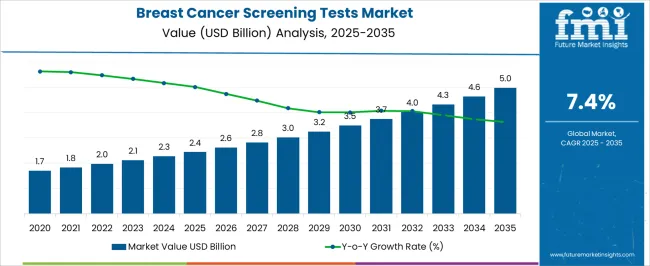

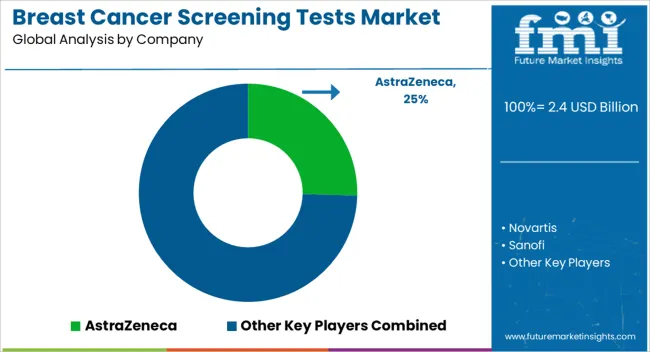

The Breast Cancer Screening Tests Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Breast Cancer Screening Tests Market Estimated Value in (2025 E) | USD 2.4 billion |

| Breast Cancer Screening Tests Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The Breast Cancer Screening Tests market is witnessing consistent growth due to the increasing emphasis on early detection and preventive healthcare measures. The current market scenario reflects a significant rise in awareness about breast cancer, particularly among women aged 35 and above, coupled with the expansion of healthcare infrastructure across both developed and emerging regions. Investment in advanced diagnostic technologies and the integration of artificial intelligence with imaging platforms are enhancing the accuracy and efficiency of screening programs.

As healthcare providers prioritize timely diagnosis and intervention, demand for comprehensive screening solutions is rising. The future outlook is shaped by initiatives promoting routine screenings, government-supported awareness campaigns, and technological advancements in non-invasive diagnostics. Increasing availability of high-quality diagnostic services in hospitals and clinical centers is enabling broader population coverage.

The market is also being influenced by a shift toward patient-centered care, where screening programs are tailored to risk profiles, leading to optimized utilization of resources and improved patient outcomes These factors collectively are paving the path for sustainable growth and innovation in the Breast Cancer Screening Tests market.

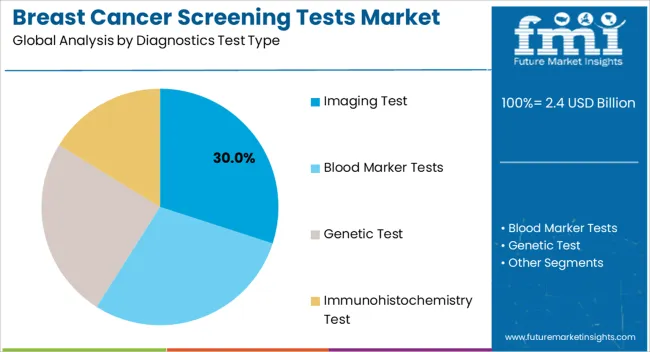

The Imaging Test segment is projected to hold 30.00% of the Breast Cancer Screening Tests market revenue share in 2025, establishing it as the leading diagnostics test type. This position has been driven by the superior accuracy and non-invasive nature of imaging modalities, which enable detailed visualization of breast tissue and early detection of abnormalities. Adoption has been accelerated by advancements in mammography, ultrasound, and tomosynthesis, which allow for higher resolution, reduced examination time, and enhanced diagnostic confidence.

Imaging tests are highly favored in screening programs due to their ability to provide immediate results, support follow-up assessments, and integrate with digital record systems. The growth of this segment is further supported by increasing patient preference for reliable and less intrusive diagnostic options.

Healthcare facilities have been able to implement these solutions efficiently because imaging technologies are compatible with standardized hospital workflows and can be upgraded through software enhancements without replacing hardware The Imaging Test segment is expected to maintain its market leadership as hospitals and clinics continue to expand preventive screening programs and emphasize early intervention strategies.

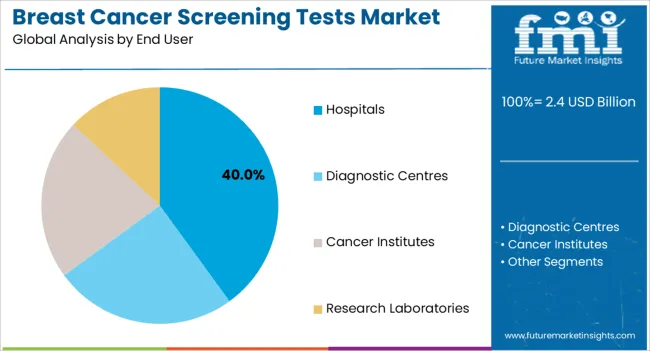

The Hospitals end-user segment is anticipated to capture 40.00% of the Breast Cancer Screening Tests market revenue in 2025, making it the largest consumer segment. This leadership has been driven by hospitals’ ability to provide comprehensive and coordinated screening programs, combining imaging, laboratory, and patient management services under one roof. The growth is supported by investments in advanced diagnostic infrastructure, the availability of trained radiologists, and the integration of digital health solutions that streamline patient flow and reporting.

Hospitals offer a centralized platform where screening, follow-up, and preventive care can be delivered efficiently, which has strengthened their role in early detection initiatives. Increasing government and private funding for breast cancer awareness and screening programs has further enhanced hospital adoption.

The ability to manage high patient volumes while ensuring standardized testing protocols has reinforced the hospitals segment’s market share As population health management strategies continue to evolve and patient awareness rises, hospitals are expected to remain the primary provider of breast cancer screening services, sustaining the growth of this segment in the coming years.

The global market for breast cancer screening tests was around 1.0% of the overall USD 2.4.0 Billion of the global cancer diagnostics market in 2025.

Growing demand for technologically sophisticated testing kits and instruments that may improve accuracy, speed, and cost-effectiveness for diagnosis is expected to be the most important growth factor over the projection period.

Rising reimbursement and insurance coverage are likely to further boost testing adoption. Government bodies across various countries have approved certain tests for nationwide reimbursement. This has led to an increase in number of tests being performed either at point-of-care testing site or at the convenience of home.

Patient advocacy organisations and organisations dedicated to breast cancer awareness and assistance are critical in boosting demand for screening tests. These organisations educate and empower women, advocate for the necessity of screening, and work to improve access to screening services.

Breast cancer screening test reimbursement policies and insurance coverage are thus, critical in driving market growth. Beneficial reimbursement policies make screening tests more accessible and inexpensive to patients, resulting in greater utilisation and demand.

Women are becoming more aware of the importance of breast health and regular screenings. Patients are increasingly taking an active role in their own health management, including seeking screening tests. These factors produces an opportune environment for the expansion of the breast cancer screening tests market.

Owed to the above factors, the global market is projected to grow at CAGR of 7.8% in forecasted period.

Breast cancer is one of the most common cancers among women around the world.

Early diagnosis using screening tests is critical for improving treatment outcomes and lowering mortality rates. As a result of the rising incidence and prevalence of breast cancer, the demand for screening tests is increasing.

Worldwide initiatives and awareness campaigns to encourage breast cancer screening have been established by governments and healthcare organizations.

These programs seek to inform the public about the value of early detection and motivate women to have routine screenings. Increased screening rates are a result of government funding and awareness programs, which further fuel the market.

Genetic testing for breast cancer susceptibility, such as BRCA gene testing, has gained prominence. Advances in genetic testing technologies and increased understanding of the genetic factors contributing to breast cancer risk have expanded the scope of screening. Genetic testing drives the adoption of personalized screening approaches and fuels market growth.

Breast cancer screening procedures, particularly mammography, can occasionally produce false-positive results, necessitating extra testing, biopsies, and concern for patients. Over diagnosis, or the detection and treatment of tumours that may or may not have caused harm, is also a source of worry. False positives and over diagnosis can increase healthcare expenses and endanger patients.

The most commonly used screening technique, mammography, may have limits in detecting breast cancer in individuals with dense breast tissue. Dense breasts have more fibrous and glandular tissue, making it difficult to detect minor abnormalities. Because of this limitation, women with dense breasts may have missed or delayed diagnoses, necessitating the adoption of additional screening procedures.

The cost of breast cancer screening tests, particularly more advanced imaging methods like breast MRI and molecular breast imaging, can be prohibitively expensive for certain people. Screening test costs and availability can vary depending on healthcare systems, insurance coverage, and individual financial circumstances. High costs may deter people from getting recommended screenings.

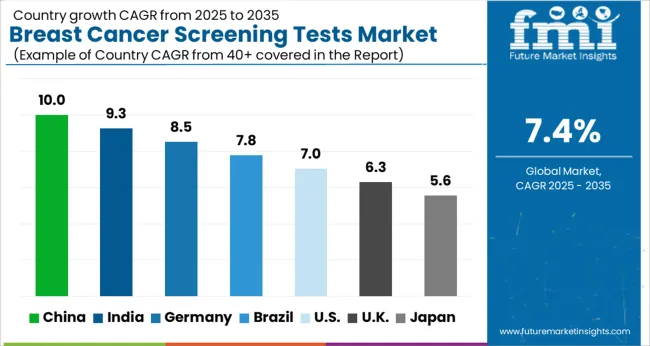

The USA occupies 31.4% of market share in 2025 globally. The expansion of the breast cancer screening tests market in the United States is highly impacted by a variety of variables, including public awareness initiatives, government policies, and technological advancements.

The United States Preventive Services Task Force (USPSTF) announced new drafting guidelines for breast cancer screening in May 2025, which significantly reduced the age at which women should begin screening from 50 to 40 years old. The main advantage of screening is that it allows for earlier detection of breast cancer. Breast cancer is virtually 100 percent treatable when detected early.

The USPSTF emphasised the importance of greater research regarding screening inequalities across different racial groups in the United States, as well as the benefits of breast ultrasonography and MRI for women with thick breasts.

The goal of these initiatives is to promote regular breast cancer screening, improve early detection rates, and ultimately reduce breast cancer mortality rates.

China expenditure on breast cancer screening test in 2025 was USD 2.4 Million.

The growing middle-class population in China has largely contributed to the expansion of the breast cancer screening tests market. Breast cancer screening tests are anticipated to become more popular as more individuals obtain access to healthcare facilities.

More importantly, advances in medical technology and the availability of novel screening techniques have supported market expansion. Digital mammography, breast ultrasonography, and breast magnetic resonance imaging (MRI), for example, are becoming more popular in China for breast cancer screening and diagnosis.

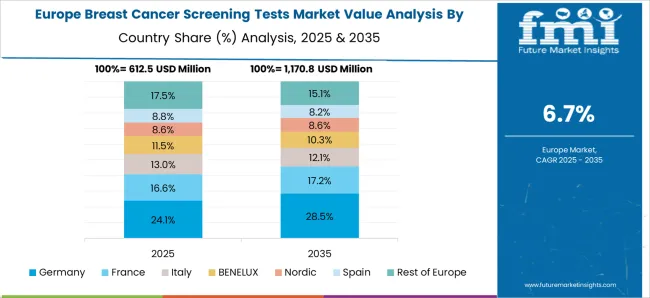

In 2025, the Germany held a significant share in the global market and contributed around USD 132.3 Million. Breast cancer is a major public health concern worldwide, especially in Germany.

Breast cancer screening programmes are in existence in Germany, like in other industrialised nations, to diagnose breast cancer at an early stage. For example, in May 2025, ESMO Breast Cancer conference was held in Germany for breast cancer researchers and physicians with a focus on innovation and care. This campaign was primarily concerned with current advancements in innovative breast cancer diagnostics, biomarkers, and treatments.

These programs usually include mammography screening for women of specific ages.

By diagnostic test type, imaging tests held 54.3% market share in world in 2025.

Imaging tests are the most effective technique to detect breast cancer early, when it is easier to treat and before it has grown large enough to produce symptoms. Regular imaging tests, such as mammograms, can help to reduce the chance of dying from breast cancer. A mammography is currently the most extensively used tool for detecting breast cancer in most women of screening age. These considerations are increasing the use of imaging testing.

The hospitals have a considerable presence in the breast cancer screening tests market, accounting for 42.3% value share in 2025, and exhibiting a high CAGR of 7.1% over the forecast period. The development of improved screening tests for cancer diagnosis and the rise in annual patient visits to hospitals around the world are both contributing factors to the rising usage of genetic testing.

Increasing government initiatives to equip hospitals with cutting-edge technology are some of the reasons that are fuelling the growth of this market.

Collaborations and partnerships among healthcare providers, research institutions, and technology businesses can encourage innovation and hasten breast cancer screening test. Collaboration in research, development, and commercialization can lead to market expansion and the creation of new applications. Numerous large firms compete in the field of breast cancer screening test. Among the well-known players in this field are:

Similarly, recent developments related to the company’s manufacturing the breast cancer screening test kits have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Spain, BENELUX, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Philippines, Malaysia, Australia, New Zealand, GCC countries, Türkiye, Northern Africa and South Africa. |

| Key Market Segments Covered | Diagnostic Test, Type End, User and Region |

| Key Companies Profiled | AstraZeneca; Novartis; Sanofi; Pfizer; Bayer AG; GlaxoSmithKline plc; Siemens Healthineers; Hologic Inc.; General Electric Company; Koninklijke Philips NV; Fujifilm Holdings; A&G Pharmaceutical, Inc.; Biocrates Life Sciences AG; Metabolomic Technologies, Inc.; Myriad Genetics; OncoCyte Corporation; POC Medical Systems, Inc.; Hologic, Inc.; Provista Diagnostics, Inc.; BioTime, Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global breast cancer screening tests market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the breast cancer screening tests market is projected to reach USD 5.0 billion by 2035.

The breast cancer screening tests market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in breast cancer screening tests market are imaging test, _mammography, _mri screening test, _molecular breast imaging test, _pet scan, _ultrasound, blood marker tests, genetic test, _fluorescence in situ hybridization, _her gene test and immunohistochemistry test.

In terms of end user, hospitals segment to command 40.0% share in the breast cancer screening tests market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Breastfeeding Accessories Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Devices Market Analysis - Innovations & Forecast 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Breast Pump Market – Trends & Forecast 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Breast Localization System Market

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Smart Breast Imaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA