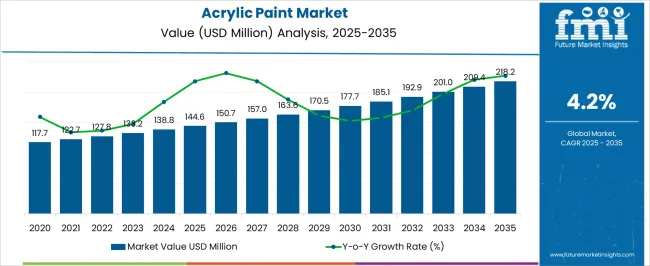

The Acrylic Paint Market is estimated to be valued at USD 144.6 million in 2025 and is projected to reach USD 218.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The Acrylic Paint market is witnessing substantial growth driven by its versatility, durability, and fast-drying properties, which make it highly suitable for a wide range of artistic, residential, and commercial applications. The market outlook is shaped by increasing demand in the construction and home improvement sectors, where aesthetic appeal, color variety, and long-lasting finishes are prioritized. Rising investments in infrastructure development, renovation projects, and interior decoration are contributing to the steady expansion of the market.

Additionally, growing awareness among consumers about eco-friendly and water-based paint options is supporting the adoption of acrylic paints. Technological advancements in paint formulations, including improved adhesion, texture, and resistance to environmental factors, are further enhancing product performance.

The shift towards modern architectural designs and customized interior solutions is boosting the need for high-quality paint products that combine functionality with aesthetic appeal As urbanization and disposable income levels rise globally, acrylic paints are expected to remain a preferred choice for both professional and DIY applications, providing ample opportunities for market growth.

| Metric | Value |

|---|---|

| Acrylic Paint Market Estimated Value in (2025 E) | USD 144.6 million |

| Acrylic Paint Market Forecast Value in (2035 F) | USD 218.2 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

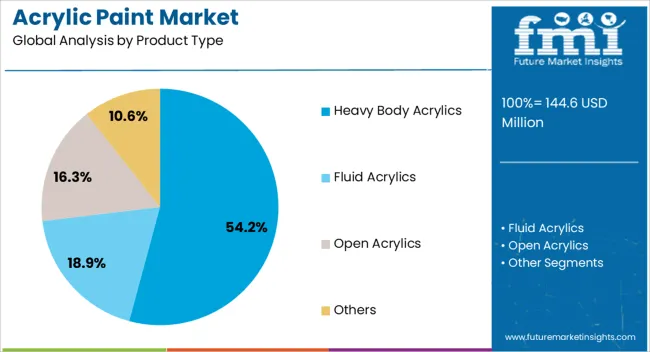

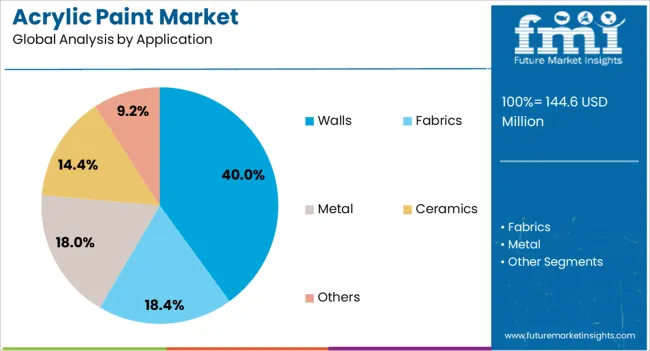

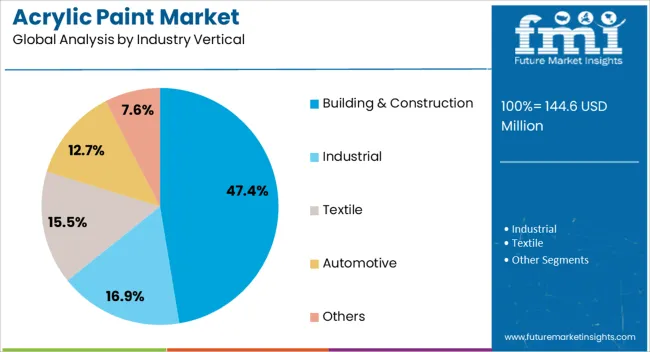

The market is segmented by Product Type, Application, and Industry Vertical and region. By Product Type, the market is divided into Heavy Body Acrylics, Fluid Acrylics, Open Acrylics, and Others. In terms of Application, the market is classified into Walls, Fabrics, Metal, Ceramics, and Others. Based on Industry Vertical, the market is segmented into Building & Construction, Industrial, Textile, Automotive, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Heavy Body Acrylics product type is projected to hold 54.20% of the Acrylic Paint market revenue share in 2025, making it the leading product type. This dominance is attributed to its high viscosity and rich pigment concentration, which allow for textured and layered painting techniques.

The segment benefits from increased adoption among professional artists and hobbyists who require superior coverage, blending capability, and color retention. The consistency and versatility of heavy body acrylics also facilitate application on various surfaces, enhancing their appeal in both artistic and decorative contexts.

Moreover, the availability of premium-quality formulations with improved lightfastness and durability has reinforced their position as the preferred choice Growing interest in creative expression, art education, and home décor projects further supports the sustained growth of this segment.

The walls application segment is expected to capture 40.00% of the Acrylic Paint market revenue share in 2025, establishing it as the leading application. The growth is driven by rising demand for interior and exterior wall finishes that offer vibrant color options, ease of application, and long-lasting durability.

Acrylic paints are increasingly preferred over conventional paints due to their resistance to fading, cracking, and moisture, which ensures enhanced performance in residential and commercial buildings. Additionally, consumer preference for low-odor, quick-drying, and eco-friendly paints has contributed to widespread adoption in wall applications.

Urbanization, rising construction activities, and aesthetic-driven renovation projects have further propelled the growth of this segment, making wall applications a dominant contributor to market revenue.

The building and construction industry vertical segment is anticipated to account for 47.40% of the Acrylic Paint market revenue in 2025, positioning it as the leading industry segment. This growth is supported by increasing construction projects, both residential and commercial, where acrylic paints are used for aesthetic finishes and protective coatings.

The adoption of modern architectural designs and interior décor solutions has heightened demand for high-quality paints that offer durability, color retention, and ease of maintenance. Additionally, rising consumer awareness about water-based, low-VOC paints aligns with sustainability trends, further boosting adoption in the construction sector.

The segment benefits from growing investment in urban infrastructure, renovation, and refurbishment projects, as well as the expanding real estate and housing markets, which together reinforce its dominant share in the Acrylic Paint market.

The historical data suggests that the acrylic paint market size changed from USD 117.7 million to USD 134.8 million from 2020 to 2025. This market progress was capped at an extremely sluggish CAGR of 2.3%.

The trending product innovation by leading acrylic paint manufacturers spurred the demand for paints. Due to the growing technological infrastructure, this was accompanied by advanced manufacturing setups.

However, the acrylic paint market growth could not break free due to COVID-19. Due to heavy restrictions, several industries were shut down, affecting the market.

| Historical CAGR from 2020 to 2025 | 2.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.2% |

The growing construction and building industry demands acrylic paints from top acrylic paint brands. Due to this, the acrylic paint market size has increased, and it is projected to enhance.

Proliferated e-commerce platforms spike the ease of distribution, assisting the acrylic paint market growth. Therefore, it is another critical demand generator.

North America will provide a wider acrylic paint market competitive landscape, as numerous competitors are actively competing in the country. Also, economic developments in the country leverage their growth in the market, fueling the acrylic paint market growth.

The growing urbanization and population in Asia-Pacific will elevate the acrylic paint market size. Moreover, governmental initiatives and policies will spur the demand trends for acrylic paints.

Sustainability guidelines and circular economy trends will encourage leading acrylic paint manufacturers to produce eco-friendly goods in Europe. Hence, this will transform the acrylic paint market’s competitive landscape in the region.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| Japan | 1.8% |

| The United States of America | 2.3% |

| Spain | 3.1% |

| China | 4.7% |

| India | 6.2% |

The Japanese acrylic paint market growth will be accelerated at a CAGR of 1.8% through 2035. The Japanese population seeks eco-friendly goods due to the rising awareness of environmental safety.

This augments the acrylic paint market size in the country, driving its growth rate. Also, non-toxic and non-volatile paints are preferred, spurring the demand for this segment in the acrylic paint market.

The United States will experience an elevated acrylic paint market size through 2035 at a CAGR of 2.3%. The growing consumer trends toward pursuing hobbies and following passion are driving the acrylic paint market growth.

The widespread awareness about personal care and growing emphasis on self-care spurs the recreational industry. These factors drive the demand for activities like painting, creating the need for acrylic paints.

The Spanish acrylic paint market size will be agitated steadily at a CAGR of 3.1% through 2035.

The Spanish educational system has included different art forms in its curriculum to ensure the wholesome growth of students. As a result, frequent requirements for colors spur the acrylic paint market growth in Spain.

The growing urbanization rate in China is attributed to the increasing population in the country. This drives the construction and building industry. Consequently, this generates demand for acrylic paints.

Commercial and non-commercial sectors are booming, requiring painting and redevelopment assignments. Thus, the Chinese acrylic paint market growth will propagate moderately at a CAGR of 4.7% through the forecasted period.

The growing concern about sustainability and the budding culture of DIY and upcycling projects spurs the demand for acrylic colors. Consumers redesign their homes with rising demand for acrylic colors.

Painting houses, refurbishing furniture, and renovating home décor are another few key drivers for the acrylic paint market growth. As a result, the Indian acrylic paint market size will increase moderately at a CAGR of 6.2%, the highest among all the countries.

Due to the growing impasto techniques, the demand for heavy-body acrylics will likely increase. Also, they will add significantly to the market growth. The construction and building industry is an important market segment, and it holds the maximum market share due to the substantial growth in the sector.

| Category | Product Type- Heavy-body Acrylics |

|---|---|

| Market Share in 2025 | 54.2% |

| Market Segment Drivers |

|

| Category | Industry Vertical- Building & Construction |

|---|---|

| Market Share in 2025 | 47.4% |

| Market Segment Drivers |

|

The global acrylic paint market is experiencing a great push due to the excessive competition in the industry. Leading acrylic paint manufacturers clutter the competitive landscape.

They employ various key expansion strategies, gaining a competitive edge. Partnerships, collaborations, product innovation, acquisitions and mergers, and international expansion are key moves benefitting them.

New entrants can negotiate a better marketplace through strategic offering of key assets against a respectable market position. Also, strategic alliances might help them gain a better marketplace. Leading acrylic paint manufacturers and new entrants fuel the acrylic paint market growth.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 144.6 million |

| Projected Market Valuation in 2035 | USD 218.2 million |

| Value-based CAGR 2025 to 2035 | 4.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | By Product Type, By Application, By Industry Vertical, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

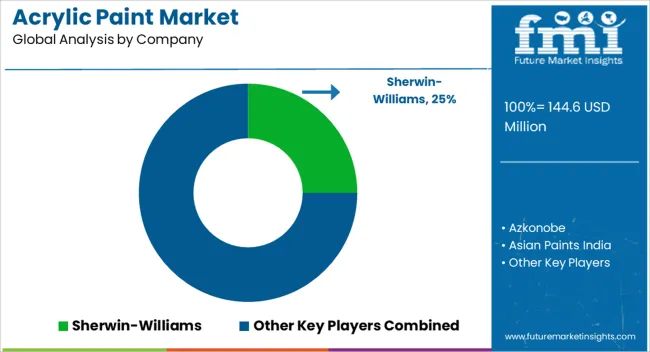

| Key Companies Profiled | Azkonobe; Asian Paints India; Basf SE; Berger Paints India; Berkshire Hathaway; Ppg Industries; The Dow Chemical; Sherwin-Williams; National Coatings; Gellner Industrial |

The global acrylic paint market is estimated to be valued at USD 144.6 million in 2025.

The market size for the acrylic paint market is projected to reach USD 218.2 million by 2035.

The acrylic paint market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in acrylic paint market are heavy body acrylics, fluid acrylics, open acrylics and others.

In terms of application, walls segment to command 40.0% share in the acrylic paint market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Paper Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Analyzing Acrylic Boxes Market Share & Industry Leaders

Acrylic Acid Market Growth - Trends & Forecast 2024 to 2034

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Acrylic Colors Market

Acrylic Container Market

Acrylic Lenses Market

Acrylic Foam Tapes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA