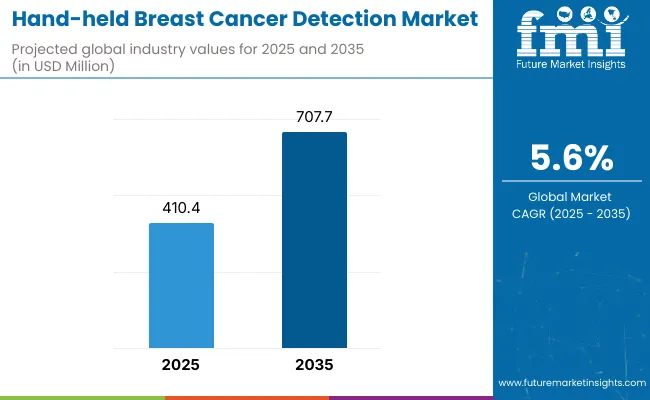

The global Hand-held Breast Cancer Detection Market is projected to reach a valuation of USD 410.4 million by 2025 and USD 707.7 million by 2035. This indicates a decade-long increase of USD 297.3 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 5.6%, representing a 1.72X increase over the ten-year period.

| Metric | Value |

|---|---|

| Estimated Value in (2025) | USD 410.4 million |

| Estimated Value in (2035) | USD 707.7 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

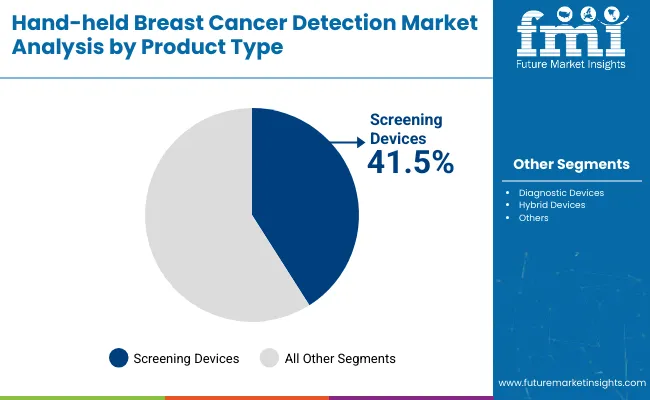

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 410.4 million to USD 538.9 million, adding USD 128.5 million which contributes to 43.2% of the total decade growth. Screening Devices will remain dominant holding around 41.0% share of the category by 2030 due to their critical role in early-stage detection and large-scale deployment in hospitals. Diagnostic Devices segment will stabilize around 37.3% by 2030, while Hybrid Devices remain niche but gradually rise toward 22% share.

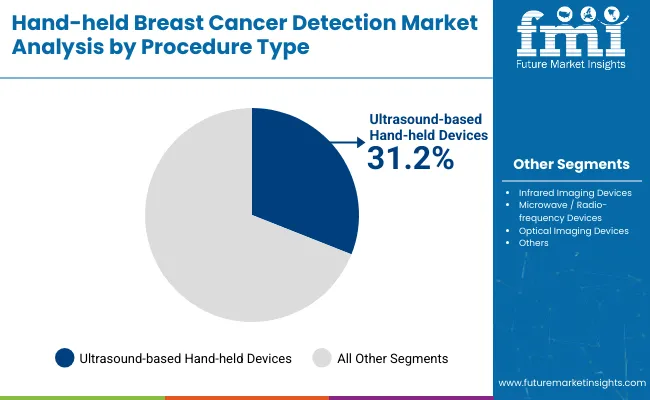

The second half from 2030 to 2035 contributes USD 168.8 million, equal to 56.8% of the total growth, as the market jumps from USD 538.9 million to USD 707.7 million. This acceleration is powered by widespread adoption of optical and ultrasound-based devices across both developed and emerging markets. By 2035, Screening and Diagnostic Devices together capture a share above 77%, while Hybrid Devices edge higher, reflecting clinical interest in multi-functional platforms. Optical Imaging Devices are likely to rise to around 29.6% share, surpassing microwave/radio-frequency technologies.

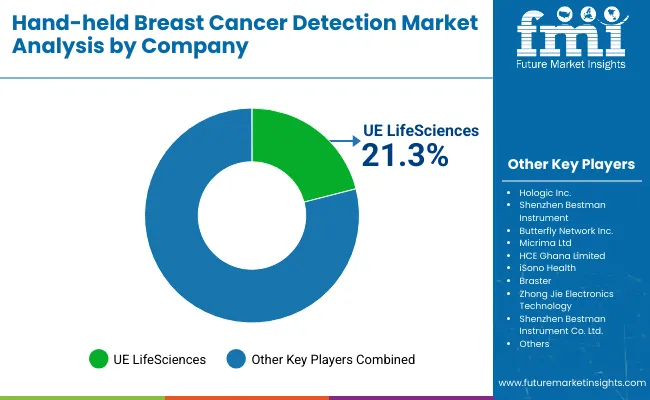

From 2020 to 2024, the overall Hand-held Breast Cancer Detection Market grew from USD 351.6 million to USD 395.7 million. Leading manufacturers such as UE LifeSciences, Hologic, and Butterfly Network, Inc. together account for a significant share of global revenue, with UE LifeSciences alone holding 21.3% share in 2025 through portable ultrasound and tactile imaging devices. Key strategies deployed by these players include expanding access in emerging markets, integrating AI-assisted imaging, and forging collaborations with cancer screening programs to pilot mobile detection initiatives.

In 2025, the Hand-held Breast Cancer Detection Market is expected to reach a value of approximately USD 410.4 million, driven by a shift from basic portable screening tools to digitally integrated, multifunctional hand-held platforms. Growth will be propelled by hospital and specialty cancer clinic investments in early detection, mobile outreach, and compliance with breast cancer screening guidelines. Providers are increasingly adopting optical imaging devices, ultrasound-based probes, and hybrid platforms equipped with digital connectivity, cloud-based diagnostics, and AI decision-support features to enhance diagnostic accuracy, streamline workflows, and extend access to underserved populations.

The Hand-held Breast Cancer Detection Market is seeing strong growth because healthcare systems worldwide face mounting pressure to improve early cancer detection, reduce diagnostic delays, and expand access to underserved populations. Major drivers include rising breast cancer incidence, government-supported screening programs, and the shift toward portable and affordable detection solutions. Innovations such as AI-assisted ultrasound probes, optical imaging devices, and hybrid platforms improve diagnostic accuracy, reduce operator dependency, and support large-scale outreach programs in low-resource settings.

The pandemic amplified focus on community-based and mobile screening models, accelerating adoption of lightweight and digitally connected hand-held devices. As healthcare budgets prioritize preventive care and decentralized diagnostics, manufacturers delivering portable, cost-efficient, and digitally integrated solutions are achieving robust sales. In countries with expanding healthcare infrastructure, particularly in Europe, China, and South Korea, new screening initiatives and technological upgrades are further boosting demand.

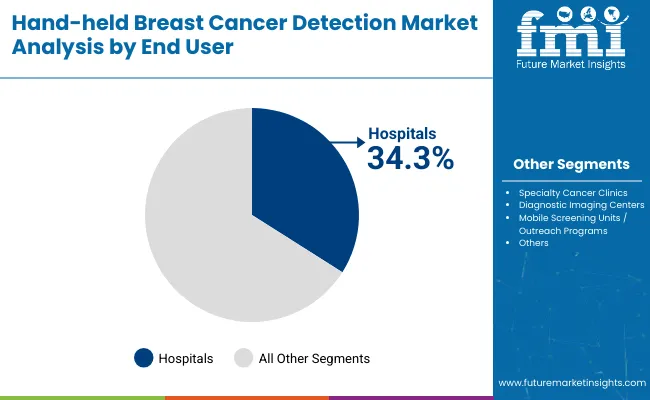

The market is segmented by product, procedure, and end-user. Product type include Screening Devices, Diagnostic Devices, and Hybrid Devices, highlighting the core elements driving adoption. Procedure classification covers Infrared Imaging Devices, Ultrasound-based Hand-held Devices, Microwave/Radio-frequency Devices, and Optical Imaging Devices. Based on End User, the segmentation includes Hospitals, Specialty Cancer Clinics, Diagnostic Imaging Centers, and Mobile Screening Units/Outreach Programs. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| By Product | Market Share (%) |

|---|---|

| Screening Devices | 41.5% |

| Diagnostic Devices | 37.2% |

| Hybrid Devices | 21.3% |

Screening devices are expected to retain a dominant position and are projected to contribute 41.5% in 2025, supported by their critical role in large-scale community and hospital-based early detection programs. Their adoption has been driven by the global emphasis on early-stage cancer identification and outreach accessibility, particularly in regions with rising breast cancer incidence.

Preference has been increasingly shown for these devices due to their portability, ease of use, and ability to deliver results without requiring complex infrastructure. Deployments have also been supported by public health initiatives and non-governmental organizations promoting preventive screening. These factors have collectively contributed to the sustained demand for screening devices over the forecast period, even as hybrid and diagnostic platforms expand their footprint in specialty care and advanced diagnostic workflows.

| By Procedure type | Market Share (%) |

|---|---|

| Infrared Imaging Devices | 28.5% |

| Ultrasound-based Hand-held Devices | 31.2% |

| Microwave / Radio-frequency Devices | 14.7% |

| Optical Imaging Devices | 25.6% |

Ultrasound-based hand-held devices have emerged as the leading procedure type and are projected to hold around 31.2% in 2025 due to their proven clinical reliability and widespread acceptance in breast imaging. Regulatory clearances by the FDA and CE have strengthened adoption, making portable ultrasound probes a trusted choice in both hospital and outreach settings. These devices enable high-resolution imaging at the point of care, improving diagnostic speed and accessibility for patients with limited access to advanced imaging centers.

Additionally, advancements in AI-powered image interpretation and wireless connectivity have enhanced clinical usability, reducing operator dependency and enabling integration into digital diagnostic workflows. With the global emphasis on early detection and minimally invasive approaches, ultrasound-based hand-held devices remain the dominant modality, while optical imaging and infrared systems expand as complementary technologies in the next decade.

| End User | Market Share (%) |

|---|---|

| Hospitals | 34.3% |

| Specialty Cancer Clinics | 24.5% |

| Diagnostic Imaging Centers | 18.2% |

| Mobile Screening Units / Outreach Programs | 23.0% |

Hospitals are expected to remain the largest end user segment, contributing around 34.3% in 2025, driven by their central role in breast cancer diagnosis and treatment pathways. Most diagnostic evaluations and confirmatory procedures are performed in hospital settings, necessitating access to advanced hand-held detection technologies. Demand has been reinforced by mandates for early detection programs and hospital-based screening initiatives supported by public health authorities.

Investments in hospital oncology infrastructure, particularly in breast imaging units and women’s health centers, have resulted in higher procurement of portable ultrasound and optical imaging devices. Procurement has also been influenced by favorable reimbursement frameworks and funding support for cancer screening programs, ensuring integration of hand-held technologies into routine diagnostic workflows in large tertiary and academic hospitals.

Regulatory Push for Early Breast Cancer Screening

The most significant growth driver in the Hand-held Breast Cancer Detection Market is the global regulatory and policy push toward early detection and population-wide screening. Organizations such as the World Health Organization (WHO) and national cancer control programs emphasize structured breast cancer screening, compelling hospitals, diagnostic centers, and community health programs to invest in affordable and portable technologies.

Hand-held devices, particularly ultrasound-based and optical imaging platforms, align with government-led outreach and NGO initiatives targeting low-resource settings. Regulatory bodies are also fast-tracking approvals for AI-assisted devices to ensure wider accessibility and consistent diagnostic outcomes. As breast cancer incidence continues to rise globally, the need for reliable, point-of-care detection methods is reinforcing procurement and integration of these devices into both hospital workflows and mobile screening units.

High Cost Barriers and Limited Infrastructure Support

Despite their clinical promise, high upfront costs and operational constraints remain key restraints. Advanced hand-held detection devices, especially those integrating AI interpretation, cloud connectivity, and multi-modal imaging, carry price tags that remain challenging for rural and resource-limited healthcare systems. Facilities with restricted budgets often defer adoption, depending instead on traditional mammography access in centralized urban hospitals.

In addition, infrastructure limitations such as inadequate internet connectivity, lack of trained staff, and minimal reimbursement coverage in certain regions slow down deployment. Retrofitting outreach programs to incorporate new portable devices also requires workflow adjustments and physician training, adding to adoption hurdles. These barriers particularly affect developing markets, where the burden of breast cancer is rising but healthcare funding remains constrained.

Convergence of Hand-held Detection with AI and Mobile Health Ecosystems

A rapidly accelerating trend is the convergence of hand-held breast cancer detection with AI diagnostics, digital health platforms, and mobile healthcare ecosystems. Instead of standalone devices, hospitals and screening programs are now adopting integrated systems that combine portable imaging probes with smartphone-based analysis, cloud storage, and tele-oncology consultations. Companies such as UE LifeSciences, Butterfly Network, and iSono Health are pioneering this convergence by embedding advanced analytics, image sharing, and interoperability features that allow seamless use across clinics and outreach programs.

This integration is not only improving diagnostic accuracy but also enabling task-shifting, where trained nurses or community health workers can conduct screenings with remote physician oversight. As health systems worldwide invest in preventive oncology and decentralized care models, hand-held detection devices are becoming strategic enablers, positioned as critical components within a broader ecosystem of digital cancer care and AI-driven diagnostics.

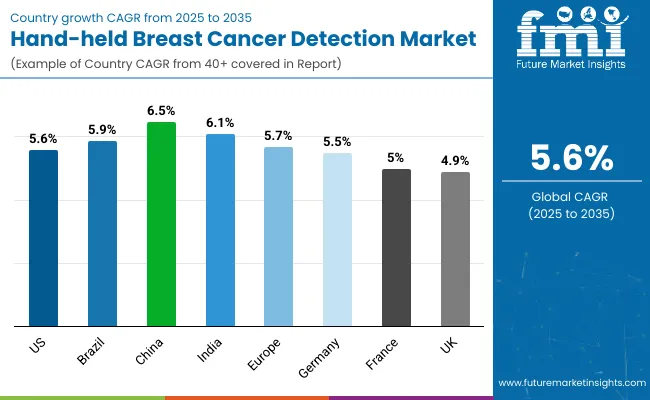

| Countries | CAGR |

|---|---|

| USA | 5.6% |

| Brazil | 5.9% |

| China | 6.5% |

| India | 6.1% |

| Europe | 5.7% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.9% |

Asia Pacific is emerging as the fastest-growing region in the Hand-held Breast Cancer Detection Market, projected to grow at a CAGR of 6.1% between 2025 and 2035. Among its key markets, China is forecast to expand at 6.5% CAGR, driven by large-scale government-backed screening programs, rising incidence of breast cancer, and increased deployment of mobile outreach units in Tier 2 and Tier 3 cities. India is projected at 6.1% CAGR, supported by national health initiatives that are prioritizing preventive oncology, low-cost diagnostics, and digital health integration. The region’s growth is reinforced by rapid healthcare infrastructure expansion, adoption of AI-enabled portable devices, and collaborations with NGOs to extend access to underserved populations.

Europe is expected to grow steadily at a 5.7% CAGR through 2035. Germany will continue to dominate with a 22.3% share by 2035, driven by early adoption of advanced imaging tools in academic hospitals and cancer clinics. France is projected to grow at 5.0% CAGR, benefitting from public hospital investments under cancer control programs, while the UK grows at 4.9% CAGR, supported by NHS modernization efforts to enhance breast cancer survival rates. Broader European market momentum stems from harmonized screening guidelines, structured reimbursement frameworks, and rising uptake of hybrid devices in both specialty clinics and diagnostic centers.

North America remains a mature but innovation-led market, with the USA projected to grow at 5.6% CAGR between 2025 and 2035. Growth is primarily driven by the replacement of legacy detection systems with AI-powered portable imaging probes and hybrid devices designed for early-stage detection. Hospitals and specialty clinics are investing heavily in digital connectivity, cloud-based diagnostics, and patient-centric screening programs. Federal funding for breast cancer prevention and growing adoption of mobile screening vans in underserved regions are fueling continued expansion. Although growth is moderate compared to Asia Pacific, the USA remains the largest single-country market in terms of revenue contribution by 2035.

The Hand-held Breast Cancer Detection Market in the USA is forecast to grow at a 2.3% CAGR, reaching USD 160.5 million by 2035. Growth is driven by federal and state-level initiatives supporting early detection programs and wider adoption of portable ultrasound and optical imaging devices. Hospitals and specialty clinics are replacing older diagnostic pathways with AI-assisted hand-held devices that enable point-of-care screening and improve outreach to underserved populations. Rising breast cancer incidence and demand for non-invasive, patient-friendly tools are strengthening adoption.

The Hand-held Breast Cancer Detection Market in the UK is projected to grow at a 4.9% CAGR through 2035, supported by NHS England’s cancer survival initiatives and investment in early detection infrastructure. The “Long Term Plan” and NHS breast screening modernization programs are driving adoption of hand-held technologies for faster and more accessible diagnostics. Growth is reinforced by the rising incidence of breast cancer and demand for cost-efficient tools that complement mammography.

The Hand-held Breast Cancer Detection Market in Germany is forecast to grow at a 5.5% CAGR, benefitting from national funding under the Krankenhauszukunftsgesetz (Hospital Future Act) and strong academic hospital networks. German oncology departments are accelerating the use of AI-powered ultrasound probes and hybrid devices, driven by a commitment to structured early detection programs. Hospitals are transitioning from reliance on mammography alone to multi-modal detection pathways integrating portable imaging. Additionally, Germany’s emphasis on ergonomic and patient-centered care is encouraging investment in non-invasive technologies.

| Europe | 2025 |

|---|---|

| Germany | 22.7% |

| France | 13.5% |

| Italy | 10.2% |

| BENELUX | 6.5% |

| Nordic Countries | 5.0% |

| Spain | 8.7% |

| Rest of Western Europe | 33.3% |

| Europe | 2035 |

|---|---|

| Germany | 20.0% |

| France | 13.3% |

| Italy | 11.1% |

| BENELUX | 7.6% |

| Nordic Countries | 6.0% |

| Spain | 9.1% |

| Rest of Western Europe | 32.9% |

The Hand-held Breast Cancer Detection Market in India is expected to grow at a CAGR of 6.1%, making it one of the fastest-growing globally. Growth is fueled by the rapid expansion of tertiary hospitals, cancer centers, and diagnostic networks across Tier 1 and Tier 2 cities. Rising breast cancer incidence and government-backed screening programs under initiatives like Ayushman Bharat are boosting adoption of affordable, portable detection devices. Hospitals are increasingly integrating screening and hybrid devices into outreach programs to extend services into rural and semi-urban areas. Additionally, local manufacturers and global players are collaborating to introduce cost-effective, AI-enabled devices tailored for India’s large patient base.

The Hand-held Breast Cancer Detection Market in China is projected to grow at a CAGR of 6.5% through 2035, supported by the government’s Healthy China 2030 policy and nationwide cancer screening campaigns. The Ministry of Health has mandated structured breast screening pathways, accelerating adoption of optical imaging and ultrasound-based hand-held devices in Class A hospitals and community clinics. Urban hospitals are adopting AI-integrated platforms, while district hospitals are focusing on low-cost, standalone devices to expand access in underserved regions. Domestic players are scaling up production while integrating digital diagnostic software into portable units.

The Hand-held Breast Cancer Detection Market in Japan is projected to reach USD 16.0 million by 2025, expanding at a 3.0% CAGR through 2035. Hybrid devices dominate with 53.8% share in 2025, reflecting Japan’s preference for advanced, multi-functional solutions that combine portability with high diagnostic accuracy. Growth is driven by the Ministry of Health, Labour and Welfare’s efforts to upgrade oncology infrastructure, alongside the rising need for ergonomic, patient-friendly technologies to manage its aging population. Universities and research centers are also actively piloting optical and AI-powered hand-held tools in early-stage clinical workflows.

The Hand-held Breast Cancer Detection Market in South Korea is estimated at USD 11.5 million in 2025, growing at a 6.1% CAGR to reach USD 20.8 million by 2035. Optical imaging devices lead with 40.2% share in 2025, supported by government-led investments in digital healthcare and oncology infrastructure under the Ministry of Health and Welfare’s initiatives. Hospitals and specialty clinics are rapidly adopting AI-enabled optical and ultrasound-based devices to meet demand for early diagnosis. The focus on community-based screening, coupled with South Korea’s advanced telehealth ecosystem, positions hand-held devices as a core tool for preventive cancer care.

The Hand-held Breast Cancer Detection Market is moderately fragmented, with global leaders, established innovators, and emerging regional players competing across screening, diagnostic, and hybrid device categories. Industry leader UE LifeSciences holds a significant market share of 21.3%, driven by its flagship iBreastExam device, which has achieved strong adoption in both developed and emerging markets through affordability, portability, and NGO-backed outreach programs. The company is expanding through collaborations with public health agencies and insurers, focusing on scaling access in India, Africa, and underserved USA communities.

Established players such as Hologic, Inc., Butterfly Network, Inc., and Micrima Ltd cater to hospitals and specialty cancer clinics with advanced imaging platforms. Their strategies emphasize AI integration, digital connectivity, and hybrid device development. Butterfly’s ultrasound-on-chip technology, Hologic’s oncology ecosystem, and Micrima’s MARIA® radio-wave imaging system illustrate a shift toward high-accuracy, non-invasive screening solutions tailored for clinical and research environments.

Emerging companies including iSono Health, Braster, Shenzhen Bestman Instrument, HCE Ghana Limited, and Zhong Jie Electronics Technology focus on cost-effective, compact solutions for mobile screening units and community-based programs. Their strengths lie in competitive pricing, portability, and localized customization, making them highly relevant in Asia Pacific, Africa, and Latin America. Many of these firms are leveraging telehealth integration, smartphone-based imaging, and AI-powered diagnostic support to differentiate in low-resource settings.

As the market evolves, competitive differentiation is shifting from conventional portable screening toward multifunctional hybrid devices, AI-enabled detection, and integration with cloud-based diagnostic ecosystems. Players who can balance clinical reliability, affordability, and digital health integration are best positioned to consolidate share in this fast-expanding segment.

Key Developments:

| Item | Value |

|---|---|

| Quantitative Units | USD 410.4 million |

| Product type | Screening Devices, Diagnostic Devices, and Hybrid Devices |

| Procedure | Infrared Imaging Devices, Ultrasound-based Hand-held Devices, Microwave/Radio-frequency Devices, and Optical Imaging Devices |

| End User | Hospitals, Specialty Cancer Clinics, Diagnostic Imaging Centers, and Mobile Screening Units/Outreach Programs |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | UE LifeSciences, Hologic, Inc., Shenzhen Bestman Instrument, Butterfly Network, Inc., Micrima Ltd, HCE Ghana Limited, iSono Health, Braster, Zhong Jie Electronics Technology, Shenzhen Bestman Instrument Co., Ltd., Others |

| Additional Attributes | Dollar sales by application and regions, Ad option trends of Hybrid Devices, Rising demand in Specialty Cancer Clinics, Growing demand across Mobile Screening Programs |

The global Hand-held Breast Cancer Detection Market is estimated to be valued at USD 410.4 million in 2025.

The market size for Hand-held Breast Cancer Detection is projected to reach USD 707.7 million by 2035.

The Hand-held Breast Cancer Detection Market is expected to grow at a CAGR of 5.6% during this period.

Key product types include Screening Devices, Diagnostic Devices, and Hybrid Devices.

Hospitals are projected to command 34.3% of the market in 2025, followed closely by specialty cancer clinics and mobile screening units.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

ESR1 Mutated Metastatic Breast Cancer Diagnostics Market - Growth & Forecast 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA