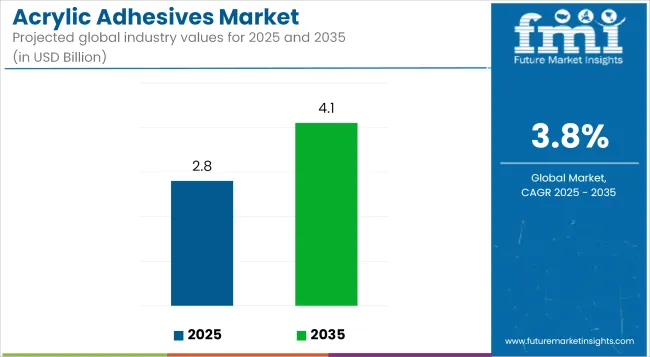

The global acrylic adhesives market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.1 billion by 2035, reflecting a CAGR of 3.8% over the forecast period. Growth is being supported by increasing adoption across automotive, construction, electronics, and packaging industries, where lightweight, high-performance bonding materials are prioritized.

Acrylic adhesives are being applied for their strong adhesion, resistance to thermal and chemical stress, and compatibility with dissimilar substrates. In automotive manufacturing, these adhesives are being used in place of mechanical fasteners for structural bonding, offering reduced vehicle weight and enhanced crash performance. According to the European Automobile Manufacturers Association (ACEA), light-weighting continues to be a key priority for achieving fuel efficiency and EV range optimization.

In electronics, acrylic adhesives are being selected for high-precision applications due to their rapid curing, high dielectric strength, and environmental stability. Dust resistance and moisture protection are enabling their use in mobile devices, printed circuit boards, and sensor assemblies. The shift toward miniaturized electronics and wearable technologies is further accelerating demand.

Packaging and construction sectors are incorporating water-based acrylic adhesives to comply with volatile organic compound (VOC) regulations enforced by the regulating agencies.Technological advancements in acrylic polymer chemistry are being utilized to enhance peel strength, elasticity, and aging resistance. As noted by Adhesives & Sealants Industry Magazine, new UV-curable and hybrid acrylic technologies are enabling faster production cycles and reduced energy consumption.

Product development pipelines are being expanded to support high-strength, temperature-resistant adhesives suitable for composite materials. Adhesive innovation is being positioned as a strategic lever for OEMs and converters to reduce cost, weight, and assembly complexity.

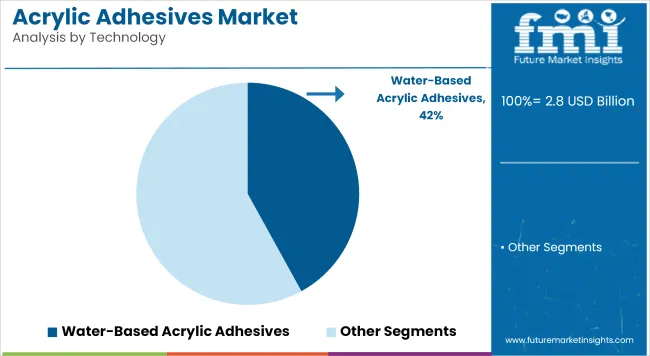

Water-based acrylic adhesives are estimated to account for approximately 42% of the global market share in 2025 and are projected to grow at a CAGR of 3.3% through 2035. These adhesives offer excellent adhesion to a variety of substrates, good UV resistance, and favorable environmental performance.

Their usage is particularly prominent in the packaging, woodworking, and pressure-sensitive label industries. The elimination of organic solvents, coupled with compliance to REACH and EPA standards, supports continued adoption across North America and Europe. Manufacturers are focusing on improving water-based acrylics' tack, shear strength, and wet surface adhesion to replace solvent-based variants in both industrial and consumer-grade applications.

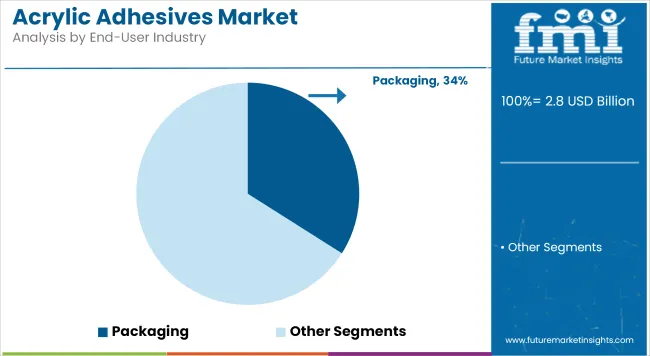

The packaging segment is projected to hold approximately 34% of the global acrylic adhesive market share in 2025 and is expected to grow at a CAGR of 3.2% through 2035. Acrylic adhesives are widely used in labeling, flexible packaging laminates, sealing tapes, and corrugated box assembly.

The growth of e-commerce, retail-ready packaging, and fast-moving consumer goods (FMCG) continues to support robust demand for acrylic adhesives, particularly in Asia-Pacific and Latin America. End users favor acrylic systems for their durability, resistance to yellowing, and compatibility with automated application equipment. As sustainability becomes a key packaging priority, water-based and repulpable acrylic adhesives are increasingly being integrated into recyclable and compostable packaging solutions.

Volatility in raw material prices

Themes oils and other petrochemical-derived component impacts Fluctuating oil prices and supply chain disruptions can lead to fluctuations in production costs and make it difficult for manufacturers to provide secure pricing. Moreover, stringent environmental regulations that encourage lower VOC emissions force adhesive manufacturers to continuously innovate, thereby imposing higher research and development costs and longer product development timelines.

Development of bio-based and sustainable adhesive solutions

As many industries around the world are turning to green manufacturing practices, renewable resource-based adhesives with reduced environmental impact are becoming more desirable. Using raw materials derived from renewable sources and implementing green chemistry approaches, manufacturers can develop adhesives that achieve the necessary performance while minimizing their impact on the environment. Such a growing interest in sustainability can offer tremendous opportunities for of differentiation and growth in the market.

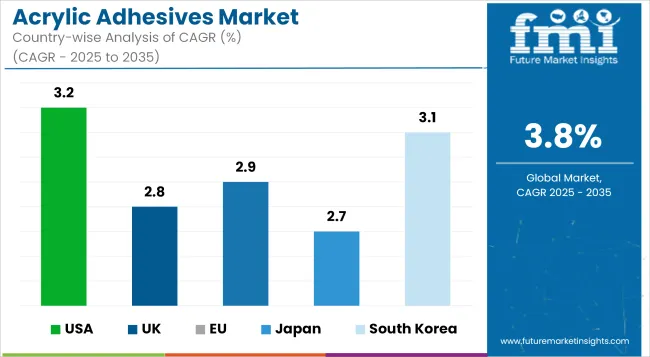

Acrylic Adhesives Market Report for Current Trends & Future Forecast The US is a significant Acrylic Adhesives Market due to its use in producing specialty chemicals, biocides, and polymer intermediates. Strong growth drivers include the well-developed chemical production industry and the growing use of acrolein in agricultural applications such as herbicides and pesticides.

Moreover, the development of waste water treatment technologies is encouraging the utilization of acrolein as a biocide to combat bacteria forming organism in the industrial water systems. Presence of prominent chemical producers, along with ongoing research on sustainable acrolein production processes, will drive growth in the market. Regulatory compliance of environmental safety standards; this remains a key factor shaping the pattern of the industry in the USA

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

The UK Acrylic Adhesives Market is gaining pace and lies on the verge of booming growth, with rising demand for acrolein derivatives in industrial processes and wastewater treatments being the answer for such growth. There is a strong focus towards sustainable and eco-friendly chemical production in the country, driving research into bio-based acrolein substitutes.

Furthermore, increasing demand for high-performance specialty chemicals from the pharmaceutical and polymer industries is driving the growth of the market. The UK’s strict environmental legislation surrounding emissions and hazardous chemical management is prompting manufacturers to turn to cleaner production methods. The future trend of the market is also likely to be driven by vigorous R&D investments for the synthesis of acrolein from deployed renewable sources of feedstock.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.8% |

In the European Union, Germany, France, and Italy lead the Acrylic Adhesives Market owing to significant demand for specialty chemicals and biocides in these regions. This has led the region's chemical industry to increase investment in green chemistry, and raised interest in the pathways through which acrolein can be produced sustainably.

Moreover, the use of acrolein in polymer formation and agricultural chemicals will also aid the growth of the market. EU regulations for chemical safety including REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals)are forcing manufacturers to look toward more innovative, less environmentally damaging production methods. The increasing adoption of acrolein-based water treatment solutions in industrial facilities to ensure compliance with environmental regulations is supporting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.9% |

Increasing utilization of acrolein in manufacturing chemical intermediates, particularly in pharmaceutical and polymer sectors, is assisting the market to grow. Furthermore, growing application in wastewater treatment and industrial hygiene in Japan is contributing to the market growth of acrolein-based biocides.

In accordance with the country’s objective for sustainability, research factories focused on getting bio-based acrolein from renewable plastids have started acquiring traction. This, along with the presence of top chemical producers and investments in advanced manufacturing technologies, is expected to propel the market growth at a steady rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.7% |

The Acrylic Adhesives Market in South Korea automotive industry is also emerging as a significant player as the country has strong demand for specialty chemicals and a growing chemical sector. Acrolein is also being used for a slew of applications in the country’s industrial and agricultural sectors, including water treatment, herbicides, and polymer synthesis.

Government programs that promote industrial sustainability and reduce the production of toxic chemicals are pushing industry to adopt greener manufacturing practices. Research and innovation investments are also making way for high-purity acrolein to meet best-in-class chemical applications. Also, the consistent regional expansion in the South Korean petrochemical industry will boost the demand for acrolein and its derivatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

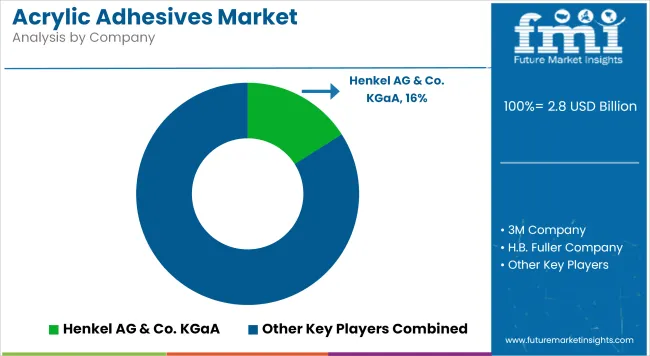

The acrylic adhesive market is highly competitive, driven by continuous innovation in product formulations and a focus on enhancing performance and sustainability. Companies are increasingly prioritizing the development of adhesives that offer superior bonding strength, environmental resistance, and fast curing times, particularly for demanding applications in the transportation, automotive, and industrial sectors.

The market remains fragmented, with both established players and new entrants seeking to capitalize on the growing demand for lightweight, durable, and eco-friendly solutions. Entry barriers are moderate, as specialized manufacturing processes and technical expertise in adhesive chemistry are essential.

Recent Developments

The overall market size for Acrylic Adhesives Market was USD 2.8 Billion in 2025.

The Acrylic Adhesives Market expected to reach USD 4.1 Billion in 2035.

The Acrylic Adhesives Market will be driven by rising demand from packaging, construction, automotive, and electronics industries, fuelled by urbanization, e-commerce growth, and sustainability trends. Advancements in reactive and hybrid adhesives, along with increasing adoption of eco-friendly, low-VOC formulations, will further propel market expansion during the forecast period.

The top 5 countries which drives the development of Acrylic Adhesives Market are USA, UK, Europe Union, Japan and South Korea.

Reactive technology segment drives to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Paper Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Analyzing Acrylic Boxes Market Share & Industry Leaders

Acrylic Acid Market Growth - Trends & Forecast 2024 to 2034

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Acrylic Colors Market

Acrylic Container Market

Acrylic Lenses Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA