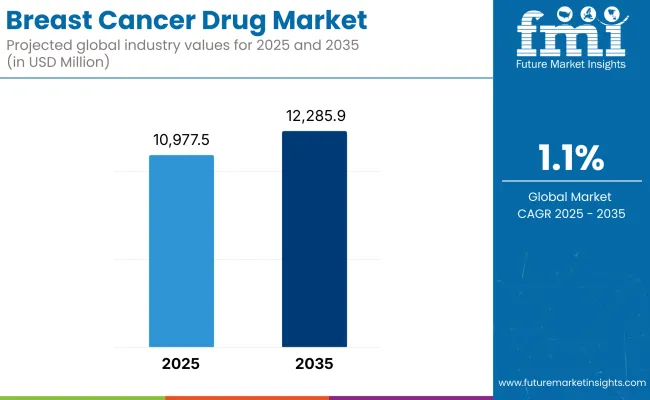

The Breast Cancer Drug market is expected to reach USD 10,977.5 million by 2025 and is expected to steadily grow at a CAGR of 1.1% to reach USD 12,285.9 million by 2035. In 2024, Breast Cancer Drug Market have generated roughly USD 10,855 million in revenues.

The market for breast cancer therapeutics is expected to undergo tremendous growth throughout the coming decade. The primary conditions that will indirectly cause this increase are statistics for breast cancer cases and awareness regarding new classes of therapy. The real catalysts for this growth will be innovations in cancer management. Developing biologics and immunotherapies are among them.

Other factor is increasing awareness of breast cancer. Apart from that, there is a shift towards personalized medicine. The introduction of new drugs with better activity and fewer side effects would also have a significant impact on this growth. AI and machine learning are also being integrated into drug discovery and treatment personalization, which will improve the treatment outcome too.

Nevertheless, very high drug prices accompanied by limited accessibility to innovative therapies in low- and middle-income countries might restrain some growth in the market. The inertia brought about by regulatory hurdles and strict approval processes for new therapies could slow down the speed of innovation.

North America has been leading in terms of breast cancer drugs as it has advanced health care infrastructure, high adoption rate of targeted therapies, and huge capital investment into cancer research. The USA has support from strong government funding organizations such as the National Cancer Institute (NCI) and FDA approvals for breakthrough therapy licenses.

An increased number of innovative treatment options improves survival rates for breast cancer patients. Yet, the high cost of cancer drugs remains a significant impediment. Disparities in the availability of advanced treatments further hinder progress. Complexities in reimbursement mechanisms create barriers to broader acceptance. The growing understanding of personalized medicine is contributing to market growth. The increasing expansion of genomic testing is also playing a key role.

The European market for breast cancer drugs has remained very significant because of solid government initiatives, an increasing number of clinical trials, and increased acceptance of biosimilar alternatives. Germany, France, and the UK form the main markets under which health care policies have been strongly boosted by investments in oncology research.

However, there are challenges arising from stringent pricing regulations and delayed approvals for new therapies under the EMA framework. The advent of precision oncology is changing the market landscape, as it is now being favored in treatment approaches that are biomarker-driven.

Furthermore, disaster-intensified bonding between pharmaceutical companies and research institutions is hastening the development of next-generation breast cancer therapies. Also, the intensification of public cancer screening programs, along with efforts dedicated to early detection, is improving treatment outcomes across Europe. There's also increased investment by governments in AI-powered drug discovery and, in the digital health solutions, pushing further market growth.

Rapid expansion of breast cancer medicines in Asia-Pacific adds to the growing burden of breast cancer cases. Advanced healthcare infrastructure with investment in pharmaceutical R&D also contributes to this growth. The emphasis is on countries such as China, Japan, and India. Barriers like inadequate access to advanced therapies, high treatment costs, and complicated regulations will threaten this market entry.

The growth of the market is well supported by the increasing availability of biosimilars and often, the increasing uptake of targeted therapies, as well as many international pharmaceutical companies moving into this region. Subsidized treatments and better accessibility of the healthcare systems thus provide needs for inexpensive medicines for breast cancer patients, which is further being complemented with initiatives of lowering cancer mortality rates. AI-based diagnostic tools and telemedicine services make comprehensive access to high-end cancer care available across the entire region.

Challenges

High Drug Development cost is hindering the market growth

The breast cancer drug market encounters a multitude of challenges such as high costs involved in the development of drugs, a stringent regulatory approval process, and inequitable access to treatment. Targeted therapies and immunotherapies come at an exorbitantly high price for the healthcare systems and patients when utilized.

This hampers widespread adoption. In addition, there are problems concerning resistance to standard treatment. Adverse side effects from chemotherapy and hormonal therapies also present challenges. Moreover, these initiatives are delayed by regulatory hurdles in emerging markets. There is also a slowdown in the approvals for innovative treatments in clinical trials.

Limited awareness in certain areas and late-stage diagnosis have an effect on the usefulness of available treatment options, consequently raising mortality rates and costs in treatment. Emphasis on disease management would require improved investment in affordable treatment, wider early detection programs, and a better health infrastructure.

Opportunities

The Increasing Adoption of Precision Medicine and Targeted Therapies Presents Significant Growth Opportunities.

Increasing adoption of precision medicine and targeted therapies creates an opportunity for growth in the breast cancer drugs market. The emergence of immunotherapy has enhanced treatment effectiveness. Antibody-drug conjugates have also contributed to this improvement. PARP inhibitors have further enhanced treatment outcomes.

These innovations have also improved survival rates in patients. An increasing demand for biosimilars is reducing the economic burden of treatment. This trend is extending access to these life-saving therapies. In addition, the advent of AI in drug discovery and optimization of clinical trials is pulling the next-generation breast cancer treatments into the fast lane.

Besides government initiatives and several nonprofit organizations, funding breast cancer research is quite critical in the patient access programs to newer therapies. The convergence of liquid biopsy and NGS paradigms supports early detection and personalized treatment planning and is another influential driver of market growth. Furthermore, partnerships between biotech and pharmaceutical companies are speeding up the development timelines and regulatory approvals.

Integration of AI and Genomics in Breast Cancer Drug Development

Medicine is probably the highest beneficiary of artificial intelligence (AI) technology and the latest genomics techniques; through their integration, drug discovery for breast cancer is getting speedier and more accurate by identifying new targets for drug discovery early. For an artificial intelligence-driven drug discovery strategy, large datasets and machine learning algorithm applications are setting potential biomarkers for speeding up the effective treatment finding process.

The importance of understanding the genetic mutations by which cancer is driven and personalized therapy production is ultimately reliant on genomics-monitoring of the changes. Another example where AI is used is streamlining trial designs through the interpretation of algorithms from patient data on the most effective comprehension of optimal dosages, treatment regimens, and their ability to succeed.

More machine learning models are utilized to complement predictive analytics-the purposes use which oncologists can better inform where and the way different patients fight specific treatments. The highly personalized offerings boost the probability of improved outcomes with less side effects while delivering therapy matched on a patient's particular set of genetics.

Development of Combination Therapies for Enhanced Efficacy

The revolutionization that combination therapies are doing in the management of breast cancer patients is making improvements in the efficacy of treatment, combating drug resistance, and increasing the survival rate. Chemotherapy in synergy with immunotherapy is turning out to be a good approach because of the immunotherapeutic power to arm the immune system against the specific targeting and destruction of cancer cells, whereas the chemotherapeutic agent directly kills tumor cells.

The combination thus optimizes response rates while minimizing the rate of recurrence. Furthermore, combining CDK4/6 inhibitors with hormonal therapies such as aromatase inhibitors has multi-targeted therapy potential. This combination promises an increase in progression-free survival. It is particularly beneficial for patients with hormone receptor-positive breast cancer.

Such combination therapy is more effective for a holistic attack against cancer cells through different tumor growth pathways. With the growing uptake of these regimens, there have been significant improvements in clinical outcomes that will soon find mainstream practice as more research and clinical trials prove them effective across different patient populations.

The breast cancer drug market has grown phenomenally from 2020 to 2024 owing to the steady increase in breast cancer cases and an increasing demand for targeted therapies. Much of the new drug presentation and delivery technology, such as targeted drug delivery, has enhanced patient outcomes. Other factors that have contributed to enhancing outcomes include better efficacy with fewer side effects.

On the flip side, increased awareness for early detection and treatment-seeking behavior among patients has aided the positive growth of the market. With the mainstream acceptance of precision medicine and personalized therapies, the new drugs have been receiving more acceptance. Hormone therapies and targeted monoclonal antibodies have also gained more recognition. All of these advances have led to improvements in clinical outcomes and survival rates.

The period from 2025 to 2035 will be characterized by exponential growth within the breast cancer drug market. Increased incidence of breast cancer, along with the rising demand for efficacious treatment options and personal considerations, will stir the forward momentum. AI-assisted technology and genomic data in drug development will allow the formulation of highly targeted and effective therapies.

Combos comprising immunotherapy and chemotherapy will gain traction as they are found to increase the survival of patients while reducing drug resistance. Besides new oral therapies and easier patient-friendly methods of drug delivery would drive compliance and therefore market growth.

In addition, ever-improving healthcare infrastructure in emerging markets will trigger further demand for breast cancer treatments. Regulatory hurdles will shape the future of the market, but strong partnerships in the drug development sector with pharmaceutical companies and healthcare systems will serve as a catalyst for meeting the growing global need for breast cancer therapies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Accelerated approvals for innovative therapies targeting unmet medical needs will be given importance, and regulatory frameworks will be activated for fast-tracking the entry of breakthrough treatments. |

| Technological Advancements | Targeted therapies and immunotherapies will be adopted, leading to higher specificity of treatment and efficacy so that the survival rate and quality of life of patients improve. |

| Consumer Demand | Awareness as key point contributing to actualizing even increased demand for treatment-of-choice, less invasive treatment alternatives, patients with better treatment outcomes and lesser side effects, or even both. |

| Market Growth Drivers | The growing breast cancer population and tremendous investments in research and development further backed by government policies encouraging innovation in therapeutics. |

| Sustainability | Initial attempts to produce environmentally-friendly manufacturing processes and minimize the environmental footprint of drug production have also led some companies to adopt green chemistry practices. |

| Supply Chain Dynamics | Viable through established distribution networks- ensuring availability of therapies in urban and near-urban healthcare facilities, at times even leading to difficulty reaching very remote communities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Establishment of generic guidelines on personalized medicine and biosimilars along with standard protocols and patient safety but fostering competition and affordability. |

| Technological Advancements | Artificial intelligence and machine learning will strengthen drug discovery and development processes, speedily naming targets that can produce new therapeutics and optimizing their regimens. |

| Consumer Demand | Patients are increasingly seeking individualized treatment plans, in collaboration with their healthcare providers, designed to fit their genetic blueprints, as well as those of their diseases, to achieve greater effectiveness with fewer adverse effects. |

| Market Growth Drivers | To promote innovation and accessibility, emerging markets with developing healthcare infrastructure. They will put more emphasis on early diagnosis and intervention; and strategic partnerships with several pharmaceutical companies and research institutions. |

| Sustainability | Total adoption in sustainable practices that include the use of biodegradable materials, energy-efficient manufacturing processes, and initiatives directed towards reducing the carbon footprint associated with drug development and distribution. |

| Supply Chain Dynamics | Digital technologies and e-commerce platforms will optimize existing supply chains with increased transparency, efficiency, and accessibility for all actors involved, ensuring timely therapy availability to the global patient population - including rural and underserved areas. |

Market Outlook

The skyrocketing prevalence of breast cancer is predicted to boost the substantial growth of the USA breast cancer drugs market. The rising number of diagnosed cases alongside improving drug development has shown an expansion in this market. Targeted therapies have gained momentum. Immunotherapies have also gained momentum.

Personalized treatment options have led to better patient outcome improvement. Public funding has helped improve demand for breast cancer drugs. Improved healthcare infrastructure has also contributed to this demand. Rising public awareness with respect to breast cancer screening has further helped improve demand for these drugs. Continuous innovation in drug formulation and treatment regimes will lead to further developments in this space.

Market Growth Factors

Market Forecast

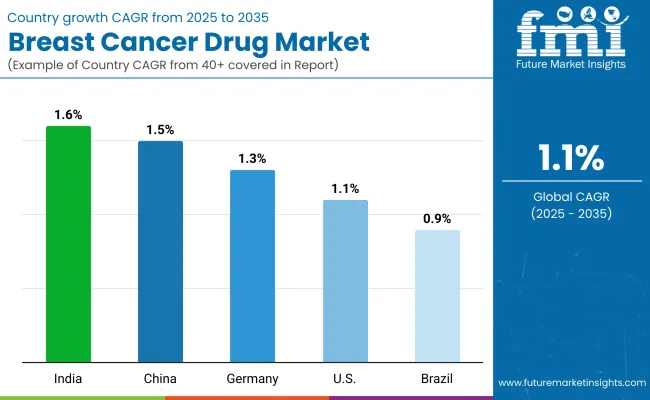

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.1% |

Market Outlook

The breast cancer therapeutic agents market in India is taking off largely due to growing incidences of breast cancer, especially in urban population segments, and more sounds being made for possible early detection and treatment. Accessibility to modern health services, coupled with partake government initiatives and awareness campaigns, points to an ever-increasing market.

Demand for effective breast cancer drugs is also attracting growing availability of targeted therapies and biologic treatment modalities. Apart from that, increased disposable incomes and enhanced health insurance coverage make treatments more accessible, which in turn are acts as a catalyst in growing the market in India.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.6% |

Market Outlook

The breast cancer meds market in China is all set to catch fire as breast cancer rates skyrocket. The eldest population is joining the new wave of people becoming increasingly aware of why a timely diagnosis matters, leading to more call-for-their-innovative and effective drugs. That, along with the fast development of China's healthcare infrastructure and enticing governmental initiatives encouraging cancer research and treatment, gives an upward thrust to market expansion.

Personalized medicine, with the growing emphasis on immunotherapy and targeted treatments, is also considered to be driving the optimistic environment for the market. Additionally, seasoned health-savvy consumers are further pouring advanced demands for drugs into the mix.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.5% |

Market Outlook

In Germany, the breast cancer drugs market is continuing its expansion due to the present surge of breast cancer throughout Germany, especially among older women. With high healthcare standards, advanced medical research, and availability of modern treatment options such as targeted therapies and immunotherapies, the German market is also getting momentum.

Germany represents an important segment in the breast cancer drugs market in Europe, given its well-established healthcare system, increasing awareness campaigns, and government-backed funding for cancer treatment. The further fillip given by advancing early-diagnosis and personalized treatment regimens offers further support to the already positive growth trajectory of the market.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 1.3% |

Market Outlook

As newer breast cancer cases increase, there is more emphasis on early detection and treatment. Brazil's breast cancer drugs market is growing quickly. Government initiatives, healthcare improvements, and awareness among the populace contribute to market expansion. Some innovative drugs have improved treatment outcomes for Brazilian women.

These include targeted therapies and biologics. The growing healthcare infrastructure and entry into health insurance are expected to drive demand for breast cancer drugs across the country. This will position Brazil as one of the emerging markets in Latin America.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 0.9% |

The growth of aromatase inhibitors (AIs) in the breast cancer market is driven by the rising prevalence of hormone receptor-positive (HR+) breast cancer.

Aromatase inhibitors (AIs) will be one of the key drug classes for breast cancers. Especially for postmenopausal hormone receptors positive (HR+) breast cancer patients. The AIs include drugs like anastrozole, letrozole, and exemestane, which inhibit estrogen production, thereby reducing tumor development and tumor relapses.

The surging prevalence rate of HR+ breast cancer, coupled with increasing trends of hormone therapy being used as first-line treatments, increasing preferences to use adjuvant endocrine therapy to avoid recurrence, was really propelling the market.

North America and Europe are the mainstream users of AI owing to stringent clinical guidelines and high levels of awareness among practitioners; however, demand is gradually rising in the Asia Pacific market. Trends likely to influence the future of AI therapy area include personalization for selecting hormonal therapy, next-generation improved tolerability aromatase inhibitors, and combined AI plus CDK4/6 inhibitors for increased efficacy.

The growth of biologic response modifiers in attributed to increasing adoption of targeted therapies in HER2-positive and triple-negative breast cancer (TNBC)

Biologic response modifiers are monoclonal antibodies and targeted therapies literally changing the treatment landscape for breast cancer. By these agents, cancer growth pathways are blocked, the immune response is enhanced, and the survival rate of patients is improved upon.

These factors are driving the market with the ever-increasing acceptance of targeted therapies in HER2-positive and triple-negative breast cancer (TNBC), the growing approvals of biosimilars to increase affordability, and the increasing need for combination immunotherapeutic regimens.

The biologics breast cancer therapies market is leading in North America and Europe, while the Asia-Pacific is under considerable growth because of government initiatives to improve access to advanced oncology drugs. Future innovations are next-generation ADCs, AI-based biomarker-guided treatment selection, and checkpoint inhibitors targeting hormone receptor-positive cancers.

Hospital pharmacies are dominating the market due to increasing adoption of combination therapies requiring close monitoring.

Hospital pharmacies serve as the principal distribution channel for breast cancer drugs as a number of treatments including chemotherapy, targeted therapies, and biologics require in-hospital administration and monitoring. Hospitals have specialized oncology wards and infusion centers as well as multidisciplinary cancer care teams for patient-specific treatment.

The increasing admissions for breast cancer, greater use of combination therapies requiring monitoring, and growth of cancer centres with integrated pharmacy services are some of the factors propelling the market demand. North America and Europe are at the forefront in distribution based on hospital pharmacies, while in Asia Pacific there is increasing adoption due to an expanding oncology healthcare infrastructure.

Future trends will include hospital-centric AI-mediated medication management, real-time tracking of oncology drugs using blockchain, and automated infusion pharmacies for targeted dosing.

The growth of retail and specialty pharmacies is due to increasing availability of oral targeted therapies

Retail and specialty pharmacies are becoming critical access points for support of oral chemotherapy drugs for breast cancer, like aromatase inhibitors, SERMs, and CDK4/6 inhibitors. Such drugs encompass a core part of long-term breast cancer management with adjuvant therapy approaches, making pharmacy access a critical enabler of adherence. Increasing availability of oral targeted therapies is observed, coupled with the general increasing demand for more convenient options for care at home and further strengthening of specialty pharmacy networks on oncology-all these fuel the future growth in area.

In case of pharmacy-based breast cancer drug distribution, North America and Europe are at the lead, while the Asia-Pacific market grows with the increasing access to healthcare and regulatory approvals of oral cancer drugs. Future advancements would include pharmacy automation for prescription tracking supported by artificial intelligence, amalgamation of digital health tools for adherence monitoring, and personal integrative pharmacy-based oncology counseling services.

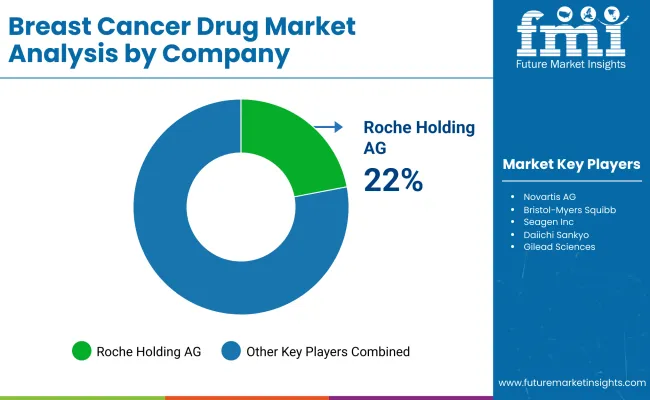

The breast cancer therapeutic agents market remains extremely competitive. It is characterized by gradually increasing incidence rates. Heightened competition in new targeted therapies. Increased investment in personalized medicine.

Companies are focusing on monoclonal antibodies, hormone therapies, and immunotherapy solutions for a sustained competitive advantage. The growing breast cancer treatment landscape is represented by established pharmaceutical companies, innovative biotechnology firms, and newly emerging oncology companies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Holding AG | 22-26% |

| Novartis AG | 18-22% |

| Pfizer Inc. | 10-14% |

| AstraZeneca PLC | 8-12% |

| Eli Lilly and Company | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Holding AG | Market leader offering targeted therapies for HER2-positive breast cancer. |

| Novartis AG | Develops advanced breast cancer treatments, including Kisqali |

| Pfizer Inc. | Provides leading breast cancer drugs such as Ibrance |

| AstraZeneca PLC | Specializes in precision medicine, including Enhertu and Lynparza for metastatic breast cancer. |

| Eli Lilly and Company | Offers Verzenio, a CDK4/6 inhibitor for HR-positive, HER2-negative breast cancer treatment. |

Key Company Insights

Roche Holding AG (22-26%)

Roche Holding AG has the highest stock in the breast cancer therapeutics. It uses usual techniques in an industry where it has an area of HER2-target therapy. Its solid portfolio of biologics and antibody-drug conjugates includes Herceptin and Kadcyla, which set the standard for HER2-positive breast cancers. Roche's commitment to supplementing innovation in personalized medicine has kept its sustainability of this leadership in oncology.

Much as innovation, research, and development, and partnerships enabled the firm to keep afloat above the waters when it comes to breast cancer treatments. This also has continued to improve patient outcomes across the globe.

Novartis AG (18-22%)

Novartis is a very trusted company when it comes to the treatment of targeted cancers. It has also pioneered such major new treatments with the CDK4/6 inhibitors, such as Kisqali, as important breakthroughs for patients with hormone receptor-positive, HER2-negative breast cancer. Further, Novartis has concentrated its efforts on precision therapies for different subtypes of breast cancer, bringing better treatment options eventually to the market.

By pouring a lot of resources into research and development efforts, Novartis becomes faster in reaching the forefront of breast cancer treatment. Innovativeness turns towards the quality of life and even in the chances of a patient surviving. The oncology segment assists in accessing the market share in anticipation of its future expansion.

Pfizer Inc. (10-14%)

Pfizer Inc. is a strong player in the oncology space. Today's choice in breast cancer treatment for hormone receptor-positive and HER2-negative status is Ibrance, which is made by Pfizer, a leading organization in cancer management. The other big stride that the organization has made toward helping patients is focused on targeted therapy in the inhibition of cancer cell proliferation.

All strides are still being taken by Pfizer in enhancing investigational studies focused on breast cancer, especially on combination therapy, thus establishing its brand presence in the market. As it continues to invest in precision medicine, there are indicators that it will play a prominent role in the changing trend toward the treatment of breast cancer.

AstraZeneca PLC (8-12%)

Lynparza is one PARP inhibitor by AstraZeneca among the anticancer agents they have developed. AstraZeneca is working on other antibody-drug conjugates. These will create options for treating patients. They focus on specific subtypes of breast cancer. Furthermore, AstraZeneca conducts research on new innovative therapeutic discovery approaches. These aim to treat triple-negative or HR-positive breast cancers. The company collaborates with other biopharmaceutical firms.

This collaboration makes it one of the significant players in the market. Thus, the continued dedication of this company toward developing breast cancer therapies will foster growth. It also considers the extent to which it can widen its presence within the market.

Eli Lilly and Company (5-9%)

Eli Lilly and Company is emerging as one of the most promising competitors in breast cancer therapy today. This is particularly true for its oral CDK4/6 inhibitor called Verzenio. The medication is one of the main options for patients struggling with hormone receptor-positive, HER2-negative breast cancer. It offers a well-performing therapeutic option.

This option markedly increases progression-free survival. The company has obtained significant advances in the oncology segment in terms of new therapies launched, and the increasing line-up reiterates its commitment to the forward march of breast cancer treatment. Giving strong importance to personalized medicine, Eli Lilly is likely to fortify its front in the market, giving patients with breast cancer everywhere new hope.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of breast cancer therapies, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs.

SERM (selective estrogen-receptor modulators)-based, aromatase inhibitors-based, biologic response modifiers-based, and other hormonal therapies-based

Hospital pharmacies, pharmacies, and drug stores

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Breast Cancer Drug Market was USD 10,977.5 million in 2025.

The Breast Cancer Drug Market is expected to reach USD 12,285.9 million in 2035.

The demand for the breast cancer drugs market will be driven by the increasing prevalence of breast cancer, advancements in drug development, growing awareness of early detection, improved healthcare infrastructure, and rising adoption of personalized medicine, leading to better treatment outcomes and expanded market access.

The top key players that drives the development of Breast Cancer Drug Market are F. Hoffmann-La Roche Ltd, AstraZeneca, Pfizer Inc., Novartis International AG, and Bristol-Myers Squibb.

Aromatase Inhibitors-based is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 13: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 14: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 29: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Drug Class, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Breastfeeding Accessories Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Devices Market Analysis - Innovations & Forecast 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Breast Pump Market – Trends & Forecast 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Breast Localization System Market

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Smart Breast Imaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA