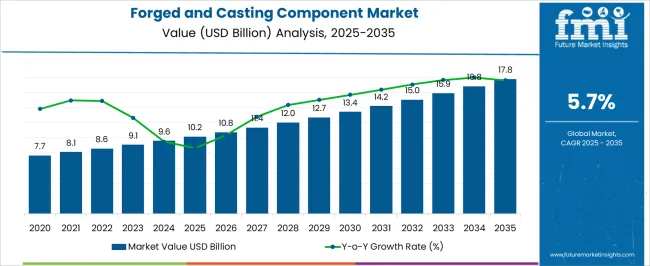

The Forged and Casting Component Market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 17.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Forged and Casting Component Market Estimated Value in (2025 E) | USD 10.2 billion |

| Forged and Casting Component Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The forged and casting component market is experiencing steady growth. Increasing demand from the automotive sector, rising industrialization, and adoption of lightweight and high-strength materials are driving market expansion.

Current dynamics are shaped by the need for precision-engineered components, regulatory standards on quality and safety, and ongoing technological advancements in manufacturing processes. The future outlook is defined by growth in electric vehicles, infrastructure development, and industrial machinery, which are expected to sustain demand for both forged and cast components.

Growth rationale is based on the enhanced mechanical properties, durability, and design flexibility of these components, the adoption of advanced alloys and optimized manufacturing techniques, and the ability of producers to meet stringent performance requirements while ensuring cost-effectiveness Strategic investments in production capacity, supply chain efficiency, and product innovation are anticipated to support continued market expansion and broader penetration across diverse end-use industries.

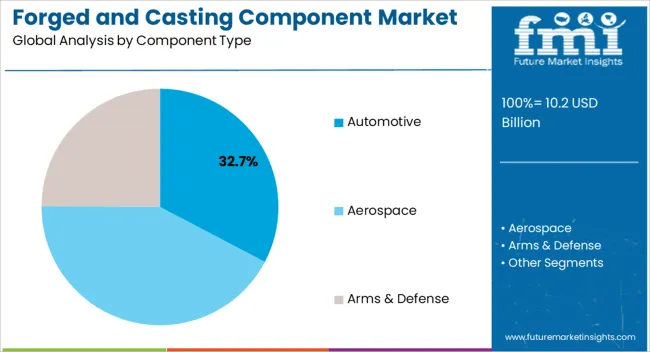

The automotive component segment, representing 32.70% of the component type category, has been leading due to its high adoption in engine parts, structural assemblies, and performance-critical applications. Demand has been driven by the automotive industry’s focus on weight reduction, fuel efficiency, and enhanced safety standards.

Production consistency, material reliability, and adherence to international quality benchmarks have reinforced its market position. Increasing production of passenger vehicles and commercial vehicles, coupled with advancements in assembly-line integration and component standardization, has further strengthened segment adoption.

Strategic partnerships between component manufacturers and OEMs have supported timely supply and scalability Technological improvements in forging and casting precision have enhanced dimensional accuracy, durability, and surface finish, ensuring that automotive components continue to dominate the market segment.

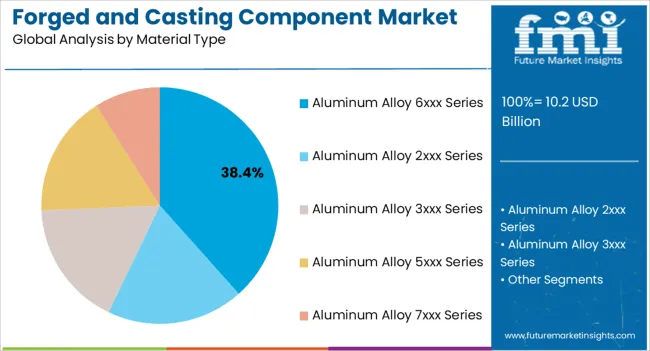

The aluminum alloy 6xxx series segment, accounting for 38.40% of the material type category, has maintained prominence due to its high strength-to-weight ratio, corrosion resistance, and formability. Its use in critical applications such as automotive chassis, structural components, and transportation equipment has driven market leadership.

Manufacturing processes that leverage this alloy have improved efficiency, surface quality, and mechanical properties, contributing to widespread adoption. Supply chain reliability, material availability, and cost competitiveness have supported stable growth.

Continuous research into alloy composition and heat treatment methods is enhancing performance characteristics, while integration with advanced manufacturing techniques ensures scalability The segment’s focus on sustainability, recyclability, and lightweight solutions has further reinforced its preference across multiple industries, underpinning its dominant market share.

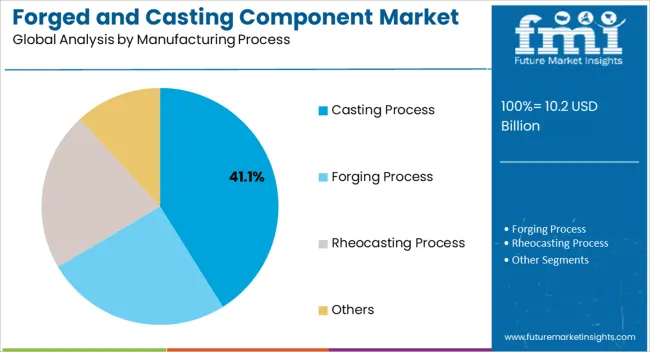

The casting process segment, holding 41.10% of the manufacturing process category, has emerged as the leading method due to its versatility, efficiency, and ability to produce complex geometries. Adoption has been facilitated by improvements in mold design, metallurgical control, and post-processing techniques, which enhance component quality, dimensional accuracy, and mechanical strength.

The segment benefits from lower production costs and high scalability, particularly for medium to large-scale production runs. Industrial sectors including automotive, machinery, and energy rely heavily on casting for both structural and functional components.

Process optimization, automation, and quality monitoring have reinforced its market leadership Continued technological advancements in casting simulation, defect reduction, and material utilization are expected to sustain its market share and support consistent growth across end-use industries.

From 2020 to 2025, the global forged and casting component market experienced a CAGR of 4.8%. It attained a total valuation of about reaching a market size of USD 9,081.3 million at the end of 2025.

| Attribute | Details |

|---|---|

| Historical CAGR (2020 to 2025) | 4.8% |

| Forecast CAGR (2025 to 2035) | 6.0% |

From 2020 to 2025, forged and casting component sales experienced steady growth. This growth can be attributed to several factors, including increased industrial production, infrastructure development, and the adoption of advanced manufacturing techniques.

The global forged and casting component industry is expected to rise at a CAGR of 6.0% during the forecast period. By 2035, the market size is predicted to reach USD 17,146.7 million.

This anticipated growth rate signifies a promising future for manufacturers and suppliers of forged and casting components. Growing aftermarket demand, increased infrastructure projects, and advancements in material technology are few of the key factors expected to boost the market.

Robust expansion of industries such as military & defense, automotive, and others will likely create a high demand for forged and casting components. These precision components are crucial for producing advanced weaponry, high-performance electronics, and other machinery and equipment.

Advancements in Forging and Casting Technologies to Boost the Market

The manufacturing landscape is undergoing a revolutionary transformation propelled by advancements in forging and casting technologies. Innovations in materials science, automation, and simulation are emerging as pivotal drivers within this dynamic environment.

The new cutting-edge developments are redefining the manufacturing process and augmenting the quality, precision, and design intricacies of component production. They are improving machines' and equipment's quality, performance, and lifespan.

The integration of novel materials and the infusion of automation synergistically enhance efficiency. It also ensures a higher degree of precision and facilitates the creation of intricate, high-performance parts.

Adopting novel materials and automation is particularly significant as it empowers industries to cater to diverse demands while minimizing waste and energy consumption. It helps them to align with the growing emphasis on sustainable practices.

The convergence of these technological leaps is reshaping the manufacturing landscape, underscoring a new era of possibilities and capabilities in forging and casting components. This is expected to provide impetus for market growth.

Rapid Urbanization to Uplift Forged and Component Market Demand

Rapid urbanization is becoming a significant catalyst for the burgeoning demand within the forged and casting components market. The expansion of cities on a global scale is instigating an exponential surge in requirements for robust and dependable components, particularly in the realm of infrastructure projects.

Forged and casting components play a pivotal role in construction machinery, transportation systems, and energy facilities that constitute the backbone of urban development. With the burgeoning urban landscape comes an amplified need for durability and reliability, driving the demand for high-quality forged and casting components.

As urban hubs evolve, forged and casting components are critical to ensuring diverse urban infrastructure elements' enduring performance, longevity, and efficiency. This symbiotic relationship between urbanization and component demand is steering sustained market growth and reshaping the forged and casting landscape in response to the evolving needs of modern urban environments.

Forged and Casting Components Market Constraints

The forged and casting components market faces restraint due to disruptions in global supply chains. Factors such as material shortages, transportation challenges, and geopolitical uncertainties can lead to delays in production and affect the timely delivery of components.

Supply chain disruptions can increase lead times, production bottlenecks, and manufacturer costs. Industries reliant on forged and cast components, including automotive, aerospace, and manufacturing, may experience reduced operational efficiency and potential project delays.

To mitigate supply chain restraint, companies must diversify suppliers, enhance visibility in supply chains, and invest in resilient sourcing strategies. By taking these steps, they might overcome this challenge.

Forged and casting components also face competition from alternative materials like composites and advanced plastics. These materials offer advantages such as lighter weight, corrosion resistance, and design flexibility.

Industries seeking lightweight solutions, such as automotive and aerospace, are exploring alternatives to traditional forged and cast components to enhance fuel efficiency and performance. As a result, the market for forged and casting components faces the challenge of demonstrating their ongoing relevance and competitiveness in the face of innovative materials.

Manufacturers must innovate by optimizing designs, exploring hybrid materials, and collaborating with end-users to meet evolving demands. They can also invest in research and development to explore new materials and processes.

Forged and Casting Components Market Trends

Where industries are increasingly setting high benchmarks for efficiency, precision, and durability in their electronic and automation solutions, the role of forged and casting components is taking center stage. These components, crafted meticulously to meet stringent demands, are emerging as the bedrock of excellence in this dynamic landscape. It's not just about the parts; it's about a new paradigm of performance enhancement.

From robust heat management solutions to intricately designed housing structures that safeguard delicate electronics, aluminum alloy forged and casting components are indispensable in enabling seamless operations. Their ability to withstand the rigors of demanding applications translates into uninterrupted functionality, minimized downtime, and prolonged equipment lifespans.

As technology and innovation converge, the forged and casting market reshapes the fabric of high-performance electronics and automation. Forged and casing components allow industries to develop lightweight, complex, high-performance products, machinery, and equipment.

The ascent of digital twin technology is reshaping the forged and casting components landscape. This emerging trend involves the creation of virtual duplicates of tangible components, a breakthrough gaining momentum.

Manufacturers harness this innovation to model and fine-tune component performance across diverse scenarios before actual production, marking a transformative departure from traditional prototyping.

By leveraging simulation-driven design, accuracy and quality are heightened, yielding components tailored to exacting specifications without exhaustive physical trials. This curtails prototyping costs and time and streamlines the design-to-manufacturing trajectory.

With digital twins at the helm, the forged and casting components market embraces a new era of precision, efficiency, and ingenuity, epitomizing the fusion of digital prowess with physical excellence. As a result, a positive growth trajectory has been predicted for the target market.

The table below highlights key countries’ market value. China, the United States, and Japan are the three key markets for forged and casting components, with projected valuations of USD 4,002.7 million, USD 2,264.0 million, and USD 491.6 million, respectively, in 2035.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 2,264.0 million |

| United Kingdom | USD 287.3 million |

| China | USD 4,002.7 million |

| Japan | USD 491.6 million |

| South Korea | USD 271.7 million |

Below table shows the expected forged and casting components market growth rates of top five countries. China, Korea, and the United States are set to experience higher CAGRs of 6.3%, 5.9%, and 5.7%, respectively, through 2035.

| Countries | Projected Forged and Casting Components Market CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

| United Kingdom | 4.6% |

| China | 6.3% |

| Japan | 4.9% |

| South Korea | 5.9% |

The United States forged and casting component market size is expected to reach USD 2,264.0 million by 2035. Over the assessment period, demand for forged and cast components in the United States will likely rise at 5.7% CAGR.

Several factors are expected to drive forged and casting components demand in the United States. One of the key drivers fueling demand is the nation's thriving manufacturing sector.

The manufacturing sector relies heavily on forged and casting components. These components are crucial in ensuring the performance and safety of machinery and structures.

Increased investments in infrastructure development and a growing emphasis on renewable energy projects are expected to create substantial opportunities for forged and casting component manufacturers. These components are essential in the construction of infrastructure projects and the production of renewable energy equipment.

Growing popularity of electric vehicles is expected to improve the United States forged and casting components market share. As the demand for electric vehicles continues to increase, demand for forged and casting components is also expected to rise.

As per the latest analysis, Germany forged and casting component industry is expected to attain a valuation of USD 597.8 million by 2035. Sales of forged and casting components in the country are predicted to soar at a CAGR of 4.9% during the forecast period.

High-performance electronics and automation systems require precision-engineered components to meet stringent quality and performance standards. As a result, companies use forged and casting components. These components play a critical role in ensuring the reliability and efficiency of these systems.

Germany is known for its advanced manufacturing capabilities and engineering expertise, making it a hub for automotive, aerospace, and machinery industries. These industries heavily rely on forged and casting components for their machinery and equipment.

As the demand for high-performance electronics and automation systems continues to rise, so will the need for specialized components. This is expected to bolster forged and casting component sales in Germany.

China forged and casting component industry value is anticipated to reach USD 4,002.7 million by 2035, moving at a CAGR of 5.9% during the forecast period. It is expected to witness robust growth due to rising demand from the arms & defense sector.

China's increasing investments in defense capabilities and focus on domestic arms manufacturing drive the demand for forged and casting components in this sector. These components are becoming vital for improving equipment performance, safety, and durability.

The arms & defense industry requires precision-engineered components to ensure the reliability and performance of military equipment, including vehicles, aircraft, and weapons systems. Forged and casting components are vital in producing these critical assets, as they offer the strength, durability, and quality required for defense applications.

China's growing geopolitical influence and the need to modernize its armed forces are leading to substantial investments in defense technology and equipment. As a result, the demand for high-quality forged and casting components is expected to surge rapidly, creating a favorable environment for growth in the forged and casting component industry.

Japan is anticipated to register a CAGR of 4.9% during the assessment period. Total market valuation in the country is predicted to reach USD 491.6 million by 2035. Rapid expansion of automotive industry coupled with changing trends in this sector is driving demand in Japan.

The Japan automotive industry is witnessing emerging trends such as electrification and lightweight. This, in turn, is expected to create high demand for forged and casting components as they can reduce overall weight of vehicles.

Increasing investments in renewable energy sector is another key factor expected to boost sales of forged and casting components in the country. Renewable energy projects rely on forged and casting components for equipment like turbine blades.

South Korea is anticipated to experience a CAGR of 5.9% throughout the forecast period. Overall, the country's forged and casting components sales revenue is set to reach around USD 271.7 million by 2035.

Several factors are expected to stimulate growth in South Korea market. These include rapid industrial growth, rising demand for fuel-efficient vehicles, and the developing of new & innovative components.

As industrialization continues to penetrate its roots across Korea, demand for forged and casting components is expected to rise robustly. This is because aerospace, construction, and automotive industries need these specialized components for producing machinery, infrastructure, and vehicles.

Below section shows the automotive segment dominating the market based on component type. It is predicted to thrive at 5.5% CAGR between 2025 and 2035.

The aluminum alloy 7xxx series segment is set to lead the market based on material type. It will likely progress at a CAGR of 5.2% during the forecast period.

| Top Segment (Component Type) | Automotive |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.5% |

The automotive segment is expected to dominate the forged and casting component industry, with a share of around 69.7% in 2025. Over the assessment period, demand for automotive forged and casting components will likely rise at 5.5% CAGR.

Forged and casting components made for automotive segment are critical components that play a pivotal role in ensuring vehicle performance, safety, and reliability. These components are becoming indispensable in the automotive manufacturing sector amid evolving trends.

Multiple factors are driving growth of the target segment. These include continuous advancements in automotive technology, stringent quality standards, and the ever-increasing demand for innovative and durable components in the automotive industry.

Emerging trends like the shift towards electric and autonomous vehicles and lightweight are expected to generate high demand for forged and casting automotive components. This is because these components are generally lighter and stronger than traditional components.

| Top Segment (Material Type) | Lead-acid |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.2% |

The aluminum alloy 7xxx series is expected to dominate the forged and casting component industry, holding a share of around 24.3% in 2025. It is poised to exhibit a CAGR of 5.2% during the assessment period.

Forged and casting components of aluminum alloy 7xxx series are known for their exceptional strength-to-weight ratio and corrosion resistance. This makes them a preferred choice in various critical applications within the forged and casting component industry.

Forged and casting components crafted from aluminum alloy 7xxx series offer superior performance, durability, and reliability. They help meet the stringent demands of aerospace, automotive, and structural engineering industries.

The 7xxx series alloys, containing zinc as the main alloying element and magnesium and copper, offer exceptional toughness. Typical chemical composition includes around 1 to 8% zinc, 0.2 to 2.9% magnesium, 1.2 to 2.4% copper, and small amounts of other elements.

Growing demand for forged and casting components made from aluminum alloy 7xxx series from diverse industries is expected to boost the target segment. Subsequently, the continuous technological advancements in materials engineering, which have led to the development of alloys with improved properties, will bode well for the target segment and the market.

Leading forged and casting component companies focus on developing innovative and technologically advanced solutions to meet evolving end-user demand. They are also adopting acquisitions, alliances, facility expansions, collaborations, mergers, and partnerships to solidify their market positions.

Recent Developments in Forged and Casting Component Market:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 10.2 billion |

| Projected Market Size (2035) | USD 17.8 billion |

| Anticipated Growth Rate (2025 to 2035) | 5.7% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units, and CAGR from 2025 to 2035 |

| Segments Covered | By Component Type, By Material Type, By Manufacturing Process, By Sales Channel, By Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan & Baltics; East Asia; South Asia Pacific; Middle East & Africa |

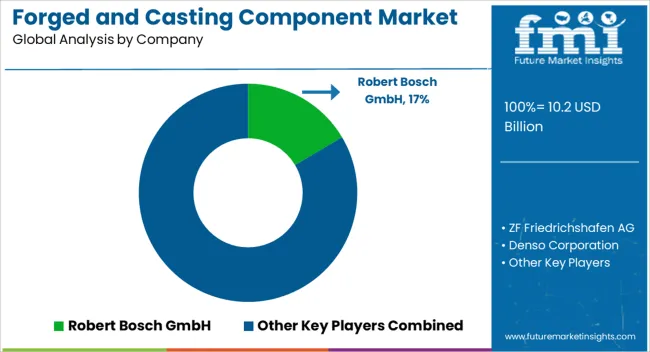

| Key Companies Profiled | Robert Bosch GmbH; ZF Friedrichshafen AG; Denso Corporation; Continental AG; Thyssenkrupp AG; Magna International; Faurecia; Valeo S.A; Lear Corporation; Eaton Corporation Plc; Delphi Automotive PLC; Schaeffler AG; BorgWarner; Hitachi Astemo, Ltd.; Mahle GmbH; JTEKT CORPORATION; Dana Incorporated; Brembo S.p.A.; Aisin Corporation; Akebono Brake Industry Co., Ltd. |

The global forged and casting component market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the forged and casting component market is projected to reach USD 17.8 billion by 2035.

The forged and casting component market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in forged and casting component market are automotive, _engine components, _transmission components, _structural components, _suspension components, _exhaust system components, _powertrain components, _interior components, _exterior components, _others, aerospace, _safety critical structural parts, _non-safety critical parts, arms & defense, _mobility, _arms & gear, high-performance electronics & automation, _heat management, _electronic-housings, _automation structural parts, food & beverage, _structural components and _functional components.

In terms of material type, aluminum alloy 6xxx series segment to command 38.4% share in the forged and casting component market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA