The breast reconstruction meshes market is expanding steadily, supported by the global rise in breast cancer surgeries and increased awareness of post-mastectomy reconstruction options. Medical journals and hospital group reports have emphasized a growing emphasis on aesthetic and functional outcomes, driving the integration of meshes into reconstructive procedures.

Plastic surgeons and oncology care teams have increasingly adopted mesh materials to improve implant positioning, reduce complication rates, and optimize long-term results. Innovations in mesh fabrication and polymer science have led to the development of safer, more compatible products that reduce foreign body reactions and improve integration with soft tissues.

Furthermore, national health policies and reimbursement reforms in several countries have facilitated patient access to reconstructive surgeries, increasing procedural volumes. Strategic collaborations between mesh manufacturers and reconstructive surgery centers have accelerated clinical adoption of newer mesh formats, particularly in implant-based approaches. As patient preference shifts toward individualized care and less invasive reconstructive techniques, the market is expected to grow, with synthetic and absorbable mesh products leading the shift toward enhanced clinical outcomes and procedural efficiency.

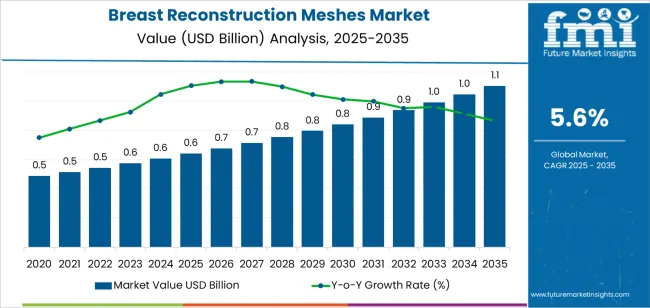

| Metric | Value |

|---|---|

| Breast Reconstruction Meshes Market Estimated Value in (2025 E) | USD 0.6 billion |

| Breast Reconstruction Meshes Market Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

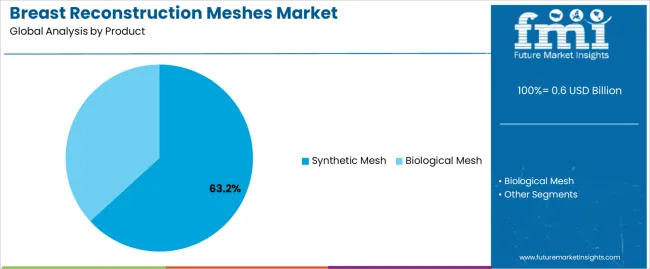

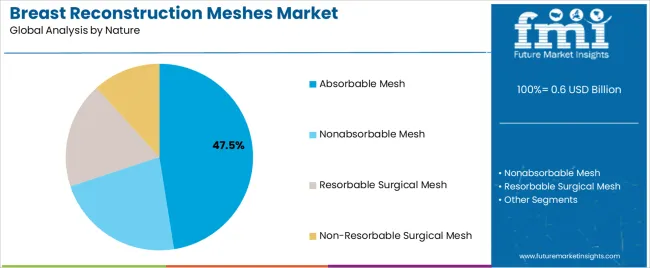

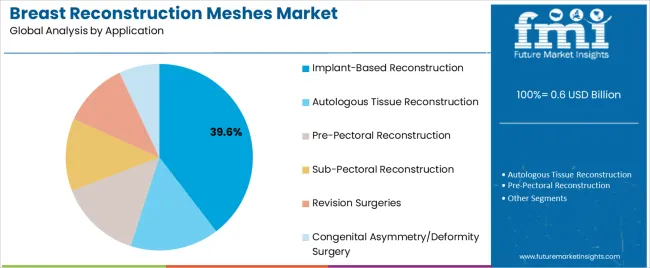

The market is segmented by Product, Nature, Application, and End User and region. By Product, the market is divided into Synthetic Mesh and Biological Mesh. In terms of Nature, the market is classified into Absorbable Mesh, Nonabsorbable Mesh, Resorbable Surgical Mesh, and Non-Resorbable Surgical Mesh. Based on Application, the market is segmented into Implant-Based Reconstruction, Autologous Tissue Reconstruction, Pre-Pectoral Reconstruction, Sub-Pectoral Reconstruction, Revision Surgeries, and Congenital Asymmetry/Deformity Surgery. By End User, the market is divided into Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Comprehensive Cancer Centers, Plastic Surgery Clinics, and Academic & Research Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Synthetic Mesh segment is projected to account for 63.2% of the breast reconstruction meshes market revenue in 2025, making it the dominant product category. This segment’s growth has been propelled by the high tensile strength, cost efficiency, and widespread availability of synthetic mesh materials.

Healthcare providers have favored synthetic meshes in reconstructive procedures due to their consistent performance in implant stabilization and ability to maintain structural integrity over time. Product development reports have highlighted ongoing innovation in lightweight, macroporous mesh designs that reduce tissue irritation and promote better tissue ingrowth.

Moreover, synthetic meshes have been adopted more broadly in hospital settings where affordability and procedural standardization are prioritized. The segment has also benefited from a well-established safety profile and lower material costs compared to biologic alternatives, making it an attractive choice in both public and private healthcare institutions. These advantages have reinforced the leading role of synthetic mesh in a market that continues to prioritize durable, reproducible reconstructive outcomes.

The Absorbable Mesh segment is projected to capture 47.5% of the breast reconstruction meshes market revenue in 2025, reflecting its growing acceptance in clinical practice. Surgeons have increasingly preferred absorbable meshes for their ability to provide temporary reinforcement during the critical phases of wound healing and implant stabilization.

Clinical studies and surgical society recommendations have noted reduced long-term foreign body complications associated with absorbable materials, especially in patients with thinner tissue coverage or those undergoing radiation therapy. The segment’s growth has been further supported by advances in biodegradable polymer technologies that ensure controlled resorption rates and predictable mechanical support.

Absorbable meshes have also gained traction in enhanced recovery protocols, where minimizing long-term implant burden is prioritized. As patient safety and minimally invasive surgical principles become more integral to reconstructive planning, the absorbable mesh segment is expected to expand its clinical footprint, offering an ideal solution in selected patient profiles.

The Implant-Based Reconstruction segment is projected to contribute 39.6% of the breast reconstruction meshes market revenue in 2025, leading among all application segments. Growth of this segment has been driven by the increasing global preference for implant-based procedures, which are typically less invasive and offer shorter recovery times compared to autologous reconstruction.

Hospital data and surgical trends have shown a rise in one- and two-stage implant reconstructions, particularly in post-mastectomy cases, where meshes are utilized to support implant positioning and reduce complications such as capsular contracture. Mesh integration in implant-based reconstructions has enabled improved cosmetic outcomes and expanded surgical options, especially in direct-to-implant procedures.

Additionally, increasing availability of acellular and synthetic mesh options tailored for implant-based techniques has simplified surgical workflows and improved patient satisfaction. The combination of procedural efficiency, surgeon familiarity, and favorable aesthetic outcomes has secured the Implant-Based Reconstruction segment’s position as a key contributor to market revenue and future growth.

Global breast reconstruction meshes market attained a CAGR of 5.5% from 2020 to 2025. For the next ten years, from 2025 to 2035, projections are that expenditure on breast reconstruction meshes will attain a 5.6% CAGR through 2035.

There is a growing emphasis on physical appearance in society, which has led to an increase in demand for cosmetic procedures, including breast reconstruction surgery and treatment. Breast reconstruction can help women feel more confident and comfortable with their bodies after a mastectomy or lumpectomy due to breast cancer or other medical conditions.

A major driving factor for the growth of the industry is the increasing importance of physical appearance. Society places a high value on physical beauty, and many people view cosmetic procedures as a way to improve their appearance and boost their self-confidence. Breast reconstruction surgery can help women feel more confident and comfortable with their bodies, which can improve their overall quality of life.

In addition to the increasing importance of physical appearance, advancements in technology and surgical techniques have also contributed to the growth of the breast reconstruction surgery and treatment industry.

Newer techniques, such as nipple-sparing mastectomy and fat grafting, have improved the outcomes of breast reconstruction surgery and made the procedure more accessible to women.

Advances in breast reconstruction technology and techniques have led to significantly improved cosmetic outcomes, with more natural-looking results that can help restore a woman's sense of self and femininity. As women continue to place greater importance on their appearance and body image, the demand for breast reconstruction surgery is expected to grow.

The increasing emphasis on physical appearance in society is driving the growth of the breast reconstruction surgery and treatment industry. Breast reconstruction surgery can help women feel more confident and comfortable with their bodies, which can improve their overall quality of life.

The industry is expected to continue to grow in the coming years due to advancements in technology and surgical techniques, as well as increasing demand for the procedure.

Tier 1 companies in the global breast reconstruction mesh market include prominent names such as Allergan, Johnson & Johnson, and Stryker. They are developing improved mesh materials, increasing product portfolios, and pursuing strategic acquisitions.

They aim to enhance mesh biocompatibility, tissue integration, and surgical results. These corporations additionally make investments in clinical research and work with healthcare experts on product development. In 2025, tier 1 companies are anticipated to acquire a 63.9% market share owing to the above factors.

Tier 2 companies are aiming for scalability by prioritizing cost-effective production, increasing product differentiation, and entering new markets. They use novel technologies and materials to increase mesh performance and compete with Tier 1 companies. These companies also prioritize strategic relationships and cooperation with medical experts and institutions to expand their industry presence.

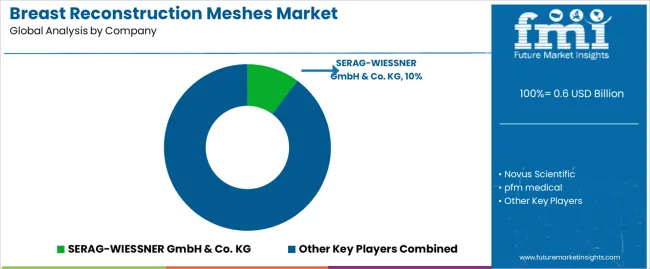

Tier 2 enterprises hope to increase industry share and growth by investing in research and development and developing distribution networks. The tier 2 companies are likely to garner a 23.2% market share in 2025. A few of the tier 2 companies include SERAG-WIESSNER GmbH & Co. KG, Novus Scientific, PFM medical, Cook Biotech, and MedSkin Solutions Dr. Suwelack AG.

Tier 3 companies in the breast reconstruction mesh industry, like Advanced Biomedical Concept Srl and Biomedica, play critical roles by emphasizing niche markets and specialized products. They frequently propose novel, specialized solutions that address unique patient demands and surgical approaches.

These firms promote competition, innovation, and individualized customer service, all of which contribute to the overall diversity and progress of the industry. They may also function as nimble, adaptive partners in cooperation with larger corporations and research institutes.

The following table shows the estimated growth rates of the top three markets. The United States, India and the United Kingdom are set to exhibit dominance in breast reconstruction industry, recording CAGRs of 5.4%, 4.5% and 4.4%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 5.4% |

| India | 4.5% |

| UK | 4.4% |

| Germany | 4.8% |

| China | 5.3% |

The industry for breast reconstruction meshes in the United States is projected to exhibit a CAGR of 5.4% during the assessment period. By 2035, breast reconstruction meshes industry size in the country is expected to reach USD 468.7 million.

The United States dominates the breast reconstruction industry due to a high prevalence of breast cancer, advanced medical technologies, supportive healthcare policies, and leading industry players like Johnson & Johnson and Allergan driving innovation and accessibility.

The market for breast reconstruction meshes in the India is projected to exhibit a CAGR of 4.5% during the assessment period. By 2035, breast reconstruction meshes market size in the country is expected to reach USD 27.9 million.

India has been continuously improving its healthcare infrastructure, including the adoption of advanced surgical techniques and medical devices. This enhancement facilitates the use of sophisticated products like breast reconstruction meshes.

Indian manufacturers and healthcare providers are incorporating the latest technologies in mesh production and surgical procedures, ensuring higher success rates and better patient outcomes. Such factors collectively make India a significant player in the breast reconstruction meshes industry.

The industry for breast reconstruction meshes in the United Kingdom is projected to exhibit a CAGR of 4.4% during the assessment period. By 2035, breast reconstruction meshes market size in the country is expected to reach USD 52.3 million.

The United Kingdom has a significant number of breast cancer cases, increasing the demand for breast reconstruction procedures that often utilize meshes.

The regional healthcare infrastructure, including the National Health Service (NHS), supports advanced surgical techniques and provides widespread access to breast reconstruction options, promoting the use of reconstruction meshes. Such factors collectively position the United Kingdom as a significant player in the breast reconstruction meshes industry.

| Segment | Polypropylene (Form Product) |

|---|---|

| Value Share (2025) | 32.1% |

The industry value of synthetic mesh in breast reconstruction meshes is USD 0.6 million, representing a sizable 55.4% market share in 2025.

Synthetic meshes are generally less expensive compared to biological alternatives, making them a preferred choice in many healthcare systems. This cost advantage extends their accessibility and usage in various reconstructive procedures.

Advances in the materials used for synthetic meshes, such as titanium-coated polypropylene (e.g., TiLOOP), have improved their biocompatibility. These meshes show good integration with surrounding tissues and reduced inflammatory responses, which enhances their safety and effectiveness in breast reconstruction

| Segment | Absorbable Mesh (From Nature) |

|---|---|

| Value Share (2025) | 32.8% |

The industry value of absorbable mesh in breast reconstruction meshes is USD 188.8 million, representing a sizable 32.8% market share in 2025.

Absorbable meshes integrate well with natural tissue, reducing long-term complications. They tend to have lower rates of infection and other post-surgical complications compared to permanent meshes.

Innovations like the TIGR Matrix provide staged degradation, offering temporary support while gradually being absorbed, leading to better aesthetic outcomes. Advantages as such contribute to the growing preference for absorbable meshes in breast reconstruction surgeries.

| Segment | Implant-based reconstruction (Form Application) |

|---|---|

| Value Share (2025) | 24.0% |

Implant-based reconstruction is projected to register a CAGR of 4.8% from 2025 to 2035.

Implant-based reconstructions are highly preferred post-mastectomy due to their effectiveness in achieving desired aesthetic outcomes. Innovations in implant materials and techniques, such as the use of synthetic meshes and acellular dermal matrices (ADMs), enhance procedural success and patient satisfaction.

These factors collectively contribute to the leading position of implant-based reconstruction in the breast reconstruction meshes market.

| Segment | Hospitals (Form End User) |

|---|---|

| Value Share (2025) | 29.6% |

Hospitals is projected to register a CAGR of 4.6% from 2025 to 2035.

Hospitals typically procure and utilize various medical devices and products, including breast reconstruction meshes, to provide reconstructive surgeries for patients who have undergone mastectomies due to breast cancer or other medical reasons.

As leading end-users in the breast reconstruction meshes market, hospitals are responsible for assessing the quality, efficacy, and safety of these products.

The breast reconstruction meshes ecosystem encompasses a diverse and dynamic competitive landscape. Leading meshes manufacturing companies are focusing on research and development, sustainable sourcing, and new formulations and biomaterials.

They are also emphasizing environment-friendly practices and product certifications to satisfy the increasing demand for natural and sustainable ingredients.

Manufacturers are also looking to preserve their market position by focusing on product quality, innovation, and matching varied customer preferences. Such mesh producers are working on innovating new biomaterials and combination of therapies which can be used in their products for added benefits.

For instance

As per product, the industry has been categorized into Synthetic Mesh- (Polypropylene, Polyester (Polyethylene Terephthalate, PET), Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF) and Expanded Polytetrafluoroethylene (ePTFE). Biological Mesh- (Bovine [Bovine Pericardium, Bovine Collagen]), (Porcine [Porcine Skin, Porcine Small Intestine] & Human

This segment is further categorized into absorbable mesh, nonabsorbable mesh, resorbable surgical mesh and non resorbable surgical mesh

Different applications include implant-based reconstruction, autologous tissue reconstruction, pre-pectoral reconstruction, sub-pectoral reconstruction, revision surgeries and congenital asymmetry/deformity surgery.

The end user segment includes hospitals, ambulatory surgical centers, speciality clinics, comprehensive cancer centers, plastic surgery clinics and academic & research institutes

Industry analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa

The global breast reconstruction meshes market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the breast reconstruction meshes market is projected to reach USD 1.1 billion by 2035.

The breast reconstruction meshes market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in breast reconstruction meshes market are synthetic mesh, _polypropylene, _polyester (polyethylene terephthalate, pet), _polytetrafluoroethylene (ptfe), _polyvinylidene fluoride (pvdf), _expanded polytetrafluoroethylene (eptfe), biological mesh, _bovine, _bovine pericardium, _bovine collagen, _porcine, _porcine skin, _porcine small intestine and _human.

In terms of nature, absorbable mesh segment to command 47.5% share in the breast reconstruction meshes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Breastfeeding Accessories Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Devices Market Analysis - Innovations & Forecast 2025 to 2035

Breast Pump Market – Trends & Forecast 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Breast Localization System Market

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Smart Breast Imaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA