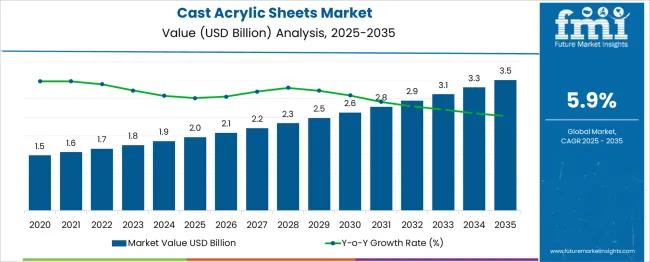

The Cast Acrylic Sheets Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

Ratio-based analysis shows a moderately back-weighted pattern, with the first half (2025–2030) increasing from USD 2.0 billion to 2.6 billion, contributing USD 0.6 billion or 40% of total growth, driven by steady demand from architectural glazing, signage, and consumer products. Annual values within this phase range from USD 2.1 billion in 2026 to 2.6 billion in 2030, showing incremental but consistent progress. The second half (2030–2035) adds USD 0.9 billion, accounting for 60% of cumulative growth, as the market reaches USD 3.5 billion, supported by adoption in automotive glazing, industrial fabrication, and advanced display solutions. The contribution ratio between the two phases is approximately 1.5:1, confirming stronger demand in later years. Multipliers reinforce this trend, with a first-half multiplier of 1.30x versus 1.35x in the second half. This acceleration is expected to be driven by innovation in UV-stable, impact-resistant grades and greater penetration in emerging markets. Manufacturers focusing on scalability, specialty formulations, and robust supply chains will capture the highest value from this back-weighted growth trajectory.

| Metric | Value |

|---|---|

| Cast Acrylic Sheets Market Estimated Value in (2025 E) | USD 2.0 billion |

| Cast Acrylic Sheets Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The cast acrylic sheets market holds a focused yet influential position across multiple plastics and display categories. Within the acrylic and polycarbonate sheets market, cast acrylic sheets represent 40–45 %, as they deliver superior optical clarity and scratch resistance compared to extruded variants. In the broader thermoplastic flat sheet market, cast acrylic commands 8–10 %, since PVC, PET, and ABS sheets dominate volume. For the architectural glazing and display substrates market, its share is 12–14 %, reflecting use in skylights, light fixtures, museum displays, and high-end interior glazing. Within the signage and point‑of‑sale display materials market, cast acrylic sheets account for 18–20 %, due to their popularity in illuminated signs, display cases, and POS fixtures. In the extensive industrial plastics and materials market, the share falls to 3–4 %, where polymer use spans engineering resins, fiber-reinforced composites, and general-purpose plastics. Though smaller in broader plastics markets, demand for cast acrylic sheets is rising driven by trends for lightweight, visually premium solutions in retail, architectural, and design sectors. Advances in UV-stable formulations, anti-fog coatings, and fabrication techniques are reinforcing these sheets as a go-to material for clarity-sensitive applications.

The cast acrylic sheets market is witnessing sustained expansion owing to its superior optical clarity, rigidity, and chemical resistance which make it ideal for a broad range of structural and decorative applications. Increasing demand from advertising, construction, transportation, and interior design industries is creating a favorable environment for market development. The ongoing shift toward lightweight, shatter-resistant alternatives to glass is supporting the adoption of acrylic sheets in both indoor and outdoor installations.

Additionally, the ability to customize thickness, color, and finish through advanced casting techniques has enabled manufacturers to serve specialized end-use demands. Regulatory trends favoring recyclable and non-toxic materials are reinforcing the appeal of cast acrylic in eco-conscious construction and design projects.

Technological improvements in manufacturing processes, especially in cell casting and continuous casting, are resulting in better surface quality and dimensional stability. As design-led infrastructure and branding aesthetics continue to gain prominence, demand for high-quality acrylic sheets is expected to rise across developed and emerging markets alike.

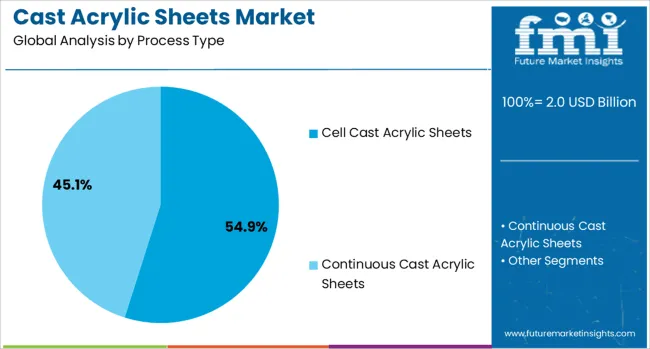

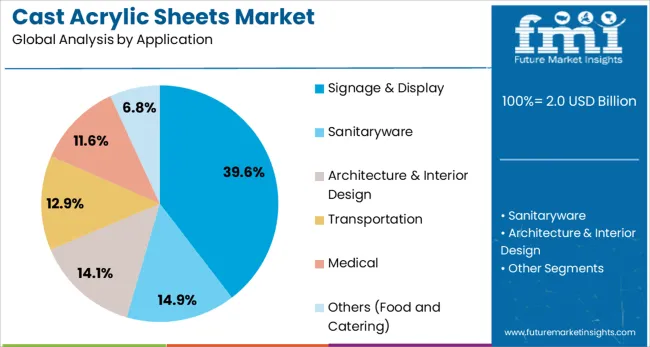

The cast acrylic sheets market is segmented by process type, application, and geographic regions. The cast acrylic sheets market is divided by process type into Cell Cast Acrylic Sheets and Continuous Cast Acrylic Sheets. In terms of application, the cast acrylic sheets market is classified into Signage & Display, Sanitaryware, Architecture & Interior Design, Transportation, Medical, and Others (Food and Catering). Regionally, the cast acrylic sheets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cell cast acrylic sheets are projected to capture 54.9% of the total revenue share in the cast acrylic sheets market by 2025, maintaining their position as the dominant process type. This segment’s leadership is being driven by the superior optical clarity, thickness uniformity, and resistance to stress cracking associated with cell cast manufacturing. The ability to produce low volume customized batches with high molecular weight material has made this process ideal for applications where quality and durability are critical.

Improved weatherability, chemical resistance, and surface hardness achieved through this method have enhanced its acceptance across high-end displays, skylights, aquariums, and architectural glazing. The precision and versatility offered by cell casting allow easy fabrication, cutting, and thermoforming, making it well-suited for bespoke applications.

Growing demand from interior design and specialty retail sectors is further reinforcing the segment’s growth, supported by its consistent performance and high-end finish. Investments in automated casting lines and quality assurance systems are also helping manufacturers improve yield and maintain international standards.

The signage and display segment is expected to account for 39.6% of the overall cast acrylic sheets market revenue in 2025, emerging as the leading application area. This growth is being fueled by the material’s excellent light transmission, vibrant color customization, and weather resistance, which are essential features for indoor and outdoor advertising structures. Businesses across retail, transportation, and hospitality sectors are increasingly investing in visual branding and illuminated signage, driving demand for durable yet aesthetically appealing display materials.

Cast acrylic sheets have been preferred in this segment due to their compatibility with laser cutting, UV printing, and backlit designs, which enables high-precision fabrication and visual impact. Their lightweight nature and ease of installation reduce structural load and labor costs, further enhancing their utility.

As digital and experiential marketing trends grow, the use of acrylic in display units, exhibition booths, and brand installations is expected to expand. The ability to maintain optical performance over time without yellowing or fading ensures continued preference in demanding commercial environments.

Cast acrylic sheets are widely applied in construction, automotive, signage, and interior design due to their clarity, strength, and UV resistance. These sheets provide an effective alternative to glass for glazing, displays, and decorative installations. Industries use them for high-end retail fixtures and architectural panels requiring durability and aesthetics. Manufacturers that deliver precise casting, surface hardness, and multiple color options are well placed to address rising demand across commercial projects, display units, and industrial components where lightweight and impact-resistant materials are essential.

Cast acrylic sheets have gained prominence because of their optical clarity, chemical resistance, and flexibility in design. They are used in aquariums, skylights, partitions, and display cases due to their excellent transparency and strength. Unlike extruded alternatives, cast acrylic provides better thermal stability and machinability, allowing complex shapes and thicker sections for structural applications. Industries have preferred these sheets for replacing glass in projects that require impact resistance and weight reduction. Customization options such as matte finishes, tinted variants, and patterned surfaces have expanded their utility in interior and exterior applications. As architectural and retail display installations increase globally, the demand for cast acrylic sheets continues to strengthen in premium and functional use cases.

Market growth has been restricted by elevated production costs resulting from slower batch casting processes compared to continuous extrusion techniques. Precision curing steps and labor-intensive handling reduce throughput and increase unit pricing, limiting their appeal in price-sensitive projects. Polycarbonate and tempered glass serve as strong alternatives in glazing and protective applications, as they often provide similar performance at lower costs in some use cases. Recycling limitations for polymethyl methacrylate present additional concerns in regions with strict waste management norms. Raw material cost fluctuations have further impacted pricing consistency for sheet manufacturers. These combined challenges have affected adoption across segments where low-cost solutions are prioritized.

Significant opportunities have emerged for hybrid solar wind diesel systems in remote and off-grid regions where consistent energy supply remains a challenge. Integration of renewable components with diesel backup is enabling reliable power generation for mining, construction, and island communities. Industrial users are exploring hybrid configurations to reduce fuel consumption and operational costs, creating additional demand. Growing interest from telecommunications and defense sectors for uninterrupted energy in critical installations has accelerated investments. Government incentives promoting renewable adoption in rural electrification projects are encouraging deployment of hybrid systems. Advancements in modular designs and scalable architectures are expected to simplify installation and improve cost competitiveness in diverse environments globally.

A strong trend toward digitalization and remote monitoring is transforming hybrid solar wind diesel projects, enabling predictive maintenance and real-time performance optimization. Integration with microgrids and energy storage solutions is becoming a standard practice to ensure stability and efficient load management. Hybrid systems are increasingly adopting advanced controllers for automated energy balancing between renewables and diesel backup. Deployment of containerized power modules is gaining traction for rapid mobility and simplified setup in challenging terrains. The shift toward data-driven operation supported by IoT platforms is improving system reliability and lowering lifecycle costs. Strategic alliances between renewable developers and OEMs are shaping future hybrid power solutions globally.

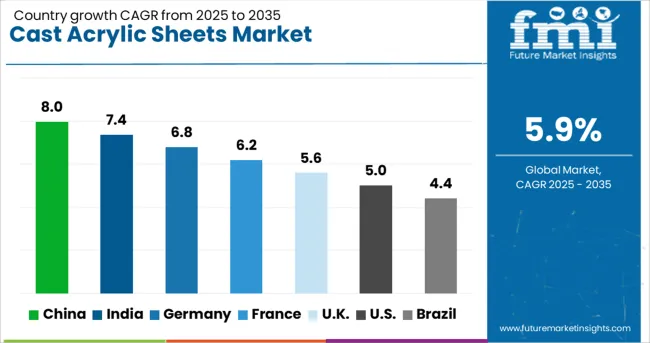

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global cast acrylic sheets market is expected to expand at a 5.9% CAGR between 2025 and 2035, fueled by increased usage in signage, furniture, construction panels, and automotive applications. BRICS nations lead growth with China at 8.0% and India at 7.4%, supported by rapid industrial output and strong adoption in architectural and advertising sectors. OECD markets maintain steady demand, with Germany at 6.8%, France at 6.2%, and the UK at 5.6%, driven by advanced design applications and renewable energy installations. Rising demand for lightweight, impact-resistant materials in solar panels and EV components further strengthens market penetration. The report includes insights from over 40 countries, with five top markets analyzed below.

China is forecast to expand at 8.0% CAGR, driven by rising demand across construction, furniture, and automotive interiors. Cast acrylic sheets are widely adopted in architectural glazing, advertising signage, and high-end furniture designs, offering durability and aesthetic appeal. Automotive manufacturers are integrating acrylic for dashboards and sunroof panels, while renewable energy projects utilize acrylic for solar applications. Domestic manufacturers are expanding capacity for tinted and specialty sheets to meet export demand. Growth is further supported by the retail sector using acrylic sheets in display units and branding applications. Export-oriented production of premium acrylic products reinforces market dominance in decorative and industrial-grade segments.

India is projected to achieve a 7.4% CAGR, supported by strong demand from retail, advertising, and furniture sectors. Cast acrylic sheets are increasingly used in point-of-sale displays, illuminated signage, and premium interior décor. Expanding residential construction and growth in modular kitchen installations further enhance market penetration. Manufacturers are focusing on lightweight, scratch-resistant sheets that cater to evolving aesthetic requirements. Healthcare and educational institutions also adopt acrylic partitions for safety and hygiene purposes. Domestic players are investing in advanced co-extrusion technology to deliver high-clarity, durable sheets for customized furniture and decorative elements. Exports of processed acrylic panels are rising, driven by competitive pricing and quality standards.

Germany is forecast to grow at 6.8% CAGR, driven by demand for energy-efficient building materials and automotive applications. Cast acrylic sheets are integrated into solar modules, interior panels, and architectural glazing for commercial and residential projects. Automotive manufacturers use acrylic in dashboards, roof panels, and premium trims to achieve lightweight designs. Germany’s strong manufacturing ecosystem promotes precision-engineered acrylic products meeting EU quality standards. Renewable energy initiatives encourage adoption of acrylic sheets in photovoltaic systems and wind turbine components. Retail sectors utilize acrylic for display units and custom signage, reinforcing steady demand across multiple verticals. Advanced R&D ensures continuous innovation in high-performance acrylic formulations tailored to industrial applications.

France is expected to post 6.2% CAGR, supported by increased utilization of cast acrylic sheets in luxury retail, lighting fixtures, and contemporary furniture. The hospitality sector demands high-gloss and frosted acrylic panels for décor enhancements, while residential interiors adopt acrylic-based solutions for partitions and kitchen modules. Retail brands increasingly prefer acrylic displays for visual merchandising due to its durability and design flexibility. Export-driven production caters to EU markets seeking high-quality acrylic materials for automotive trims and architectural features. Local manufacturers are expanding into specialty sheets, offering anti-scratch and UV-resistant properties for outdoor signage and public installations. These developments position France as a key European hub for value-added acrylic products.

The UK is projected to grow at 5.6% CAGR, driven by demand from signage, exhibitions, and modular office interiors. Cast acrylic sheets are increasingly utilized in retail branding, point-of-sale structures, and partitioning systems due to their lightweight and aesthetic versatility. The furniture industry is adopting acrylic panels in contemporary designs, complementing trends in open-plan office spaces. Weather-resistant sheets dominate outdoor advertising and transport infrastructure applications. Manufacturers focus on delivering bespoke acrylic solutions with rapid turnaround for retail and event sectors. Rising adoption of acrylic sheets in architectural projects and interior remodeling indicates continued market expansion across residential and commercial spaces.

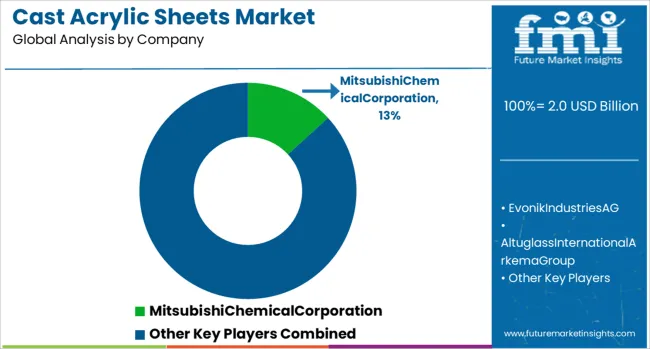

The cast acrylic sheets market is highly competitive, with major players such as Mitsubishi Chemical Corporation, Evonik Industries AG, Altuglass International (Arkema Group), 3A Composites GmbH, Aristech Surfaces LLC, MADREPERLA Spa, Spartech, Astari Niagara International, Pyrasied Xtreme Acrylic, Asia Poly Industrial Sdn Bhd, SCG Chemicals Co., Ltd., Shanghai Acrylic (Cast) Chemical Corporation, Jokema Industry Co. Ltd., and Limacryl NV driving growth through material innovation and global distribution networks.

Market structure features moderate concentration, with high entry barriers due to capital-intensive production processes, proprietary casting technologies, and strict quality standards for applications in construction, automotive, medical devices, and signage. Leading companies like Mitsubishi Chemical and Evonik leverage strong R&D pipelines and integrated supply chains to deliver premium-grade sheets with superior optical clarity, UV resistance, and impact strength. Altuglass and 3A Composites focus on architectural and display solutions, offering a variety of colors and finishes to serve design-oriented markets. Regional players such as Asia Poly Industrial and Shanghai Acrylic compete on cost efficiency, catering to price-sensitive segments while maintaining international quality certifications.

Competitive differentiation centers on product durability, weather resistance, dimensional stability, and ease of fabrication, along with customization options for industrial and decorative uses. Strategic priorities for market leaders include expanding capacity in Asia-Pacific, adopting automation for precision casting, and introducing eco-friendly variants to align with environmental regulations. Future growth will be driven by demand for lightweight, shatter-resistant alternatives to glass, particularly in automotive glazing, sanitary ware, and high-end furniture. Benchmarking focuses on transparency levels, surface finish quality, processing flexibility, and compliance with global safety standards, positioning innovation-focused companies for steady leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Process Type | Cell Cast Acrylic Sheets and Continuous Cast Acrylic Sheets |

| Application | Signage & Display, Sanitaryware, Architecture & Interior Design, Transportation, Medical, and Others (Food and Catering) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MitsubishiChemicalCorporation, EvonikIndustriesAG, AltuglassInternationalArkemaGroup, 3ACompositesGmbH, AristechSurfacesLLC, MADREPERLASpa, Spartech, AstariNiagaraInternational, PyrasiedXtremeAcrylic, AsiaPolyIndustrialSdnBhd, SCGChemicalsCo.,Ltd, ShanghaiAcrylic(Cast)ChemicalCorporation, JokemaindustryCo.Ltd, and LimacrylNV |

| Additional Attributes | Dollar sales are segmented by sheet type (clear, colored, UV-stabilized, flame-retardant) and end-use sectors (architectural glazing, signage, point-of-sale displays, industrial components). Demand is driven by aesthetic and durability needs in construction and visual merchandising. Regional leadership comes from Asia‑Pacific for volume supply, while North America and Europe emphasize premium performance products. Innovation focuses on UV-protective and scratch-resistant coatings, low-emission resins, and thermoformable thick acrylics for curved facades and lighting applications. |

The global cast acrylic sheets market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the cast acrylic sheets market is projected to reach USD 3.5 billion by 2035.

The cast acrylic sheets market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in cast acrylic sheets market are cell cast acrylic sheets and continuous cast acrylic sheets.

In terms of application, signage & display segment to command 39.6% share in the cast acrylic sheets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casting Mold Market Size and Share Forecast Outlook 2025 to 2035

Cast Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Casted Automotive Components Market Size and Share Forecast Outlook 2025 to 2035

Casting Multi-stage Centrifugal Blower Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Polyol Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Cast Aluminum Heating Board Market Size and Share Forecast Outlook 2025 to 2035

Casters Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Market Growth – Trends & Forecast 2025 to 2035

Castration-Resistant Prostate Cancer (CRPC) Treatment Market Insights - Demand, Size & Industry Trends 2025 to 2035

Castor Oil Derivatives Market Growth - Trends & Forecast 2025 to 2035

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Podcasting Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Die Casting Services Market Analysis - Growth & Forecast 2025 to 2035

Gray Cast Iron Profile Market Size and Share Forecast Outlook 2025 to 2035

Gray Cast Iron Rod Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA