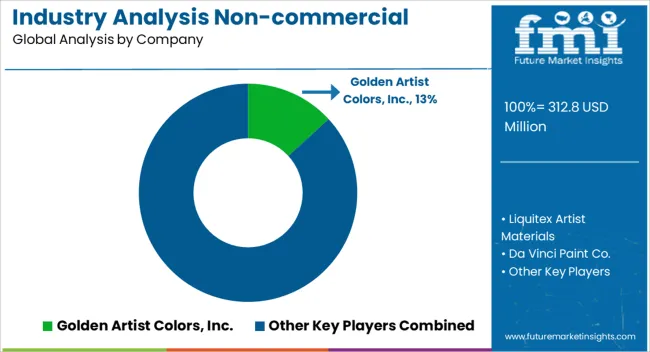

Established companies such as Liquitex and Golden Artist Colors dominate the United States non-commercial acrylic paint industry, owing to their brand awareness and broad product offerings.

New entrants and specialized players are challenging this supremacy with novel products. Industry rivalry is fueled by shifting customer tastes, technology improvements, and price strategies.

Recent Development

In August 2025, Engineered Polymer Solutions (EPS) launched EPS 2786, a new all-acrylic polymer for top-notch gloss interior and exterior architectural DIY and/or professional paints.

| Report Attributes | Details |

|---|---|

| Current Market Size (2025) | USD 299.3 million |

| Projected Market Size (2035) | USD 466.5 million |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projection Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD million |

| by Type | Fluid Acrylics, Heavy-Body Acrylics, Slow-Drying Agents |

| by Grade | Artist Grade, Student Grade |

| By Application | Wood, Metal, Fabrics, Ceramics, Canvas, Paper |

| by Sales Channel | Online, Offline |

| Regions Covered | West (USA), Midwest (USA), Northeast (USA), South (USA) |

| Key Players | Golden Artist Colors, Inc., Liquitex Artist Materials, Da Vinci Paint Co., Chroma Atelier, Crafts 4 All, Daler-Rowney, Faber-Castell, Winsor & Newton, Koninklijke Royal Talens B.V., Reeves, M. Graham & Co., PEBEO SAS, HK Holbein Inc., Decoart Inc., Mont Marie |

| Additional Attributes | Growth in DIY culture, eco-friendly formulations, digital art integration |

| Customization and Pricing | Available upon request |

The industry trifurcates into fluid acrylics, heavy-body acrylics, and slow-drying agents by type.

The sector bifurcates into artist grade and student grade based on grade.

Non-commercial acrylic paints find application in wood, metal, fabrics, ceramics, canvas, and paper.

The sector bifurcates into online and offline based on sales channels.

The industry analysis is conducted in the Southwest, Southeast, Midwest, Northeast, and West parts of the United States.

The global industry analysis non-commercial acrylic paint in the united states is estimated to be valued at USD 312.8 million in 2025.

The market size for the industry analysis non-commercial acrylic paint in the united states is projected to reach USD 485.7 million by 2035.

The industry analysis non-commercial acrylic paint in the united states is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in industry analysis non-commercial acrylic paint in the united states are heavy-body acrylics, fluid acrylics and slow-drying agents.

In terms of grade, artist grade segment to command 57.5% share in the industry analysis non-commercial acrylic paint in the united states in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Growth in the United States – Trends & Forecast 2024-2034

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Mezcal Industry Analysis in Japan - Consumer Demand & Industry Trends in 2025

Mezcal Industry Analysis in Korea – Trends, Demand & Industry Growth

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Asia Pacific Dental Market Analysis – Growth, Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA